Best Options Trading Apps Reviews

The best options trading app in 2024 - eToro

Top options trading apps in 2024 are:

-

1

eToro - best for beginners in the United States

-

2

Degiro - best in Europe

-

3

Saxo Bank - best for international clients

-

4

eOptions - best for comfortable trading

-

5

Cap Trader - best for access to a wide range of financial instruments

-

6

SwissQuote - trustworthy and low-risk

-

7

Interactive Brokers - best for Day traders

In this article, the experts at TU will look at the best apps that provide options trading. They will also analyze options strategies that you can use to trade and lay down some tips to select the best options trading app in the market. Furthermore, the experts will give you some tips on how you can manage your risk effectively.

List of the best options trading apps

eToro - best for beginners in the United States

| Parameter | eToro |

|---|---|

Options trading fee per contract |

$1 |

Minimum deposit |

USD 200 |

Fees class |

Low |

Deposit method |

Bank transfers, eToro Money, PayPal, Skrill, and Neteller |

Withdrawal method |

Same as deposit methods |

Withdrawal fee |

$5 withdrawal fee |

Number of trading instruments |

5,000+ instruments from a wide range of asset classes |

Inactivity fees |

$10 per month after twelve months of inactivity |

eToro serves as an accessible entry point for newcomers venturing into the realm of options trading. Designed with a user-centric approach, the platform offers a suite of tools aimed at guiding beginners on their initial trading path.

Best features:

Simplicity in design

eToro's interface is tailored to be straightforward, ensuring a seamless introduction to the world of trading.

Copy-trading

For those less versed in options trading, the platform allows users to replicate the strategies of experienced traders, offering valuable insights and knowledge.

Smooth registration

The platform's onboarding process has been optimized for efficiency, enabling swift and hassle-free account setup.

Diverse asset portfolio

eToro spans across a spectrum of assets, including cryptocurrencies, stocks, and ETFs, catering to the varied preferences of users.

Interactive learning environment

By fostering interactions among traders, eToro creates an environment conducive to collaborative learning, allowing beginners to learn from others' experiences and enhance their trading understanding. This community-driven aspect adds an extra layer of value to the platform's offerings.

Degiro - best in Europe

| Parameter | Degiro |

|---|---|

Options trading fee per contract |

€2 |

Minimum deposit |

Nil |

Fees class |

Low |

Deposit method |

Bank Transfer |

Withdrawal method |

Bank Transfer |

Withdrawal fee |

Nil |

Time to Open Account |

Signing up just takes 15 minutes on average, while the approval of your account could take 1 day. |

Inactivity fees |

Nil |

DEGIRO, originally established in 2008 as an institutional broker, has transitioned to offer accessible retail services since 2013. Operating across 18 European countries, it has amassed a vast clientele, making it a significant player in Europe's brokerage scene.

Best features:

Global exchanges access

DEGIRO provides access to over fifty exchanges in thirty countries, enabling traders to diversify investments across the globe.

Comprehensive technical analysis

Traders benefit from about twenty technical indicators and the ability to compare charts with various indices, offering data-driven insights.

Client-centric innovation

The platform's continuous improvements, fueled by user feedback, ensure an evolving trading experience that aligns with users' evolving needs.

Low fees and no minimum deposit

DEGIRO boasts competitive fees and doesn't impose a minimum deposit requirement for account opening.

User-friendly interface

With a focus on catering to both beginners and experienced traders, the platform offers an interface designed for ease of use.

Saxo Bank - best for international clients

| Parameter | Saxo Bank |

|---|---|

Options trading fee per contract |

from $0.75 |

Minimum deposit |

1 EUR |

Fees class |

Low |

Deposit method |

Bank transfer, credit/debit cards |

Withdrawal method |

Bank transfer, credit/debit cards |

Withdrawal fee |

No |

Time to Open Account |

71,000+ |

Inactivity fees |

No |

Saxo Bank is an online trading platform that offers trading in stocks, ETFs, futures, options and more across global markets. For options trading, broker provides access to options on individual stocks and indices listed on major global exchanges like NYSE, NASDAQ, CBOE, Euronext etc. Totally 20 exchanges are available.

Best features:

Advanced trading platforms

SaxoTraderGO and SaxoTraderPRO are known as powerful trading platforms, providing advanced order types, research and analytics tools.

Strong regulation

Saxo Bank is regulated by multiple financial authorities globally, including in the UK, Denmark, Australia, Switzerland. This provides assurance that broker adheres to high regulatory standards, allowing traders secure access across jurisdictions.

Extensive options offering

Saxo Bank offers a wide range of options contracts on stocks, indices, commodities, and currencies, with 3500+ options instruments available for trading.

Option strategies

Broker offers a library of predefined option strategies, including covered calls, iron condors, and butterfly spreads, to help traders develop and execute complex trading plans.

Low commissions and fees

The company offers competitive commissions and fees on options trades, making it an affordable option for traders.

eOption - best for comfortable trading

| Parameter | eOptions |

|---|---|

Options trading fee per contract |

$0.65 |

Minimum deposit |

No minimum deposit for U.S. residents; International accounts require a minimum of $25,000 equity |

Fees class |

Low |

Deposit method |

Wire Transfer, Electronic Transfer (ACH), Cheque, Account Transfer, Stock Certificate, and Depositing Funds and Securities |

Withdrawal method |

Same as deposit methods |

Withdrawal fee |

First withdrawal free, then 2% per transaction |

Inactivity fees |

$50 inactivity fee on accounts that haven’t traded at least twice in the past 12 months or have less than $10,000 in credit or debit balances |

Launched in 2007 under the umbrella of its parent company, Regal Securities—a seasoned player since 1977—eOption has been purposefully designed to cater to options and equities traders. This brokerage platform distinguishes itself by targeting traders who value competitive costs and efficient trading. Geared towards both occasional traders and those with more active involvement, eOption's value proposition extends beyond mere pricing considerations. Maybe, you are also interested in information about eOption available countries.

Best features:

Low cost

eOption shines as an ideal hub for those frequently engaged in options trading, offering cost-effective solutions that align with their trading frequency.

Browser-based platform

Positioned for accessibility, the browser-based trading platform ensures an intuitive interface for swift and convenient order entry.

Educational outreach

While it may not have an extensive resource arsenal, eOption is actively enhancing its educational outreach, aiming to empower traders at all skill levels.

Transparent trading costs

eOption prioritizes clarity by displaying trading costs, including exchange fees, during the order verification process. This feature contributes to a more informed trading experience.

Diverse trading platforms

Alongside eOption Trader, the platform offers access to Sterling Trader Pro, DAS|WEB, and DAS|Pro Direct Access Trading platforms, expanding options for high-frequency traders.

CapTrader - best for access to a wide range of financial instruments

| Parameter | CapTrader |

|---|---|

Options trading fee per contract |

$0.75 |

Minimum deposit |

$2,000 |

Fees class |

Low |

Deposit method |

Bank transfer |

Withdrawal method |

Bank transfer |

Withdrawal fee |

Nil |

Number of trading instruments |

|

Inactivity fees |

For portfolio value < $1,000, a monthly fee of $1 applies |

Established in Germany in 1997, CapTrader serves as an introducing broker to Interactive Brokers, tapping into the renowned Interactive Brokers software for its trading activities. With a strong foothold in Dusseldorf, CapTrader positions itself as a conduit to a comprehensive array of trading instruments, spanning various asset categories and trading tools.

Best features:

Platform variety

CapTrader's offerings include multiple platforms, ranging from the sophisticated Trader WorkStation (TWS) tailored for shares, ETFs, futures, and options trading, to the user-friendly Web Trader, and the convenient Mobile Trader app.

Broad asset access

Traders can delve into Forex, commodities, stocks, ETFs, futures, options, and CFDs, thereby accessing an extensive spectrum of trading opportunities.

Client fund security

A commitment to safeguarding traders' interests is evident through the practice of keeping all funds in segregated accounts, isolated from the broker's own funds.

Negative balance protection

CapTrader prioritizes financial security by ensuring that traders are protected from incurring negative balances, thereby mitigating potential deficit risks.

Robust analytics and analysis

Equipping traders with analytical tools for both fundamental and technical analysis, CapTrader fosters informed decision-making through a range of resources that enhance trading proficiency.

SwissQuote - trustworthy and low-risk

| Parameter | SwissQuote |

|---|---|

Options trading fee per contract |

CHF1.50 / €1 |

Minimum deposit |

$0 |

Fees class |

Low |

Deposit method |

Wire transfer, credit/debit card, and online payment services |

Withdrawal method |

Bank transfer |

Withdrawal fee |

$10 |

Inactivity fees |

$10 for inactivity of 6 months |

Founded in 1996 in Switzerland, Swissquote Group has earned a position of trust and recognition in the world of brokers. With a listing on the Swiss stock exchange and a substantial client base spanning Europe, Asia, the Middle East, and Latin America, Swissquote operates as a legacy broker authorized by prominent regulators. This enables robust protection for traders and a range of offerings, both of which contribute to its reputation.

Best features:

Advanced charting tools

Swissquote offers traders advanced charting tools, enhancing their analytical capabilities and enabling better decision-making.

Multinational account access

With accounts across multiple regions, Swissquote traders can access a broad range of options, currencies for Forex trading, CFDs on stock indices, commodities, bonds, and more.

Expert advisors and Autochartist

Through the MT4 platform, traders can employ Expert Advisors for copy trading and utilize the Autochartist tool for devising their trading strategies.

Educational resources

Swissquote provides notable educational resources to assist traders in gaining deeper insights and improving their trading prowess.

Key consideration regarding SwissQuote’s dual platforms

Traders must distinguish between the offerings of Swissquote's London-based EU-branded platform and its Switzerland-based banking ecosystem to align their trading needs effectively.

Interactive Brokers - best for Day traders

| Parameter | Interactive Brokers |

|---|---|

Options trading fee per contract |

$0.65 |

Minimum deposit |

Nil |

Fees class |

Low |

Deposit method |

Bank Transfer, Credit and Debit cards |

Withdrawal method |

Same as deposit methods |

Withdrawal fee |

First withdrawal is free, subsequent are chargeable |

Time to Open Account |

1 day |

Inactivity fees |

Nil |

Catering to professional investors and day traders, Interactive Brokers stands as a preferred choice for those deeply committed to trading. The platform offers an extensive suite of tools, research capabilities, and a comprehensive menu of investment types. With both desktop and mobile versions, Interactive Brokers caters to various trader profiles.

Best features:

Comprehensive research and analysis

The IB Trader workstation boasts a wealth of tools for researching, tracking, and executing investments, supported by a rich variety of indicators.

Competitive commissions and fees

Interactive Brokers maintains competitive commissions and fees, with options for both individual investors and more experienced traders.

Wide range of asset classes

Encompassing nearly every major asset class, Interactive Brokers provides access to international markets across a significant number of countries.

IBKR Lite for beginners

The platform acknowledges beginners with IBKR Lite, a more approachable version, offering commission-free trades on U.S. stocks, ETFs, and mutual funds.

Interactive AI tool

For assistance and answers, Interactive Brokers integrates an AI tool that aids in addressing traders' queries and facilitating trades.

AvaTrade (AvaSocial) - for FX options trading

| Parameter | AvaTrade |

|---|---|

Options trading fee per contract |

$1 |

Minimum deposit |

$100 |

Fees class |

Low |

Deposit method |

Credit cards, wire transfer, Skrill, Perfect Money and Neteller |

Withdrawal method |

Same as deposit methods |

Withdrawal fee |

Nil |

Inactivity fees |

$50 after 3 months of inactivity |

With a strong presence since its inception in 2006, AvaTrade positions itself as a leading online Forex and CFD broker, focusing on customer empowerment. Having an impressive clientele spanning over 150 countries, AvaTrade has historically upheld a trading experience aligned with its clients' expectations.

Best features:

AvaOptions platform

AvaOptions introduces a distinctive way to display option-chain data, making trading strategies more accessible and intuitive.

Proprietary and MetaTrader platforms

AvaTrade offers a range of platforms, including its proprietary AvaTradeGO and AvaOptions, along with MetaTrader (MT4 and MT5) for Android and iOS devices.

AvaProtect volatility protection

An innovative feature, AvaProtect, allows traders to reduce risk on open trades through partial hedging with Forex options.

Charting and indicators

The AvaTradeGO app provides traders access to 93 indicators and integrated research tools, enhancing chart analysis capabilities.

Educational resources

Committed to education, AvaTrade equips traders with resources to expand their knowledge and trading skills, contributing to their overall success.

Best options strategies

Covered call

A covered call is a way to earn additional yield on your shareholdings by risking the outcome of being forced to sell your shares. If you own shares in a company and think the price wouldn’t rise much, you can sell a call option on those shares, which would give others the right to buy your shares later at a set price. If the price stays below the agreed upon option exercise price, you get to keep the premium earned for that option. If it goes higher, the call option will get exercised and you will have to sell your shares.

Covered call strategy Illustration

Consider this illustration, where an investor is long 100 $SPY ETF shares at a price of $436.39 per share. They may write an out-of-the-money call option contract (of 100 shares) at exercise price of $441 and receive roughly $6.12 in premium income per share (total $612). Their net position will be safe as long as the price of $SPY does not fall below $430.27, which is the break even point. If the price closes below this point at expiry, the investor will book a loss equivalent to (loss on shares – total premium earned, i.e. $612). Moreover, they may earn a maximum profit of $1,074 ($612 + $462 price appreciation from current price of $436.39) if the price of $SPY closes at or above $441 at expiry.

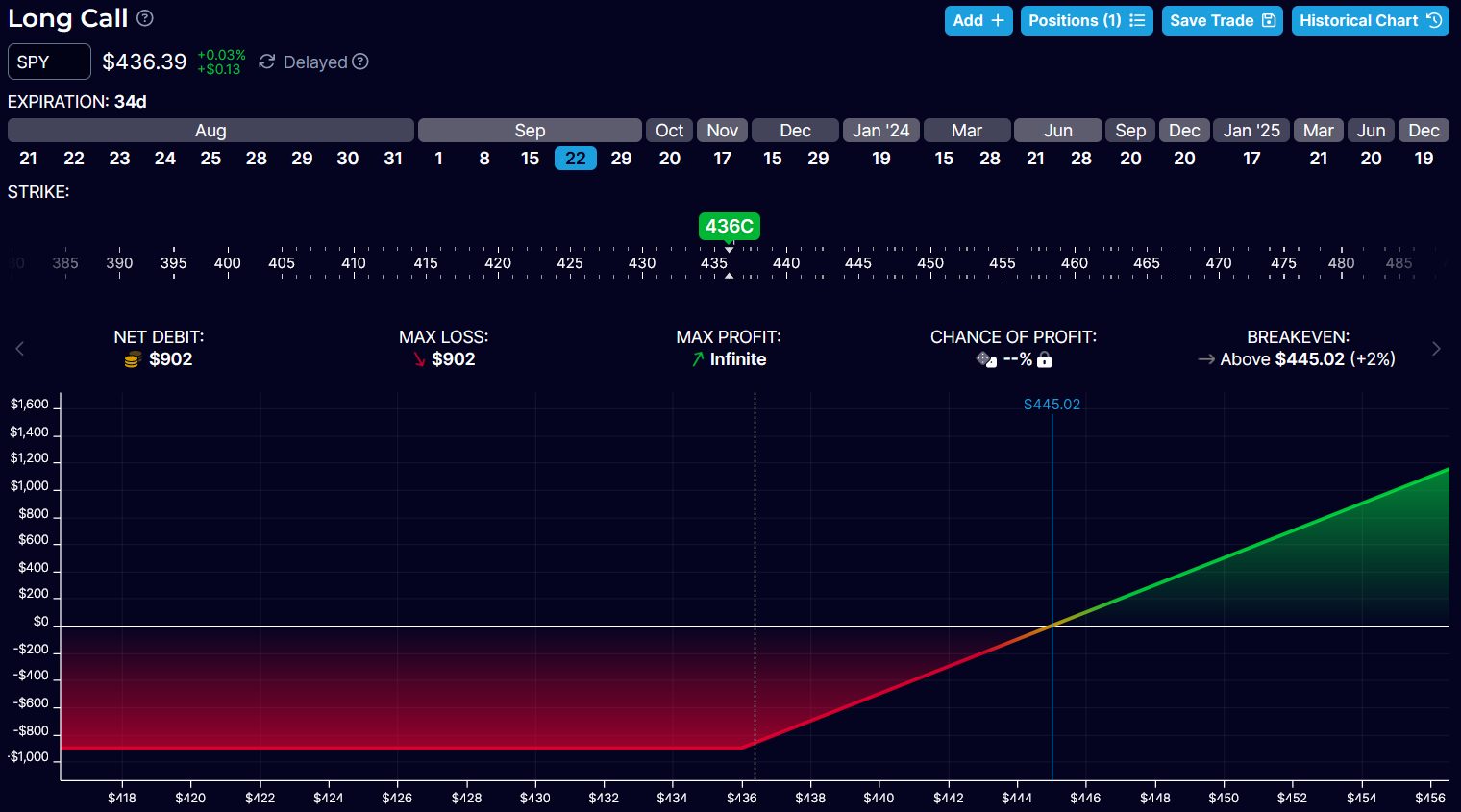

Long call

A long call is like reserving a deal. You believe a company's stock will rise, so you pay a small fee to buy the right to purchase the shares at a set price later. If the shares rise, you buy at the lower price you reserved. If not, you only lose the fee.

Long call strategy Illustration

Consider this illustration, where an investor purchases a $436 strike call option on $SPY shares at a premium of $9.02 per share (total premium of $902). This gives them the right to buy 100 $SPY shares at a price of $436 per share at expiry. Their holding will turn profitable when $SPY crosses above $445.02, which is the breakeven point (Strike price of $436 + premium paid of $9.02). If the price closes below $436 at expiry, the option will expire worthless and the investor may face the maximum loss of $902 (which was the total premium paid). The maximum profit for the investor here is unlimited, given that share price can theoretically rise indefinitely.

How to choose the best options trading apps

When deciding on an options trading app, consider the following factors to ensure you make the right choice:

Cost and commissions

Try to opt for those apps that offer competitive or commission-free trading. An app with a high fee can eat into your profits, so choosing a platform that aligns with your budget and trading goals is very important.

User-friendly interface

Before trading, check if the app has an intuitive interface. A user-friendly app makes executing trades, research, and monitoring your portfolio easier.

Educational resources

An app offering options trading should offer educational content for beginner and advanced traders. This could include articles, videos, and webinars on complex options strategies.

Charting and analysis tools

Good charting features and options analysis tools like option chains and volatility calculators are important in making informed decisions.

Order execution

Always choose an app that has a reliable and fast order execution. A delay or an error in executing the trade can lead to missed opportunities or losses.

Mobile compatibility

In today’s remote and fast-paced world, every app should have its own mobile version so that you can trade on the go.

Variety of options

While selecting an app, make sure that the app provides a wide range of options contracts, and assets to trade. Diverse options allow you to tailor your strategy to different market conditions.

Demo Accounts

Some apps provide paper trading apps that allow you to practice trading with virtual funds. This is an excellent way to familiarize yourself with the platform and test different strategies before using real money.

How much money do you need for options trading?

The capital required for options trading varies significantly and depends on several factors, including your trading goals, risk tolerance, chosen trading strategy, and the type of underlying assets you plan to trade. Here's a closer look at these factors:

Trading goals

If you want to generate consistent income through options trading, you will need to start with a much larger capital. On the contrary, if you are aiming for occasional trades or speculative positions, you may require much less capital.

Risk tolerance

Options trading is inherently risky, and having a higher risk tolerance will allow you to deploy more capital to options trading. On the other hand, if you are risk averse, you can approach trading with a more conservative approach and take smaller positions.

Trading strategy

Different strategies have varying capital requirements. Strategies like covered calls or cash-secured puts typically require less capital as they involve hedging and conservative positions. More complex strategies like iron condors or straddles may require larger capital due to potential higher risks.

Underlying assets

Your capital needs and allocation depend on the type of assets that you’re willing to trade. You can trade options on individual stocks, ETFs, indices, or commodities, and each has its own different requirements.

Is options trading risky?

Yes, options trading carries inherent risks, but there are strategies you can employ to help reduce and manage these risks. Here's how to navigate options trading while minimizing potential downsides:

Educate yourself

To effectively manage your risk, understand the fundamentals first. Learn about the basics of options, their different strategies, and how they work. You can invest time and learn about market conditions, trends, and other factors that influence options prices.

Start small

Begin with a modest capital allocation. This minimizes potential losses while you're learning the ropes. As you gain experience and confidence, you can gradually increase your trading size.

Risk management

Use stop-loss orders to limit potential losses on individual trades. Determine the maximum percentage of your trading capital you're willing to risk on any given trade.

Choose conservative strategies

Strategies like covered calls and cash-secured puts are considered more conservative as they provide downside protection. They are suitable for traders seeking steady income while minimizing risk exposure.

Understand probabilities

Options trading involves assessing probabilities. Learn how to analyze option Greeks, like delta and theta, to gauge potential outcomes and risks.

Risk-reward ratio

Evaluate the potential risk and reward of each trade. Consider trades with a favorable risk-reward ratio, where potential gains outweigh potential losses.

FAQ

What is the best trading platform in 2024?

The best trading platform can vary based on individual preferences and needs. Research and compare options to find what suits you.

How do I trade options on Robinhood 2024?

To trade options on Robinhood, open the app, find an option you want, select "Trade," choose your strategy, set details, and confirm the trade.

Which broker is best for futures and options?

There are several brokers catering to futures and options trading. Research and compare features, fees, and tools to find the best fit for you.

Which is the best app for option chain?

Various trading apps offer option chain data. Explore app reviews and features to find the one that provides reliable option chain information. Opstra is one such platform that provides reliable data on option chains.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).