According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MT4

- MT5

- cTrader

- Sterling Trader

- Currenex

- CIMA

- MFSA

- 2015

Our Evaluation of Tradeview

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Tradeview is a moderate-risk broker with the TU Overall Score of 6.26 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Tradeview clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Tradeview Markets is a Forex trading and passive investing broker focused on clients in Europe, Southeast Asia, and Canada.

Brief Look at Tradeview

Tradeview Markets is an ECN and CFD broker that has been operating since 2004. The company offers trading with 5 asset classes. There is also a separate Tradeview Markets unit providing stock CFD trading services. The office is headquartered in the Cayman Islands. Over 100 000 clients from different countries use the broker’s services. The broker operates under a financial services license issued by the Cayman Islands Financial Regulator (CIMA, 585163) and the Malta Financial Services Authority (MFSA, C 93990).

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Over 100 trading instruments.

- Spreads from 0.1 pip.

- Five types of trading terminals.

- Access to the cTrader Copy service.

- Low threshold for entering the market from $100.

- Limited training.

- Technical support works 24/5 only.

- There are withdrawal fees.

TU Expert Advice

Financial expert and analyst at Traders Union

The Tradeview Markets broker has been providing trading services since 2004 and puts its best foot forward to provide clients with attractive trading terms. It is an ECN broker that provides direct access to over 50 liquidity providers and executes orders very fast. All quotes also come directly from liquidity providers, guaranteeing their objectivity.

The broker offers clients two types of trading accounts with favorable trading terms. The spread in the company starts from 0.1 pips, and the fixed commission is $2.50. Tradeview Markets offers clients margin trading with the leverage of up to 1:400.

The Tradeview Markets website provides all the information about commissions and current spreads. If necessary, the information can be clarified with the customer support staff. The Tradeview Markets broker made the Traders Union rating, thanks to favorable commissions, four types of trading terminals, the copy trading service, and a good reputation.

- You prefer having a wide range of assets to trade, including Forex, stocks, futures, options, indices, and cryptocurrencies, this broker offers diverse choices that cater to different trading styles and preferences. Whether you're interested in traditional assets or emerging markets like cryptocurrencies, you'll find various opportunities to explore.

- You require advanced trading features as their platforms, including MetaTrader 4, cTrader, and Currenex, provide advanced trading features such as sophisticated charting tools, automated trading capabilities, and social trading options. These features are beneficial for traders who rely on advanced strategies and tools to execute their trades effectively.

- You prioritize having Islamic swap-free accounts that comply with Shariah law, this broker may not be suitable for you as they currently do not offer Islamic accounts.

- You rely heavily on educational resources to enhance your trading knowledge and skills, you may find this broker lacking compared to some competitors.

Tradeview Trading Conditions

Your capital is at risk. There is a risk of loss in trading foreign currencies and it is not suitable for everyone. We are compensated for our services through the bid-ask spread.

| 💻 Trading platform: | МТ4 (desktop, mobile, web), МТ5 (desktop, mobile), cTrader, CurreneX, Sterling Trader |

|---|---|

| 📊 Accounts: | Demo, Innovative Liquidity Connector, X Leverage Account |

| 💰 Account currency: | USD, EUR, GBP, JPY, CAD, AUD |

| 💵 Deposit / Withdrawal: | Credit cards, wire transfer, Neteller, Skrill, Uphold, Sticpay, AdvCash, UnionPay, Fasapay, Paytrust, Cryptocurrencies, Accentpay, Interac, Payretailers, Transfermate, Bitwallet, Uphold and Jpay |

| 🚀 Minimum deposit: | From $100 |

| ⚖️ Leverage: | Up to 1:100 (Innovative Liquidity Connector), up to 1: 400 (X Leverage Account) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,2 pips |

| 🔧 Instruments: | Currency pairs (60), indices (9), metals (3), energy resources (3), cryptocurrencies (5),over 5,000 real U.S. stocks and options |

| 💹 Margin Call / Stop Out: | 100% |

| 🏛 Liquidity provider: | Over 50 Liquidity providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution |

| ⭐ Trading features: | There is a fee for account inactivity |

| 🎁 Contests and bonuses: | No |

The Tradeview Markets broker offers clients over 100 trading instruments, and with the Tradeview Markets unit one can trade CFDs on over 5,000 real U.S. stocks and options. You will have access to four types of trading terminals – MetaTrader 4, MetaTrader 5, cTrader, CurreneX and Sterling Trader. Clients can work with leverage up to 1:100 or up to 1:400, depending on the type of trading account. You can test your strategies using a free demo account.

Tradeview Key Parameters Evaluation

Video Review of Tradeview

Share your experience

- Best

- Last

- Oldest

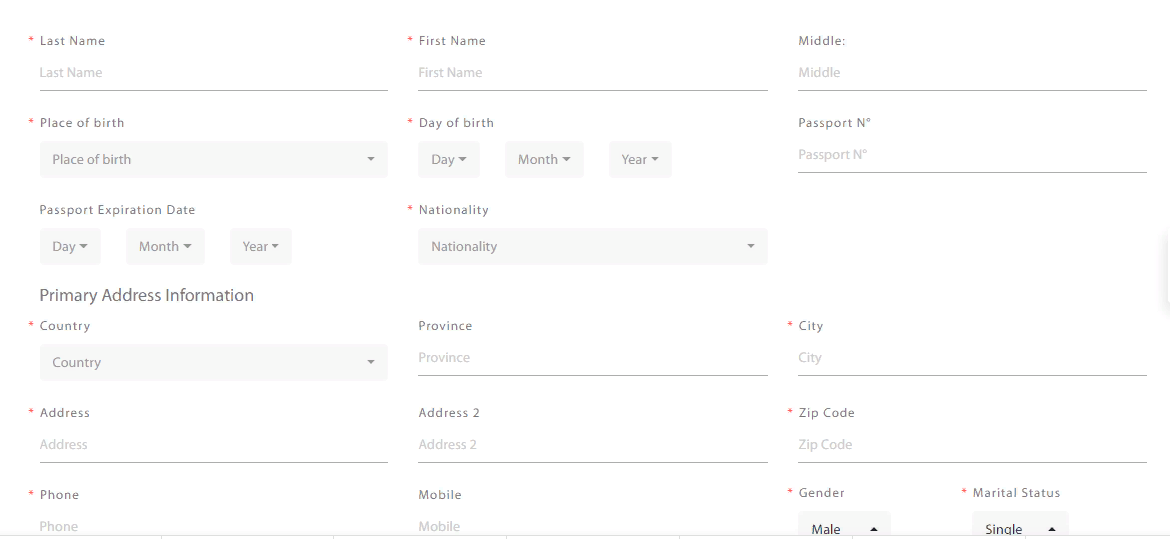

Trading Account Opening

Become a client of a broker by opening a trading account to start trading with Tradeview Markets. A quick guide looks as follows:

Click on the Live Account button on the broker's website.

Further, the broker will offer you to choose the type of account – Individual, Joint, or Corporate.

After that, you will see the registration. Specify here all the necessary information such as personal data, residential address, tax information, etc.

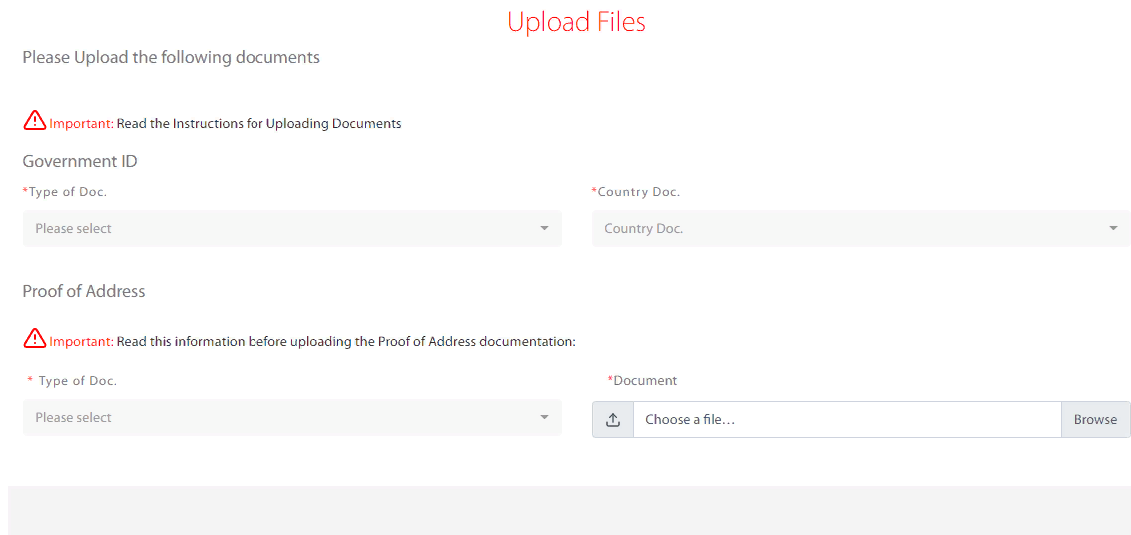

At the end of the form, the broker will offer to go through verification. Upload scanned copies of an identity card and a document confirming your residence address.

Also in the personal account, you will have access to:

-

Quotes and spreads for all trading instruments in Live mode, as well as price dynamics.

-

Trading ideas for the instruments are provided directly on the service. The company provides trading ideas in the form of reviews from its experts based on fundamental and technical analysis.

-

Screener. With this tool, you can select your preferred trading instruments and monitor all key indicators such as current price, dynamics, previous value indicators.

-

Scripts. This section contains add-ons and extensions for the MetaTrader 4 and MetaTrader 5 trading terminals.

Regulation and safety

Tradeview has a safety score of 7/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 10 years

- Not tier-1 regulated

Tradeview Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

MFSA MFSA |

Malta Financial Services Authority | Malta | Up to €20,000 | Tier-2 |

| CIMA | Cayman Islands Monetary Authority | Cayman Islands | No specific fund | Tier-3 |

Tradeview Security Factors

| Foundation date | 2015 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Tradeview have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No deposit fee

- Inactivity fee applies

- Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Tradeview with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Tradeview’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Tradeview Standard spreads

| Tradeview | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,2 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,3 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Tradeview RAW/ECN spreads

| Tradeview | Pepperstone | OANDA | |

| Commission ($ per lot) | 2,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,2 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,3 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Tradeview. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Tradeview Non-Trading Fees

| Tradeview | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0-1,5 | 0 | 0 |

| Withdrawal fee, USD | 0-35 | 0 | 0-15 |

| Inactivity fee ($, per month) | 50 | 0 | 0 |

Account types

Tradeview Markets offers clients two types of trading accounts – X Leverage Account and Innovative Liquidity Connector. The maximum leverage is 1:400. The minimum deposit is $100. Make a deposit of $1,000 to open an Innovative Liquidity Connector account.

Types of accounts:

A demo account is available for all types of trading terminals.

Tradeview Markets is a perfect broker for clients specializing in trading and preferring to work with ECN technology.

Deposit and withdrawal

Tradeview received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Tradeview provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- USDT (Tether) supported

- Bitcoin (BTC) accepted

- BTC available as a base account currency

- Low minimum withdrawal requirement

- Withdrawal fee applies

- PayPal not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

What are Tradeview deposit and withdrawal options?

Tradeview provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT.

Tradeview Deposit and Withdrawal Methods vs Competitors

| Tradeview | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Tradeview base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Tradeview supports the following base account currencies:

What are Tradeview's minimum deposit and withdrawal amounts?

The minimum deposit on Tradeview is $100, while the minimum withdrawal amount is $30. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Tradeview’s support team.

Markets and tradable assets

Tradeview provides a standard range of trading assets in line with the market average. The platform includes 1400 assets in total and 40 Forex currency pairs.

- 40 supported currency pairs

- Copy trading platform

- Indices trading

- Crypto trading not available

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Tradeview with its competitors, making it easier for you to find the perfect fit.

| Tradeview | Plus500 | Pepperstone | |

| Currency pairs | 40 | 60 | 90 |

| Total tradable assets | 1400 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Tradeview offers for beginner traders and investors who prefer not to engage in active trading.

| Tradeview | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

Tradeview received a score of 9.25/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- One-click trading

- Free VPS for uninterrupted trading

- Trade directly from TradingView

- Trading bots (EAs) allowed

- No access to a proprietary platform

- Strategy (EA) Builder is not available

- No access to API

Supported trading platforms

Tradeview supports the following trading platforms: MT4, MT5, cTrader, TradingView. This selection covers the basic needs of most retail traders. We also compared Tradeview’s platform availability with that of top competitors to assess its relative market position.

| Tradeview | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | Yes | No | Yes |

| TradingView | Yes | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | No | Yes | Yes |

Key Tradeview’s trading platform features

We also evaluated whether Tradeview offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 180 |

| Tradable assets | 1400 |

Additional trading tools

Tradeview offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

Tradeview trading tools vs competitors

| Tradeview | Plus500 | Pepperstone | |

| Trading Central | Yes | No | No |

| API | No | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | Yes | No | Yes |

Mobile apps

Tradeview supports mobile trading, offering dedicated apps for both iOS and Android. Tradeview received a score of 7/10 in this section, indicating a generally acceptable mobile trading experience.

- Mobile alerts supported

- Solid iOS user feedback, with a rating of 4.9/5

- Indicators supported

- Mobile 2FA not supported

We compared Tradeview with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| Tradeview | Plus500 | Pepperstone | |

| Total downloads | 100,000 | 10,000,000 | 100,000 |

| App Store score | 4.9 | 4.7 | 4.0 |

| Google Play score | 4.9 | 4.4 | 4.0 |

| Mob. 2FA | No | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

Training with Tradeview Markets brokers is limited. The company provides brief reviews of the main indicators for traders, the trading platform video reviews, and information about CFDs.

Tradeview Markets doesn’t provide cent accounts, so the demo account is the only option to consolidate the knowledge acquired during study.

Customer support

Tradeview Markets technical support is available from Monday through Friday. No support is available on weekends.

Advantages

- You can ask a question without being a client of the company in the online chat.

- Support available in 9 languages

Disadvantages

- Operates 24/5

Available communication channels with customer support specialists include:

-

phone number (specified in the Contact section);

-

email;

-

online chat on the website and in the personal account;

-

contact form;

Not only a registered client but also a trader without an active account can ask questions.

Contacts

| Foundation date | 2015 |

|---|---|

| Registration address | Grand Cayman, KY1-1002; 5th Floor Anderson Square, 64 Shedden Rd, PO Box 1105 |

| Regulation |

CIMA, MFSA

Licence number: 585163, IS/93990 |

| Official site | https://www.tradeviewforex.com/ |

| Contacts |

+1 345 945 6271

|

Comparison of Tradeview with other Brokers

| Tradeview | Eightcap | XM Group | RoboForex | Octa | LiteFinance | |

| Trading platform |

MT4, MT5, cTrader, Сurrenex, Mobile platforms, Sterling Trader | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader4, MetaTrader5, OctaTrader | MT4, MT5, MultiTerminal, Sirix Webtrader |

| Min deposit | $100 | $100 | $5 | $10 | $25 | $10 |

| Leverage |

From 1:1 to 1:400 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:40 to 1:1000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | 7.00% |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.6 points | From 0.5 points |

| Level of margin call / stop out |

100% / No | 80% / 50% | 100% / 50% | 60% / 40% | 25% / 15% | 50% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | Yes |

Detailed Review of Tradeview Forex

The Broker Tradeview Markets puts forth its best efforts to ensure its clients with attractive terms. The company operates on ECN technology that provides direct access to liquidity markets. The broker offers clients the opportunity to work with any trading strategy. There are two types of trading accounts available such as the Trade execution type (Market Execution) and Tradeview Markets, which allows you to auto trade.

Tradeview Markets by the numbers

-

over 100,000 open trading accounts.

-

over 100 companies cooperating under the White Label affiliate program.

-

17 years in the field of brokerage services.

Tradeview Forex is a broker for active trading

Tradeview Markets, the ECN and CFD broker, provides traders with a wide range of trading instruments in the Forex market, five types of trading terminals, and precise spreads. Users have access to currency pairs, as well as CFDs on indices, energies, metals, Crytocurrenciens and over 5,000 real U.S. stocks and options. Traders can also profit from passive investing at Tradeview Markets brokers. For this purpose, the broker offers users the cTrader Copy trading platform.

You also can work with the MetaTrader 4, MetaTrader 5, cTrader, Sterling Trader and CurreneX trading terminals. The Tradeview Markets broker allows all types of trading strategies such as scalping, intraday, and hedging. You can connect to trading with one click.

Useful Tradeview Markets Services:

-

TradeGateHub. This analytical service is available for Tradeview Markets clients. Traders are provided with a range of tools for technical, fundamental analysis, news, etc.

-

Pivot Calculators. They allow you to calculate the trend reversal points based on the indicators of a simple average, i.e., the average values of the maximum, minimum, and the close of the previous period.

-

Economic calendar. Tradeview Markets provides clients with information about all significant financial events that will take place shortly. You can set up filters by asset, date, the importance of the event, etc., in the economic calendar.

Advantages:

Over 100 trading instruments are available for trading.

The company stores the clients’ funds in segregated accounts to ensure the safety of their funds.

Protection from negative balance is provided.

The floating spreads are from 0.1 pips.

The popular cTrader Copy social trading platform is available to investors.

There are five types of trading terminals.

All clients, regardless of the type of account, are provided with a complete list of trading instruments, a free demo account, and other opportunities.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i