What is Ethereum (ETH)? Is it a Good Investment?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Ethereum (ETH) is a decentralized blockchain platform that enables smart contracts and decentralized applications (dApps). It's a leading player in DeFi and NFTs, offering significant potential as an investment. However, its volatility, high fees, and competition from other blockchains make it a high-risk investment. It can be a good option for long-term investors.

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, stands as one of the pioneers in the blockchain space. It's not just a cryptocurrency; Ethereum is the foundation for decentralized applications (dApps) and smart contracts, redefining industries like finance, gaming, and digital art. But as with any investment, it's important to take a careful look into Ethereum's technology, its potential, and the risks involved. Let's explore what Ethereum is and whether it's a good investment for you.

What is Ethereum (ETH)?

Ethereum, created by Vitalik Buterin and launched in 2015, brought a revolutionary concept to blockchain technology: smart contracts. Unlike Bitcoin, which is primarily a digital currency, Ethereum serves as a decentralized platform where developers can build and deploy dApps. This functionality has transformed Ethereum into the backbone of decentralized finance (DeFi) and non-fungible

tokens (NFTs).

Ethereum is much more than a cryptocurrency. It's a blockchain platform powered by Ether (ETH), the native token used to fuel transactions and run dApps. Ethereum offers developers the tools to create decentralized applications that don’t rely on a single entity, making it one of the most powerful blockchain ecosystems.

How does Ethereum work?

At its core, Ethereum is a decentralized, open-source blockchain. It uses blockchain technology to validate and record transactions. But what sets Ethereum apart is its ability to run smart contracts — self-executing contracts with the terms of the agreement directly written into code.

Proof-of-stake vs. Proof-of-work

Originally, Ethereum used the Proof-of-Work (PoW) consensus mechanism, similar to Bitcoin. However, PoW is energy-intensive, which led Ethereum to transition to Proof-of-Stake (PoS) in 2022. With PoS, validators are chosen based on the number of tokens they hold and are willing to "stake," making the network more energy-efficient.

Here’s a side-by-side comparison table of Proof-of-Work (PoW) vs. Proof-of-Stake (PoS), highlighting differences in energy consumption and security:

| Feature | Proof-of-Work (PoW) | Proof-of-Stake (PoS) |

|---|---|---|

| Energy Consumption | High - requires massive computational power, leading to high energy usage. | Low - validators are selected based on staked assets, reducing energy needs. |

| Security | High - Secured through decentralized mining with competition between miners. | High - Secured by validators who risk losing their staked assets for dishonest behavior. |

| Consensus Mechanism | Miners solve complex problems to validate transactions. | Validators are chosen based on the amount of crypto staked. |

| Efficiency | Less efficient due to the high energy consumption and slower transaction speeds. | More efficient with faster transaction speeds and lower energy costs. |

| Rewards | Miners are rewarded with new coins for validating blocks. | Validators earn rewards proportional to their staked amount. |

| Environmental Impact | Significant environmental impact due to energy consumption. | Minimal environmental impact due to low energy requirements. |

| Decentralization | Relies on decentralized mining power, but large mining pools can dominate. | Encourages decentralization by allowing more participants to become validators. |

Ethereum upgrades

Ethereum is constantly evolving. Its most significant upgrade, Ethereum 2.0 (also known as "The Merge"), shifted the network to PoS and introduced sharding — a process that splits the blockchain into smaller, more manageable pieces to improve scalability and transaction speeds.

Is Ethereum (ETH) a good investment?

Now, the big question — should you invest in Ethereum? The answer depends on your investment goals and risk tolerance, but Ethereum's potential is undeniable.

Why invest in Ethereum?

There are more reasons to invest in Ethereum than we can possibly cover in this article, but here are the top few:

Smart contracts pioneer. Ethereum was the first to use smart contracts, and today, most of the world’s smart contracts still run on its network. These little self-executing codes let developers create apps without middlemen, covering everything from finance to digital art.

Ethereum is driving the DeFi scene. More than half of the money flowing into decentralized finance (DeFi) is built on Ethereum. That means if you’re exploring DeFi, you’re almost certainly using Ethereum.

The energy-efficient upgrade. Ethereum’s switch to Proof of Stake has made it a much greener option. Before this upgrade, it required a ton of energy, but now it’s a lot more eco-friendly.

Lower fees and faster transactions. Ethereum used to be known for its slow and expensive transactions, but Layer-2 solutions like Arbitrum have made it a lot cheaper and quicker. This has made it more attractive for everyday users and developers alike, which keeps the network buzzing.

Beyond just finance. While Ethereum is huge in finance, it’s also being used in areas like gaming, digital art, and even decentralized voting systems. This flexibility means it’s more than just a crypto investment — think of it as a multi-tool for the future of digital innovation.

Ethereum is a development standard. Ethereum’s coding standards are like the building blocks for new tokens and apps. So, even when people build new tokens or NFTs, they usually use Ethereum’s guidelines. As long as people keep making new projects, Ethereum will stay in the spotlight.

Big names are already involved. Companies like Microsoft and Visa are using Ethereum to experiment with new ideas, showing that it’s more than just for techies or crypto enthusiasts. When big firms get involved, it usually means a technology is sticking around.

Factors to consider before investing

Here are a few factors to keep in mind when considering Ethereum as an investment:

Volatility. Ethereum, like other cryptocurrencies, is highly volatile. Prices can fluctuate significantly in short periods due to market sentiment, technological updates, or regulatory changes.

Competition. While Ethereum is the leader in smart contracts, it faces competition from other blockchains like Solana, Cardano , and Binance Smart Chain , which offer faster transaction speeds and lower fees.

Security risks. Smart contracts are not foolproof. Vulnerabilities in their code can lead to significant losses, as seen with the 2016 DAO hack.

How to invest in Ethereum

Ready to invest in Ethereum? Here’s how to get started:

Create a wallet. Start by creating a crypto wallet (e.g., MetaMask or Ledger) to store your Ether securely.

Choose an exchange. Use a reliable cryptocurrency exchange that offers the right features and security in line with your investment goals. We have shortlisted the top exchanges based on our own research, which you can compare from the table below:

Create an account and get ready. Once you have decided on the crypto exchange, create and account, complete the verification process, and deposit funds.

Purchase Ethereum. The next step is to purchase Ethereum through the available pairs on your selected exchange.

Store Ethereum. For long-term storage, hardware wallets provide the highest level of security.

Staking Ethereum. Stake your ETH to earn passive income by participating in Ethereum’s Proof-of-Stake network.

| CEX | DEX | P2P | Coins Supported | Min. Deposit, $ | Spot Maker Fee, % | Spot Taker fee, % | Open account | |

|---|---|---|---|---|---|---|---|---|

| Yes | No | Yes | 329 | 10 | 0,08 | 0,1 | Open an account Your capital is at risk. |

|

| Yes | No | No | 278 | 10 | 0,25 | 0,4 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 250 | 1 | 0,25 | 0,5 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 72 | 1 | 0,1 | 0,2 | Open an account Your capital is at risk. |

|

| No | No | No | 1817 | No | 0 | 0 | Open an account Your capital is at risk. |

Ethereum tips for beginners

Start small and understand gas fees. Unlike typical stock trades, Ethereum transactions come with a fee called “gas.” Make small trades initially to get comfortable with how these fees work and how they change at different times of the day.

Pick a reliable wallet. Security is crucial, so make sure to use trusted wallets like MetaMask or Trust Wallet to store your ETH. Avoid keeping your coins on exchanges, as they are more vulnerable to hacks. For added safety, look into hardware wallets like Ledger once your holdings grow.

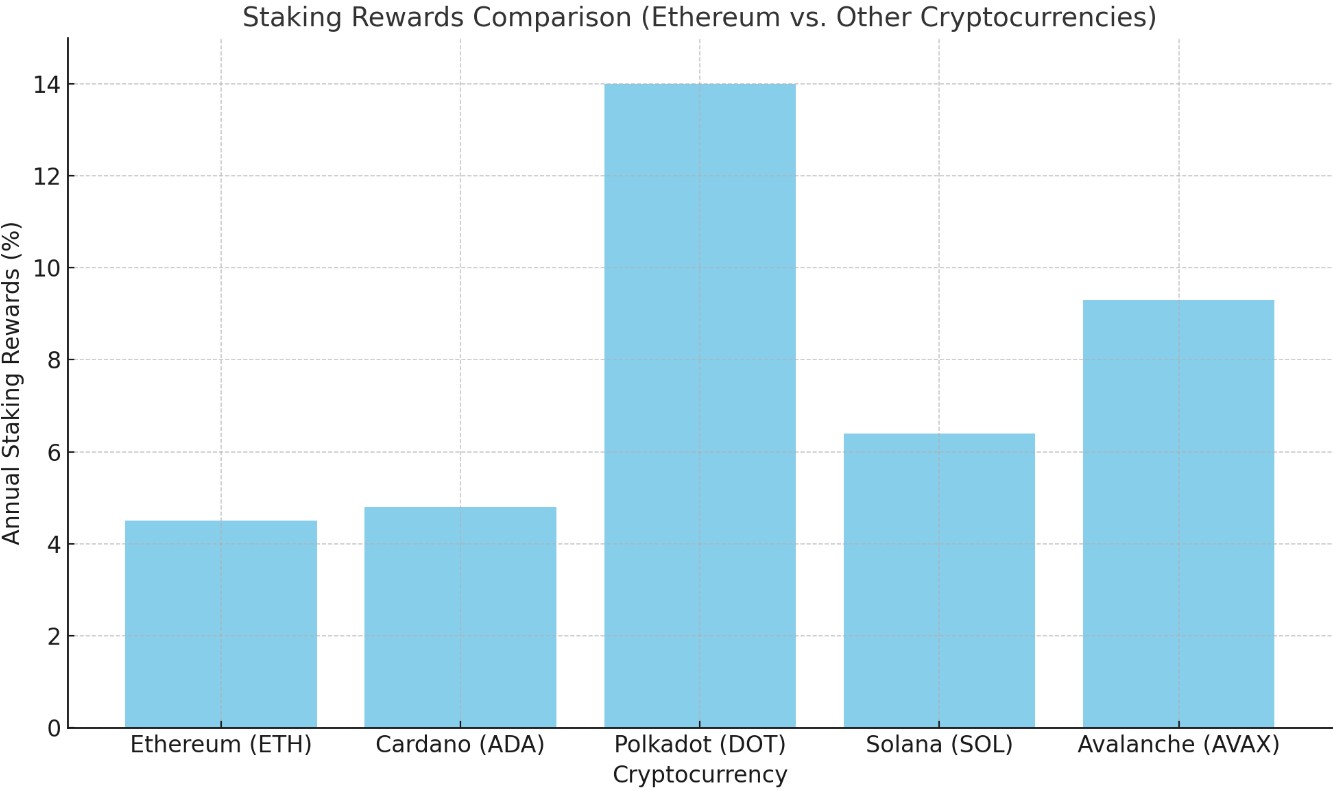

Check out staking for easy rewards. Ethereum 2.0 now lets you earn rewards through staking. Even if you don’t have 32 ETH to run your own node, look into platforms like Coinbase or Binance that offer staking pools, which let you earn small rewards on smaller amounts of ETH. Discover Ethereum staking rates and how they work.

Keep up with Ethereum news. Join communities like r/Ethereum on Reddit or follow Ethereum-focused Twitter accounts. Staying updated on news, upcoming upgrades, or potential forks will keep you ahead of the curve and ready for any surprises in the market.

Try out demo trading first. If you’re new to trading Ethereum, start with demo accounts. Practicing with fake funds will help you understand market trends and test different strategies without putting your real money at risk.

Risks and warnings

While Ethereum offers tremendous potential, it’s essential to understand the risks involved.

Crazy high fees when everyone’s trading. Imagine trying to buy a small item, but the fee to complete the purchase is three times the cost of the item itself. When there’s a lot of activity on Ethereum, the fees can become ridiculously high, making even simple transactions a hassle. You don’t want to be stuck paying those if you need to act fast.

A tiny bug can cost a fortune. Ethereum’s smart contracts are like automated programs that do exactly what they’re coded to do, for better or worse. If there’s even a tiny mistake, it can get exploited, and suddenly, funds vanish. This has happened before, and it’s a scary thought for anyone with money in these contracts.

The risk of a community breakup. If there’s a big disagreement among Ethereum’s developers and community, it could lead to a split, creating two versions of Ethereum. This would be like a messy divorce, causing confusion over which version is the “real” one and potentially making both versions worth less.

Flash loans — super risky tricks. Flash loans sound cool because you can borrow a lot without putting up anything, but they’re often used in shady ways. Hackers have used these to mess with prices or empty entire liquidity pools. If you’re involved in Ethereum’s DeFi scene, this can cause massive losses in seconds.

Pros and cons of investing in Ethereum

- Pros

- Cons

Ethereum dominates DeFi with over 60% market control, giving it a strong foothold in decentralized finance.

It powers everything from NFTs to smart contracts, making it the go-to platform for digital innovation.

Staking ETH can earn you steady rewards, acting like passive income without active trading.

Thousands of developers are constantly building on Ethereum, which means the ecosystem keeps growing.

It redefines money by automating transactions, turning complex financial processes into easy scripts.

Even with upgrades, high fees and congestion are still a problem during peak times.

The ecosystem can be confusing for newcomers, who may struggle to navigate dApps, staking, and DeFi.

Failed projects in the ecosystem can hurt its reputation, adding systemic risk for users.

The Proof of Stake switch improved energy efficiency, but critics still debate its environmental impact.

Rapid upgrades make long-term planning tough, as the network’s core functions might shift suddenly.

How much can I earn by investing in Ethereum?

Ethereum has historically provided significant returns, but earnings depend on various factors, such as timing and market conditions.

For example, investors who bought ETH in 2018 would have seen a 275% increase during the 2021 bull run. However, the price has since dropped, and Ethereum remains volatile.

A graph showing Ethereum’s price history from 2016 to the present:

By staking ETH, you can earn annual yields between 5-10%, depending on the network’s performance and the amount staked.

Play smart with Ethereum

Ethereum isn’t just a cryptocurrency; it’s a huge platform that’s reshaping digital finance and apps. If you’re new to investing, don’t just think about buying and holding ETH. Look at options like staking with platforms that let you earn rewards without locking up your money completely, which means you can still use your ETH to earn more through other methods, like farming or lending. This gives you a more active role in growing your investment, making it more hands-on and rewarding than simply waiting for ETH’s price to go up.

Another smart strategy is to focus on Ethereum’s "side roads" — Layer 2 projects like Arbitrum and Optimism. These networks make transactions faster and cheaper, solving some of Ethereum’s biggest problems. If you pick up tokens related to these projects, you could gain from Ethereum’s growth without paying the sky-high fees that regular ETH investors deal with.

Conclusion

Ethereum (ETH) offers immense potential as both a technological platform and an investment. Its dominance in decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts has solidified its place in the blockchain world. The transition to Proof-of-Stake and continuous upgrades like Ethereum 2.0 and sharding aim to make the network faster, more efficient, and environmentally friendly.

However, Ethereum is not without risks. Its high volatility, competition from other blockchains, and potential regulatory changes make it a challenging investment. For beginners, starting small and learning the basics is essential. For advanced traders, Ethereum provides opportunities for staking, trading, and leveraging its market movements, but timing is critical.

FAQs

Are there any risks of losing Ethereum when transferring between wallets?

Yes, incorrect addresses or network errors can result in a loss of funds. Always double-check wallet addresses and ensure you're using the correct network (e.g., Ethereum vs. Binance Smart Chain).

What happens to my staked Ethereum if the network goes down?

If the Ethereum network experiences an outage, your staked ETH remains secure, but you may temporarily lose the ability to unstake or transfer it until the network is back online.

Can I stake Ethereum directly from my hardware wallet?

Some hardware wallets, like Ledger, allow staking through integrated platforms. However, you’ll need to connect the wallet to a staking service or use an external interface to stake your ETH.

How are Ethereum gas fees calculated, and how can I reduce them?

Gas fees are based on network demand and the complexity of your transaction. You can reduce fees by transacting during off-peak times or using Layer 2 solutions like Arbitrum or Optimism.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.