Best Effective Forex Exit Strategies

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

To effectively exit a Forex trade, traders can use techniques such as support and resistance levels, trailing stops and fixed profit targets. These methods help determine optimal exit points and manage risks. Implementing a well-planned exit strategy is essential to maximizing profits and minimizing losses.

Exiting a trade is crucial in Forex trading, as it can significantly impact profitability. In this article, we explore various exit strategies, including support and resistance levels, trailing stops, and technical indicators, to help you make informed exit decisions. Understanding and implementing these strategies can enhance your trading performance and better manage your trades.

Best Forex exit strategies

Forex exit strategies are methods and tactics that traders use to determine the best moment to close their positions. These strategies aim to maximize profits and minimize losses, helping traders avoid excessive losses and secure their earnings at the most appropriate time.

The optimal time to exit a Forex trade depends on several factors and individual trader preferences. Key considerations include reaching target profit or stop-loss levels, using technical indicators, and signals for timing. Market conditions, economic events, and personal financial goals significantly influence exit decisions. Technical analysis, involving charts and indicators like moving averages, helps predict price movements and identify exit points. Fundamental analysis also plays a role by considering economic and political factors impacting currency rates, allowing traders to make informed long-term exit decisions based on macroeconomic indicators and news events.

Support and resistance levels

Support and resistance levels are price points where a trend is likely to reverse or continue. Support is a level where the price tends to find support as it falls, meaning the price is unlikely to fall below this level. Resistance is a level where the price tends to find resistance as it rises, meaning the price is unlikely to rise above this level. These levels can be identified using historical price data and charts.

Traders often use support and resistance levels to determine exit points. If the price approaches a resistance level, traders might close their positions to lock in profits. Similarly, if the price approaches a support level, traders might close their positions to avoid losses.

Support level plotted through technical analysis

Support level plotted through technical analysisTrailing stop

A trailing stop is a dynamic stop-loss that automatically follows the price movement at a set distance. For example, if you set a trailing stop at 20 pips, it will follow the price as long as it moves in your favor but will stay in place if the price moves against you.

Advantages of a trailing stop include automatic risk management and the ability to lock in profits as the price continues to move favorably. Disadvantages can include the possibility of premature position closure during short-term price fluctuations.

Trailing stop loss implemented through technical analysis

Trailing stop loss implemented through technical analysisFixed profit targets

Fixed profit targets are predetermined levels at which a trader plans to close a position to secure profits. These targets can be set based on technical analysis or personal financial goals.

The benefits of this method include a clear understanding of goals and reduced emotional stress. Disadvantages may include loss of potential profits if the price continues to move favorably beyond the target. For instance, using Fibonacci levels like 38.2% or 61.8% as profit targets can help traders capitalize on expected price retracements within a trend.

Time Limits

Time limits involve setting specific time frames for exiting a position, regardless of market conditions. This can be a day, a week, or another period of time.

Setting time frames helps avoid staying in a position too long and reduces the impact of market uncertainty. It also helps traders stay disciplined and avoid excessive waiting in hopes of a market reversal.

Indicators and oscillators

Technical indicators and oscillators, such as the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence), can help traders identify overbought or oversold market conditions.

Traders can use the RSI to exit a trade when the indicator shows values above 70 (overbought) or below 30 (oversold). The MACD can signal an exit when the signal line crosses the MACD line from above.

Using RSI Strategy

Using RSI StrategyFundamental events

Economic news and events, such as employment reports, interest rate decisions, and political events, can significantly impact currency markets. Traders should consider these events when making exit decisions.

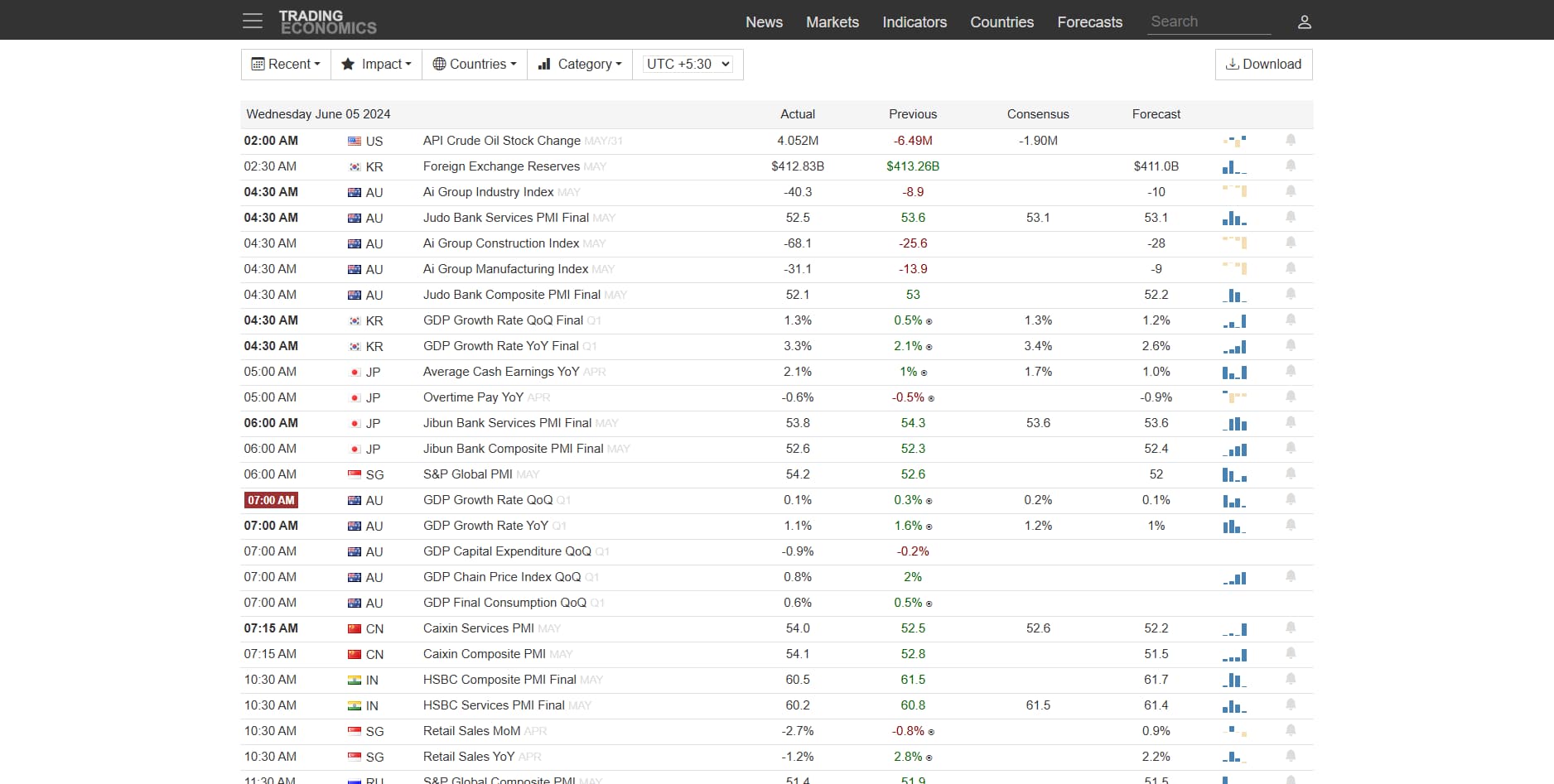

An economic calendar helps traders track upcoming economic events and predict their impact on the market. By using the calendar, traders can plan their exits in advance to avoid unwanted surprises and market volatility.

Fundamental analysis through Trading Economics

Fundamental analysis through Trading EconomicsHow to choose the right exit strategy?

Analyzing your trading style

Before choosing an exit strategy, it’s essential to understand your trading style. There are several types of traders: scalpers, day traders, swing traders, and long-term investors. Each style has its characteristics and requires different exit approaches. For example, scalpers, who make numerous short trades throughout the day, might prefer using support and resistance levels for quick exits. Long-term investors, on the other hand, may rely more on fundamental events and economic news.

Considering the level of risk and reward

Risk management is a crucial aspect of choosing an exit strategy. It's important to consider your comfort level with risk and your reward goals. Determine how much you are willing to lose in a single trade and what level of profit you consider sufficient. This will help you choose strategies that match your expectations. For example, trailing stops can be useful for those who want to protect their profits while allowing the trade to "grow." Fixed profit targets might be beneficial for traders who prefer clear and definite results.

Practical tips for choosing a strategy

Test different strategies. Before finalizing your choice, test several methods on a demo account. This will help you understand which strategies work best according to your style and goals.

Use a combination of strategies. Sometimes one strategy might not be effective under different market conditions. Consider using a combination of strategies, such as trailing stops and support and resistance levels, to achieve a more flexible approach.

Evaluate and adjust. Markets are constantly changing, and your exit strategy should adapt to these changes. Regularly assess the effectiveness of your chosen strategy and be ready to make adjustments as needed.

Learn and improve. Continuous learning and skill improvement will help you better understand the market and choose more effective strategies. Read books, attend webinars, and participate in trading communities to exchange experiences and learn about new approaches.

We have selected several brokers for safe and enjoyable trading. Working with these brokers will help you increase your capital. We invite you to familiarize yourself with the comparative table to make a reasoned choice.

| Demo | Min. deposit, $ | Max. leverage | Min Spread EUR/USD, pips | Scalping | Trading bots (EAs) | Open account | |

|---|---|---|---|---|---|---|---|

| Yes | 100 | 1:300 | 0,5 | Yes | Yes | Open an account Your capital is at risk. |

|

| Yes | No | 1:500 | 0,5 | Yes | Yes | Open an account Your capital is at risk.

|

|

| Yes | No | 1:200 | 0,1 | Yes | Yes | Open an account Your capital is at risk. |

|

| Yes | 100 | 1:50 | 0,7 | Yes | Yes | Study review | |

| Yes | No | 1:30 | 0,2 | Yes | Yes | Open an account Your capital is at risk. |

A poorly timed exit can quickly turn a profitable trade into a loss

As an experienced Forex trader, I cannot overstate the importance of a well-defined exit strategy. While entering a trade involves significant analysis and planning, the decision to exit can be even more crucial. A poorly timed exit can quickly turn a profitable trade into a loss, while a well-planned exit can secure gains and protect your capital. In my trading career, I have found that using a combination of exit strategies tailored to specific market conditions and my trading style has been the key to consistent success.

One of the most effective approaches I have used is combining technical indicators with fundamental analysis. For instance, I often rely on support and resistance levels to set initial exit points, but I also keep an eye on major economic events that could impact the market. This dual approach ensures that I am not only reacting to price movements but also anticipating potential market shifts. Additionally, the use of trailing stops has been invaluable in locking in profits while allowing trades to run in favorable market conditions.

Ultimately, the best exit strategy is one that aligns with your trading objectives and risk tolerance. It's essential to continuously evaluate and adjust your strategies as market conditions change.

Conclusion

We explored various exit strategies in Forex trading, including support and resistance levels, trailing stops, fixed profit targets, time limits, indicators and oscillators, and fundamental events. Each strategy offers unique advantages and can be customized to fit different trading styles and risk tolerance. A well-defined exit strategy is crucial for maximizing profits and minimizing losses, as it helps prevent emotional decisions. Practicing and adapting these strategies to your trading style is essential. Use a demo account to test different methods and make adjustments as market conditions change. Continuous learning and refinement will lead to greater success in Forex trading.

FAQs

What role does psychological discipline play in exiting trades?

Psychological discipline is crucial as it helps traders stick to their exit plans and avoid impulsive decisions that could lead to losses.

Can automated trading systems help with exit strategies?

Yes, automated trading systems can help by executing pre-set exit strategies, ensuring consistency and removing emotional bias.

How can market sentiment analysis aid in exit decisions?

Market sentiment analysis provides insights into the overall mood of traders, helping predict potential market reversals and optimal exit points.

What is the significance of volatility in deciding exit points?

Higher volatility can lead to more significant price swings, making it essential to set wider stop-loss and take-profit levels.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex indicators are tools used by traders to analyze market data, often based on technical and/or fundamental factors, to make informed trading decisions.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

The informal term "Forex Gods" refers to highly successful and renowned forex traders such as George Soros, Bruce Kovner, and Paul Tudor Jones, who have demonstrated exceptional skills and profitability in the forex markets.

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.