Forex Line Trading | Tips And Examples

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Forex line trading involves using lines such as trend lines, support, and resistance levels to predict future price movements. These lines help traders identify potential entry and exit points and understand market trends. Here are some Forex line trading tips:

Forex line trading is a simple and effective trading strategy based on the use of trend lines and support and resistance levels. In this article, we will discuss the top Forex line trading tips along with examples, risks related to this strategy, and impact of major events on this set-up.

Forex line trading tips and examples

Identify key support and resistance levels

Support and resistance levels are important parameters for identifying potential entry and exit points in trading. Support levels show where the price can stop falling and turn upwards, and resistance levels show where the price can stop rising and start declining.

Using these levels in combination with other technical indicators, such as moving averages, can enhance trading decisions. Traders can place buy orders near support levels and sell orders near resistance levels.

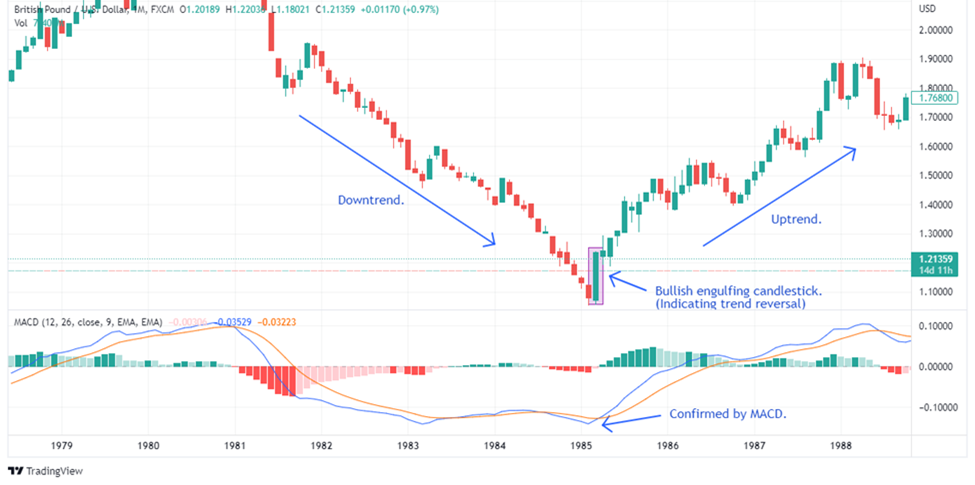

Use trend lines for market direction

Trend lines help in identifying the overall direction of the market. An uptrend is indicated by a line drawn along the lows, while a downtrend is marked by a line along the highs.

Trend lines are used not only to identify trends but also to predict potential reversals. When a trend line is broken, it can signal a change in market direction.

Incorporate moving averages

Moving averages smooth out price data to help identify the direction of the trend. Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) are the most commonly used types.

Combining short-term and long-term moving averages can provide signals for entry and exit points. For example, a buy signal occurs when a short-term moving average crosses above a long-term moving average.

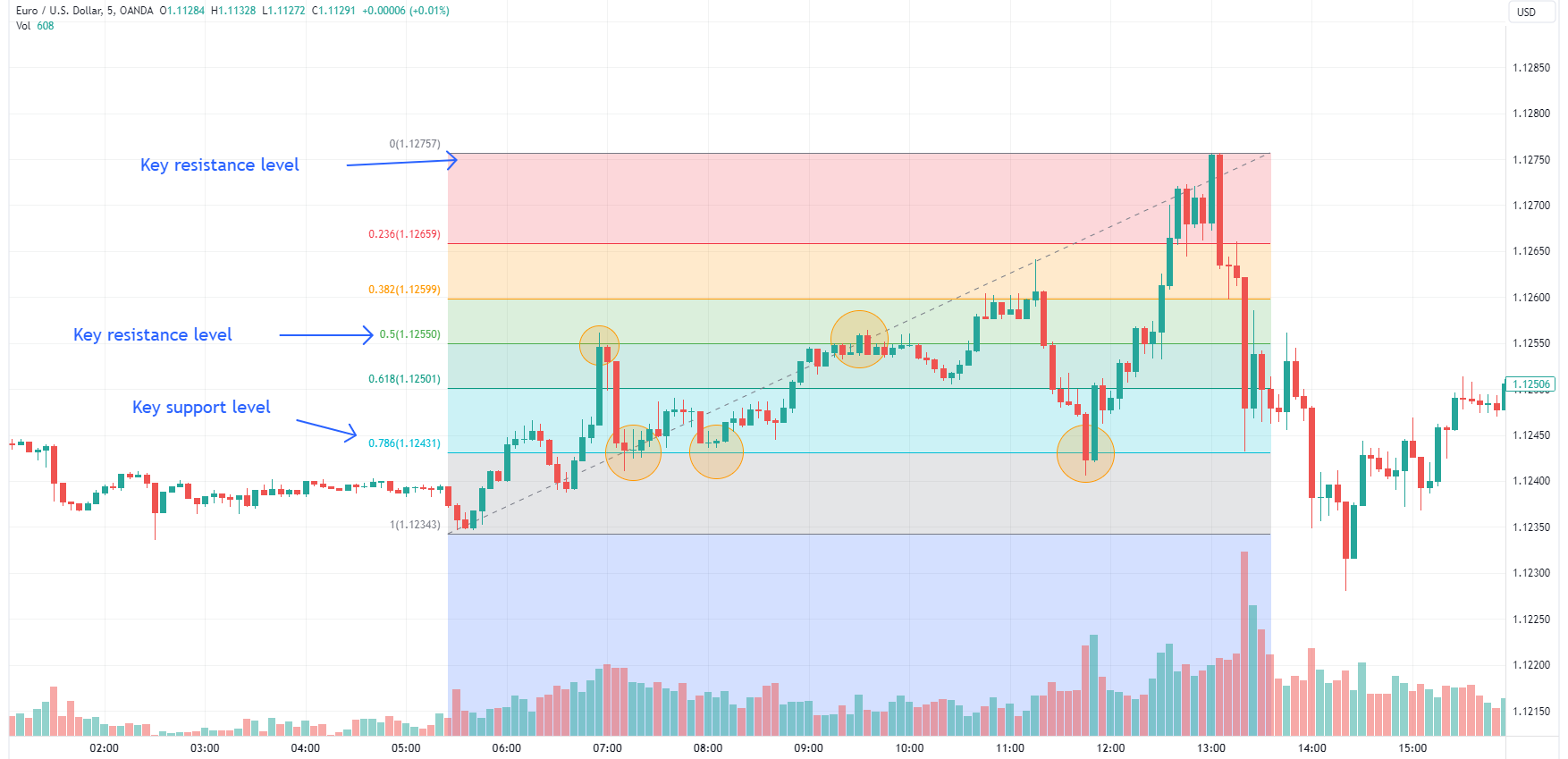

Leverage Fibonacci retracement levels

Fibonacci retracement levels help in predicting potential reversal points by identifying levels where price movements are likely to stall and reverse.

Fibonacci levels are used in conjunction with other indicators to confirm potential reversal points. Common retracement levels include 38.2%, 50%, and 61.8%.

Utilize price action trading

Price action trading focuses on historical price movements to make trading decisions. It involves analyzing candlestick patterns, chart patterns, and trend lines. Key price action patterns like pin bars, inside bars, and engulfing patterns can provide signals for entering or exiting trades.

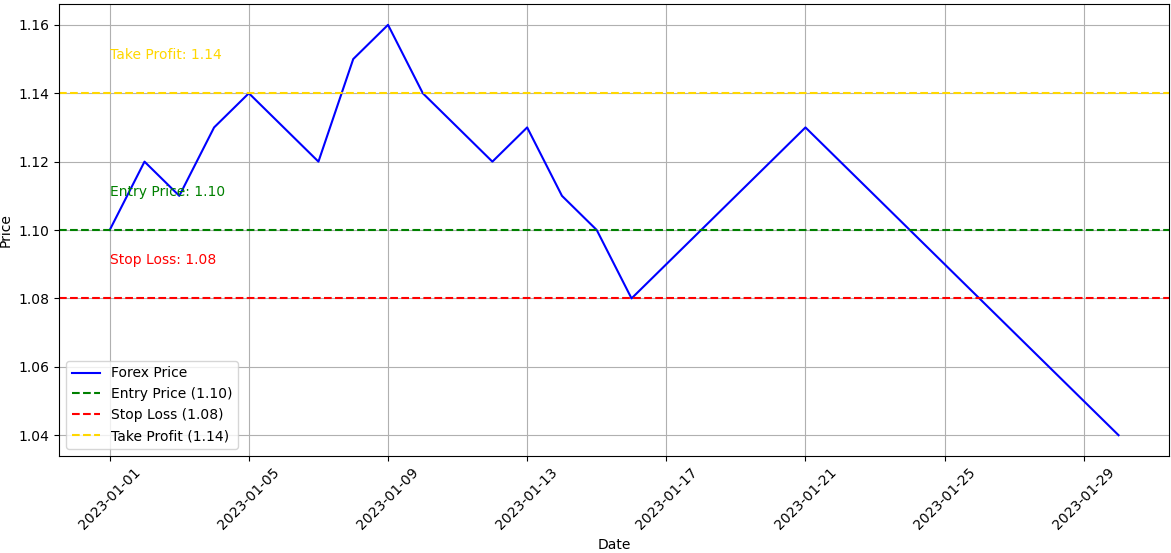

Implement risk management techniques

Risk management is crucial in trading. Using stop-loss and take-profit orders helps manage potential losses and secure profits.

Proper risk management strategies can significantly improve long-term trading success. Traders should never risk more than a small percentage of their capital on a single trade.

Risks and how to avoid them

The main risks that you may encounter in Forex line trading and their mitigation strategies are discussed below:

Market volatility can lead to significant price swings, increasing the potential for both gains and losses;

Leverage risks can amplify both gains and losses, making it a double-edged sword in trading;

Economic and geopolitical risks can bring large movements in Forex prices.

How to avoid them:

Setting stop-loss orders can help limit potential losses and protect your capital;

Diversifying your investments across multiple assets can help reduce overall risk;

Adjusting trade size based on risk tolerance and account size helps manage potential losses.

Recommendations on Forex line trading

There are a few key recommendations that can really help you up your Forex trading game. First off, mastering the basics is essential. Make sure you understand how to draw and use trend lines, as well as identify support and resistance levels. These tools are helpful for spotting trading opportunities and making smart decisions.

Another important tip is to keep an eye on moving averages. They can help you identify trends and potential reversals, giving you a clearer picture of the market. Don't forget about risk management either. Always set stop-loss orders to protect your capital and avoid significant losses.

Next thing to keep in mind is staying disciplined. Stick to your trading plan and don't let emotions drive your decisions. Consistency and a clear strategy are your best friends in trading.

Lastly, never stop learning. The Forex market is constantly evolving, so keep educating yourself. Read market reports, take online courses, and stay updated with financial news. The more you learn, the better you'll become at anticipating market movements and making profitable trades.

Conclusion

Forex line trading is a simple strategy using trend lines and support and resistance levels. A major part of the strategy is identifying support and resistance levels to spot entry and exit points, where buying is done near support and selling is done near resistance. For traders using this strategy, applying risk management techniques, such as stop-loss and take-profit orders is important for managing losses and securing profits. Risks in Forex line trading include market volatility, leverage, and geopolitical events. These can be mitigated by setting stop-loss orders, diversifying investments, and adjusting trade size. Finally, maintaining discipline, adhering to a trading plan, and continuous learning are key for improving trading skills and making profitable trades.

FAQs

How do I draw trend lines on a Forex chart?

To draw a trend line, connect at least two high points for a downtrend line or two low points for an uptrend line. The more points a trend line touches, the more significant it becomes.

What are support and resistance levels in Forex trading?

Support levels are price points where a currency tends to find buying interest and stop falling, while resistance levels are points where selling interest prevents the price from rising. Identifying these levels helps in making informed trading decisions.

Why are moving averages important in Forex trading?

Moving averages smooth out price data to help identify trends. They are used to generate buy and sell signals based on crossovers and to confirm the direction of the trend. Common types include Simple Moving Averages (SMA) and Exponential Moving Averages (EMA).

How can Fibonacci retracement levels be used in Forex trading?

Fibonacci retracement levels are used to identify potential reversal points by dividing the vertical distance between high and low points by key Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 100%). These levels help predict where the price might retrace before continuing in the original direction.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.