How to Buy/Sell on Eightcap

To buy/sell on Eightcap, follow these simple steps:

Log in or register if you are a new user.

Verify your account by providing relevant proof of identity and residential documents.

Fund your live trading account with at least $100 using any of the payment options that are convenient for you.

Select from a wide range of assets to trade, including indices, crypto, commodities, and currencies.

Analyze the assets using the chart tools and the several indicators available on your preferred trading platform.

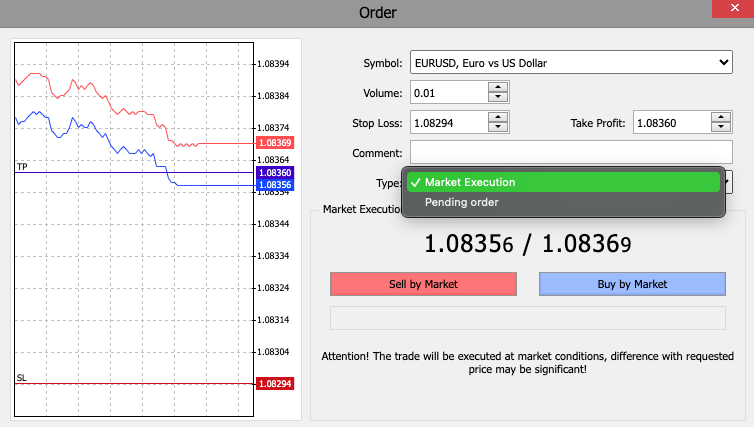

Set the order volume, stop loss and take profit, market type, and select to buy or sell depending on your trading strategy.

Navigating the complexities of financial markets can be a daunting task for many traders. Platforms like Eightcap aim to simplify this process with their intuitive interface and robust regulatory framework. As an authorized trading platform regulated by Tier-1 authorities such as the Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA), Eightcap offers traders a transparent and secure environment to engage in global financial markets. In this article, TU experts will walk you through the buying and selling process on Eightcap, giving you important pointers on using the platform, placing your first trade, and managing risk.

What is the minimum deposit at Eightcap?

The minimum deposit of EightCap is $100.

Does Eightcap have low fees?

Eightcap does not impose any costs on FX or CFD products; they charge minimal fees for trading stocks and ETFs. Open positions held overnight could incur expenses (swap), but as Eightcap doesn't charge for deposits, withdrawals, or inactivity, it doesn't impose non-trading fees. The Raw Account offers clients tighter spreads even though there is a commission associated with each trade made on the account.

How do I place an order on Eightcap?

Placid orders on Eightcap depend on your preferred trading platform. In MetaTrader 4, orders are usually placed either the Toolbar's New Order button or the Market Watch. Double-clicking or right-clicking on the instrument in the Market Watch will bring up the Order window where you can make changes to your order.

Is the EightCap swap free?

Eightcap offers two types of accounts: its reasonably priced commission-based Raw account and its commission-free Standard account. Currently, there isn't a swap-free account.

How to start trading on the EightCap platform

As a beginner trader, the process starts with registration, verifying your account, and making your initial deposit. The minimum deposit amount to trade on a live account is $100. However, opening a demo account, which is accessible to all new traders, allows you to start trading for free regardless of whether you initially opened a standard or raw account.

Eightcap's demo accounts allow new users to familiarize themselves with the trading environment and test the platform before trading live. These accounts typically last for 30 days and are best for practicing how to buy/sell on Eightcap and assessing and refining trading strategies without risking any capital. If needed, traders can request an extension through customer support. Eightcap utilizes the MT4/MT5 trading platforms, offering traders flexibility in setting account balances and leverage. Traders can also trade on the platform web terminal if they cannot download MT4/MT5 trading platforms to trade with the demo account.

To open a demo account, visit the Eightcap website and click the “Create demo account” button. Complete the required fields and copy the login details emailed to you to gain access to the preferred trading terminal.

In a nutshell, to start trading on the EightCap platform, the steps below summarize the process.

Log in or register if you are a new user.

Verify your account by providing relevant proof of identity and residential documents.

To get started with trading on a real account, open a demo account and practice buying and selling on EightCap.

Fund your live trading account with at least $100 using any of the payment options that are convenient for you.

Select from a wide range of assets to trade, including indices, crypto, commodities, and currencies.

Analyze the assets using the chart tools and the several indicators available on your preferred trading platform.

Set the order volume, stop loss and take profit, market type, and select to buy or sell depending on your trading strategy.

Let's do an example of how to trade on EightCap

The process of buying or selling an asset on EightCap is straightforward. Let's use the EUR/USD to show an example of how you can trade on EightCap.

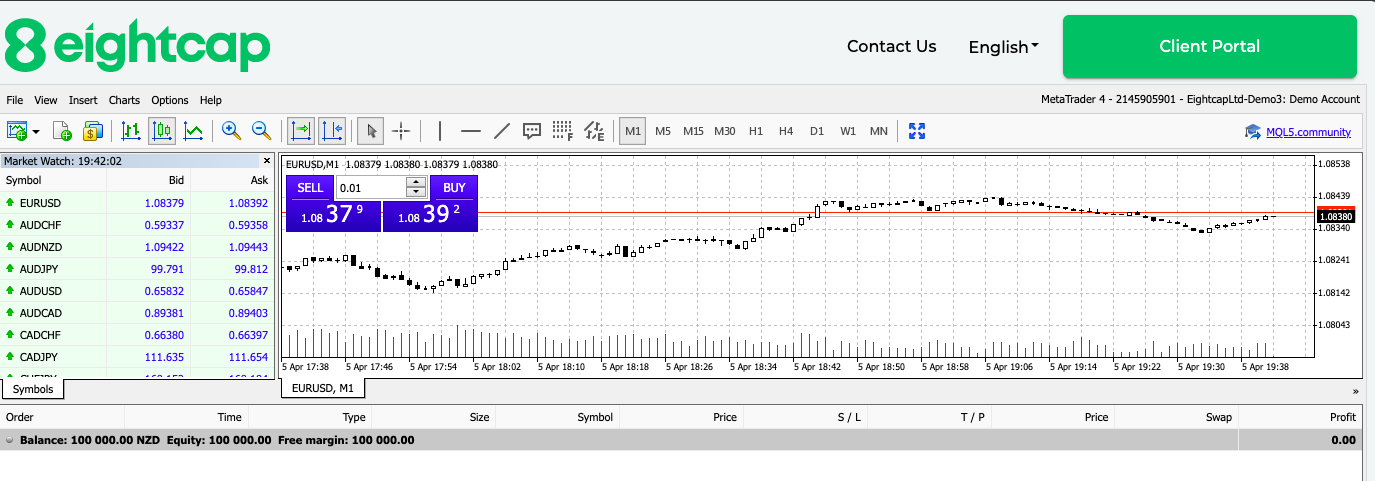

Firstly, open your trading platform on EightCap. For this example, we will be using the EightCap webtrader. Select the EUR/USD pairs.

Selecting trading pairs

Use technical and fundamental analysis tools to analyze the current market conditions and determine your trading strategy.

Analyzing the market

Based on your research and trading plan, choose whether you want to buy (long) or sell (short) the EUR/USD pair. Set stop-loss and take-profit orders to manage your risk and protect your profits. Click on buy or sell to open the trade position.

Order setup and authentication

Note:

It's important to note that Forex trading carries a high level of risk and may not be suitable for all investors. It's advisable to practice risk management and only trade with funds that you can afford to lose.

Available trading instruments on Eightcap

Eightcap grants traders access to the following financial instruments:

Forex (Major, minor, and exotic currency pairs, such as for example EUR/USD, GBP/JPY, and USD/TRY)

Indices (popular stock indices such as the S&P 500, FTSE 100, and DAX 30).

Shares (shares of major companies listed on global stock exchanges, such as Apple, Google, and Amazon).

Commodities (commodities like gold, silver, crude oil, and natural gas, providing opportunities to profit from changes in commodity prices).

Cryptocurrencies (popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), etc.).

Platform & Features

Eightcap offers a comprehensive suite of trading platforms tailored to suit various preferences and needs. First and foremost, traders have access to the highly regarded MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These trading platforms are known for their stability, speed, and extensive features, providing users with advanced charts, technical indicators, and expert advisors for seamless trade management from analysis to execution. Within the MetaTrader platforms, traders benefit from a range of advanced order types, including multiple pending and stop orders such as buy limits, sell limits, buy stops, sell stops, and trailing stops.

Eightcap provides users with a web trading terminal renowned for its intuitive charts, technical analysis tools, and consistent experience across devices. This web trading tool offers a wide range of custom indicators and functionalities, empowering traders to conduct in-depth analysis, backtest strategies, and execute trades directly from charts.

Eightcap mobile apps offer users extensive features, ensuring seamless access to their accounts and real-time market data feeds across various platforms. These apps are compatible with both MetaTrader and TradingView. With these apps, traders can harness advanced charting and analysis tools, enabling them to delve into market trends and make informed decisions.

How much does it cost to trade on EightCap?

To start trading on Eightcap, you need to deposit a minimum of $100. Fees traders are likely to pay when trading with the EightCap platform are spreads, swaps, and commissions. They are also known as rollover rates. These fees represent the interest accrued or paid for holding positions overnight. Spreads replace brokerage fees; they show the difference between a financial instrument's asking and buying prices, expressed in pip amounts. Read more about trading costs: Eightcap spreads explained in our article.

Spread charges are associated with opening positions, commission fees are incurred with transactions, and swap rates are applied after the cutoff time, typically 5 p.m. EST. Costs from spreads, swaps, and commissions on EightCap vary depending on the chosen account types, the commission-based Raw account, and the spread-only Standard account.

| Account type | Spread | Commissions | Min. / Max. Trade Size | Minimum Deposit: |

|---|---|---|---|---|

Raw Account | From 0.0 pips | Each side: 3.5 AUD, USD, NZD, SGD, CAD | 2.25 GBP | 2.75 EUR per standard lot traded | 0.01 lots / 100 lots | $100 |

Standard Account | From 1.0 pips | No Commission* (Shares include commission) | 0.01 lots / 100 lots | $100 |

TradingView Account | From 1.0 pips | No Commission* (Shares include commission) | 0.01 lots / 100 lots | $100 |

Spreads based on assets

| Assets | Spreads |

|---|---|

Euro / US Dollar | Spread from 0 pips |

Gold / US Dollar | Spread from 0.12 pips |

Bitcoin / US Dollar | Spread from 0.12 USD |

Spread from 0.12 USD | Spread from 0.12 USD |

Spot Brent Crude Oil | Spread from 0.03 USD |

US30 Dow Jones Industrial Average | DJIA | Wall Street 30 Cash | Spread from 1.6 USD |

UK 100 Cash | FTSE 100 | Financial Times Stock Exchange 100 Index | Spread from 1.2 GBP |

Eightcap distinguishes itself by offering a fee structure devoid of non-trading fees, including deposit, withdrawal, and inactivity fees. Furthermore, third-party fees and currency conversions are kept to a minimum thanks to various account-based currencies and deposit and withdrawal choices offered by 13 payment processors.

Expert Opinion

EightCap's extensive account features make buying and selling on the platform simple. It is that easy: all you have to do is sign up, validate your broker account, pick a trading platform, decide which assets to trade, analyze them, and initiate a position. A demo account, devoid of any upfront deposit requirement, offers a no-cost platform for trading, enabling you to engage in buying and selling transactions. For newcomers to EightCap, this account serves as a valuable tool for honing the fundamentals of trade execution.

The broker also provides a Raw and Standard account. Traders with more experience and primarily trading forex CFDs will enjoy the Raw account with minimum trade sizes of 0.01 and spreads as low as 0.0 pips, depending on the instrument, with a $100 minimum deposit.

Conclusion

While you prepare to buy/sell on Eightcap, ensure you research the trading instruments available on Eightcap and only trade assets you understand. Remember to trade only amounts you can bear to lose, and using a demo account to learn how to buy and sell on Eight is recommended.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).