According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- no minimum

deposit

- MT5

- FSA

- 2008

Our Evaluation of MarketsVox

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

MarketsVox is a moderate-risk broker with the TU Overall Score of 5.09 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by MarketsVox clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

The MarketsVox broker may not have outstanding features, but it offers many constructive advantages. It provides a wide range of assets, genuinely narrow spreads, reasonable commissions, and high leverage. Traders are unrestricted in their trading and have full customization of the MT5 trading platform, including trading widgets. The educational system is based on mentorship, is highly valued by experts, and will benefit clients at any level. The options for passive income are a significant advantage. However, the platform has significant regional limitations, does not include cryptocurrencies in its pool, and does not offer a referral program to individuals.

Brief Look at MarketsVox

Traders have access to currency pairs and CFDs on indices, commodities, and metals. In addition to a demo account, there are three real accounts, each of which can be transformed into a swap-free (Islamic) account. Spreads are market average, and the Standard account has no commission, while the ECN account has a commission of $6 per lot. Deposits and withdrawals can be made via bank cards, bank accounts, and electronic transfer systems. Passive income is available through the integrated copy trading service and MAM accounts. The broker also offers a partnership program for businesses. Traders operate through the MT5 trading platform (desktop, mobile, and browser versions). Educational resources include a glossary and mentorship (available upon request for a fee). New clients can expect three types of bonuses.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- A free demo account and no minimum deposit requirement for real accounts (though there is a recommended amount).

- The broker provides numerous widgets for fundamental and technical analysis (integrated with the MT5 trading platform).

- Narrow spreads combined with low commissions ensure clients have reasonable trading costs.

- Maximum leverage is 1:2000, and the platform does not impose restrictions on trading strategies and methods.

- MAM accounts and copy trading services enable traders to earn passive income and gain unique experience.

- The company is officially registered in Seychelles and regulated by the FSA SD142 (Financial Service Authority), ensuring transparency and reliability.

- Technical support is available via email, live chat, and a ticketing system on the website.

- Residents of Belgium, New Zealand, Iran, North Korea, the Korean Democratic People's Republic, and several other countries cannot collaborate with this broker.

TU Expert Advice

Financial expert and analyst at Traders Union

The trading brand MarketsVox is owned by ForexVox (Seychelles) Financial Services Ltd, which was initially based in London but later relocated to Seychelles. The broker is regulated by the FSA (Financial Service Authority), and the license has been verified. There are no recorded instances of this company failing to fulfill its obligations to clients, and the stated cooperation conditions are observed.

The broker's spreads are average, as are the trading commissions. There are no commissions for Standard accounts, while ECN accounts have a fee of $6 per full lot.

The platform provides a demo account for familiarizing oneself with its capabilities and practicing strategies. Additionally, upon client request, their account can be converted to swap-free mode. The maximum leverage is 1:2000, which is sufficient for generating substantial profits even with little capital. Also, the risk is not excessively increased (as is the case with leverage ratios of 1:1000, 1:2000, and higher). The broker's asset pool includes many of the most demanded currency pairs, as well as CFDs from four groups.

The passive income options include joint accounts like MAM and the proprietary copy trading service. Both features are implemented at a high-quality level, and there are no complaints about them. However, there are some concerns about client support as it does not operate on weekends, and there is no call center. Also, remember that this broker has certain regional restrictions.

MarketsVox Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT5 |

|---|---|

| 📊 Accounts: | Standard, ECN, Cent |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Deposit / Withdrawal: | Bank transfers, Visa/Mastercard debit, and credit cards, electronic wallets such as Neteller, SticPay, etc. |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | Up to 1:2000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,2 pips |

| 🔧 Instruments: | Currency pairs, CFDs on indices, commodities, and metals |

| 💹 Margin Call / Stop Out: | 100%/20% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

Free demo account, three real accounts with no minimum deposit; Narrow spreads, and low commissions;< Two options for passive income are mam accounts and copy trading; Trading is only through mt5 platform; You can connect several brokerage widgets. |

| 🎁 Contests and bonuses: | up to 100% |

Often, if a broker offers multiple real accounts, the minimum deposit required depends on the account chosen by the client. However, it is different in the case of MarketsVox. There are only three real accounts, and there are no minimum deposit requirements. In other words, traders are free to deposit as much as they deem necessary, even as low as $1. The platform recommends $100 for a Standard account and $500 for an ECN account, but these are just recommendations and not mandatory conditions. The leverage does not depend on the account type; it is determined solely by the traded asset. The highest trading leverage is available for currency pairs, reaching 1:2000. As for this company's technical support, it operates around the clock on weekdays. Managers can be contacted via email, live chat on the website, and through the user account. Additionally, there is a standard ticket system available.

MarketsVox Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

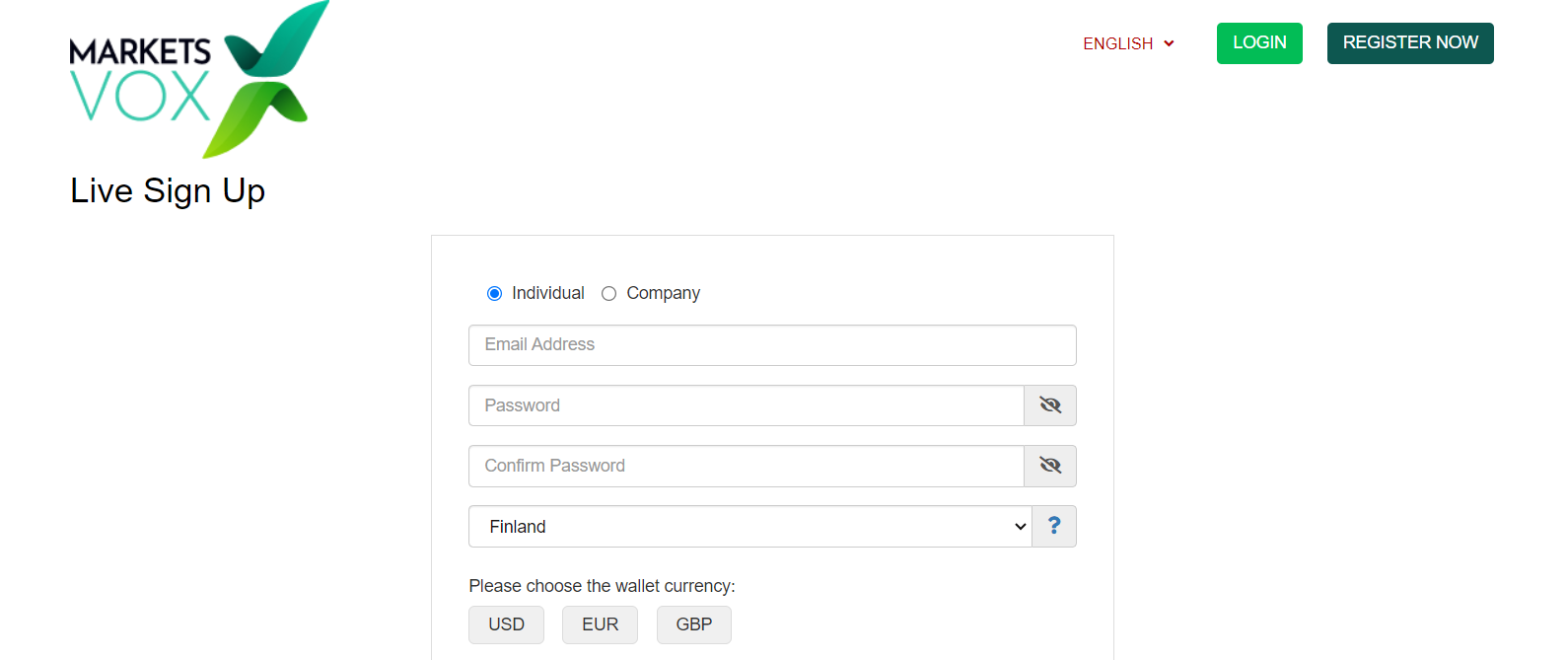

Trading Account Opening

To start collaborating with this broker, you need to register on their official website, verify your information, make a deposit, and download the trading platform. TU experts explain below the sequence of actions and describe the capabilities of the MarketsVox user account.

Go to this broker's website. In the top right corner, select the language of the interface. Click on “Open Live Account”.

Choose how you would like to be addressed, enter your first and last names, date of birth, and complete address, including the postal code. Select your country of residence, and enter your email address and phone number. Finally, select the account type and only USD as the base currency. Agree to the terms of service by checking the box at the bottom. Click on “Finish”.

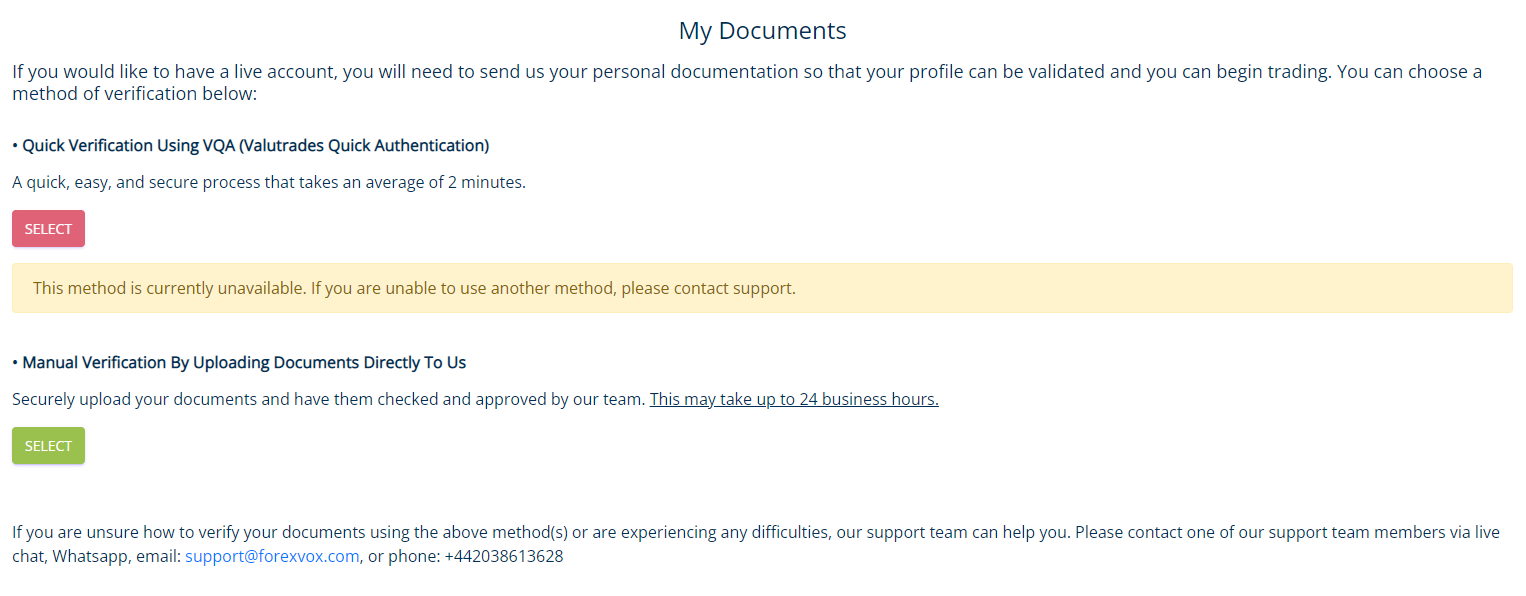

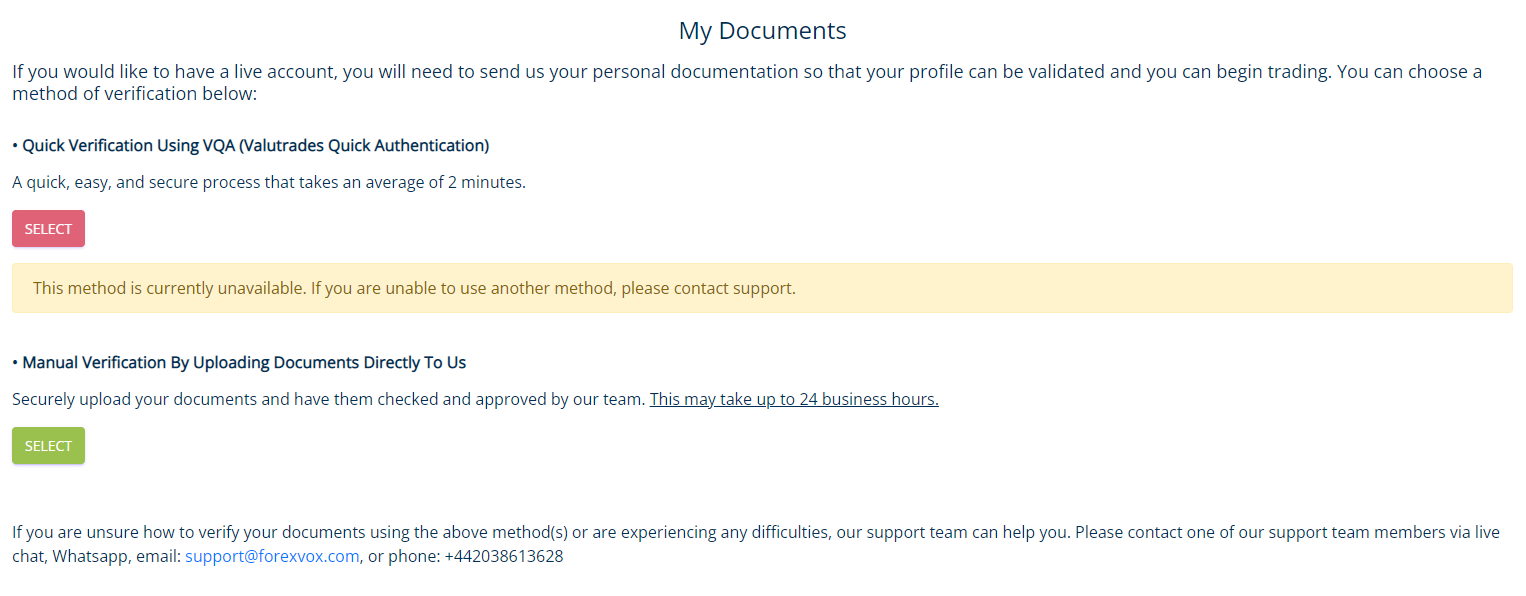

You will be taken to the user account, specifically the verification page. Here, you need to confirm the previously provided information. You can do this using the traditional method by submitting scans/photos of the required documents or through the VQA (Visual Question Answering) system. The second option is faster, but you can choose either method. Simply follow the instructions on the screen, and then wait for the verification process to be completed.

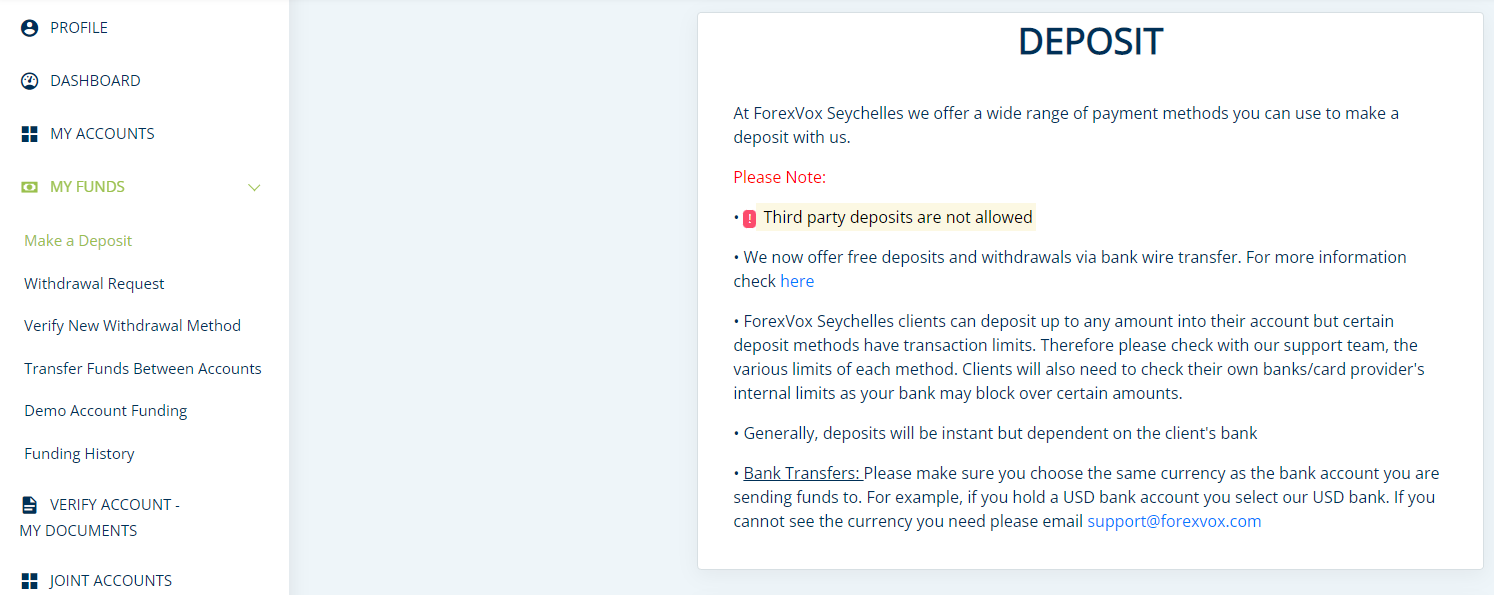

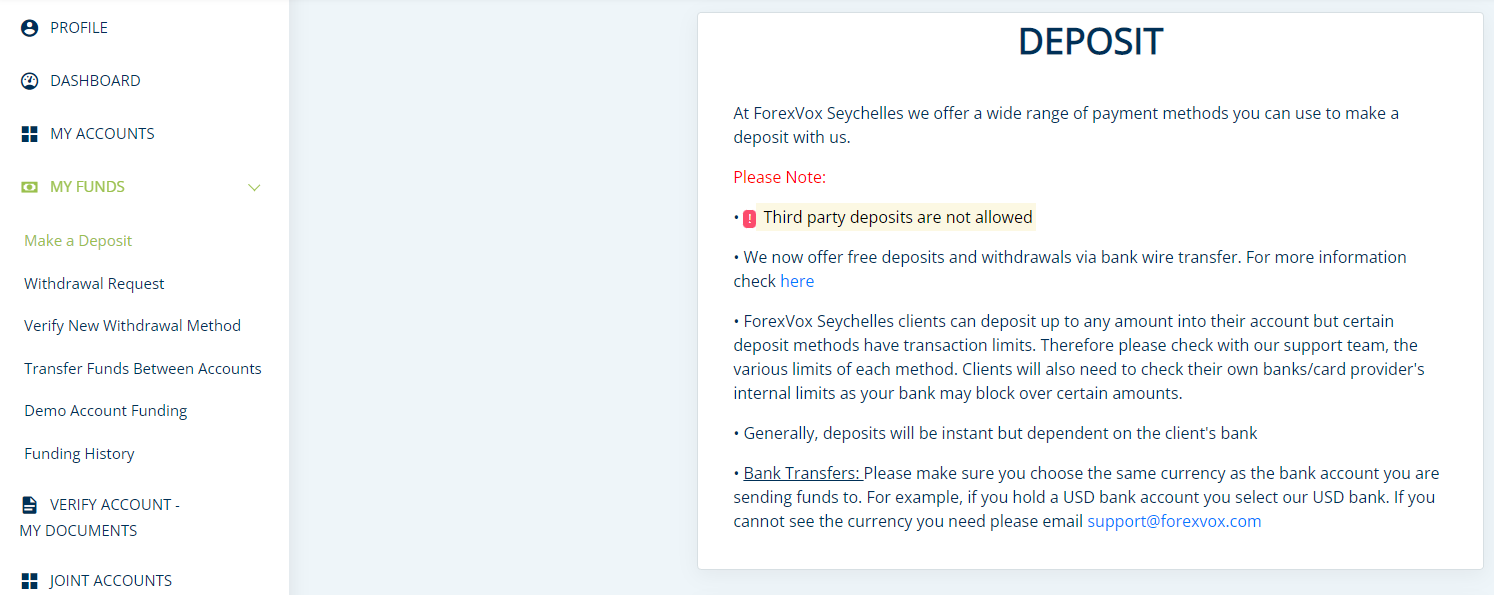

Click on “My Funds” in the left menu, then select “Make a Deposit”. Read the warning, choose the deposit method, and follow the instructions on the screen. Wait until the account balance is updated.

Click on “Downloads” in the left menu. Choose the version of the MT4 trading platform that suits you. Download the distribution and install the platform on your device. Launch it, enter the registration details received in the email sent to your provided email address, and start trading.

Your ForexVox user account also provides access to:

-

Profile. Used to edit users’ personal data and change passwords.

-

Dashboard. Displays summarized information about open accounts with detailed parameters.

-

My Accounts. This section is used to open/close accounts and collect automated statistics.

-

My Funds. Allows you to deposit funds, withdraw profits, and perform related operations.

-

Verify Documents. This is the section where verification is initiated, and the progress of the verification is displayed.

-

Joint Accounts. This section is necessary for connecting to MAM accounts as either a manager or investor.

-

Downloads. This section allows traders to download the MT4 trading platforms.

-

Affiliate Resources. This section is intended for business community representatives.

-

Product Information. Displays useful information such as swaps, futures expiration dates, etc.

-

Social. Provides the opportunity to switch to a copy trading platform (additional registration is required).

-

Exported Reports. This section shows a list of reports that the trader has requested for their accounts.

-

Contact Us. This section allows you to submit a ticket to client support from the user account.

Regulation and safety

MarketsVox has a safety score of 4.7/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 17 years

- Not tier-1 regulated

MarketsVox Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

MarketsVox Security Factors

| Foundation date | 2008 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker MarketsVox have been analyzed and rated as Low with a fees score of 10/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of MarketsVox with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, MarketsVox’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

MarketsVox Standard spreads

| MarketsVox | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,1 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,1 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

MarketsVox RAW/ECN spreads

| MarketsVox | Pepperstone | OANDA | |

| Commission ($ per lot) | 2,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,2 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with MarketsVox. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

MarketsVox Non-Trading Fees

| MarketsVox | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Typically, traders first pay attention to the differences between the offered accounts. At MarketsVox, in addition to the demo account, there are three real accounts that differ only in spreads and trading commissions. The Standard account has higher spreads but no commission. The ECN account, on the other hand, has lower spreads but comes with a commission of $6 per full lot. In both cases, clients have access to leverage of 1:2000 and a full range of trading instruments. Therefore, the choice of account is not as crucial as with other brokers. Additionally, any account can be converted into an Islamic account (without swap fees) upon request. Also in the case of MarketsVox, there is no need to think about choosing a trading platform because this broker works only with MT5. Why specifically MT5? The answer is obvious! Most experts consider MetaTrader 4 as one of the best if not the best, trading software. Its conceptual advantage lies in the ability for extensive customization through hundreds of plugins.

Account types:

As a rule, users first open a demo account. This allows them to explore the platform and, if necessary, test various strategic decisions. Subsequently, they can register a real account of either type and start trading fully. If clients opt for mentorship, an experienced specialist assists them in making decisions and guides the trading process.

Deposit and withdrawal

MarketsVox received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

MarketsVox provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- BTC available as a base account currency

- No withdrawal fee

- Low minimum withdrawal requirement

- USDT (Tether) supported

- Only major base currencies available

- PayPal not supported

- Wise not supported

What are MarketsVox deposit and withdrawal options?

MarketsVox provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT.

MarketsVox Deposit and Withdrawal Methods vs Competitors

| MarketsVox | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are MarketsVox base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. MarketsVox supports the following base account currencies:

What are MarketsVox's minimum deposit and withdrawal amounts?

The minimum deposit on MarketsVox is $0, while the minimum withdrawal amount is $5. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact MarketsVox’s support team.

Markets and tradable assets

MarketsVox offers a limited selection of trading assets compared to the market average. The platform supports 100 assets in total, including 60 Forex pairs.

- 60 supported currency pairs

- Crypto trading

- Indices trading

- No ETFs

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by MarketsVox with its competitors, making it easier for you to find the perfect fit.

| MarketsVox | Plus500 | Pepperstone | |

| Currency pairs | 60 | 60 | 90 |

| Total tradable assets | 100 | 2800 | 1200 |

| Stocks | No | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products MarketsVox offers for beginner traders and investors who prefer not to engage in active trading.

| MarketsVox | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

MarketsVox received a score of 6.25/10, reflecting an average offering in terms of trading platforms and tools. The broker covers essential functionality but may fall short in some advanced features or platform diversity compared to leading competitors.

- MetaTrader is available

- Trading bots (EAs) allowed

- API access for automated trading

- Free VPS for uninterrupted trading

- No access to a proprietary platform

- No TradingView integration

- Strategy (EA) Builder is not available

Supported trading platforms

MarketsVox supports the following trading platforms: MT5. This selection covers the basic needs of most retail traders. We also compared MarketsVox’s platform availability with that of top competitors to assess its relative market position.

| MarketsVox | Plus500 | Pepperstone | |

| MT4 | No | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | No | Yes | Yes |

Key MarketsVox’s trading platform features

We also evaluated whether MarketsVox offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | No |

| Scalping | No |

| Supported indicators | 50 |

| Tradable assets | 100 |

Additional trading tools

MarketsVox offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

MarketsVox trading tools vs competitors

| MarketsVox | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | Yes | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

MarketsVox supports mobile trading, offering dedicated apps for both iOS and Android. MarketsVox received 2/10 in this section, which suggests limited user interest or weak performance of the apps.

- Android and iOS apps

- Weak user feedback on Android

- Mobile 2FA not supported

We compared MarketsVox with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| MarketsVox | Plus500 | Pepperstone | |

| Total downloads | No data | 10,000,000 | 100,000 |

| App Store score | No data | 4.7 | 4.0 |

| Google Play score | No data | 4.4 | 4.0 |

| Mob. 2FA | No | Yes | Yes |

| Mob. Indicators | No | Yes | Yes |

| Mob. Alerts | No | Yes | Yes |

Education

It is important for traders to continuously improve their theoretical knowledge. Each trader addresses this task individually, especially considering that there are several ways to do so, such as specialized literature (usually in electronic format), dedicated forums, webinars, and lectures. Some brokers, understanding their clients' desire to learn, offer them various options. Sometimes it's just expanded FAQs on trading, but often companies create comprehensive courses. MarketsVox positions itself in this regard. The broker's website provides a glossary for beginners, but no other materials are provided. However, there is a paid mentoring service where experienced market participants are constantly in touch with the trader and assist them in their trading activities. Currently, Adam Harris and Beat Nussbaumer act as mentors. They are experienced players with an impeccable track record, from whom even self-proclaimed professionals can learn a thing or two.

Therefore, MarketsVox clients only have free access to the glossary. The glossary should not be considered educational material in the traditional sense as it is more of a guide to the basics of trading. If a trader has some available funds, it is recommended to work with a mentor for at least some time, as it will provide valuable theory and real-world practice.

Customer support

Every trader sooner or later encounters a problem that they cannot solve on their own. It is important that at such times, a company's client support comes to the aid of the client with competent and prompt assistance. If client service specialists are slow to respond or unable to resolve the issue at hand, the trader is likely to become disappointed with the broker they are working with and may switch to a competitor. This is bound to happen if the support team consistently demonstrates incompetence. That's why most brokers strive to provide high-quality client service. In the case of MarketsVox, traders can contact the support team via email and live chat. The website also features a standard ticketing system. The specialists are available around the clock on weekdays.

Advantages

- Multiple channels of communication are available for contacting client support.

- You don't have to be an existing client of this broker to receive assistance.

Disadvantages

- No call center is available.

- Client support is not available on weekends.

You can use the following contact options:

-

Email.

-

Live chat on the website and in the user account.

-

Ticket in the "footer" of any page.

The broker has official profiles on the following social platforms: Facebook, LinkedIn, Twitter, Instagram, and YouTube. You can also reach out to its managers there. It is recommended to follow this broker to stay updated on their events and not miss out on important news.

Contacts

| Foundation date | 2008 |

|---|---|

| Registration address | CT House, Office 9A, Providence, Mahe, Seychelles |

| Regulation |

FSA

Licence number: SD142 |

| Official site | https://marketsvox.com/en/ |

| Contacts |

Comparison of MarketsVox with other Brokers

| MarketsVox | Eightcap | XM Group | RoboForex | Pocket Option | FxPro | |

| Trading platform |

MT5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | No | $100 | $5 | $10 | $5 | $100 |

| Leverage |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 1.2 point | From 0 points |

| Level of margin call / stop out |

100% / 20% | 80% / 50% | 100% / 50% | 60% / 40% | 30% / 50% | 25% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | Yes | No | No | Yes | No | No |

Detailed review of MarketsVox

ForexVox (Seychelles) Financial Services Ltd has been operating on the international stage for many years. The company underwent a major rebranding when it moved from the United Kingdom to Seychelles. The rebranding was driven by internal decisions rather than a lack of trust from clients. Currently, this company provides brokerage services at a consistently high level, at least in terms of technical aspects. For example, every client has the opportunity to obtain a free Virtual Private Server (VPS). MarketsVox operates its data centers instead of leasing computing power. This indicates that MarketsVox is a serious organization that plans to continually enhance its technological infrastructure. In terms of security, this broker uses SSL protocols to ensure secure internet connections.

MarketsVox by the numbers:

-

The minimum deposit is $0.

-

The maximum leverage is 1:2000.

-

There are 100+ trading instruments available.

-

There are 10+ deposit/withdrawal options available.

-

A welcome bonus for the first deposit is 100%.

MarketsVox is a Forex and CFD broker with comfortable trading conditions

For any broker, it is important to have a deep and diverse pool of financial instruments. The more assets available to a trader, the broader their trading opportunities and the easier it is to diversify risks. In this case, we are dealing with a pool that includes over 100 instruments, including currency pairs and CFDs. The contracts cover indices, commodities, and metals. A well-constructed investment portfolio allows traders to generate profits even in the face of an obvious negative trend in one instrument, thanks to the stable and progressive positions of others. An additional advantage is the moderate leverage of 1:2000. This level of leverage is sufficient to significantly increase profit potential. Trading risks also increase, but they will not be as substantial as with leverage of 1:1000 or higher.

Other services offered by MarketsVox:

-

MAM accounts. Managers of joint accounts earn additional profits from commissions charged to investors. In turn, investors earn passive income with reduced risks.

-

Copy trading. Signal providers earn additional income by charging fees to investors for successful trades. Investors, in addition to passive income, gain experience by observing skilled traders.

-

Analytical widgets. The broker provides an economic calendar, calculators, charts, and other tools in the form of plugins for the MT trading platform and its copy trading service.

Advantages:

The broker is an excellent choice for beginner traders as there is no minimum deposit requirement, and a free demo account is available.

Clients enjoy the advantage of narrow spreads, a wide range of assets, and no trading restrictions.

The use of the MetaTrader 5 trading platform is a significant advantage as MT solutions are universal, user-friendly, and functional.

MAM accounts and copy trading services enable traders with different levels of experience and trading approaches to earn additional income.

MarketsVox mentorship has predominantly positive reviews, making it an accessible and valuable option for personal education.

Latest MarketsVox News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i