Ethereum 2.0 (ETH) Staking Guide

Overcrowding on the Ethereum (ETH) network has driven transaction fees through the roof, making its use unfeasible in many scenarios. Customers are prepared to pay hefty transaction fees because of the extremely high monetary value of the transactions, which has contributed to the success of DeFi programs. Ethereum calls its transaction fees "gas," because they are used to finance more than just transactions but actual applications running on the Ethereum network. Ethereum's high gas fees make it difficult for non-financial DApps to operate on the platform.

The Ethereum Foundation has worked hard on a network update (formerly known as ETH2) that aims to solve these concerns by enhancing the Ethereum network's security, efficiency, speed, and scalability. Since it is both secure and scalable, the Ethereum network can handle more transactions, reduce bottlenecks, and open the door to new applications, not just in the financial sector.

A new staking mechanism will replace Ethereum's current mining system to implement this change. Staking is the act of actively validating transactions on a Proof-of-Stake blockchain (similar to mining). In these blockchains, anyone with sufficient cryptocurrency could validate transactions and receive staking rewards. Staking Ethereum on cryptocurrency exchanges is possible. Read this guide to learn how to stake Ethereum 2.0, the best wallets to use for staking ETH, and the benefits and potential rewards you may receive from ETH 2.0.

Start Investing in ETH Right Now With ByBit!How to stake Ethereum from your wallet

Using a reputable crypto exchange or staking pool is the quickest and easiest way to begin staking Ethereum 2.0. Beginners should utilize this option if they lack the technical expertise to run a full node or do not have the required 32 ETH. These platforms may impose fees ranging from 15% to 25% of staking earnings for infrastructure, security, and convenience.

One of the simplest ways to obtain Ethereum for staking is through cryptocurrency exchanges. This post will teach you how to stake Ethereum on an exchange. For traders with fewer than 32 ETH, the best way to stake ETH is to use an exchange wallet and perform the following actions:

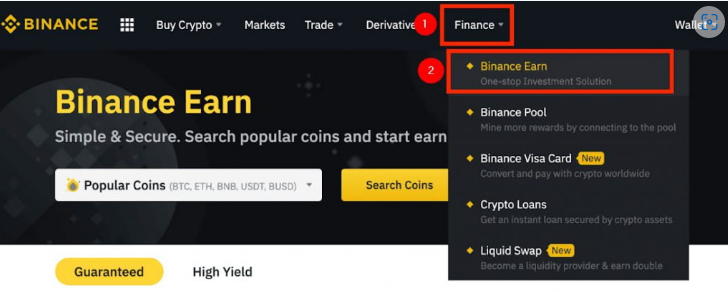

Step 1: Open the Binance page

Log in to Binance, then click the "Binance Earn" link in the main menu under the Finance tab.

Binance Earn

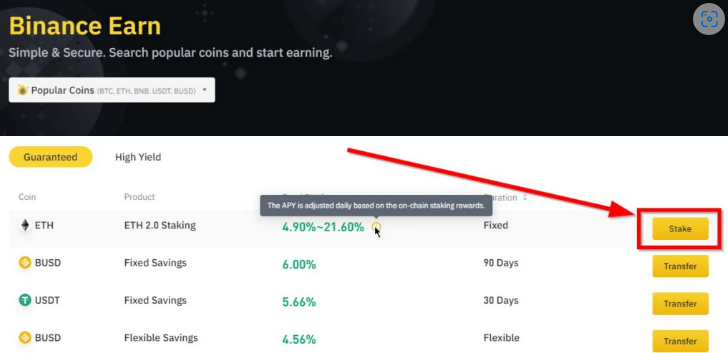

Step 2: Go to the Ethereum 2.0 staking page

From the Binance Earn page, click on the ETH2 staking button.

the ETH2 staking button

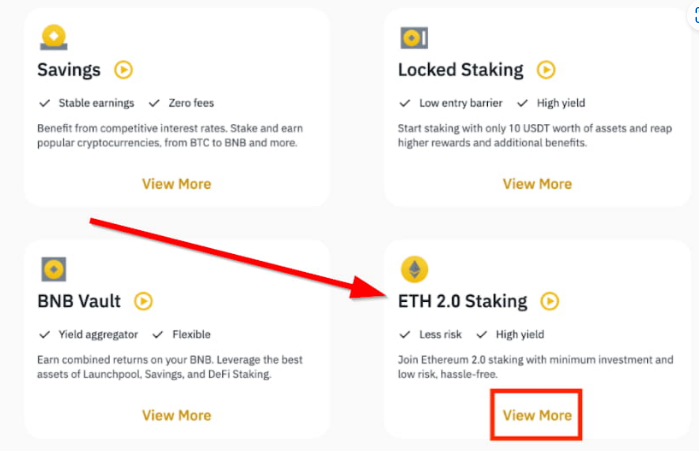

You may learn more about ETH 2.0 staking by using the "View More" button in the section below the one displayed above.

How to learn more about ETH 2.0

Step 3: Continue to stake your Ethereum

To begin staking ETH 2.0 on Binance, visit the site and choose "Stake Now."

How to stake your Ethereum

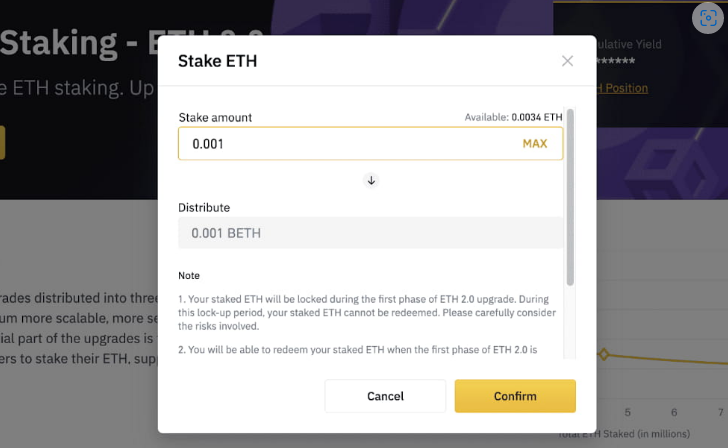

Step 4: Enter the desired stake amount in ETH

Following your previous step, click on the "Stake Now" button. Binance will open a dialogue window where you must input the ETH amount you wish to withdraw from the Spot wallet. It is possible to wager a minimum of 0.1 ETH. Click to confirm.

The "Stake Now" button

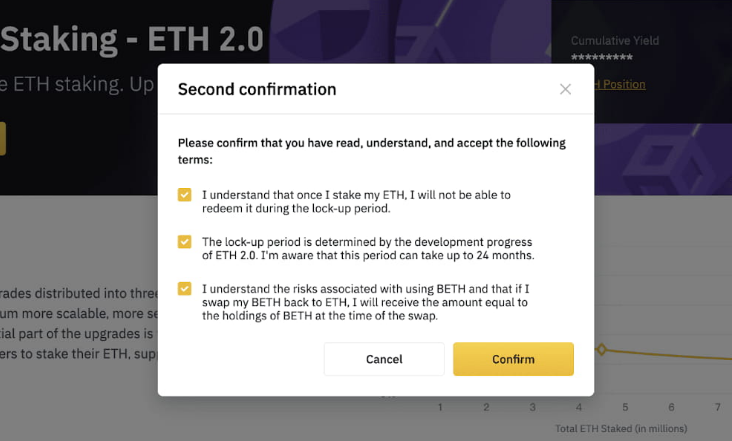

Step 5: Add one more confirmation

Binance will ask you to verify the transaction again. Tick all three boxes and hit [Confirm] to stake your Ethereum currency.

Second confirmation

ETH staking on Binance results in the exchange depositing BETH tokens into your Spot wallet, equivalent to the amount of ETH you staked. To view your current BETH balance, visit the Spot and Fiat page. Your Spot wallet's BETH balance is what Binance will use to distribute your Binance ETH staking rewards. BETH tokens will still be used to distribute the incentives.

It is important to know that the Binance marketplace facilitates the purchase and sale of BETH tokens. On Binance, the price of BETH tokens is lower than the price of Ethereum, the coin on which the token is based. This is since market supply and demand affect the price of BETH despite the asset's 1:1 issuance ratio.

Binance Staking Guide | All Supported Tokens and RewardsWhat is a typical Ethereum 2.0 staking reward?

The APY produced is used to calculate Ethereum stake payouts. The payment is affected by the number of staked ETH tokens and the total number of network validators. The interest rate rises when fewer ETH are staked on the network.

The interest rate, on the other hand, decreases as more ETH is locked into the network. Regardless of the interest rate, high or low, the constructed annual rewards will not be withdrawn until ETH2.0 is available.

The staked ETH will remain in place until Phase 1 is completed and cannot be withdrawn or sold. Some exchanges, however, have created tokens that may be used for trades or withdrawals that match the amount of ETH pledged. The investor's strategy also determines profits from Etherium 2.0 staking. Compared to non-custodial staking, investors' rewards will be significantly smaller if they use a staking pool.

What is the best wallet to stake Ethereum?

Examining the coin's website where you wish to keep your crypto(s) is one method of selecting a wallet. There are a variety of solutions designed expressly for various cryptocurrencies. However, it's wise to look around if you intend to protect various cryptocurrencies in one place. Read the content below to decide what's best for you.

Hot wallets

A hot wallet is a computer or other internet-connected device. These are typically free and offer further services, such as trading or staking, in exchange for fees. A hot wallet makes Bitcoin transactions relatively simple, but it may be more vulnerable to hackers potentially accessing your cryptocurrency via the internet.

Cold wallets

A cold wallet, a Bitcoin storage option, is unavailable online. They are referred to as "hardware wallets" and work with physical media, most commonly in the form of a USB stick. These are usually expensive because you need to buy gear to hold the cryptocurrency. It is considered the most secure type of wallet because it requires hackers to access your device and the associated PIN/Password. However, if you lose the physical device, it may not be easy to recover your currency.

Hosted wallets

These wallets are operated on a different server that you cannot access. Hackers employ these Bitcoin wallets because they store the funds from server-side wallets.

Decentralized wallets

This particularly secure crypto wallet allows only one person to access the keys. A decentralized wallet will never guarantee complete privacy. Another disadvantage is that you cannot rely on a third party to send, receive, or store your money.

Exchange wallets

These wallets are linked to cryptocurrency exchanges, making trading and transactions straightforward.

Mobile wallets

These wallets work with mobile operating systems like iOS and Android. These wallets enable you to manage private keys and conduct transactions from anywhere. Coinbase, Binance, and Cex.io are some well-known platforms that have mobile wallets.

Desktop wallets

Users can use desktop wallets to store private keys.

Best Crypto Wallets Security & Fees ComparisonEthereum staking rewards by crypto exchanges | Compared

Using a reputable crypto exchange is the quickest and easiest way to begin staking ETH 2.0 or other cryptocurrencies. These platforms may impose fees ranging from 15% to 25% of staking earnings for infrastructure, security, and convenience.

Here is a step-by-step guide on how to stake using the Binance cryptocurrency exchange:

Step 1: Make sure you add funds to your Binance account so you can buy ETH 2.0 or other cryptocurrencies.

Step 2: You can find the tab 'Earn' under the menu bar. Click on 'Staking'.

Step 3: There is a tab called 'Locked Staking' under which you can search for your desired coin and then click 'Stake' to proceed.

Step 4: Next, you need to determine the amount you want to stake and enter it; then click 'Confirm' to proceed.

The following comparative table shows the stake rewards of crypto exchanges.

| Binance | ByBit | Huobi Global | OKEx | Crypto.com | |

|---|---|---|---|---|---|

Tether (USDT) |

10.00% |

4.25% |

Up to 20% APY |

10.00% |

6.5% |

USD COIN (USDC) |

N/A |

5.50% |

Up to 20% APY |

12.00% |

6.5% |

Ethereum 2.0 (ETH) |

5.20% |

1.75% |

Up to 20% APY |

4.07% |

4% |

Binance Coin (BNB) |

10.00% |

N/A |

Up to 20% APY |

N/A |

3% |

Solana (SOL) |

1.50% - 14.79% |

0.58% |

Up to 20% APY |

12% |

4.5% |

Ethereum (ETH) |

2.00% - 15.79% |

0.55% |

Up to 20% APY |

5% |

3% |

Cosmos (ATOM) |

1.42% - 30.49% |

1.10% |

Up to 20% APY |

N/A |

5% |

Tezos (XTZ) |

2.00% - 8.67% |

N/A |

Up to 20% APY |

N/A |

N/A |

Polkadot (DOT) |

3.00% - 20.98% |

1.32% |

Up to 20% APY |

N/A |

12.5% |

Algorand (ALGO) |

1.00% - 8.24% |

5% - 10% |

Up to 20% APY |

N/A |

3% |

|

|

|

|

|

|

What is the Max Ethereum 2.0 Reward?

Binance offers a maximum return of 5.20% on ETH 2.0 staked there, while OKEx offers a maximum return of 4.07%.

Is Ethereum staking a good idea?

Ethereum is one of the most well-known altcoins, and many investors and enthusiasts regard it as much more than just another cryptocurrency. Based on the technical analysis by experts at the Traders Union, Ethereum is currently an attractive purchase based on its current trajectory. Experts believe it will surpass $4,000 near the end of 2023.

Is Ethereum staking a good idea? There is no simple answer when it comes to whether or not staking Ethereum is a good idea, as this largely depends on the individual investor's goals and needs. For those looking to generate passive income over the long term, staking Ethereum can be a great way to achieve this. The price of Ethereum has been on the rise in recent years, and there is potential for this trend to continue in the future. This makes Ethereum a promising investment option for those looking to create long-term wealth. Discover Ethereum staking rates and how they work.

However, for those seeking short-term earnings, staking Ethereum may not be the best idea. The volatility of cryptocurrencies can lead to sharp decreases in value, which could completely erase any profits made from staking. It's important to do your research before investing in any cryptocurrency and to understand the risks involved.

10 Best Coins to Stake During The Crypto WinterHow high can Ethereum go in 2024, 2025, and 2030?

The most crucial factor in deciding whether to purchase a particular cryptocurrency is its price. For your convenience, TU compiled long-term Ethereum coin price projections that can help you decide whether to buy it. Even though these predictions are very helpful, sometimes they don't turn out to be accurate.

Ethereum (ETH) price prediction for 2024

According to the analytical forecast by Anton Kharitonov, Ethereum price will be within $1,278.957 - $1,880.819 by the end of 2023. It will be possible to earn money throughout the year from volatility.

| Month | Minimum Price | Maximum Price | Average Price | Change |

|---|---|---|---|---|

| December 2023 | $1,278.957 | $1,880.819 | $1,504.655 | -3.58 % |

Ethereum (ETH) price predictions for 2025, 2030, and 2033

| Year | Price in the middle of the year | Price at the end of the year | Average growth, % per year |

|---|---|---|---|

| 2023 | $1,069 | $1,775 | +14% |

| 2023 | $1,868 | $1,617 | +4% |

| 2024 | $1,782 | $2,103 | +35% |

| 2025 | $2,330 | $2,630 | +69% |

| 2026 | $2,926 | $2,733 | +76% |

| 2027 | $2,979 | $3,223 | +108% |

| 2028 | $3,465 | $3,705 | +139% |

| 2029 | $3,849 | $4,080 | +163% |

| 2030 | $4,310 | $4,538 | +192% |

| 2031 | $4,765 | $4,964 | +220% |

| 2032 | $5,175 | $5,397 | +247% |

| 2033 | $5,618 | $5,735 | +269% |

| 2034 | $5,950 | $6,164 | +297% |

Can I mine Ethereum?

The Merge upgrade is Ethereum's long-awaited conversion from a proof-of-work consensus mechanism to a proof-of-stake consensus mechanism. As far as the user is concerned, the merge should be seamless. However, for those who staked their ETH, balances will not be unlocked nor will they be available to trade or transfer immediately after the Merge. Staked ETH is expected to be unlocked and accessible once the Ethereum protocol completes its upgrades. According to current estimates, this upgrade will be completed in early 2023.

Unlike proof-of-work, which relies on high-powered computers to solve complex algorithms, proof-of-stake validates transactions through network users who own large amounts of the blockchain's native token. With the merge, Ethereum becomes one of the first blockchains to convert from proof-of-work validation to proof-of-stake, which will reduce energy usage and decrease miner uncertainty. The switch will likely sideline miners who benefited from proof of work.

FAQ

Is it safe to stake Ethereum?

Due to the possibility of network failures or defects, Ethereum staking bears some risk. As a result, before staking Ethereum, assess the advantages and disadvantages.

What's the difference between Ethereum 1.0 and Ethereum 2.0?

Ethereum 1.0, the initial Ethereum blockchain, was released in 2015. Ethereum 2.0 is in the developmental stage and significantly enhances the Ethereum network. It will convert from a PoW to a PoS consensus model.

What is ETH 2.0 staking?

ETH 2.0 staking is keeping Ethereum in a wallet to support network security and gain incentives for staking Ethereum.

Is it worthwhile to stake Ethereum?

Ethereum staking is beneficial in the long run since you will receive an annual percentage reward on the amount staked. However, you will not be able to make money until Ethereum 2.0 is operational.

Glossary for novice traders

-

1

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

2

Leverage

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

-

3

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

4

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

5

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.