A List Of The Most Volatile Forex Pairs

According to the data for 2024, the most volatile pairs (whose rates change the most during the day) are the following pairs:

-

AUD/JPY: 102.5 pips or 1.16% per day

-

NZD/JPY: 95.9 pips or 1.15% per day

-

AUD/USD: 72 pips or 1.08% per day

-

NZD/USD: 68.70 pips or 1.09% per day

-

CAD/JPY: 132.98 pips or 1.00% per day

-

USD/RUB: 1.77% per day

-

USD/ZAR: 1.54% per day

-

USD/BRL: 1.14% per day

The forex market, renowned for its pronounced volatility, offers abundant trading prospects and heightened risks. Multiple factors contribute to currency volatility, including liquidity, time of day, geopolitical tensions, economic stability, and the sentiment of forex traders.

This article comprehensively evaluates these factors to rank the most volatile forex pairs, focusing on major and minor pairs possessing greater liquidity than infrequently traded exotics.

-

What is volatility?

Volatility gauges the intensity and frequency of asset price changes like forex currency pairs. Picture a roller coaster – high volatility means sharp ups and downs, while low volatility indicates a smoother ride. Understanding volatility is essential for forex traders to set realistic expectations, manage risk effectively, and choose suitable trading strategies.

-

Why is volatility important in Forex?

Volatility is a dual-force factor. It enhances profit potential by providing more opportunities for buying low and selling high with larger price swings. However, it also magnifies potential losses as the market can rush against you.

-

Is high volatility good in Forex?

It hinges on your risk tolerance and trading approach. High volatility can entice experienced traders with robust risk management, offering more significant profit potential. Yet, beginners or risk-averse traders may find it overwhelming, leading to substantial losses. The ideal volatility level depends on individual preferences and trading goals.

-

What is the most volatile Forex pair?

Among the major currency pairs, AUD/JPY was the most volatile pair in 2023, trading actively during both Asian and other sessions. The fluctuation was 102.5 pips or 1.16% per day. It was caused by the fundamental background.

How do you find volatile Forex pairs?

You can use online tools like scanners and calculators to identify volatile forex pairs. These tools help analyze market data and highlight currency pairs experiencing significant price movements. By monitoring these fluctuations, traders can gain insights into which pairs are more dynamic and potentially lucrative.

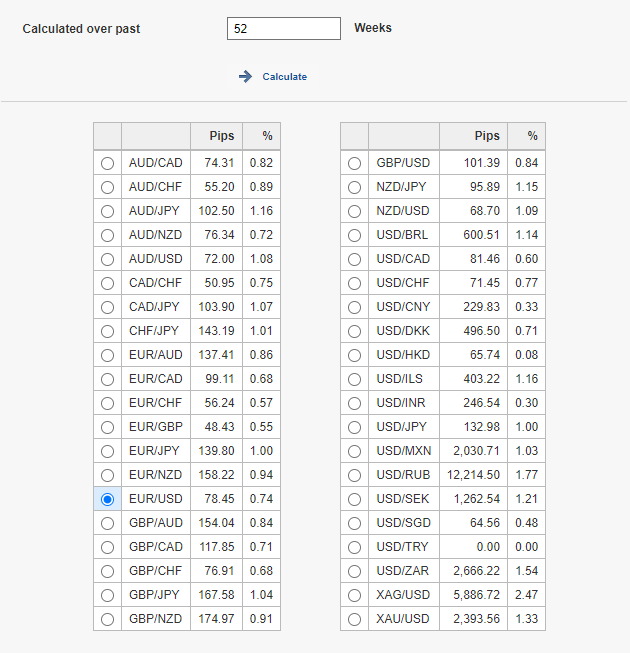

Volatility calculator by investing.com

One tool for measuring volatility is the calculator from Investinig.com. This is what we used to prepare this ranking of the most volatile forex pairs.

To understand and measure volatility in the forex market, you can refer to this article on - How to Measure Volatility In Forex.

The most volatile major and minor forex pairs

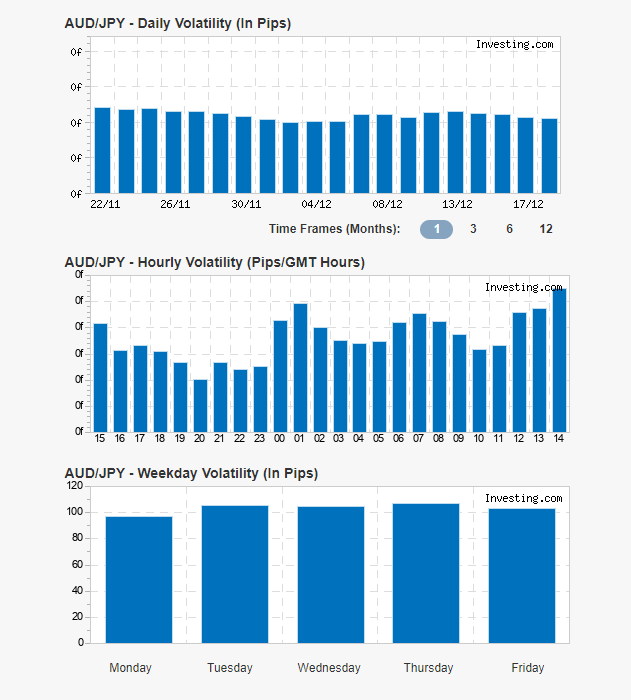

AUD/JPY. This pairing involving the Australian dollar (AUD) and Japanese yen is consistently among the most volatile currency pairs. The country's exports of minerals and metals have an impact on the commodity currency AUD, whereas the Japanese yen is special because the Bank of Japan has a distinctive and independent monetary policy. The uniqueness of the AUD/JPY pair, which increases its volatility, is the fact that it is actively traded during all three trading sessions: Asian, European, and American.

AUD/JPY Volatility

NZD/JPY. As New Zealand's economy is closely linked to Australia due to its geographical location, the reasons for the high volatility of the NZD/JPY pair are the same as those listed for AUD/JPY above.

AUD/USD. AUD/USD, featuring the US dollar, ranks among the most actively traded volatile FX pairs. Australia’s economy, heavily influenced by commodity exports like coal and iron, contributes to high trading volumes. The London session is considered optimal for trading this major pair, likely influenced by global financial activity across Tokyo, London, and New York sessions.

NZD/USD. New Zealand's agricultural exports, which include milk, eggs, meat, and timber, have a significant impact on NZD, another commodity currency. Export destinations primarily include nearby countries such as China and Australia, creating few economic ties to the USD. Pairing these currencies represents economies on opposite sides of the world relying on different economic drivers.

CAD/JPY. The Canadian dollar (CAD) and Japanese yen pairing involve two economies linked by the presence of a commodity currency (CAD). Japan, heavily dependent on oil, and Canada, a significant oil exporter, see their economies influenced by oil prices. While Canada doesn’t export much oil to Japan, the shared dependence on oil prices contributes to volatility in the CAD/JPY exchange rate. Significant trade relations between Canada and Japan in other markets enhance the overall volatility of the exchange rate.

The most volatile exotic forex pair

USD/RUB. The "US Dollar and Russian Ruble" is a currency pair subject to the tumultuous effects of geopolitical tensions and economic instability. Geopolitical turmoil, including sanctions, military conflicts, and international relations, significantly influences the Ruble's value. Escalation can lead to a downward spiral, while de-escalation or positive diplomatic developments can result in sudden surges. Global oil and gas prices further impact the Ruble, with rising energy prices and robust export volumes strengthening the currency while falling prices or export disruptions weaken it. Another element of unpredictability is the Ruble's internal economic stability, which is a result of central bank decisions and fiscal policies.

USD/ZAR. The pairing of the United States dollar (USD) and the South African rand (ZAR) revolves around the value of gold. Major gold exporter South Africa observes how USD-denominated gold prices affect the value of its currency. When the US economy strengthens, it can impact gold prices and, consequently, the rand's value. Beyond gold, South Africa faces economic challenges such as energy and infrastructure crises. The USD, considered one of the most stable currencies, contributes to the volatility in this currency pair, given the instability of the rand.

USD/BRL. The US dollar and Brazilian real pairing reflect the exchange rate between the United States and Brazil. An emerging market, Brazil grapples with a turbulent economy and potential political scandals. Both former president Jair Bolsonaro and current president Lula da Silva have been involved in corruption scandals, impacting the national economy. Coupled with the challenges of developing a commodity export-based economy, the real value exhibits considerable volatility against the stable USD.

Best Forex brokers

How to trade volatile pairs

Trading in volatile pairs demands a thoughtful strategy, acknowledging the inherent fluctuations in the market. When tackling this distinctive challenge, it's crucial to be mindful that:

-

Increase stop-loss size. Adjusting the size of your stop-loss can serve as a protective measure during heightened volatility. A broader safety net helps mitigate the impact of sudden and significant price swings, enhancing risk management.

-

Reduce position size. Scaling down your position size in volatile markets effectively minimizes potential risks. A smaller position offers greater flexibility and reduces exposure to sharp market movements, safeguarding your capital during unpredictable market conditions.

-

Adjust settings of indicators/strategy. Volatility may necessitate modifying the settings of your chosen indicators or trading strategy. Adapting these parameters to align with current market conditions enhances the effectiveness of your strategy in navigating unpredictable price actions.

To navigate this dynamic landscape, here's a step-by-step guide:

-

Open broker account. Open a broker account, and for reliable recommendations, consult lists like "Forex Brokers List for 2023 — the Reliable & Licensed."

-

Choose your strategy. Select a strategy that aligns with your goals and risk appetite in forex trading.

-

Practice on a demo account. Practice on a demo account before engaging in real trades. It allows you to refine your skills, understand market dynamics, and test your chosen strategy without risking actual funds.

-

Switch to Real:

-

Move to real trading once you've gained confidence and proficiency through demo trading.

-

Apply the principles of your chosen strategy to navigate the live market.

-

Consider potential adjustments for volatile pairs, including increasing stop-loss size, reducing position size, and tweaking indicator or strategy settings to align with market volatility.

-

This approach ensures a well-informed and strategic entry into trading volatile currency pairs.

What are the least volatile major pairs?

EUR/CHF. The pairing of the Euro (EUR) and the Swiss Franc (CHF) presents a scenario where the Swiss Franc, known for its stability and safe-haven status, tends to exhibit limited movements. With occasional exceptions like the black swan event in 2015, the CHF typically remains relatively stable, especially against major currencies such as the Euro and the US Dollar. The average volatility of the pair in 2023 was 0.57% per day.

EUR/GBP: Like the euro/franc, the euro/dollar pair reflects the proximity of the two economies defined by geography. EUR/GBP fluctuations are therefore not significant, averaging 0.55% per day over 2023.

Summary

Volatility is extremely important to consider when selecting forex pairs for trading, setting up risk management and optimising trading strategies. Among volatile pairs, AUD/JPY was the leader in 2023, while EUR/GBP and EUR/CHF stand out among pairs with low volatility. However, due to the influence of fundamental factors, the position of currency pairs in the volatility rating may change.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Professionally, he has been a marketing professional running his agency for three years now. His agency helps finance projects to grow with the help of internet technologies. Upendra Goswami is an active investor and enthusiast of stocks and cryptocurrency.

Knows about

trading, blockchain, cryptocurrency, stock trading

Alumnus of

JECRC UDML College of Engineering, Jaipur

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.