eToro Stock Trading

eToro is one of the leading stock trading platforms in the industry. In this post, we will discuss whether or not eToro is as free as it claims to be. We will also look at all the stock trading options available on the platform.

What are Stocks?

eToro USA LLC does not offer CFDs, only real Crypto/ Stocks assets available.

Yes, you can trade stocks at eToro.

There are two main ways that you can trade stocks at eToro:

Trading real shares: this involves buying and selling trades directly

Contracts for Difference(CFDs): this involves trading stock price movements

Stocks are only one of the 5000 trading instruments at eToro. Here are the main instruments you can trade at eToro together with their benefits:

Indices

A stock index measures the performance of a particular group of stocks over time. They are used to evaluate overall stock performance.

Indices are not traded directly. Instead, they are traded indirectly by capitalizing on their price movements. This mode of trade is made possible by CFDs. Although this may sound difficult, trading indices on eToro is simplified. The platform is popular for its easy-to-use format. The only thing you need to know is why indices are worth your time:

The ability to trade in both directions.

A relatively small amount of capital is needed: this is possible through leverage, where you can use a x3 leverage to control $3000 with only $1000.

Eliminates the need to study individual stocks:since indices give an overall view of how a market is doing, you will not need to dive into companies’ financial reports before every trade.

Commodities

Commodities are raw materials that are the building blocks of the global economy. You can either trade commodities directly or through CFDs. The benefits of trading commodities are:

Numerous trading opportunities due to the volatility of commodities

Leverage that can boost capital and gains

Trading with leverage involves high risk.

Protection against inflation

24/7 Trading

Lowering of portfolio risk through diversification

ETFs

ETF stands for exchange traded fund. These funds are used to track the performance of stock market indices. They are great instruments to consider because:

Access to a wide range of markets

Low trading costs

Portfolio diversification

Easy trading

Currencies

Currency trading is a common form of forex trading. eToro, however, makes currency trading special by allowing social trading. With social trading, you are allowed to buy and sell currencies mimicking the trades of more established and successful traders.

Crypto Assets

Although many people still hesitate to invest in cryptocurrency, trading crypto on eToro has several benefits:

High volatility increases trading opportunities

Availability of leverage

24/7 Trading

Availability of the top 5 trading crypto assets

US Stocks Direct Trading

With eToro you can trade in all major markets. In addition to trading on eToro being easy and straightforward, the platform offers zero commissions and relatively low minimum investment limits. Direct stock trading in the US has never been easier.

Due to Pattern Day Trading (PTD), traders are limited to a maximum of 3 trades per day, in any rolling 5 market days. These trades refer to buying and selling any security or instrument, therefore including stocks. However, a trader can trade stocks, trade other assets.

The best thing is that the benefits of trading stocks with eToro do not end at the process being straightforward. Here are more benefits of trading stocks with eToro:

0% commission for stocks except for short or leveraged positions.

Competitive trading fees

Protection of personal information and funds

Social trading platform with a community of 20M+

Insurance of up to 1M Euro, GBP and AUD for qualified traders

The best thing about owning stocks is that you can also both trade and invest them. Here are a few reason you should invest your stocks with eToro:

Stocks are a lucrative long-term investment

You do not need a large amount of money to start trading stocks

Stocks protect your money from inflation

Stocks are easier to buy and sell

You can lower your portfolio risk by spreading your money of several different stocks

Stocks CFDs

You can trade stocks (Nvidia stock, Apple stock, Google stock, Tesla stock etc.) as CFDs if you are aiming for day and short-term trading. With CFD stocks, you have the advantage of trading in both directions like with indices, and use leverage for more exposure.

What is eToro Minimum Deposit for Stock trading?

In the US, the first deposit must be at least $10. In other countries the minimum first deposit will be $50 for most, but it can range from $200 to $10,000 in Israel.

Countries with a minimum deposit of $50 are:

Australia

Austria

Cyprus

Denmark

Estonia

Finland

Germany

Greece

Guernsey

Hungary

Indonesia

Ireland

Italy

Latvia

Liechtenstein

Malaysia

Malta

Netherlands

Norway

Portugal

Singapore

Spain

Sweden

Switzerland

Taiwan

Thailand

Vatican City

United Kingdom

In minimum first deposit is $1000 in the following countries:

French Polynesia

Isle Of Man

Jersey Island

Kuwait

New Zealand

Reunion Island

It is important to note that:

All deposits made via bank transfer must be at least $500.

Corporate accounts also have a different minimum first-time deposit of $10,000

How To Buy and Sell Stocks on eToro

Follow these steps to start buying and selling stocks on eToro:

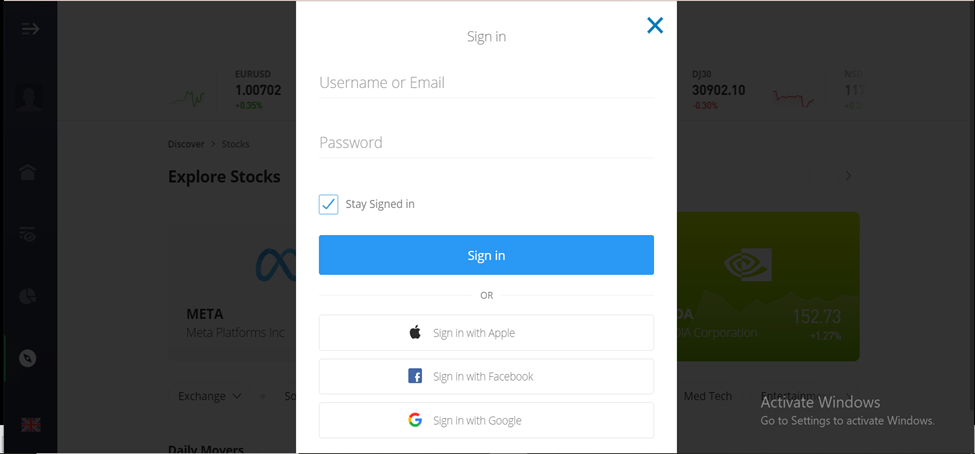

Sign in to your eToro account or create one.

How to buy and sell stocks on eToro

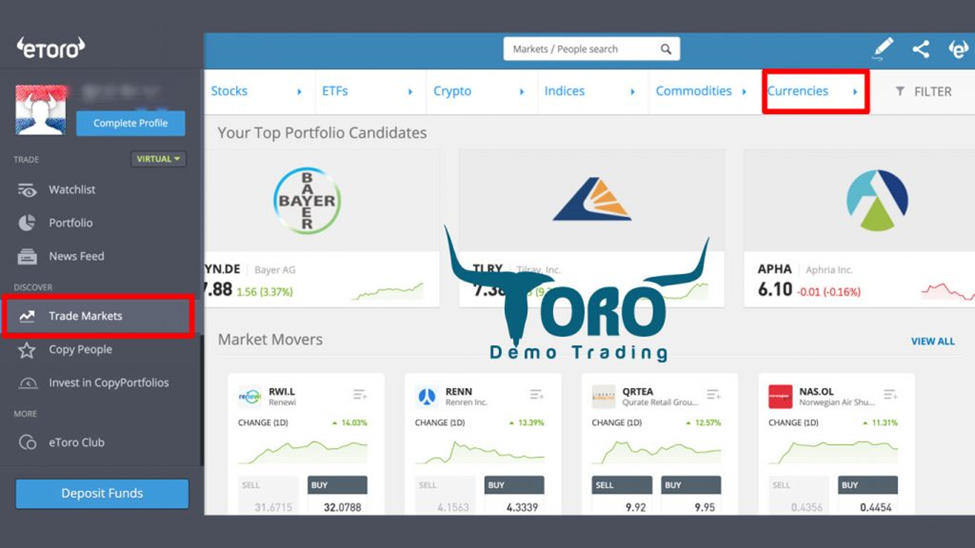

Go to the Markets page, then select Stocks. You will be shown a list of all the stocks available to trade.

How to buy and sell stocks on eToro

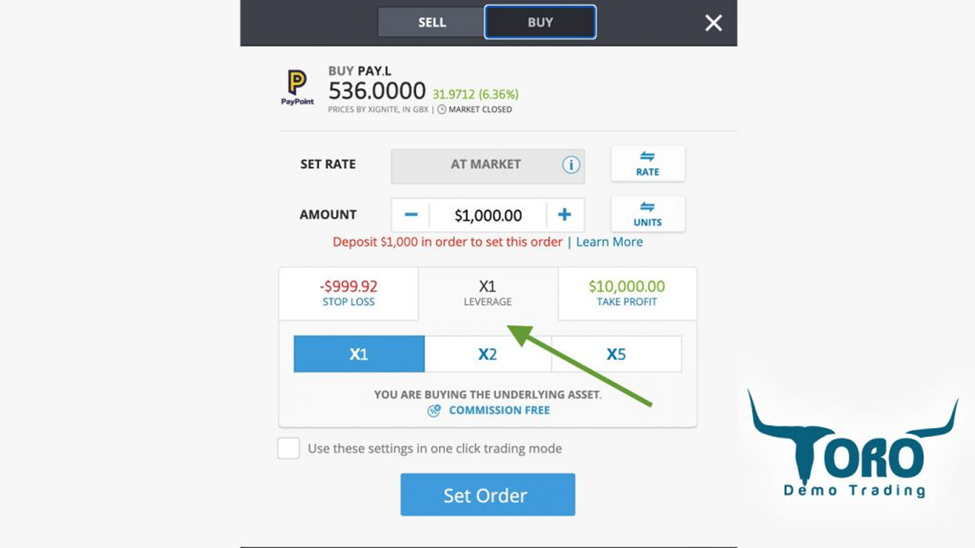

After choosing a stock, select Trade then Buy

Enter the amount of money you want to invest

Set leverage to x1 and profit parameters

How to buy and sell stocks on eToro

Open Trade

That is all it takes to begin trading stock with eToro.

eToro Stock Trading Fee and Spread

eToro does not charge trading fees or commissions on stocks and EFTs. However it does charge a 1% commission on crypto assets.

Since it does not charge a commission on stocks, it also does not charge spread. However, eToro does charge non-trading fees, such as an inactivity fee and a $5 fee for withdrawals.

US Stocks

US stocks are charged the same way as regular eToro stocks. They are not charged any commission.

Stock CFDs

Stock CFDs are charged the same way as regular stocks unless they stay open overnight. When this happens, they incur a small fee, relative to the value of the position.

Do I Pay an Extra Fee for Copy Trading Stocks?

No, there are no extra charges for copy trading.

Can I Copy Trade Stock on eToro?

Yes, copy trading you can copy trade on eToro. Copy trading is one of the most attractive features on eToro. New and old traders alike can legally copy the trades of successful traders to earn high profits.

In January 2023 eToro had over 5 top traders to copy from. At the top of the list was Jeppe Kirk Bonde. Bonde is a professional Strategy Consultant whose preferred strategies are accurate market analysis and diversification of trades. In this case, traders who would like to emulate Bonde will use these same strategies and can even replicate exact trades.

Can I Trade Fractional Shares on eToro?

Yes. You can buy fractional shares on eToro.

Purchase fractional shares of any size above your investment minimum to access more expensive stocks with less capital.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

"Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more"

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

FAQ

Why Can’t I Trade Stocks on eToro?

There are three main reasons you may not be able to trade stocks:

The market may be closed at the time

Pattern day trading rules are prohibiting your trade

Your profile is incomplete and therefore invalid

What Is Pattern Day Trading?

Pattern Day Trading is a rule set up by the Financial Industry Regulatory Authority (FINRA) to protect retail investors from the risks of day trading. The rules limit the number of trades by each trader for each security to 3. Therefore, traders can only buy or sell the same security 3 times in any rolling 5 market days.

What Does Trading in Both Directions Mean?

Trading in both directions means that you can both go long and short on the instrument. For example, you can both buy (go long) and sell (go short) and index and thus profit from both upward and downward price movements.

What Is a Fractional Share?

A fractional share is just as its name suggests: a fraction of a single stock. Say the price of a stock is $5000 and a trader invests $50 of the stock, they would then own a fraction of that stock.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

The area of responsibility of Mikhail includes covering the news of currency and stock markets, fact checking, updating and editing the content published on the Traders Union website. He successfully analyzes complex financial issues and explains their meaning in simple and understandable language for ordinary people. Mikhail generates content that provides full contact with the readers.

Mikhail’s motto: Learn something new and share your experience – never stop!

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.