According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $250

- MT4

- CySEC

- 2019

Our Evaluation of Trust Capital

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Trust Capital is a broker with higher-than-average risk and the TU Overall Score of 4.42 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Trust Capital clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Trust Capital's CFD trading conditions are generally average. It grants access to hundreds of assets from seven groups, providing a variety of available strategies and portfolio diversification. As trading is conducted through the MT4 platform, traders can customize their workspace. The entry barrier is relatively low, with a free demo available, and a minimum deposit of $250 on a real account. The commission policy is moderately transparent, with no additional markups. The partnership program is beneficial. Unfortunately, there are no options for passive earnings. However, Trust Capital offers an excellent training program for traders of different levels.

Brief Look at Trust Capital

Trust Capital is a contract for (price) differences (CFD) broker that offers over 200 assets in the following groups: currencies, cryptocurrencies, stocks, indices, commodities, metals, and energies. It provides a free demo account and two real accounts. The minimum deposit is $250, and the spread starts from 0.9 pips with no trading commission on Solo accounts. Holders of Solo accounts are traders who fully control their accounts and trade independently. The margin call and stop-out levels are 100% and 50%, respectively. The platform supports MetaTrader 4, including its mobile version. There are no trading restrictions, which allow scalping, hedging, and the use of advisors. The broker conducts educational lectures on its website and organizes webinars. It offers basic technical and fundamental analysis tools, such as calculators, newsfeeds, and an economic calendar. Deposits and withdrawals are processed through major channels such as Visa bank cards, PayPal, Neteller, Skrill, e-wallets, and crypto-wallets. Trust Capital offers partnership opportunities to anyone interested, with initial partner earnings starting at $10 per referral but potentially increasing to $300. The company's customer support is available via phone, email, and LiveChat on weekdays.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- The free demo account allows exploring the broker's capabilities without risk and practicing trading strategies.

- There are competitive spreads on real accounts, with no trading commission on Solo accounts and market-average commission on Together accounts, which are currency pairs that typically move in the same direction, such as EUR/USD and GBP/USD.

- The company has excellent technical infrastructure, ensuring prompt trade execution, and stable virtual servers.

- Trust Capital uses the versatile MetaTrader 4 trading platform, suitable for both beginner and experienced traders.

- Deposits and withdrawals can be made through various well-known channels, and withdrawal fees are at the competitors’ level.

- The broker provides free educational materials that are highly valued by users and experts.

- The partnership program offers an opportunity for additional earnings from referrals.

- The broker lacks transparency, as traders may not know the commission size on the Together accounts until opening one.

- Apart from the partnership program, there are no other options for additional earnings, such as copy trading and MAM and PAMM accounts.

- The company does not offer services to residents of the United Kingdom, the Czech Republic, Belgium, Iran, and some other countries.

TU Expert Advice

Author, Financial Expert at Traders Union

Trust Capital offers trading over 200 CFDs across seven categories, including currencies, cryptocurrencies, stocks, indices, commodities, metals, and energies, all through the MetaTrader 4 platform. The broker provides two live account types and a free demo account, with a minimum deposit of $250. Competitive spreads start from 0.9 pips, and there are no trading fees on the Solo account. The brokers clients benefit from comprehensive educational materials and a flexible partnership program. Deposits and withdrawals are processed through various popular channels.

However, Trust Capital has some drawbacks, including the lack of transparency regarding fees for the Together account and limited passive income options. Client support operates only on weekdays, and technical limitations in mobile trading can be restrictive for some users. Trust Capital may suit traders who value using the MT4 platform and require varied CFDs, but those looking for advanced account features and broad asset selections may find better options.

Trust Capital Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | Demo, Solo, Together |

| 💰 Account currency: | USD, EUR |

| 💵 Deposit / Withdrawal: | Visa, Skrill, Neteller, bank transfer, PayPal, Swift, Crypto |

| 🚀 Minimum deposit: | $250 |

| ⚖️ Leverage: | Up to 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,2 pips |

| 🔧 Instruments: | CFDs on currencies, cryptocurrencies, stocks, indices, commodities, metals, energies |

| 💹 Margin Call / Stop Out: | 100% / 50% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: |

Demo account, two real accounts, all assets are CFDs; Over 200 trading instruments from 7 groups; Average market spread, no trading commissions on Solo accounts; Small withdrawal fees, multiple deposit/withdrawal options; Clients trade through the MT4 trading platform; No copy trading or PAMM. |

| 🎁 Contests and bonuses: | Yes. There are bonuses in the form of rebates from Traders Union |

In the case of a demo account, it is sufficient to complete registration and verification; no deposit is required. For the Solo account, a minimum deposit of $250 is required, while for the Together account, a minimum deposit of $1000 is required. This is a standard practice where brokers offer multiple account types with varying minimum deposit requirements. Traders can deposit more than the specified amount but not less; otherwise, they will not be able to engage in trading. The broker provides a modest trading leverage of up to 1:30, which is the same for all account types. Trust Capital's technical support operates on weekdays from 9:00 to 23:00 Pacific Time. Support is not available during nights and weekends. Contacting support can be done via telephone (two numbers), email, LiveChat on the website, and within the user account. The broker also has profiles on social platforms, through which one can reach out to the managers. However, it should be noted that currently, the company is focused on its website and does not actively develop some of its social media pages. For example, this applies to YouTube, where the broker's account has undergone several restarts, so the latest videos were released three years ago.

Trust Capital Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start collaborating with the broker, create a user account on their official website. Then, verify your account information and make a deposit. After that, by downloading the MT4 trading platform, traders can start trading. The experts at TU have prepared a step-by-step guide on the registration process and the features of the Trust Capital user account.

Go to the broker's website. In the upper right corner, select the interface language, which is monitored by Google Translate. Click on “Open Live Account”.

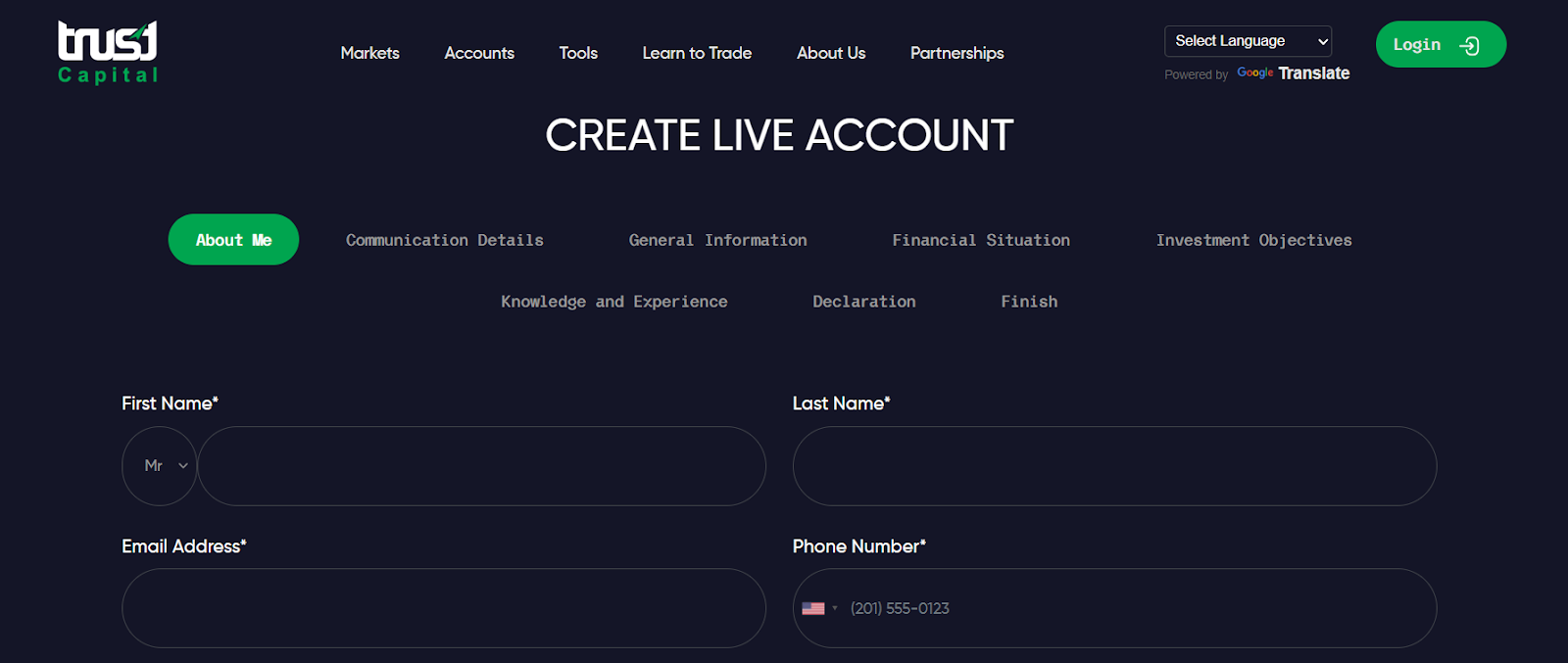

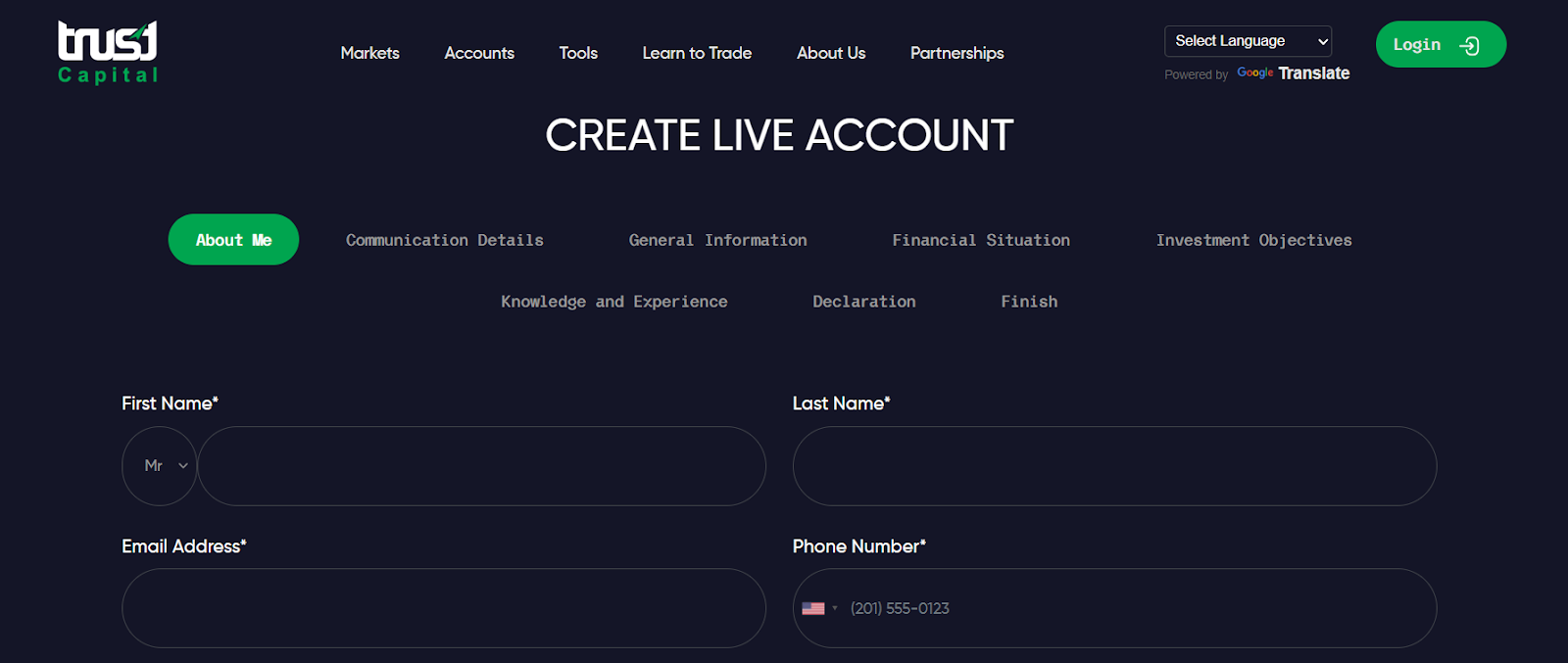

Provide your contact information. Enter your name, surname, email address, phone number, and your country of residence. Agree to the terms of cooperation and complete the anti-bot verification by checking the boxes. Click on “Begin”.

Enter your registration address with the postal code. Click on “Save and Continue”.

Enter your date and place of birth, nationality, and occupation. Choose the account type - Solo or Together. Specify the base currency for the account – USD or EUR. Agree to the data processing conditions. Answer a couple of questions. Click on “Confirm”.

Answer a few more questions regarding your financial status, trading experience, and preferences.

After providing all the answers, you will receive an email to the provided email address. This email will contain instructions for verification. Following the instructions, send the required photos/scans to the broker's email. Once the specialists verify them, you will receive a notification with your registration details. These details are required for logging into the user account. After that, deposit funds, download the MT4 trading platform, and start trading.

Your Trust Capital user account also provides access to:

Traders can track information about active accounts, detailing each parameter. They can also open or close accounts, including demo accounts.

Deposits and profit withdrawals are carried out through the corresponding features of the user account. There is also a LiveChat for contacting technical support.

The user account provides access to the educational section and the affiliate program menu, where a list of referrals and the bonuses received for them are indicated.

Traders have access to typical technical analysis tools and a link to newsfeeds. In the corresponding section, users can download the MT4 trading platform.

Regulation and safety

Trust Capital has a safety score of 8.5/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record of less than 8 years

Trust Capital Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

Trust Capital Security Factors

| Foundation date | 2019 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Trust Capital have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- Above-average Forex trading fees

- Deposit fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Trust Capital with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Trust Capital’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Trust Capital Standard spreads

| Trust Capital | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,9 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,8 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,9 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,8 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Trust Capital RAW/ECN spreads

| Trust Capital | Pepperstone | OANDA | |

| Commission ($ per lot) | 2,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,2 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Trust Capital. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Trust Capital Non-Trading Fees

| Trust Capital | Pepperstone | OANDA | |

| Deposit fee, % | 2,5 | 0 | 0 |

| Withdrawal fee, % | 2,5 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

The account type is of paramount importance. With Trust Capital, it is quite simple as they offer two real accounts plus a demo account. The Solo option is versatile, with a reduced initial deposit and spread, and no commission. The Together option differs with an increased initial deposit ($1000) and higher spreads, starting from 1.8 pips, plus a trading commission. However, Together provides priority technical support, expanded education options, and a personal manager. The training process also differs, as it is more personalized. Essentially, Together accounts are designed for users with substantial capital who are willing to invest significant amounts in CFDs, thus requiring an elite approach from the broker. Otherwise, the accounts do not have any differences: both offer market order execution, a minimum trade size of 0.01 lots, and margin call and stop-out requirements at 100% and 50%, respectively.

Account types:

As a rule, traders prefer to start with a demo account. These accounts allow them to familiarize themselves with the platform, assess its advantages and disadvantages, and quickly test various strategies without risking financial losses. If a trader is satisfied with the performance on the demo account, they can make a deposit according to the requirements of the chosen real account. When selecting an account type, users typically consider their experience, financial capabilities, and ambitions.

Deposit and withdrawal

Trust Capital received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

Trust Capital offers limited payment options and accessibility, which may impact its competitiveness.

- Bank card deposits and withdrawals

- Bitcoin (BTC) accepted

- Bank wire transfers available

- USDT (Tether) supported

- High minimum withdrawal requirement

- PayPal not supported

- Only major base currencies available

What are Trust Capital deposit and withdrawal options?

Trust Capital offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire, Neteller, BTC, USDT. This limitation may restrict flexibility for users, making Trust Capital less competitive for those seeking diverse payment options.

Trust Capital Deposit and Withdrawal Methods vs Competitors

| Trust Capital | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Trust Capital base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Trust Capital supports the following base account currencies:

What are Trust Capital's minimum deposit and withdrawal amounts?

The minimum deposit on Trust Capital is $250, while the minimum withdrawal amount is $250. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Trust Capital’s support team.

Markets and tradable assets

Trust Capital offers a limited selection of trading assets compared to the market average. The platform supports 200 assets in total, including 50 Forex pairs.

- Crypto trading

- Indices trading

- 50 supported currency pairs

- Limited asset selection

- Copy trading not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Trust Capital with its competitors, making it easier for you to find the perfect fit.

| Trust Capital | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 200 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Trust Capital offers for beginner traders and investors who prefer not to engage in active trading.

| Trust Capital | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | Yes | No | No |

Trading platforms & tools

Trust Capital received a score of 6.25/10, reflecting an average offering in terms of trading platforms and tools. The broker covers essential functionality but may fall short in some advanced features or platform diversity compared to leading competitors.

- Trading bots (EAs) allowed

- MetaTrader is available

- One-click trading

- Free VPS for uninterrupted trading

- No access to cTrader and its advanced tools.

- Strategy (EA) Builder is not available

- No TradingView integration

Supported trading platforms

Trust Capital supports the following trading platforms: MT4. This selection covers the basic needs of most retail traders. We also compared Trust Capital’s platform availability with that of top competitors to assess its relative market position.

| Trust Capital | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | No | Yes | Yes |

Key Trust Capital’s trading platform features

We also evaluated whether Trust Capital offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 68 |

| Tradable assets | 200 |

Additional trading tools

Trust Capital offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

Trust Capital trading tools vs competitors

| Trust Capital | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | No | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

Trust Capital supports mobile trading, offering dedicated apps for both iOS and Android. Trust Capital received 2/10 in this section, which suggests limited user interest or weak performance of the apps.

- Android and iOS apps

- Indicators not supported

We compared Trust Capital with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| Trust Capital | Plus500 | Pepperstone | |

| Total downloads | No data | 10,000,000 | 100,000 |

| App Store score | No data | 4.7 | 4.0 |

| Google Play score | No data | 4.4 | 4.0 |

| Mob. 2FA | No | Yes | Yes |

| Mob. Indicators | No | Yes | Yes |

| Mob. Alerts | No | Yes | Yes |

Education

Traders can only be successful if they constantly strive for improvement. This includes regular trading and theoretical preparation. The latter involves studying e-books, specialized forums, relevant webinars, and more. Recognizing the importance of knowledge, some brokers seek to enhance the skills of their clients by providing them with learning and self-education opportunities. Trust Capital is precisely such a company; its clients can attend seminars at company offices and participate in real-time webinars. They have access to newsfeeds, analytics, articles on various topics, and a trading glossary. It's a substantial amount of data that is regularly updated and replenished, and the materials are interesting for both beginners and experienced market participants. However, priority is given to teaching the basics of trading.

Although part of the educational course is only available to traders using premium accounts, there is more than enough material for beginner and intermediate-level players. The information is well-structured and easy to filter. It focuses less on money management and trading psychology, but Trust Capital provides up-to-date and practical information even on these challenging topics.

Customer support

Technical support is crucial for a broker because all traders, regardless of their experience and skills, inevitably will encounter situations they cannot resolve on their own. If they do not receive prompt and competent assistance, they may become disappointed with the broker and switch to its competitors. Trust Capital's customer support is highly appreciated by its users. Responses to inquiries are quick, specific, and comprehensive. Managers can be contacted via phone, email, or LiveChat. The only thing to note is that support operates for 14 hours a day and only on weekdays. It is not available during nights and weekends.

Advantages

- You can contact support even if you are not a client of the broker.

- Managers work without breaks during the daytime and on weekdays.

- All standard communication options are available.

Disadvantages

- Working hours are 14/5.

You can clarify any questions related to trading, deposits/withdrawals, or other matters with the support team of Trust Capital. To do so, use the following channels:

-

Phone number;

-

Second phone number;

-

Fax;

-

email;

-

LiveChat on the website and in the user account.

Traders can also submit a ticket on the contact page. The Trust Capital broker has official profiles on the following social platforms: YouTube, Instagram, Twitter, Facebook, and LinkedIn. It is worth subscribing to the company's active page to stay updated with its latest news.

Contacts

| Foundation date | 2019 |

|---|---|

| Registration address | 23 Olympion Street | Libra Tower Office: 202 | 3035 Limassol | Cyprus |

| Regulation |

CySEC

Licence number: 369/18 |

| Official site | trustcapitaltc.eu |

| Contacts |

+35725378899, +97145785767

|

Comparison of Trust Capital with other Brokers

| Trust Capital | Eightcap | XM Group | RoboForex | IC Markets | FBS | |

| Trading platform |

MetaTrader4, Mobile platforms | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, cTrader, MT5, TradingView | MT4, MobileTrading, MT5, FBS app |

| Min deposit | $250 | $100 | $5 | $10 | $200 | $5 |

| Leverage |

From 1:1 to 1:30 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0.4 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 1 point |

| Level of margin call / stop out |

No / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 50% | 40% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | No |

Detailed review of Trust Capital

The Trust Capital broker is well-known in the global market. It offers over 200 assets, all of which are contracts for difference (CFDs). Since the spread is floating and corresponds to the market average, collaborating with the company is economically beneficial. Especially considering that there is no trading commission on Solo accounts, and the withdrawal fees are generally low, with PayPal being free. Trust Capital uses the MetaTrader 4 trading platform, which attracts more users. After all, MT4 is the most versatile platform due to its extensive customization options. It also includes a mobile version which frees you from a desk. Little is known about the company's technological stack, but the high execution speed and platform stability indicate that Trust Capital employs innovative solutions that meet modern standards.

Trust Capital by the numbers:

-

The minimum deposit is $250.

-

Over 200 CFDs are available.

-

The minimum spread is 0.9 pips.

-

Commission on Solo accounts is $0.

-

Referral program payout is up to $300 per partner.

Trust Capital is a convenient CFD broker

Companies that offer only CFDs do not differ significantly in terms of basic trading conditions. For a trader, it is important to have CFDs represented in as many assets as possible and preferably in multiple groups. With Trust Capital offering over 200 assets in its pool, this issue is resolved. There are CFDs on currencies, cryptocurrencies, stocks, indices, commodities, metals, and energies. This means that for the company's clients, it is not difficult to form a diversified portfolio that allows them to offset negative trends in one instrument with stable and growing positions in others. In addition, the variety of assets allows for the use of various trading strategies. Considering the favorable commission policy, quality education, and integration with MT4, Trust Capital's conditions can indeed be characterized as comfortable.

Trust Capital’s analytical services:

-

Calculator. A comprehensive service that includes four calculators: profit and loss calculation, pips calculation, Fibonacci calculation, and pivot calculation. These calculators are useful for simplifying the search for entry points in trades and calculating costs.

-

Economic calendar. This is one of the simplest and most effective tools for fundamental analysis. The service displays the most significant events that can impact quotes, along with the changes in projected trends.

-

Market news. An intelligent newsfeed where relevant events affecting selected assets are published. Users can filter posts based on arbitrary timeframes.

Advantages:

The broker is loyal to new clients, offering a demo account and a low minimum deposit of only $250 for a Solo account. All assets from the platform's pool are immediately accessible.

Since traders work through the MT4 trading platform, they can trade with maximum convenience on a computer, tablet, or smartphone; plus there are hundreds of plugins available for MT4.

The basic technical and fundamental analysis tools offered by the broker significantly simplify the lives of its clients, allowing them to trade more successfully.

Traders can see the broker's fee amount before executing a trade, with no hidden charges.

The affiliate program allows anyone interested to earn additional income for referring clients, with a maximum referral payout of $300.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i