According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- MetaTrader5

- TradingView

- ASIC

- SCB

- CySEC

- FCA

- 2009

Our Evaluation of Eightcap

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Eightcap is one of the top brokers in the financial market with the TU Overall Score of 9.1 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Eightcap clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the broker’s clients are fully satisfied with the company.

Eightcap has favorable working conditions due to a large choice of instruments, tight spreads, high leverage, and no withdrawal fees. Integration with popular trading platforms and basic deposit/withdrawal options greatly facilitates work with the broker and reduces the entry threshold. In addition to comfortable conditions and low financial costs, traders get free educational materials and special services for technical analysis. A relative disadvantage is the absence of opportunities for passive income. Also, the broker works only with CFDs, so other groups of trading instruments are not available.

Brief Look at Eightcap

Eightcap is a leading Forex and CFD broker, offering over 800 trading instruments, including currency pairs, cryptocurrencies (not available with the FCA entity), indices, stocks, and commodities. With tight spreads starting from 0 pips, leverage up to 1:500, and no withdrawal fees, Eightcap provides a competitive trading environment. The broker is regulated by top-tier authorities such as ASIC and FCA, ensuring a secure trading experience.

Comprehensive educational resources, advanced analytics, and innovative functionality such as code-free automated trading and enhanced order execution with FlashTrader distinguish the platform from others.

Though Eightcap does not offer passive income opportunities or joint accounts, it is a popular choice for those seeking a reliable and feature-rich broker. Eightcap offers MetaTrader4 and MetaTrader5 integrated with Flash Trader. In addition, traders can use Acuity's AI-powered economic calendar.

Eightcap’s UK Entity:

Eightcap is an FCA authorised and regulated broker that offers CFD trading on over 600 markets across forex, indices, commodities, and shares. Eightcap’s UK entity is the only dedicated, specialist TradingView broker in the UK, providing a tailored product experience to get the most out of trading via TradingView.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- The broker is registered in the Bahamas and Seychelles, and is regulated by the Securities Commission of the Bahamas (SCB, SIA-F220), ASIC (391441), FCA (921296), CySEC (246/14). Also, it partners with many proprietary firms;

- Negative balance protection;

- Traders need to deposit only $100 to open a live account, and the broker imposes few trading limits on its clients;

- Hundreds of the most popular CFDs are available, and the pool is constantly expanding;

- Eightcap provides one of the most profitable trading costs with really tight spreads;

- Almost all options for depositing/withdrawing funds are available and the broker does not charge a withdrawal fee;

- The broker’s clients can work through any of the three top trading platforms, including mobile versions of the MetaTrader solutions;

- The company provides high-quality training, extensive analytics, and its own developments for automated trading.

- No joint accounts, copy trading, or other options for passive income.

TU Expert Advice

Financial expert and analyst at Traders Union

Eightcap has been in business for 14 years. This is one of the largest brokers with millions of clients globally. It is registered in Seychelles and the Bahamas, and controlled by SCB. All this indicates the reliability and transparency of the company. Nevertheless, Traders Union experts checked it and found no confirmed conflicts with its clients, problems with tax reporting, or other negative aspects.

In terms of trading conditions, Eightcap rightfully takes one of the leading positions. The reason is that it manages to keep extremely low spreads. The declared indicator for account types with a raw spread is from 0 pips. The broker does not hide anything, thus current spreads can be checked on the website. For a number of assets, they really start from 0 pips, while the average indicator is about 0.5-0.7 pips. For most other brokers such parameters seem unreachable.

But spreads are not the only advantage of Eightcap. The broker offers over 800 assets. This is an impressive number, but keep in mind that those are CFDs only. That is, currencies, cryptocurrencies, stocks, indices, and commodities are not available as independent instruments, but only in the form of CFD trading. This is not necessarily a disadvantage; traders just need to understand what they are working on. No other broker provides so many CFDs on cryptocurrencies. Plus, the maximum leverage is 1:500. By itself, the indicator is market average, however, in combination with other advantages of the broker, it provides much more opportunities.

Eightcap has no options for passive income, and this can really be defined as a conditional disadvantage. There is not even a referral program, that is, the company's clients can earn only by actively trading in the available markets. Also, you can trade via MT4/MT5 from a desktop or smartphone, while the TradingView solution is available for browsers. Here the broker also offers comfortable working conditions. That's why its clients love it.

- You are in search of a reliable platform that has been operating for many years. Eightcap is one of the largest brokers and is regulated by SCB, ASIC, FCA, and CySEC, with dozens of proprietary trading companies as partners.

- You value a wide variety of contracts for difference (CFDs) of different types. Currently, Eightcap offers CFDs on currency pairs, stocks, indices, metals, commodities, and other assets, totaling more than 800 financial instruments.

- You require a low minimum deposit and comfortable trading costs. A Standard account can be opened with a deposit starting from $100, but the claimed spread of 1 pips is actually higher. An unprocessed spread of 0 pips is available on the Raw account, but it comes with a high fee.

Eightcap Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, and TradingView |

|---|---|

| 📊 Accounts: | Standard, raw, demo |

| 💰 Account currency: | AUD, USD, GBP, EUR, NZD, CAD, and SGD |

| 💵 Deposit / Withdrawal: | Visa, MasterCard, POLI, wire transfer, BPAY, UnionPay, Skrill, Neteller, BTC and ETH wallets, PayPal, WorldPay, FasaPay, PayRetailers, and PSP |

| 🚀 Minimum deposit: | 100 USD |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | CFDs on currency pairs, cryptocurrencies, indices, stocks, commodities, and precious metals |

| 💹 Margin Call / Stop Out: | 80%/50% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | No |

| ⭐ Trading features: |

Free 30-day demo account; Account types with standard and raw spreads; Minimum deposit is $100; Over 800 assets in the pool; High leverage; High-quality training; A lot of current analytics; Special tools for technical and fundamental analyses |

| 🎁 Contests and bonuses: | No |

The minimum deposit for most brokers is determined by the account type. That is, in order to trade with real money, you need to deposit a certain amount. For example, from $10 or $1,000. With Eightcap, the minimum deposit is $100 regardless of the account type. Thus, traders need to deposit at least this amount when opening a live account. Further, traders can focus only on their own preferences and the minimum trade volume, which is a standard lot of 0.01. Leverage also does not depend on the account type but on the asset. The highest trading leverage, which is always relevant for currency pairs, is 1:500. This is more than enough to increase the profit potential, although the risk increases proportionally. The broker's technical support is ready to respond promptly by phone, email, or live chat. An important plus is that multilingual support works 24 hours a day, but not on weekends.

Eightcap Key Parameters Evaluation

Video Review of Eightcap

Share your experience

- Best

- Last

- Oldest

PK Rawalpindi

PK Rawalpindi  NL Amsterdam

NL Amsterdam  LV Riga

LV Riga  UZ Tashkent

UZ Tashkent  PK

PK Overall all good

Not found any

KE Nairobi

KE Nairobi Good analytics

None

NL Amsterdam

NL Amsterdam professionals

nope

Trading Account Opening

To start working with the broker, create a user account and open a trading account. TU experts have prepared a step-by-step guide on registration and also highlighted the features of Eightcap’s user account.

Go to the broker's official website. In the upper right corner, select the interface language and click the “Create Account” button. You can also click the “Log In” button.

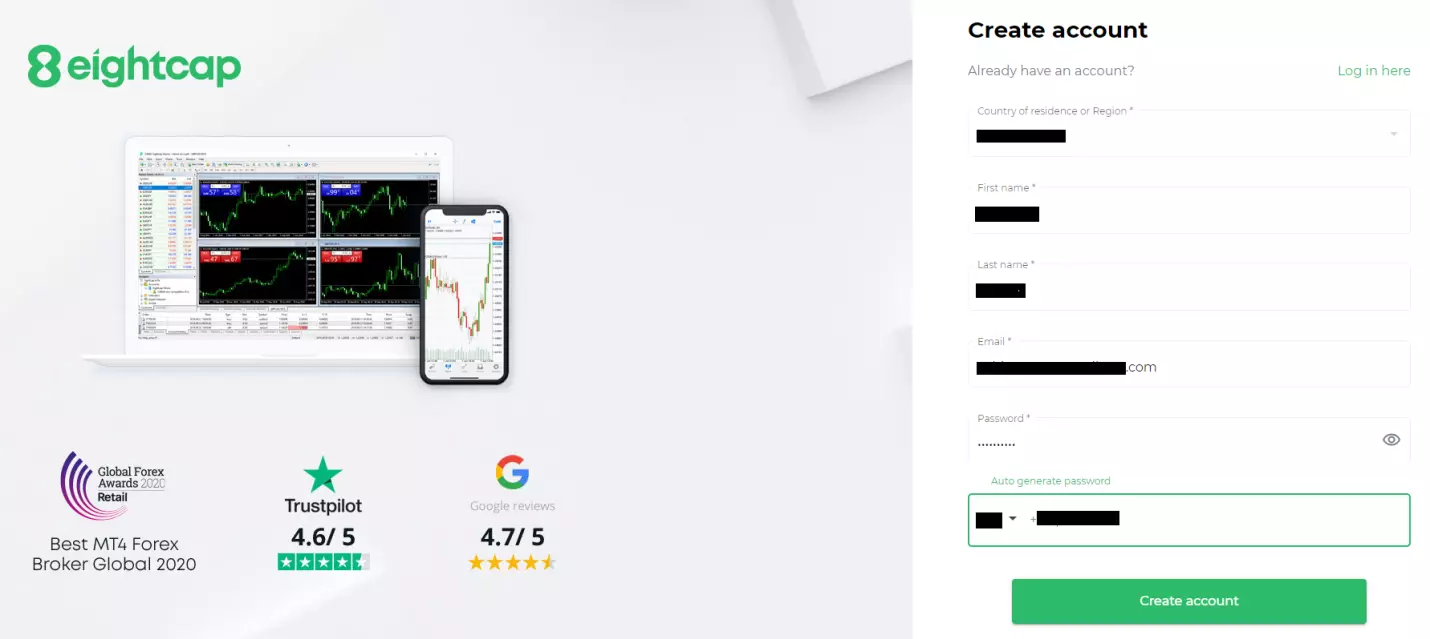

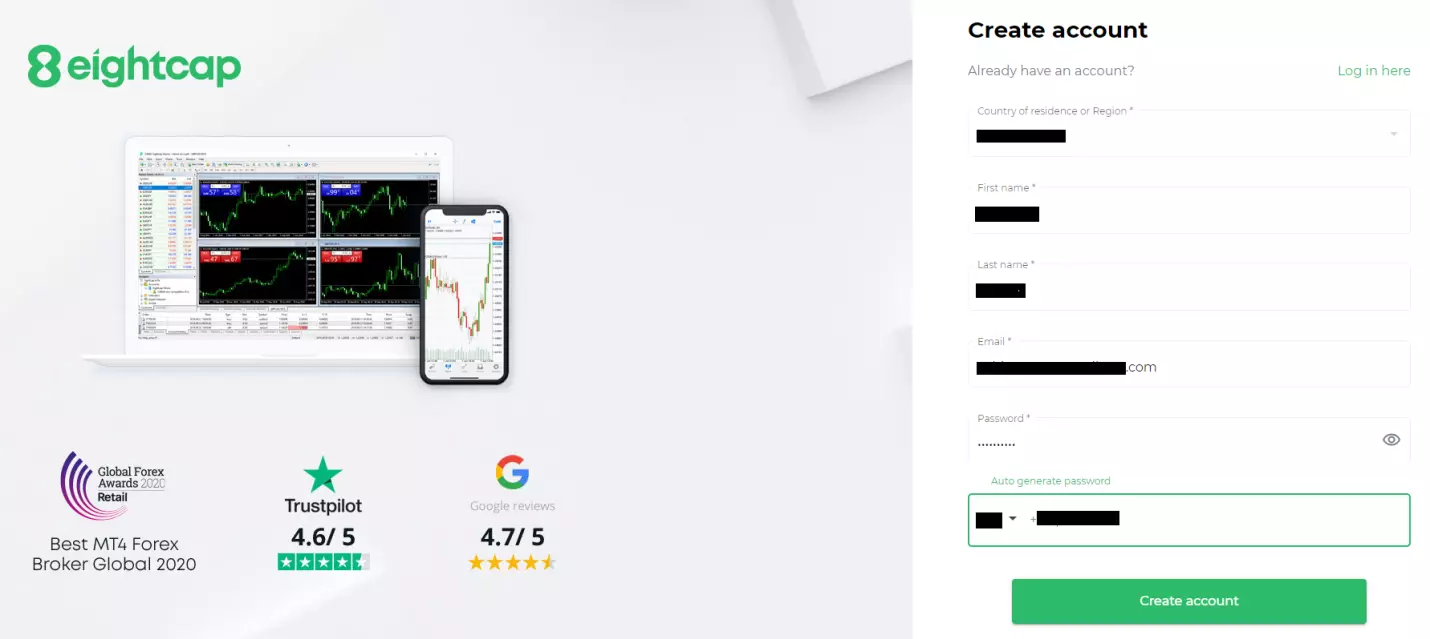

Indicate your country of residence, then enter your first and last names, email, and phone number. Create a password and click the “Create Account” button.

An email with a link will be sent to the provided address. Follow this link to complete your registration. You will be redirected to your user account.

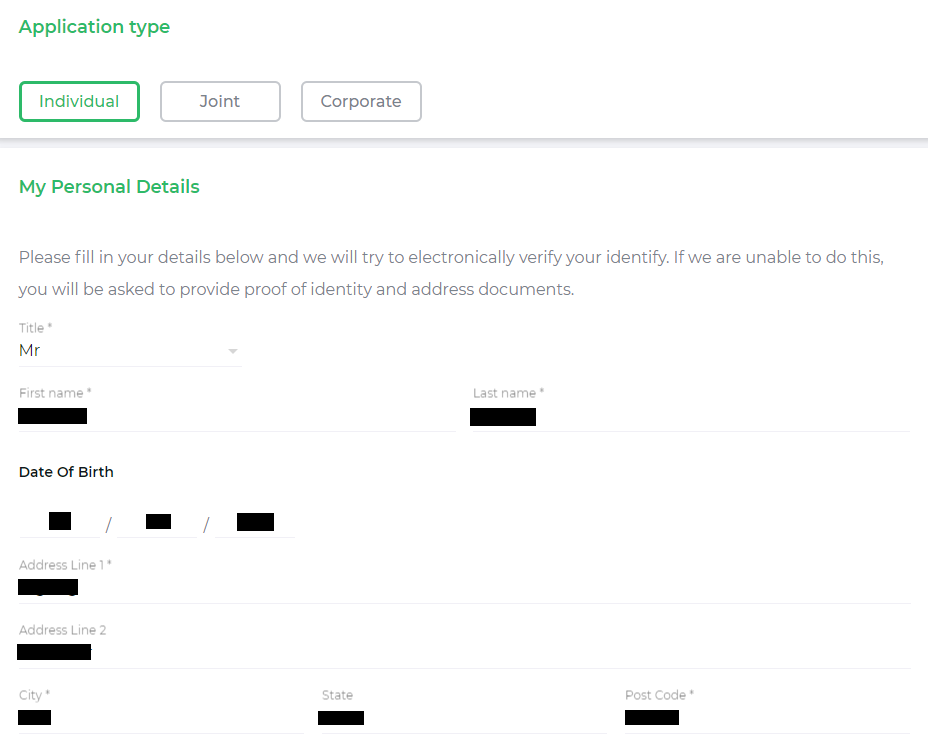

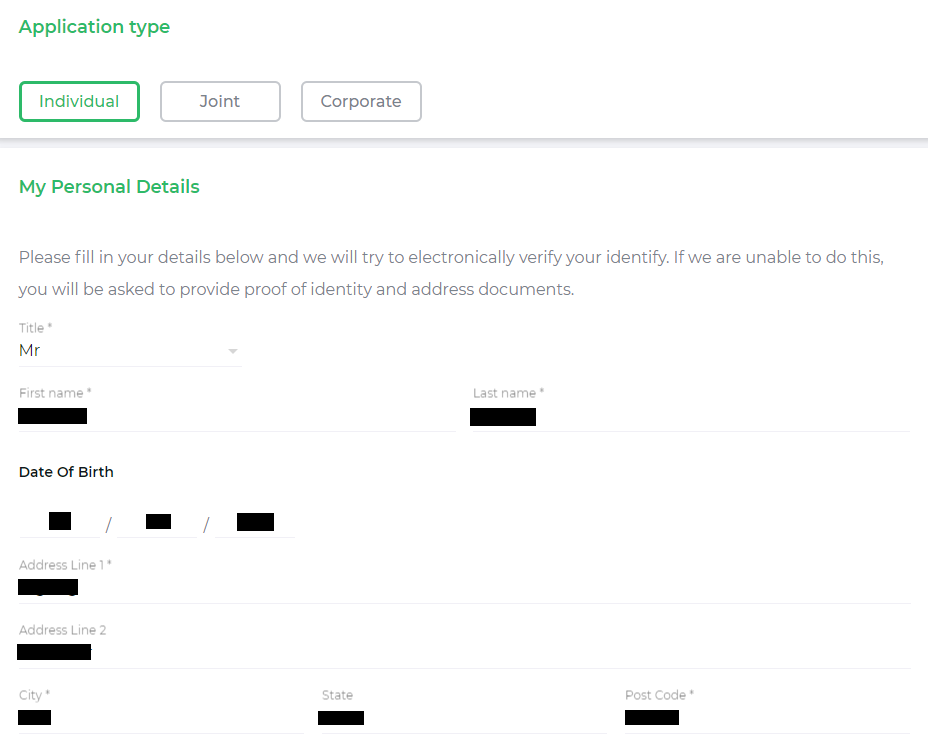

Select an account type and fill in the missing information about yourself, such as date of birth, place of registration, and tax identification number or its equivalent for your country. Click the “Next” button.

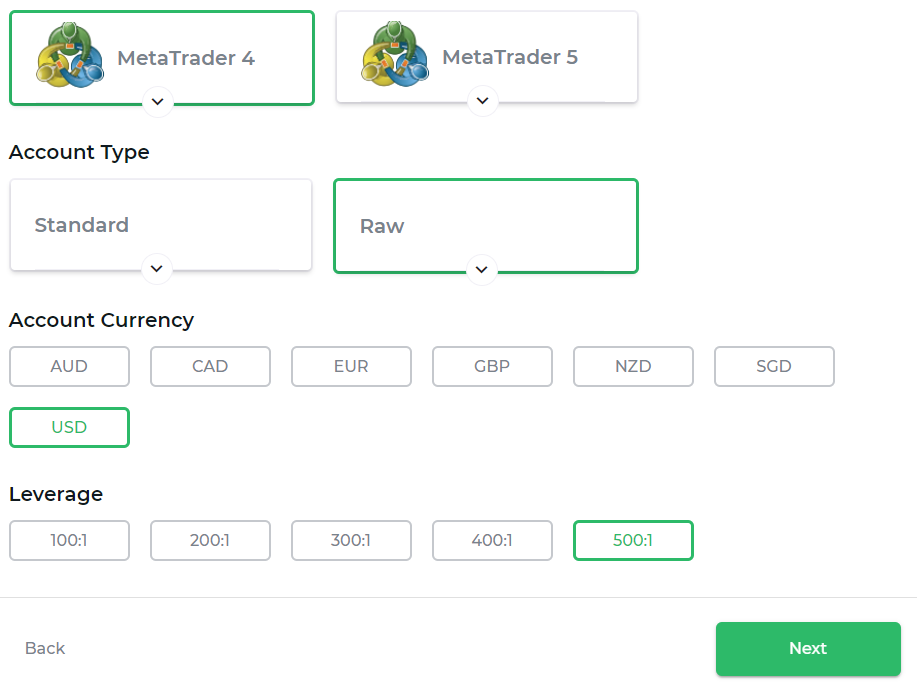

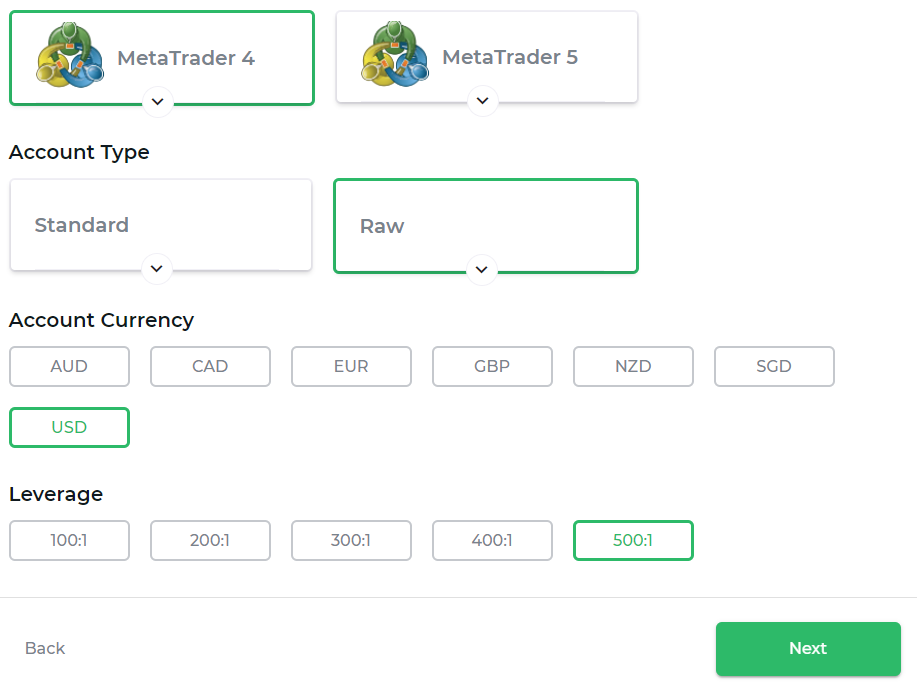

Select a trading platform, account currency, and leverage. Click the “Next” button.

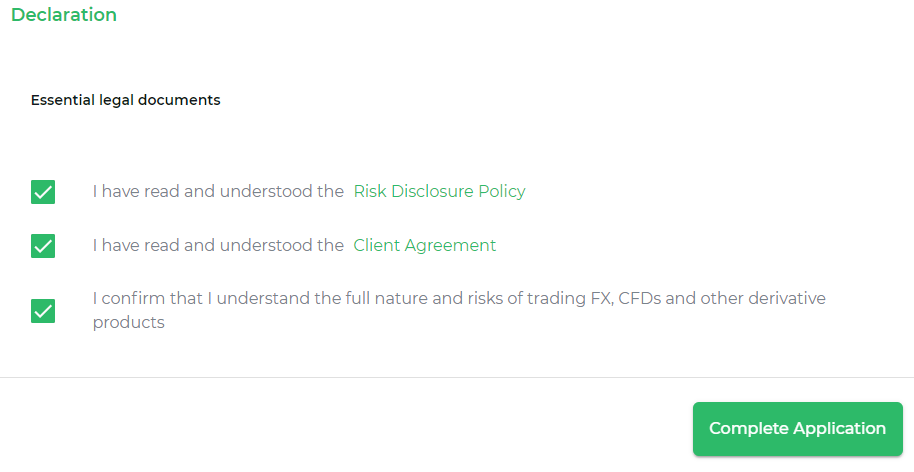

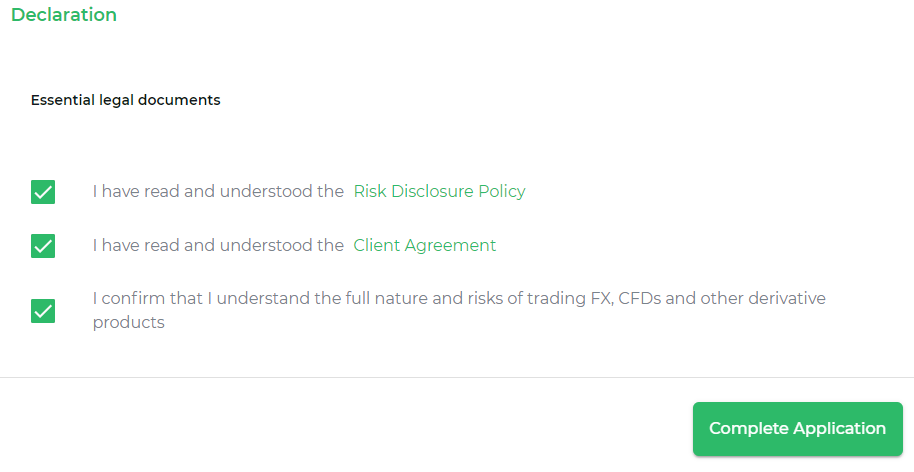

Agree to the terms of service by ticking the three boxes and click the “Complete Application” button.

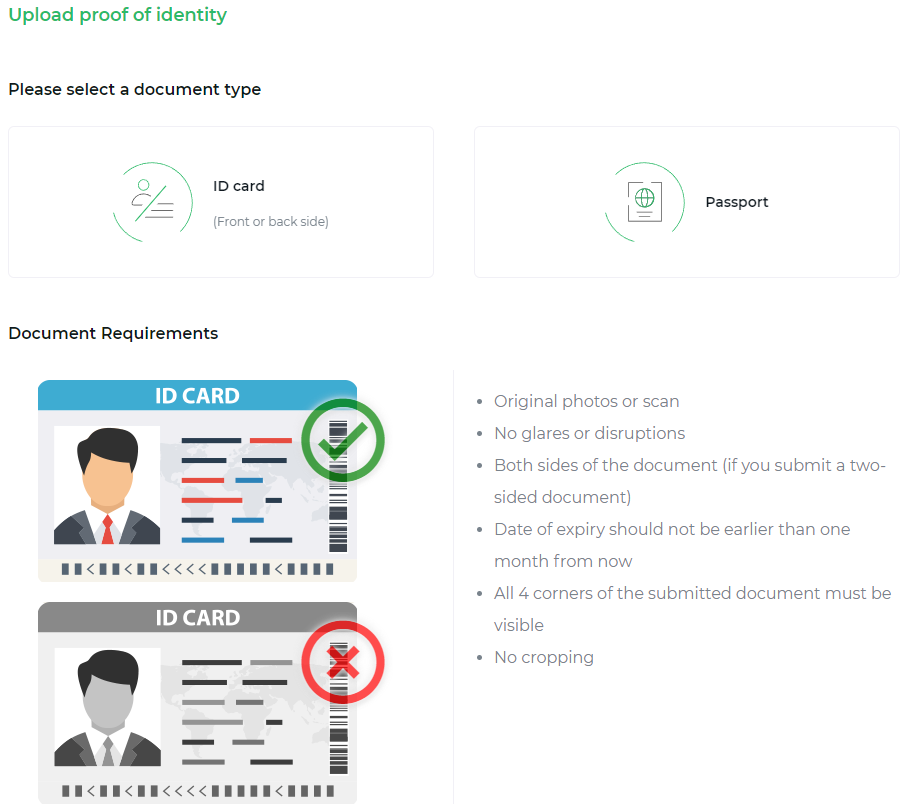

You will automatically be redirected to the verification block. Provide scans/photos of required documents. Read the comments on the screen carefully.

Once verification is complete, go to the “Deposit/Withdrawal” section and follow the instructions on the screen to deposit funds. Now you can download the trading platform you have chosen and get started.

Features of the user account:

Dashboard. It displays aggregated data about each trader's accounts;

Trading accounts. In this block, traders can open new accounts and close the old ones;

Deposit/withdrawal. It is a block for replenishing the account balance and withdrawing profits using the selected method;

Partners. Here functions for corporate clients who want to work with the broker are available;

Economic calendar. The smart calendar is placed in a separate block to simplify the work;

Reports. In this block, you can generate standard reports on trading results;

Help and support. There is a live chat and details for contacting the broker.

Regulation and safety

Eightcap has a safety score of 10/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 16 years

- Strict requirements and extensive documentation to open an account

Eightcap Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

SCB SCB |

Securities Commission of The Bahamas | Bahamas | No specific fund | Tier-2 |

Eightcap Security Factors

| Foundation date | 2009 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Eightcap have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Eightcap with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Eightcap’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Eightcap Standard spreads

| Eightcap | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,4 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,8 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Eightcap RAW/ECN spreads

| Eightcap | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,3 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Eightcap. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Eightcap Non-Trading Fees

| Eightcap | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

It happens that the choice of account type is of great importance, because different accounts often have significantly different trading conditions. Eightcap’s account types differ only in fees. In the first case, there is a standard spread without a fee; and in the second case, there is a raw spread combined with a fee. It cannot be said that one account type is more profitable than another. Traders need to focus on their own strategic preferences. An important point is the trading platform. Eightcap offers three platforms. MT4 and MT5 are considered the most functional and are easily customizable. Iterations include desktop and mobile versions. But if a trader prefers to work through a browser, it is better to use TradingView. Also, the broker offers a lot of educational and analytical materials, and the basics are available even to unregistered users, but it is recommended to study them first.

Account types:

In most cases, traders first open a demo account. This is a great opportunity to get acquainted with the broker, as well as to practice and improve strategies. Then the broker's clients choose one of the live account types in accordance with their preferences. Both account types are financially profitable.

Eightcap - How to open, deposit and verify a trading account | Firsthand experience of TU

Deposit and withdrawal

Eightcap received a High score for the efficiency and convenience of its deposit and withdrawal processes.

Eightcap excels by providing a broad selection of payment methods, ensuring minimal costs and a seamless experience for users seeking efficient fund management.

- Low minimum withdrawal requirement

- No withdrawal fee

- Supports 5+ base account currencies

- USDT (Tether) supported

- Wise not supported

What are Eightcap deposit and withdrawal options?

Eightcap stands out with an excellent selection of deposit and withdrawal methods, a variety of base currencies, and zero broker fees, making it an excellent choice for traders seeking low costs and maximum flexibility. Available methods include Bank Card, Bank Wire, PayPal, Skrill, Neteller, BTC, USDT.

Eightcap Deposit and Withdrawal Methods vs Competitors

| Eightcap | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | Yes | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Eightcap base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Eightcap supports the following base account currencies:

What are Eightcap's minimum deposit and withdrawal amounts?

The minimum deposit on Eightcap is $100, while the minimum withdrawal amount is $0-50. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Eightcap’s support team.

Markets and tradable assets

Eightcap provides a standard range of trading assets in line with the market average. The platform includes 800 assets in total and 40 Forex currency pairs.

- 40 supported currency pairs

- Indices trading

- Crypto trading

- Copy trading not available

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Eightcap with its competitors, making it easier for you to find the perfect fit.

| Eightcap | Plus500 | Pepperstone | |

| Currency pairs | 40 | 60 | 90 |

| Total tradable assets | 800 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Eightcap offers for beginner traders and investors who prefer not to engage in active trading.

| Eightcap | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

Eightcap received a score of 8/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- API access for automated trading

- Trade directly from TradingView

- Strategy (EA) Builder is available

- One-click trading

- No access to a proprietary platform

- No access to Free VPS

- No access to cTrader and its advanced tools.

Supported trading platforms

Eightcap supports the following trading platforms: MT4, MT5, TradingView, WebTrader. This selection covers the basic needs of most retail traders. We also compared Eightcap’s platform availability with that of top competitors to assess its relative market position.

| Eightcap | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | Yes | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key Eightcap’s trading platform features

We also evaluated whether Eightcap offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | No |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 110 |

| Tradable assets | 800 |

Additional trading tools

Eightcap offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

Eightcap trading tools vs competitors

| Eightcap | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | Yes | No | Yes |

| Free VPS | No | No | Yes |

| Strategy (EA) builder | Yes | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

Eightcap supports mobile trading, offering dedicated apps for both iOS and Android. Eightcap received 4/10 in this section, which suggests limited user interest or weak performance of the apps.

- Supports mobile 2FA

- Indicators supported

- Mobile alerts supported

- Weak user feedback on Android

- Low app installs across iOS and Android

We compared Eightcap with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| Eightcap | Plus500 | Pepperstone | |

| Total downloads | 1,000 | 10,000,000 | 100,000 |

| App Store score | No data | 4.7 | 4.0 |

| Google Play score | No data | 4.4 | 4.0 |

| Mob. 2FA | Yes | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

Some brokers try to help traders in researching trading on certain markets. This is an advantage because only successful traders constantly engage in self-learning, and not just blind trading alone. Studying materials by industry experts, reading specialized books, and attending webinars taught by experienced trainers provide useful knowledge, which is then applied in practice to create successful trading strategies. Eightcap refers to brokers that offer a comprehensive educational system and materials presented in different formats. Most of the basic information will be extremely useful for novice traders, while professional market participants can receive up-to-date analytics and unique expert materials.

In some reviews, traders note the absence of structured training and its narrow focus. Experts agree with this, but Eightcap provides a very significant amount of information for trading CFDs, which compares favorably with most of its competitors.

Customer support

Technical (client) support is important for any broker because traders are constantly faced with various situations that they cannot solve without professional help. Sometimes the reason is the inattention of a user. But there are also cases when a technical failure has occurred or the task really requires involvement of an expert department. If support is not available, does not respond quickly enough, or lacks competence, traders may get frustrated and go to another broker. Eightcap offers top-level support. Specialists are rated as experts, according to traders' reviews. They are available 24 hours a day in 24 languages, but only on weekdays. All major communication channels, such as email, live chat, and call center are available.

Advantages

- Non-clients of the broker can contact technical support

- Specialists are available 24/5

Disadvantages

- Support is not available on weekends

Whether you are the broker’s client or just want to register with it, you can contact technical support via the following communication channels:

-

main call center;

-

additional call center;

-

email;

-

live chat on the website and in the user account.

Also, traders can visit the company's physical office in the Bahamas or Seychelles. However, first, clarify the working hours by phone.

Contacts

| Foundation date | 2009 |

|---|---|

| Registration address | 2nd Floor, Ebrahim Building, Office No. 5 and 9, Francis Rachel Street, PO Box 1196 Victoria, Mahé, Seychelles |

| Regulation |

ASIC, SCB, CySEC, FCA

Licence number: 391441, SIA-F220, 246/14, 921296 |

| Official site | https://www.eightcap.com/ |

| Contacts |

+61 3 8375 9700 +61 3 8373 4800

|

Comparison of Eightcap with other Brokers

| Eightcap | XM Group | RoboForex | Exness | FxPro | 4XC | |

| Trading platform |

MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT5, MT4, WebTrader |

| Min deposit | $100 | $5 | $10 | $10 | $100 | $50 |

| Leverage |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | 10.00% | No | No | No |

| Spread | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

80% / 50% | 100% / 50% | 60% / 40% | 60% / No | 25% / 20% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | No | Yes | Yes | No | No |

Detailed review of Eightcap

The brand is owned by Eightcap Global Limited, which was registered in 2009. It’s headquartered in the Bahamas and is regulated there and in Seychelles. The broker has a powerful technological base. This is easy to confirm, for example, by the speed of order execution, which does not exceed 30-50 ms. Eightcap also uses virtual dedicated servers, which increase the platform’s speed. If traders need their own server, they can rent it from the company for a reasonable amount. Not all brokers offer this opportunity. Eightcap also provides completely unique solutions, which is a powerful analytical tool that allows you to almost completely automate trading, minimizing any risks. Even the broker’s economic calendar is non-standard, it is connected to its own self-learning system, which focuses the trader's attention on the most significant events, filtering data by region and time frame.

Eightcap by the numbers:

-

Minimum spread is 0 pips;

-

Minimum deposit is $100;

-

Over 800 financial instruments;

-

Maximum leverage is 1:500;

-

30,000,000 clients.

Eightcap is a broker for novice traders and professionals

Usually, one of the main advantages of a broker is the number of assets. Eightcap only has CFDs, but there are more than 800 of them, which is one of the highest numbers on the market. Traders can work with CFDs on currencies, cryptocurrencies, stocks, etc. This facilitates a diversified portfolio and using a wide range of strategies. Minimal trading costs are a universal advantage. Novice traders can get really extensive training, which is presented in various formats ranging from articles to webinars.

Useful services offered by Eightcap:

-

AI-powered economic calendar. A regular calendar shows the most important economic and political events that may affect the position of an asset. The Eightcap variant differs in that it can filter data for specific regions and time frames.

Advantages:

The broker is suitable for novice traders because it has a small minimum deposit, a lot of assets, high-quality training, and intuitive trading platforms with extensive functionality;

Also, the platform is highly evaluated by professionals because it has high leverage, a lot of cutting-edge analytics, and special services, including automated trading;

The company's universal strengths include a powerful technology stack, speed and transparency, 24/5 technical support, and adaptability.

Latest Eightcap News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i