According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- MT5

- FCA

- SCB

- FSC

- 2009

Our Evaluation of Infinox

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Infinox is a moderate-risk broker with the TU Overall Score of 6.63 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Infinox clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Infinox is a CFD and Forex broker suitable for traders who prefer ECN and STP technology.

Brief Look at Infinox

Infinox is a CFD and Forex broker that has been providing trading services since 2009. The company has its head office in the Bahamas, as well as 14 regional offices. The broker provides the opportunity to trade currency pairs (Forex) and contracts for difference (CFDs) on stocks, stock indices, commodities, cryptocurrencies, and futures. Infinox operates under licenses from the UK (FCA, 501057), Mauritius (FSC, GB20025832), and the Bahamas (SCB, SIA F-188) regulators.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Six classes of trading instruments.

- Access to CFDs on stocks in eight markets.

- Insurance for deposits up to USD 500,000.

- Access to IX Social and MQL5 copy trading services.

- Tight spreads (from 0.2 pips on an ECN account).

- No PAMM accounts.

- Limited educational materials.

- The support service works only 24/5.

TU Expert Advice

Author, Financial Expert at Traders Union

Infinox offers CFD and Forex trading through the MT4 and MT5 platforms, catering to traders with varying preferences for ECN and STP accounts. Its clients can trade a diverse range of instruments, including Forex and CFDs on stocks, indices, commodities, cryptocurrencies, and futures. The broker allows traders to explore these markets with leverage up to 1:500, no minimum deposit requirement, and a demo account. Additionally, Infinox enhances trading convenience with copy trading services and deposit insurance up to $500,000, offering an added level of financial security.

However, Infinox presents drawbacks such as limited account types and absence of PAMM accounts, which may deter traders seeking more flexibility in account offerings. The educational resources provided are limited, potentially posing a challenge for individuals looking to enhance their trading knowledge. Moreover, client support is only available 24/5, which may not align with all traders' needs for continuous assistance. Infinox may suit experienced traders who value advanced trading technology but may not be suitable for those focusing on educational resources or looking for various account management options.

- You're comfortable with widely-used platforms, as Infinox offers the MetaTrader 4 and 5 platforms. These platforms are renowned for their user-friendly interfaces and extensive features, making them suitable for traders of all levels.

- You are looking for insurance for deposits. With deposit insurance up to USD 500,000, Infinox provides an added layer of security and peace of mind for traders, ensuring that their funds are protected in case of unforeseen circumstances.

- You're interested in copy trading, Infinox offers access to IX Social and MQL5 copy trading services. These platforms allow you to replicate the trades of experienced traders automatically, potentially boosting your trading performance.

- You're specifically looking for PAMM accounts. Infinox may not be the right choice for you as they do not offer this service.

- You rely heavily on educational resources to enhance your trading knowledge and skills, as you may find Infinox lacking in this aspect.

Infinox Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Infinox Ltd and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | МТ4 (desktop, mobile, web), МТ5 (desktop, mobile) |

|---|---|

| 📊 Accounts: | Demo, STP, ECN |

| 💰 Account currency: | USD, EUR, GBP, AUD |

| 💵 Deposit / Withdrawal: | Credit cards, wire transfers, Neteller, Skrill |

| 🚀 Minimum deposit: | From USD 1 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: |

currency pairs (34) CFDs on stocks (8 markets) indices (14) commodities (14) cryptocurrencies (5) futures (5) |

| 💹 Margin Call / Stop Out: | 100% / 50% |

| 🏛 Liquidity provider: | More than 20 large banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | There is an inactivity fee on the account |

| 🎁 Contests and bonuses: | No |

The Infinox broker offers traders five classes of instruments. These are Forex, as well as CFDs on stocks, indices, commodities, futures, and cryptocurrencies. Margin trading with leverage up to 1:500 is available to traders. Muslim clients can open a dedicated Muslim (swap-free) account. You can test the broker's platforms, trading conditions and practice trading on Infinox using a demo account.

Infinox Key Parameters Evaluation

Video Review of Infinox

Share your experience

- Best

- Last

- Oldest

US Toms River

US Toms River Got to know about INFINOX thanks to pure luck

-

US Valparaiso

US Valparaiso Grateful for the Islamic Account

-

MD Varniţa

MD Varniţa Trading lots from 0.01

No profit withdrawals to debit or credit cards; minimum deposits of 50 USD

BM Hamilton

BM Hamilton I’ve learnt trading from scratch here

-

DE Lebach

DE Lebach INFINOX has a long history and strong regulatory licenses.

The downside is the $15 fee for withdrawals made via wire, Skrill, or Neteller if you withdraw more than once a month.

CA Hamilton

CA Hamilton in the review

The downside is the limited account options. There are only two types to choose from, which might not work for everyone’s needs.

CY Limassol

CY Limassol +

-

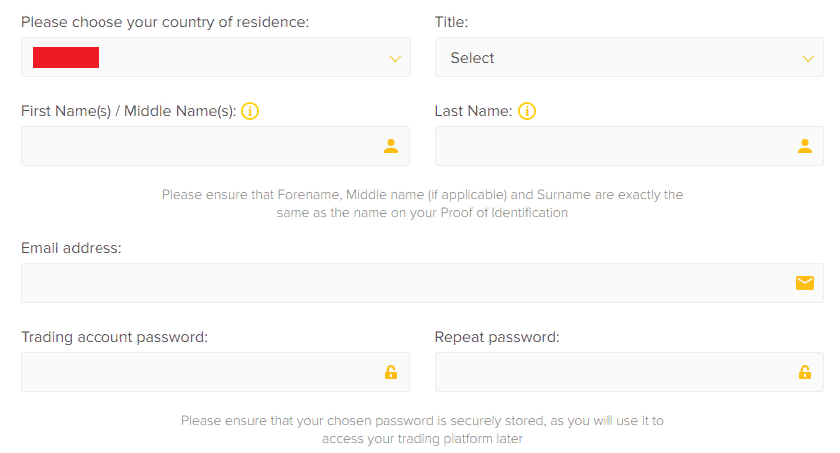

Trading Account Opening

To start trading with the Infinox broker, you need to register. Below are brief instructions on how to open an account on the platform.

On the main page of the site, you need to click on the Sign Up button.

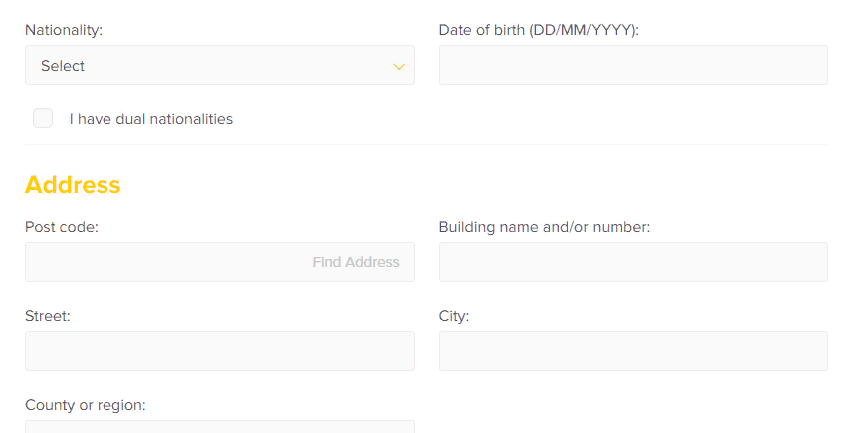

After that, a form with basic information will appear. Here you need to enter your first name, last name, email address, password, and country of residence. Also in this form, you can select the type of trading account.

Further, the broker will ask you to provide more detailed information. You will be asked to provide your residential address, age, nationality, financial details, etc. You also need to agree with the terms of the internal documents, such as the User Agreement, Privacy Policy, and Risk Warnings.

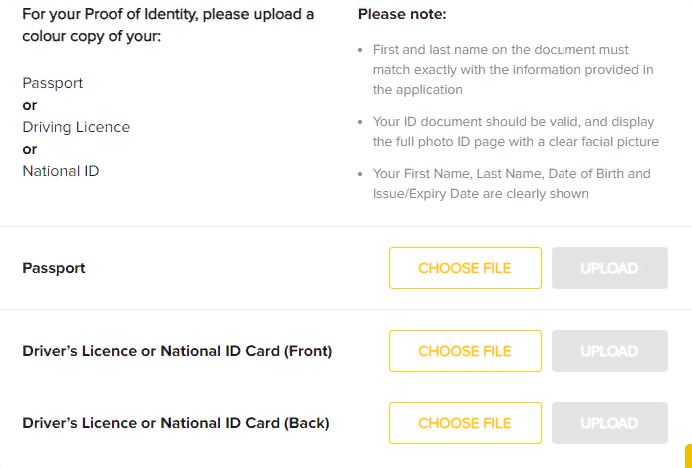

Next, complete the verification procedure. To do this, you need to upload scanned copies of your identity card and residential address. You also need to upload a selfie with ID in hand.

Also in the personal account, the trader has access to:

-

The ability to open Infinox wallets in different currencies. The platform allows you to carry out not only replenishment and withdrawal of funds but also transactions between users' wallets.

-

Instruments. This is where traders can access Autochartist, MQL5 and other tools available on the platform.

-

Downloads. Here the company's clients can download all versions of the MetaTrader 4 and MetaTrader 5 trading terminals, including desktop (for Windows) and mobile (for iOS and Android). From there you can also go to the web version of the trading platform.

Regulation and safety

Infinox has a safety score of 9.5/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 16 years

- Strict requirements and extensive documentation to open an account

Infinox Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

SCB SCB |

Securities Commission of The Bahamas | Bahamas | No specific fund | Tier-2 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

Infinox Security Factors

| Foundation date | 2009 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Infinox have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Infinox with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Infinox’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Infinox Standard spreads

| Infinox | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,5 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,9 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,9 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Infinox RAW/ECN spreads

| Infinox | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,15 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Infinox. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Infinox Non-Trading Fees

| Infinox | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

The Infinox broker offers its clients two main types of trading accounts - STP and ECN. The key difference between the two is the fee policy. Traders have access to all types of trading instruments and leverage up to 1:500, regardless of the selected type of trading account. There are no requirements for the size of the minimum deposit on any account.

Account types:

Infinox is a broker for clients who prefer to work using ECN and STP technologies, but without dealing with the platform.

Deposit and withdrawal

Infinox received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Infinox provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Supports 5+ base account currencies

- No deposit fee

- Minimum deposit below industry average

- USDT (Tether) supported

- PayPal not supported

- Wise not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

What are Infinox deposit and withdrawal options?

Infinox provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT, Ethereum.

Infinox Deposit and Withdrawal Methods vs Competitors

| Infinox | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Infinox base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Infinox supports the following base account currencies:

What are Infinox's minimum deposit and withdrawal amounts?

The minimum deposit on Infinox is $50, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Infinox’s support team.

Markets and tradable assets

Infinox provides a standard range of trading assets in line with the market average. The platform includes 900 assets in total and 45 Forex currency pairs.

- Indices trading

- 45 supported currency pairs

- Commodity futures are available

- No ETFs

- Bonds not available

Infinox Supported markets vs top competitors

We have compared the range of assets and markets supported by Infinox with its competitors, making it easier for you to find the perfect fit.

| Infinox | Plus500 | Pepperstone | |

| Currency pairs | 45 | 60 | 90 |

| Total tradable assets | 900 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Infinox offers for beginner traders and investors who prefer not to engage in active trading.

| Infinox | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Customer support

Support operators are available 24 hours a day, five days a week. Support is provided in over 20 languages.

Advantages

- In the online chat, you can ask a question without being a client of the company

- Support is available in over 20 languages

Disadvantages

- Works only 24/5

This broker provides the following communication channels for existing clients and potential investors:

-

phone number (as specified in the Contact section);

-

email;

-

online chat on the website and in the personal account;

-

feedback form;

Not only a registered client but also a trader without an active account can ask the broker's representative a question.

Contacts

| Foundation date | 2009 |

|---|---|

| Registration address | 201 Church St, Sandyport, West Bay Street, P.O Box N-3406, Nassau, Bahamas |

| Regulation | FCA, SCB, FSC |

| Official site | https://www.infinox.com/ |

| Contacts |

0-800-060-8744

|

Education

There is no training section on the Infinox website. All information is presented in the form of videos on the broker's Youtube channel. Training is limited and the broker only provides information on the use of its services.

The broker does not have cent accounts, so traders can practice their knowledge only on a demo account. The demo account is provided free of charge, with no time limits.

Comparison of Infinox with other Brokers

| Infinox | Bybit | Eightcap | XM Group | LiteFinance | AMarkets | |

| Trading platform |

MT4, MT5 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, MultiTerminal, Sirix Webtrader | MT4, MT5, AMarkets App |

| Min deposit | $1 | No | $100 | $5 | $10 | $100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:1000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | No | 7.00% | No |

| Spread | From 0.8 points | From 0 points | From 0 points | From 0.8 points | From 0.5 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | No / 50% | 80% / 50% | 100% / 50% | 50% / 20% | 50% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | No |

Detailed Review of Infinox

The Infinox broker does everything possible to ensure that clients get the best trading opportunities. The company does not impose restrictions on the use of any trading strategies. Infinox provides clients with the opportunity to work with six classes of trading instruments and provides access to CFDs on stocks from eight world markets. Traders have access to the Market type of order execution. The STP, ECN, and Islamic accounts are available to clients.

Infinox by the numbers:

-

More than 11 years of experience in the market.

-

Offices in 15 countries around the world.

-

10 awards earned during its period of operation.

Infinox is a broker for traders and investors

The Infinox broker operates on STP and ECN technologies. This means that when trading on any Infinox account, clients get direct access to liquidity providers, minimal spreads and commissions, and fast execution without requotes and slippage. Infinox provides traders with access to six types of trading instruments, including Forex and CFDs on stocks, commodities, stock indices, cryptocurrencies, and futures. Passive investors can earn income through the IX Social trading service by copying the trades of managing traders.

The broker provides clients with the opportunity to work with proven trading terminals such as MetaTrader 4 and MetaTrader 5. The service allows automated trading, you can configure the opening and closing of trades in one click.

Useful services of the Infinox broker:

-

Autochartist. This is one of the world's most popular technical analysis platforms. Autochartist includes over 100 tools and indicators, trend analyses, and candlestick analysis.

-

VPS. This is a dedicated server that relieves you from having to constantly monitor trading operations. If the terminal accidentally closes or the trader leaves, the trade will not be canceled, but due to the connection to the VPS, it will be completed.

-

MQL4 and MQL5. These are communities of traders who trade via MetaTrader 4 and MetaTrader 5. Here, clients have access to a copy trading service, trading robots, and additional tools for technical analysis.

Advantages:

There are six asset classes available for trading.

To ensure the safety of client funds, the company holds them in segregated accounts.

Tight spreads (from 0.2 pips) on ECN accounts.

Investors have access to the IX Social, MQL4, and MQL5 social trading platforms.

The broker provides free analytics and online tools to improve the quality of trading.

Infinox clients get access to AutoChartist and MQL5 for free. You can also use VPS without restrictions.

Latest Infinox News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i