DeFi vs. Traditional Banks: Examining The Rise Of Decentralized Finance

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

DeFi is a natural progression of the market, as it was needed to allow free trade and exchange of crypto between people. Banks are inherently more dangerous than DeFi — the 2008 stock market crash is a great illustration of that. DeFi isn’t going to kill the banks, the likely outcome is cooperation. Most of the risks DeFi poses is caused by poor execution, rather than malice (as in the case with banks). At the end, DeFi and Traditional banking will marry each other if the CBDCs are to be mass-adopted.

If you’re just trying to understand what DeFi is — this article is for you. Read it to understand how the DeFi ecosystem works, why it was made that way and what makes it similar to the traditional banking system. We’ll also explore inherent risks of the DeFi, how they are handled in traditional banking and what it means for the end user — you.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

DeFi — the banking in reverse for the decentralized economy

Imagine you have a financial system run by geeks who don’t want any bureaucracy around — that’s what Decentralized Finances, or DeFi, is in nutshell. Let’s break it down step by step.

How DeFi became a thing and why

DeFi is actually the natural stage of market development. Pre-2010, crypto was a wild west — you had to look for people to come up online and sell you the crypto you were looking for. First exchange platforms like BitcoinMarket.com started to pop-up, and soon people had Mt. Gox, Bitstamp, Coinbase, but it was quickly proven why the future of crypto is only with DeFi.

Jed MacCaleb acquired Mt. Gox. (Magic: The Gathering Online Exchange) domain name in 2007 and made it into crypto exchange platform, but then sold it in 2011 to Mark Karpeles and quickly the website got grifted by an unknown hacker who took all the crypto and went away. Mt. Gox bounced back and was handling nearly 70% of the Bitcoin exchange transactions by 2013, but the damage was done and people quickly realized they can’t rely on any centralized exchange at all.

Post-2011, crypto was facing a question: how to decentralize crypto trading? — Mt. Gox hack proved that crypto can’t rely on third-party websites trying to run an exchange, since they get hacked really quickly, rely on the whims of their owners, and serve as targets for attackers. Vitalik Buterin realized this quicker than others and started to cook hard: he went on and on to push Ethereum beyond its capabilities and develop what is known as Smart Contracts.

3 key problems of pre-DeFi crypto smart contracts solved

Low liquidity markets — not enough people offering to sell or buy at the expected price, which breaks down market dynamics.

Over reliance on third parties — the owner of the crypto exchange can just sell it on the whim. Case with FTX highlighted this problem again — the exchange team can just use your money to do overleveraged illegal trades using insider data.

Wobbling prices — result of being a low-liquidity market, pricing for cryptos wobbled too much as there weren't enough buy-sell orders to support natural price movement.

How smart contracts unlocked DeFi Market for the whole crypto

DeFi is how you reduce volatility in a crypto economy. See, in part, crypto is volatile because there isn’t enough liquidity in the market to support price movement — not enough people are ready to buy or sell, and the market as a whole is still in an early speculative phase.

In 2015 Ethereum launched smart-contracts which did 3 things:

Eliminated the need for humans as a third party: smart-contracts allowed automated, on-the-fly currency exchange without human intervention.

Allowed to transparently run autonomous programs inside the blockchain: you could write a simple script, deploy it in the blockchain, and have people be able to scan the full code of that script before using it.

Mint Crypto without creating the underlying blockchain: lock a number of crypto or any collateral, really, in the smart-contract and you effectively can create another crypto.

And with that, 3 key things were resolved in crypto space:

Trustless execution: every smart-contract is executed in public, without the need to disclose your or theirs identity.

Eliminated the possibility of a grift: every crypto-to-crypto swap operation since the launch of smart-contracts needed no human to operate, and thus, eliminated the possibility to scam you out of money during exchange.

Allowed the DeFi market to appear: since you have a Trustless Execution and No-Grift system, the decentralized finances technology is unlocked.

How DeFi went from smart contracts to decentralized banking system

To explain what happened next in DeFi let’s take a quick dive into Traditional Banking. Every bank out there allows you to place deposits and earn a small % for holding your money. Those deposited funds are used by the bank to lend off credits — mortgages, leases, corporate write-offs and so on.

The point is — thanks to the depositary system, banks could access more money than they essentially had stored, increase their profits, and tap into your savings like it’s their own funds. Where’d you think those deposited funds go if you lock them for 12 months, and why would the bank pay you an extra for holding them longer and not withdrawing when you want to?

Think of the deposited funds inside the bank as the pool of money the bank can use. Say, that bank wants to give credits in a foreign currency, but how? It does two things: buys up some of that currency and opens up deposits in that currency, both of which serve as a pool of liquidity — funds that could be used by the bank to lend off money for a while. Deposited money is used for credits, and in case of mishap, the bank covers losses with currency they purchased beforehand. You won’t even notice this trick happens in real time, but that’s why banks don’t want you to withdraw deposited funds early — they need a guarantee they can use your money for a while.

How liquidity pools unlocked the full potential of DeFi

Wouldn’t it be cool to be able to deposit your crypto and receive monthly payments? That’s what Liquidity Pools are for — smart-contracts that can hold large lumps of money, provided by the people, which can be used for all kinds of things: leveraged trading, lending, supporting a currency price on the market, providing more money to work with during cryptocurrency exchange.

Here what liquidity pools did for Crypto:

You can lock your crypto to receive payments in that same coin overtime.

This created incentive for people to Lock Value, and allow for money to be aggregated.

Those smart-contracts can then provide money to the market: for trading or lending.

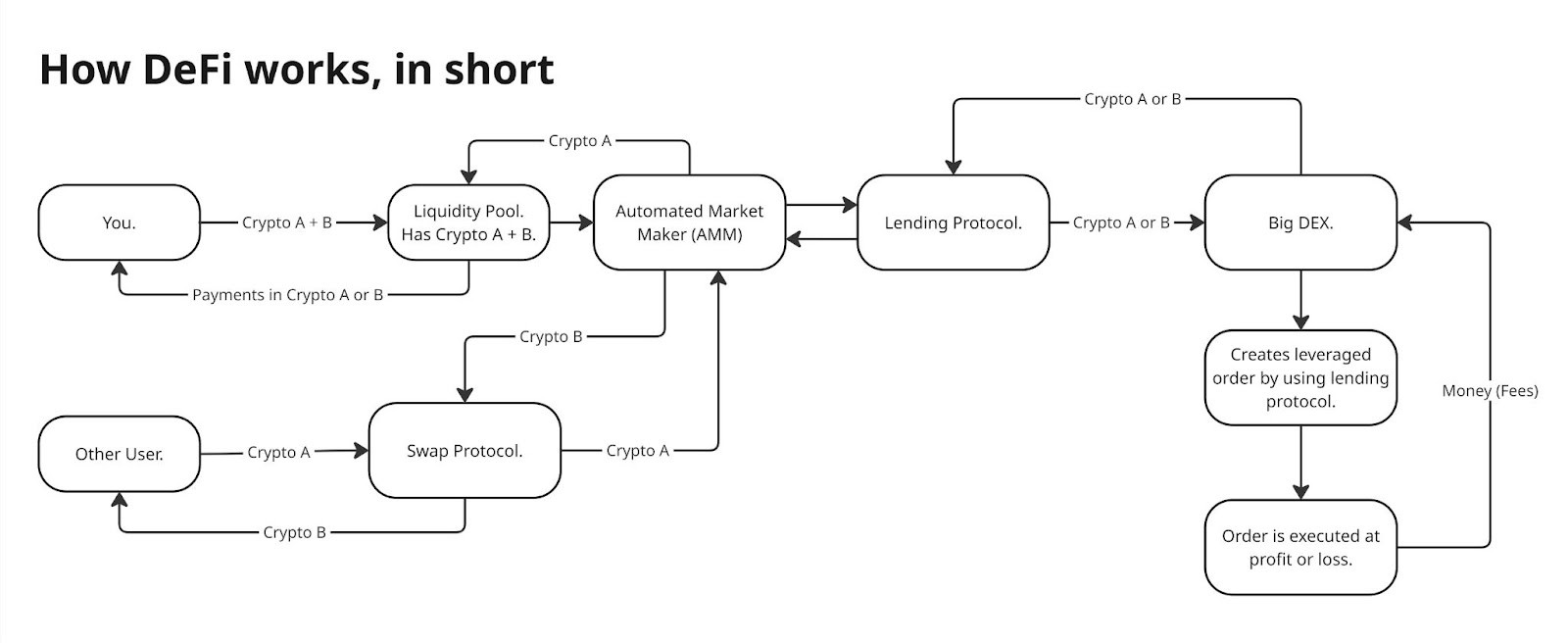

Next step after the liquidity pools are AMMs, or Automated Market Makers. AMM’s are why automated SWAP platforms exist: those are the protocols that place orders on the market, sell or buy, with the sole purpose of letting you swap Coin A into Coin B. For this to work, people have to lock in their crypto in the Liquidity Pool — both Coin A and Coin B, preferably one being a stablecoin. Next, those funds are taken by AMM the very instant someone wants to swap Coin A to Coin B or vice-versa.

With liquidity pools and AMMs, the SWAP protocols can be run. What are SWAP protocols? The Decentralized Exchange Platforms, or DEXs for short, that can use your wallet as a trading account and let you swap Coin A into Coin B without KYC and the fear of being hacked. Think Uniswap, SunSwap, Hyperliquid, Curve Finance, Meteora, and all of the one-page websites that allow you to hook up a wallet and swap crypto.

What DeFi shares in common with baking system

What DeFi does is — how bankers say it — makes money work for money. If you grossly oversimplify, what happens is that people provide money to a liquidity pool, AMM uses that money to swap cryptocurrency on demand or provide it as a leverage during DEX trading — depending on the case. What this does is creates a Deposit-Credit dynamic — people can stake (deposit) their crypto, earn a % off of it, while other people can tap into those funds via Swap or Lending Protocols. All of this runs without a single office clerk — solemnly with smart-contracts, on-demand and without human intervention.

The Deposit-Credit dynamic turned crypto into a decentralized version of the banking system — self-reliant, self-sufficient and capable of currency exchange on the fly. This was like a jump from steam engines to landing on the moon for the whole ecosystem — people were finally able to swap crypto without third parties, and cryptocurrencies themselves got a use-case as being used as liquidity in the pools (or deposits).

What came after DeFi plugged in the Deposit-Credit system?

Staking dApps started to pop-up, offering people to lend crypto and earn off of it.

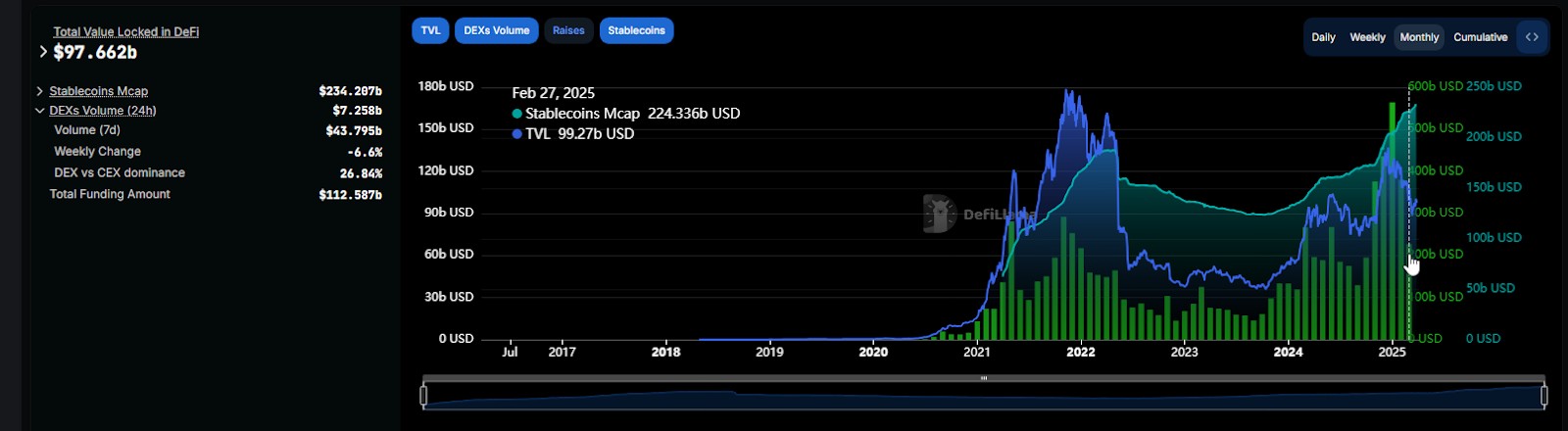

Total Value Locked (TVL) metric appeared — it says how much money people locked up in liquidity pools.

DEX platforms started to offer leverage trading — something unheard of before.

Cryptocurrencies gained access to financial support generated by liquidity pools.

Crypto prices started to wobble much less — thanks to AMMs there was always someone ready to sell or buy coins at the price you expected.

DEXes started to rival with the Centralized Exchanges (CEXs) and offer their users comparable experience.

Here’s how much money is in the DeFi system as of 2025 — $97 Billions. $7B out of those are produced by daily trading volume on DEXs, which snowballs into $43B weekly trading volume. On top of that, DeFi uses stablecoins inside numerous liquidity pools, which amass a total of $225B in market cap. In short — DeFi is big, but still smaller than Bank of America at $3.2T. To scale — 1,000,000,000 is a billion, while 1,000,000,000,000 is a trillion.

DeFi vs Centralized Banking — analyzing the risks

DeFi has a whole new set of risks than banking. See, in traditional banking, it is expected that at some point authorities will abuse their power, give off a few privileged mortgages supported by low-level assets, and snowball your entire economy into a 2008 stock market crash — this is what you get by letting people have too much freedom with your finances. Another side-effect of having too many people in the banking is that it is costly, slow, and cannot be integrated via API into any app under 5 minutes, plus you have to comply with a ton of regulations to actually access money.

DeFi gets rid of power abuse by authorities — can’t snowball it into privileged mortgages, but it comes with different flavours of danger.

DeFi and Banking compared in terms of risks

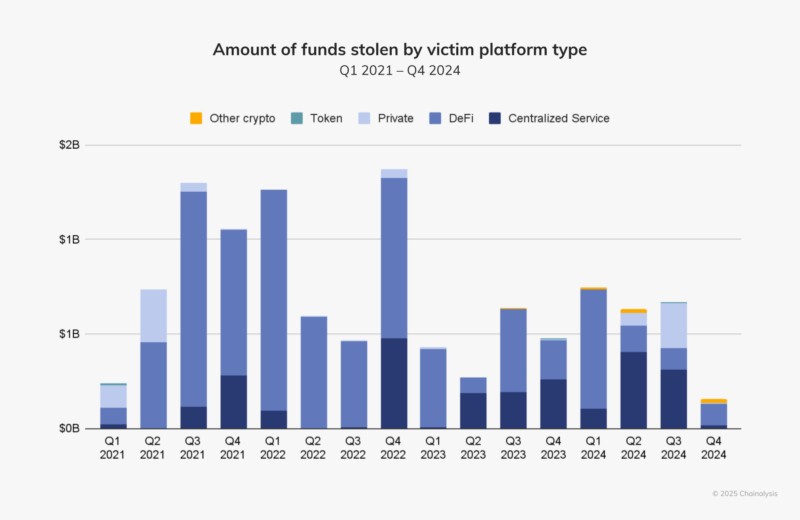

Protocols can be hacked — it’s hard, teams spend lots of time to tackle the issue, but it is still possible. When protocols are hacked — money is gone, drained, and up to be traced by Chainalysis and ZachXBT. In some cases hackers return money back, in other — FBI takes over the case and together with Interpol they crack down the hackers real hard.

Bank hacks are rare — we have the 1994 russian bank hack, the recent Slavik heist in 2014, some people getting creative with ATMs to snatch $45M in 2013 , but that’s it — direct bank hacks are rare.

Major bank hacks, like with HBSC, Equifax, Heartland, CapitalOne and so on often result in personal financial data theft — not a direct money extraction. After data is stolen, it has to be processed by other criminals, usually phishers, to extract any money out of victims.

Some members of Lazarus Group got really creative with SWIFT in 2015-2016 and snatched $100M directly from banks, but that is rather an exception, than a rule.

On the contrary, here are risks that are unique to banking system:

Inflation — inherent flaw of the unlimited supply.

Interest rate hikes — Federal Reserve wants money and gets it by hiking the rates, value is not adjusted dynamically for the whole market and is calculated by hand.

Ownership changes — yesterday it was a private bank, tomorrow it is nationalized and all the accounts are thoroughly reviewed.

Government takedowns — if bank is used for money laundering, it can, and will be taken down.

What types of risks DeFi suffer from the most

DeFi Hacks happen much more often than bank hacks. While the total amount of stolen funds started to stagnate year over year thanks to North Korean Lazarus Group getting some well deserved rest, it is still a risk to consider. On average, DeFi bleeded around $1B a year since 2021 due to being violated by the hackers.

Hacks are the result of poor security, and hackers are priced into the market. In the fiat world, you have the SEC as the natural regulator of economic behaviour. In crypto, hackers are the force of nature that enforces natural selection principles onto the DeFi — taking the weak protocols for others to improve their security.

After DeFi hacks comes impermanent loss — it’s the loss over the price wobbling of the assets in the liquidity pool. Goes something like this: you stake Crypto A and Crypto B, suppose, B starts to drop in price and A remains steady (in range), then, you suffer an impermanent loss at rate of B bleeding value on the market. Happens all the time and people are aware of that, which is why liquidity pools have to offer returns that account for impermanent loss. Modern liquidity pools account for that dynamically — AMM adjusts returns in a way that helps to reduce losses from the market fluctuations, but hey, it’s crypto, you have swings of 30% to either side in a day here.

How do AMMs tackle the impermanent loss?

You put Crypto A and Crypto B into a liquidity pool.

Crypto B loses some value, AMM throws in some of the Crypto A to account for the loss, you end up with a slightly bigger amount of Crypto A and less of Crypto B.

Same goes for the growth in price: if Crypto A pumps, AMM takes some of it away from you to keep the balance.

To make things balanced, AMM treats the liquidity pool as a whole, and takes an equal amount from each user, proportionally to the size of their stake so they won’t lose too much money.

Why banking risks are more dangerous than any DeFi hack

No amount of DeFi hacks can topple the one case when banks go unchecked and lend too many mortgages that use funny things as collateral. See, when banks bleed money, Wall Street picks it up to make insane amounts of profit — generational wealth made on the bones crushed by the market snowballing down the drain.

Remember this: the stock market crash of 2008, caused by banks that gave too many mortgages supported by thin air, resulted in $16T wiped out only from the household market. To scale — that’s 4 years of Germany’s GDP from 2021 to 2025 in less than a year being annihilated at once. And Wall Street guys picked it up to make insane short positions — basically, borrowing assets to sell them at the height of price and buying them back at the lowest lows. Michael Burry is famous for predicting the stock market crash of 2008 because he knew you can’t support mortgages with thin air and call it a day — people called that Big Short and made a movie about it.

While DeFi market risks only with digital security — when banks screw over, it sends ripples through the entire world economy at once and causes things like Great Recession. No amount of crypto schemes can cause that level of destruction at once to the whole world, as the DeFi is silently isolated inside the crypto ecosystem.

Why CBDC is the marriage ring for Banks and DeFi

Coexistence and cooperation is the past of least resistance. See, banks are fond of CBDCs, and those come with the ability to connect modern banking systems with the DeFi markets, as Central Bank Digital Currencies are easier to put into Hybrid Liquidity Pools (something you are going to see in 5 years time) than traditional fiat money. Currently, you have to convert fiat into a stablecoins to directly transfer their value, with CBDCs you won’t need that conversion, and — in theory — should be able to stake eddies together with crypto inside a Liquidity Pool that allows to freely swap Crypto to CBDCs without any KYC.

Technically, staking is the same mechanism as the Bank Deposits, and CBDCs can play on both fields at once if they are mass adopted.

There are number of risks to the Hybrid Liquidity Pools approach:

Once staked inside the LP, CBDCs can be remotely deactivated by the issuing bank if they have such a degree of control, which would force the market to adapt.

If said CBDCs are deactivated inside the Hybrid Liquidity Pool, the supported asset is effectively killed — all the value from deactivated CBDCs are instantly evaporated, which creates an opening for crypto price manipulation.

Banks can view CBDC-to-Crypto exchange and Liquidity Staking as money laundering, and ban such use cases for their CBDCs.

Here what outweighs the risks of CBDCs coming into DeFi:

Tether Foundation already acts like a Payment Service Provider.

Stablecoins are just CBDCs with extra steps.

Direct Fiat-Crypto Liquidity Pools would mean a big leap for DeFi and Traditional Banking.

If CBDCs are allowed to be used in Liquidity Pools (or if there are no limitations on it) crypto would get a power up the likes of which the world has never seen before.

Both, DeFi and banking, serve the same purpose — to maintain the financial infrastructure behind their underlying systems. CBDC is the marriage ring that would allow them both to utilize powers of each other without damaging the other side. On one hand — SEC and other regulators would have full control over fiat currency in the crypto ecosystem, on the other — crypto would gain a direct fiat-to-crypto link it has been looking for over a decade now.

Until this happens, you still have the option to ride the crypto wave through investments. In the table below, we have presented the top crypto exchanges for beginners. You can compare them and choose the best one as per your personal needs:

| Crypto | Foundation year | Min. Deposit, $ | Coins Supported | Spot Taker fee, % | Spot Maker Fee, % | Alerts | Copy trading | Tier-1 regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2017 | 10 | 329 | 0,1 | 0,08 | Yes | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 2011 | 10 | 278 | 0,4 | 0,25 | Yes | Yes | Yes | 8.48 | Open an account Your capital is at risk. |

|

| Yes | 2016 | 1 | 250 | 0,5 | 0,25 | Yes | No | Yes | 8.36 | Open an account Your capital is at risk. |

|

| Yes | 2018 | 1 | 72 | 0,2 | 0,1 | Yes | Yes | Yes | 7.41 | Open an account Your capital is at risk. |

|

| Yes | 2004 | No | 1817 | 0 | 0 | No | No | No | 7.3 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Will DeFi replace traditional banking?

If you're just getting started in crypto, understand this first: crypto and fiat aren't enemies — they're entangled. Most people still use fiat to enter or exit the crypto market, and centralized exchanges are deeply tied to traditional banking. Banks have been around for thousands of years for a reason—the Lindy Effect shows that systems that last tend to keep lasting. So even if you're passionate about decentralization, don’t ignore the power and influence of legacy finance. Learn how both systems interact, because your money will likely touch both.

Second, don’t fall into the trap of thinking DeFi will “replace” banks overnight. It’s more accurate to say DeFi and banking are evolving alongside each other. Banks will always serve countries and regulatory systems, while DeFi represents the raw, borderless potential of peer-to-peer finance. As a beginner, your edge lies in understanding both sides. Use banks for stability and access, but study DeFi for innovation and autonomy. Treat them as two toolsets in your financial toolbox, not rivals.

Conclusion

DeFi isn’t here to kill off banks — it’s more like giving the old system a new engine. Central Bank Digital Currencies could end up being the bridge that links both worlds, letting crypto plug directly into the traditional money system. That changes everything: what we call “staking” in crypto could soon look a lot like your savings account, just with more control in your hands. If you’re smart, you’ll learn how to work with both. Use banks for what they’re good at, and lean on DeFi where it gives you more freedom. That’s where the real edge is.

FAQ

Will DeFi replace traditional banking?

No, most likely, they’re going to coexist and cooperate.

Is DeFi better than regular baking systems?

They aren’t in the same weight category to be properly compared, but in essence — DeFi is faster and cheaper, while banks are safer.

Can DeFi pose danger to the banking system?

Nope, they play in separate fields. Unless banking starts to be dependent on DeFi — they are no danger to each other.

What made DeFi real?

Smart-contracts, Liquidity Pools, Automated Market Makers (AMMs), tokenization standards, the Lending Protocols.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.