According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- 100$

- WebTrader

- MetaTrader4

- CySEC

- FCA

- FSCA

- 2010

Our Evaluation of IronFX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

IronFX is a reliable broker with the TU Overall Score of 7.13 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by IronFX clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

The broker is focused on cooperation with active traders, regardless of their trading experience.

Brief Look at IronFX

IronFX was launched in January 2010 by a team of specialists in finance and software development. Today, IronFX has grown to be among the industry leaders that provide online trading services globally. Customers can use the MT4 advanced trading platforms and trade more than 300 tools from 6 various asset classes. IronFX serves individual as well as corporate clients from over 180 countries. IronFX is highly valued for providing cutting-edge technological innovation on trading platforms and trading tools.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- round-the-clock communication with a multilingual support TEAM on weekdays;

- wide range of trading assets;

- the verification procedure can be repeated;

TU Expert Advice

Financial expert and analyst at Traders Union

Over the years of cooperation with Traders Union, IronFX has established itself as a partner that strictly fulfills its obligations. The broker offers accounts for both beginners and professionals.

The IronFX website has a convenient multilingual interface. Data on trading conditions are presented in full and described in as much detail as possible.

In the process of working with IronFX, clients can trade the following financial instruments: currencies, metals, indices, commodities, futures, and stocks.

- Regulatory approval is crucial for you, as IronFX is a regulated broker holding licenses from authorities such as CySEC, FCA, ASIC, and FSCA.

- You are interested in a wide range of trading instruments, including over 200 Forex pairs, metals, indices, commodities, futures, shares, and cryptocurrencies. IronFX provides access to these assets on various platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, and the IronFX mobile app.

- You are from a select set of countries, as IronFX does not accept clients from the USA, Canada, Iran, Cuba, Sudan, Syria, and North Korea.

- A history of fines concerns you, as IronFX has faced fines from regulators in the past for violations of trading laws, although the broker claims to have resolved most of these issues.

IronFX Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61.8% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | Live Floating/Live Fixed: Standard, Premium, VIP, Zero Fixed; STP/ECN Accounts: No commission, Zero Spread, Absolute Zero |

| 💰 Account currency: | USD, EUR, GBP, AUD, JPY, PLN, CZK JPY, PLN, and CZK |

| 💵 Deposit / Withdrawal: | Wire bank transfers, Local bank transfers, credit/debit cards, payment apps (Skrill, Neteller, etc.) |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | 1:30 (FCA), 1:30 (CySEC), 1:1000 (FSCA) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,4 pips |

| 🔧 Instruments: | Forex, Commodities, Indices, Stocks, Metals, Futures (ALL CFDs) |

| 💹 Margin Call / Stop Out: | Depending on the trading instrument |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Android, iOS, WebTrader |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | ECN, STP, Market Maker |

| ⭐ Trading features: | Indicators; Advanced Terminal. |

| 🎁 Contests and bonuses: | No |

IronFX is regulated by multiple reliable bodies, in particular CySEC, FCA, FSCA. IronFX provides clients with the best terms for active trading. The minimum amount for replenishing an account is $100, the leverage is 1:30. IronFX offers demo accounts so traders can test the platform and practice strategies. The Company serves retail and institutional customers from over 180 countries.

IronFX Key Parameters Evaluation

Video Review of IronFX

Share your experience

- Best

- Last

- Oldest

MY Taman Prai

MY Taman Prai The biggest advantage of ironfx is the education that they offer. I mean it’s completely free and there is no need to buy expensive courses or books about trading. It’s way more beneficial to attend live webinars, where experienced traders share with some real profitable strategies and tips for trading in the markets. They are pretty frequent as well, which is a big plus. The on;y thing is to keep notes from those webinars, as they give a lot of information.

I don’t think they have a disadvantage that needs to be highlighted. They are pretty normal in every other area, nothing too special or bad. I can call it consistency ?

GB Newtownabbey

GB Newtownabbey IronFX offers a lot of tools for effective trading. I like how they came up with an idea of adding the web trader platform because I can’t trade on the go, it distracts my focus and discipline, it’s impossible to stick to the plan when you see somewhere how your assets are dropping by 3-4%. That’s why I prefer trading only on the desktop because I don’t look at charts every hour, I’m just setting take profits and stop losses. You have a strategy, a plan and you have to follow it even if something goes wrong in financial markets, this is what I understood when I was reading multiple books about trading.

Obviously, the lack of the MT5 felt strongly and it’s strange for a broker of such a level to not offer the more modern version of the trading terminal. I believe they will add it soon or later because I noticed that a lot of people asked about this request.

DE Giessen

DE Giessen There is a good variety of assets, includng forex pairs and CFDs. Fast platform performance.

The plaform feels slightly outdated in terms of visuals, but functionally solid.

ZA Cape Town

ZA Cape Town The academy was quite good. I tried to learn through youtube or AI bots, but they lack structure. This has strucuture, especially in the trading school, where I learn the basics first and then progress, like that. The trade platform is very complex under the hood, but was not hard to start with. Easy to understand at least.

The signal copying/providing seems underdeveloped, I couldnt find people to follow who I would genuenly believe would give me profits. There are a lot of accounts to choose from, but no guidence on that, hard to know which one is best for what,. without looking at answers on Quora or on here. They could improve on that I think.

GB Glasgow

GB Glasgow When it comes to picking a trader to follow, there are countlessss of strategies backed by detailed performance data on the returns and stuff. This helps to set my expectations for each trader.

The fees are too high for some to follow. I mean they can charge fees for each trade taken…

FR Cannes

FR Cannes The IronFX offers favourable trading conditions on a live zero fixed spread account. It has tight spreads and I hardly notice the difference between bid and ask prices when I’m trading during immense volatility and the publication of the important macroeconomic news. It allows me to open big trading positions with 3-5 lots and I don’t need to worry about how much I can lose on spreads.

Of course, they have a little con on the account, it turns out that they charge commissions for opening and closing trades. Luckily, I’m not scalping and prefer to hold positions for a long time, hence, I usually open 5-7 trades every week.

US Alpharetta

US Alpharetta Trading Account Opening

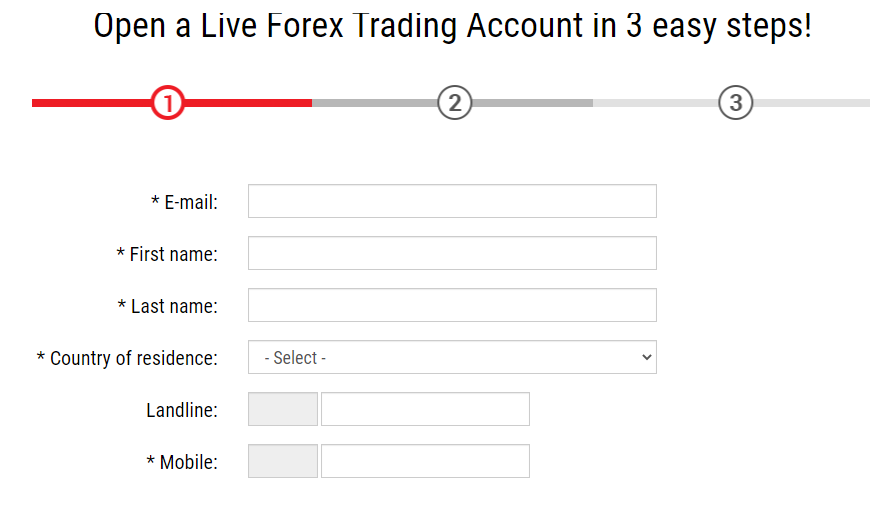

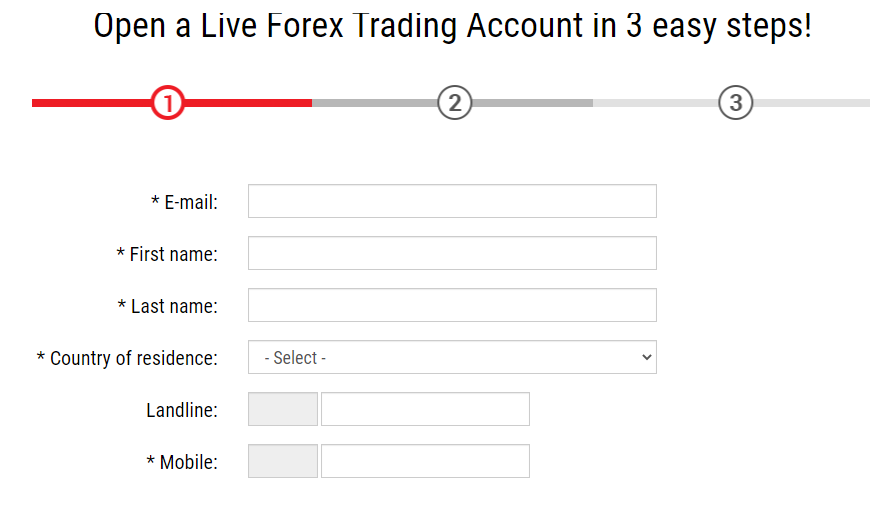

We suggest you study the registration procedure closely and take a virtual tour of your personal account to know how to become a client.

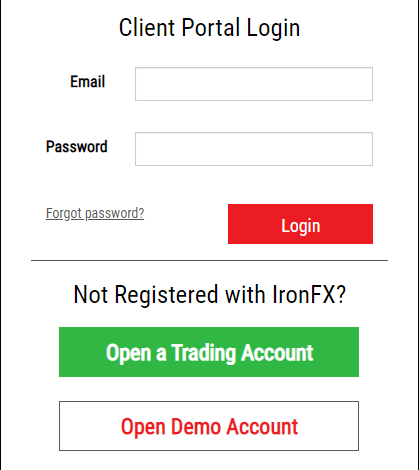

Follow the Traders Union website, go through a short registration, follow the referral link to the broker's website. Click on the "Register" or "Start Trading" button on the main page.

Fill in the form with personal data, indicate the country of residence, select the type of account, leverage, and base currency. NOTE: Fill in the personal data in English only.

Come up with a password for your personal account and confirm the registration by clicking on the "Open your trading account" button.

Your application for opening an account will be sent for confirmation. Then the broker will send you your account login information to your email address. Upon confirmation of the application, you will instantly be allowed to access your personal account.

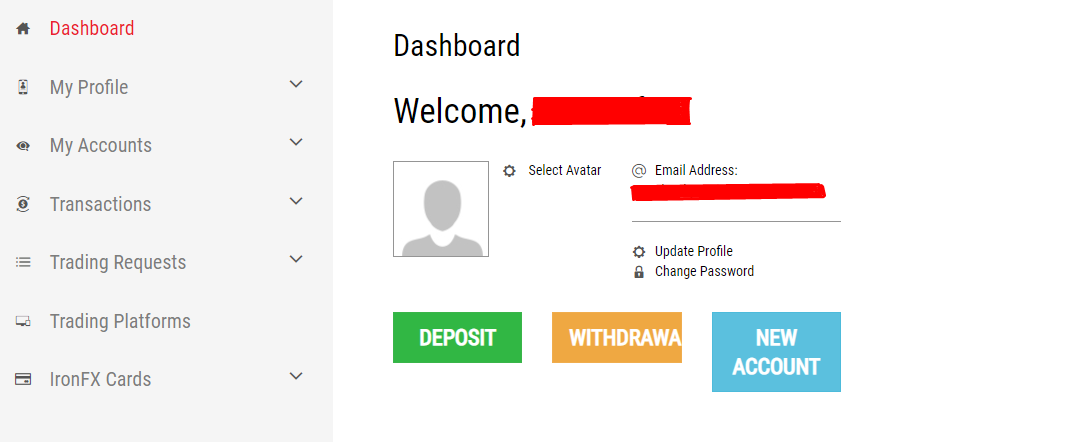

In your personal account, you will have access to the following functions: financial transactions — account funds replenishment/withdrawal/transfer between accounts.

Also, the personal account allows the client to access useful extra functions from the following sections:

-

"My profile". Changing your personal account settings;

-

"My accounts". Managing current accounts and creating new ones;

-

“Trading platforms”. Select and customize the platforms;

-

"Trade requests". Trading account settings, bonus information, password collection, and recovery;

-

“Instruments”. Search bar to speed up the process;

-

"IronFX Card". Card information, card request, card review.

IronFX - How to open, deposit and verify a trading account | Firsthand experience of TradersUnion

Regulation and safety

IronFX has a safety score of 9.7/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 15 years

- Strict requirements and extensive documentation to open an account

IronFX Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

| BMA (Bermuda) | Bermuda Monetary Authority | Bermuda | No specific fund | Tier-3 |

IronFX Security Factors

| Foundation date | 2010 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker IronFX have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of IronFX with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, IronFX’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

IronFX Standard spreads

| IronFX | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,7 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,2 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,8 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,3 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

IronFX RAW/ECN spreads

| IronFX | Pepperstone | OANDA | |

| Commission ($ per lot) | 2 | 3 | 3,5 |

| EUR/USD avg spread | 0,4 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,5 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with IronFX. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

IronFX Non-Trading Fees

| IronFX | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

The broker offers a wide range of trading accounts, including accounts for novice traders in the foreign exchange market and more experienced participants. The differences are in the base currency, spread size, minimum volume of transactions and, a commission for the transaction.

Types of accounts:

Deposit and withdrawal

IronFX received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

IronFX provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- USDT (Tether) supported

- Low minimum withdrawal requirement

- BTC available as a base account currency

- No deposit fee

- Limited deposit and withdrawal flexibility, leading to higher costs

- Wise not supported

- PayPal not supported

What are IronFX deposit and withdrawal options?

IronFX provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT.

IronFX Deposit and Withdrawal Methods vs Competitors

| IronFX | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are IronFX base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. IronFX supports the following base account currencies:

What are IronFX's minimum deposit and withdrawal amounts?

The minimum deposit on IronFX is $100, while the minimum withdrawal amount is $50. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact IronFX’s support team.

Markets and tradable assets

IronFX offers a limited selection of trading assets compared to the market average. The platform supports 200 assets in total, including 80 Forex pairs.

- 80 supported currency pairs

- Commodity futures are available

- Copy trading platform

- Bonds not available

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by IronFX with its competitors, making it easier for you to find the perfect fit.

| IronFX | Plus500 | Pepperstone | |

| Currency pairs | 80 | 60 | 90 |

| Total tradable assets | 200 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products IronFX offers for beginner traders and investors who prefer not to engage in active trading.

| IronFX | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

IronFX received a score of 9.5/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- Free VPS for uninterrupted trading

- MetaTrader is available

- API access for automated trading

- Proprietary platform with unique features

- No TradingView integration

- Strategy (EA) Builder is not available

Supported trading platforms

IronFX supports the following trading platforms: MT4, MT5, cTrader, Proprietary platform, WebTrader. This selection covers the basic needs of most retail traders. We also compared IronFX’s platform availability with that of top competitors to assess its relative market position.

| IronFX | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | Yes | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | Yes | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key IronFX’s trading platform features

We also evaluated whether IronFX offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 68 |

| Tradable assets | 200 |

Additional trading tools

IronFX offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

IronFX trading tools vs competitors

| IronFX | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | Yes | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

IronFX supports mobile trading, offering dedicated apps for both iOS and Android. IronFX received a score of 7.5/10 in this section, indicating a generally acceptable mobile trading experience.

- Indicators supported

- Mobile alerts supported

- Strong Android user ratings, currently at 4.8/5

- Low app installs across iOS and Android

- Weak user feedback on iOS

We compared IronFX with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| IronFX | Plus500 | Pepperstone | |

| Total downloads | 10,000 | 10,000,000 | 100,000 |

| App Store score | 3.0 | 4.7 | 4.0 |

| Google Play score | 4.8 | 4.4 | 4.0 |

| Mob. 2FA | Yes | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

A section on the official website of the IronFX is devoted to Forex trading education. It offers a wealth of useful content for novice traders, including articles, tutorials, and educational podcasts. Additionally, to assist clients in adapting their trading strategies to market changes, the company publishes market trends and financial news.

To reinforce theory with practice, traders can use the demo account provided by the broker on MT4. The risks of losing funds are eliminated since the trader uses virtual money. The available amount of virtual deposit is $100,000.

Customer support

If any problems or questions arise, you can contact the broker's support service, which works around the clock, 5 days a week.

Advantages

- Multilingual support

- A large number of communication methods

Disadvantages

- The support doesn’t work on weekends

- No callback function

This broker provides the following communication channels for existing clients and potential investors:

-

by email;

-

call the hotline;

-

message to online chat;

-

search for answers in the FAQs section.

Communication with the support service is carried out both from your personal account and directly from the broker's website.

Contacts

| Foundation date | 2010 |

|---|---|

| Registration address | Iapetou 2, Agios Athanasios, 4101, Limassol, Cyprus |

| Regulation | CySEC, FCA, FSCA |

| Official site | https://www.ironfx.eu/ |

| Contacts |

+357 25027212, +27 11 017660, +44 (0) 207 416 6670

|

Comparison of IronFX with other Brokers

| IronFX | Eightcap | XM Group | RoboForex | VT Markets | 4XC | |

| Trading platform |

WebTrader, MetaTrader4 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader4, MetaTrader5, VT Markets App, Web Trader+ | MT5, MT4, WebTrader |

| Min deposit | $100 | $100 | $5 | $10 | $50 | $50 |

| Leverage | From 1:30 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | Yes | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

40% / 20% | 80% / 50% | 100% / 50% | 60% / 40% | No / 50% | 100% / 50% |

| Order Execution | STP, Market Maker, ECN | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | No | No | Yes | No | No |

Detailed Review of IronFx

IronFX provides its services to traders globally. The broker considers its main goal to provide clients with the most comfortable trading terms. The broker allows its clients to engage in active trading. For traders with different needs, the company provides a wide range of trading instruments —from standard to exotic currency pairs, stocks, metals, and commodities.

IronFX by the numbers:

-

over 1,200,000 traders have opened accounts here.

-

communication with the support service and personal managers is carried out 24/5;

-

during 10 years of work, the broker has received over 30 local and international awards;

-

over 300 trading assets are available for trading.

IronFX is one of the best solutions for active trading

IronFX is an online trading broker that offers wide functionality and comfortable trading terms for both novice and professional traders. The company offers a choice of demo account and 7 types of real accounts. There are micro-accounts for novice traders and classic and professional trading accounts. The main feature of the professional accounts is the STP/ECN mechanism for bringing transactions to the interbank market, which makes it possible to increase the speed of order execution.

For trading, you can choose a trading platform of your choice: from the classic MetaTrader 4 to the portable version of WebTrader.

Advantages:

wide range of trading accounts;

a trader can choose the best trading platform for himself;

Latest IronFX News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i