Sniper Swap Review

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Sniper Swap is an Meme CDEX Exchange launched in 2024, aiming to revolutionize the way users trade cryptocurrencies. It offers a unique trading experience, particularly for early access to new tokens. It supports any Meme token on any BlockChain network.

Sniper Swap uses advanced sniper bots that detect and execute trades at the moment new liquidity pools are created, providing a first-mover advantage. The platform is designed for high-speed and automated trading, with features like automated trading and safety settings to mitigate risks. However, users should be aware of potential scams and the inherent risks of rapid trading environments. In this article, we will talk about the key features, advantages, disadvantages, and trading mechanisms of Sniper Swap.

Main features of Sniper Swap

Sniper Swap stands out in the crowded market of decentralized exchanges due to its unique features and user-friendly interface. Key features include:

Decentralized trading. Trade directly from your wallet without the need for a central authority.

High security. Utilizes blockchain technology to ensure secure and transparent transactions.

Low fees. Competitive trading fees compared to traditional exchanges.

Liquidity pools. Users can provide liquidity to earn rewards.

Cross-chain compatibility. Supports multiple blockchain networks for wider asset availability.

User-friendly interface. Designed to be accessible for both beginners and experienced traders.

Staking and farming. Opportunities to earn passive income through staking and yield farming.

How to get started with Sniper Swap

Starting with Sniper Swap is straightforward. Go to the Sniper Swap website and follow these steps:

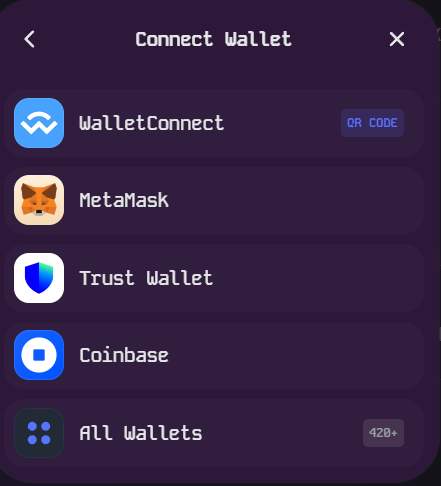

Set up a cryptocurrency wallet: Ensure you have a compatible wallet like MetaMask, Trust Wallet, or WalletConnect.

Connect your wallet: Visit the Sniper Swap website and connect your wallet.

Add funds: Transfer the desired amount of cryptocurrency to your wallet.

Start trading: Access the trading interface and start swapping your assets.

The intuitive interface of Sniper Swap makes it easy for users to navigate the platform, execute trades, and manage their portfolios.

How to trade on Sniper Swap

Trading on Sniper Swap involves the following steps:

Select trading pairs: Choose the cryptocurrency pairs you wish to trade.

Set trading parameters: Specify the amount you want to trade and any price limits.

Execute the trade: Confirm the transaction from your wallet.

Monitor your portfolio: Keep track of your trades and manage your holdings.

Sniper Swap provides real-time data and analytics to help users make informed trading decisions. The platform's cross-chain compatibility allows for seamless trading of assets across different blockchain networks. You can learn about innovative ways to make money, tap-tap games and more on TU Airdrop Daily channel.

Listing / Partners (Coming soon)

According to the roadmap, the conclusion of partnerships with Bybit, Binance, OKX is planned for 2025. Let's take a look at the trading conditions offered by these exchanges:

| Coins Supported | Spot Taker fee, % | Spot Maker Fee, % | Fiat supported | Foundation year | Open account | |

|---|---|---|---|---|---|---|

| 329 | 0,1 | 0,08 | No | 2017 | Open an account Your capital is at risk. |

|

| 278 | 0,4 | 0,25 | No | 2011 | Open an account Your capital is at risk. |

|

| 250 | 0,5 | 0,25 | No | 2016 | Open an account Your capital is at risk. |

|

| 72 | 0,2 | 0,1 | No | 2018 | Open an account Your capital is at risk. |

|

| 1817 | 0 | 0 | No | 2004 | Open an account Your capital is at risk. |

Pros and cons of Sniper Swap

Like any trading platform, Sniper Swap has its advantages and disadvantages. Here are the main pros and cons:

- Advantages

- Disadvantages

- Decentralized nature. Increased security and control over assets.

- Low fees. More cost-effective compared to traditional exchanges.

- User-friendly. Easy to navigate for traders of all levels.

- High liquidity. Liquidity pools ensure smooth and efficient trading.

- Staking and farming opportunities. Additional earning mechanisms for users.

- Limited customer support. No centralized customer service for assistance.

- Volatility of crypto assets. Risk associated with the fluctuating value of cryptocurrencies.

- Regulatory uncertainty. Potential legal and regulatory challenges.

- Learning curve. Beginners might need time to understand DEX functionalities.

How to provide liquidity on Sniper Swap

Providing liquidity on Sniper Swap allows users to earn rewards and contribute to the platform's liquidity pools. Follow these steps to provide liquidity:

Select a liquidity pool. Choose a pool that supports the assets you want to provide.

Deposit assets. Deposit equal values of the selected assets into the liquidity pool.

Earn rewards. Receive liquidity provider (LP) tokens and earn rewards based on trading fees.

Monitor your investment. Track the performance of your liquidity provision and manage your assets.

Providing liquidity not only helps maintain the efficiency of the exchange but also offers users a way to earn passive income through trading fees and additional incentives.

Take the time to familiarize yourselves with the platform and its features

Sniper Swap represents a significant advancement in the area of decentralized exchanges. Its combination of user-friendly design, low fees, and enhanced security makes it an attractive choice for cryptocurrency traders. However, it's essential to approach DEX trading with a clear understanding of the risks involved.

I recommend that users take the time to familiarize themselves with the platform and its features before diving into trading. The decentralized nature of Sniper Swap offers many benefits, but it also requires users to take on more responsibility for their trades and asset management.

Sniper Swap provides a well-built platform for traders looking to leverage the advantages of decentralized exchanges. By offering features like staking, yield farming, and cross-chain compatibility, it caters to a wide range of trading strategies and preferences.

Summary

Sniper Swap is a decentralized exchange that offers a secure, efficient, and user-friendly platform for trading cryptocurrencies. Its unique features, such as low fees, high security, and opportunities for staking and farming, make it an attractive option for traders. However, users should be mindful of the potential risks, including the volatility of crypto assets and regulatory uncertainties.

Overall, Sniper Swap provides a valuable platform for trading digital assets while maintaining control over one's funds. Its decentralized nature, combined with a range of features designed to enhance the trading experience, positions it as a strong contender in the DEX market.

FAQs

How can I start trading on Sniper Swap?

To start trading, set up a compatible cryptocurrency wallet, connect it to the Sniper Swap website, add funds, and begin trading by selecting trading pairs and executing transactions.

What are the main advantages of Sniper Swap?

The main advantages include decentralized trading, low fees, high security, user-friendly interface, and opportunities for staking and yield farming.

What risks are associated with using Sniper Swap?

The risks include the volatility of cryptocurrency values, potential regulatory issues, limited customer support, and a learning curve for beginners.

Can I earn passive income on Sniper Swap?

Yes, users can earn passive income through liquidity provision, staking, and yield farming opportunities offered by Sniper Swap.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.