What Is The Zigzag Indicator?

ZigZag is a popular technical analysis indicator that looks like a broken line on a price chart (hence the name) and is based on past important extremes. Analysts use the ZigZag indicator to identify trends and their reversals, but this can be tricky because ZigZag is a lagging indicator that can be redrawn on the chart.

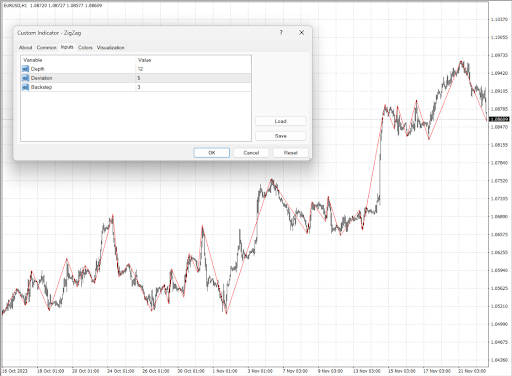

Zigzag indicator is used to filter out insignificant price movements. It points out whenever the price changes more than pre-specified rate of percentage. The screenshot below shows that if you add the ZigZag indicator to a chart in the Metatrader platform, a red broken line will appear above the price candles.

Zigzag indicator. Metatrader

-

Is ZigZag a lagging indicator?

Yes, it is a lagging indicator because the lines are plotted only after the closing of the time period. It means the indicator will draw a permanent line only after the price has moved significantly.

How the Zigzag indicator works?

A trader can see Zigzag lines only when there is a price movement between a swing highs and swing lows. Generally, the indicator lines will appear only when there is a price movement more than a certain percentage, say 5%. It helps traders in identifying trends by reducing irrelevant price changes in charts in all the time frames.

How to calculate the ZigZag indicator?

There are mainly three parameters based on which Zigzag indicator is calculated. These parameters and calculations are as follows:

Fix price level. To set the percentage-based threshold, traders need to choose a percentage value, such as 5%. It means the indicator will only consider price movements exceeding 5% as significant. Alternatively, for a fixed value threshold, you specify a specific price amount, like $1. If the price moves more than $1, the ZigZag indicator will recognize it as significant.

Depth. Depth refers to how significant a price movement must be before the ZigZag indicator draws a line. For example, if you set the depth at 10 points, the indicator will only draw lines when the price moves at least 10 points in the chosen direction.

Retrace. The retrace parameter determines the percentage or value by which the price must retrace from a significant high or low before a new ZigZag line is drawn. If you set the retrace value at 5%, it means the price must retrace 5% from the last significant high or low before a new line is drawn.

Pros and cons for using a Zigzag indicator

The primary advantage of using the Zigzag indicator is that it is highly effective in making quick decision making by letting traders know about the right potential market trends. Traders don’t have to consider the minor price fluctuations that might be random.

However, there are two primary cons that a trader has to consider when using a Zigzag indicator. These are as follows:

Redraws trend lines

If the price continues to move after a line is drawn, it might decide to redraw that line which can be confusing and might lead to making wrong trading decisions.

Not a standalone tool

While the ZigZag indicator is helpful, it's not a magic solution by itself. To make well-informed trading decisions, it's often best to combine it with other technical analysis tools and indicators.

What is the ZigZag indicator used for?

There are mainly three reasons to use Zigzag indicators as a primary tool for traders. These are as follows:

Zigzag indicator for trend identification

It draws lines on the chart that follow the direction of the price movement, making it easy to spot whether the market is going up or down.

Zigzag indicator for trend reversal identification

When the ZigZag lines change direction, it signals that there might be a shift in the market's momentum. It is valuable information for traders looking to time their entries and exits.

Zigzag indicator for support and resistance identification

These are price points where the market often reacts. The ZigZag indicator highlights these levels by connecting significant highs and lows, which can be useful for making trading decisions.

Conclusion

ZigZag indicator is a versatile tool that traders can use to enhance their technical analysis. It helps identify trends, potential reversals, and critical support and resistance levels. However, traders should be aware of its limitation, the potential for redrawn tops or bottoms. By understanding how to use the indicator effectively, traders can make more informed decisions and improve their trading strategies.

However, it is important to understand the drawbacks of using the tool so that potential losses can be avoided.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Professionally, he has been a marketing professional running his agency for three years now. His agency helps finance projects to grow with the help of internet technologies. Upendra Goswami is an active investor and enthusiast of stocks and cryptocurrency.

Knows about

trading, blockchain, cryptocurrency, stock trading

Alumnus of

JECRC UDML College of Engineering, Jaipur

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.