Do Binary Brokers Really Pay?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Yes, reputable binary brokers pay. However, payment security and frequency depend heavily on the broker's integrity and the regulatory framework governing its activities.

Proper payments are usually made by regulated and reputable companies. The highest payout binary brokers let traders take up to 100% of their profits. In this comprehensive guide, we delve into the intricacies of binary options payouts, exploring the typical risks and regulatory considerations, and advise beginners on how to navigate this dynamic market with confidence.

Do binary brokers pay?

The simple answer is yes, but the frequency and security of payments largely depend on the broker's trustworthiness and the regulatory environment it operates in.

Reliable brokers are typically regulated by major financial authorities that ensure compliance with strict standards, including timely payouts. Profits from successful trades can vary significantly, with some brokers offering up to 100% or more on certain contracts. For example, in Japan, roughly one in four traders earns on binary options, and the average payout rate is about 95%.

When discussing the possibility of working with binary brokers, it is important to remember that access to such services may depend on your country of residence. Binary options may be prohibited or restricted by law in some jurisdictions. Before engaging in binary options trading, make sure you are fully aware of the laws and regulations in your country regarding such financial instruments.

Are binary brokers legit in my country?

Before engaging in binary options trading, it is crucial to understand the regulation in your country. Here is a brief overview of binary broker regulation in some major regions:

United States : In the United States, binary options are regulated by the Securities and Exchange Commission ( SEC) and the Commodity Futures Trading Commission (CFTC). Binary options trading for retail investors is limited and requires registration with specialized platforms

European Union : In the European Union, binary options are regulated in accordance with the ESMA (European Securities and Markets Authority) directive. It includes measures aimed at protecting investors, including restrictions on selling binary options to retail investors

Japan : In Japan, binary options are regulated by the Financial Services Agency ( FSA). The FSA ensures the stability of the financial system and the protection of investors through regulatory measures

South Africa : In South Africa, binary options are regulated by the Financial Sector Conduct Authority ( FSCA). The FSCA regulates market conduct and ensures fair treatment of financial services consumers

Please note that the regulatory environment may change, and it is always recommended to check current regulatory acts and rules in your country before engaging in binary options trading.

How do binary options brokers make money?

For binary options brokers, the main sources of income are:

1. Payout Structure : While traditional brokers often earn from spreads (the difference between the buy and sell price) or commissions on trades, binary options brokers do not usually charge such fees directly. Instead, their revenue model is based on the difference between the payout percentage and the actual risk they take.

When you place a binary option trade, you predict whether an asset's price will rise or fall within a certain time frame. If you are right, the broker pays you a predetermined percentage of your investment (e.g., 80-90%). If you are wrong, you lose your investment. The broker benefits from this difference, as the total payout for winning trades is usually less than the total amount of traders’ losses.

For example, you are investing $100, and the payout is 80%. If you win, you will receive $180 ($100 investment + $80 profit). If you lose, the broker will keep your $100.

2. Trading Volume: Brokers make money on high trading volumes. The more transactions are made on a broker’s trading platform, the more the company earns from its payout structure. Even with many winning trades, the system generally works in favor of the broker.

3. Additional Fees : Some brokers charge additional fees, such as withdrawal fees, inactivity fees for dormant accounts, or fees for using certain payment methods. These fees can add up and contribute to the broker's revenue.

4. Hedging : Some brokers hedge their positions by placing trades in the opposite direction of their clients' trades in the real market. This way, they can offset potential losses from successful trades by their clients, ensuring a more stable profit margin.

In summary, binary options brokers make money through the structured payout system, trading volume, additional fees, and sometimes hedging strategies. This model ensures that over time, the broker earns a profit from the cumulative trading activity on their platform.

So, to see how much brokers earn, refer to the examples in the table below.

| Broker name | Highest payout, % | Trading fee | Non- Trading fee | Minimum deposit | Bonus, % | Deposit fee | Withdrawal fee, % | Inactivity fee | Open an acoount |

|---|---|---|---|---|---|---|---|---|---|

| Pocket Option | 96 | $0.65 per option contract | No | $5 | 50 | No | 1 | No | Open an account Your capital is at risk. |

| Binarium | 90 | Yes | No | $5 | 20-100 | No | 0-1 | No | Open an account Your capital is at risk. |

100 | Yes | Yes | $5 | 100 | No | Depends on method | $50 per year | Open an account Your capital is at risk.

| |

| QUOTEX | 95 | No | No | $10 | 30 | No | No | $50 per year | Open an account Your capital is at risk. |

| IQcent | 95 | Yes | Yes | $20 | 100 | 5,00% | 5 | $10 monthly | Open an account Your capital is at risk. |

| RaceOption | 90 | 1-2,5% | No | $10 | 20-100 | 5,00% | 0-5 | $10 monthly | Open an account Your capital is at risk. |

How do Binary options brokers pay money?

When traders inquire, "Do binary brokers pay?", they are often concerned about the transparency and straightforwardness of the payment process. Most legitimate brokers will outline their payout structures and withdrawal processes clearly on their platforms. These typically include:

| Payment Method | Description | Pros | Cons |

|---|---|---|---|

| Bank Transfer | Money is transferred directly to the client's bank account. Transfer time may vary depending on the bank and country | Secure. Widely accepted | Slow processing time. Potential fees |

| Electronic Wallets | Money is transferred to the client's electronic wallet, such as PayPal, Skrill, Neteller, and others. This is usually the fastest way to receive funds | Fast processing time. Convenient | Fees may apply. Limited availability depending on region |

| Credit/Debit Cards | Money is transferred to the client's credit or debit card. Processing time may depend on the bank and payment system | Instant or same-day processing. Widely accepted | Potential fees. Security concerns due to fraud possibilities |

| Check | Money is sent to the client in the form of a bank or electronic check. Delivery and processing time may take several days | Physical proof of payment | Slow delivery time. Potential for check to be lost or stolen |

| Cryptocurrencies | Money is transferred to the client's wallet in the form of cryptocurrency, such as Bitcoin, Ethereum, and others. This is typically a fast and anonymous method of payment | Fast transaction time. Anonymity | Volatility in cryptocurrency prices may lead to loss. Limited acceptance compared to fiat currencies |

How to avoid problems with non-payments from binary brokers?

Facing payment issues with a binary options broker can be a frustrating experience, but there are steps traders can take to address the situation effectively. To mitigate the risk of encountering such issues and protect their investments, traders must be proactive and vigilant.

Maintain comprehensive records

Keeping thorough records of all transactions and communications with your binary options broker is essential. This documentation can serve as evidence in the event of a payment dispute and help support your case when seeking resolution.Choose reputable brokers

Selecting a reputable binary options broker is crucial for safeguarding your investments. Conduct thorough research before choosing a broker, checking regulatory licenses, reading client reviews, and assessing the broker's track record for reliability and integrity.Stay informed about Industry developments

Keeping abreast of industry news, developments, and regulatory changes can help you make informed decisions and identify potential risks before they escalate into payment issues. Stay informed through reputable financial news sources, forums, and industry publications.Be wary of unrealistic promises

Exercise caution when brokers make unrealistic promises of guaranteed returns or pressure you to deposit funds quickly without proper due diligence. Remember, if it sounds too good to be true, it probably is.Watch for red flags

Be vigilant for warning signs of potential scams, such as unresponsive customer support, delays in processing withdrawals, or discrepancies in account balances. Trust your instincts and investigate any suspicious activity promptly.Report suspected fraud

If you suspect fraudulent activity or encounter payment issues with your binary options broker, don't hesitate to report it. Contact regulatory authorities, industry ombudsmen, or consumer protection agencies to file a complaint and seek assistance in resolving the issue.

Here are some examples where complaints about binary options fraud led to resolutions:

SEC Settlement with Kai Petersen and Associates:

Kai Petersen, along with Gil and Raz Beserglik, were involved in a significant binary options fraud. They agreed to pay substantial penalties and disgorgements to settle the SEC's charges without admitting or denying the allegations. Although the settlement amounted to millions of dollars, it primarily funded the SEC's investor protection programs rather than fully reimbursing the victims.

SpotOption Case:

The SEC charged SpotOption and its executives, Pini Peter and Ran Amiran, for defrauding investors out of more than $100 million through deceptive binary options trading schemes. The case highlighted SpotOption's manipulation of trading platforms and payout structures to ensure investor losses. This action by the SEC demonstrated a commitment to holding top executives accountable for such fraudulent activities.

Tommy Rutgersson's Case:

Tommy Rutgersson from Sweden experienced a binary options scam with SecuredOptions, where he and his brother lost around €100,000. After extensive efforts, including legal action and media exposure, the invested money was traced and eventually returned. This case underscores the importance of persistent legal and regulatory pressure in resolving such fraud cases.

These examples illustrate how regulatory bodies like the SEC and law enforcement agencies can take significant actions against fraudulent binary options brokers, sometimes resulting in partial or full restitution for victims.

What to do if a binary broker doesn't pay?

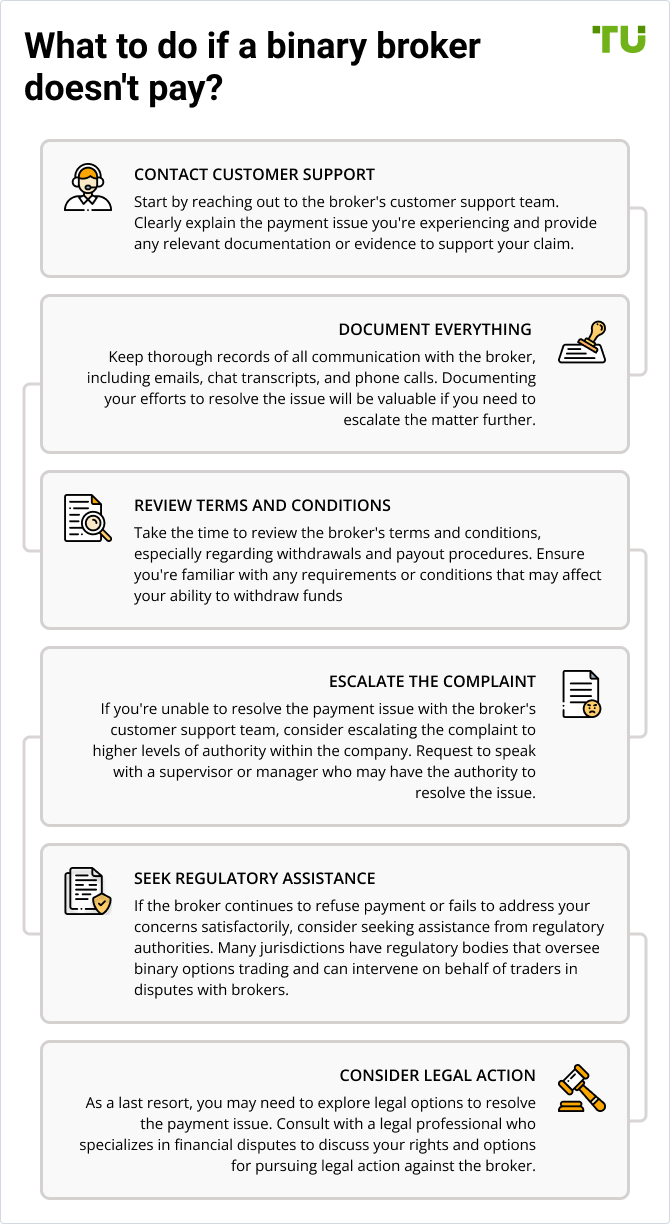

Below is a step-by-step guide for readers encountering payment problems with their binary options broker:

Contact customer support

Start by reaching out to the broker's customer support team. Clearly explain the payment issue you're experiencing and provide any relevant documentation or evidence to support your claim.

Document everything

Keep thorough records of all communication with the broker, including emails, chat transcripts, and phone calls. Documenting your efforts to resolve the issue will be valuable if you need to escalate the matter further.

Review terms and conditions

Take the time to review the broker's terms and conditions, especially regarding withdrawals and payout procedures. Ensure you're familiar with any requirements or conditions that may affect your ability to withdraw funds.

Escalate the complaint

If you're unable to resolve the payment issue with the broker's customer support team, consider escalating the complaint to higher levels of authority within the company. Request to speak with a supervisor or manager who may have the authority to resolve the issue.

Seek regulatory assistance

If the broker continues to refuse payment or fails to address your concerns satisfactorily, consider seeking assistance from regulatory authorities. Many jurisdictions have regulatory bodies that oversee binary options trading and can intervene on behalf of traders in disputes with brokers.

Consider legal action

As a last resort, you may need to explore legal options to resolve the payment issue. Consult with a legal professional who specializes in financial disputes to discuss your rights and options for pursuing legal action against the broker.

How to choose a trustable binary options broker?

Choosing the right binary options broker is paramount for beginner traders, as it sets the stage for your entire trading experience. Here are some key considerations to keep in mind when selecting a broker:

Regulation and licensing

Ensure that the broker you choose is licensed and regulated by reputable authorities in the jurisdiction where they operate. Regulatory oversight provides a layer of protection for traders and helps ensure fair and transparent trading practices.

Trading platform

Evaluate the broker's trading platform to ensure it is user-friendly, intuitive, and equipped with essential features and tools for analysis and execution. A well-designed platform can streamline your trading experience and facilitate better decision-making.

Asset variety

Look for a broker that offers a wide range of assets for trading, including currencies, commodities, stocks, and indices. Diversifying your trading portfolio across different asset classes can help spread risk and maximize opportunities for profit.

Customer support

Assess the broker's customer support services to ensure they are responsive, helpful, and accessible when you need assistance. Prompt and reliable customer support can make a significant difference in resolving issues and addressing concerns effectively.

| Broker Name | Trading Platform | Assets | Customer Support | Open an Account |

|---|---|---|---|---|

| Pocket Option | Web, Desktop (Windows and Mac), Mobile (Android and iOS), MT4, MT5. Pros: User-friendly interface, social trading, various indicators and signals, demo account. Cons: Limited regulation, high-risk nature of binary options | 130+ assets including forex, stocks, commodities, indices, and cryptocurrencies. Examples: EUR/USD, GBP/USD, gold, oil, Bitcoin | 24/7 support via chat, email, and phone. Extensive educational resources | Open an account Your capital is at risk. |

| Binarium | Web and Mobile. Pros: Easy-to-use platform, low minimum deposit. Cons: Limited advanced features | Forex, cryptocurrencies, commodities, stocks. Examples: EUR/USD, Bitcoin, gold, Apple | Email and live chat support. Comprehensive FAQ section | Open an account Your capital is at risk. |

| Binary.com | Web, Desktop, Mobile (Android and iOS). Pros: Advanced charting tools, multiple account types, demo account. Cons: Complex for beginners | 100+ assets including forex, commodities, stocks, indices. Examples: USD/JPY, gold, S&P 500 | 24/7 support via chat, email, phone. Extensive educational materials | Open an account Your capital is at risk.

|

| QUOTEX | Web, Mobile. Pros: Fast execution, user-friendly interface, demo account. Cons: Limited account types | 100+ assets including forex, commodities, indices, cryptocurrencies. Examples: EUR/USD, gold, Bitcoin | 24/7 support via chat and email | Open an account Your capital is at risk. |

| IQcent | Web, Mobile. Pros: Cent accounts, social trading features, demo account. Cons: Higher minimum deposit | 100+ assets including forex, commodities, stocks, indices, cryptocurrencies. Examples: EUR/USD, gold, Apple | 24/7 support via chat, email, phone. Educational resources available | Open an account Your capital is at risk. |

| RaceOption | Web, Mobile. Pros: High payouts, fast withdrawals, demo account. Cons: Higher minimum deposit | 100+ assets including forex, commodities, indices, cryptocurrencies. Examples: USD/JPY, oil, Bitcoin | 24/7 support via chat, email, phone. Limited educational resources | Open an account Your capital is at risk. |

Summary:

Pocket Option stands out for its social trading features and extensive range of assets but has limited regulatory oversight

Binarium offers a straightforward platform with low minimum deposits, ideal for beginners but lacks advanced features

Binary.com provides a robust platform with advanced tools suitable for experienced traders but can be complex for novices

QUOTEX is known for its fast execution and user-friendly interface but offers fewer account types

IQcent offers cent accounts and social trading features but requires a higher minimum deposit

RaceOption provides high payouts and quick withdrawals but also requires a higher minimum deposit and has fewer educational resources

Why binary options are highly risky investments?

Binary options are highly risky investments, and most traders lose their money for several reasons:

All-or-Nothing Structure. Traders bet on whether an asset's price will be above or below a certain level at a specified time. If their prediction is incorrect, they lose their entire investment.

Short Time Frames. This increases the difficulty of accurately predicting price movements, leading to a higher likelihood of losses.

High Fees and Commissions. These costs are often not clearly disclosed upfront.

Low Winning Probability. The probability of winning a binary options trade is typically less than 50%, especially when factoring in the broker’s edge. Over time, the odds are stacked against the trader, leading to cumulative losses.

Lack of Regulation. This means there is little protection for traders against fraudulent activities or unfair practices.

Due to these factors, binary options trading is considered highly risky, and the majority of traders end up losing their money. It's essential for anyone considering binary options to fully understand the risks and approach this type of investment with caution.

Expert opinion

When choosing a binary options broker, I follow a systematic approach to ensure reliability, security, and favorable trading conditions. I recommend researching the broker's reputation by reading reviews and ratings on trusted financial websites and forums. Positive feedback from other traders is a good indicator of reliability.

Next, always compare the payout rates offered by different brokers. Competitive payout rates, such as 85% for successful trades, are essential for maximizing profits. However, I also pay close attention to any conditions or fees associated with these rates.

It is important to evaluate the available deposit and withdrawal methods. A reliable broker should offer a variety of secure and convenient options, including PayPal, Skrill, and bank transfers. I always test the broker's platform using a demo account. This allows me to familiarize myself with the interface, tools, and overall user experience without risking real money. A good demo account should closely mimic live trading conditions. By following these steps, you will be able to choose a reliable broker, optimize my trading strategy, and withdraw your profit without any problems.

Conclusion

The question of "Do binary brokers pay?" is answered affirmatively when dealing with regulated and reputable brokers. But the key to a successful trading experience is not only knowing that binary brokers pay, but also ensuring that you choose a broker that aligns with your trading needs and financial goals. Navigating the binary options industry requires vigilance, skepticism, and a healthy dose of caution.

Binary options trading can indeed be profitable, but it carries considerable risks that should not be overlooked. The binary nature of these options means that an incorrect prediction results in a total loss of the invested amount. Therefore, traders must exercise due diligence, understanding both the potential rewards and the significant risks involved.

By being aware of the prevalent scams and red flags, educating yourself about the risks involved, and exercising due diligence before investing, you can protect yourself from falling victim to fraudulent practices. Trust your instincts, conduct thorough research, and seek advice from trusted sources to safeguard your investments and financial security. Remember, trading is a journey, not a destination, so stay patient, stay disciplined, and keep learning and growing as a trader.

FAQs

Why may binary options brokers refuse to pay out winnings?

There are several common reasons for this. Binary options brokers may deny payouts due to issues with account verification, bonus terms, or suspected fraudulent activity. Sometimes, market volatility and liquidity limits can also prevent brokers from making payments promptly.

How can I resolve payment issues with a binary options broker?

First, try to contact the company’s client support to resolve the issue directly. Keep thorough records of all transactions and communications, and file a complaint with regulatory authorities or seek legal assistance if necessary.

What are the signs of a potential binary options scam?

Be on the alert if the broker guarantees returns, tries to convince you to deposit funds quickly, and does not provide clear information about fees and risks. Also be careful if you see poor client reviews or find out about regulatory sanctions.

What steps can I take to prevent payment issues with binary options brokers?

Choose reputable brokers with positive reviews, thoroughly review their trading conditions, and stay informed about industry developments. Keeping comprehensive records of transactions and communications can also help resolve disputes more effectively.

How can I check the transparency and reliability of a binary options broker?

Review its regulatory filings, assess its track record, and read client reviews. It is also important to make sure the broker is licensed and regulated by reputable authorities in the jurisdiction where it operates.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

The CFTC protects the public from fraud, manipulation, and abusive practices related to the sale of commodity and financial futures and options, and to fosters open, competitive, and financially sound futures and option markets.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.