eToro FAQs | Help for Traders and Tips

eToro Summary

-

Where is eToro based?

Located in Central Israel, the headquarters of eToro are complemented by registered offices spanning Cyprus, the United Kingdom, the United States, and Australia. The inception of this brokerage occurred in 2007 in Tel Aviv, under the name RetailFX, by brothers Yoni Assia and Ronen Assia alongside David Ring.

-

Is eToro available worldwide?

Partially, eToro is available worldwide; the broker is available in 140 countries with more than 20 million users. Unfortunately, eToro has suspended accepting clients from some countries due to regulatory requirements and business decisions based on risk management considerations.

This includes countries like: Albania, Belize, Colombia, Egypt, French Guiana, Iceland, Jamaica, Kenya, Luxembourg, Maldives, Nauru, Oman, Peru, Qatar, Slovenia, Tonga, Ukraine, Vietnam, Zimbabwe, Andorra, Benin, Cuba, Denmark, Fiji, Guatemala, Hungary, Indonesia, Jordan, Lebanon, Malaysia, Netherlands, Oman, Philippines, Romania, Senegal, Thailand, Uruguay, Zambia, Armenia, Botswana, Cyprus, Ecuador, Finland, Guyana, Haiti, Ireland, Kazakhstan, Lithuania, Malta, Nepal, Oman, Portugal, Seychelles, Turkey, Uzbekistan, Yemen, Zambia, Australia, Brazil, Costa Rica, Dominican Republic, Estonia, Gabon, Honduras, Italy, Kuwait, Madagascar, Norway, Panama, Russia, Slovakia, Taiwan, Uganda, Venezuela, Zimbabwe, Bahamas, Canada, Djibouti, Ethiopia, Germany, Honduras, Israel, Kyrgyzstan, Mexico, Nicaragua, Pakistan, Rwanda, Singapore, Tanzania, United Arab Emirates, Vietnam, Zambia, Angola, Bhutan, Chad, El Salvador, France, Greece, Haiti, Iraq, Jamaica, Kyrgyzstan, Mozambique, Netherlands, Oman, Paraguay, Sudan, Thailand, Uzbekistan, Zambia.

-

What makes eToro different from other trading platforms?

eToro stands apart from other trading platforms thanks to its social copy trading and cryptocurrency trading features. Given that it provides traders and investors with access to over 5,000 distinct financial assets, such as stocks, cryptocurrencies, ETFs, indices, currencies, and commodities, this broker is highly recommended in the investment industry. The personalized social news feed is another exclusive feature of eToro, and traders of all skill levels can utilize the platform thanks to its user-friendly design and simple interface.

-

Is there a mobile app for eToro?

Yes, there is a mobile app available for eToro. You can easily download the eToro app for both iOS and Android devices. Simply go to the Google Play Store or the iOS App Store. type "eToro" into the search bar, and follow the installation instructions to install the eToro Android App. The app offers access to the full range of assets available on the main website, allowing you to view live prices and your complete trading history. Additionally, you can fund your trading accounts directly through the app. The eToro trading app is designed to cater to different trader's specific trading needs and preferences, offering a user-friendly interface similar to the eToro website.

-

How do I contact eToro customer support?

Yes, eToro offers a mobile app for convenient access to your account. Additionally, if you have an eToro Money account, you can utilize the chat function to communicate with the customer service team during operating hours (Monday-Friday, 10:00-18:00). You can contact eToro's Customer Service Center by phone at 1-888-271-8365 or by visiting their official website at https://www.etoro.com/en-us if you have any questions or complaints.

-

Does eToro offer educational resources for traders?

eToro offers a comprehensive educational resource with courses covering various trading topics, from basic concepts to advanced strategies, and these resources are in video tutorials, articles, and courses. They include:

-

Investing 101

-

Crypto 101

-

Summer School

-

eToro Basics

Whether you're new to trading or aiming to enhance your skills, the eToro Trading Academy can support you in achieving your goals. These resources offer valuable insights into market trends, investment strategies, and global market analysis.

-

Does eToro offer any bonuses or promotions for users?

New users on eToro may receive a bonus upon completing their account verification process. By opening an investment account through eToro's website or mobile apps, eligible users may be eligible for a $10 crypto bonus.

Additionally, eToro offers a "Refer a Friend" promotion where both the referrer and the referred friend can receive a $30 reward from eToro. To participate, users must verify their residency in one of the eligible US states.

Regulation and Safety

-

Is eToro legit?

Yes. eToro is a legitimate social investment and multi-asset brokerage company with 10 offices worldwide, including US, UK, Israel, Cyprus, and Australia centers. Each eToro investment account is registered to a particular eToro entity. eToro regulators include:

-

eToro (Europe) Ltd, regulated by the Cyprus Securities and Exchange Commission (CySEC).

-

eToro (UK) Ltd, regulated by the Financial Conduct Authority (FCA).

-

eToro AUS Capital Limited, regulated by the Australian Securities & Investments Commission (ASIC).

-

eToro (Seychelles) Ltd, regulated by the Seychelles Financial Services Authority.

-

Is eToro safe to use? What do traders think?

It is safe to use eToro because of the attention it pays to various top-tier financial regulators, such as the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Financial Conduct Authority (FCA) in the UK.

Once more, eToro employs encryption technology, two-factor authentication, and frequent security audits to reduce cybersecurity risks and separate client funds from its operating funds to guarantee that clients' money is kept private and safe. eToro keeps its business practices transparent by giving customers comprehensive and unambiguous information about its services, costs, and trading risks.

Trading Features

-

Can I buy stocks on eToro?

Yes. Traders can buy stocks on eToro with their verified eToro account. You may trade stocks in real-time and gain commission-free access to over 3,000 stocks in various industries through the account, which gives you access to all of eToro's resources. Investing in the underlying asset of stocks comes with zero commission, which implies no markup, ticketing fees, management fees, or rollover fees.

-

Can I buy cryptocurrencies on eToro?

Yes. The eToro investment platform offers trading and investing in cryptocurrencies. With no additional fees, the eToro trading platform is a great choice for investors as it lets you invest in all of the major cryptocurrencies, such as Bitcoin, Cardano, Ethereum, Stellar, Tron, XRP, Litecoin, Ripple, Ethereum, Bitcoin Cash, and Cardano.

-

Does eToro offer leverage?

Yes, eToro does offer leverage. It varies by jurisdiction. For example, eToro offers leverage in the UK, but only to the extent of its capabilities. The maximum leverage ratio is 30:1 for major currencies, and the difference in ratios depends on the type of commodity traded.

Trading stocks with leverage allows for up to x5 leverage, but it's important to understand that all leveraged positions are traded as Contracts for Difference (CFDs). For those with experience and a higher risk appetite, leveraging trading within a crypto investment strategy can potentially enhance and optimize positions for greater returns.

The leverage amounts offered by eToro vary depending on the asset class:

- Up to x400 for major currency pairs like EUR/USD.

- Up to x100 for Gold, other commodities, and major indices.

- Up to x50 for non-major currency pairs.

- Up to x10 for non-major indices, CFD stocks, and ETFs.

-

Can I trade options on eToro?

The eToro Options app is only available in the United States at this time. Nonetheless, eToro provides a broad array of investment choices through the main eToro app for users who reside outside the United States, including Stocks, Currencies, Commodities, ETFs, Cryptocurrencies, and Indices. It is crucial to remember that eToro Options functions as a different, mobile-only platform with different holdings and cash balances from the main eToro app.

-

What is eToro's policy on scalping?

eToro prohibits the practice of scalping, which is defined as a trading strategy involving frequent small trades for minimal profits rather than fewer trades for larger gains, according to its Terms and Conditions. For further details regarding this policy, you can consult the Terms and Conditions provided on the platform. Additionally, eToro may enforce penalties or account restrictions for users found engaging in scalping activities.

-

Can I use automated trading strategies on eToro?

Certainly! On eToro, you can utilize automated trading strategies through their copy trading feature. This process involves selecting a user whose trading activities you wish to replicate, specifying the amount you want to allocate, and clicking the "COPY" button. By doing so, you'll automatically mirror their positions in real time and proportionally. Importantly, you have the flexibility to start or stop copying a user whenever you desire.

-

Does eToro offer any trading signals or analysis?

eToro provides various trading signals and analysis tools to assist traders in making informed decisions. These include price patterns, technical indicators, and charting analysis, all of which are meant to shed light on potential future price movements. Furthermore, eToro provides trading signals in an automated manner, frequently by copying signals from the accounts of profitable traders. This format reduces issues commonly associated with other signal formats, such as delays, missed signals, or confusion in interpretation, ensuring timely and clear guidance for traders.

-

Can I use eToro for day trading?

Yes. You can use eToro for day trading, as it provides a platform that allows users to trade various financial instruments within the same trading day to capitalize on short-term price movements. On eToro, users can access real-time market data, advanced charting tools, competitive spreads, leverage options, and a wide range of trading features suitable for day trading activities. However, it's important to note that day trading carries inherent risks, including the potential for significant losses due to rapid price fluctuations.

-

Can I use eToro for long-term investing?

For long-term investing, eToro offers access to over 5,000 financial assets, including stocks, cryptocurrencies, ETFs, indices, currencies, and commodities, with options for both leveraged and unleveraged investments. However, it's crucial to note some limitations of the platform. First off, investors must bear the extra costs associated with eToro's USD account denomination, lack of support for tax-free wrappers and pension investments, which restricts their options for tax-efficient investing, and inability to absorb UK stamp duty tax on UK shares.

Deposit, Withdrawal and Fees

-

Does eToro pay?

Yes. eToro pays traders profits generated from investments carried out on the platform. A large number of stocks on the eToro platform pay dividends to owners in cash or additional stock. Your account might be credited or debited if you trade dividend-paying stocks, ETFs, or indexes, depending on whether the position was opened manually, included in a copy, or was a component of a Smart Portfolio. Customers have the freedom to withdraw funds from their eToro accounts at any time. Once the margin that was used has been subtracted, you can withdraw funds from your eToro account up to the remaining balance.

-

Is there a minimum deposit required to use eToro?

The minimum deposit on eToro is based on geography, which implies that what traders in one country pay as their minimum deposit differs from what traders in other Jurisdictions may be paying.

| Countries | Minimum deposit |

|---|---|

Germany |

$100 |

Malta |

$50 |

Italy |

$100 |

United States |

$100 |

Cyprus |

$50 |

Denmark |

$50 |

Switzerland |

$50 |

Belgium |

$100 |

Malaysia |

$50 |

United Kingdom |

$100 |

Portugal |

$50 |

United Arab Emirates |

$100 |

Thailand |

$50 |

Spain |

$100 |

Czech Republic |

$100 |

Singapore |

$50 |

Luxembourg |

$100 |

Hungary |

$50 |

Slovenia |

|

Netherlands |

$50 |

Greece |

$50 |

Norway |

$50 |

Monaco |

$100 |

Romania |

$100 |

Ireland |

$50 |

Slovakia |

$100 |

Indonesia |

$50 |

Sweden |

$50 |

Poland |

$100 |

Australia |

$50 |

France |

$100 |

New Zealand |

$1000 |

Kuwait |

$1000 |

Philippines |

$1000 |

Isle Of Man |

$1000 |

Reunion Island |

$1000 |

French Polynesia, |

$1000 |

Jersey Island |

$1000 |

Croatia |

$2000 |

Bulgaria |

$2000 |

Cayman Islands |

$2000 |

Vietnam |

$2000 |

South Africa, |

$2000 |

Gibraltar |

$2000 |

Israel |

$10000 |

If you cannot find your country on the list, contact eToro customer service to find out what the minimum deposit is and whether the platform accepts clients from your location.

-

What are the fees for trading on eToro?

When trading on the eToro platform, anticipate the following fees:

-

Spread: This is the difference between the buy and sell prices of an asset, commonly used by brokers to charge fees.

-

Conversion fee: Applicable to non-USD deposits and withdrawals.

-

Overnight fee: Also known as a rollover fee, it is the payment for holding a CFD position overnight.

-

Withdrawal fee: All withdrawal requests are subject to a $5 USD fee.

-

Inactivity fee: Charged after 12 months with no login activity (charge a $10 fee once a month on any of your remaining balances).

Additionally, there are fees associated with transferring crypto and using the eToro Money crypto wallet. Dividends may also be credited to or debited from your available balance. Buying or selling crypto assets on eToro incurs a 1% fee, but there are no account opening or management fees. For actual stock and ETF trades, eToro does not impose a commission fee.

-

How long does it take for withdrawals to process on eToro?

Withdrawal processing times on eToro vary depending on several factors. After submitting your withdrawal request, you will get an email confirming its status within two business days. However, the actual processing time may extend up to 10 business days, contingent upon the chosen payment method.

-

Is there a fee for withdrawing funds from eToro?

Indeed, there is a $5 fee applicable to all withdrawal requests. Additionally, withdrawals made in currencies other than USD may incur conversion fees. It's important to note that aside from the fee imposed by eToro, you might also encounter charges from other parties involved in the transfer process, such as intermediary banks, receiving banks, or your credit card provider.

Getting Started

-

How do I open an account on eToro?

You can begin investing with a $50 minimum deposit in many countries, so before you get started, find out what the recommended amount is for your area. To begin the process:

-

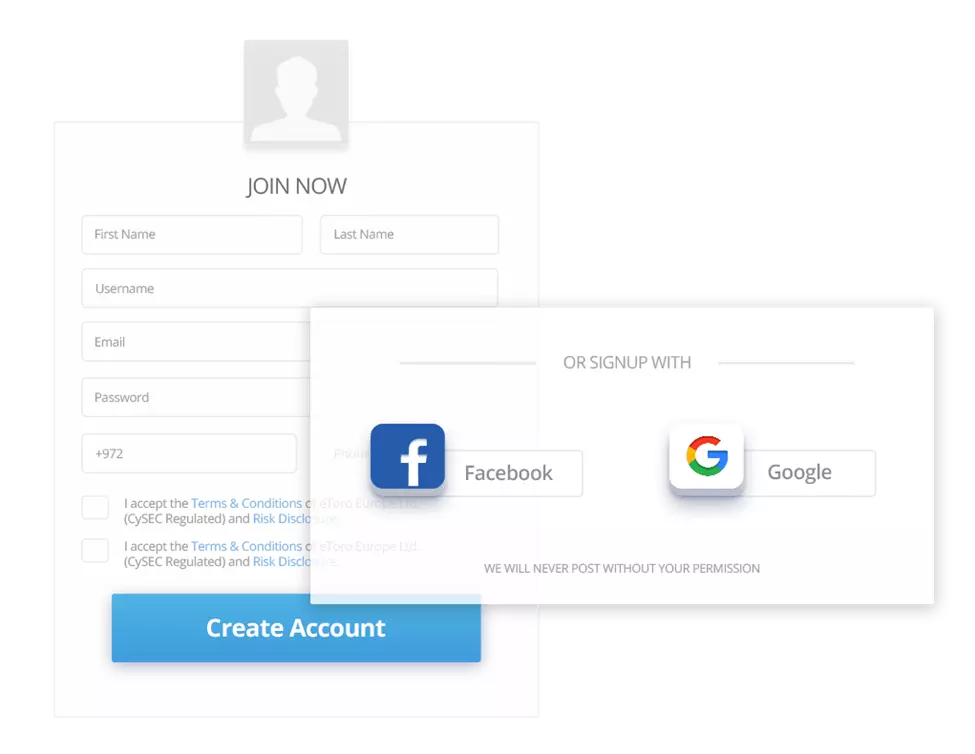

Visit www.eToro.com, locate the "Join Now" or "Trade Now" button.

eToro website

-

Input the necessary personal information to open a new trading account.

-

Read through eToro's Terms & Conditions and privacy policy before submitting any information, and check the box to indicate your agreement.

-

Clicking the "sign-up" button will finish the sign-up process and account verification is next. The Know Your Customer (KYC) procedure requires you to present proof of identity (such as a valid passport or other officially issued identification) and confirmation of residence (such as a current utility bill dated within the last three months).

eToro website

-

How to verify an eToro account?

To verify your eToro account, consider the following:

-

To begin verification, go to the verification section and submit a proof of identity (POI) and proof of address (POA). ensure your POI includes your name, date of birth, clear photograph, issue date, and visible expiration date, if applicable. A passport is recommended for quicker processing, but you can also use a driver's license or any government-issued ID. If your document is double-sided, upload both sides. For POA, provide a document with your full name, current address issued within the last 3 months, and clearly visible issuer's name or logo.

-

also you need documents for proof of address. These include bank statements, credit card statements, utility bills, tax letters or bills, rental agreements issued by the government, letters from the local municipality, phone bills, or internet bills.

The eToro verification process typically takes 1-3 business days, but it may vary. Some users have reported occasional delays in the verification process, which can be resolved by providing clear and accurate documentation as requested by eToro's verification team.

-

Which account type is best on eToro?

When considering which account type is best on eToro, it's important to understand the features and benefits each one offers:

-

Personal (Retail) Account: This is eToro's default account type, offering access to trade all available assets, copy other traders, and invest in Smart Portfolios.

-

Professional Account: Designed for experienced traders, professional account holders have the option to utilize higher leverage when opening trades.

-

Corporate Account: Tailored for business purposes and legal entities, corporate accounts allow trading with capital belonging to a business entity.

-

Islamic Account: Specifically crafted for Muslim clients, Islamic accounts adhere to Sharia law by abstaining from charging interest-based fees.

For beginners, the Personal (Retail) Account is often recommended due to its user-friendly features, access to diverse investment options, and the provision of a virtual portfolio (demo account) for risk-free practice. However, individuals with substantial trading experience and a desire for greater leverage may consider applying for a Professional Account after meeting the necessary criteria.

Programs and Investment tools

-

What is the eToro Club and how does it work?

The eToro Club operates as an ongoing loyalty program designed to enhance the trading experience for valued clients. Membership is automatically granted to clients maintaining a tier balance of at least $5,000, with five tiers ranging from Silver to Diamond.

Each tier offers escalating benefits:

-

Silver tier members gain exclusive access to market webinars, data-driven Smart Portfolios, hand-picked partner apps, and a dedicated Customer Success Agent.

-

In addition to all Silver perks, Gold members get access to live webinars and weekly updates on expert market analysis.

-

Platinum members get all the Gold benefits plus free access to premium digital publications, extra partner apps, and no withdrawal fees.

-

All prior tier benefits are still available to Platinum+ members, along with access to top digital financial publications and tickets to private sporting and cultural events.

-

Diamond members, the highest tier, receive invitations to exclusive Diamond events and all prior benefits, including free access to premium digital publications.

-

Does eToro offer a referral program?

Yes, eToro has a referral program where you can get compensated for introducing friends to the eToro network. You will receive $5 when the friend you referred opens an eToro Options account and deposits money. Additionally, you and your friend will receive a $30 reward from eToro for each new eligible user who joins through your referral link and deposits at least $100. You can claim the Refer a Friend reward up to ten times, and rewards are typically credited to both accounts within 15 days of a successful deposit.

-

What is copy trading and how does it work on eToro?

Copy trading is a prominent feature offered by eToro known as CopyTraderTM. This tool allows users to discover and follow investors whose trading strategies they admire with a minimum of $200. Users simply select the investor they wish to emulate, specify the amount they want to allocate to copying their trades, and click the "COPY" button. Subsequently, the system automatically mirrors the chosen trader's positions in real-time and in direct proportion to the allocated amount. Users have the flexibility to commence or cease copying a particular investor at any given time, granting them control over their investment strategy.

-

Can I become a popular investor on eToro?

Distinguish yourself as a prominent investor on eToro by showcasing your expertise and knowledge to attract followers. As a Popular Investor, you have the opportunity to garner recognition, develop a thriving business, and generate substantial income through accumulating copiers that replicate your trades. Additionally, you can leverage eToro's social trading features to interact with fellow investors, further enhancing your reputation and reach within the platform's community.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).