What Are The Best Trading Hours For USD/CAD?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The best time to trade USD/CAD for more significant price movements and higher potential for profit, is during the market session overlap of London and New York, which occurs from 12PM to 4PM GMT, and at the closing hours of the American market session from 8PM to 10PM GMT, when market news may be more eventful. Volatility and liquidity are higher during these hours.

The U.S.A. and Canada are home to two of the world’s largest economies and major currencies, the U.S. dollar and Canadian dollar. As longitudinal neighbors, the two nations’ markets operate during the same hours and share a strong trade relationship. Their currency pairing, USD/CAD is therefore one of the most traded in Forex. In this article, we’ll be looking at when is the best time to trade USD/CAD in Forex, how to trade USD/CAD in Forex, and the advantages of trading USD/CAD.

Is USD/CAD a good pair to trade?

The USD/CAD pairing, nicknamed the “Loonie” pair, is widely considered a very stable pair to trade, and is the 6th most popular in terms of trading volume. The U.S.A. and Canada have two of the largest economies in the world, making their respective currencies, the U.S. dollar (USD), and the Canadian dollar (CAD) a relatively stable choice to trade.

Even though the US and Canada are neighbors, their economies have very different characteristics. Canada is famous for being rich in resources, particularly oil, so the Canadian dollar’s behavior tends to correlate with commodity prices. The U.S. dollar is the world’s reserve currency and used for the vast majority of trades. USD and CAD are both considered free-floating fiat currencies, and the two countries have a strong track record of trade relations, making USD/CAD highly liquid.

USD/CAD trading hours

The Forex market is open 24 hours a day, five days a week, allowing traders to trade major currency pairs at any hour during the trading week. This means that traders can trade the USD/CAD pairing 24 hours a day, five days a week. The USA and Canada share mostly the same time zones, (Canada has six time zones, four of which are the same as the U.S.A. 's) so most of each country’s trading is done within the same market sessions. We’ll use Greenwich Meridian Time (GMT) for this article, although if trading from the USA you might want to convert times to Eastern Standard Time (EST).

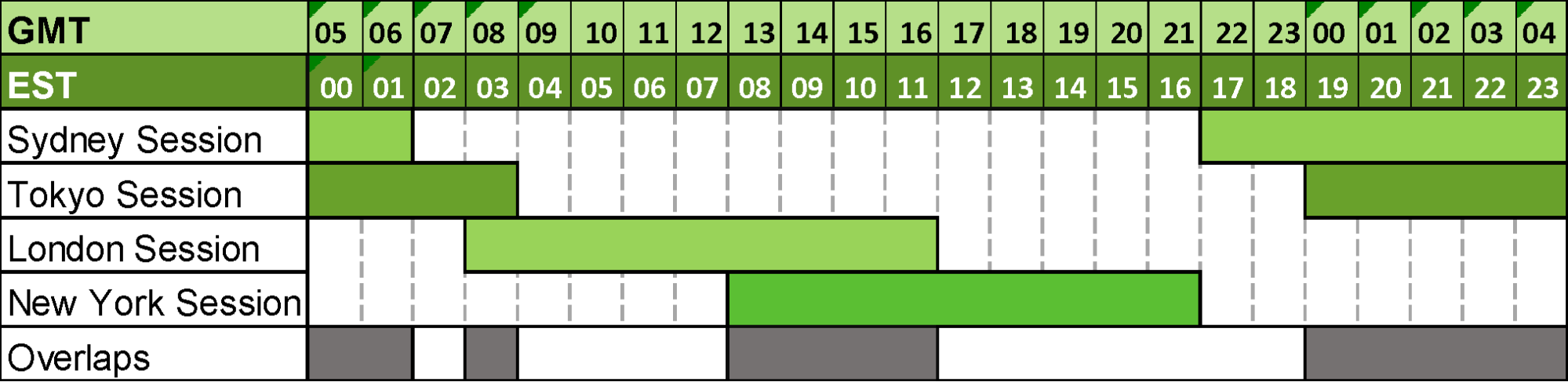

There are four major foreign exchange markets around the world, each with their own market sessions throughout the trading day:

Tokyo Session (Asian Session): Runs from 12:00 AM to 9:00 AM GMT. It’s dominated by Asian markets

London Session (European Session): Is open from 8:00 AM to 5:00 PM and overlaps with Tokyo, providing liquidity. The EUR, GBP, and CHF pairs are most active

New York Session (North American Session): Running from 1:00 PM until 10:00PM GMT, this session overlaps with London, resulting in high liquidity. USD pairs are the most in focus. This is also when most CAD training takes place

Sydney Session (Pacific Session): Open from 10:00 PM to 7:00 AM GMT. It’s the smallest session, and AUD and NZD pairs are most active. It overlaps with Tokyo’s session and provides continuity between sessions

Market Session Hours in Forex

Market Session Hours in ForexWhat affects the USD/CAD rate

The USD/CAD rate is affected by multiple factors unique to each country. When trading USD/CAD, take the following factors into account:

Federal Reserve (FED) Interest Rates : Changes in interest rates set by the FED can influence the USD/CAD rate. Higher interest rates in the United States may attract foreign capital, increasing demand for the USD

Bank of Canada Interest Rates : Similar to the FED, decisions by the Bank of Canada regarding interest rates can impact the USD/CAD exchange rate. Changes in Canadian interest rates can affect the attractiveness of the Canadian dollar

Commodity Relationship : Canada is a major exporter of oil, and its economy is closely tied to commodity prices, especially crude oil. Changes in oil prices can influence Canada's terms of trade and, consequently, affect the value of CAD against the USD

Economic Indicators : Economic indicators such as Gross Domestic Product (GDP) and employment data from the U.S.A. and Canada can influence the exchange rate. Both countries have strong economies

Toronto and New York Stock Exchanges : The stock exchanges of New York and Toronto open at the same time, from 9:30AM to 4:00PM EST. Forex price movements often correlate with the opening hours of these stock markets, seeing larger price fluctuations and trading volume

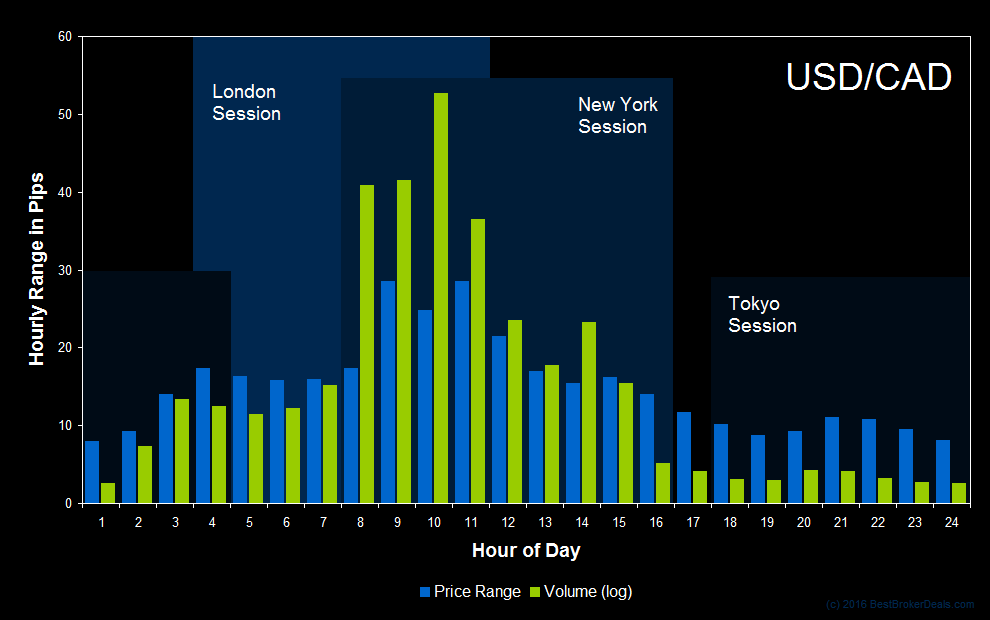

USD/CAD trading volume and price range by hour

USD/CAD trading volume and price range by hourThe best times to trade USD/CAD

The best times to trade USD/CAD are typically during the American, or New York, market session, when volatility is high. Volatility is highest in the final hours of the New York session, and also when it opens and overlaps with the end of the European (London) session. If you’re seeking lower volatility and decreased risk, trade outside of these hours.

London – New York overlap : From 12PM to 4PM GMT, (7AM to 12PM EST) the end of the London market session overlaps with the opening of the New York market session. Volatility is high here

End of American session : The American (New York) session runs from 1:00 PM until 10:00PM GMT, or 8AM until 5PM EST. Volatility is at its highest from 8PM to 10PM GMT (3PM to 5PM EST), when the session is ending

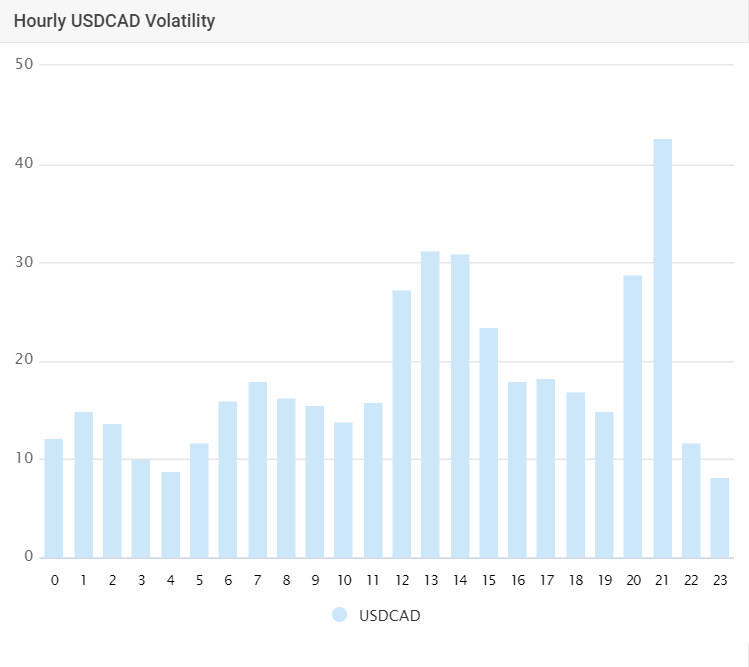

USD/CAD volatility by hour, GMT Time Zone (Source: Myfxbook)

USD/CAD volatility by hour, GMT Time Zone (Source: Myfxbook)When choosing the best day for trading USD/CAD, be aware that Friday sees the highest volatility, making it the optimal day for seeking high returns. Monday has the lowest volatility.

When looking at the best time to trade USD/CAD, be aware of your own timezone, and how it relates to the GMT times we have described here.

How to trade USD/CAD

There are several factors that are unique to the USD/CAD pair that will affect your trading strategy, depending on the type of trading you’re engaged in.

News Trading

If trading USD/CAD based on current events and news, follow the Bank of Canada (BoC) and the Federal Reserve (FED) for interest rate decisions, economic outlooks, and policy statements. Keep an eye on economic indicators such as GDP, employment data, and inflation reports from both the U.S. and Canada. Also, track developments in the oil market, as Canada is a major oil exporterIntraday Trading

When intraday trading USD/CAD, implement strategies based on short-term price movements and patterns observed during the trading day. Use technical indicators such as Moving Averages, Relative Strength Index ( RSI), and stochastic oscillators for intraday analysis. Identify chart patterns like triangles, flags, and head and shoulders in shorter time framesLong-Term Trading

Use fundamental analysis techniques. Evaluate the overall economic health of the U.S.A. and Canada, looking at GDP growth, employment trends, and fiscal policies. Analyze long-term trends using fundamental analysis. Consider factors like interest rate differentials between the U.S.A. and Canada

For those trading in Canada, Traders Union has put together a list of the six best trading platforms in Canada to help you figure out how to trade there.

Pros of trading the USD/CAD currency pair

There are several advantages to trading the USD/CAD pairing over other currencies.

Liquidity and Narrow Spread : The USD/CAD is a major currency pair, ensuring high liquidity. Traders can enter and exit trades relatively easily, and the bid-ask spread is generally lower compared to less liquid pairs

Economic Indicators : Both the U.S. and Canada release a variety of economic indicators regularly. Both countries feature prominently in global market news. This abundance of fundamental data provides ample opportunities for traders to base their decisions on economic events

Correlation with Oil Prices : Canada is a major oil exporter, and the Canadian dollar (CAD) often correlates with oil prices. Traders who follow and understand the dynamics of the oil market may be particularly attracted to trading USD/CAD

Predictable Trading Hours : The USD/CAD pair is most active during the overlap of the U.S. and Canadian trading hours, providing predictable times for trading opportunities

Stock Exchanges : The New York Stock and Toronto stock exchanges are open at the same time, making it easier to follow both simultaneously and track their effect on USD/CAD price movements

For a more in-depth look at the USD/CAD pairing and to follow up-to-date news related to the pairing, click here.

Best Forex brokers

Summary

Overall, USD/CAD is one of the most sought after pairs, due to its high volatility and liquidity. The strong relationship between the U.S.A. and Canada, as well as their shared time zones, makes USD/CAD a stable pair to trade. Beginners should be wary of the risks that come with trading USD/CAD, as times of high volatility see significant price movements. Make sure to adopt a stringent risk management strategy to avoid incurring large losses.

FAQs

What time is USD CAD most active?

It’s most active and sees highest volatility on Friday at the end of the New York session, from 8PM to 10PM GMT (3PM to 5PM EST).

What is the best time to trade in Canada?

The answer depends on the traders preferences (are they seeking higher volatility?) and on current trends. Volatility and liquidity are highest during peak trading hours, when both the London and New York sessions are open. This is at 1PM to 5PM GMT (8AM to 12PM EST).

How do you trade USD vs CAD?

Monitor economic indicators, interest rates, and oil prices. Use technical analysis for entry/exit points and take fundamental factors into consideration for a comprehensive approach.

Which Forex broker is best for trading in Canada?

Traders Union experts list MultiBank as the best Forex broker in Canada. See our full list for more.

Related Articles

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

BaFin is the Federal Financial Supervisory Authority of Germany. Along with the German Federal Bank and the Ministry of Finance, this government regulator ensures that licensees abide by eurozone laws.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

The Stochastic Oscillator is a technical indicator used in financial analysis to gauge the momentum of a security's price and identify overbought or oversold conditions by comparing the closing price to a specified price range over a defined period.