How to Cash Out Bitcoin - 6 Best Options

How to cash out Bitcoin:

Сryptocurrency exchange - the most reliable option.

P2P service - the fastest and least expensive option.

Instant Exchange Services - an option for transferring military-technical cooperation to any other currencies.

Bitcoin ATMs - an option for quick cash withdrawal.

Bitcoin is fascinating, but it can also be confusing and even scary. The fluctuations alone are enough to scare some, but what happens when you want to cash out your bitcoin? Fortunately, there are several options.

In this article, we're going to cover the most viable options you have when it comes to cashing out your Bitcoin.

So, without further ado, let's begin.

Start trading cryptocurrencies right now with Coinbase!

Cryptocurrency Exchange

Our first option for cashing out Bitcoin is through a cryptocurrency exchange. What is a cryptocurrency exchange? Cryptocurrency exchanges are a popular way to cash out bitcoin.

Numerous exchanges offer this service, giving you the option to trade your cryptocurrency for another digital currency or even for fiat currency (U.S. Dollars). The most popular cryptocurrency exchange today is Coinbase.

Coinbase allows you to purchase crypto with USD. After you've bought Bitcoin, you can sell your crypto to cash out bitcoin.

Read more about 10 Best Bitcoin Brokers👍 Pros of cryptocurrency exchange

• User-friendly: Most cryptocurrency exchanges offer first-time investors a familiar, friendly way to trade and invest in cryptocurrencies. In contrast to crypto wallets and peer-to-peer transactions, which can be complicated, centralized exchange users can log in to their accounts, manage their accounts, and make transactions online.

• Reliable: In terms of transactions and trading, cryptocurrency exchanges provide an extra layer of security and reliability. Centralized exchanges offer higher comfort levels as they facilitate transactions through a centralized, well-developed platform.

👎 Cons of cryptocurrency exchange

• Cost of transactions: Cryptocurrency exchanges can charge high transaction fees, unlike peer-to-peer transactions, when you trade in large amounts.

• Hacking risk: Companies that operate cryptocurrency exchanges are responsible for their customers' holdings. Exchanges with a high volume of bitcoin are a ripe target for hackers.

How to cash out Bitcoin via Coinbase

To cash out your bitcoin on Coinbase, you need to first sell your bitcoin for cash. Here are the steps:

Using a web browser:

Step 1: Select the assets tab to view your cash balance.

Step 2: Enter the cash-out amount on the cash out tab and then click Continue.

Step 3: Next, select your cash-out destination.

Step 4: To complete the transfer, click cash out now.

With the Coinbase mobile app:

Step 1: Select > Cash out

Step 2: Choose your transfer destination and cash-out amount, then tap Preview Cash out.

Step 3: Click cash out to complete the process.

P2P Services

P2P or peer-to-peer exchanges are decentralized cryptocurrency exchanges (DEX) allowing users to carry out peer-to-peer transactions with no middlemen required. Some users prefer decentralized exchanges due to specific issues with centralized exchanges. Maybe, you also can be interested in information about types of cryptocurrency exchanges.

Verified buyers and sellers can trade cryptocurrencies hassle-free on peer-to-peer exchanges. Buyers and sellers find each other via sophisticated matching algorithms. As a buyer or seller, you may have additional features you expect from your counterpart.

By allowing market participants to transact directly without an intermediary to process transactions and retain funds, a P2P cryptocurrency exchange platform eliminates the need for order books and controls the platform's assets.

Learn more about Top-6 Free Bitcoin Signal Providers👍 Pros of P2P services

• Numerous payment choices: Conventional exchanges do not offer nearly as many payment options as P2P exchanges.

• Security: Decentralized exchanges enhance security. Secondly, there are no third parties involved with decentralized exchanges. Users can control currency and other types of securities.

• A global market: Among the benefits of P2P exchanges is that they give you access to a worldwide market of cryptocurrency buyers and sellers. In a matter of seconds, you can sell bitcoins to people around the world.

👎 Cons of P2P services

• Slower trading speeds: Even though P2P transactions can occur almost immediately after both parties confirm them, one party can postpone them for various reasons.

Traditionally, you do not need to wait for buyer or seller confirmation before you begin trading. However, P2P allows the buyer or seller to cancel the transaction halfway through.

• Low liquidity: P2P exchanges are not popular among professional traders, who rely on fast transactions to execute big deals and prefer centralized exchanges.

As of now, these exchanges can only be beneficial to individuals who are concerned with specific benefits such as privacy, security, and multiple payment options.

How to cash out Bitcoin with Bybit

Users can trade a number of cryptocurrencies, including Bitcoin, on the well-known cryptocurrency trading platform Bybit. Here's a detailed tutorial on using Bybit to pay out Bitcoin:

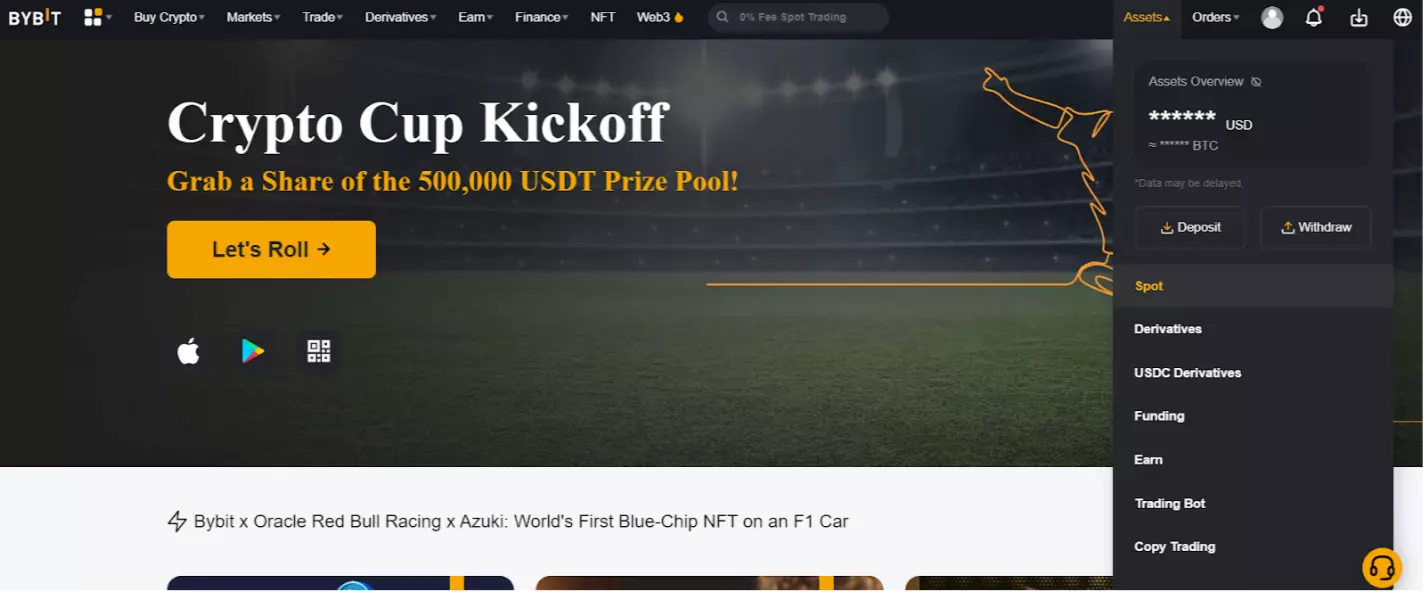

Step 1: Log in to your Bybit account.

Step 2: Navigate to the homepage and click the “Assets” button.

How to cash out Bitcoin with Bybit

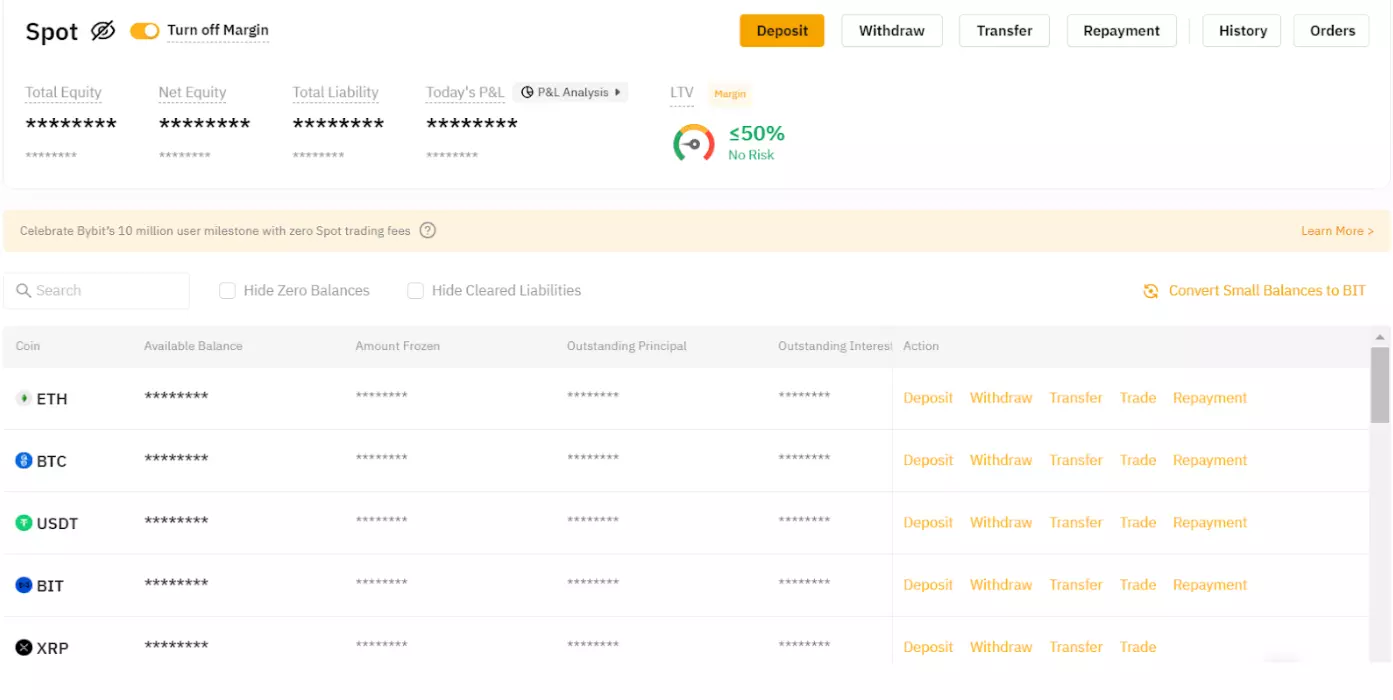

Step 3: Navigate to the spot wallet and click on “Withdraw” in the column of Bitcoin.

How to cash out Bitcoin with Bybit

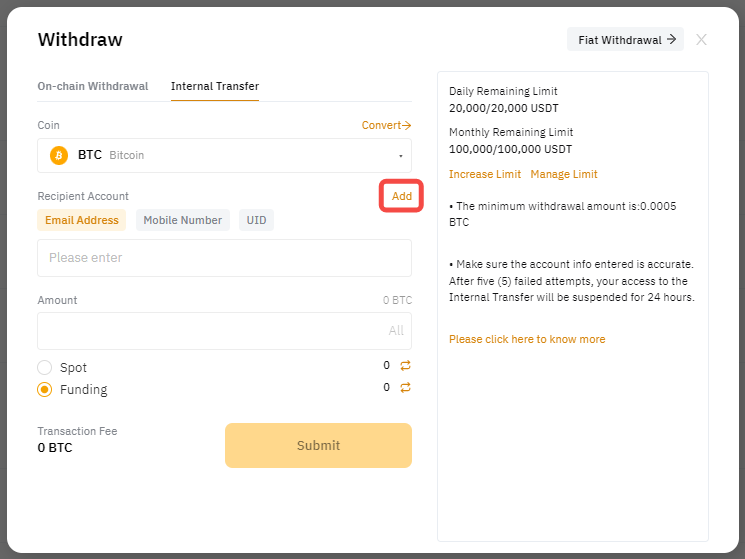

Step 4: Enter the amount of Bitcoin you want to withdraw or click the “All” button to make a complete withdrawal.

Step 5: Choose the blockchain network you would like to use.

Step 6: Click on “Wallet Address” and select the address of your receiving wallet.

How to cash out Bitcoin with Bybit

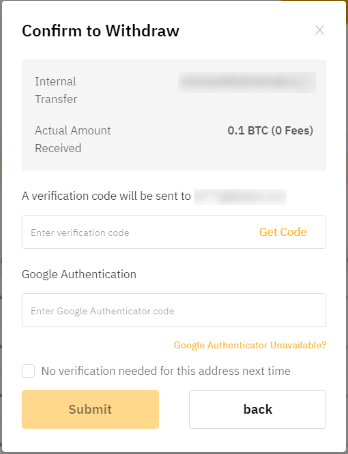

Step 7: Review the withdrawal request, confirm the verification code, and click “Submit” to confirm the withdrawal.

How to cash out Bitcoin with Bybit

However, you should note that Bybit does not support direct withdrawals to a bank account. Therefore, you may need to transfer your funds to another exchange that supports fiat withdrawals.

Read more about What Determined Bitcoin PriceInstant Exchange Services

An instant exchange service aggregates prices and liquidity from multiple custodial trading exchanges. It allows for easy registration and provides a simple exchange user interface.

This is unlike custodial exchanges like Binance, which safeguard your cryptocurrency. There are some limitations to the volume and price of trades on these exchanges, and their sign-up processes can be lengthy. They also present a more professional interface for trading.

👍 Pros of instant exchange services

• Safety of funds: One of the significant differences between instant exchanges and traditional exchanges is how funds are managed. You retain custody of the assets you trade on instant exchanges because funds are received and deposited directly to your wallet vs. custodial services that hold them for you.

Instant crypto exchanges let you retain custody of your funds, giving you more control and enhanced security.

• Easy registration and user-friendly interface: Many traditional exchanges require long sign-up processes that require identity verification and lengthy processing times.

Contrary to this, you can trade crypto-to-crypto trading pairs using only your email, smartphone, or wallet address with instant crypto exchanges.

Changelly, for example, requires you to sign up for your account through your email address or social media page - a process that takes just minutes.

👎 Cons of instant exchange services

• Complicated for beginners: Joining an instant exchange is straightforward, but wallets require knowledge and experience.

The learning curve and responsibility of safeguarding your crypto assets can be daunting for novice cryptocurrency users. As lost funds are often not recoverable, users should thoroughly research how wallets work.

• Trading fees are high compared to their counterparts: It is imperative to consider trading fees. In contrast, many traditional platforms charge closer to 0.05–0.50%, whereas instant crypto exchanges charge closer to 0.25–0.50%.

If you trade frequently and have a high price sensitivity, a traditional exchange solution may make more sense.

How to cash out bitcoin via Changelly

Step 1: Click the "Wallet" tab.

Step 2: Verify whether your bitcoins are in your trading or main account before withdrawing. Firstly, if the funds are in your trading account, you should move them to your main account if necessary. Then click "Withdraw.".

Step 3: Enter the amount of the withdrawal. The number of symbols after the decimal point should not exceed eight. If not, your request will not be approved.

Step 4: Type the destination into the "Address" field.

Step 5: Review all the details carefully before you confirm the withdrawal. You will not be able to reverse the process once the funds are withdrawn.

Step 6: The next step is to enter your authentication code (if you enabled 2FA), and then you will be prompted to click "Withdraw." You will need to confirm this withdrawal by email.

Step 7: Go to your email and open the message from Changelly PRO titled "Withdrawal confirmation.". Double-check that the information in the email (the amount and the destination address) is accurate, and then click the confirmation link.

Step 8: Congratulations! Your withdrawal was successful.

PayPal

With PayPal's push into cryptocurrency last year, users in the United States can now purchase, trade, hold, and pay with cryptocurrencies, including bitcoin. PayPal's Venmo mobile wallet also lets customers buy and sell cryptocurrencies.

As little as $1 can be deposited into your current PayPal account to get started. However, you do not own the bitcoin you purchased.

PayPal manages the wallets, so you don't always control your bitcoins. Usually, when you buy bitcoin, you receive two things: A public key and a private key. Your public key is your wallet address, and your private key controls that wallet.

Your PayPal public address is accessible, but PayPal controls the private key.

For you to withdraw the value from your Cryptocurrency Hub, you must sell your Crypto Assets (in this case, Bitcoin) and withdraw the cash proceeds from the sale, or use the cash proceeds to make purchases.

👍 Pros of using PayPal to cash out Bitcoin

• User-friendly interface: PayPal is a household name and popular digital platform. It also has an intuitive user interface, which means even beginners can use it.

• Learn at your own pace: Stay current on crypto news and understand the basics right from the app.

• Your crypto's protected: There's no digital key to lose, and they will replace your crypto if your account gets hacked.

👎 Cons of using PayPal to cash out Bitcoin

• Account limitations: Unlike other traditional cryptocurrency exchange platforms, PayPal can limit your account for the slightest reason, thereby restricting your access to the service. This can lead to several inconveniences.

• Fees: PayPal has been known to charge substantial fees.

How to cash out Bitcoin via PayPal

If you want to cash out your Bitcoin on PayPal, you need to sell your Bitcoin. Then, withdraw the cash proceeds from the sale, or use the cash proceeds to make purchases.

Here are the steps to cash in your Bitcoin

Step 1: Log in to your PayPal account.

Step 2: Click on the cryptocurrency tab and select Bitcoin.

Step 3: Next, click sell. You will need to confirm some tax information before indicating the sale amount.

Step 4: Once done, click "Sell Now," and proceeds from the sale will go to your cash account.

Bitcoin ATMs

At Bitcoin ATMs, customers can deposit cash that can be converted to Bitcoins or convert Bitcoins to money and then withdraw it. The Bitcoin ATM makes it possible and convenient for people to exchange their Bitcoins for Cash.

The convenience of withdrawing funds from bitcoin wallets can be convenient at shopping malls, hotels, and other places where people may need cash.

In some ATM models, a paper wallet is printed with a Q.R. code scanned for Bitcoin deposits. There is no need for a digital wallet! Depending on the ATM model, you may need a digital wallet on your phone to use it.

👍 Pros of using Bitcoin ATMs to cash out Bitcoin

• Convenience: With Bitcoin ATMs, people can conveniently turn Bitcoin into Cash. A Bitcoin ATM allows people to walk up to the machine and scan their Bitcoin address with a Q.R. code. You can deposit fiat money or convert Bitcoin into fiat and withdraw it. The process is straightforward and convenient.

As a result, Bitcoin ATMs can reduce the friction associated with an exchange between fiat and Bitcoin. Just like regular ATMs, Bitcoin ATMs are convenient.

• Ease of use: Many people believe that cryptocurrencies are too tricky to use. A Bitcoin ATM is a significant way for cryptocurrencies to become more accessible for people.

It is effortless to use Bitcoin ATMs in many cases because people are already used to using fiat ATMs. It is, therefore, no surprise that over sixty countries have adopted Bitcoin ATMs.

• Speed: Bitcoin ATMs also speed up transactions dramatically. A Bitcoin ATM eliminates the need to transfer money from bitcoin wallets into bank accounts or vice versa. Transferring money via this method can take up to a day.

In contrast, you can instantly convert Bitcoin into fiat currency with a Bitcoin ATM. It takes some Bitcoin ATMs to complete a transaction as short as 15 seconds.

It makes accessing money Abroad easier: Travelers can use Bitcoin ATMs to exchange Bitcoin for local fiat currency instead of resorting to currency exchanges in foreign countries.

As a result, obtaining local fiat currencies is simplified for people who are trying to get cash in foreign countries.

👎 Cons of using Bitcoin ATMs to cash out Bitcoin

• Unavailability: Even though Bitcoin ATMs are now available in over 60 countries, this does not imply that they can be found on every street corner in every city. Most people are likely unaware of where their nearest Bitcoin ATM is.

Due to the difficulty of finding Bitcoin ATMs, people cannot rely on them being easy to locate everywhere, unlike fiat currency ATMs.

• High fees: Bitcoin ATMs are frequently criticized for their high charges. Standard fiat currency ATMs do not charge fees for withdrawals or deposits made at the bank's ATMs. However, if the transaction is made on an ATM owned by another financial institution, the charges are often a few dollars.

Bitcoin ATMs tend to be quite expensive compared to standard fiat currency ATMs. However, Bitcoin ATMs are so costly because they are relatively new. So, there are not as many competitors in the cryptocurrency ATM business yet.

• Poor service reliability Bitcoin ATMs are still having issues with service reliability since the infrastructure is still emerging. Bitcoin ATMs, for instance, are frequently reported as non-functional and depleted of cash.

If many people discover an ATM immediately, the cash supply can quickly run out.

• If the Bitcoin ATM runs out of cash and cannot exchange Bitcoin for money, it will be an issue. As a result, Bitcoin ATMs fail to accomplish their primary purpose. Hopefully, these problems will become less frequent in the future. In the meantime, they remain a significant concern.

How to cash out Bitcoin via ATMs

Here are the steps to cash in your Bitcoin

Step 1: Locate a Bitcoin ATM

Step 2: At the ATM, select the crypto you want to sell (in this case, you will choose Bitcoin).

Step 3: Next, accept the terms and conditions.

Step 4: You will need to choose a cash limit after accepting the machine's Terms of Service. There are two options: "up to $900" and "more than $900".

Step 5: The next step is to enter your phone number to receive a single-use password so that you can complete the transaction. You'll receive the password through text.

Step 6: Once you have confirmed your phone number and name, you will have to input how much bitcoin you'd like to exchange for cash.

Step 7: When you decide how much crypto you want to exchange for cash, the Bitcoin ATM will print a Q.R. code receipt for you. Next, open your cryptocurrency app on your smartphone.

Step 8: Wait for the network to confirm your transaction. Upon confirmation of your request, you will receive an automated text message informing you that your funds are available for withdrawal.

Step 9: When you have received one confirmation of your blockchain transaction, you can withdraw cash from the ATM. To do so, you need to scan the Q.R. code on the ticket with your ATM camera. You will need to enter your phone number again to verify your identity. The machine will dispense your cash once you establish your identity.

Crypto Wallets

A crypto wallet keeps your private keys - the passwords that allow you to access your cryptocurrencies - safe and accessible to send and receive cryptocurrencies like Bitcoin. These wallets come in many sizes and shapes, from hardware wallets like Ledger to mobile apps like Coinbase Wallet. These wallets make cryptocurrency as easy as shopping online with a credit card.

We recommend Ledger as one of the most reliable crypto wallets for cashing out Bitcoin. You can also sell your Bitcoins through Ledger's partner Coinify.

Your Ledger hardware wallet allows you to securely and conveniently manage your crypto assets. In addition, you can sell your Bitcoins whenever you like through Ledger Live.

Here's how it works: you send Coinify your crypto securely through the Ledger sell, and then they send the promised amount of fiat money (U.S. dollars) to the bank account you specify.

First, you would select the amount you would like to trade, and Coinify would tell you how much you would receive in return. Your Ledger device will not be able to sell crypto without your permission.

👍 Pros of using crypto wallets to cash out Bitcoins

• Simple and easy to use live interface: The interface of these wallets is easy to understand and use when you have sold your cryptocurrency.

• High-security standards: Wallets offer a series of security features to protect your assets.

• Allows instant transactions across geographies

• Low transaction fees

👎 Cons of using crypto wallets to cash out Bitcoins

• Bluetooth integration may be used as a vector for cyber-attacks

• May be challenging for beginners.

What Is The Best Way To Cash Out Bitcoin?

Essentially, it depends on what you are looking for in terms of your comfort and ease of use.

Beginners looking for an easy way to Cash out Bitcoin may use a crypto exchange. A P2P service may be of interest to intermediate or advanced users since it eliminates any need for a middleman.

A Bitcoin ATM is an excellent choice that offers convenience.

How to Spend Bitcoin Directly?

You don't always need to cash out your bitcoin to spend it. There are alternative ways to spend your crypto.

Some of these ways include:

-

Paying with Bitcoin anywhere that accepts it, including merchants such as Microsoft, Expedia, and Overstock

-

Invest your Bitcoin. You can use your Bitcoin to buy stocks or funds. It is possible to do this on the platform where you have your Bitcoin or use an investment service.

-

Donating to charities. Several organizations accept Bitcoin donations. You can get involved in ICOs and other cryptocurrencies.

-

You can also use it to buy things online like video games and gift cards.

-

Offline, some restaurants and other merchants now accept Bitcoin.

Summary

Bitcoin, like other cryptocurrencies, will continue to enjoy a bright future buoyed by the enthusiasm of investors. Whether you're interested in trading, buying, or selling Bitcoin, you'll find no shortage of options.

If you're looking to cash out bitcoin and convert your digital assets into cold hard cash, these methods are all viable options. The option you deploy will depend on your personal preference and level of experience. If you're looking to start with something simple, buying an exchange is a good option. If you're looking for more control, a P2P platform may be right for you.

FAQs

How can I cash out Bitcoin?

The most effective ways to cash out Bitcoin are through a third-party broker, over-the-counter trading, or third-party trading platforms. Peer-to-peer trading is also an option.

Can you cash out Bitcoin for real money?

In a sense, you could "cash out" your bitcoins by shopping online through a service such as Moon or Lolli that accepts Bitcoin as a currency. However, if you want to convert bitcoins into fiat currencies, such as the U.S. dollar, you'll have to convert them into fiat currencies.

How do I transfer bitcoins to a Cash App?

Here's how to deposit bitcoins into your Cash App:

- Navigate to the Bitcoin tab on the home screen.

- Click Deposit Bitcoin.

- Use an external wallet to scan, copy, or share the Cash App Bitcoin address.

- Verify with your PIN or Touch ID.

Can I buy a house with Bitcoin?

Yes - but you and the seller need to agree. You'll also need to work with title insurance companies and escrow firms that are comfortable handling cryptocurrency rather than 'real world' money.

Glossary for novice traders

-

1

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

2

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

3

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

4

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

5

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).