Which is the Best Crypto to Day Trade?

Cheapest crypto exchange to buy crypto - Bybit

-

Best cryptocurrencies for day trading often include Bitcoin (BTC) and Ethereum (ETH) due to high liquidity and market cap

-

Ripple (XRP) and Binance Coin (BNB) offer unique advantages for day trading, like rapid transactions and ecosystem integration

-

Successful day trading strategies incorporate both technical and fundamental analysis

In the fast-paced world of cryptocurrency, day trading stands out as both a thrilling opportunity and a formidable challenge. It's a realm where volatility can translate into significant profits within the span of just a few hours.

However, this very unpredictability also poses a considerable risk, making it imperative for traders to grasp the fundamentals of the crypto market and the dynamics of intraday trading. The question then arises: which cryptocurrency is best suited for day trading?

This article aims to unravel this mystery. By shedding light on the essential aspects of crypto day trading, we endeavor to pave your path to becoming a more informed and, consequently, a more successful trader.

-

What is Day Trading?

Day trading is the practice of buying and selling financial instruments within the same trading day to capitalize on short-term price movements.

-

Is crypto good for day trading?

Crypto is popular for day trading due to its significant volatility, which can provide opportunities for high returns.

-

What is the best cryptocurrency exchange for day trading?

The best cryptocurrency exchange for day trading typically offers high liquidity, low fees, robust security, and a user-friendly platform. Binance and ByBit are often favored among traders.

-

Is crypto day trading profitable?

Crypto day trading can be profitable, but it requires a deep understanding of the market, a well-crafted strategy, and strict risk management.

How to start trading crypto intraday

To successfully launch into the world of crypto day trading, consider the following detailed steps:

-

Clarifying Investment Goals and Risk Appetite:

-

Clearly articulate your financial objectives with day trading

-

Perform a thorough self-assessment to determine the level of market fluctuation you can endure without compromising your peace of mind

-

-

Selecting an Optimal Trading Platform

-

Opt for platforms with intuitive interfaces that facilitate rapid trading decisions and execution

-

Search for competitive fee structures to ensure that transaction costs don't erode your profits

-

Demand a diverse range of tradable assets and tools that enable you to craft and execute various trading strategies

-

Emphasize the importance of stringent security features to protect your capital against cyber threats and exchange vulnerabilities

-

-

Leveraging Exchange Ratings:

-

Utilize comprehensive reviews and ratings of crypto exchanges found on reputable financial websites

-

Evaluate each platform based on key performance metrics such as user experience, fee schedules, the breadth of available cryptocurrencies, and the robustness of security measures

-

To learn more about the best crypto exchanges, read our guide on 10 Best Crypto Exchanges (2024).

Ethereum (ETH)

Ethereum attributes for day trading are highlighted by:

-

Substantial Market Presence:

-

Second only to Bitcoin in liquidity, Ethereum provides a stable ground for executing substantial trades quickly and effectively

-

The high liquidity also means ETH is less prone to extreme volatility, enabling more predictable intraday trading

-

-

Hub of Innovation and Fluctuation:

-

The platform's native support for dApps and smart contracts introduces beneficial volatility, a key ingredient for profitable day trading

-

Upgrades such as Ethereum 2.0 can significantly influence price points, presenting timely opportunities for traders

-

-

Impact of DeFi and NFTs:

-

As the backbone of the DeFi and NFT markets, Ethereum's relevance extends beyond its own ecosystem, affecting demand and price stability

-

Its widespread adoption in various investment products further cements its position as a preferred asset for day trading due to increased liquidity and market activity

-

Ripple (XRP)

Ripple's XRP offers unique advantages for intraday traders, thanks to:

-

Real-World Financial Utility:

-

XRP's design for efficient cross-border transactions positions it as a vital tool for international banking, enhancing its credibility and market liquidity

-

Its capacity for swift, cost-effective transfers appeals to financial institutions, potentially driving its price upon new partnerships or regulatory news

-

-

Dual Volatility Sources:

-

XRP's price is influenced by both global crypto market sentiment and Ripple-specific developments, offering traders varied opportunities for profit

-

Its comparatively low price enables holding larger quantities, magnifying the impact of price shifts on trading outcomes

-

Binance Coin (BNB)

Binance Coin stands out in day trading for reasons tied to:

-

Strong Exchange Association:

-

BNB's integral role in the Binance ecosystem, including trading fee discounts, bolsters its demand and liquidity, key for quick, efficient trades

-

This close relationship with one of the world's leading exchanges provides a steady foundation for its volume and price movements

-

-

Strategic Supply Management:

-

Binance's regular "burns" of BNB, aimed at reducing supply, can create speculative opportunities as traders anticipate the impact on price

-

These actions, combined with BNB's utility across Binance's services, create a dynamic trading environment with potential for profit based on platform activity and tokenomics

-

Best crypto exchanges for day trading

Strategies and considerations for crypto day trading

Crypto day trading thrives on volatility, where rapid price movements can spell significant profits or losses. Traders must be adept at predicting and adapting to market fluctuations to succeed. A phenomenon known as the “Block of Pop” encapsulates this—where a sudden price spike, often driven by news or large trades, can create fleeting opportunities for the vigilant trader.

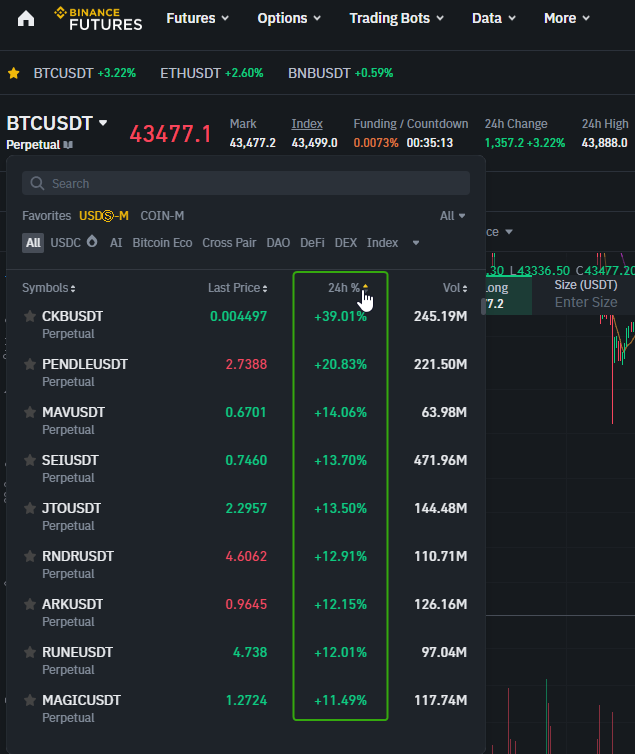

The image depicts price movements of certain crypto assets within a 24-hour window

Active cryptocurrency lists, highlighting coins with substantial 24-hour movements, are indispensable tools for traders. These lists pinpoint where volatility is peaking, guiding traders to opportunities for in-depth analysis and potential entry points.

Effective market analysis marries the technical with the fundamental. Technical analysis deciphers chart patterns and indicators, while fundamental analysis considers economic factors and overarching market narratives. A skilled trader navigates these waters by synthesizing both approaches, aiming to predict the market's next move.

Yet, the keystone of day trading is not found in analytics alone, but in the mental resilience required to navigate this high-stress environment. It's about maintaining discipline amidst chaos, managing losses, and understanding the psychological toll the market can exert. Trading simulators serve as critical training grounds, allowing traders to hone their strategies and mental toughness without risking real capital.

Ultimately, crypto day trading extends beyond number crunching. It's a test of one's psychological fortitude and strategic acumen. Simulators, active currency lists, and a solid grasp of market analysis form the triad that underpins a trader's preparedness for the real-world arena of cryptocurrency markets.

Example of an intraday trade on the cryptocurrency market

Intraday trading in the cryptocurrency market involves a strategic blend of technical analysis, risk management, and a disciplined mental attitude. Let’s walk through a hypothetical trade using the Bitcoin (BTC) chart provided.

Example of an intraday trade, BTC/USD market

Technical Analysis:

Using the Supertrend indicator on the BTC chart, we identify a shift from red to green, signaling a potential entry point for a long position. This indicator suggests an imminent bullish trend.

Calculations for Entry:

-

Entry Point: BTC price at $40,000

-

Position Size: 0.5 BTC

-

Total Investment: $20,000 (0.5 BTC * $40,000/BTC)

Risk Management:

-

Stop Loss: Set at $39,500, just below a recent low to limit potential loss

-

Risk per Trade: $500 (0.5 BTC * ($40,000 - $39,500))

-

Risk-to-Reward Ratio: $20,000 (0.5 BTC * $40,000/BTC)

Trade Execution:

-

Exit Target: BTC price at $41,500 based on the 1:3 risk-to-reward ratio

-

Potential Profit: $750 (0.5 BTC * ($41,500 - $40,000))

Outcome Scenarios*:

-

Positive Outcome: The market trends upwards as anticipated, reaching the $41,500 exit target. The trade closes with a $750 profit

-

Negative Outcome: BTC drops to the stop loss at $39,500. The trade is automatically closed, resulting in a $500 loss

* Excluding commissions, slippages and other variables

This hypothetical scenario demonstrates the importance of combining technical signals with strategic risk management. By setting clear entry, exit, and stop-loss points, the trader manages potential outcomes, aiming to maximize gains while minimizing losses. Such calculated approaches are essential for successful intraday trading in the volatile crypto market.

Setting up for success in crypto day trading

Success in crypto day trading doesn't just happen. It's the result of meticulous planning and disciplined execution. Here are essential tips to set you up for success:

-

Define Clear Trading Goals and Set Realistic Targets: Begin with a clear vision of what you want to achieve through day trading. Set daily, weekly, and monthly profit targets, but ensure they're realistic and reflect your capital and risk tolerance. Your goals should be specific, measurable, attainable, relevant, and time-bound (SMART)

-

Risk Management: An absolute tenet of day trading is to never risk more than you can afford to lose. Each trade should only comprise a small percentage of your total capital, often suggested as no more than 1-2%. Utilize stop-loss orders to automatically exit trades at a predetermined level to protect against significant losses

-

Use a Trading Journal: Keeping a record of all your trades, including the strategy used, the entry and exit points, the outcomes, and any relevant market conditions or personal notes, can be invaluable. A trading journal allows you to review your decisions and outcomes, learn from your mistakes, and improve over time

-

Stay Informed and Flexible: The crypto market is influenced by a plethora of factors including regulatory news, technological advancements, and macroeconomic trends. Stay informed by following crypto news, market analyses, and community discussions. However, be ready to adapt your strategy as the market changes. Flexibility and the ability to pivot your approach based on new information are key to success

-

Embrace Technology: Use trading tools and technologies to your advantage. Charting software, trading bots for automation, and real-time news alerts can enhance your trading efficiency. However, remember that technology should aid, not replace, your strategic decision-making process

For further insights, read our article on How to Become a Successful Crypto Investor?

Conclusion

Successful crypto day trading is built on a foundation of well-defined goals, stringent risk management, and continuous learning. By setting realistic targets, using stop-loss orders to protect your capital, and keeping a detailed trading journal, you lay the groundwork for informed trading decisions.

Keeping up with market trends and technological advances will further sharpen your competitive edge. Embrace the learning curve, adapt to the market's ebbs and flows, and let your strategies mature with experience. Keep learning, keep trading, and may your diligence turn volatility into opportunity.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Day trading

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

-

4

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

5

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).