Forex Trading NZ – Best Forex Brokers, Regulation & Taxes

Best Forex Broker In New Zealand - Tickmill

Top Forex Brokers In New Zealand:

-

1

Tickmill - Accepts New Zealand traders, Low spreads

-

2

FxPro - Accepts New Zealand traders, Big choice of deposit options

-

3

XM - Accepts New Zealand traders, Low spreads

-

4

XTB - Accepts New Zealand traders, Big choice of trading assets

-

5

IG - Offers New Zealand's traders big choice of trading assets

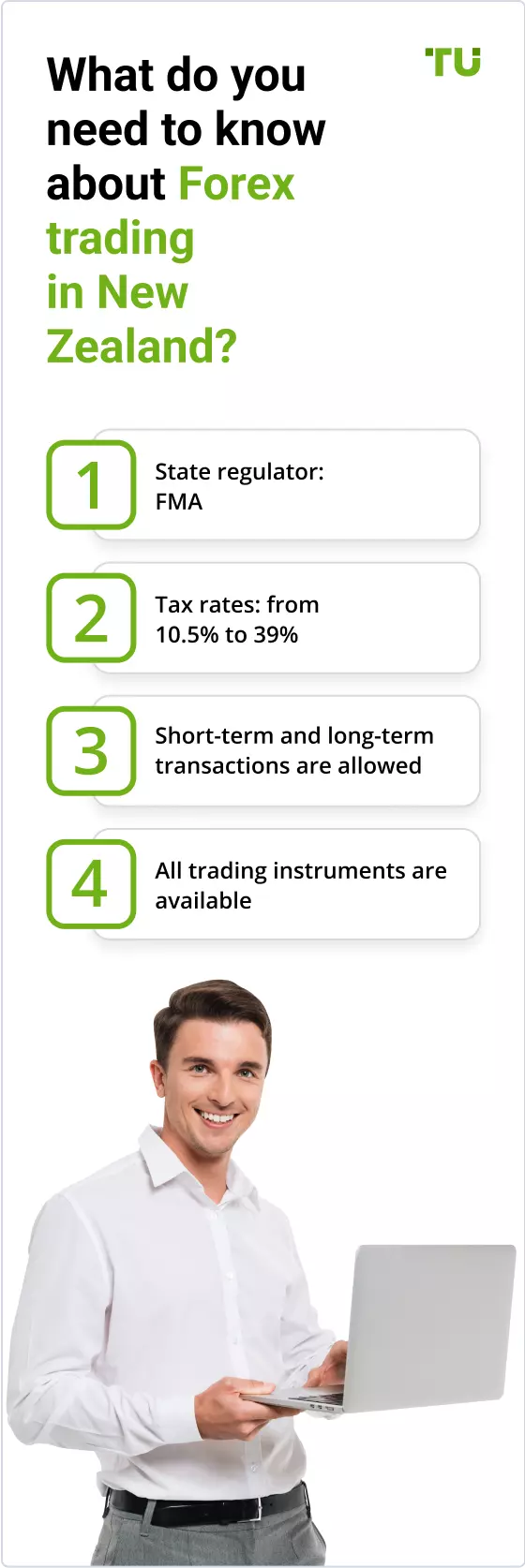

Forex trading is quite popular among traders and investors in New Zealand. Before starting Forex trading, New Zealand citizens have to be aware that they could only trade on the Forex market with a broker that is authorized by the local regulator, which is The Financial Markets Authority (FMA), or accepts traders from New Zealand.

If you are looking for the best forex broker New Zealand, we have prepared a list of brokers that can be used by New Zealand citizens. In this article, you will discover what are the best Forex trading NZ brokers, what is the Forex trading NZ tax, and some other things NZ Forex traders should know.

Top 14 Best Forex Brokers In New Zealand

The Traders Union experts have carefully analyzed the best Forex brokers in the market to provide you with a selection of the best 15 Forex brokers in New Zealand.

Our main criteria for identifying these brokers was that they either have to be regulated by the FMA, or they must be authorized to accept clients from New Zealand. Also, we did not neglect favourable trading conditions for these brokers, and you can be sure that you will get the best trading experience while trading with these brokers.

To help you learn more about the brokers included in this rating, the Traders Union experts have done a complex analysis of them, and they created the below table to make your job easier.

| Broker | Regulation | Accepting NZ residents | Advantages | Minimum Deposit |

|---|---|---|---|---|

|

CySEC, FCA, FSCA |

Yes |

Accepts New Zealand traders, Low spreads |

$100 |

|

|

CySec, FCA |

Yes |

Accepts New Zealand traders, Big choice of deposit options |

$100 |

|

|

CySec, FCA |

Yes |

Accepts New Zealand traders, Low spreads |

$5 |

|

|

FCA |

Yes |

Accepts New Zealand traders, Big choice of trading assets |

$0 |

|

|

FMA, ASIC, FCA |

Yes |

FMA Regulated broker, Big choice of trading assets |

$0 |

|

|

FMA |

Yes |

FMA Regulated broker, low Forex fees |

$200 |

|

|

FMA, ASIC, FCA |

Yes |

FMA Regulated broker, low fees |

$0 |

|

|

SEC, CFA |

Yes |

Great choice of international markets, low fees |

$0 |

|

|

FMA, FCA |

Yes |

FMA Regulated broker, Big choice of trading assets |

$1 |

|

|

ASIC, FSCA |

Yes |

Accepts New Zealand traders, Big choice of trading platforms |

$100 |

|

|

CySEC, ASIC |

Yes |

Accepts New Zealand traders, Big choice of trading assets |

$100 |

|

|

FCA, MAS |

Yes |

Accepts New Zealand traders, Big choice of trading assets |

$2000 |

|

|

FCA, ASIC, DFSA |

Yes |

Accepts New Zealand traders, Very low spreads |

$0 |

|

|

FCA, ASIC |

Yes |

Accepts New Zealand traders, Big choice of trading platforms |

$200 |

Best NZ Forex Trading Platforms Comparison

| Broker | EURUSD Everage Spread | Trading Platforms | Markets (for example, forex, us stocks etc) | Investment Options | Funding Methods |

|---|---|---|---|---|---|

|

0.27 pips |

MT4, WebTrader |

Forex, stock indices, oil, gold and silver, bonds |

Copy Trading |

Credit card, debit card, bank transfers, Skrill, Neteller |

|

|

1.3 pips |

MT4, MT5, cTrader, FxPro Edge |

Forex, Spot Indices, CFDs, Spot metals, CFDs on Crypto |

Copy Trading |

Credit card, debit card, bank transfers, Skrill, PayPal, Neteller |

|

|

0.1 pips |

MT4, MT5 |

Forex, CFDs on currency, stocks, stock indices, precious metals, energy products |

Copy Trading |

Credit card, debit card, bank transfers, Skrill, Neteller |

|

|

0.9 pips |

MT4, xStation5 |

Currencies, stocks, indices, raw materials, CFDs, and cryptocurrencies |

Forex Signals |

Credit card, debit card, bank transfers, PayPal, Skrill |

|

|

1.04 pips |

MT4, L2 Dealer, IG web platform, ProRealTime |

Currencies, assets of stock and commodity markets, cryptocurrencies |

Copy Trading |

Credit card, debit card, Bank transfer |

|

|

0.845 pips |

MT4, MT5, WebTrader |

Forex, Index CFDs, Commodities, Precious Metals, Energy |

Copy Trading |

Credit card, Skrill, |

|

|

0.74 pips |

MT4, Next Generation |

Forex, Cryptocurrencies, Indices, Stocks, Commodities, ETFs |

Copy Trading |

Credit card, debit card, bank transfers |

|

|

0.1 pips |

Client Portal, Trader Workstation, IBKR Mobile |

Forex, stocks, options, futures, metals, bonds, ETF, mutual funds, CFDs |

PAMM account |

Wire, check, ACH |

|

|

0.8 pips |

WebTrader, Plus500 Platform |

Currency pairs, CFDs on commodities, metals, stocks, indices, cryptocurrencies, options and ETFs |

Copy Trading |

Debit card, credit card, bank transfers, PayPal, Skrill |

|

|

0.91 pips |

MT4, ZuluTrade, WebTrader, AvaTrade Mobile Apps |

Currency pairs, stocks, cryptocurrencies, indices, metals, commodities, CFDs |

Copy Trading |

Credit card, debit card, wire transfers, some e-wallets |

|

|

1.2 pips |

MT4, MT5, WebTrader, iress |

Forex, indices, metals, oil, gas, raw materials, securities, cryptocurrency |

Copy Trading |

Credit card, debit card, bank transfers, PayPal, Skrill, Neteller, and other |

|

|

0.7 pips |

Saxo TraderGo, Saxo TraderPro |

Forex, CFDs, stocks, ETFs, futures, bonds, Forex options, quoted options |

Trade Signals |

Credit card, debit card, bank transfers |

|

|

0.09 pips |

MT4, MT5, cTrader |

Forex, Cryptocurrency, Index CFDs, Stocks, Currency Indices, Commodities |

Copy Trading |

Credit cards, debit cards, bank transfers, electronic wallets |

|

|

1.1 pips |

MT4, MT5, WebTrader, Vantage FX App |

Currency pairs, CFDs on stocks, indices, and commodities |

Copy Trading |

Credit card, debit card, Neteller |

How to Choose the Best Forex Trading Platform in New Zealand?

Although all the brokers included in this article have great capabilities, they are not ideal for every Forex trader. Choosing the best broker for you ensures that you will get lots of satisfaction and better results while trading with it. To help you choose the best Forex trading NZ Broker, here are five aspects to pay attention to before choosing a broker:

1. Low fees

While choosing a broker, you should aim to choose a broker that has the lowest trading fees possible. This is because trading with high trading fees means that you will have less profit and bigger losses in some cases. You should also pay attention if that broker has inactivity fees or high deposit and withdrawals fees.

2. Low spreads

The spread is the difference between the bid and ask price. Trading with high spreads amplifies the risk of losing more money if you place an unsuccessful trade, but that risk is minimized if the spreads are low.

3. Variety of assets

Just in case you might want to diversify your trading instruments, you should consider choosing a broker that also gives you the possibility to trade different types of assets other than currency pairs only.

4. Reviews from users

Reviews from previous users of a broker are great sources of information if you want to choose a broker. If you see multiple negative reviews from previous users, you should be aware that there might be a problem with that broker, and it is probably not a good idea to trade with it.

5. Regulation

It is very important to choose a broker that is regulated by a reputable financial authority. It ensures that your money is safe while trading with that broker. It is usually not a good idea to choose a broker that is not regulated because that might lead to certain unpleasant situations. To check a broker’s regulation, you should visit its website because such information is often displayed on the broker’s website. Or you can search for it in other places online.

6. Lot sizes

In Forex trading, a standard lot consists of 100,000 units of the base currency. So if you want to buy a whole lot of EURUSD, you would pay €100,000 for it. If you want to trade with smaller amounts of money, you should choose a Forex broker that allows you to trade smaller lots. For example, a mini lot (0.1 lot) is 10,000 units of currency, a micro lot (0.01 lot) is 1,000 units of currency, and a micro lot (0.001 lot) is 100 units of currency.

Best FMA Regulated Forex Brokers in New Zealand

If you are especially looking for FMA regulated brokers, we have prepared a short listing of the best FMA regulated brokers for you. Here they are:

IG – Best FMA Regulated Broker

IG is a well-known broker that was established in 1974 in the UK. Since then, it has offered brokerage services to countless clients. Today, IG allows you to trade currencies, stocks, and cryptocurrencies. This broker is regulated by the FMA, ASIC, and FCA regulators. Because it has been regulated by the FMA since September 2016, it can be trusted by New Zealand traders.

IG has trading fees that vary depending on the financial instruments that are traded. Also, this broker has commissions for certain deposit options, and there is also an inactivity fee if no trading activity was performed for two years.

BlackBull Markets

BlackBull Markets is a quite popular Forex broker that has been regulated by the FMA since 2020. Other than currency pairs, this broker also lets you trade index CFDs, commodities, and precious metals.

This broker has low trading fees, which are $3 per lot per trade for Forex trading. There are no inactivity or account maintenance fees, but there is a $5 withdrawal fee.

CMC Markets

CMC Markets was founded in 1989 and is one of the largest companies in Forex and CFD trading. The firm offers a variety of trading assets, such as indices, stocks, and cryptocurrencies. A high level of trust is built on the FMA, ASIC, and FCA regulations.

CMC Markets has some trading fees that vary upon the assets that are traded and the number of trades a user makes per month. There is no deposit, withdrawal, or account management fees, but there is an inactivity fee that is charged after 12 months of inactivity.

Plus500

Since 2008, Plus500 has become an active trading platform in which traders can buy and sell over 2,000 financial instruments. Plus 500 is one of the fastest-growing brokers that offer CFDs.

Plus500 offers a wide variety of trading assets such as currency pairs, CFDs on commodities, metals, stocks, indices, cryptocurrencies, options, and ETFs.

This broker is regulated by the FMA and the FCA regulatory, which means that it can be trusted by New Zealand citizens and not only for trading different financial instruments.

This broker’s Forex trading fees are included in the spread, which is quite average for most currency pairs. Also, there are no deposit or withdrawal fees, and there is an inactivity fee that is charged after three months of inactivity.

Is Forex Trading Legit in NZ? Rules and Limitations

Just in case you were wondering if Forex trading is legal in New Zealand, it is. It is even allowed by the New Zealand Government, which created the FMA regulatory. The FMA controls the brokers that offer their services in NZ to ensure that the New Zealand citizens are safe while trading or investing in different types of financial instruments.

It is absolutely legal to trade currency pairs and other types of assets in NZ. New Zealand traders are protected against fraud by the FMA. The FMA is responsible for supervising the activities of the brokers offering their services in NZ. To learn more about the FMA rules, visit its official website.

Forex Trading in New Zealand – Basic Taxes

New Zealand does not have special taxation rules for Forex traders. All the capital gained through trading currency pairs and other types of financial instruments is considered as income.

In New Zealand, income is taxed as follows:

-

$0- $14,000 : 10.5% tax rate

-

$14,001- $48,000 : 17.5% tax rate

-

$48,001- $70,000 : 30% tax rate

-

70,001- $180,000 : 33% tax rate

-

More than $180,000 : 39% tax rate

Top 3 NZ Forex Trading Platforms for Beginners

If you are a beginner Forex trader looking for the best NZ Forex brokers for beginners, we have selected three brokers from this listing that you will enjoy using.

We paid attention to favourable trading conditions offered by brokers for beginners, such as great educational materials, easy to use platforms, reasonable account minimums, and other features.

An easy to use platform, educational materials, and cent or demo accounts are great features for beginners because they help beginner traders learn how to trade more efficiently. So you should choose a broker that offers those features.

Passive investment options, such as copy trading or PAMM, are great features for beginners because they allow beginner traders to automatically copy the trades executed by experienced traders and make higher profits.

Low account minimums and low fees are other features beginners should look for because they give them better trading conditions.

| Broker | Account minimum | Passive investment options | Accounts for beginners | Education |

|---|---|---|---|---|

|

$100 |

PAMM, Copy Trading |

Demo, Cent Account |

Trading courses, Videos, Guides, Articles |

|

|

$100 |

MAM, Copy Trading |

Demo Account |

Guides, Articles, Videos, eBooks |

How to Verify FMA Authorization

To ensure a safe trading experience, you are advised to verify whether your selected broker is authorised by the FMA (Financial Markets Authority) of New Zealand. New Zealand’s FMA is the government agency responsible for financial regulation. It sets and enforces financial regulations and ensures all financial market exchanges and participants comply.

By checking whether FMA has authorized a forex broker, you can ensure the safety of your investment. The FMA's official website defines its key statutory objective as promoting and facilitating the development of fair, efficient, and transparent financial markets. It also notes that it will use its enforcement powers against participants likely to harm capital markets' open and transparent functioning.

Follow these steps to verify FMA authorization:

Look up the FMA website: Visit the official FMA website and check their list of authorised financial service providers.

Search for a broker: In the search bar, enter the broker's name and confirm their authorization status on the FMA list.

Verify Details: Ensure that the broker’s details match the FMA records. The details to check include:

● Business name

● Location

● FSP (Financial Service Provider) Number

Check the disclosure text from the broker’s New Zealand homepage: The final step is identifying the register number from the broker's disclosure text. The disclosure text is at the bottom of the broker's NZ homepage.

Pros and Cons of Forex Trading in New Zealand

While forex trading is perceived as an easy money-making venture in New Zealand, it is quite difficult and highly engaging. Forex is the largest and most liquid market in the world. Consequently, trillions of dollars are exchanged in a single day. It can be a lucrative and flexible career for many New Zealanders. Here are its pros:

Low Cost: Forex trading incurs extremely low costs through brokerage commissions. Most forex brokers realise profits from the spreads between forex currencies. Therefore, you don't have to worry about eliminating overhead costs and separate brokerage charges.

High Liquidity: Unlike other financial markets, Forex has the highest daily trading value. As a result, it has the highest liquidity. Liquidity represents the ease with which a certain asset can get converted into cash. The high liquidity level eliminates the possibility of price anomalies and manipulation. It also provides tighter spreads leading to efficient pricing.

Suits Different Trading Styles: Since the forex markets run all day, they provide traders convenience. Short-term traders can take positions over short durations, while long-term traders can make their long-term positions.

Accessibility: The Forex market operates on a 24/5 basis. Therefore, traders can engage at their convenience.

Regulation: Trading is regulated by New Zealand’s FMA. Government regulation provides traders with a level of security over their investments.

On the other hand, the cons include:

Volatility: The forex market is highly volatile. A sudden price fluctuation can lead to unexpected losses.

Risk of loss: Forex carries high-risk levels. Traders can lose more than their initial investment.

Emotional challenges: Emotional decision-making while trading can lead to losses.

Best Time to Trade in New Zealand

No one time is identified as the best forex trading time in New Zealand. However, the global optimal time is said to be in the timeslot when the U.S./London markets overlap. This time is between 8 a.m. and noon Eastern Time (EST). For seasoned NZ investors, we have compiled three optimal time slots based on GMT+12:

5 a.m. – 12 p.m.: This period overlaps the European and Asian trading sessions. It provides liquidity and significant price movements.

12 p.m. – 7 p.m.: This period overlaps the U.S. and European sessions. It offers increased trading activity and is suitable for active traders.

7 p.m. – 5 a.m.: The Asian markets are about to open, and the U.S. markets are active. Traders can capitalise on market reactions.

Our Methodology

The TU experts have researched the market to identify the best online Forex brokers that are regulated by the FMA or accept traders from New Zealand to create this rating.

Some aspects we paid attention to while including those brokers in this rating were the fees charged by brokers, favourable trading conditions, reviews from previous users, the platforms that are used by the brokers, the selection of trading instruments, research features, and other aspects. Then, we ranked them based on their overall features.

Summary

We hope that you have enjoyed reading this article and you have identified at least one broker that you will enjoy trading with. We want you to remember that trading with a FMA regulated broker does not remove all the Forex trading risks. Which means you should still be precarious while trading currency pairs or other financial instruments with FMA regulated brokers.

FAQs

Should beginners use copy trading?

Copy trading is a great feature that can bring you higher profits, but only if you copy the trades of a very good trader. Otherwise, you will lose money.

Can I trade with brokers that are not regulated by the FMA in NZ?

You could do that, but the FMA advises NZ citizens to only use FMA regulated brokers.

Is Forex trading risky?

Yes, Forex trading is considered a high-risk investment, and you should be very precarious while doing it.

Do Forex brokers charge high fees?

Some Forex brokers charge higher fees than others, and you should pay attention to the fees charged by the broker before creating a brokerage account with it. Also, choose a broker with low spreads because the spread is also a type of fee.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses who want to improve their Google search rankings to compete with their competition.

Over the past four years, Alamin has been working independently and through online employment platforms such as Upwork and Fiverr, and also contributing to some reputable blogs. His goal is to balance informative content and provide an entertaining read to his readers.

His motto is: I can dream or I can do—I choose action.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.