AI Stock Trading: How Smart Algorithms Trade

AI stock trading is revolutionizing the financial markets. With the global algorithmic trading market is projected to reach $19 billion by 2024, growing at a CAGR of 10.5%. We will explore the intricacies of AI Stock Trading and its transformative impact on financial markets.

Key tools for AI Stock Trading:

- AI Trading Bots - automated systems that execute trades based on pre-set algorithms

- AI Data Analysis Software - use machine learning algorithms to predict market movements and provide recommendations

- AI- Sentiment analysis tools - analyze online content to gauge market sentiment

- AI-powered portfolio management - help to manage portfolios by optimizing asset allocation and minimizing risk.

How to use AI for stock trading

AI stock trading leverages algorithms and machine learning to analyze vast amounts of market data, predict stock movements, and execute trades. The relevance of AI in stock trading is growing exponentially.

Here are some key AI tools commonly used in stock trading.

AI Trading Bots

AI trading bots are automated systems that execute trades based on pre-set algorithms. These bots analyze market conditions, historical data, and trading signals to make informed decisions without human intervention. They are particularly useful for high-frequency trading and can operate 24/7, ensuring that opportunities are not missed due to human limitations. Learn more about AI Trading Bots: Do They Really Work? in our article.

How to use AI for stock trading

How to use AI for stock trading

Speed and efficiency: Execute trades in milliseconds, faster than any human;

Emotionless trading: Make decisions based on data and algorithms, eliminating emotional biases;

24/7 Operation: Monitor and trade in global markets continuously.

AI Data Analysis Software

AI data analysis software processes vast amounts of financial data to identify patterns, trends, and insights that are not easily discernible by humans. These tools use machine learning algorithms to predict market movements and provide recommendations.

Data-driven insights: Generate actionable insights from complex data sets;

Predictive analysis: Forecast market trends and potential stock performance;

Customized reports: Tailor analysis to specific trading goals and strategies.

Sentiment analysis tools

These tools analyze news articles, social media, and other online content to gauge market sentiment. By understanding the general mood of investors, traders can make more informed decisions.

Market sentiment: Gauge public opinion and its impact on stock prices;Market sentiment: Gauge public opinion and its impact on stock prices;

Timely updates: Stay informed about market-moving news and events;Timely updates: Stay informed about market-moving news and events;

Risk management: Anticipate market reactions and adjust strategies accordingly.Risk management: Anticipate market reactions and adjust strategies accordingly.

Portfolio management software

AI-powered portfolio management tools help traders and investors manage their portfolios by optimizing asset allocation and minimizing risk. These tools analyze market conditions, investment goals, and risk tolerance to provide tailored recommendations.

Optimized portfolios: Create and maintain a balanced portfolio aligned with investment goals;Optimized portfolios: Create and maintain a balanced portfolio aligned with investment goals;

Risk mitigation: Use algorithms to minimize potential losses and manage risk;

Performance tracking: Continuously monitor and adjust portfolios for optimal performance.

Factor |

Description |

Importance |

|---|---|---|

Accuracy and Reliability |

Consistency and precision in AI predictions |

Ensures informed decision-making, highlights the most reliable tools |

Usability and User Interface |

Ease of navigation and feature utilization |

Enhances trading experience, emphasizes platforms with intuitive design |

Customization and Flexibility |

Ability to tailor AI tools to specific strategies |

Crucial for advanced traders, allows for various trading styles and preferences |

Backtesting and Historical Data |

Validates strategies against historical data |

Ensures robustness and effectiveness of trading strategies |

Integration with Brokerages |

Seamless connection with brokerage accounts |

Streamlines trading process, allows for efficient trade execution |

Cost and Subscription Plans |

Financial commitment required for using the platform |

Important for budget considerations, visual comparison of cost distribution |

Customer Support and Resources |

Availability of customer service and educational resources |

Provides assistance and enhances user learning, especially important for beginners |

Market Coverage |

Range of markets and asset types supported (stocks, ETFs, Forex, etc.) |

Allows for diversified trading opportunities, critical for traders looking to expand their investment portfolio |

Performance and Speed |

Speed of data processing and trade execution |

Crucial in fast-paced markets, ensures timely decision-making and execution |

AI Trading Bots

AI Trading Bots

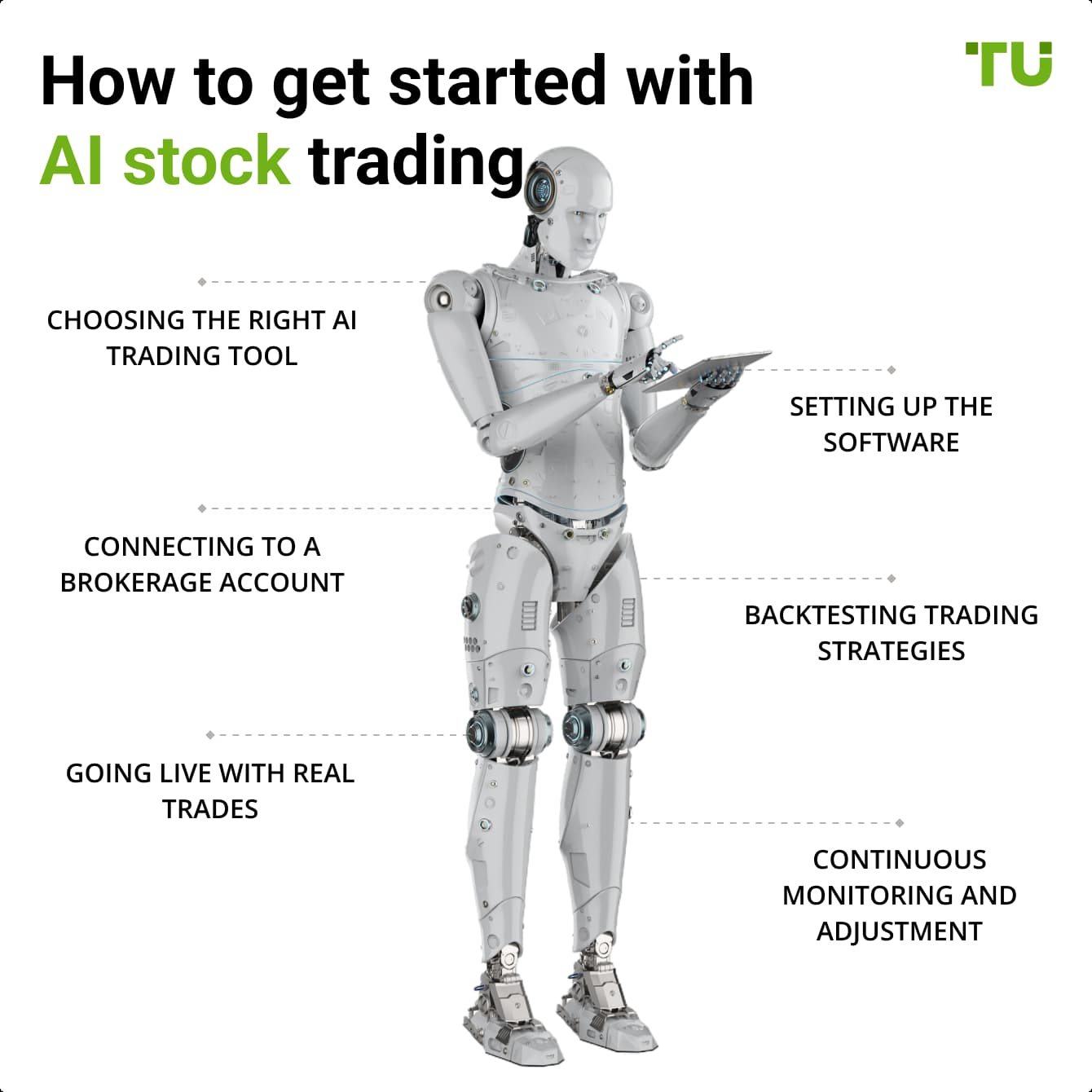

1. Choosing the right AI trading tool

To begin your journey into AI stock trading, it's crucial to select the right AI trading tool that aligns with your individual trading goals and preferences. Start by identifying your trading objectives and the features you need from an AI tool.

2. Setting up the software

Once you have chosen your AI trading tool, the next step is to install and configure the software. Follow the detailed instructions provided by the platform for installation. After installing the software, configure the settings to match your trading preferences.

3. Connecting to a brokerage account

For seamless trading, you need to link your AI trading tool with your brokerage account. This connection allows the AI to execute trades on your behalf based on the strategies you set.

We have studied the brokers that support AI stock trading and created a comparative table.

| Broker | Accounts | Instruments | Spread, (pips) | Leverage | Minimum deposit, (USD) | AI Stock trading | Open an Account |

|---|---|---|---|---|---|---|---|

Demo, User |

CFDs on stocks, Forex, cryptocurrencies, indices and commodities, real stocks, options, ETFs (not available for all countries), futures (for U.S. residents only) |

0.5 points |

Up to 1:30 or up to 1:300 |

100 |

Yes |

Open an account Your capital is at risk. |

|

Razor, Standard |

CFDs on Forex, Index, Stocks, Currency Indices, Commodities, ETFs, Crypto |

0 points |

Up to $400:1 retail, 500:1 Pro |

0 |

Yes |

Open an account Your capital is at risk.

|

|

Standard, Core, Swap-free, Premium, Premium Core |

FX, Indices, Bullion, Commodities, Crypto |

0 points |

Up to 1:200 |

0 |

Yes |

Open an account Your capital is at risk. |

|

Standard account, Commission account, Direct Market Access account (DMA) |

Forex, cryptocurrencies, indices, commodities, stocks |

0.2 points |

Up to 1:400 |

100 |

Yes |

Study review | |

Real, Demo |

Stocks, options, futures, currency, metals, bonds, ETF, mutual funds, CFD, EPF, Robo-portfolios, hedge funds, forecast contracts (Product availability is dependent on IBKR affiliate and client country of residence) |

0 points |

Depending on the asset |

0 |

Yes |

Open an account Your capital is at risk. |

|

Demo and CFD |

Forex; CFDs on indices, commodities, and stocks; |

0.4 points |

Up to 1:200 |

1 |

Yes |

Study review |

4. Backtesting trading strategies

Before you start live trading, it’s essential to test and validate your trading strategies using historical data. Most AI trading platforms offer backtesting features that allow you to see how your strategies would have performed in the past.

Backtesting trading strategies

Backtesting trading strategies

5. Going live with real trades

After you have backtested and fine-tuned your strategies, you can transition to live trading. Start by trading with a small amount of capital to minimize risk as you get accustomed to live trading.

6. Continuous monitoring and adjustment

AI stock trading is not a set-it-and-forget-it process. Regularly review and refine your trading strategies to adapt to changing market conditions. Continuously monitor the performance of your AI tools.

List of top AI stock solutions

AI stock trading solutions and tools vary widely in terms of features and capabilities. Here’s a look at some of the most popular options.

Broker/Platform |

Features |

Pricing |

Best for |

|---|---|---|---|

Advanced algorithms, real-time data analysis, AI trading bots |

$118/month (Standard), $228/month (Premium) |

High-probability trading opportunities and actionable insights |

|

Automated technical analysis, backtesting, candlestick pattern recognition |

$33/month (Standard), $97/month (Elite) |

Recognizing candlestick patterns and executing automated trades |

|

AI trading systems, hedge fund-style portfolios, extensive strategy library |

$75/month (Standard), $200/month (Advanced) |

Extensive AI-generated strategies and diverse asset coverage (stocks, ETFs, Forex). |

|

BlackBoxStocks |

Options trading, automated scanners, trading community |

$99.97/month |

Automated scanners for market opportunities and an active trading community |

Robust AI integration, automated trading, real-time market analysis |

Free to use, broker fees apply |

Widespread use and support, extensive community resources, and support for a variety of asset classes |

Benefits of using AI in stock trading

-

Stronger risk management.

AI tools enhance risk management by making data-driven decisions, which reduces the likelihood of emotional trading;

-

Lowering costs.

AI can significantly lower operational costs by automating tasks traditionally performed by human traders;

-

Automation and efficiency.

The ability of AI to automate trading processes leads to increased efficiency and faster execution of trades;

-

Predictive market forecasting.

AI’s predictive capabilities allow for accurate market forecasts, helping traders stay ahead of market movements.

Key risks of using AI in stock trading

-

Data quality and integrity.

AI systems rely heavily on data. Poor-quality or corrupted data can lead to inaccurate predictions and flawed trading decisions;

-

Overfitting.

AI models may become too tailored to historical data, making them less effective in predicting future market behavior, leading to potential losses;

-

Lack of transparency.

AI algorithms can be complex and difficult to interpret, making it challenging for traders to understand how decisions are being made;

-

Market volatility.

AI systems can struggle in highly volatile markets, where rapid and unpredictable changes can lead to significant financial losses;

-

Cybersecurity threats.

AI systems are susceptible to hacking and cyberattacks, which can compromise trading strategies and sensitive financial data.

-

Weak legal regulation:

Determining liability for decisions made by AI can be legally complex, especially in cases of significant losses. The use of AI regularly leads to market manipulation, which can cause ethical and legal conflicts due to gaining an unfair (from the financial regulator's point of view, of course!) market advantage.

The main thing in AI trading: choose the right platform

When incorporating AI into my stock trading strategy, I follow a methodical approach to ensure accuracy, reliability, and strategic advantage. I recommend starting by assessing the AI platform's performance through backtesting with historical data .

Next, evaluate the AI platform's integration capabilities with your existing brokerage account. Seamless integration is crucial for efficient trade execution and real-time data analysis.

Look for platforms that offer robust analytical tools and customizable features to tailor strategies to your specific trading goals.

User interface and usability are also key factors. I always test the AI platform using a demo account to get a feel for its functionality and performance without risking real capital.

Additionally, consider the costs associated with the AI trading platform. While some tools may have higher upfront or subscription fees, their advanced features and superior performance can justify the investment.

Conclusion

AI stock trading represents a significant advancement in financial technology, offering sophisticated tools that can enhance trading efficiency, accuracy, and profitability. By harnessing the power of advanced algorithms and machine learning, AI trading platforms can analyze vast amounts of market data, identify patterns, and execute trades faster and more accurately than human traders.

For beginners, it's essential to start with user-friendly platforms that offer comprehensive educational resources and support. The key to successful AI stock trading lies in continuous learning and adaptation. Traders should regularly monitor the performance of their AI tools, backtest their strategies with historical data.

FAQs

What is AI stock trading and how does it work?

AI stock trading involves using artificial intelligence algorithms to analyze market data, predict stock movements, and execute trades. These algorithms process vast amounts of information at high speeds, identifying patterns and trends that may not be evident to human traders.

What are the benefits of using AI in stock trading?

AI in stock trading offers several benefits, including stronger risk management, lower operational costs, and increased efficiency. AI algorithms can process large datasets quickly and identify trading opportunities that might be missed by human traders.

What are the potential risks and challenges associated with AI stock trading?

One major risk is the potential for over-reliance on AI systems, which can lead to complacency and reduced human oversight. AI algorithms can also be opaque, making it difficult to understand their decision-making processes, which raises transparency and accountability concerns.

How can beginners get started with AI stock trading?

Beginners can start with AI stock trading by choosing user-friendly platforms that offer educational resources and simpler tools. It is essential to start with platforms that provide comprehensive training programs and support for new users. Beginners should begin with basic trading strategies.

Related Articles

Team that worked on the article

Igor is an experienced finance professional with expertise across various domains, including banking, financial analysis, trading, marketing, and business development. Over the course of his career spanning more than 18 years, he has acquired a diverse skill set that encompasses a wide range of responsibilities. As an author at Traders Union, he leverages his extensive knowledge and experience to create valuable content for the trading community.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

A trading system is a set of rules and algorithms that a trader uses to make trading decisions. It can be based on fundamental analysis, technical analysis, or a combination of both.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.