deposit:

- 1$

Trading platform:

- Web platform

- SEC

- FINRA

- SIPC

J.P. Morgan Self-Directed Investing Review 2024

deposit:

- 1$

Trading platform:

- Web platform

- 1:1

- Most of the accounts are designed for long-term inactive investing or transferring money into trust management

Summary of J.P. Morgan Trading Company

J.P. Morgan is a broker with higher-than-average risk and the TU Overall Score of 4.48 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by J.P. Morgan clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. J.P. Morgan ranks 72 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

J.P. Morgan Self-Directed Investing is a trading and investing broker focused on experienced market participants.

The J.P. Morgan Self-Directed Investing service is in the brokerage division of JPMorgan Chase & Co Financial Corporation, and it offers investment services through JP Morgan Securities LLC (JPMS). The broker is part of one of the largest and oldest financial services corporations in the United States, with a reputation for transparency, accountability, and reliability. The broker provides services of long-term and retirement investment in securities within the USA market, services of active trading, and portfolio algorithmic investing. Trading assets are stocks of companies, ETF-fund shares, options, securities of retirement and investment funds, treasury notes, bills, US, corporate, and municipal bonds, derivatives, secondary market assets, etc.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | From $1 to $500. |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | The market difference between the purchase and sale price |

| 🔧 Instruments: | Stocks, options, ETFs, credit default swaps, and government and corporate bonds, etc. |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with J.P. Morgan:

- Flexible and clear tariff policy. For private investing the deposit is from $1, for automatic portfolio investing the deposit amount is from $500.

- Strict regulation. The SEC regulates J.P. Morgan Self-Directed Investing, and it is a member of FINRA CRD#: 79/SEC#: 801-3702,8-35008 and SIPC (the investor compensation fund). The broker is also subject to an annual external audit and is controlled by an exchange auditor.

- Offers trading accounts and retirement accounts.

- Automated Investing is an investment option that ensures that an investment portfolio follows the criteria set by the investor. The brokers’ analysts manage the portfolio.

- Additional products. Every broker's client can take advantage of other investment and financial offers from concessional lending to the development of a personal financial plan and trust management services.

👎 Disadvantages of J.P. Morgan:

- The services are only available to U.S. residents. Possible schemes to work through intermediary funds/companies lead to a significant increase in the trade cost.

- Emphasis on financial products. Technological trading tools go into the background.

Evaluation of the most influential parameters of J.P. Morgan

Geographic Distribution of J.P. Morgan Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of J.P. Morgan

"Simple, transparent, and inexpensive" — that's how you can describe the package of J.P. Morgan Self-Directed Investing broker’s services. J.P. Morgan is a brand with over a century of history. It is a multinational financial conglomerate, which is among the largest in the United States. J.P. Morgan Self-Directed Investing is part of the brokerage division of the conglomerate that focuses on private investors and traders. The tariff policy is as simple and flexible as possible because there are specific amounts of commissions per contract, transaction, asset ownership, and advisory fees.

The broker's investment products are divided into two groups: independent and automatic investing. The advantage of the first option is the absence of restrictions at the start. Deposit from $1 and small commissions from $0.65 per transaction. With these terms, every person can deposit a few USD and practice on shares with a cent price, so practicing is virtually free. Automatic investing implies the use of JP Morgan Automated Investing software to form a portfolio based on input data. The broker's analysts manage it. Here, fees are even simpler: an initial deposit and an advisory fee.

When you first meet J.P. Morgan Self-Directed Investing, you get a positive impression. Clear tariffs for every type of transaction in .pdf format, the ability to trade all derivative assets and stocks in the largest U.S. stock markets, retirement accounts, investment portfolios, and all of this with a deposit available to everyone. Open an account in a few clicks!

Dynamics of J.P. Morgan’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

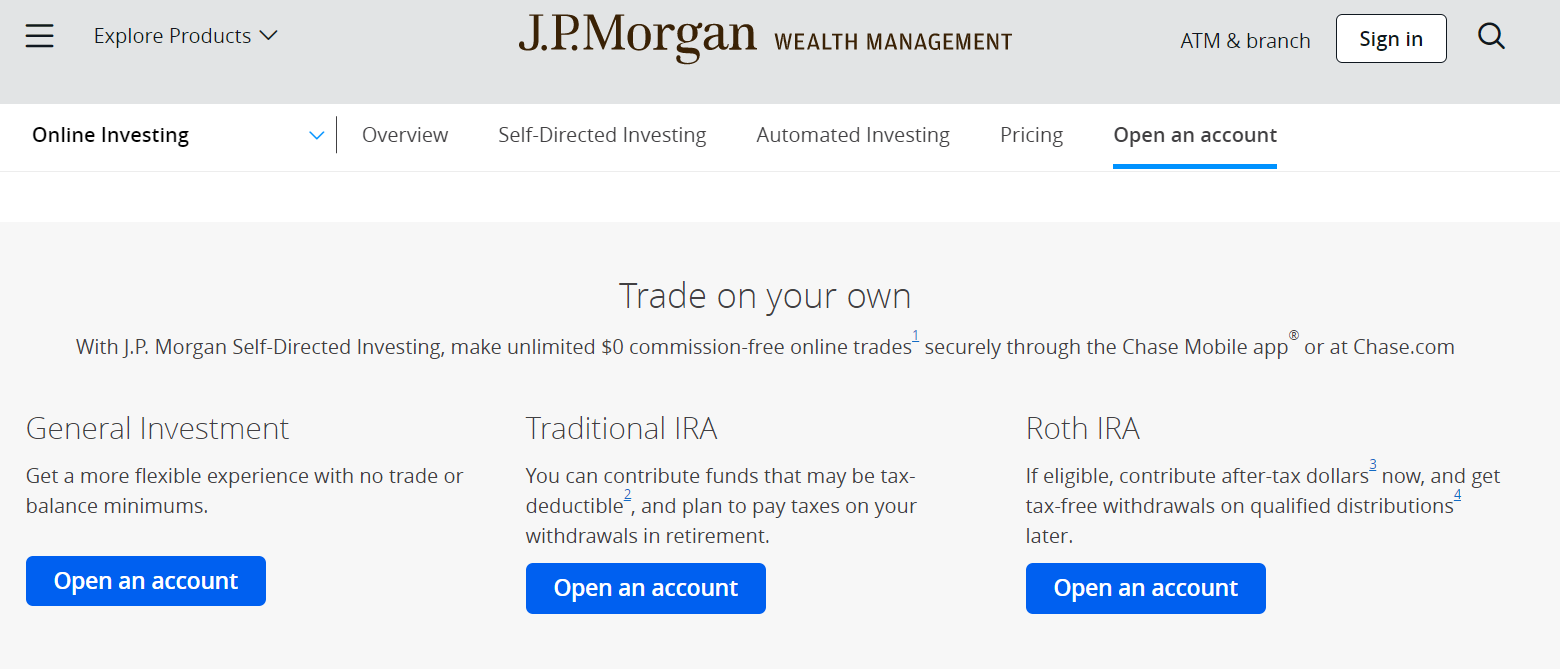

J.P. Morgan Self-Directed Investing is an investment broker. Its products come in two categories: Self-Directed Investing and Automated Investing. Self-Directed Investing offers both classic and retirement investment accounts. Retirement accounts differ from each other by the principle of accrual of tax rates and are intended for accumulation. A classic investment account is designed for periodic trading; it has no restrictions on the deposit or transaction amounts.

Automated Investing is a J.P. Morgan Self-Directed Investing solution

Automated Investing is a software solution that allows you to form investment portfolios according to your desired risk level and adjust them dynamically by adjusting to market trends. The technology implies 4 types of portfolios with the risk ranging from conservative to aggressive. The conservative portfolio involves investing 75% of the money in fixed-income assets — Treasury securities, bonds, etc., and 25% in U.S. stocks and stocks of companies in other countries. Only 10% is allocated to fixed-income assets in an aggressive portfolio.

Investment features:

-

Automated Investing technology helps to automatically form an underlying portfolio according to the set parameters of risk, target return, and term. But the investor may adjust the composition of the portfolio at his own discretion. Investment portfolios are designed for a horizon of 1-3 years.

-

To start you need to deposit $500 and keep a minimum account balance of $250.

-

The commission for consulting services is 0.35% per year of the amount of investment. There are fixed commissions for individual transactions.

Automated Investing involves selecting a portfolio of investments based on the investor's answers to questionnaires. This model differs from Self-Directed Investing in that the broker's analysts control and manage the portfolio for the client.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Affiliate programs from J.P. Morgan Self-Directed Investing:

Affiliate programs are not included in the company's development policy.

Trading Conditions for J.P. Morgan Users

The J.P. Morgan Self-Directed Investing broker is an investment company that gives traders access to exchange-traded stock assets of the U.S. markets. The company's tariff policy is aimed at maximum simplification of commission charges. The commissions indicated on the website already include exchange and depository fees, there are no hidden commissions. The entry threshold is from 1 USD for independent investment and 500 USD for the trust management program.

1$

Minimum

deposit

1:1

Leverage

13/5

Support

| 💻 Trading platform: | Web platform |

|---|---|

| 📊 Accounts: | Automated Investing, Self-Directed Investing (3 sub-account types) |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank payment systems |

| 🚀 Minimum deposit: | From $1 to $500. |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | n/a |

| 💱 Spread: | The market difference between the purchase and sale price |

| 🔧 Instruments: | Stocks, options, ETFs, credit default swaps, and government and corporate bonds, etc. |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | n/a |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Most of the accounts are designed for long-term inactive investing or transferring money into trust management |

| 🎁 Contests and bonuses: | Yes, possible Trader Union bonuses |

J.P. Morgan Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Self-Directed Investing | from $0.65 | No |

| Automated Investing | from $0.15/month | No |

The detailed rates for each asset in the context of the different types of accounts are available on the broker's website in .pdf format.

Analysts for the Traders Union also compared the average commission per J.P. Morgan Self-Directed Investing contract with similar values of its competitors. The commissions for trading shares by pending orders were taken for comparison (the broker doesn’t charge commissions for online transactions with shares).

| Broker | Average commission | Level |

| J.P. Morgan | $20 | High |

| Charles Schwab | $11 | Medium |

| Ally Bank | $4 | Low |

Detailed Review of J.P. Morgan Self-Directed Investing

J.P. Morgan Self-Directed Investing is focused more on those private traders who are not active participants in trading. There are no CFDs or other high-risk assets and no professional trading tools. The products presented are mid- and long-term investment products, retirement, and trust management accounts. There are also accounts for active trading, but the broker doesn’t focus on them, and there is no information about trading platforms, payment methods, or trading tools on the website.

J.P. Morgan Self-Directed Investing’s success by the numbers:

-

Over 20 thousand trading assets of the primary and secondary market with any level of risk — from fixed-income instruments to high-risk assets.

-

Over 75% of the investment portfolios created by the broker's analysts have shown positive returns over the past 20 years.

J.P. Morgan Self-Directed Investing is an investment brokerage for private investors

J.P. Morgan Self-Directed Investing is a broker for private long-term investments in stock assets. The tariff policy is designed to encourage private clients to hold purchased assets instead of short-term speculation.

Do you want to join the ranks of J.P. Morgan Self-Directed Investing investors, but don't know where to start? The broker offers an investment advisory service. The advisor will help you develop your personal investment strategy, and you can meet with him periodically to rebalance your portfolio. The advisor will inform you of the most important news and market trends. The terms of the advisor's assistance are stipulated individually.

Useful services of J.P. Morgan Self-Directed Investing:

-

This service automatically forms an investment portfolio according to the input data specified. It is available in the Automated Investing group.

Advantages:

Transparency of tariff policy.

Access to the primary and secondary stock markets.

Cross audits, licenses from the world's most respected regulators, and the reputation of the corporation's name.

J.P. Morgan Self-Directed Investing is among the best brokers in the United States for the passive long-term investment of individuals.

How to Start Making Profits — Guide for Traders

To transfer money into trust management (Automated Investing), answer the questions such as these: how much money are you willing to invest, and what level of risk is suitable for you? Depending on your responses, you will be offered options for your investment portfolio. Then replenish the deposit for the amount of $500 and execute an investment contract. The second option is an independent investment.

Types of Self-Directed Investing accounts:

A General Investment account is an individual taxable device designed to work with securities. The trader can deposit the account for any amount from $1, and buy/sell assets, etc. There are no penalties for early withdrawal.

There is no information on the website regarding a demo account, or on how trades are conducted on an individual taxable account.

Bonuses Paid by the Broker

Bonuses are not included in the broker's development policy.

Investment Education Online

J.P. Morgan Self-Directed Investing is the investment brokerage division of JPMorgan Chase & Co. Therefore, the Financial Education section applies to the entire corporation and contains information not only about trading and investing, but also about personal finance in general.

Security (Protection for Investors)

J.P. Morgan Self-Directed Investing Financial LLC is licensed by the Securities and Exchange Commission (SEC) and is a member of the Financial Services Industry Regulatory Service (FINRA). The broker is also a member of the Securities Investor Protection Corporation (SIPC).

👍 Advantages

- Licenses from one of the world's most respected regulators

- Availability of a compensation fund

- External independent audit and stock exchange audit

👎 Disadvantages

- Not identified

Withdrawal Options and Fees

The broker cooperates with bank payment systems within the framework of national legislation. There is no more detailed information on the broker's website.

Customer Support Service

Support is available Monday through Friday from 8:00 a.m. to 9:00 p.m. and Saturday from 9:00 a.m. to 5:00 p.m., Eastern European time. It is possible to agree on an individual schedule with a personal consultant.

👍 Advantages

- Professional support

👎 Disadvantages

- No 24/7 support

There are several ways to contact support:

-

via email;

-

by toll-free telephone;

-

via social media.

Contacts

| Foundation date | 1971 |

| Registration address | 1111 Polaris Parkway, Columbus, US-OH 43240 |

| Regulation |

SEC, FINRA, SIPC |

| Official site | https://www.chase.com/personal/investments/online-investing |

| Contacts |

Phone:

1.844.399.4337

|

Review of the Personal Cabinet of J.P. Morgan

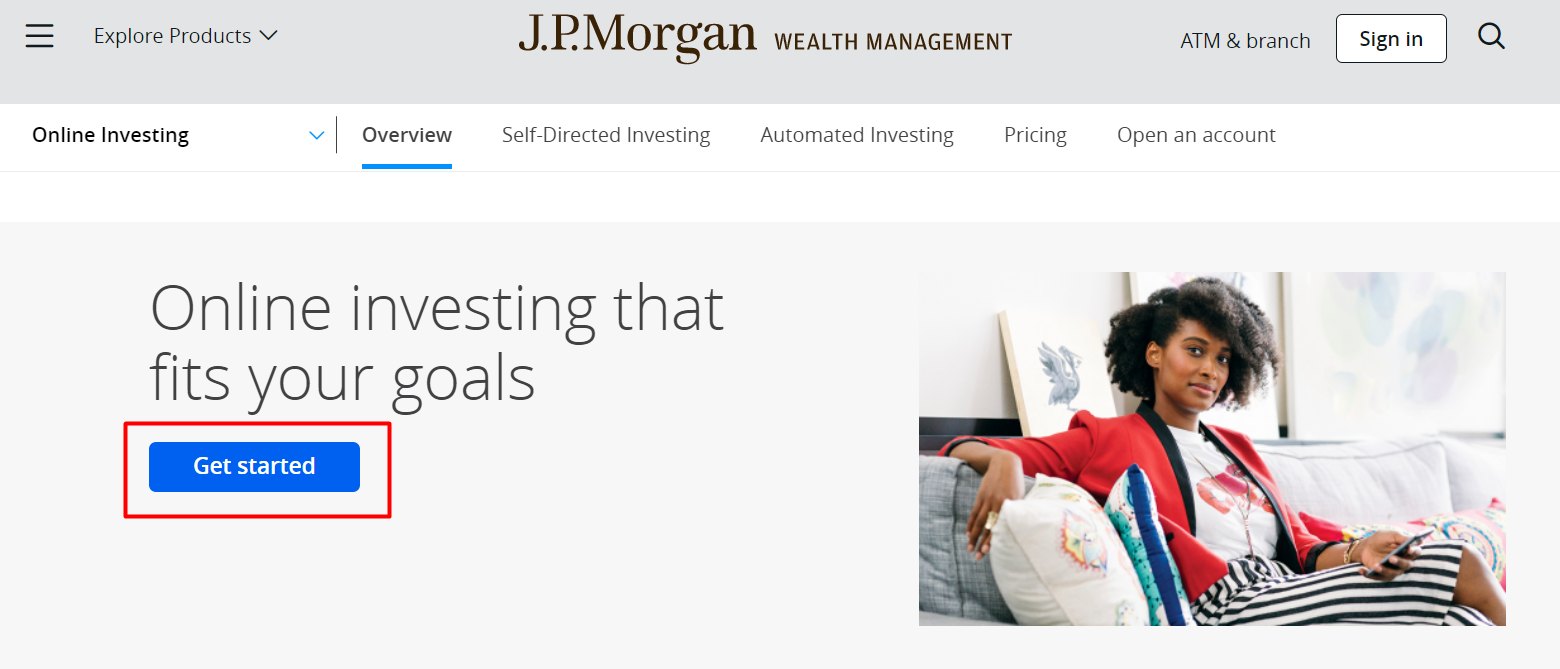

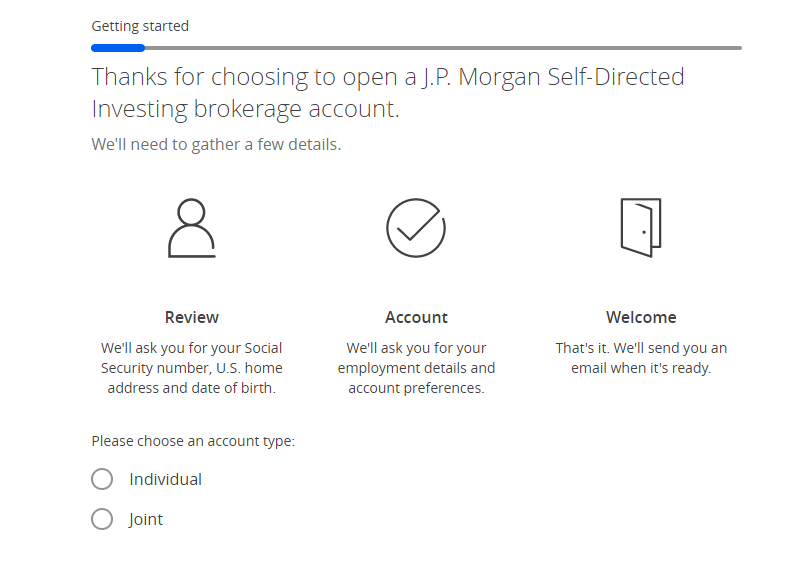

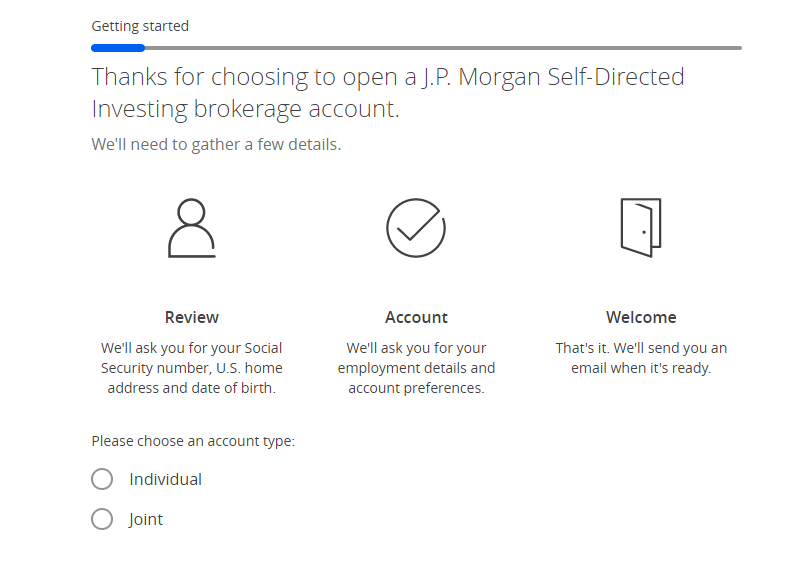

Follow these steps to open an investment account:

Click the "Get Started" button on the main page.

Select the type of investment account to be opened: independent, retirement account, managed account.

Fill in the questionnaire:

After completing the application, representatives of the broker will contact you to open an investment account and give you further instructions.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the J.P. Morgan rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about J.P. Morgan you need to go to the broker's profile.

How to leave a review about J.P. Morgan on the Traders Union website?

To leave a review about J.P. Morgan, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about J.P. Morgan on a non-Traders Union client?

Anyone can leave feedback about J.P. Morgan on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.