Webull Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Proprietary platform

- 1:2 for overnight trades, 1:4 for intraday trades

- Access to margin trading is available when depositing funds from $2,000

Our Evaluation of Webull

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Webull is a reliable broker with the TU Overall Score of 7.21 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Webull clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

Webull is a trading and investing broker focused on experienced market participants.

Brief Look at Webull

Webull is an American broker-dealer headquartered in New York City and is a FINRA (CRD#: 289063/SEC#: 8-69978), SIPC, NYSE, and NASDAQ member. The company was incorporated in May 2017, and in January 2018 it was already registered with the SEC and CFTC. It is part of Webull Financial LLC and is licensed to carry out brokerage activities in all 50 US states. The broker offers a wide range of stock market assets, futures, professional analytics and an intuitive trading platform with a variety of technical and fundamental analysis tools.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Zero commission when trading stocks, options, and ETFs.

- No minimum deposit requirements for brokerage and retirement (IRA) accounts.

- Access to professional intelligent analytics and trading tools.

- There is no support for trading in mutual funds, futures, bonds or stocks of the OTC markets.

- It doesn’t provide an opportunity to make transactions with currency pairs.

- Cryptocurrency trading is available only in mobile applications.

- Replenish your account from $2,000 to trade with favorable leverage.

TU Expert Advice

Author, Financial Expert at Traders Union

Webull offers a wide range of trading instruments including stocks, options, ETFs, and cryptocurrencies. The broker provides a proprietary trading platform that is accessible via desktop, mobile, and web, featuring advanced research tools and over 50 technical indicators. Webull facilitates trading without fees on stocks, options, and ETFs, with no minimum deposit requirement on its brokerage accounts. Leverage is 1:2 for overnight trades and 1:4 for intraday trades, underlining its appeal to experienced traders seeking margin trading.

While Webull presents several advantages, it also has notable drawbacks. The platform does not support mutual funds, futures, or Forex trading. Cryptocurrency trading is restricted to mobile platforms, and ACH transfers are the primary method for deposit and withdrawal, which may incur additional fees. These constraints make Webull less suitable for traders prioritizing a wide asset range or seeking robust client support, such as live chat. Therefore, Webull is better aligned with traders focused on stock and ETF trading, particularly those comfortable with mobile platforms and ACH transactions.

Webull Summary

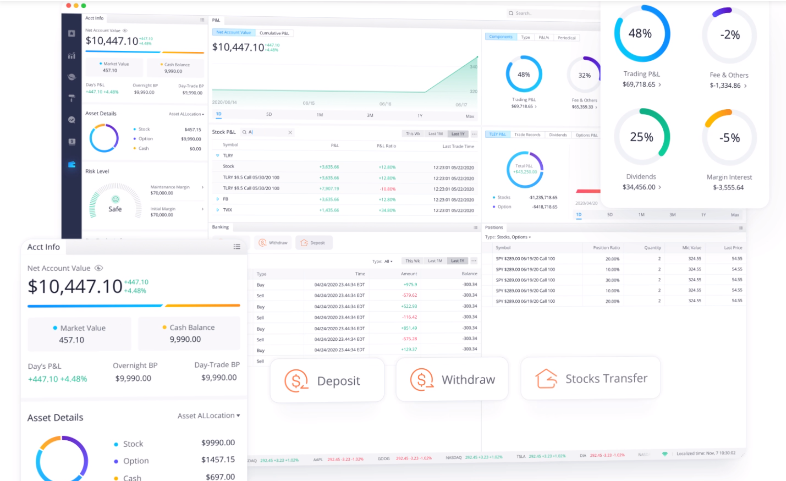

| 💻 Trading platform: | Proprietary platform |

|---|---|

| 📊 Accounts: | Paper account (demo), margin account, cash account |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Wire transfer, payments through the automated clearing house ACH |

| 🚀 Minimum deposit: | From $1 |

| ⚖️ Leverage: | 1:2 for overnight trades, 1:4 for intraday trades |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 EUR/USD spread: | No |

| 🔧 Instruments: | Stocks, options, futures, ETFs, ADRs, cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | Access to margin trading is available when depositing funds from $2,000 |

| 🎁 Contests and bonuses: | Yes |

The Webull broker provides an opportunity to invest in popular stock market assets with zero commission. On November 19, 2020, the company added cryptocurrencies to the instruments available for trading. However, transactions with digital currency can be performed only in the mobile application. This broker allows you to trade with leverage from 1:2 up to 1:4. The amount of the margin depends on the type of trades. The minimum deposit for all types of brokerage accounts starts at $1.

Webull Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

Follow the instructions to become a Webull customer:

Go to the broker’s official website and click on "Open an account" or the "Start" button on its main page.

Enter your email address or phone number, and then confirm it. Click "Open Account" in the middle of the navigation bar. In most cases, the account creation application will be automatically approved. Fill in your details indicating a valid SSN (Social Security Number) or ITIN (Personal Taxpayer Identification Number). US residents shall provide a document evidencing US citizenship, permanent resident card, or valid visa.

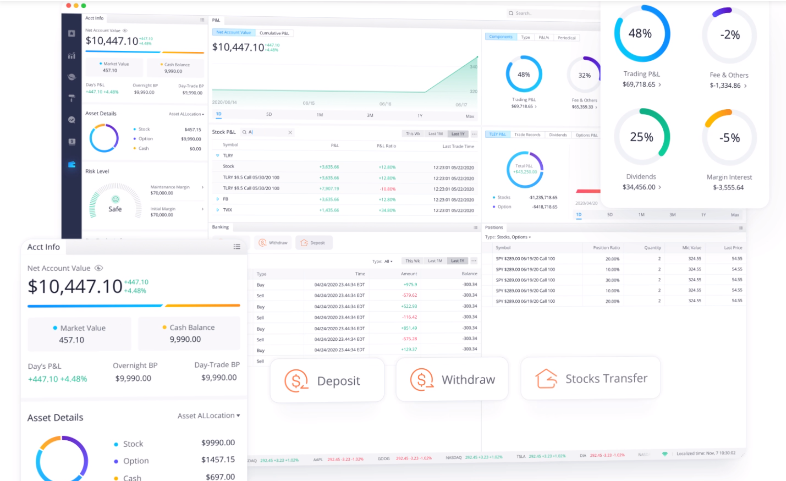

The following is available in the Webull personal account:

Also, in the user's personal account you can:

-

View the watchers generated for the most interesting assets.

-

Study reviews of the global and cryptocurrency markets, as well as data on the US and Hong Kong exchanges.

-

Select the most promising tools by region (USA, Canada, China) and sectors (chemistry, transport, energy, etc.) using a screener.

-

Contact a technical support representative.

Regulation and safety

Webull Financial LLC is a broker-dealer registered with the US Securities and Exchange Commission (SEC) and the Financial Services Regulatory Authority (FINRA). The company is a member of the Securities Investor Protection Corporation (SIPC), the New York Stock Exchange (NYSE) and Nasdaq.

The brokerage is insured. Coverage limits protect securities and funds up to $37.5 million for securities of any client and up to $900,000 for a trader's funds with an active account at Webull. However, cryptocurrency trading is offered through an account with Apex Crypto, which is not a registered broker-dealer or FINRA member, so digital currency assets are not insured.

Advantages

- The broker is insured.

- You can file a complaint with the body that controls the broker’s activities

Disadvantages

- The insurance does not apply to cryptocurrencies

- Time consuming period to open an account and for verification

- Limited choice of payment systems following the requirements of regulators

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Marginal | From $0.02 | Yes |

| Cash | From $0.02 | Yes |

Additional commission for funds withdrawal can be charged by banks, recipients, intermediaries, and senders of payments. We compared the trading fees of webull.com and popular online brokers. Please keep in mind when analyzing data from the table that Webull does not provide access to the foreign exchange market, so the level assigned can be considered conditional.

Account types

Webull offers two types of trading accounts for individual clients: cash and margin. They differ in purchasing power, the type of transactions available, and their number.

Types of accounts:

Webull has a demo account called Paper Account. You can go there from the broker's website or through the mobile application of the trading platform.

Webull focuses on independent investors and active traders with an average-to-high level of experience.

Deposit and withdrawal

-

There are 2 ways to withdraw funds: bank transfer and ACH transfer (only for customers with a bank account opened in the United States). International transfers shall be carried out through the SWIFT channel. Local bank transfers for US residents are processed using a nine-digit ABA transit code number.

-

Withdrawals via ACH take 4-5 business days. Internal bank transfers within the United States are processed within 2 business days, international transfers take up to 5 business days.

-

Withdrawals through ACH are commission-free. The broker charges a fee for withdrawing money by bank transfer: it is $25 for traders from the United States, and $45 for clients from abroad. Also, extra commissions can be charged by the sending bank/intermediary/recipient.

Investment Options

Webull enables you to invest free capital in over 5,000 shares, options, ETFs, and ADRs.

ETFs are Webull's popular investment solution

Webull’s clients can diversify their portfolio by choosing ETF trading. The broker provides hot ETF lists and screeners, making it easier for an investor to find promising assets. Features of investments in exchange-traded funds through the Webull intermediary:

An investor can track ETFs according to specified parameters such as industries, countries, or strategies.

Trading is available 24/5 (excluding market holidays).

The broker doesn’t charge ETF trading fees; however, fees are charged by the SEC and FINRA regulators.

You can manage your portfolio from any device.

ETFs are baskets of stocks and bonds that combine the benefits of investment diversification and trading flexibility. ETFs are traded on major exchanges, making them fairly straightforward tools for professionals.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Webull’s affiliate program:

Referral program. The partner gets 2 free shares that cost from $8 to $1,600 for each connected referral who has replenished the balance for $100 or more within 30 days from the date of opening the account.

Publishing a unique referral link on various sites allows you to get extra income for attracting new clients to the brokerage company.

Customer support

Support service assistance is available 24/7.

Advantages

- Twenty-four/seven availability

- Support service languages: English and Chinese

Disadvantages

- No online chat

There are several ways to contact customer support:

-

by phone, using the numbers indicated on the site;

-

by email;

-

Write a message in Facebook Messenger or Twitter.

It is not necessary to open an account to contact the broker's representatives. Support is available to all traders, even without registering at www.webull.com.

Contacts

| Foundation date | 2017 |

|---|---|

| Registration address | 44 Wall Street, New York, NY, USA |

| Regulation | US Securities and Exchange Commission (SEC), Financial Services Regulatory Authority (FINRA), Securities Investor Protection Corporation (SIPC) |

| Official site | webull.com |

| Contacts |

Education

There is no training or education section on www.webull.com. You can find useful information by clicking the Help button. In addition to reference data covering the stock exchange, the company's website has a blog and a Market section with an overview of the trading markets.

Trading on a demo account allows you to consolidate the acquired theoretical skills in practice without financial risks.

Detailed Review of Webull

The Webull broker offers to increase your purchasing power by using margin accounts. The company gives traders temporary money even before the funds are credited to the balance, which allows them to start trading without waiting for the money to be transferred to the bank account. You can trade stocks and ETFs with instant purchasing power; however, this option is not available for trading options or cryptocurrencies.

Webull by the numbers:

-

$150 million is the total coverage of securities and customer funds.

-

Over 5,000 trading assets are available.

-

$0 is a commission for trading stocks, ETFs, and options.

Webull is a broker for professional traders using key analytics

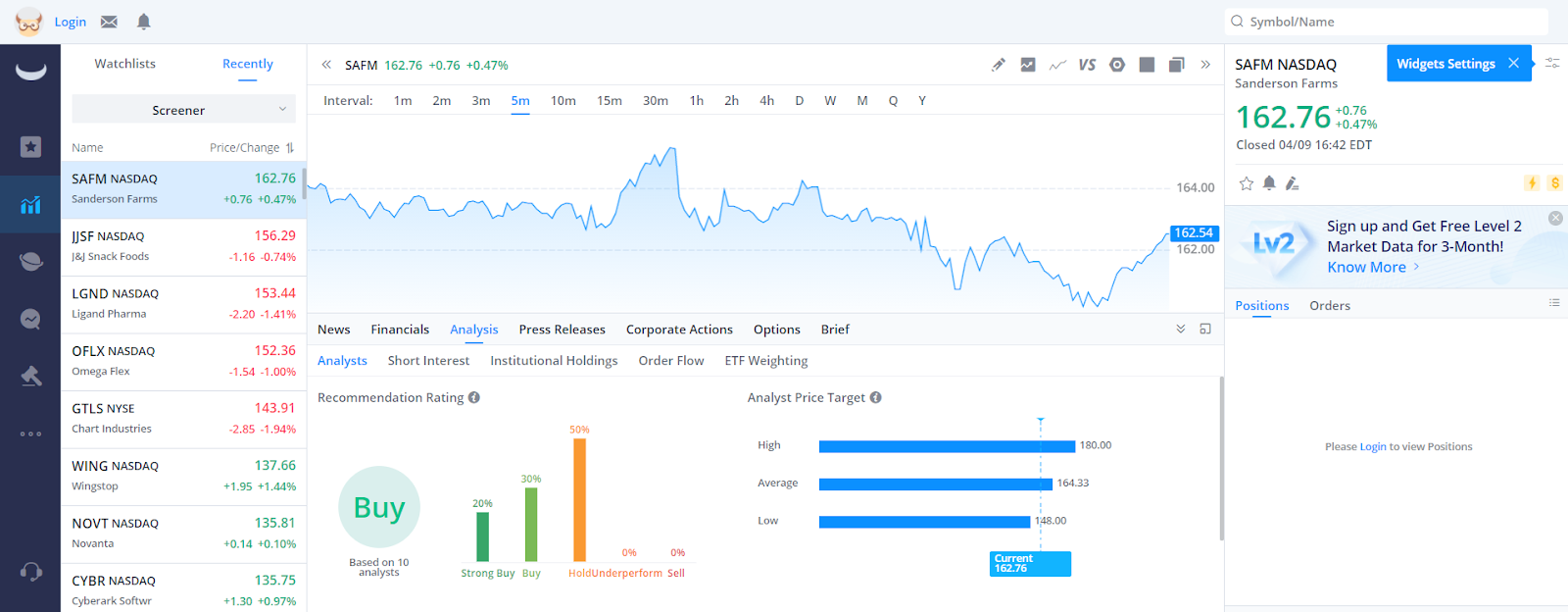

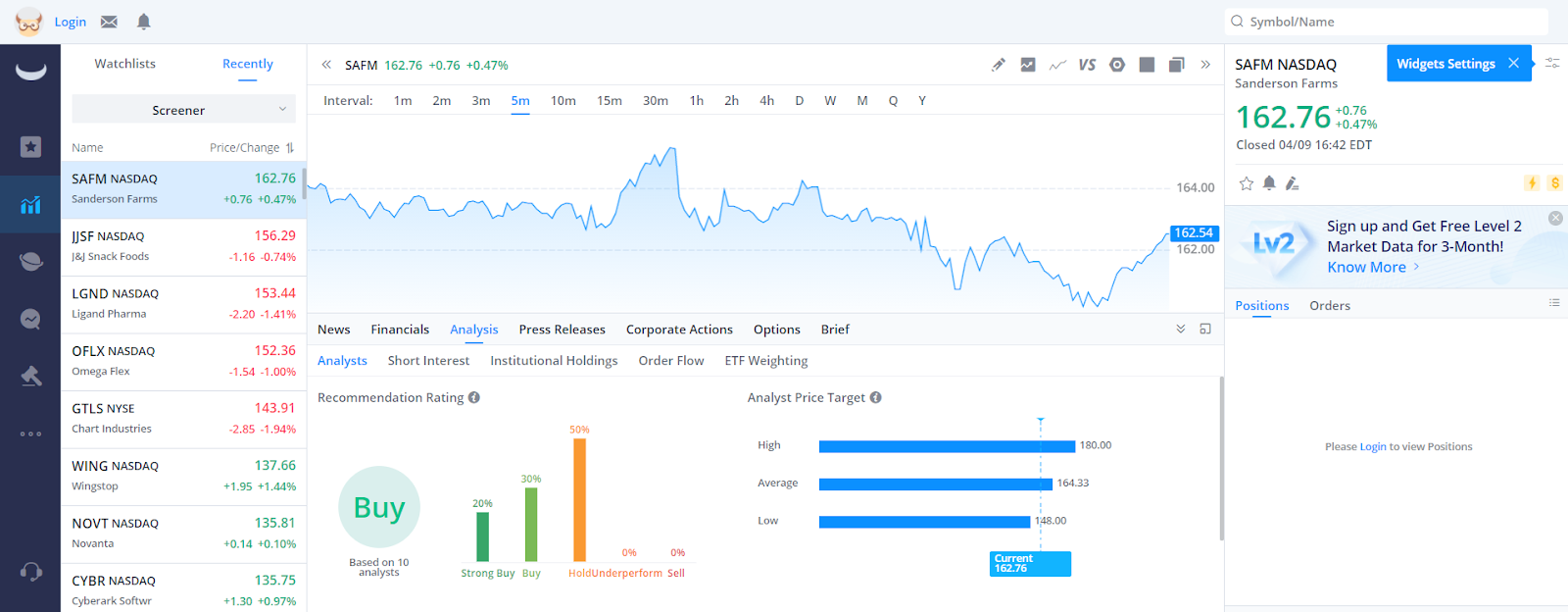

Webull allows you trade stocks, ETFs, options, cryptocurrencies and ADRs. The company offers advanced trading capabilities including various types of orders. Its clients get access to deep analysis tools such as intuitive charts, various screeners, detailed fundamental data crunchers, and industry news. The broker also provides advanced second-level Nasdaq TotalView quotes (free for the first three months after opening an account).

The Webull terminal is accessible from any device. Desktop platform with support for multiple screens and increased performance is compatible with Windows, Mac, Linux and supports over 45 widgets, 50 technical indicators, and 12 charting tools. The mobile application is available for Android iOS devices. The web version runs on Chrome, Safari, Firefox and other browsers.

Useful Webull services:

-

Market. Market data for 6 asset categories (stocks, ETFs, indices, Forex, futures, cryptocurrencies) and over 100 exchanges, including Nasdaq, NYSE, LSE, HKEX, SGX, NSE, and BOM.

-

Advanced charts. Linear, candlestick, and bar charts with timeframes from 1 to 60 minutes are available. They display the history of the asset's price changes over 5 years.

-

Indicators. MACD and RSI oscillators, Bollinger bands, moving averages, cash flow indices, etc., are presented.

-

Financial calendars. Displays upcoming reports on business earnings, IPOs and other financial events.

-

Stock screeners. A tool for searching trading strategies with the ability to customize filters based on fundamental or technical analyses.

Advantages:

You can trade from mobile, desktop, tablet or web platforms.

The terminal has options that make the work as convenient as possible: you can place orders and view tickers using just your voice, or use the "Big Button Mode" to place trades quickly.

The broker supports extended trading hours: full pre-trades from 4:00 AM to 9:30 AM ET and untimely hours from 4:00 pm to 8:00 pm ET.

Over 5,000 different stocks and ETFs can be traded without commissions.

No software fees, no account opening or maintenance fees.

If the requirements for the balance size are met, you’ll have access to short positions and an unlimited number of daily transactions.

Latest Webull News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i