Best Time To Trade Forex In France

The optimal time for Forex trading in France is during the overlap of the U.S. and London markets. This period provides the highest liquidity and trading volume, which usually occurs between 13.00 and 17.00 CET.

The Forex market operates on a 24/7 operational schedule, primarily because of the diverse operational requirements across different nations. With the world divided into various time zones, Forex trading is always ongoing. But precisely because of these different time zones, traders in some countries are most active during specific hours, aligning with their local times.

France mainly follows the Central European Time (CET) zone, which corresponds to UTC+1. However, it adjusts its clocks during the daylight saving period. From the last Sunday of March to the last Sunday in October, France moves to the Central European Summer Time (CEST), or UTC+2.

Forex trading sessions in France

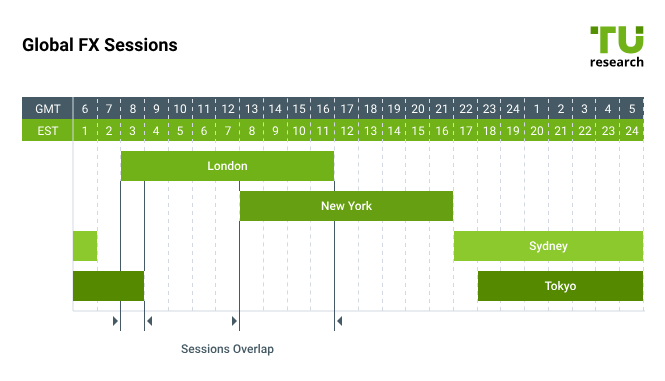

Different time zones dictate distinct peak activity periods in the Forex market:

Asian Session: Spanning from 23.00 UTC to 9.00 UTC, the Tokyo session primarily sees a high trade volume in currency pairs linked to the Japanese yen (JPY), such as USD/JPY, EUR/JPY, and GBP/JPY

European Session: Running from 8.00 UTC to 17.00 UTC, this session, heavily influenced by London, witnesses heightened trading in pairs like EUR/USD, GBP/USD, and USD/CHF

American Session: Focused around New York, this session is active from 13.00 UTC to 22.00 UTC. Traders here mainly deal in pairs such as EUR/USD, USD/JPY, and GBP/USD

Forex global trading sessions

Time zones in France

Forex trading sessions are particularly influenced by time zones. This is something that those looking to grasp the basics of how to start Forex trading should consider. There are several reasons why this happens:

An active trading session guarantees higher liquidity

During the day, traders can have access to economic releases

Traders can avoid overnight risks – according to the strategies they use

To assess the best time to trade Forex in France, traders should consider the specific time zones of the country – namely CET (UTC+1) and CEST (the Summer Time, corresponding to UTC+2).

What is the best time to trade Forex in France?

Forex trading is a global activity, and while it operates 24/7, there isn't a universally best time to trade. However, to maximize potential gains and navigate the market effectively, traders should be aware of specific time zones and their influence on trading. France Forex market hours don’t make exceptions.

But how do time zones influence Forex market hours? France operates within the Central European Time (CET) zone. Active trading sessions, especially those that overlap with major financial hubs like London and New York, mean amplified liquidity, making certain hours more favorable for trading.

Furthermore, trading within these specific hours allows traders to avoid risks like overnight risks – especially when they choose to keep their positions open on a short-term.

Considering both the influence of specific time zones and the global overlapping times when liquidity peaks, the best time to trade Forex is between 13.00 and 17.00 CET. This window corresponds to the overlap of the U.S. and London sessions, offering traders the best opportunity to capitalize on market movements.

Best time to trade Forex – TU research

When evaluating the best time to trade Forex in France, traders should take into account both the country's specific time zones and peak global activity windows.

As mentioned, the overlapping hours between the U.S. and London sessions, primarily from 13.00 to 17.00 CET, give more opportunities to traders, because of the higher liquidity.

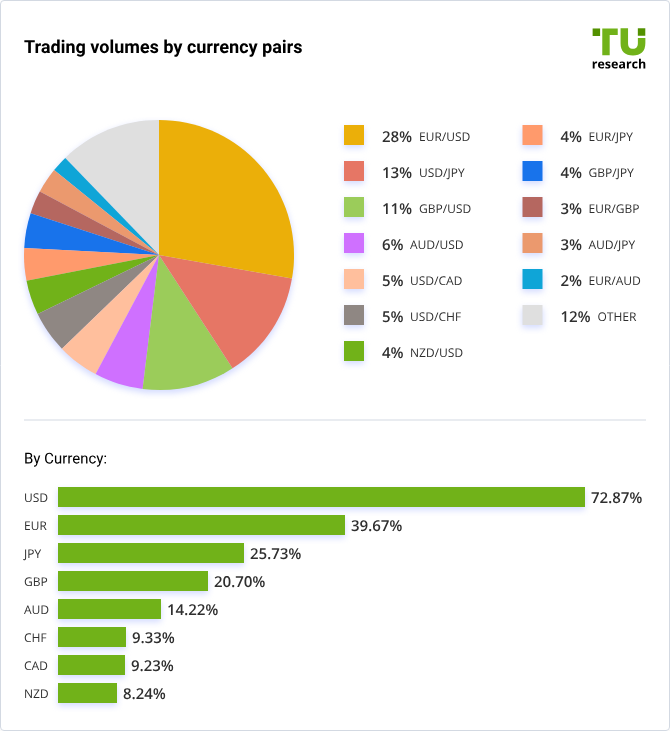

TU's in-depth research highlights that this recommended window isn't solely based on market overlaps. In the context of France, the prominence of the EUR/USD pair plays a pivotal role. Data, collected from traders, Forex brokers, and institutions like the Bank for International Settlements, shows that the EUR/USD pair dominates the trading landscape, accounting for 27.95% of all trades.

TU's in-depth research highlights that this recommended window isn't solely based on market overlaps. In the context of France, the prominence of the EUR/USD pair plays a pivotal role. Data, collected from traders, Forex brokers, and institutions like the Bank for International Settlements, shows that the EUR/USD pair dominates the trading landscape, accounting for 27.95% of all trades.

This means that the mentioned overlap is beneficial also because it encompasses the activity of the U.S., which is the main participant in the trading of one of the major global pairs.

Trading volumes by currency pairs

Best time for Forex day trading in France

For day traders, the interval from 8 a.m. to 5 p.m. CET in France is ideal, marked by superior liquidity. This heightened liquidity is vital as it ensures smoother trade executions, avoiding risks related to lower levels of liquidity.

Among day traders, EUR/USD remains a prime choice, but also pairs that involve currencies such as GBP and CHF, and other major European currencies are worth noting.

Best Forex pairs to trade during the French session

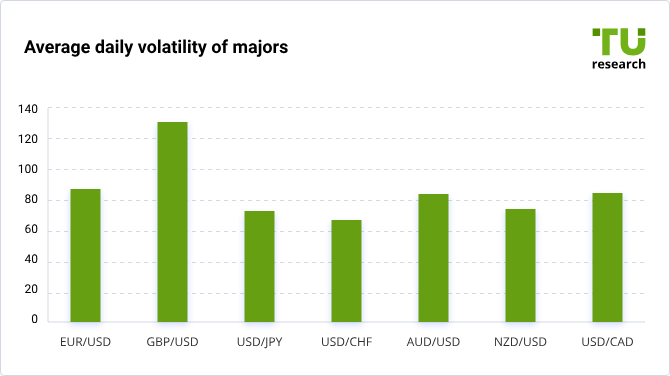

The EUR/USD pair remains a top choice for many traders, primarily due to the significant influence of European economic news on its movements. As major announcements or economic data releases from the Eurozone can lead to volatility in this pair, it's often at the forefront of many trading strategies – especially those that involve short-term holdings.

However, the trading landscape isn't limited to just EUR/USD. Pairs involving the British Pound (GBP), Swiss Franc (CHF), and other prominent European currencies also see considerable activity. Given the interconnected nature of European economies and the propensity for economic events in one country to impact neighboring nations, these pairs offer several opportunities to traders.

Whether it's reacting to economic news, political events, or monetary policy decisions from major European central banks, traders have a range of options when selecting which pairs to trade during the French session.

Average daily volatility of majors

Trading is not only about choosing the best pairs and time frames, but also the right tools.

Selecting the best Forex broker in France, according to traders’ needs, is paramount. Engaging with a reputable broker ensures access to top-tier resources, tools, and guidance. This journey begins with understanding market dynamics, leveraging demo accounts, and mastering risk management. The subsequent decision of how to choose a Forex broker hinges on multiple factors, including fees, platform usability, and customer support. For those at the onset of their trading journey, the ideal choice would be the best Forex broker for beginners, which offers robust educational resources and a user-friendly platform.

When choosing the best Forex broker, traders should evaluate if the broker offers the opportunity to trade certain currencies, according to the specific needs of the country where the trader operates.

Time to pause Forex trading in France

What time does the Forex market open in France? As mentioned, Forex trading is a 24/7 activity, but as we find the best time to trade Forex, we can also find times when trading should be stopped.

Trading isn't about continuous action. Strategic pauses, especially during times of low liquidity or preceding major economic announcements, are recommended – especially to beginners.

Best Forex brokers in France

IC Markets

IC Markets is an Australian-based company that was incorporated in 2007. IC Markets is a safe broker that provides competitive spreads on contracts for difference. It offers more than 2250 trading instruments.

It is known for offering online trading solutions through its top-notch platforms for all types of traders. Apart from Forex trading, it allows traders to trade futures, stock indices, and commodities. IC Markets attracts traders with its high leverage, low spreads, and low commission fees.

IC Markets offers cutting-edge trading platforms, low latency connectivity, and superior liquidity. Trading with IC Markets will involve fees starting at $3 USD, spreads starting at 0 pips, and commission-free trading depending on the account the trader selects.

The Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Authority (FSA), and the Securities Commission Bahamas (SCB) are just a few of the international regulatory bodies that have authorized and overseen the broker.

XM Group

Overall, XM can be summarized as a trustworthy broker that provides contracts for difference and low spreads on 1000+ trading instruments. XM Group is a community of regulated online brokers that has been offering their services since 2009.

It was registered as a service provider in 2015 under the company Trading Point of Financial Instruments Pty Ltd. However, XM is currently regulated by two securities commissions, the Cyprus Securities and Exchange Commission, and the Australian Securities and Investments Commission. The group founded XM Global in 2017, and the International Financial Services Commission now oversees it.

The minimum deposit amount required to register an XM live trading account ranges from $5 to $10,000, and the broker does not charge any fees for our deposit/withdrawal options. Inactive accounts are charged a monthly fee of $5, or the full amount of the free balance in these accounts if the free balance is less than $5. No charge is imposed if the free balance in the trading account is zero.

FAQs

What time does the Forex market open in France?

The Forex market operates 24 hours a day, ensuring global accessibility. However, in terms of the primary trading hours that align with France's activity, it begins with the European session starting at 9.00.

What is the best time period to trade Forex in France?

The optimal time for Forex trading in France is during the overlap of the U.S. and London markets. This period provides the highest liquidity and trading volume, which usually occurs between 13.00 and 17.00 CET.

Who is the best Forex trader in France?

Identifying the "best" Forex trader in France can be subjective as success metrics in trading can vary. While France prides itself with several seasoned traders and financial institutions active in the Forex market, it's challenging to pinpoint a single individual as the best. Success in Forex trading can be gauged by profitability, consistency, risk management, and other factors.

Is Forex legal in France?

Yes, Forex trading is legal in France. The Autorité des Marchés Financiers – AMF (the Financial Markets Authority) – is the institution charged to regulate Forex trading in the country. In fact, Forex operates under stringent regulations to protect traders and maintain the integrity of the financial market. It's essential for traders to ensure they use licensed brokers and stay informed about local regulatory guidelines.

Team that worked on the article

Rosalia Mazza is a contributor to the Traders Union website. As a seasoned financial and trading blogger with hands-on experience as a trader, Rosalia has consistently delved into the intricacies of the financial world. Her affiliation as an ordinary member of SIAT further highlights her dedication to the field.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).