Don’t risk it.

Always play safe and exit the trade promptly if conditions are unfavorable.

Editorial Note:

While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

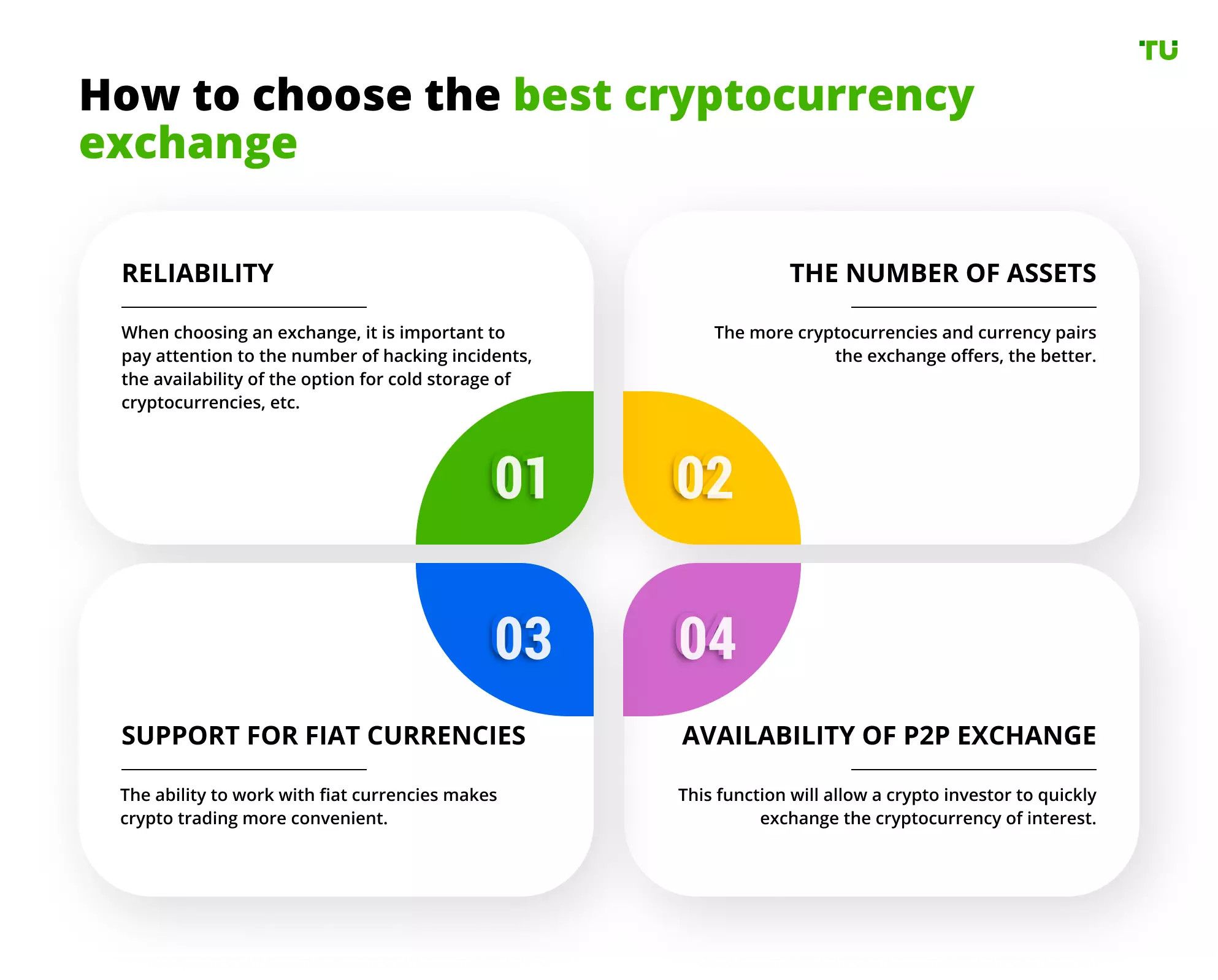

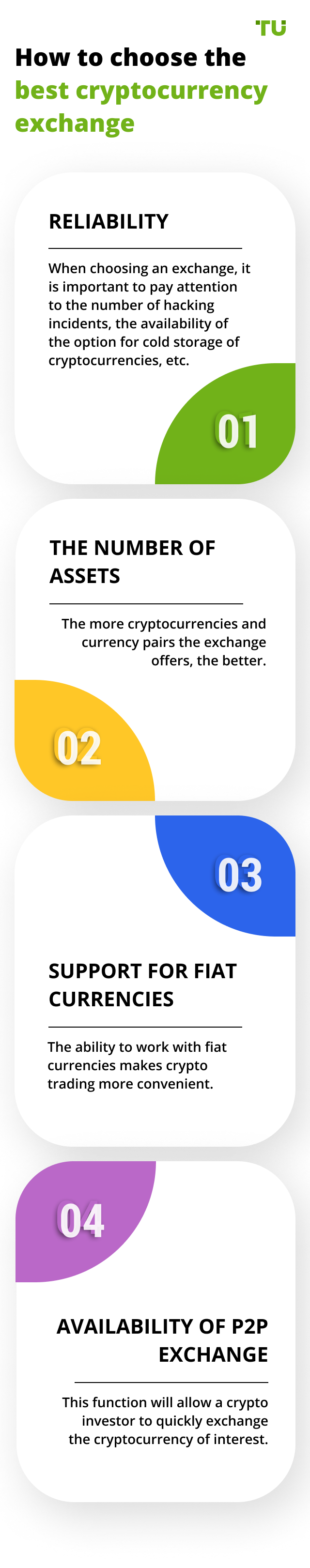

In a cryptocurrency exchange, traders can exchange one cryptocurrency for another. Exchanges are also made for other assets, such as national currencies (dollar, euro, yuan). Our Crypto Exchanges Rating evaluates platforms that provide access to cryptocurrency trading. An investor must first understand how to trade on a cryptocurrency exchange and how to choose the best cryptocurrency exchange to make money with Bitcoin and other digital currencies.

Cryptocurrencies are digital currencies, each of which has a unique encrypted computer code. Cryptocurrencies are a new kind of digital financial asset. They, as well as traditional currency pairs, are also subject to changing exchange rates, and earning strategies are based on that. Bitcoin (Bitcoin, BTC) is one of the most popular cryptocurrencies in the world today.

Best Crypto Exchanges for 2024 (United States)

Your location is United States

We’ve selected Top Crypto Exchanges providing services in your country. If you would like to learn about the best crypto exchanges in a different region, please use the “Find my crypto exchange” service.

The cryptocurrency exchange rating was created by Traders Union experts to provide everyone with objective and independent information about the best crypto exchanges. Traders Union specialists have access to the internal trading and client indicators of a record number of cryptocurrency exchanges, and can also analyze data from thousands upon thousands of traders. This is precisely why the Traders Union rating of cryptocurrency exchanges is the most objective rating available for 2024.

Do you prefer watching videos? Then watch the video summary of this article.

Below you will find all the information.

Just study the cryptocurrency exchange rating compiled by financial specialists and analysts of the Traders Union to choose the best exchange for cryptocurrency trading. Also, you must familiarize yourself with the main crypto-exchange trading terms in its profile. You can then open an account using the referral link of the Union.

Study the available services and trading tools for cryptocurrency trading on the company's website to form an impression of the crypto exchange’s quality of service. It is important to know if a cryptocurrency exchange is available in your country. On the Traders Union website, you will find the best exchanges that operate in different countries and regions - for example, Australia, USA, UK, Europe, etc.

Study the official website of the cryptocurrency exchange in detail to independently conduct a comprehensive analysis of its services and offers.

These are the sections that should be available on a reliable cryptocurrency exchange website:

A section on each cryptocurrency exchange, with a description of its history, its purpose, and mission in the cryptocurrency market, as well as the country and registration address, the name of the financial regulator, and the exchange’s license number and contact details of the crypto exchange.

This section describes the exchange’s trading conditions and trading instruments. Here you can find a list of available cryptocurrencies, price movement charts of a selected asset, current price quotes, as well as information about the fees of the cryptocurrency exchange. In the TU rating, you can find commission-free cryptocurrency exchanges.

An educational section with basic information about the cryptocurrency market, which will help a novice trader learn the basics of crypto trading. Also, there’s a help section with detailed guides for working with the cryptocurrency exchanges, such as instructions for opening a trading account, working with a trading platform, etc.

The section with analytics and the latest news of the cryptocurrency market on the cryptocurrency exchange website will enable you to estimate the market situation in real-time and, as a result, invest in a particular digital asset more effectively, thus, hopefully, making more profit.

The customer support portal ensures prompt communication with representatives of the cryptocurrency exchange when questions arise.

and a 24/7 support service are additional advantages of a crypto exchange.

You can register a personal account on the website of a cryptocurrency exchange. It stores the client's data, information about account verification, trading activity on accounts, the deposit/withdrawal transactions history, as well as extra tools available only to registered users.

Author, Financial Expert

at Traders Union

After the crash of FTX and several other smaller cryptocurrency platforms, investors are paying increasing attention to their reliability. And for a good reason. Of course, investors should focus on the transparency of the exchange data, regulations, and methods of information protection. Traders Union experts, when compiling the rating, dedicated considerable attention and time to evaluating the reliability and stability of exchanges.

The optimal choice of a cryptocurrency exchange also largely depends on the goals of a specific investor. Some exchanges specialize in spot trading, offering a vast selection of coins specifically for spot trading and investing. Others focus on the futures market, where key indicators include commission size, integration of the trading platform with bots, and high liquidity. The third type of exchanges has created comfortable conditions for earning passive income through staking. To make the optimal choice, thoroughly read detailed reviews on the Traders Union portal.

Don’t risk it.

Always play safe and exit the trade promptly if conditions are unfavorable.

Be patient.

Wait for optimal trading signals to start. Patience allows you to avoid unnecessary risks and rash moves.

Controlling the order book with the list of quotes is an extremely important skill since the further profit of the trader depends on the quotes.

Be aware.

Always be aware of information on the volume and capitalization of the market. This will allow you to predict future quotations and market behavior.

Being informed of current conditions in the primary market enables you to minimize the number of unsuccessful transactions. Veteran traders also recommend minimizing trading losses by committing no more than 50% of the amount of money in your trading account at any one time. Close a trade if market conditions become unfavorable.

Important

It is quite difficult to trade large amounts on crypto exchanges, since other traders, having found such orders, always try to be proactive and begin to sell their coins widespread, as they expect new activity in the market. So, divide your application into several small orders, which should not exceed 0.5 BTC.

Keep in mind that cryptocurrency exchanges get their main liquidity from limited groups of participants that can make a significant correction in the rate, and it is very important to be able to detect a change in trend and place appropriate orders promptly.

NFT (non-fungible tokens) allow you to sell objects of art, gaming objects and other singular digital objects. Top exchanges offer NFT marketplaces.

Decentralized Finance (DeFi) are the financial instruments of the 21st century; they enable users to provide services to each other without intermediaries such as traditional banks and insurance companies.

Tokenized assets – cryptocurrency exchanges are increasingly offering access to trade not only cryptocurrencies, but also tokenized Forex pairs, stocks, real estate, and other financial assets. This expands the area of use of the exchanges.

Crypto exchange fees are an essential aspect to consider when choosing a platform. Choosing the crypto exchange with the lowest fees helps give you a bigger profit when trading. Let's explore the different types of fees commonly associated with cryptocurrency exchanges:

Trading fees are charges imposed by exchanges for executing trades on their platforms. They are typically calculated as a percentage of the trade's value or as a fixed fee per trade. These fees can vary significantly among exchanges. It's important to consider the fee structure and compare it with other platforms to ensure you're getting the best value for your trades.

Some exchanges may charge fees for depositing funds into your trading account. These fees can vary depending on the payment method used, such as bank transfers, credit/debit cards, or cryptocurrency deposits. It's advisable to review the deposit fee structure of an exchange before initiating any transactions to understand the potential costs involved.

Similar to deposit fees, withdrawal fees are charges imposed by exchanges when you withdraw funds from your trading account. These fees can also vary depending on the withdrawal method chosen and the cryptocurrency being withdrawn. It's essential to consider withdrawal fees, especially if you plan to move your funds frequently or in large amounts.

Account fees are charges associated with maintaining an account on a crypto exchange. Some exchanges may require users to pay a subscription fee or a fee for accessing premium features or services. It's important to review the account fee structure of an exchange to understand any potential ongoing costs.

Opening a crypto exchange account is a straightforward process. Here is a step-by-step guide.

Go to the crypto exchange website using a web browser of your choice.

Click on the "Sign Up" or "Register" button on the homepage. You will be directed to the registration page.

Enter your email address and choose a strong password for your account. Make sure to follow any specified password requirements.

Check your email inbox for a verification email from your crypto exchange. Click on the verification link provided to confirm your email address.

To enhance the security of your account, set up Two-Factor Authentication (2FA). This typically involves linking your account to an authenticator app, such as Google Authenticator or Authy, to generate one-time verification codes.

Bybit may require you to complete a Know Your Customer (KYC) verification process. This process involves providing personal information and identity verification documents, such as a passport or driver's license. Follow the instructions provided by crypto exchange to complete the KYC verification.

Once your account is verified, you can proceed to fund your account. Select the desired cryptocurrency and follow the instructions to deposit funds into your account.

It's advisable to start with small amounts and gradually increase your trading activity as you gain experience and confidence in the market.

I have been using bybit p2p for some time without any issues but the last transaction was not a smooth one. As usual unless the buyer completes the transaction within 15 minutes, the order will be automatically canceled and the coins held in escrow will be returned to your Spot Account, but this time I placed an order paid and was waiting to get the funds in my account, the order timed out and I have already reached out to the customer service to have the funds released but while I was making my complaint I received the funds although the customer support later replied that it could be a network issue. But That was scary. I think Bybit should ensure that p2p transactions are completed within the order time and if the time elapses do the needful.

Delta Exchange offers a good set of features for crypto traders. One of the positive aspects is that all popular cryptocurrencies are represented on the exchange. This allows traders to conveniently work with major digital assets and diversify their portfolios. However, there are some disadvantages. In particular, Delta Exchange lacks investment solutions. For those looking for passive income opportunities or long-term investments, this can be a significant disadvantage. In general, Delta Exchange is suitable for those interested in active trading of popular cryptocurrencies, but it is worth considering that investment opportunities here are limited.

Although the HuobiGlobal platform’s wealth of features including the vast deposit and withdrawal methods, it takes time to get funds paid into my account and the customer service are not responsive. While this has been an ongoing challenge which after some time the funds is deposited into my account, My challenge is the response time of the customer service whenever I contact them and this is beginning to give me concerns. I notice transactions during business hours comes in faster but something need to be done to make this process faster.

I have been actively using the BitMart platform for a few months now, and I would like to point out its advantages. One of the main reasons why I chose BitMart is the possibility of not only spot trading, but also futures trading. This allows me the flexibility to manage my portfolio and use different strategies to maximize my profits. Particularly impressive is the ability to trade futures with leverage up to x100. This provides traders with additional opportunities to maximize their returns, although it does require caution and a good understanding of the market. BitMart offers advanced tools and features for those looking to get the most out of their trading, and this makes the platform one of the best of its kind.

One of the best crypto exchanges I ever dealt with (apart from the biggest ones, of course). You don’t have to be a whale to take advantage of their special trading offers and taker fees for example. I only trade on my laptop via web browser, so I have nothing to say about KickEX app

I have been using Yobit exchange for a few months now, and I would like to point out that it is one of the best platforms for trading cryptocurrencies. One of the main reasons why I chose Yobit is the huge selection of cryptocurrencies. Here you can find not only popular coins such as Bitcoin and Ethereum, but also a lot of lesser-known altcoins, which gives great opportunities for portfolio diversification. In addition, the exchange offers trading pairs with fiat currencies, which greatly facilitates deposit and withdrawal of funds. I would also like to note the simple and convenient interface of the Yobit trading terminal. Everything is intuitive, and the speed of operations is high. Even a beginner will find it easy to understand and start trading on this platform. For me, the convenience and functionality of the interface are important criteria, and Yobit fully meets my expectations.

I like Binance’s trading terminal. It is modern, sleek, and shows relevant information you need for your trades spot on. At the same time, it is not intimidating to navigate around which is a common problem for crypto platforms that prioritize a modem vibe in their UI. It instantly shows the summary of my crypto portfolio, the distribution between assets and the amount, and has the daily PnL (profit and loss) record for the day. This way it is so easy to track which assets performed well in the last 24 hours and which ones lagged behind. I like to hold only a handful of assets for easy traceability of my wins. But even when I add a couple more, it is still uncomplicated to make sense of my stats. Love that crypto is now in a rollercoaster that only goes up and seeing all those greens in my portfolio gives me a great sense of motivation.

I recently started using this platform and it has changed my cryptocurrency trading experience. The interface is incredibly user-friendly, making it easy to navigate and execute trades. One of the outstanding features of StormGain is the variety of trading tools available, which has been important for me to make informed decisions. In addition, the customer support team is prompt and helpful, quickly resolving any issues that arise. However, I have noticed that the withdrawal process can be a bit slow at times. Overall, this is a reliable platform for both beginners and experienced traders.

I’m primarily interested in passive income and YouHodler offers good conditions: the more you trade, the higher the interest accrued on your assets. For example, you receive 6% per annum simply by depositing USD, which is great. If you trade a minimum of $50,000 per month, your interest is 9%. To receive 12%, a minimum trading volume of $5 million is required. So, currently, I am a trader and passive investor, and both are profitable and hassle-free. The exchange doesn’t charge trading fees. However, deposit and withdrawal fees are considerable. I lack analytics here since expert opinion on the market situation is very important. I hope that YouHodler adds new opportunities and am sure that it can surprise me.

Recently started using stormgain and was pleasantly surprised by the quality of their service. One of the biggest pluses is that they offer a free cryptocurrency wallet, which is really convenient and beneficial. It makes managing my assets much easier and I no longer worry about the safety of my funds. The interface of the platform is intuitive, even if you are new to the world of cryptocurrencies. It is easy to navigate, find the necessary information and perform transactions. The presence of detailed instructions and hints is especially pleasing, which makes using the service even more pleasant. Technical support of stormgain works at the highest level. They answer any questions quickly and professionally, helping to solve any problems. This gives me confidence and assurance that I am in good hands. All in all, stormgain has been a real find for me. I hope that they will continue to develop and delight their users with new features and functions. I recommend to everyone who is looking for a reliable and convenient service for working with cryptocurrency!

To buy cryptocurrency, you need to choose a reputable crypto exchange, create an account, deposit funds into your account, select the desired cryptocurrency, and place a buy order at the current market price or a specific price of your choice. Once your order is filled, the purchased cryptocurrency will be credited to your exchange account, and you can choose to transfer it to a personal wallet for added security if desired.

The number of crypto exchanges is continually evolving as new platforms emerge and existing ones evolve or shut down. Currently, there are thousands of crypto exchanges available worldwide, catering to different markets and offering various features and services.

Bybit, one of the biggest crypto exchanges today, is known for its extensive selection of cryptocurrencies, making it one of the exchanges with the most coin options. It offers a wide range of cryptocurrencies, including major ones like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), as well as numerous altcoins and new project listings.

The amount of money required to buy crypto depends on various factors, including the price of the cryptocurrency you wish to purchase, the exchange's minimum investment requirements, and your personal investment goals.

A crypto exchange is an online service where traders exchange similar digital (crypto) currencies at a favorable rate. Cryptocurrency trading is the process of digital assets buying and selling to reap a profit from the difference in their rates.

Pay attention to its position in the ranking when choosing a cryptocurrency exchange. The higher position they are in the rating table reflects their reliability and popularity among traders.