Fake Forex Brokers List | Australia

Due to a structured and moderately liberal regulatory framework, Australia has become one of the fastest developing and most promising Forex centers. Brokers can count on flexible regulation there, and traders can count on favorable trading terms. However, this does not mean that Australian Securities and Investments Commission (ASIC) allows brokerage organizations to engage in misconduct. ASIC requires strict compliance with local legislation and revokes licenses of those who go beyond the legal field.

In this article, the Traders Union will explore the Fake Forex Brokers List for Australia, which contains a series of companies that have been caught in fraud. Let's look at the main signs of these scam projects and how they are trying to lure traders into their trap.

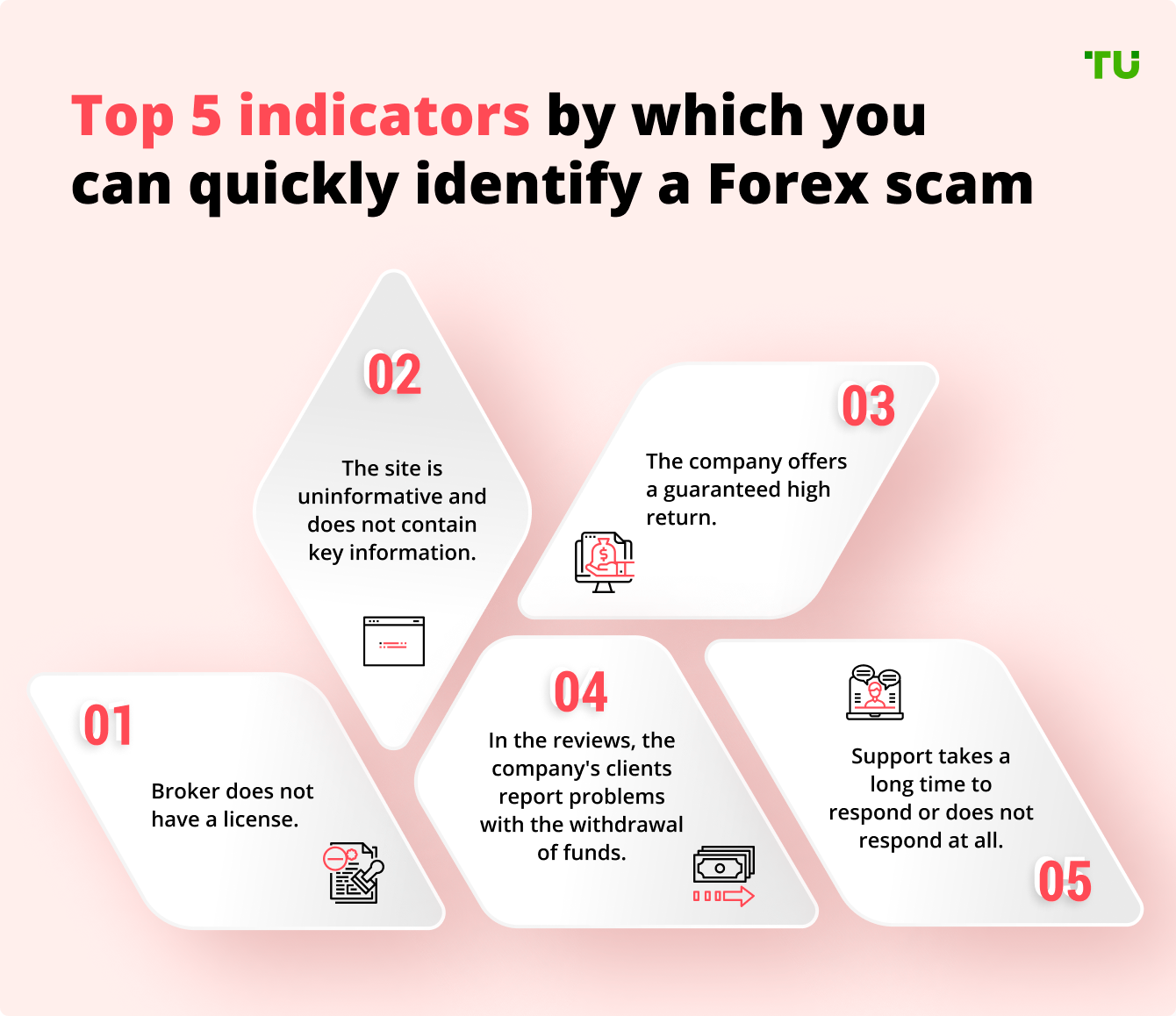

5 Indicators which help you to identify a scam

Is Forex legal in Australia?

Forex is an international currency market where traders earn money through transactions using various assets (currency pairs, raw materials, stocks, indices, etc.). The number of Australian retail investors is increasing every year. According to Finance Magnates, about 25 million people live in the country and it has the highest percentage of traders per capita.

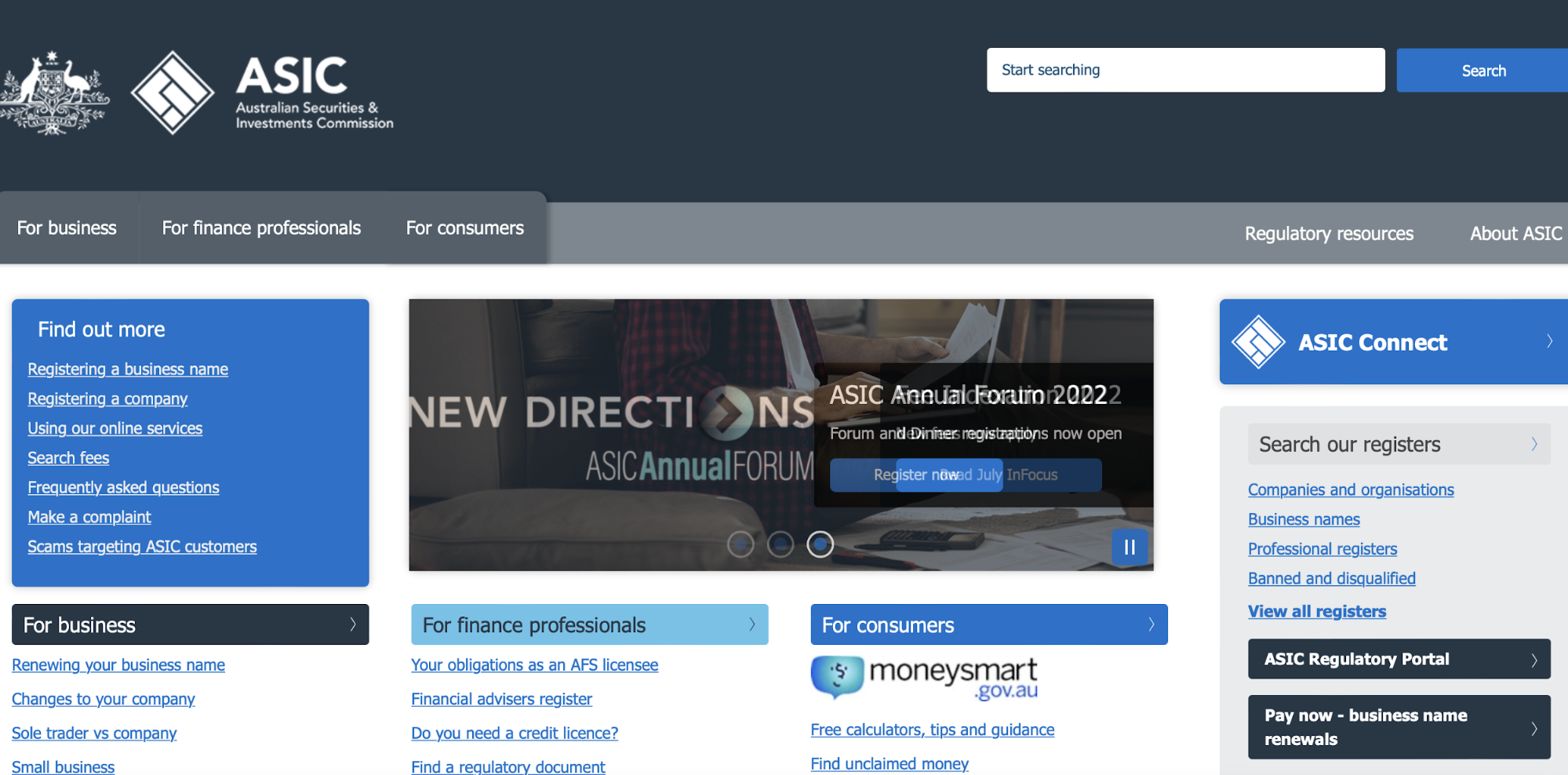

The activities of Forex brokers are regulated. In 2020-2021, Australian Securities and Investments Commission issued 339 new licenses against 565 applications for registration that were submitted. Information about all licensed companies is publicly available on the official website of the regulator. You can check the registration date, controlled domains, etc.

Australian Securities and Investments Commission

ASIC is guided in its operation by the Corporations Act (2001), the Insurance Contracts Act (1984), and the National Consumer Credit Protection Act (2009). To obtain a license, several conditions must be met. In particular, the broker must have a working capital of at least $1 million. For traders, cooperation with a licensed ASIC broker is a guarantee of reliability and security of capital. Also, Australian investors can choose financial partners with American or European licenses from reputable regulators such as BaFin, FCA, and others.

Forex License Types - Best Forex Trading RegulatorsBlacklist of Forex brokers in Australia

In order not to get into a financial scam, you should check the Forex Scammer List. This includes fake brokerage organizations that have managed to deceive a large number of people and show no sign of letting up.

In the table below you will see a list of scammers, the date of the foundation of scam projects, and the minimum losses that can be incurred in cooperation with them. The Traders Union will also give a brief overview of these brokerage organizations and reveal the main facts of each method of scam. Do not lose your vigilance; save your capital.

| Name | Establishment date | Minimal losses |

|---|---|---|

10brokers com |

2017 |

$50 |

Arena FX |

2012 |

$1 |

Axis Capital Group |

2020 |

$250 |

Fibonetix |

2018 |

$250 |

FTO Capital |

2016 |

$250 |

KontoFX |

2018 |

$250 |

PrivateFX |

2015 |

$100 |

Trade Ltd |

2018 |

$200 |

UFX |

2007 |

$100 |

AGM Markets |

2011 |

$250 |

BlaFX |

2015 |

$25 |

SJB capital limited |

2020 |

$250 |

KLM Trade |

2010 |

N/A |

10brokers

10brokers offers Forex trading, as well as working with binary options. The company has been known since 2017. Initially, it got good reviews, but judging by the latest feedback on the web, it has already started scamming and stopped fulfilling its obligations. The broker does not have a certificate of incorporation or a trading license, and the company is blacklisted by the Australian regulator. The minimum loss in this scam project is $50.

The main signs of its scams include:

-

absence of legal grounds for operation;

-

problems with releasing profits (clients complain that it is impossible even to withdraw the initial deposit);

-

non-fulfillment of assumed obligations and disclaiming any financial liability;

-

slow responses by technical support, traders have to wait for several hours;

-

spoiled reputation on the web.

ArenaFX

ArenaFX was "awarded" a place in the Forex Scam List for a reason. It conducts illegitimate activities and appropriates traders’ deposits. The company has been working for several years and managed to deceive a large number of people, as evidenced by many negative reviews. The minimum loss is $1, but the scammers do not limit themselves to that amount. They give empty promises and use psychological pressure to get financial injections in large amounts.

The main signs of its scams include:

-

offshore registration in the Virgin Islands and absence of a brokerage license;

-

financial extortion;

-

fake trade advice that leads to the loss of traders’ deposits;

-

complete absence of payment discipline;

-

fake contact details;

-

refusal unilaterally to cooperate.

Axis Capital Group

According to legend, the Axis Capital Group brand is managed by ACG Financial Management Limited, a British company, but it is owned by the Olympus Investment LLC offshore company (Saint Vincent and the Grenadines). This fraudulent broker deliberately creates confusion and deceives about a long-term operation. In fact, the project was launched only in 2020. The company lures newcomers with a wide choice of trading tools, a moderate entry barrier, and promises of qualified support. In the reviews, real clients note that the company lies with every word.

The main signs of its scams include:

-

operating without a license, in violation of international standards and regulations;

-

the imposition of bonuses at the first deposit of funds and the enslaving conditions of their processing;

-

manipulated trading software that scammers use for personal gain;

-

groundless refusals to pay profits.

Fibonetix

Fibonetix was founded in 2018. The broker is managed by Zeus Tech & Trading Group Ltd based in Luxembourg. The platform has access to trading a wide range of assets, margin trading with leverage up to 400x, and analytical and auxiliary tools. The entry barrier is $250, several tariff plans with varied features are offered.

The main signs of its scams include:

-

complete legal insecurity due to the absence of a license;

-

presence in the ASIC blacklist;

-

manipulates trading software;

-

exaggerated leverage;

-

issues with support;

-

refusals to withdraw funds.

FTO Capital

FTO Capital claims to be registered in the UK, but there is no license from the FCA regulator at the place of registration of the company. ASIC has already blacklisted this broker, as it does not fulfill its obligations and pursues exclusively its own lucrative goals. MetaTrader 4 and WebTrader are offered by the company as trading software, and the minimum deposit is $250.

The main signs of its scams include:

-

violation of international standards and regulations;

-

unregulated activity;

-

abnormal widening of spreads during trading operations;

-

refusal to withdraw profit for fictitious reasons;

-

rude and indifferent attitude of support team;

-

financial extortion and psychological pressure.

KontoFX

The KontoFX is a brokerage organization that has been providing services since 2018. The brand is managed by NTMT Transformatic Markets OU based in Tallinn, Estonia. As its main goal, the organization indicates the provision of the best trading opportunities for both professionals and beginners.

On the broker's platform, a lot of attention is paid to the advantages of cooperation. The site has a simple yet functional trading platform, a variety of trading accounts with an entry barrier of $250, a powerful training base, and qualified support. However, the reputable regulators FCA and ASIC published warnings back in 2021 that this company is fraudulent and conducts criminal activities.

The main signs of its scams include:

-

presence of this company on the blacklist of several reputable regulators;

-

unauthorized provision of services (there is no certificate of incorporation or license);

-

financial lawlessness – refusal to withdraw funds, extortion of money in payment of fake commissions and taxes;

-

fraud with transactions – fabricated technical failures in the terminal, and manipulation of quotes and charts.

PrivateFX

On the PrivateFX platform, it is stated that the broker was established with the participation of Concorde Capital in 2015. The company promises to use advanced technologies to ensure comfortable and safe trading. The minimum deposit is $100, there are opportunities for earning both through independent trading and through PAMM.

The main signs of its scams include:

-

lies about regulated activities;

-

presence on the ASIC blacklist;

-

exhausting deposits of traders and disclaiming liability;

-

the advice of pseudo-analysts;

-

partial or complete cancellation of transactions;

-

issues with financial discipline;

Trade Ltd

Trade Ltd claims many years of trading experience in financial markets, but in fact, this platform has existed only since 2018. In the reviews, traders note the connection with the fraudulent Glenmore Investments project, which began to engage in scam activities under the pressure of negative reviews. Trade Ltd lures beginners with promises of high profitability, support for several trading systems at once (including mobile trading), stability of spreads, access to margin trading, etc.

The main signs of its scams include:

-

absence of a brokerage license;

-

a policy of hidden activity to mislead potential victims;

-

an abundance of negative reviews on various web resources;

-

disclaimer of liability for monetary damage caused;

-

using fabricated reviews to artificially inflate its ratings.

UFX

UFX is one of the old Forex brokers and has been providing services since 2007. The company is registered in Vanuatu and has received permission from the VFSC offshore regulator. The broker relies on active traders who prefer trading with high leverage and fixed spreads. There is also a trade copying service on the platform. Feedbacks on the web about this brokerage organization are controversial. Real users write that the company is a ratings cheat and engages in writing fabricated reviews and comments.

The main signs of its scams include:

-

no license by the offshore regulator;

-

ratings cheat (paid reviews and articles);

-

issues with the withdrawal of funds;

-

blocking accounts of unwanted users;

-

ignoring requests and complaints to support;

-

controlled trading software.

AGM Markets

AGM Markets has long experience, has been providing services since 2011, and cooperates with traders from 140 countries. At some point, the broker received a CySEC license in Cyprus and had a good reputation among traders. However, now users write that the office is engaged in scam activities and stopped fulfilling its obligations. Today there are a lot of negative reviews on the web, and the ASIC heeded the complaints of traders and blacklisted the AGM Markets.

The main signs of its scams include:

-

spoiled reputation, lack of trust on the part of traders;

-

issues with the execution of transactions (constant technical failures in the terminal, suspicious widening of spreads, etc.);

-

complaints about the absence of payment discipline;

-

fraud in the withdrawal of funds and demanding additional fees, taxes, and insurance;

-

telephone scam and the imposition of services;

BlaFX

It is discouraging that one more unscrupulous forex broker like BlaFX in Australia has joined the growing list of scammers in the internet market. Their modus operandi involves contacting prospective clients and inspiring them to place an initial minimum deposit.

To avoid being entrapped by such schemes, it is wise that concerned individuals commence sought-after withdrawals through the proper, timely submission of an official request. Then, keeping a close eye on the process involved is advisable to ensure nothing compromises a successful transaction. Failure to adhere strictly to such measures within six months could hinder customers' ability to file chargebacks.

SJB CAPITAL LIMITED

Based on certain unsettling information that emerged after an investigation of their business practices, we advise against using SJB capital limited for your forex needs. Anonymity mixed with finance raises concerns for us; subsequently, one concerning matter we found was cloaked ownership within this enterprise.

Another concern was discovering other dishonest sites from an identical server platform utilized by SJB capital limited, adding doubts concerning business reliability. With the ongoing speculation regarding their website hosting provider's overall services, we have deemed it risky to trust your financial transactions within their care, so take caution.

KLM Trade

Another fake forex broker on the Australian scammer list is KLM Trade. The website lures investors with promises of high profits, but Klm is not credible and ranks low for trustworthiness. Hence our advice is to steer clear of this platform at all costs.

Online investment carries risks that could lead to loss of money; therefore, we urge caution while transacting on unverified sites like KLM Trade. This service's suspicious nature stems from its recent development and lack of user traffic or social media links.

We strongly advise against conducting any business with them. When interacting with unfamiliar websites, proceed cautiously by conducting proper research beforehand and remaining vigilant.

How to Check if a Forex Broker is Legitimate: 5 Steps

The International Forex market attracts traders, but also scammers, who will not miss an opportunity to empty your wallet. The majority of scammers lure naïve investors with promises of exorbitant income, ‘assistance’ in trading, and good trading conditions.

Forex scams are increasing each year, with scammers coming up with new schemes to trick as many people as possible out of all their money, before a large number of revealing reviews appears on the Internet.

That is why before registering on a trading platform and entrusting a broker with your money, you need to perform a full analysis and evaluate all risk factors. This will help you avoid losing your money and find a truly worthy financial partner. Let’s discuss the key factors you need to consider when choosing a broker.

1. Check regulatory information about your broker

First, you need to check whether the company you are interested in operates legally in Australia. This is a guarantee that your broker will provide services in good faith and be held accountable in case of some illegal actions. A potential financial partner providing services in the RSA may also have licenses of reputable regulatory authorities from other jurisdictions (FCA, ASIC, BaFin, etc.).

Brokers operating legally do not try to conceal their legal documents, providing scanned copies of the certificate of incorporation, licenses. In the very least, a company should list the numbers of licenses on its website, so that traders could verify this information. Information about licenses can usually be found in the footer of a broker’s website or in a separate tab or section.

NOTE! Do not believe the provided information right away; always verify it!

2. Check the database on the regulatory authority’s website

You can check the broker's license directly on the website of the regulatory authority. You can search by the document number or company name. This will allow you to learn whether the company is regulated or not.

3. Get to know broker’s website

The next important step involves assessment of the broker’s website. Financial companies that are serious about working successfully with traders will provide the following information:

Project’s roadmap and strategic development plans;

Legal information and internal documents with clearly specified details of cooperation, and key rules;

Risk disclosure;

Specifications of contracts, indicating the minimum deposit, spreads, etc.;

Diversity of payment methods with specification of payment procedures and fees;

A good choice of channels to contact customer support: phone support, live chat, pages on social media, etc.).

4. Does a broker guarantee profit?

A broker cannot guarantee that you will earn a profit, as it acts solely as an intermediary between the Forex market and traders. Brokers are responsible for prompt execution of client orders, stable operation of the platform, quality analytical instruments and good advice from a personal manager, or customer support. The following should not be on a broker’s website:

Guarantees that you will earn a profit;

Promises of colossal profit in a short time and without specialized knowledge;

Stories about ‘unique’ earning algorithms and secret schemes.

Main Tips to Avoid Forex Scams

This section presents you with five practical tips aimed at helping you steer clear of such fraudulent schemes.

Check the Legitimacy of the Forex Broker

Before investing, it is recommended to confirm the validity of your chosen Forex broker. A reliable method involves consulting the Australian scammer list or checking their registration status on the ASIC (Australian Securities and Investments Commission) website.

Look for Reviews From Other Traders

To obtain valuable perspectives on a specific forex broker, peruse the feedback of other traders who have availed themselves of their services. Such evaluations can be readily accessed on trusted social media forums.

Watch Out for Promises of Unrealistic Returns

When considering a forex broker who asserts that they can provide lofty investment gains, prudence is key. Respectable brokers can supply general forecasts regarding prospective returns. Still, a broker needs the power to guarantee exact levels of monetary gain.

Avoid Forex Brokers that Ask for Large Upfront Fees

When exploring potential forex brokers in Australia, be wary of those requiring significant payments or deposits beforehand. Established and legitimate providers offer fair and reasonable charges based on the scale of your financial commitment.

Protect your investments and stay informed! Upgrade now to access our comprehensive list of fake forex brokers in Australia. Don’t fall victim to scammers, stay ahead of the game with our regularly updated Australian scammer list.

The Best Forex Brokers in Australia

eToro

eToro was founded back in 2007, and it's our top pick for multiple reasons. It's regulated in one tier-2 jurisdiction and two in tier-1, including ASIC (Australian Securities and Investment Commission). It's a great choice for all types of Forex traders in Australia.

IC Markets

IC Markets was founded back in 2007 in Sydney, Australia, and it's regulated in one tier-2 and one tier-1 jurisdiction. It's also regulated and authorized by ASIC, making it a safe brokerage for Forex trading in Australia.

FAQs

How are brokers regulated in Australia?

The activities of Forex brokers are supervised by the Australian Securities and Investments Commission (ASIC). The above regulator is guided by the Corporations Act, the Insurance Contracts Act, and the National Consumer Credit Protection Act, as well as other regulations. To obtain a local license, companies must meet several conditions (in particular, the working capital must be at least $1 million). The requirements are serious.

Why is it worth cooperating with a regulated broker?

Cooperation with a regulated broker is a guarantee of the safety and security of your funds. In case of a violation of the obligations assumed, the company will be liable under the law. Australian traders are advised to choose financial partners who have received permission from ASIC or other reputable regulators.

How to recognize a financial scammer?

Fraudulent companies operate without legal grounds, their license was revoked due to client fraud, or are registered in an offshore zone that provides services "under the auspices" of dubious regulators. It is mandatory to verify the availability and authenticity of a license. Also, a clear sign of fraud is an abundance of negative reviews.

Where to look for truthful reviews about a broker?

Fake brokers are often engaged in ratings fraud, so you should not believe the reviews that are published on their websites or other dubious web resources. It is better to refer to independent reviewers, such as the Traders Union. The ratings of companies here are formed based on the reviews from real clients.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.