According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- 1000$

- MT4

- FCA

- FSA

- ASIC

- CGSE

- JSC

- FSC

- FSCS

- 1997

Our Evaluation of Hantec Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Hantec Markets is a moderate-risk broker with the TU Overall Score of 6.29 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Hantec Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Hantec Markets is a professional manual and algorithmic trading broker that focuses on the European and Asian markets.

Brief Look at Hantec Markets

The Hantec Markets (also, Hantec) broker was founded in Hong Kong in 1990. Initially, the company focused only on the Chinese and Taiwan markets, providing classic services on OTC financial markets. In 2008, the broker was rebranded and offices were opened in Australia, Great Britain, Japan, and other countries during the next two years. Today, Hantec is a multinational company with 18 offices in the European and Asian regions and is licensed by six regulators.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Large range and reliability. Its regulators include FCA (UK), ASIC (Australia), and FSA (Japan), which are considered some of the strictest regulators in the world.

- Segregated accounts and partner banks are Barclays and Lloyds.

- Deposits of traders are insured by the Financial Services Compensation Scheme for £85,000.

- A relatively small entry threshold for trading stock and commodity assets is just $0-$100.

- Relatively small floating spread — from 0.2-0.5 pips.

- The high minimum deposit for trading currency pairs is $1,000.

- Lack of reversal competitive advantages. There are no proprietary technological developments, copyright applications, or passive investment services.

- Lack of comprehensive presentation of information on trading terms.

TU Expert Advice

Financial expert and analyst at Traders Union

Hantec Markets is a broker with ambitious goals. Over the past 12 years, the company has obtained the support of six regulators in the European and Asian regions. The company is completely transparent and it doesn’t hide its partners. Also, its legal documentation is in the public domain, and you can request extra information from support at any time.

This broker focuses on creating a technological model of communication between all market participants. The implemented MT4 ECN Bridge system, a liquidity bridge, allows you to instantly process orders and transfer information worldwide without the participation of a broker. And although the broker doesn’t have investment programs or original trading developments, its order processing speed and constant liquidity support are considered a competitive advantage.

As for its disadvantages, there are many questions for this crude website regarding the types of trading accounts and trading terms. But the support is always ready to answer the questions instantly. In general, the broker leaves a positive impression and can be recommended as a reliable partner for traders with any level of trading experience.

- You prioritize trading with brokers regulated by reputable authorities such as the Financial Conduct Authority (FCA), Financial Services Authority (FSA), Australian Securities and Investments Commission (ASIC), China Securities Regulatory Commission (CGSE), Japan Securities Clearing Corporation (JSC), Financial Services Commission (FSC), or Financial Services Compensation Scheme (FSCS). Regulation provides a level of protection and oversight that can be important for traders.

- You value the security of your deposits and seek protection against unforeseen events, as this broker provides deposit insurance through the Financial Services Compensation Scheme (FSCS) for amounts up to £85,000.

- You're looking for brokers with lower minimum deposit requirements, as they require a high minimum deposit of $1000. High minimum deposits can be prohibitive for traders with limited capital or those who prefer to start with smaller initial investments.

Hantec Markets Trading Conditions

| 💻 Trading platform: | MT4, including mobile version |

|---|---|

| 📊 Accounts: | For retail and professional clients |

| 💰 Account currency: | USD, EUR, GBP, CHF, CAD, AUD, PLN, and AED |

| 💵 Deposit / Withdrawal: | Wire transfer, Visa, Skrill, and Neteller |

| 🚀 Minimum deposit: | $1,000 |

| ⚖️ Leverage: | Up to 1:200 for currencies |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Currency, stock, commodity assets, cryptocurrencies |

| 💹 Margin Call / Stop Out: | No/40% |

| 🏛 Liquidity provider: | Barclays, Lloyds |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | Special terms for qualified traders |

| 🎁 Contests and bonuses: | No |

The broker has over 150 trading instruments, including cryptocurrencies. Leverage depends on the type of asset; for currencies, the maximum leverage is 1:200 following the requirements of regulators. The deposit depends on the type of asset.

Hantec Markets Key Parameters Evaluation

Video Review of Hantec Markets

Share your experience

- Best

- Last

- Oldest

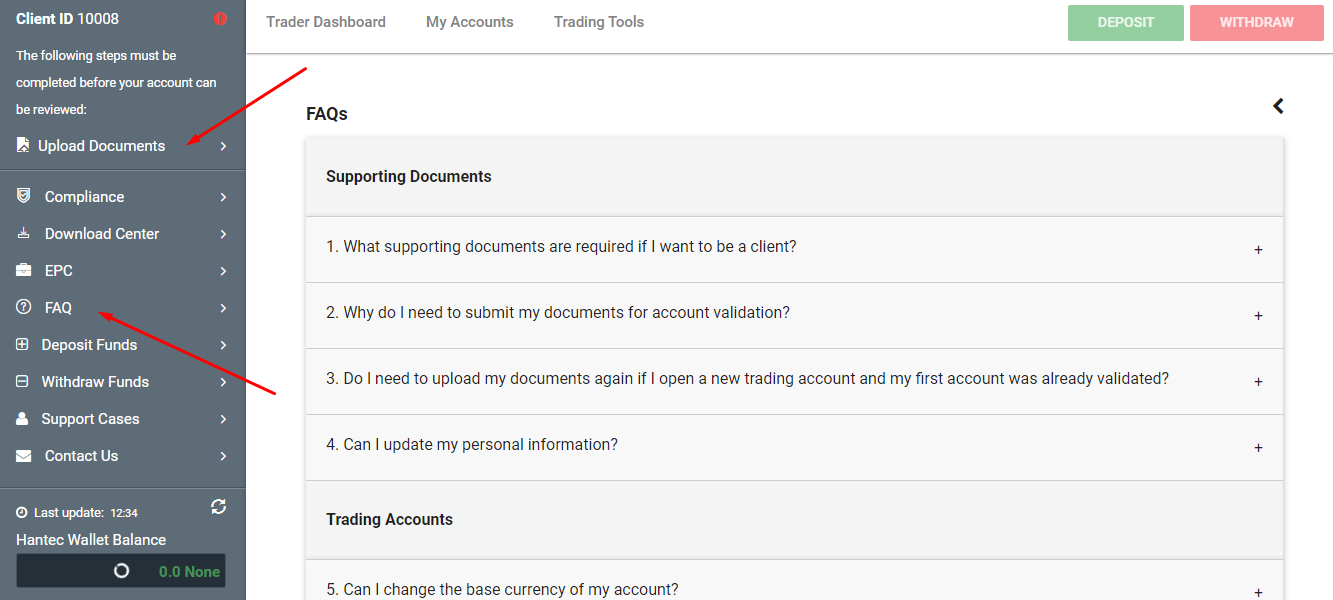

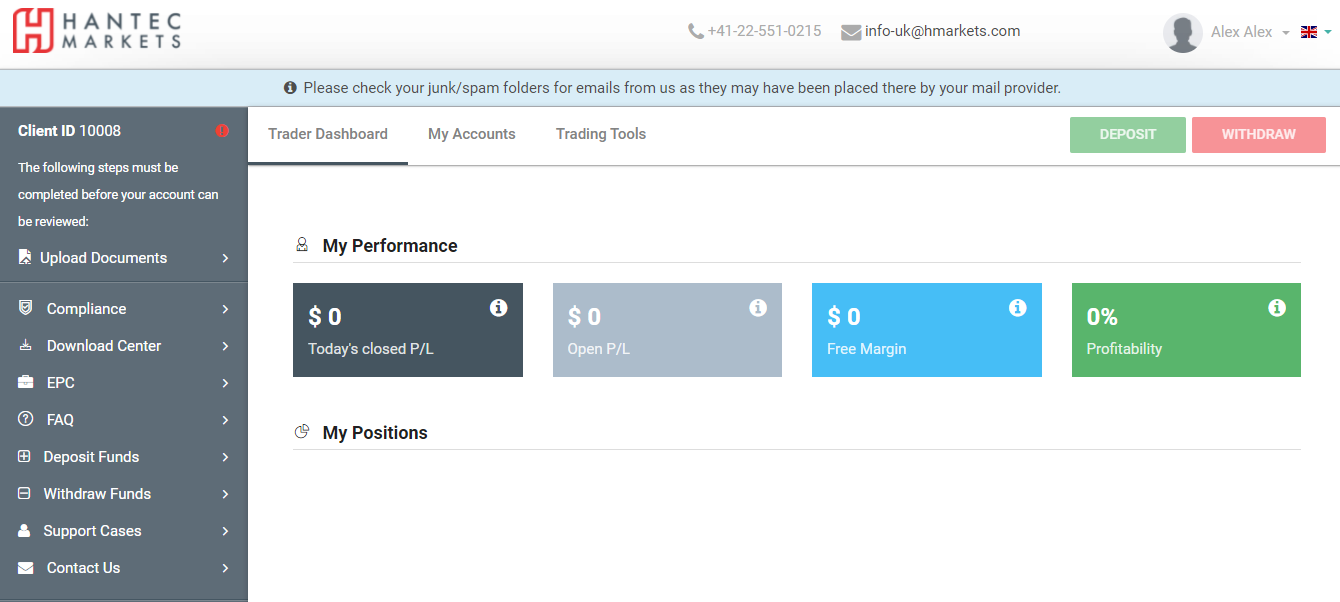

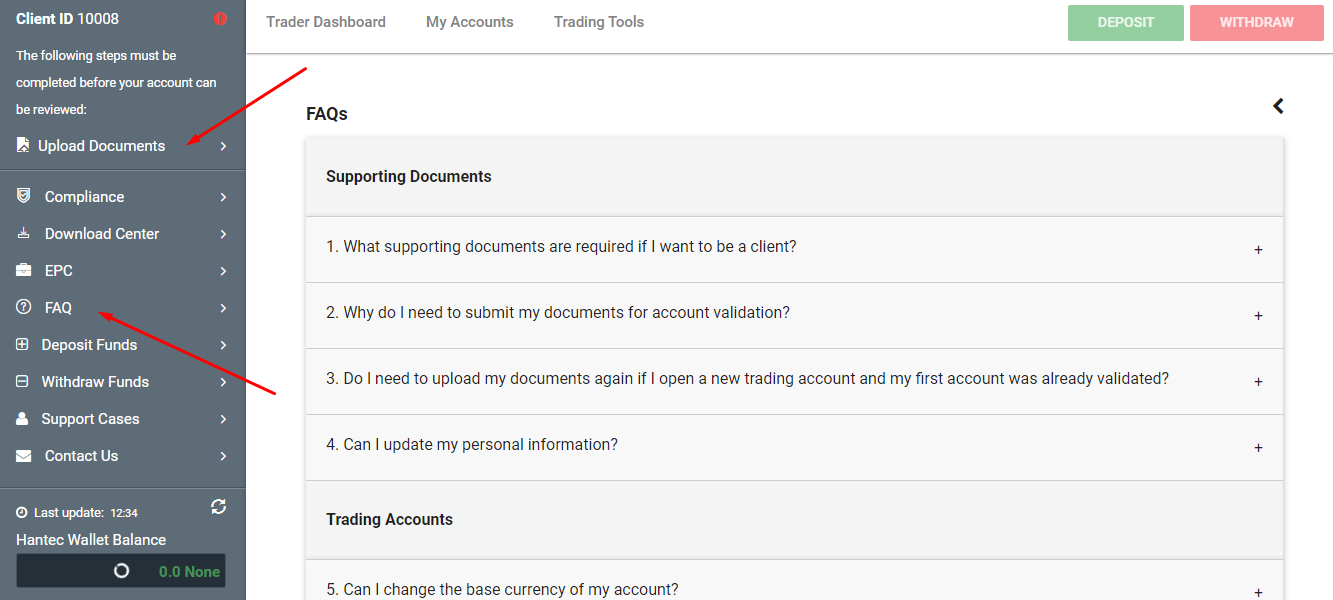

Trading Account Opening

Register on the Traders Union website before opening an account with Hantec Markets. Use a referral link and get spread compensation in the form of bonuses in the future.

How to open an account with Hantec Markets:

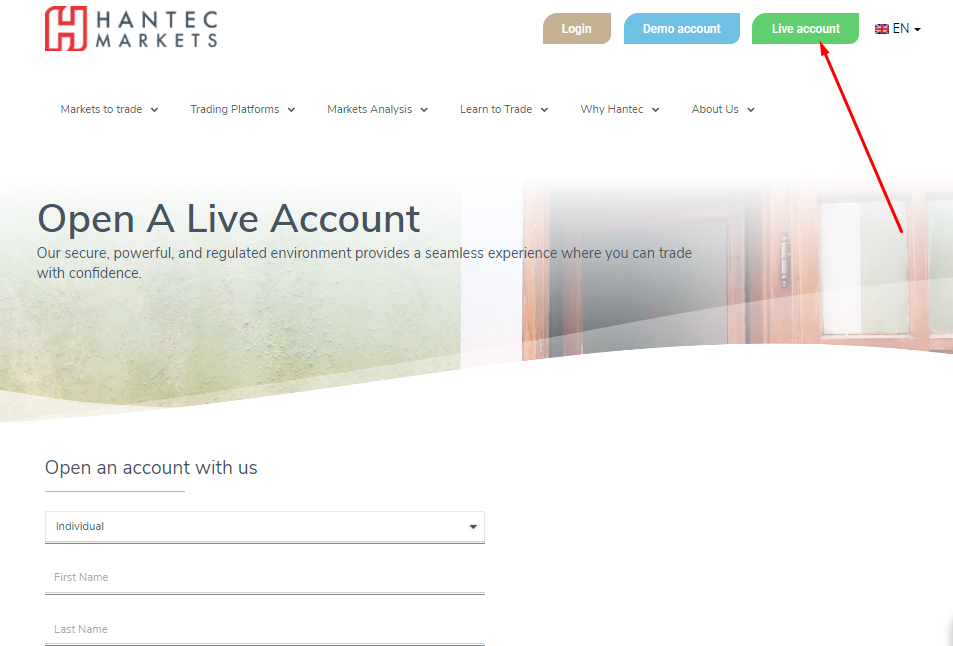

Opening an account. On the Hantec Markets website, you can open a real or demo account from any tab:

Important notice! After opening a demo account, you will get access to the MT4 trading platform and to the broker's server. Registration allows you to study only the functionality of the platform. To gain access to your personal account, opening a real account is required. When opening a real account, provide only reliable information to avoid problems with verification in the future.

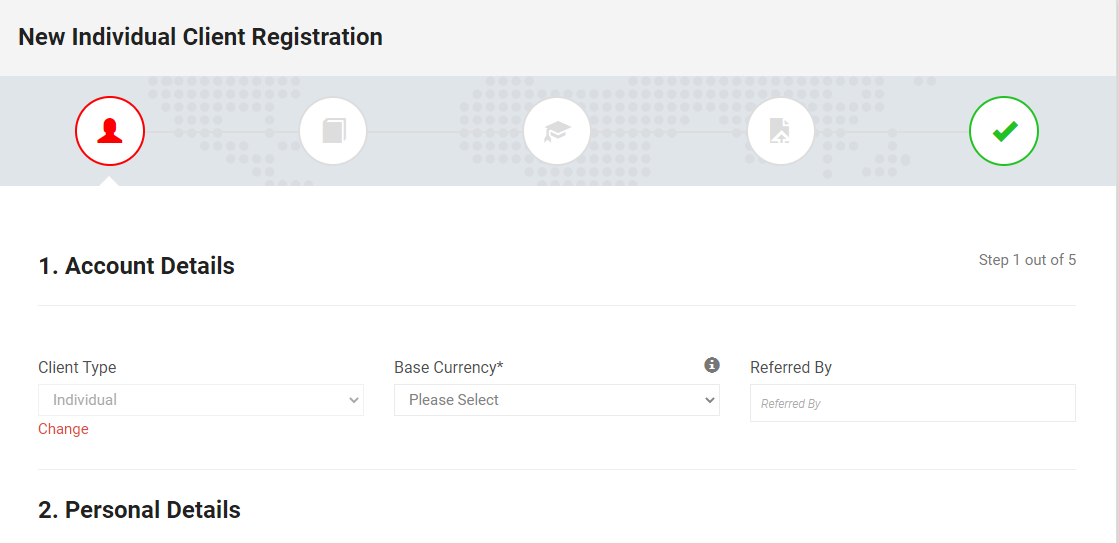

Filling out the application. It consists of 5 steps, including uploading documents for verification. It can be skipped temporarily.

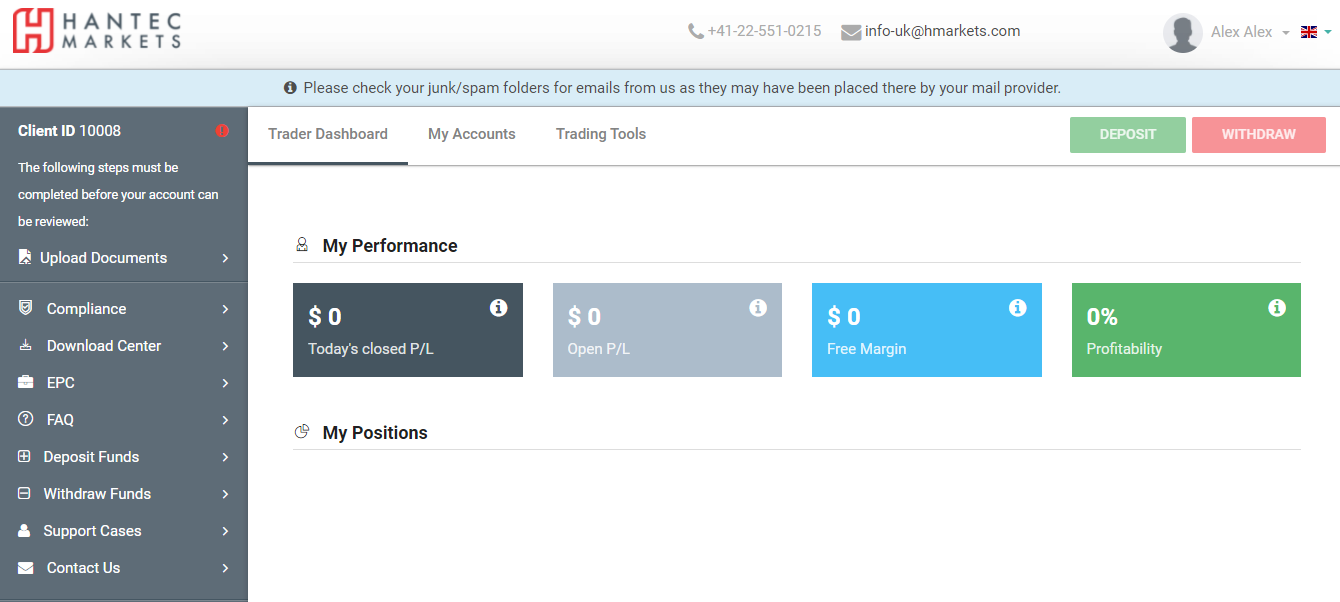

The functionalities of the personal account:

Also in the personal account, you will have access to:

-

Replenishment and withdrawals. Tabs become active only after verification.

-

Proceeding to the status of a professional client.

-

Access to the platform.

-

Compliance.

Regulation and safety

Hantec Markets has a safety score of 9.5/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 28 years

- Strict requirements and extensive documentation to open an account

Hantec Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

Hantec Markets Security Factors

| Foundation date | 1997 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Hantec Markets have been analyzed and rated as Low with a fees score of 10/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Hantec Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Hantec Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Hantec Markets Standard spreads

| Hantec Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,3 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,3 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,7 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Hantec Markets RAW/ECN spreads

| Hantec Markets | Pepperstone | OANDA | |

| Commission ($ per lot) | 2 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Hantec Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Hantec Markets Non-Trading Fees

| Hantec Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

There is no clear division into account types on the Hantec website, but information may change as the website is updated. The broker has a clear separation between retail and professional investor accounts, however. Moreover, trading terms are less favorable for those who qualify as professional traders. More precisely, the broker does not indicate the competitive advantages of such accounts. Perhaps this is due to the requirements of regulators. For both types of accounts for foreign currency assets the deposit is from $1,000, and for commodity assets, it’s from $100, There are no requirements for stock assets and cryptocurrencies.

Types of accounts:

Deposit and withdrawal

Hantec Markets received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Hantec Markets provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No deposit fee

- Minimum deposit below industry average

- Bank card deposits and withdrawals

- No withdrawal fee

- BTC payments not accepted

- Wise not supported

- USDT payments not accepted

What are Hantec Markets deposit and withdrawal options?

Hantec Markets provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Skrill, Neteller.

Hantec Markets Deposit and Withdrawal Methods vs Competitors

| Hantec Markets | Plus500 | Pepperstone | |

| Bank Wire | No | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Hantec Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Hantec Markets supports the following base account currencies:

What are Hantec Markets's minimum deposit and withdrawal amounts?

The minimum deposit on Hantec Markets is $100, while the minimum withdrawal amount is $30. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Hantec Markets’s support team.

Markets and tradable assets

Hantec Markets offers a wider selection of trading assets than the market average, with over 2650 tradable assets available, including 40 currency pairs.

- 40 supported currency pairs

- Indices trading

- 2650 assets for trading

- Futures not available

- Copy trading not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Hantec Markets with its competitors, making it easier for you to find the perfect fit.

| Hantec Markets | Plus500 | Pepperstone | |

| Currency pairs | 40 | 60 | 90 |

| Total tradable assets | 2650 | 2800 | 1200 |

| Stocks | No | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Hantec Markets offers for beginner traders and investors who prefer not to engage in active trading.

| Hantec Markets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

The support service is ready to answer trade-related questions 24 hours a day, except on weekends and holidays.

Advantages

- Responds quickly

- Professional answers

Disadvantages

- None found

The broker provides the following communication channels:

-

Chat on the broker’s website.

-

Contact form;

-

London office phone number.

You can contact individual offices in other regions.

Contacts

| Foundation date | 1997 |

|---|---|

| Registration address | 5-6 Newbury St, Barbican, London EC1A 7HU |

| Regulation | FCA, FSA, ASIC, CGSE, JSC, FSC, FSCS |

| Official site | https://hmarkets.com/ |

| Contacts |

London Office: +442070360850

|

Education

Hantec Markets' theoretical knowledge base is considered one of the best among European and Asian brokers. There is a separate section for training on the broker's website. All the information is structured following each trader's skill level.

A demo account is provided for practicing trading skills and testing strategies.

Comparison of Hantec Markets with other Brokers

| Hantec Markets | Eightcap | XM Group | RoboForex | Bybit | 4XC | |

| Trading platform |

MT4 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader5 | MT5, MT4, WebTrader |

| Min deposit | $100 | $100 | $5 | $10 | No | $50 |

| Leverage |

From 1:1 to 1:200 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0.2 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No / 40% | 80% / 50% | 100% / 50% | 60% / 40% | No / 50% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | No | No | Yes | No | No |

Detailed Review of Hantec Markets

Hantec Markets' mission is to maximize transparency and improve data processing technology. The company’s strategy is based on the trust and maximum support of its traders. Therefore, it has one of the best theoretical training bases, transparent pricing, and high order processing speed. The broker operates following the requirements of the regulators. Therefore, there is relatively small leverage here, and special terms for qualified traders.

Hantec Markets by the numbers:

-

Over 15 offices in Europe and Asia.

-

Over 10 years delivering brokerage services.

-

7 licenses of European and Asian regulators.

Hantec Markets is a professional trading broker

Data transmission technology - MT Bridge ECN includes a liquidity bridge that connects directly to suppliers and ECN systems with complete security of information while it’s processing. The FIX API protocol provides direct access to interbank quotes, which increases the speed of transactions.

Trading platform - МТ4. An additional application is a mechanism for managing multiple accounts such as MAM technology. The offer may be of interest to those who work with different client accounts or are experimenting with several types of strategies in which different levels of deposit are required for risk management.

Hantec’s useful services:

-

The Training section contains everything including risk management policy and fundamental theory.

-

There is an economic calendar and professional market analysis.

Advantages:

Segregated accounts and availability of an insurance fund.

Licenses from European and Asian regulators. Ongoing external cross-audit.

Technological improvement of the transmission of data and the information processing model.

Narrow spreads.

Loyal trading terms for several assets.

It has an Islamic account and demo accounts for practicing trading skills.

Latest Hantec Markets News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i