According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- SWFX

- JForex Trader

- FINMA

- 1998

Our Evaluation of Dukascopy

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Dukascopy is a moderate-risk broker with the TU Overall Score of 6.61 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Dukascopy clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Dukascopy Bank is a Swiss innovative online bank based in Geneva, Switzerland, providing Internet based and mobile trading services (with focus on foreign exchange, bullion, CFD and binaries), banking and other financial services through proprietary technological solutions.

Brief Look at Dukascopy

The company has been founded on 2 November 2004 in Geneva by Andre and Veronika Duka, Swiss nationals residing in Geneva who still own 99% of the company. Dukascopy Bank is regulated by the Swiss Financial Market Supervisory Authority FINMA both as a bank and a securities firm. Dukascopy Bank provides a wide range of free financial information and other attractive resources through its website, Dukascopy TV online television, Freeserv products and its active online Dukascopy community counting over 130'000 members. Deposit insurance protects the credit balances of private and corporate clients in the event of a bank or securities firm's bankruptcy. This guarantee is regulated by law. Dukascopy has an insurance fund with up to CHF 100 000 coverage per client and institution.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Attractive trading conditions;

- regulated by FINMA;

- 19 years in the market;

- deposit protection up to CHF 100 000 per client;

- online account opening with video identification;

- large liquidity pool- 20+ banks;

- ECN trading technology;

- low spreads - from 0,1 pips on EUR/USD;

- instant order execution;

- wide range of free financial information and other attractive resources through its website, Dukascopy TV online television;

- wide variety of trading platforms, JForex, MT4, Forex mobile;

- manual and automated trading and trading directly form the chart;

- hedging and scalping allowed;

- sliggage control;

- swap free accounts upon request;

- 250 indicators and chart studies and automated trading historical tester;

- wide range of trading orders: MIT, limit orders, eco and TP/SL orders;

- high-quality customer service- 24/7 customer support available in 12 languages;

- up to 100% deposit bonus.

- leverage up-to 1:200;

- higher trading commissions for Islamic account traders;

- each account is given a deposit limit based on the information provided at the account opening;

- impossible to open new positions on weekends.

TU Expert Advice

Financial expert and analyst at Traders Union

Dukascopy has been providing brokerage services for over 14 years and during that period it has proven its reliability to thousands of clients again and again. Some of the company's priorities are high-quality customer service and providing its clients with the best trading conditions. The Dukascopy broker provides traders with one of the most accurate quotations on the market, fast execution of orders, and high liquidity assets.

The company is one of the safest European brokers that offer favorable conditions for both professional and novice traders. Throughout its history, Dukascopy has received tons of positive feedback. According to its clients, the company's accreditation, trading conditions, and deposit security are all higher than most other brokers. Traders also note the speedy execution of orders and the most accurate quotes, which is important for successful trading.

There are also negative reactions to the company's work. In particular, they suffer from long withdrawals of funds and high trading commissions. Clients are also dissatisfied with the long process of account verification. The reason for this is the high level of security that the company guarantees traders, which is achieved by the complex registration procedure.

With all questions and arising problems, the clients of the company can address a multilingual support service. They are available 24 hours a day, 6 days a week. At any time, except Saturday, the broker's staff is ready to provide traders with qualified assistance and help solve any problems as soon as possible. You can contact the support team by phone, as well as by chat or using the feedback form.

Dukascopy is considered one of the most reliable and secure brokers, as evidenced by the numerous awards and feedback from satisfied clients.

- You prioritize low spreads and commissions. Dukascopy boasts tight spreads and competitive commissions, particularly for forex and CFDs, making it appealing to cost-conscious traders seeking to minimize trading costs.

- You value a wide range of tradable assets. Dukascopy offers access to over 6,500 assets, including forex, CFDs on shares, metals, energies, indices, and cryptocurrencies, providing diverse trading opportunities to suit various strategies.

- You are looking for extremely high leverage. Dukascopy offers leverage up to 1:200, and if you prefer brokers that provide even higher leverage options, this limitation might influence your decision.

- You are looking for lower trading commissions for Islamic account traders. If you seek more favorable commission structures for Islamic accounts, Dukascopy's fee arrangement may not align with your preferences.

Dukascopy Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | JForex Trader, MetaTrader 4, SWFX |

|---|---|

| 📊 Accounts: | Demo FX, Live FX |

| 💰 Account currency: | USD, CHF, EUR, GBP, AUD, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NOK, NZD, PLN, RON, CNH, SEK, SGD, TRY, XAU and ZAR |

| 💵 Deposit / Withdrawal: | Wire transfer, MasterCard, Visa, Maestro, Visa Electron, Skrill, Neteller |

| 🚀 Minimum deposit: | USD 100 for Dukascopy Europe and USD 1000 for Dukascopy Bank |

| ⚖️ Leverage: | From 1:1 to 1:200 on weekdays/ from 1:1 to 1:20 on weekends |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,3 pips |

| 🔧 Instruments: | Over 1200 trading instruments on CFD, currency pair, commodities, stocks and cryptocurrency |

| 💹 Margin Call / Stop Out: | 100%/200% |

| 🏛 Liquidity provider: | Dukascopy Bank SA |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | Automated trading; Top-tier level of protection of clients; Lightning-fast order execution; Telephone support service is available 24/6. |

| 🎁 Contests and bonuses: | Yes |

Traders choose Dukascopy because of its reputation for providing a secure trading environment. Dukascopy Bank, based in Switzerland, is regulated by the Swiss Financial Market Supervisory Authority (FINMA), ensuring compliance with strict financial standards and client accounts protection up to CHF 100’000.

Dukascopy prides itself on offering competitive trading conditions to its clients. With tight spreads, low commissions, and deep liquidity from multiple liquidity providers, traders can execute trades at competitive prices, enhancing their profitability.

Dukascopy also allows traders to choose from a variety of trading accounts, including Standard, ECN, and Islamic accounts, catering to different trading styles and preferences.

In addition to the popular MT4 Dukascopy offers proprietary trading platform JForex for both desktop and mobile, which enables traders to monitor and trade the markets on-the-go from anywhere. TJForex4 mobile platform provides real-time quotes, order management features, and full account access, ensuring that traders never miss an opportunity. With Dukascopy, you can transfer funds directly from the JForex platform to a multi-currency banking account (MCA) instantly and without any fees. MCA account supports card and crypto payments.

Dukascopy Key Parameters Evaluation

Video Review of Dukascopy

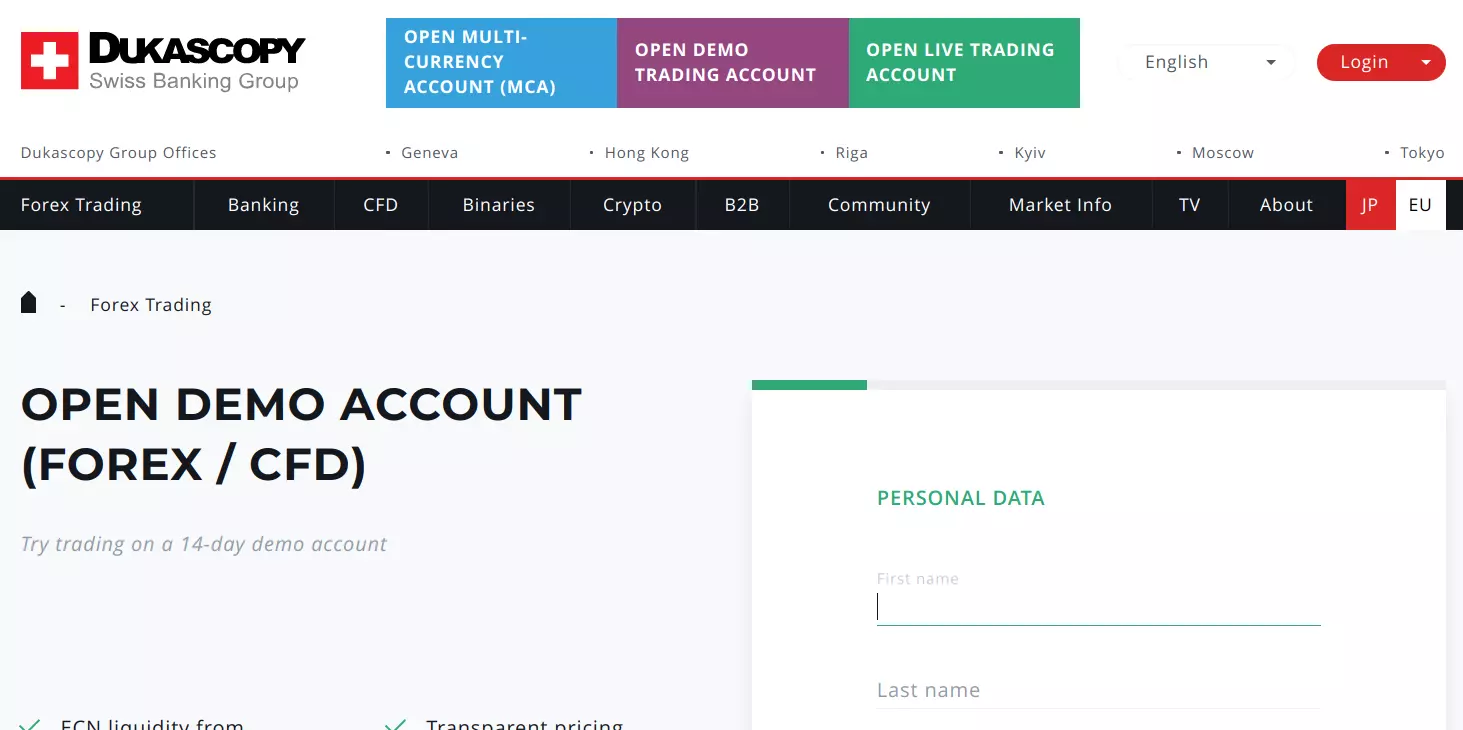

Trading Account Opening

It is a good suggestion to get acquainted with the registration procedure and go on the online excursion to the personal account.

If you do not have a Dukascopy account yet, you should go to the broker's main page and choose the type of account you would like to open:

For registered users, there is a "login" button in the upper right corner.

After you have chosen your account type, click on the appropriate box and the registration form will appear. For different accounts, it is different and requires different levels of verification.

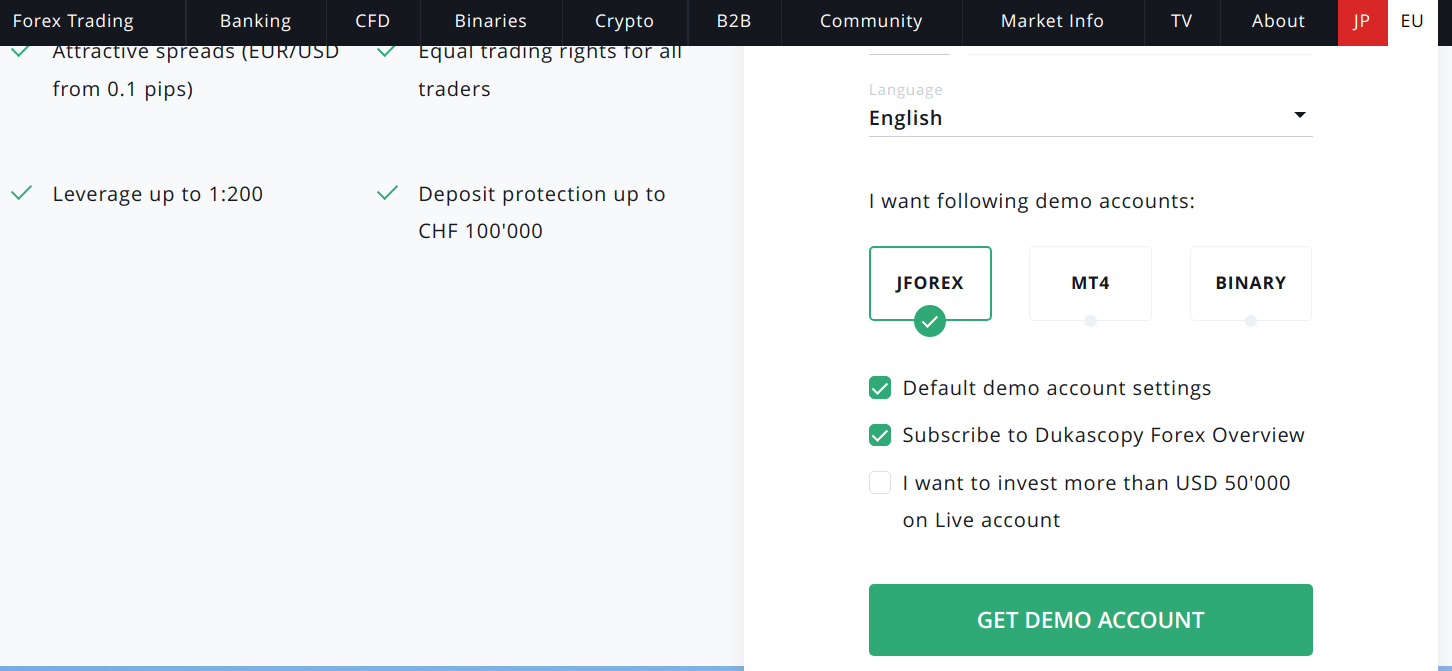

To open a demo account, you will need to enter basic personal information:

After completing the form, click on "Get a demo account". The login name and password to access any of your selected demo accounts will be sent to you via email.

The Live account registration procedure requires more time and data. Thus, the client must follow the procedure to verify his identity. More details about opening a Live (active) account can be found here:

The procedure to open a Live account is lengthy because to start trading the client needs to open an account with Dukascopy Bank, after which the trading on foreign exchange and stock markets will become available to the client.

In his personal account, the trader has access to profile settings, methods of withdrawal of funds, as well as reports, and a journal. All functions related to the trading process and training are located in the main menu.

Regulation and safety

Dukascopy has a safety score of 9.8/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record over 27 years

- Strict requirements and extensive documentation to open an account

Dukascopy Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

JFSA JFSA |

Japan Financial Services Agency | Japan | No specific fund | Tier-1 |

FINMA FINMA |

Swiss Financial Market Supervisory Authority | Switzerland | CHF 100,000 | Tier-1 |

FCMC FCMC |

Financial and Capital Market Commission | Latvia | No specific fund | Tier-2 |

Dukascopy Security Factors

| Foundation date | 1998 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Dukascopy have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No deposit fee

- Above-average Forex trading fees

- Inactivity fee applies

- Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Dukascopy with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Dukascopy’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Dukascopy Standard spreads

| Dukascopy | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,1 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,3 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,1 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Dukascopy RAW/ECN spreads

| Dukascopy | Pepperstone | OANDA | |

| Commission ($ per lot) | 2 | 3 | 3,5 |

| EUR/USD avg spread | 0,3 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,4 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Dukascopy. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Dukascopy Non-Trading Fees

| Dukascopy | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0-2,5 | 0 | 0 |

| Withdrawal fee, USD | 0-2,5 | 0 | 0-15 |

| Inactivity fee ($, per month) | 8,33 | 0 | 0 |

Account types

To start trading with Dukascopy, you must open an account with Dukascopy. In particular, the Live FX account is only available to traders who have opened a bank account. For demo accounts, a short registration is sufficient. To fund a Live account, the trader has 24 currencies to choose from. The trader can also invest by opening a PAMM account.

Types of accounts:

Traders can trade both on the proprietary platform of the broker (SWFX), on the standard MetaTrader 4 platform, or in the mobile application. Due to the variety of trading platforms, it is not necessary to have a PC and you only need to use a smartphone.

Deposit and withdrawal

Dukascopy received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Dukascopy provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Bank card deposits and withdrawals

- BTC available as a base account currency

- USDT (Tether) supported

- No deposit fee

- PayPal not supported

- Withdrawal fee applies

- Limited deposit and withdrawal flexibility, leading to higher costs

What are Dukascopy deposit and withdrawal options?

Dukascopy provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Neteller, BTC, USDT.

Dukascopy Deposit and Withdrawal Methods vs Competitors

| Dukascopy | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Dukascopy base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Dukascopy supports the following base account currencies:

What are Dukascopy's minimum deposit and withdrawal amounts?

The minimum deposit on Dukascopy is $100, while the minimum withdrawal amount is $100. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Dukascopy’s support team.

Markets and tradable assets

Dukascopy provides a standard range of trading assets in line with the market average. The platform includes 1200 assets in total and 300 Forex currency pairs.

- ETFs investing

- 300 supported currency pairs

- Crypto trading

- Bonds not available

- Copy trading not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Dukascopy with its competitors, making it easier for you to find the perfect fit.

| Dukascopy | Plus500 | Pepperstone | |

| Currency pairs | 300 | 60 | 90 |

| Total tradable assets | 1200 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | Yes | Yes | No |

Investment options

We also explored the trading assets and products Dukascopy offers for beginner traders and investors who prefer not to engage in active trading.

| Dukascopy | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

Dukascopy received a score of 7.65/10, reflecting an average offering in terms of trading platforms and tools. The broker covers essential functionality but may fall short in some advanced features or platform diversity compared to leading competitors.

- One-click trading

- Strategy (EA) Builder is available

- API access for automated trading

- Trading bots (EAs) allowed

- No access to cTrader and its advanced tools.

- No TradingView integration

- No access to Free VPS

Supported trading platforms

Dukascopy supports the following trading platforms: MT4, MT5. This selection covers the basic needs of most retail traders. We also compared Dukascopy’s platform availability with that of top competitors to assess its relative market position.

| Dukascopy | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | No | Yes | Yes |

Key Dukascopy’s trading platform features

We also evaluated whether Dukascopy offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | No |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 250 |

| Tradable assets | 1200 |

Additional trading tools

Dukascopy offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

Dukascopy trading tools vs competitors

| Dukascopy | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | Yes | No | Yes |

| Free VPS | No | No | Yes |

| Strategy (EA) builder | Yes | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

Dukascopy supports mobile trading, offering dedicated apps for both iOS and Android. Dukascopy received a score of 7.55/10 in this section, indicating a generally acceptable mobile trading experience.

- Solid iOS user feedback, with a rating of 4.5/5

- Supports mobile 2FA

- Mobile alerts supported

- Low app installs across iOS and Android

- Weak user feedback on Android

We compared Dukascopy with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| Dukascopy | Plus500 | Pepperstone | |

| Total downloads | 10,000 | 10,000,000 | 100,000 |

| App Store score | 4.5 | 4.7 | 4.0 |

| Google Play score | 3.1 | 4.4 | 4.0 |

| Mob. 2FA | Yes | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

To make traders' work more effective and raise the level of their skills, Dukascopy provides clients with educational and analytical materials. With its help, a trader can deepen his knowledge about the market and improve his trading strategy.

It's recommended to use a demo account to master the obtained knowledge in practice. Thus, you can study, test different methods and trading styles at the same time, without risking your capital by using a demo account. This training format fits beginners and experienced traders who want to test new trading strategies.

Customer support

The support team is available 24 hours a day, 7 days a week from Sunday to Friday, inclusive, during which the Dukascopy support team is available to help with problems or answer questions.

Advantages

- Support 24 hours a day, 6 days a week

- Prompt responses to customer requests

- Several options for contacting support, including callback function

- Qualified support personnel

- Multi-lingual support service

Disadvantages

- No contact with support on Saturday

There are several ways to get in touch with the Dukascopy support team:

-

write a message in Live Chat on the website;

-

call the phone number indicated on the website;

-

request a callback;

-

contact the call center;

-

fill out the feedback form on the site; or

-

write a standard letter and send it through the post office.

Contacts

| Foundation date | 1998 |

|---|---|

| Registration address | ICC, Entrance H, Route de Pré-Bois 20, 1215 Geneva 15, Switzerland |

| Regulation | FINMA |

| Official site | https://www.dukascopy.bank/swiss/ |

| Contacts |

+41 (0) 22 799 48 59

|

Comparison of Dukascopy with other Brokers

| Dukascopy | Eightcap | XM Group | RoboForex | Vantage Markets | 4XC | |

| Trading platform |

MobileTrading, WebTrader, JForex, Java | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5, TradingView, ProTrader, Vantage App | MT5, MT4, WebTrader |

| Min deposit | $100 | $100 | $5 | $10 | $50 | $50 |

| Leverage |

From 1:30 to 1:200 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0.1 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

100% / 200% | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 50% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | No | No | Yes | No | No |

Detailed Review of Dukascopy

The company has provided its services as a broker since 2004. During that period, the broker was awarded more than 22 nominations, including "The Best Liquidity Provider", "The Best Forex Bank" and "The Broker of the Year", among many others. The company works every day to improve the quality of customer service and to provide the best trading conditions in the European market.

The broker's activity as a bank and a securities dealer is regulated by the Swiss financial market regulator FINMA. The company is also periodically audited, both externally and internally, for compliance with Swiss laws and regulations.

Dukascopy by the numbers:

-

the minimum spread is 0.1 pip;

-

there are several representative offices around the world including in Japan, Hong Kong, Latvia, and Switzerland;

-

There are 6 days of round-the-clock support service;

-

It has more than 15 years of providing traders with brokerage services;

-

It has 22 awards in the following categories, including: Broker of the Year, Best Liquidity Provider, Best Forex Bank, etc;

-

There are 24 currencies that have been accepted for deposit;

-

100 thousand Swiss francs is the maximum amount of insurance for clients' funds.

Dukascopy is a reliable broker for European-centric trading

The brokerage company is dedicated to providing traders with European-standard services. Dukascopy offers favorable trading conditions to both newbies and experienced participants of the market and provides them with the same quotes and trading tools.

Its European accreditation is an advantage. The company is regulated by the Swiss authorities, which makes Dukascopy one of the most reliable brokers in Europe. Besides, the clients of the broker can enjoy attractive trading conditions such as tight spreads, high liquidity of assets, permission to use robots for automated trading, and deposit insurance for each client.

As an ECN broker, Dukascopy provides traders with direct access to the interbank market without intermediaries. This provides for a higher speed of order execution and liquidity of assets, which has been repeatedly stated by our clients in their feedback.

To make trading even more comfortable, the broker offers its clients the trading system visualization service. It is a constructor with the help of which every trader can build the most profitable strategy for his trading system. The developers have made the interface of the constructor as simple and intuitive as possible, so even a beginner can build a working strategy.

Dukascopy holds training seminars and webinars, as well as gives clients access to dozens of training videos and more sophisticated analytical materials to improve their skills.

Also, on the broker's website, traders can find a currency calculator, information about spreads, breaking news, and how to use technical indicators.

Advantages:

Narrow spreads — from 0.1 pip;

A large number of orders of different types, including stop-loss and limit;

ECN liquidity: Forex, Metals, CFDs on indices, stocks, cryptocurrencies, raw materials, and binary options;

Lightning-fast order execution;

Automated trading: this includes scalping, and hedging, which are allowed;

Credit or debit cards are available for deposits;

Prices and liquidity are the same for all clients;

24 currencies are available for deposit;

Telephone support service is available 24 hours a day, 6 days a week, from Sunday to Friday;

Training materials for novices who want to improve their skills;

Top-tier level of protection of clients' funds because each deposit is insured up to CHF 100 thousand.

Latest Dukascopy News

Articles that may help you

Check out our reviews of other companies as well