Best ChatGPT Forex trading strategies and uses

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Here is a step-by-step process on how you could use ChatGPT in Forex trading:

- Formulate a trading idea

- Engage ChatGPT for strategy generation

- Code review and debugging

- Backtesting

- Forward testing on a demo account.

The intersection of artificial intelligence and Forex trading has paved the way for innovative approaches and tools. ChatGPT, an AI-powered chatbot, holds immense potential as a resourceful assistant in the Forex market. This article explores the best ChatGPT Forex trading strategies and their practical applications. By leveraging the analytical capabilities of ChatGPT, traders can enhance decision-making, automate tasks, and uncover valuable insights for more informed and efficient trading.

What is ChatGPT and how does it work?

ChatGPT is an advanced chatbot that harnesses the power of artificial intelligence to engage in conversations and assist users in the realm of trading. Utilizing natural language processing (NLP), this intelligent system comprehends user queries and formulates human-like responses. By being trained on extensive datasets of conversational data, ChatGPT is capable of generating contextually relevant and interactive replies to various inquiries. The underlying mechanism involves an analysis of the user's input, followed by the application of NLP algorithms to generate potential responses. These responses are then filtered through trained models to select the most suitable one. Notably, ChatGPT possesses the ability to retain conversational context, enabling it to provide more accurate and meaningful responses to subsequent queries.

How to make a Forex trading strategy with ChatGPT?

Crafting a Forex trading strategy involves careful planning and leveraging the analytical capabilities of ChatGPT. Here's a step-by-step guide to developing an automated strategy using ChatGPT:

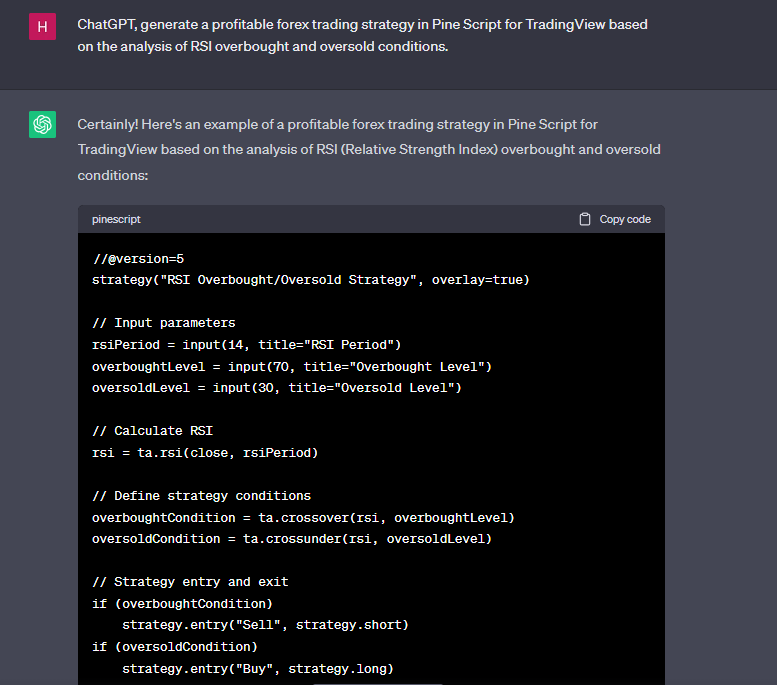

Formulate a trading idea: Begin by analyzing market trends and indicators to identify a potentially profitable trading concept. For example, you may consider using the Relative Strength Index (RSI) to identify overbought and oversold conditions.

Example Prompt: "ChatGPT, generate a profitable Forex trading strategy in Pine Script for TradingView based on the analysis of RSI overbought and oversold conditions."

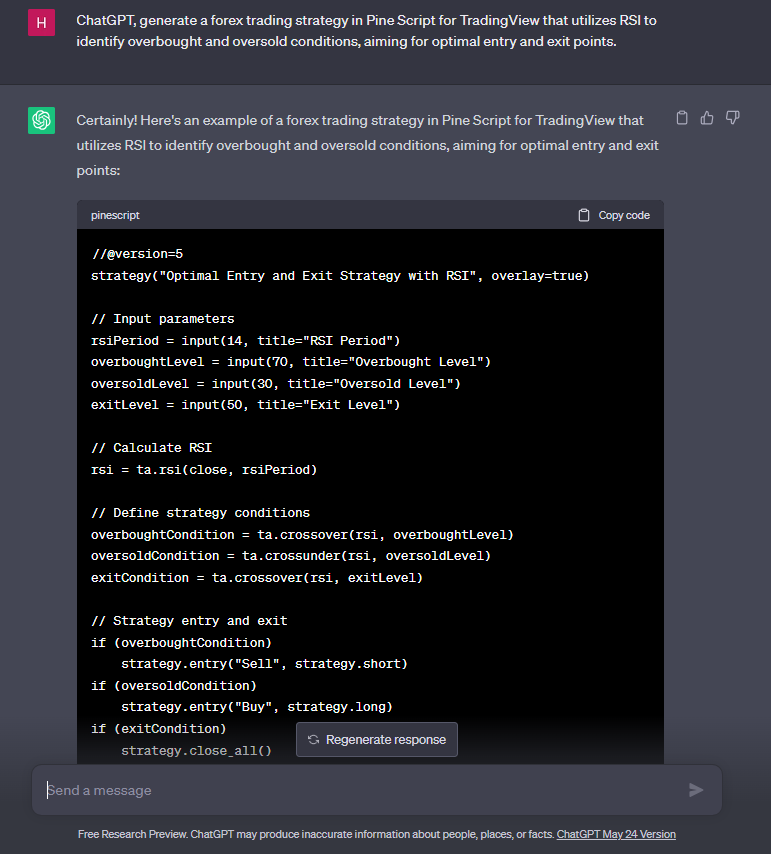

Engage ChatGPT for strategy generation: Request ChatGPT to create a trading strategy in Pine Script for TradingView that incorporates the identified concept.

Example Prompt: "ChatGPT, generate a Forex trading strategy in Pine Script for TradingView that utilizes RSI to identify overbought and oversold conditions, aiming for optimal entry and exit points."

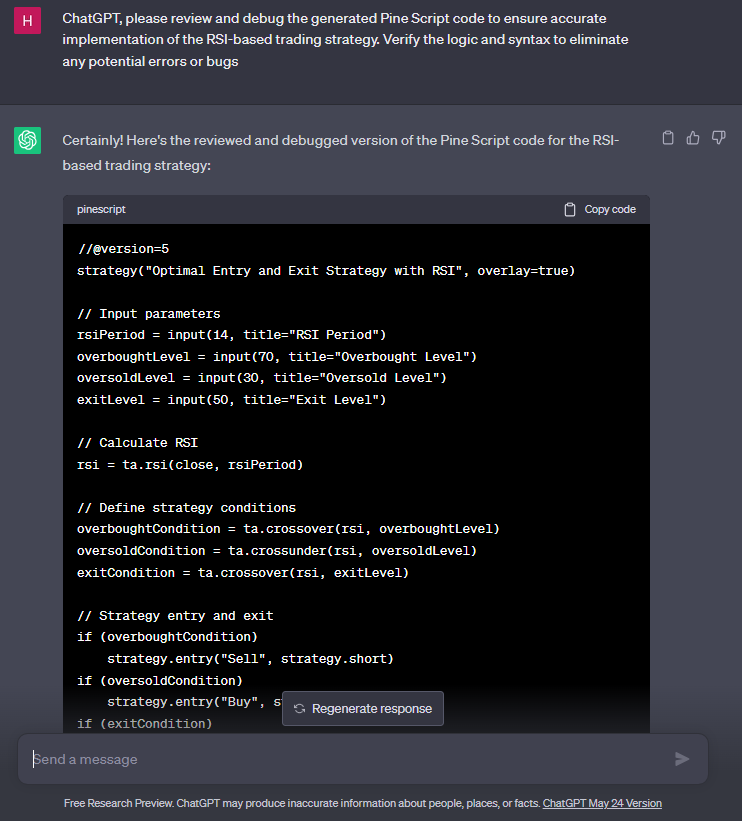

Code review and debugging: Thoroughly review the generated strategy code provided by ChatGPT. Analyze the code for any potential errors or inconsistencies. Verify the accuracy of the implementation and identify any areas that require adjustments.

Example Prompt: "ChatGPT, please review and debug the generated Pine Script code to ensure accurate implementation of the RSI-based trading strategy. Verify the logic and syntax to eliminate any potential errors or bugs."

Backtesting: Utilize backtesting tools within TradingView or other platforms to assess the performance of the strategy. Conduct a comprehensive analysis of key metrics such as profitability, risk-adjusted returns, drawdowns, and trade frequency.

Backtesting

BacktestingForward testing on demo account: Deploy the strategy on a demo account within TradingView to evaluate its performance in real-time market conditions. Monitor its effectiveness, fine-tune parameters if necessary, and assess its consistency and adaptability.

Additionally, you can trade directly with some brokers from your TradingView account, which simplifies execution and allows you to monitor and manage trades seamlessly from a single interface. We have compared several brokers that offer integration with this popular platform for technical analysis and strategy testing.

| Plus500 | Pepperstone | OANDA | |

|---|---|---|---|

|

Min. deposit, $ |

100 | No | No |

|

TradingView |

Yes | Yes | Yes |

|

ECN |

Yes | Yes | Yes |

|

EUR/USD spread |

No | 0,1 | 0,15 |

|

Open an account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Best tools and techniques can be used to effectively trade with ChatGPT

When utilizing ChatGPT for trading, several tools can enhance its effectiveness. Here are three essential tools:

News aggregators: Utilize news aggregators to gather real-time market news and updates. These platforms consolidate news from various sources, allowing traders to stay informed about economic events, company announcements, and global developments that impact financial markets. Integrating news aggregators with ChatGPT enables the chatbot to provide up-to-date insights and responses.

Technical analysis software: Employing robust technical analysis software enhances the trading process alongside ChatGPT. These tools provide advanced charting capabilities, indicators, and analytical tools to identify market trends, patterns, and potential entry/exit points. By combining ChatGPT's insights with technical analysis software, traders gain a comprehensive view of the market and can make more informed trading decisions.

Risk management tools: Implementing risk management tools is crucial for successful trading. These tools help traders define and control their risk exposure, including setting stop-loss orders, calculating position sizing based on risk tolerance, and monitoring portfolio performance. Integrating risk management tools with ChatGPT ensures a disciplined approach to trading and helps protect against excessive losses.

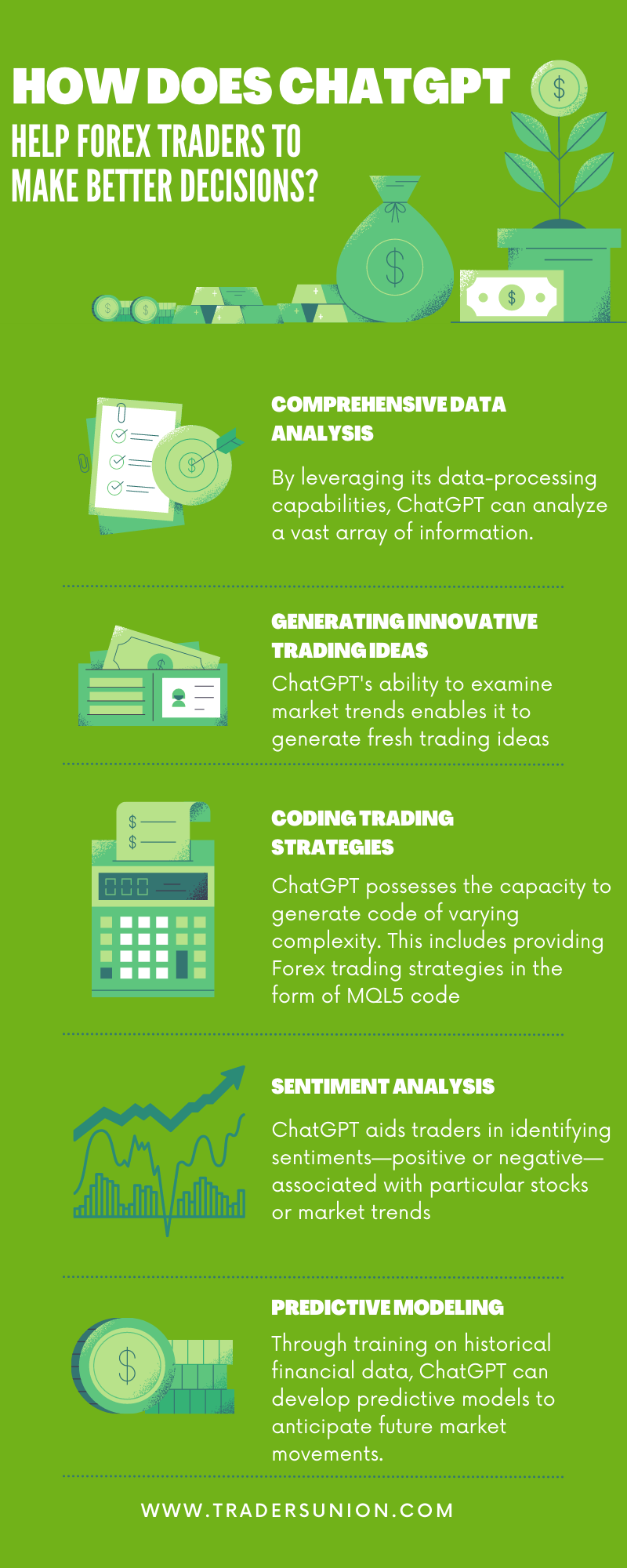

How does ChatGPT help Forex traders to make better decisions?

Integrating ChatGPT into Forex trading can prove beneficial. Here's how ChatGPT can assist traders in making better decisions:

Comprehensive data analysis: By leveraging its data-processing capabilities, ChatGPT can analyze a vast array of information, including news articles, economic indicators, and market trends. Through this analysis, it can identify hidden patterns and correlations that may elude human traders. These insights enable traders to refine and optimize their trading strategies in line with prevailing market conditions.

Generating innovative trading ideas: ChatGPT's ability to examine market trends, news articles, and various data sources enables it to generate fresh trading ideas. By presenting alternative perspectives and uncovering new opportunities, ChatGPT can stimulate creative thinking among traders.

Coding trading strategies: ChatGPT possesses the capacity to generate code of varying complexity. This includes providing Forex trading strategies in the form of MQL5 code, which traders can readily employ and adapt to suit their specific needs and preferences.

Sentiment analysis: ChatGPT aids traders in identifying sentiments—positive or negative—associated with particular stocks or market trends. By gauging market sentiment, traders gain valuable insights that inform their decision-making processes.

Personalized trading assistance: Leveraging its natural language processing capabilities, ChatGPT can understand and interpret human language. Future iterations of ChatGPT may offer personalized advice and sophisticated suggestions by considering a trader's unique trading preferences, risk tolerance, and objectives.

Predictive modeling: Through training on historical financial data, ChatGPT can develop predictive models to anticipate future market movements. By leveraging these models, traders can identify potential opportunities, enabling them to execute more profitable trades.

Backtesting: ChatGPT can simulate the performance of trading strategies using historical data. This invaluable feature enables traders to evaluate the viability and effectiveness of a strategy before committing real funds, minimizing potential risks.

Pros and cons of using ChatGPT in Forex trading

- Pros

- Cons

- Versatility: ChatGPT offers a wide range of functionalities that prove valuable in Forex trading. From data analysis to code generation for trading strategies, sentiment analysis, and personalized trading assistance, ChatGPT can perform diverse tasks to support traders effectively.

- Efficient data processing: Leveraging its AI capabilities, ChatGPT can rapidly process and analyze vast volumes of data, surpassing human capacity. This efficiency saves traders significant time and effort in gathering and analyzing information.

- Error reduction: By automating various aspects of the trading process, such as data analysis and strategy development, ChatGPT helps mitigate errors that can arise from human oversight. This can lead to more accurate and informed decision-making.

- Cost-effective solution: Compared to hiring human analysts, integrating AI like ChatGPT can offer a cost-effective solution. It eliminates the need for a dedicated human resource and reduces associated expenses.

- Knowledge limitations: It is important to note that ChatGPT's knowledge is static and confined to information available until September 2021. Consequently, it lacks awareness of events, trends, or market developments that have occurred after that timeframe. Traders should consider this limitation and incorporate up-to-date information from other sources.

- Accuracy of information: While ChatGPT can process substantial amounts of data and provide insights based on it, the accuracy of these insights is not guaranteed. Traders should exercise caution and validate the information using alternative sources or employ additional analytical techniques.

- Risk of over-reliance: Relying solely on AI carries the risk of neglecting other critical aspects of trading. Human intuition, market experience, and understanding of geopolitical contexts are factors that AI may not fully comprehend. It is essential to strike a balance between utilizing AI tools and leveraging human expertise to make well-rounded trading decisions.

Tips to keep in mind while using ChatGPT in Forex trading

Realistic expectations: It is crucial to approach ChatGPT as a tool for long-term success and consistent profits rather than expecting overnight millionaire status. Maintaining realistic expectations sets the foundation for a balanced and sustainable trading approach.

Market monitoring: Stay vigilant and stay informed about the latest market news and events that can potentially impact your trading activities. Keeping a pulse on market developments allows for timely adjustments and informed decision-making.

Implement stop-loss orders: To mitigate potential losses in volatile markets, consider implementing stop-loss orders. These orders automatically trigger the sale of a position if the market moves against your position, limiting potential downside risks.

Develop a comprehensive trading plan: Before executing any trades, establish a well-defined trading plan that outlines your strategies, goals, risk tolerance, and preferred trading style. A comprehensive plan serves as a roadmap and helps maintain discipline in your trading activities.

Leverage technical analysis: Utilize technical analysis techniques to identify patterns, trends, and indicators in the market. By analyzing price charts, volume data, and various technical indicators, you can gain insights to inform your trading decisions and enhance your chances of success.

Test and practice: Prioritize using a demo account to practice and test your trading strategies. This allows you to refine your approach, assess the effectiveness of your strategies, and develop sound risk management techniques without risking real capital. Practicing in a simulated environment builds confidence and proficiency.

ChatGPT Forex trading vs. traditional Forex trading

| Parameter | ChatGPT Forex Trading | Traditional Forex Trading |

|---|---|---|

| Data Analysis | Efficient pattern recognition. | Manual data analysis. |

| Speed of Decision-Making | Quick response generation. | Human decision-making speed. |

| Emotional Bias | Absence of emotional bias. | Influence of emotions. |

| 24/7 Availability | Round-the-clock availability. | Limited trading hours. |

| Cost-Effectiveness | Cost-effective solution. | Additional expenses possible. |

| Contextual Understanding | Limited contextual understanding. | Broader contextual analysis. |

| Risk Management | Assists with risk management. | Reliance on trader expertise. |

| Adaptability | Can be trained and updated. | Adaptation based on market changes. |

Best strategies for ChatGPT trading

Trend-Following: This strategy involves capitalizing on the prevailing price trends by aligning trades in the direction of the trend, aiming to profit from sustained price movements.

Momentum Trading: By taking advantage of sudden surges in trading volume and price volatility, this strategy aims to ride the momentum generated by these rapid market movements.

Contrarian Trading: Contrarian trading involves going against the prevailing market sentiment and trends, with the belief that market reversals and corrections can present profitable opportunities.

Scalping: Scalping is a short-term trading approach where traders aim to capitalize on small price fluctuations by executing quick trades within a short time frame, usually minutes or hours.

Momentum Trading: In momentum trading, traders seek to profit from the continuation of existing price momentum, regardless of whether the market is trending or moving sideways. This strategy relies on identifying and capitalizing on the strength of prevailing market movements.

FAQs

Can ChatGPT code a fully automated trading system?

In theory ChatGPT can generate code for automated trading systems, but it requires extensive prompts about desired system logic. Human traders should review and test any system extensively before real money deployment.

Is ChatGPT used by professional traders currently?

ChatGPT is very new but some professional traders are likely early experimenters. Many traders are still assessing its utility versus risks. We can expect more adoption as capabilities improve over time.

Does ChatGPT actually trade itself or make predictions?

No, ChatGPT does not trade itself or make market predictions. It generates responses based on its training data.

What are the limitations when using ChatGPT for trading?

Limitations include the need for quality training data, lack of subjective discretionary decision making, overfitting potential when optimizing, and the inability to directly connect it to live trading without an execution system. Human oversight is still essential.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Social trading is a form of online trading that allows individual traders to observe and replicate the trading strategies of more experienced and successful traders. It combines elements of social networking and financial trading, enabling traders to connect, share, and follow each other's trades on trading platforms.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

An ECN, or Electronic Communication Network, is a technology that connects traders directly to market participants, facilitating transparent and direct access to financial markets.