According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MT4

- MT5

- WebTrader

- AvaTrader

- Mobile Apps

- AvaSocial

- AvaOptions

- BVI FSC

- CySec

- ASIC

- JFSA

- FSCA

- FFAJ

- ISA (Israel)

- 2006

Our Evaluation of AvaTrade

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

AvaTrade is a reliable broker with the TU Overall Score of 7.06 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by AvaTrade clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

AvaTrade is a brokerage company that provides optimal working conditions for all traders with any skill level. The broker provides customers with security by protecting their data and finances, and they are constantly working to improve the service.

Brief Look at AvaTrade

AvaTrade was founded in 2006 in Dublin, Ireland. The company has offices in 10 countries. It currently has over 300, 000 registered users and processes more than 2 million transactions every month. These factors contribute to AvaTrade being a reliable and trusted broker. They are accredited across five continents and are one of the market leaders. The broker is regulated by the Australian Securities and Investment Commission (ASIC, 406684), the Japanese FSA ( 1662), and the South African FSCA ( 45984). AvaTrade holds accreditation by the Central Irish Bank ( C53877 ), the Abu Dhabi Financial Services Regulatory Authority (190018), and the British Virgin Islands Financial Services Commission ( SIBA/L/13/1049), CySEC ( 347/17). AvaTrade allows traders to trade stocks, securities, indices, cryptocurrencies, and currency pairs. In total, the offer more than 1,200 tools to customers.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- a wide range of trading instruments;

- there is a license for the provision of services on the territory of 5 continents;

- customer service operates around the clock and provides competent assistance to users in 14 languages;

- a wide choice of convenient trading platforms;

- ability to trade from mobile devices;

- availability of an account for representatives of Islam (swap-free);

- for reliable storage of customer funds, the broker uses a segregated account;

- option for automated trading using trading advisors, indicators, and other analysis tools;

- no restrictions on trade and scalping;

- availability of training materials and conducting webinars for beginners and experienced traders.

- the site interface is not user-friendly;

- customer service efficiency and response time

- trading terminals are prone to occasionally freeze.

TU Expert Advice

Financial expert and analyst at Traders Union

AvaTrade has proved to be a reliable partner that regularly performs for its customers. The reliability of the broker, as well as its high-quality service and favorable trading conditions, are often mentioned by the company's customers in their reviews.

At times, users are dissatisfied with a delay in withdrawing funds, but the competent customer service finds the best solutions to eliminate the difficulties a trader has encountered. The same users note that, despite some difficulties, the broker transfers the necessary funds in full amount.

All the users, without exception, note that AvaTrade offers almost the largest assortment of various assets and analytical tools that make automated trading possible. Also, the broker's advantages are minimal commissions, low spread, and fast execution of orders, as hundreds of satisfied customers claim.

Of particular note is providing security: customers' funds are stored on segregated accounts, and the broker's activity is accredited in the EU, Japan, Australia, South Africa, and the British Virgin Islands. Fulfillment of all legal obligations regarding these regulators makes AvaTrade one of the most reliable companies, regularly included in the lists of the best brokers.

- You prefer to employ various trading styles without restrictions and also aim for passive income. AvaTrade doesn't limit its clients — they can scalp, hedge, trade the news, and use advisors. The broker offers a partnership program and its own copy trading service.

- You require special conditions and tools for trading. With a standard account, you have the option to convert it into an Islamic account at any time. The broker provides calculators, signals, news feeds, and analytical tools to facilitate trading for its clients.

- You are looking to start with a minimal deposit and value transparency. To open a user account at AvaTrade, you need to deposit a minimum of $100. Many parameters are hidden from unregistered users, including trading fees.

AvaTrade Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, AvaSocial, AvaOptions, AvaTrader, mobile and web versions of МТ |

|---|---|

| 📊 Accounts: | Standard, Demo |

| 💰 Account currency: | AUD, JPY, GBP, USD, EUR, CHF |

| 💵 Deposit / Withdrawal: | MasterCard, bank transfers, e-wallets |

| 🚀 Minimum deposit: | 100$ |

| ⚖️ Leverage: | 1:30 to 1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,6-0,9 pips |

| 🔧 Instruments: | Forex pairs, Cryptocurrencies, Commodities, Indices, Stocks, Bonds, Vanilla Options and ETFs |

| 💹 Margin Call / Stop Out: | 25% / 10% |

| 🏛 Liquidity provider: | Currenex |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Instant Execution |

| ⭐ Trading features: | Cryptocurrencies and CFDs trading; Islamic accounts. |

| 🎁 Contests and bonuses: | Yes |

AvaTrade offers traders only two types of accounts - Standard and Demo accounts. Trading conditions for Standard accounts differ across different trading platforms.

When registering a Demo account, traders will receive a bonus in the form of 10,000 US dollars on the account for obtaining trading skills.

Another advantage of AvaTrade, which is often noted by traders, is a large choice of assets - there are more than 250 of them.

The broker’s customers also distinguish a low spread and commissions, the speed of order execution, and a wide range of trading platforms. Beginners will appreciate the availability of microlots.

AvaTrade Key Parameters Evaluation

Video Review of AvaTrade

Share your experience

- Best

- Last

- Oldest

ZA Johannesburg

ZA Johannesburg  NL Amsterdam

NL Amsterdam  ES Oviedo

ES Oviedo The service helps reduce the risk

I didn’t find any serious cons

KE Nairobi

KE Nairobi Cash deposit and the trading process as straightforward and easy-to-follow. The platform is user friendly, and the support team is very responsive.

The registration process took a bit longer than expected to get the account verified.

PK Rawalpindi

PK Rawalpindi a wide range of trading instruments; there is a license for the provision of services on the territory of 5 continents; customer service operates around the clock and provides competent assistance to users in 14 languages; a wide choice of convenient trading platforms; ability to trade from mobile devices; availability of an account for representatives of Islam (swap-free); for reliable storage of customer funds, the broker uses a segregated account; option for automated trading using trading advisors, indicators, and other analysis tools; no restrictions on trade and scalping; availability of training materials and conducting webinars for beginners and experienced traders.

No weakness

PK Islamabad

PK Islamabad Good company

No weakness

DE Frankfurt am Main

DE Frankfurt am Main Good customer service

Did not find it possible to contact the manager by phone

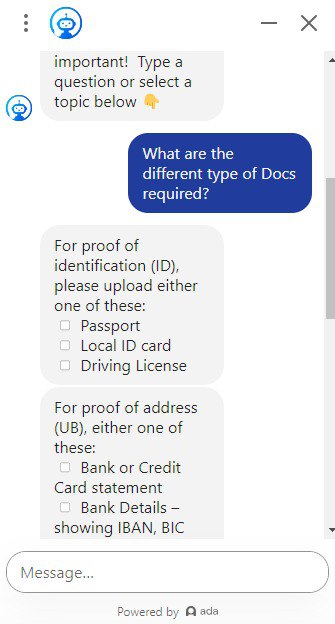

Trading Account Opening

To make your work with AvaTrade as comfortable as possible, we suggest that you familiarize yourself with step-by-step instructions for opening a trading account and take an online tour of your account.

You can enter your account or go through the registration procedure directly from the main page of the broker’s site using the Registration or Login buttons.

If you have an open account, you need to enter your e-mail address and password.

Unregistered users should click the Registration button - then a window for entering the necessary data will appear.

After filling out a short form, the Open an Account button will be activated. Click it and go to the second part of the registration - entering personal data.

Here you also need to specify your financial data, choose a trading terminal, and the base currency of the account.

The last step is to read and accept the Terms and Conditions and confirm the registration, after which you will get into your account.

You will find all the available functions in the Personal account menu.

On the main page of AvaTrade you will all the necessary information about:

-

Forex;

-

CFD;

-

cryptocurrencies;

-

platforms;

-

trading;

-

education.

The block of information about the brokerage company is also here.

Regulation and safety

AvaTrade has a safety score of 10/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record over 19 years

- Strict requirements and extensive documentation to open an account

AvaTrade Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

BVI FSC BVI FSC |

British Virgin Islands Financial Services Commission | British Virgin Islands | No specific fund | Tier-2 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

JFSA JFSA |

Japan Financial Services Agency | Japan | No specific fund | Tier-1 |

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

FFAJ FFAJ |

Financial Futures Association of Japan | Japan | No specific fund | Tier-1 |

| ISA (Israel) | Israel Securities Authority | Israel | No specific compensation fund for forex | Tier-1 |

AvaTrade Security Factors

| Foundation date | 2006 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker AvaTrade have been analyzed and rated as Medium with a fees score of 5/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of AvaTrade with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, AvaTrade’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

AvaTrade Standard spreads

| AvaTrade | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,6 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,9 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,9 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,3 | 1,4 | 0,5 |

Does AvaTrade support RAW/ECN accounts?

As we discovered, AvaTrade does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with AvaTrade. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

AvaTrade Non-Trading Fees

| AvaTrade | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 16,66 | 0 | 0 |

Account types

AvaTrade offers its customers only two types of accounts - real and demo. At the same time, the broker gives great freedom when choosing a trading terminal. Different terminals are adapted for different types of trading, therefore, before starting work, you should familiarize yourself with the specification of trading platforms.

To start working with AvaTrade, you need to open an account.

More than 5 trading platforms are used for trading, among which the most popular are (MT4, MT5) and the broker's development (AvaTrader). All the platforms have a mobile version.

When opening a demo account, a customer receives a balance of 10,000 US dollars. The money cannot be withdrawn to a real account, but they can help you get your first experience in trading and after that - earn real money on a real account.

AvaTrade - How to open, deposit and verify a trading account | Firsthand experience of Traders Union

Deposit and withdrawal

AvaTrade received a High score for the efficiency and convenience of its deposit and withdrawal processes.

AvaTrade excels by providing a broad selection of payment methods, ensuring minimal costs and a seamless experience for users seeking efficient fund management.

- Low minimum withdrawal requirement

- Bank wire transfers available

- Supports 5+ base account currencies

- USDT (Tether) supported

- Wise not supported

What are AvaTrade deposit and withdrawal options?

AvaTrade stands out with an excellent selection of deposit and withdrawal methods, a variety of base currencies, and zero broker fees, making it an excellent choice for traders seeking low costs and maximum flexibility. Available methods include Bank Card, Bank Wire, PayPal, Skrill, Neteller, BTC, USDT.

AvaTrade Deposit and Withdrawal Methods vs Competitors

| AvaTrade | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | Yes | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are AvaTrade base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. AvaTrade supports the following base account currencies:

What are AvaTrade's minimum deposit and withdrawal amounts?

The minimum deposit on AvaTrade is $100, while the minimum withdrawal amount is $100. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact AvaTrade’s support team.

Markets and tradable assets

AvaTrade offers a limited selection of trading assets compared to the market average. The platform supports 250 assets in total, including 60 Forex pairs.

- Copy trading platform

- Indices trading

- 60 supported currency pairs

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by AvaTrade with its competitors, making it easier for you to find the perfect fit.

| AvaTrade | Plus500 | Pepperstone | |

| Currency pairs | 60 | 60 | 90 |

| Total tradable assets | 250 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products AvaTrade offers for beginner traders and investors who prefer not to engage in active trading.

| AvaTrade | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

AvaTrade received a score of 9.4/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- Trading bots (EAs) allowed

- Proprietary platform with unique features

- MetaTrader is available

- Free VPS for uninterrupted trading

- No access to cTrader and its advanced tools.

- No TradingView integration

- Strategy (EA) Builder is not available

Supported trading platforms

AvaTrade supports the following trading platforms: MT4, MT5, Proprietary platform, WebTrader. This selection covers the basic needs of most retail traders. We also compared AvaTrade’s platform availability with that of top competitors to assess its relative market position.

| AvaTrade | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | Yes | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key AvaTrade’s trading platform features

We also evaluated whether AvaTrade offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 80 |

| Tradable assets | 250 |

Additional trading tools

AvaTrade offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

AvaTrade trading tools vs competitors

| AvaTrade | Plus500 | Pepperstone | |

| Trading Central | Yes | No | No |

| API | No | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

AvaTrade supports mobile trading, offering dedicated apps for both iOS and Android. AvaTrade received a score of 6.5/10 in this section, indicating a generally acceptable mobile trading experience.

- Indicators supported

- Mobile alerts supported

- Strong Android user ratings, currently at 4.0/5

- Mobile 2FA not supported

- Weak user feedback on iOS

We compared AvaTrade with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| AvaTrade | Plus500 | Pepperstone | |

| Total downloads | 1,000,000 | 10,000,000 | 100,000 |

| App Store score | 3.0 | 4.7 | 4.0 |

| Google Play score | 4.0 | 4.4 | 4.0 |

| Mob. 2FA | No | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

Information

The broker’s website has the Training section, which contains hundreds of text and video materials. Among them, there is both a base intended for training beginners and deeper analytics for advanced training of experienced traders.

If you want a more effective training system, you should use a demo account. Putting theory into practice will help you gain a better understanding of the material and will enable you to use the acquired knowledge safely to generate income on a live account.

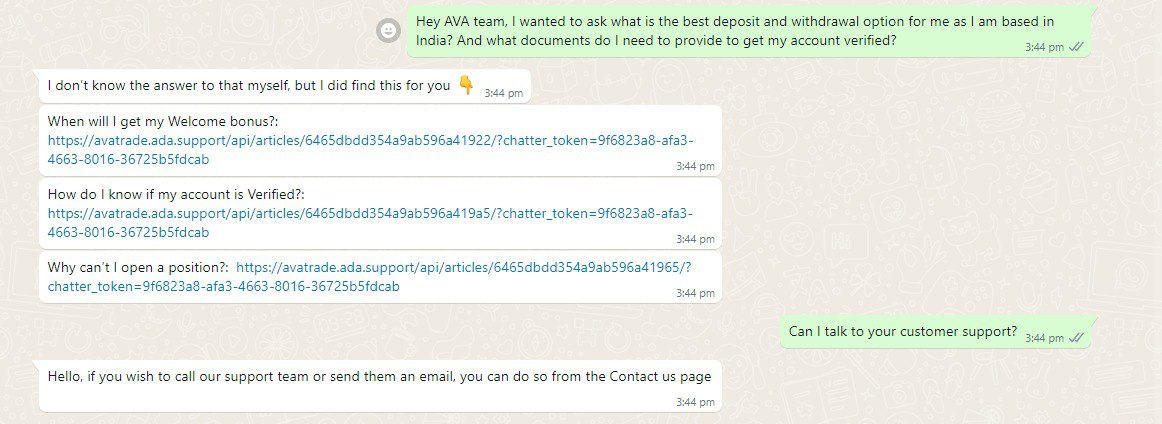

Customer support

Information

You can contact AvaTrade customer service at any time of the day from Monday to Friday. Professional experts provide help in 14 languages.

Advantages

- Friendly and qualified employees

- Comprehensive answers to any questions of users

- Multilanguage support — 14 languages

- Assisting in case of difficulties in work and other issues

- Round the clock support during the working week

Disadvantages

- Does not work on the weekend (Saturday, Sunday)

- Responses could be quicker

You can contact the customer service via the following:

-

email;

-

a phone call to any of the numbers indicated at the site;

-

a message to the online chat at the broker’s site;

-

filling out a form for a callback at the site.

Contacts

| Foundation date | 2006 |

|---|---|

| Registration address | AvaTrade Financial Center, Five Lamps Place, Amiens St, Mountjoy, Dublin, D01 A7V2. |

| Regulation |

BVI FSC , CySec, ASIC, JFSA, FSCA , FFAJ, ISA (Israel)

Licence number: SIBA/L/13/1049, 347/17, 406684, 1662, 45984, 1574, 514666577 |

| Official site | avatrade.com |

| Contacts |

+1-212-941-9609

|

Comparison of AvaTrade with other Brokers

| AvaTrade | Eightcap | XM Group | RoboForex | Exness | TeleTrade | |

| Trading platform |

MT4, MobileTrading, AvaTrader, AvaOptions, AvaSocial, AVA Option, MT5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 |

| Min deposit | $100 | $100 | $5 | $10 | $10 | $10 |

| Leverage |

From 1:200 to 1:400 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | 1.00% |

| Spread | From 0.9 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0.2 points |

| Level of margin call / stop out |

25% / 10% | 80% / 50% | 100% / 50% | 60% / 40% | 60% / No | 70% / 20% |

| Order Execution | Instant Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | Yes |

Detailed Review of AvaTrade

AvaTrade has been providing services at the market for more than 14 years and during this time it has become one of the leading companies. It is consistently on the list of the best Forex brokers. The broker diligently fulfills its obligations towards the customers and regulatory authorities, implements innovations in its activity, and is constantly working to improve its service.

The company's activity is regulated by 7 commissions at the same time: CBI (EU), B.V.I. FSC (British Virgin Islands), ASIC (Australia), FSCA (RSA), CySEC, FSA, and FFAJ (Japan). The broker uses segregated accounts for more reliable protection of customer's funds.

Here are some figures about AvaTrade brokers, which can be interesting for traders:

-

a wide range of trading instruments - more than 250 assets;

-

customer service that speaks 14 languages, available 24 hours 5 days a week;

-

accreditation from 7 regulatory authorities from five continents;

-

the company's monthly turnover is more than 60 billion US dollars;

-

the company’s experience is 14 years of work at the financial services market;

-

more than 200 thousand customers worldwide;

-

since 2009 the broker has received 9 awards for the quality of services provided.

AvaTrade is an ideal choice for all traders

AvaTrade is a great platform for beginner traders. The broker provides customers with comfortable working conditions, while the reliability, confirmed by a large number of licenses, which means that it can guarantee newcomers trade safety.

A wide choice of assets also attracts traders - from currency pairs to cryptocurrencies, indices, stocks, and commodity trading. AvaTrade broker was one of the first to include profitable cryptocurrency contracts in the list of instruments.

Another advantage of the company is the option for automated trading, the use of technical tools for analysis in the work. A customer can use the popular ZuluTrade platform or their exclusive AvaTrade GO. Also, the broker provides an opportunity to develop a personal trading algorithm using APIs.

Advantages:

availability of special accounts forIslamic traders;

large choice of trading platforms, mobile trading;

permission to use advisers, indicators, charts, and other instruments for automated trading;

Training section: Educational platform, tutorial videos, analytical materials and webinars for traders;

provides support by qualified experts 5 days a week at any time of the day;

high level of protection for customer funds stored at segregated accounts;

high level of accreditation. Licenses from the leading regulators across 5 continents.

Latest AvaTrade News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i