According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $25

- MetaTrader4

- MetaTrader5

- OctaTrader

- MISA

- FSC (Mauritius)

- 2011

Our Evaluation of Octa

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Octa is one of the top brokers in the financial market with the TU Overall Score of 8.2 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Octa clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the broker’s clients are fully satisfied with the company.

The Octa broker has tried to adapt its conditions as much as possible to the various trading strategies used by traders. However, at the moment the company is more focused on active market participants, rather than passive investors.

Brief Look at Octa

Octa is a reputable broker that offers competitive trading conditions on 300+ instruments, with spreads from 0.6 pips and zero non-trading commissions. The broker provides access to popular MT4/5 trading platforms and a proprietary OctaTrader platform with advanced features.

The company offers bonuses, contests, and a comprehensive education section to enhance traders' skills. With a strong focus on the Asia-Pacific region and a growing global presence, Octa has earned numerous awards for its services.

While passive investment options are limited to copy trading, Octa's overall trading environment and excellent customer support make it an attractive choice for traders seeking a reliable and user-friendly experience.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Offers proven platforms for trading such as MetaTrader 4, MetaTrader 5 and OctaTrader.

- Tight spreads from 0.6 pips and no non-trading commissions from the broker for deposits or withdrawals of funds.

- Wide trading opportunities including a variety of assets and access to a service for copying trades.

- Available minimum deposit. To start trading, you need to deposit at least $25 into your account.

- Execution of more than 97% of orders without slippage.

- The ability to choose the type of spread (floating or fixed) on MT4 accounts and MT5.

- Octa provides its own trading platform - OctaTrader with Space, a smart feed with trading ideas and deep analysis. OctaTrader is powered up with price alerts and instant trading notifications.

- Limited choice of investment solutions to generate passive income.

- The list of payment systems changes regularly.

TU Expert Advice

Author, Financial Expert at Traders Union

Octa provides trading services through MT4, MT5, and its proprietary OctaTrader platforms. It offers over 300 trading instruments, including Forex pairs, cryptocurrencies, indices, and stocks, with spreads starting at 0.6 pips. Traders benefit from high leverage up to 1:1000, zero non-trading fees, and a low minimum deposit requirement of $25. The broker supports all trading strategies and provides bonuses, contests, and educational resources to enhance trading experiences.

On the downside, Octa may not meet the needs of traders looking for extensive passive investment options, as its offerings are limited primarily to copy trading. Additionally, frequent changes in available payment systems may be inconvenient for some users. Overall, Octa suits active traders seeking flexible trading conditions and robust client support, but may not be the best fit for those prioritizing passive income strategies or stable platform features.

- You wish to avoid paying non-trading fees. Octa does not charge fees for depositing, withdrawing funds, or currency conversion. This means that a trader's expenses are limited to spreads and trading fees.

- You prefer straightforward and clear trading conditions. The broker works with the MT4 and MT5 platforms and offers a proprietary OctaTrader platform. The minimum deposit is $25, and spreads start from 0.6 pips. The available assets depend on the chosen platform.

- You require complete transparency. The broker offers only one account (excluding demo), and some parameters are hidden from unregistered users. For instance, you won't know the trading fee in advance.

- You value platform stability. According to user reviews, the deposit/withdrawal methods used by Octa change regularly. Currently, only Visa, Neteller, Skrill, and a few cryptocurrency wallets are available. This is not the most extensive or user-friendly selection.

Octa Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, OctaTrader |

|---|---|

| 📊 Accounts: | MetaTrader 4, MetaTrader 5, OctaTrader |

| 💰 Account currency: | USD, EUR |

| 💵 Deposit / Withdrawal: | Bank transfer, Neteller, Skrill, Visa/MasterCard, Bitcoin, cryptocurrency, instant bank transfer, local banks, e-wallets |

| 🚀 Minimum deposit: | From USD 25 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,6-1 pips |

| 🔧 Instruments: | 52 currency pairs, gold, silver, 3 energies, 10 indices, 34 cryptocurrencies, 150 stocks, 26 intraday assets |

| 💹 Margin Call / Stop Out: | 25%/15% |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | All trading strategies are allowed; MT4 account with a floating or fixed spread. |

| 🎁 Contests and bonuses: | Contests on demo accounts on MT4 with the opportunity to win real money; bonus from 10 to 50% of the deposit amount; Status program; Trade and win program |

Octa trading conditions are suitable for both experienced and novice Forex traders. The broker offers tight market spreads from 0.6 pips, a wide range of assets, and popular trading terminals. The maximum leverage for currencies is 1:1000; cryptocurrencies - 1:200; metals - 1:400; oil - 1:100; and indices - 1:400. The minimum deposit for all types of accounts is $25. The broker provides a bonus for replenishment, and also regularly holds contests with prizes, cash, and trading rewards.

Octa Key Parameters Evaluation

Video Review of Octa

Share your experience

- Best

- Last

- Oldest

KE Nairobi

KE Nairobi  FR Paris

FR Paris  PL Warsaw

PL Warsaw  CA Beauharnois

CA Beauharnois  NG Abuja

NG Abuja Reliable

None

PK Wah

PK Wah Trusted Platform

Some of the features could work better

PK Islamabad

PK Islamabad Convenient trading platform, good trading conditions

no sufficient trading indicators

Trading Account Opening

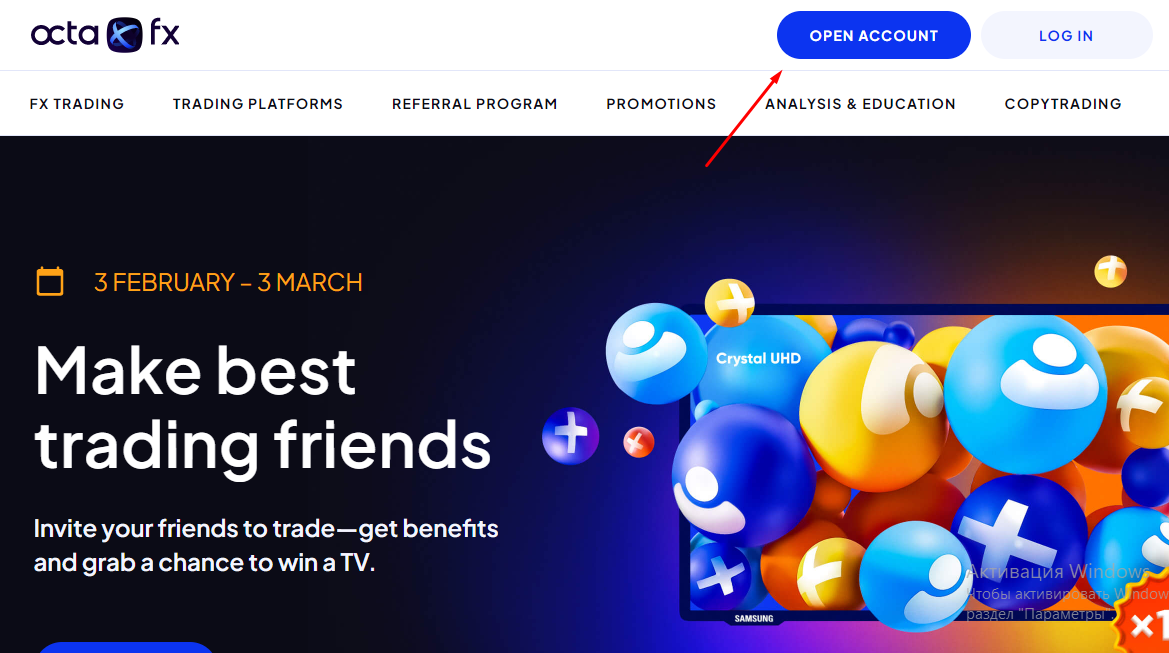

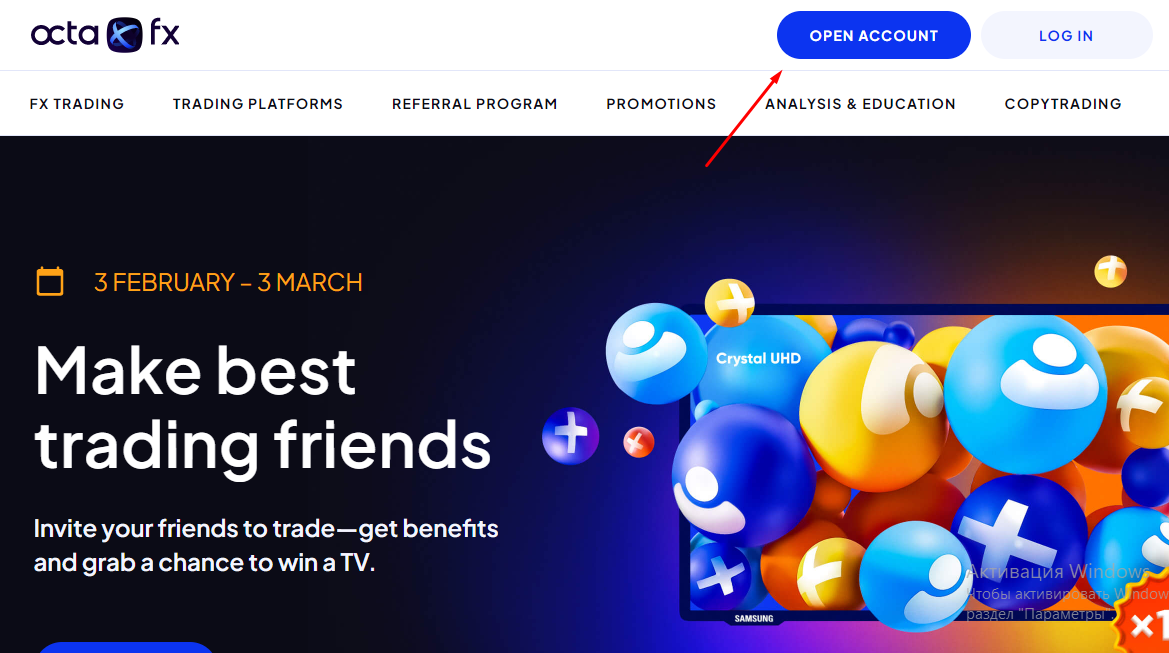

To start trading Forex through the Octa broker, you need to become its client. Here is a brief instruction on how to open a trading account and create a personal account:

On the main page of the broker's official website, click Open Account.

Fill out the form with your first name, last name, and email, or register with your Facebook or Google account. Confirm your email address and then log in to your Personal Account. Select your trading account type (MT4, MT5) and click Continue. After that, a letter with the credentials of the created trading account and PIN code will be sent to the email you specified during registration. After verififying your identity, you can make a deposit and then select assets to trade.

The functionality of the Octa personal account:

-

Making a deposit, withdrawing funds, applying for a deposit bonus.

-

Connection to the platform for copying trades.

Also in the personal account, a trader can perform the following actions:

-

Go to the web terminal for trading through the browser of a mobile device or PC.

-

Set up trading conditions by adjusting the leverage.

-

Change the type of swap account to Islamic.

-

Add your account to Monitoring. This allows you to share your performance, charts, profit, orders, and history with other users, who select a trader to copy trades in the Monitoring section.

Regulation and safety

Octa has a safety score of 4.9/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 14 years

- Not tier-1 regulated

Octa Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

| MISA (Mwali) | Mwali International Services Authority | The Comoros | No specific fund | Tier-3 |

Octa Security Factors

| Foundation date | 2011 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Octa have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Octa with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Octa’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Octa Standard spreads

| Octa | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,6 | 0,5 | 0,1 |

| EUR/USD max, pips | 1 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,6 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,1 | 1,4 | 0,5 |

Does Octa support RAW/ECN accounts?

As we discovered, Octa does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Octa. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Octa Non-Trading Fees

| Octa | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Octa offers three types of live accounts. They differ in the assets available for trading, the level and type of spread, and the existence/nonexistence of additional trading commissions.

Account types:

You can open a demo account on each of the available trading platforms.

Octa is a broker that offers favorable trading conditions to traders of any experience.

Deposit and withdrawal

Octa received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Octa provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Bitcoin (BTC) accepted

- Low minimum withdrawal requirement

- Minimum deposit below industry average

- No deposit fee

- Only major base currencies available

- Wise not supported

- PayPal not supported

What are Octa deposit and withdrawal options?

Octa provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT, Ethereum.

Octa Deposit and Withdrawal Methods vs Competitors

| Octa | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Octa base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Octa supports the following base account currencies:

What are Octa's minimum deposit and withdrawal amounts?

The minimum deposit on Octa is $25, while the minimum withdrawal amount is $5. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Octa’s support team.

Markets and tradable assets

Octa offers a limited selection of trading assets compared to the market average. The platform supports 277 assets in total, including 52 Forex pairs.

- Crypto trading

- Copy trading platform

- 52 supported currency pairs

- Bonds not available

- Futures not available

Octa Supported markets vs top competitors

We have compared the range of assets and markets supported by Octa with its competitors, making it easier for you to find the perfect fit.

| OctaFX | Plus500 | Pepperstone | |

| Currency pairs | 52 | 60 | 90 |

| Total tradable assets | 277 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Octa offers for beginner traders and investors who prefer not to engage in active trading.

| OctaFX | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Live chat operators are in touch every day 24/7

Advantages

- There is an online chat

- You can contact support by e-mail and via messengers

- Support is available in 13 languages

Disadvantages

- Weekend opening hours are limited

To communicate with the broker, the client can use:

-

online chat;

-

instant messaging services Twitter, Telegram, Facebook, Instagram, LinkedIn, TikTok;

-

internal tickets of the client terminal.

You can contact technical support representatives from the broker's website and through your personal account.

Contacts

| Foundation date | 2011 |

|---|---|

| Registration address | Rue De La Democratie, office 306, 3rd floor, Ebene Junction, Ebene 72201, Mauritius |

| Regulation |

MISA, FSC (Mauritius)

Licence number: T2023320, GB21027161 |

| Official site | https://www.octafx.com/ |

Education

A novice trader will find a lot of useful educational information on the Octa website in the Education section. In addition to the basics of trading, the services and conditions that the broker offers to its clients are described in detail here.

Trading on a demo account is an opportunity to test all the theoretical knowledge gained by using the demo account which does not allow financial losses.

Comparison of Octa with other Brokers

| Octa | Bybit | Eightcap | XM Group | AMarkets | 4XC | |

| Trading platform |

MetaTrader4, MetaTrader5, OctaTrader | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, AMarkets App | MT5, MT4, WebTrader |

| Min deposit | $25 | No | $100 | $5 | $100 | $50 |

| Leverage |

From 1:40 to 1:1000 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:3000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.6 points | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points |

| Level of margin call / stop out |

25% / 15% | No / 50% | 80% / 50% | 100% / 50% | 50% / 20% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | No | No | No | No | No |

Detailed Review of Octa

Octa has been providing brokerage services for over 11 years and is constantly increasing the number of its active users. The broker works with a large number of liquidity providers around the world, so his clients receive the best-aggregated prices. Octa trade servers and data centers are located throughout Europe and Asia, ensuring low latency and stable connections. The company operates on the ECN/STP model and executes orders at market price in less than 0.1 seconds.

A few figures about the broker, which are published on its official website:

-

More than 12 million open trading accounts.

-

More than 500 million completed trades.

-

Serving customers from 150 countries.

-

Presence of 60 international awards from financial experts in the Forex industry.

Octa is a reliable broker for entering the Forex market

Octa offers low spreads, various commission-free deposit and withdrawal methods, and negative balance protection. A wide range of trading instruments is available to clients. In addition to currency pairs, metals and CFDs, here you can trade Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ripple cryptocurrencies. The terminals are compatible with any device with internet access and they support all major tools, including one-click trading, advanced charting, and technical analysis. Octa uses modern technologies to protect the transactions and personal data of customers. The user's personal account is protected by SSL and 128-bit encryption, and 3D secure technology is used to process credit and debit cards.

The broker provides its clients with the classic trading platforms MetaTrader 4 and MetaTrader 5, which is also very popular among traders. All of them are available in mobile and desktop versions. It is also possible to trade directly through a web browser without installing the platform on your device.

Useful services of Octa:

-

AutoChartist. A free automatic alert service compatible with MT4 and MT5 with over 83% trend prediction accuracy for currency pairs.

-

Traders tools. Useful tools, such as profit and trade calculators, real-time quotes, and rating of the best trading accounts available for copying are offered.

-

Analytics. The section includes market information, economic calendar, market analysis, Forex news, interest rates, and a holiday calendar.

Advantages:

You can trade with high leverage. The maximum size is 1:1000 for currency pairs.

High-level protection of customer funds and data (personal and payment) is processed through a secure SSL protocol, a license, and segregated accounts.

A platform for copying trades with the ability to control risks is available.

There is high-quality and free analytics such as market analysis, Forex news, and real-time quotes.

The availability of online chat, the operators of which promptly answer questions and solve technical problems that arise.

The broker allows the use of all trading strategies such as: hedging, scalping, news trading, and the use of advisors on all types of accounts.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i