RoboForex User Experience. What Works And What Doesn’t

RoboForex has mostly met what I was hoping for, offering a dependable platform with user-friendly tools and plenty of asset options. I like the competitive spreads and fast ewallet withdrawals, but slower bank transfers and occasional delays in customer service can be frustrating. It’s a good pick for traders who want flexibility and useful features, though those who prefer strict regulation or quicker bank transfers might want to consider other brokers. For now, I plan to stick with RoboForex, as the positives still make it worth using for me, while I keep an eye out for better trading options in the future.

Trading with RoboForex has been a rollercoaster of ups and downs, with every trade teaching me a new lesson about market movements and my own trading habits. When I first signed up, I needed a platform that wouldn’t just check boxes but would really sync with how I like to trade — quick, efficient, and with tools I can trust. Now, I've settled into a rhythm, using RoboForex’s reliable execution and practical features daily. From the charting tools that help me spot trends faster to the execution speed that saves me from market slip-ups, my experience has been about finding ways to make each trade smoother and more rewarding. Come, as I walk you through my journey with this broker, highlighting things that RoboForex got right and those that it didn’t.

Why RoboForex?

For me, trading has always been about balancing risk and reward, a pursuit that needs careful thinking and reliable tools. RoboForex stood out with its impressive array of features, from a wide selection of assets like currencies, stocks, to a platform backed by regulations that instilled confidence. It had the blend of reputation and innovation that I was looking for. And that was enough for me to take a try with this broker.

You’ll understand it more once this review takes you through my entire experience— from the registration and setup process, and the trading tools I explored, to my honest impressions of trading on their real and demo accounts.

About RoboForex

RoboForex has been around since 2009, and over the years, I've watched it evolve into something remarkable. What stands out most, in my opinion, is how they constantly tune in to what traders like me really need. For example, they offer so many trading options that I never feel limited. Having thousands of assets at my fingertips, including Forex, stocks, and commodities, makes diversification a breeze without needing to jump between platforms.

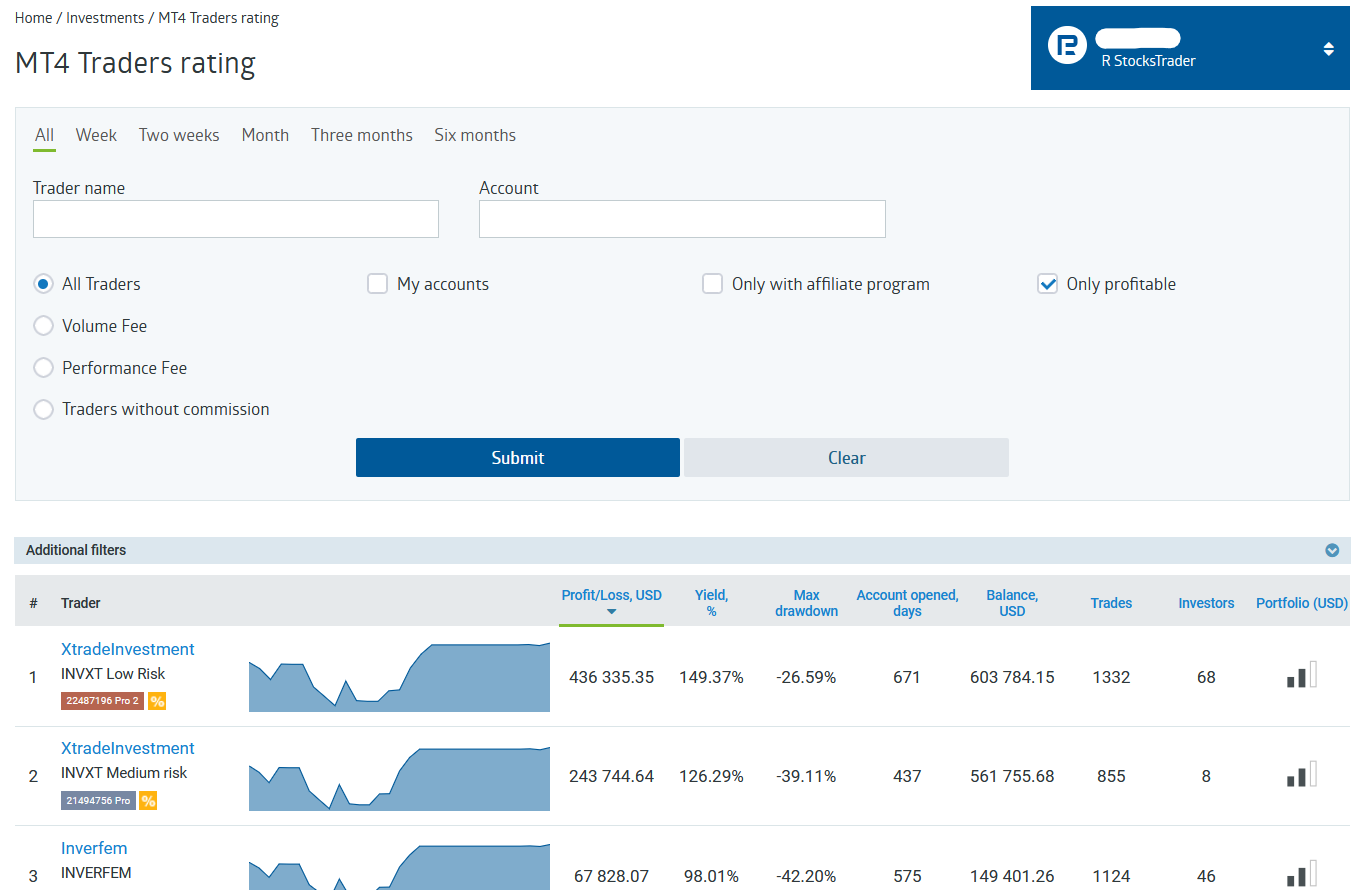

Another big deal for me is their custom trading platforms. RoboForex’s R Trader and MetaTrader 5 are intuitive yet powerful, perfect for me when I need to react quickly in chaotic market situations. But beyond the tech and the sheer variety, what really keeps me hooked is their focus on making trading stress-free for folks like me. I still remember when I stumbled upon their CopyFX feature—it was a total game changer. As a newbie, it let me mirror what the pros were doing, which was a lifesaver when I was starting out and even brought in some good returns. Now that I’ve gained more experience, I take full advantage of their tight spreads and lightning-fast execution during those adrenaline-pumping news moments. It's this mix of flexibility and thoughtful features provided by this broker that makes me suggest it to my close aides.

How did I narrow down to RoboForex?

Choosing RoboForex wasn’t just a spur-of-the-moment decision. I approached it methodically, using criteria I knew would make or break my trading experience. Here’s what guided me.

-

License and regulation. The first thing I checked was whether RoboForex had a legitimate operating license. This broker is regulated by the IFSC, and while that may not be as big as top-tier licenses, it’s solid enough to provide a safety net. Knowing my funds were somewhat protected put my mind at ease.

-

Reputation. I’m not one to blindly trust marketing claims, so I dug deep into forums and even reached out to a few traders I respect. The consensus was that RoboForex has been dependable for over a decade. Sure, there were a few complaints, but show me a broker without any, and I’ll show you a unicorn.

-

Low commissions and fees. Here’s where things got interesting. I compared commissions, spreads, and fees across multiple brokers. RoboForex came out on top for most of my trading needs. Their ECN account structure is perfect for me, especially when scalping or trading during major news releases. Those low spreads mean every pip matters.

-

Platform convenience. The convenience of their trading platforms is second to none. MetaTrader 5 was familiar territory, but what really got me hooked was R Trader. It’s a fully web-based platform, and yet, it feels incredibly capable. I can monitor multiple assets simultaneously, and the charting tools are genuinely a dream to work with.

-

Tools and assets. RoboForex's wide range of trading instruments caught my attention. Having access to over 12,000 assets is a game changer. I’m all about diversifying, and being able to trade everything from Forex pairs to even U.S. stocks on one account? That’s a big deal for me. Their automated trading tools are also a massive plus—I use them regularly to test strategies without risking real money upfront.

Checking ratings and reviews of RoboForex

When I thought about choosing RoboForex as my broker, I knew I couldn’t just trust a shiny ad that promises the world. I went all in, checking ratings and digging into reviews because making a smart choice needed more than empty praise or generic ratings. I started with trusted places like Trustpilot, where traders spill their true experiences. I didn’t just look at the star ratings; I read through what people were actually saying about spreads, withdrawals, customer service, and order execution. It was all about spotting patterns — were the same issues or good points popping up again and again?

I also went on Reddit and smaller trading groups to hear from people who’d been using the platform for a long time. They shared the kind of nitty-gritty details you don’t get in quick reviews — how the spreads held up when the market got wild or if withdrawals were straightforward without hidden fees.

My personal expectations from RoboForex

One of the most important features for me is having really tight spreads when trading activity is at its peak. When I'm trading around big news events or during the busiest trading sessions, those narrow spreads can be the difference between a winning and losing trade. Another big deal for me is access to next-level tools for managing risk. I’m talking about more than just standard stop-loss or take-profit settings. I look for features like adjustable trailing stops and more advanced order options that let me keep a steady grip on my positions. These tools give me peace of mind when I’m not constantly staring at the screen but still want to maintain control over my trades. And, while I’m at it, a helpful support team that’s there round the clock is more important than most people realize. Knowing that I can get immediate assistance if there’s ever an issue has kept me confident during those late hours when I trade. Luckily, RoboForex ticked all the boxes for me, and that is when I dropped the hammer.

Registration, verification, and first impressions

My Experience With RoboForex. How I trade

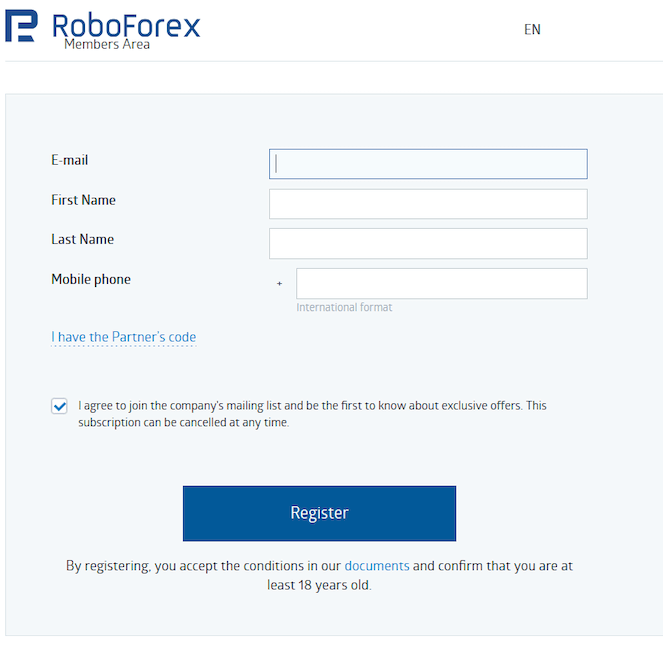

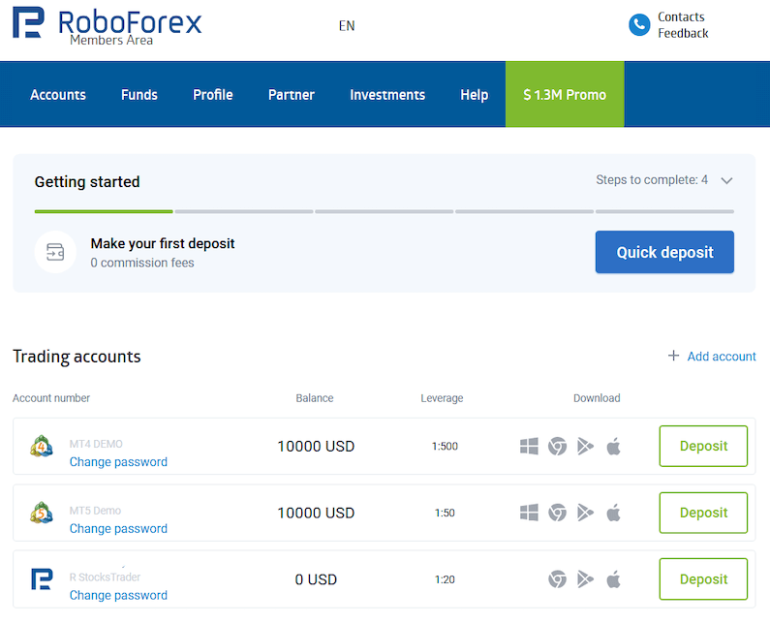

When I first registered with RoboForex, I was pleasantly surprised by how straightforward the process was. It began with filling out a simple form on their website, requiring basic personal information like my name, email, and phone number. After submitting the form, I received a confirmation email almost instantly, which included my login details for the Members Area. This area is essentially the control center for managing accounts, deposits, and withdrawals.

My Experience With RoboForex. How I trade

I liked the automatic creation of my first trading account upon registration. This meant I could dive into exploring the platform without any delays. However, to fully utilize all features, especially for deposits and withdrawals, completing the verification process was essential. This involved uploading documents to confirm my identity and address. The verification was completed within two business days, which I found quite efficient.

My Experience With RoboForex. How I trade

My Experience With RoboForex. How I trade

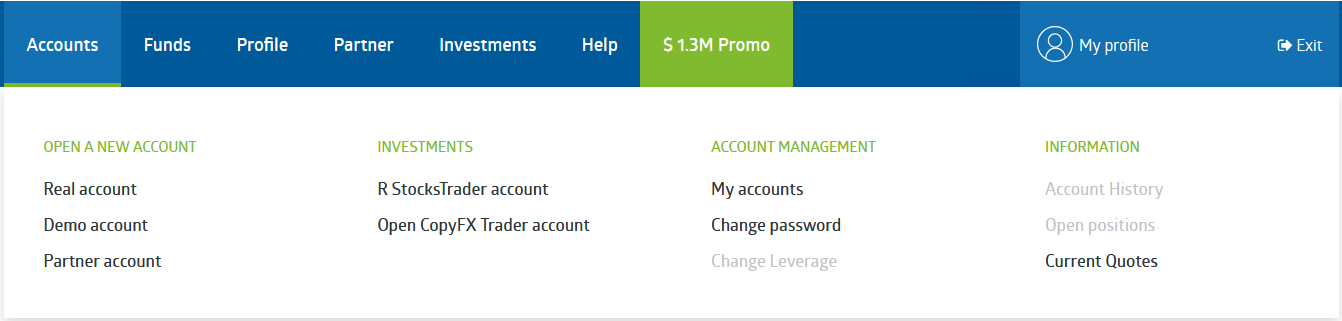

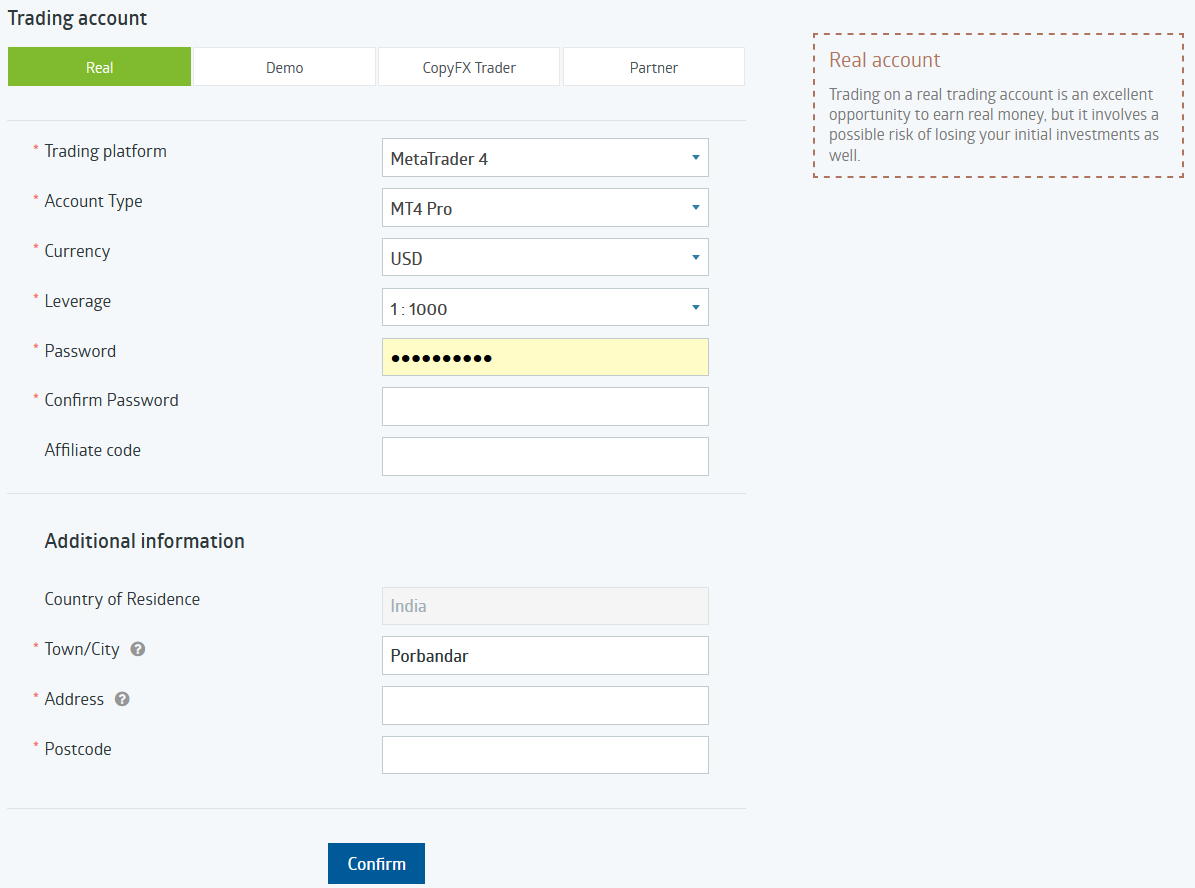

For those looking to open additional accounts, the process is equally user-friendly. Within the Members Area, there's an option to add new accounts. You can customize these accounts by selecting parameters such as account type, base currency, and leverage. This flexibility allowed me to tailor my trading experience to my specific needs.

RoboForex tutorial video

RoboForex demo account review

My Experience With RoboForex. How I trade

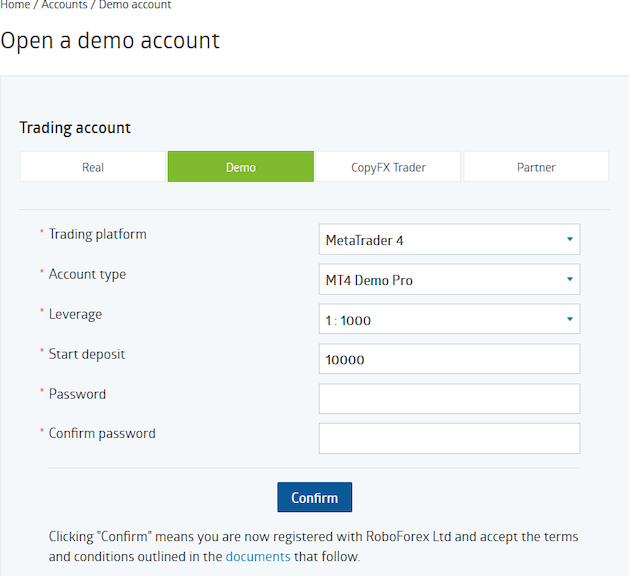

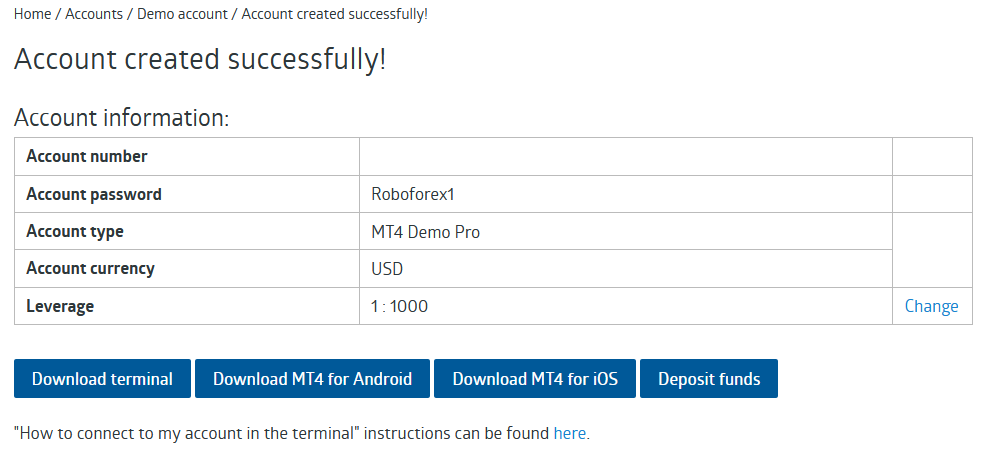

Opening a demo account was quite simple. Just hover over the “Accounts” tab from the Members Area and click on “Demo Account”. Then, fill in the form as per your preferences and you’re ready to go. Once the account is created, link it to your MT5 terminal as per the instructions provided at the account creation page.

My Experience With RoboForex. How I trade

RoboForex’s demo account is one of the better practice platforms I’ve used, but it’s not without its quirks. When I first started, what stood out to me was how close it felt to the real trading environment. The tools available are great: from Forex and stock charts to real-time price feeds. I appreciated the range of trading instruments, which let me experiment with strategies I wouldn’t dare try with real money. The execution speed is pretty fast, often comparable to live trading, so you get a decent sense of timing your entries and exits.

That said, there are some subtle differences that only show up after spending time on it. The demo platform’s order execution is quick, but it lacks that tiny slippage you experience when trading live—where your patience and reflexes are really tested. The interface is intuitive and user-friendly, which is great for new traders like I once was, but even as someone with more experience, I find it slick enough for serious practice sessions.

Advantages? You can explore everything from setting stop losses to tracking multiple trades at once, just as you would on a live account. It’s a playground where you can test the waters without burning your capital. But here’s the kicker: the psychological edge is missing. No demo account, no matter how advanced, replicates the sweat-inducing moments when real money is on the line.

Limitations? Some advanced analytics tools that I rely on when trading live are trimmed down or not present at all. Plus, while you can practice with large, hypothetical amounts, this can give you a false sense of security. When I switched from demo to live trading, I had to recalibrate my risk management entirely.

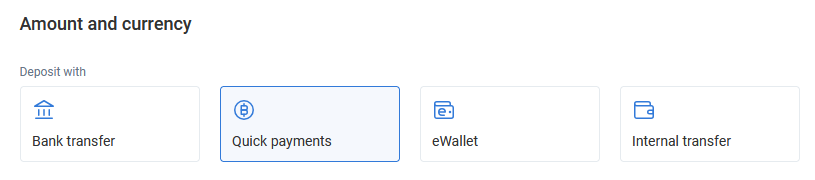

How convenient are RoboForex deposit methods?

My Experience With RoboForex. How I trade

As an Indian trader with RoboForex, I've explored various deposit methods to fund my trading account. The steps were clear, and I didn't have to guess what to do next. It's great that most deposit methods don't come with extra fees, meaning more money goes into my trades. Deposits through AstroPay showed up in my account within a few hours, and even the bank transfer option didn't take more than a day.

How is the RoboForex trading platform and tools?

Platform overview

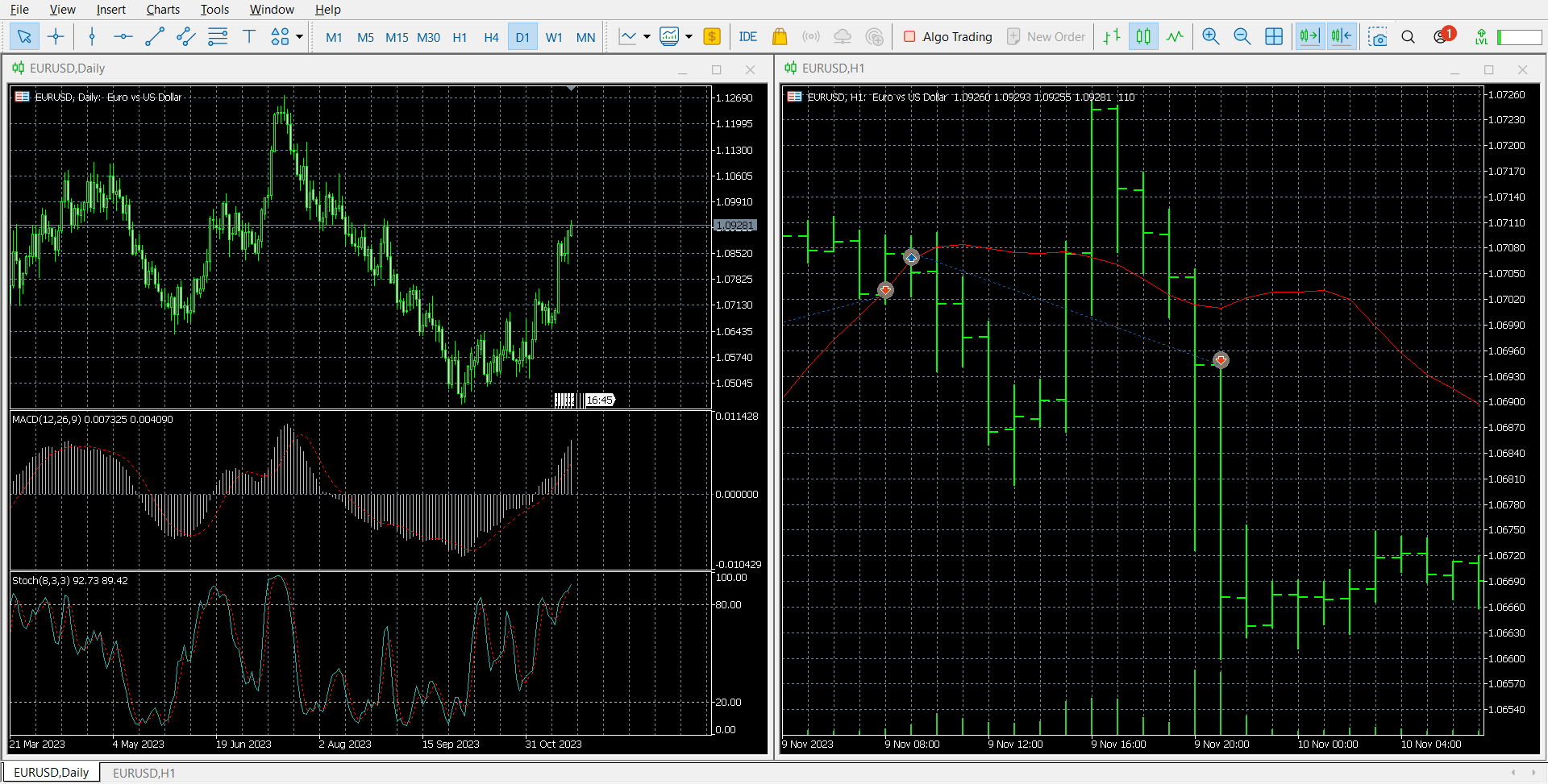

My Experience With RoboForex. How I trade

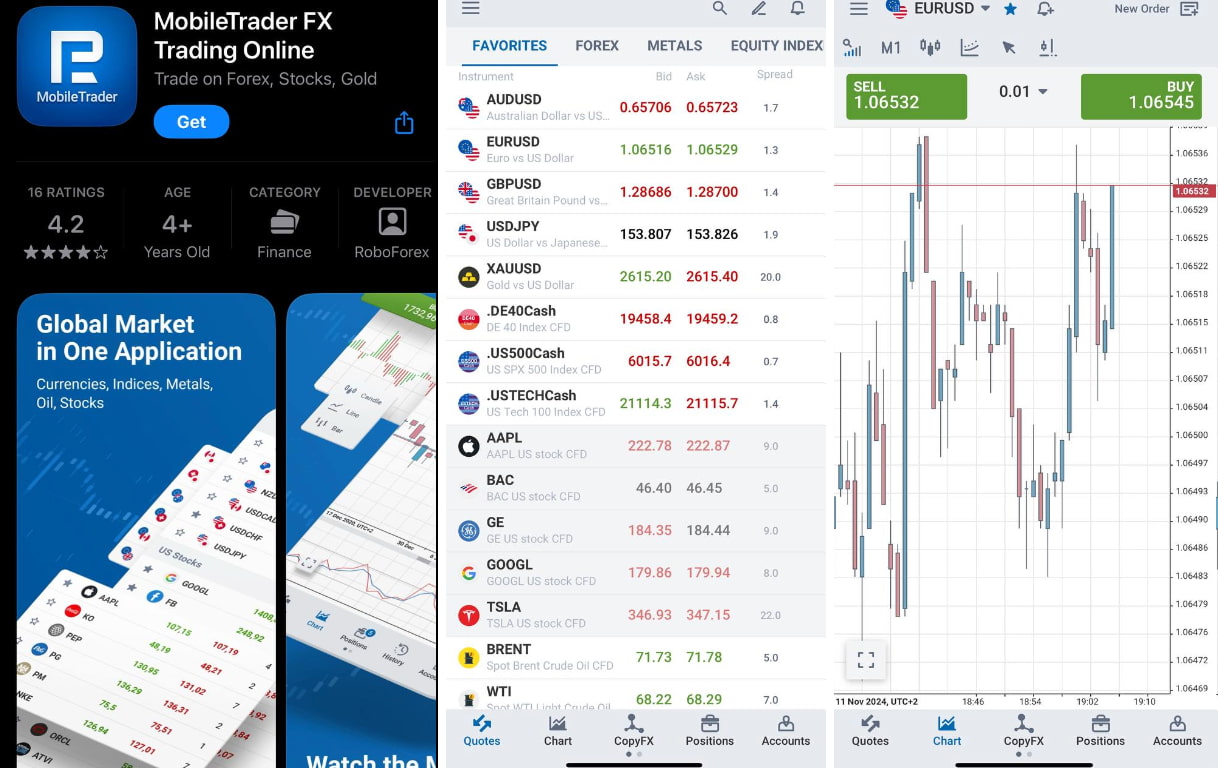

RoboForex’s trading platforms, like R Trader and MetaTrader 5, are user-friendly without being overly simplistic. I appreciate that I don’t have to wade through endless settings to get started. The experience on both desktop and mobile is seamless. The mobile app, in particular, is reliable and makes it easy to monitor the market or place quick trades when I’m away from my desk.

Functionality and tools

My Experience With RoboForex. How I trade

What I really appreciate is the variety of assets available—everything from Forex pairs and stocks to commodities. It feels like everything I need is in one place. The charting options are customizable, which suits different trading styles. I rely on the built-in indicators, like RSI and MACD, and they do the job well. For someone like me who values solid analysis, the tools cover most of what I need. The economic calendar built into the platform is also useful for tracking key events without flipping through multiple websites.

My Experience With RoboForex. How I trade

Trading experience

Trading on a real account has been generally smooth. Most of my trades are executed quickly, which is a relief during active market hours. While slippage does happen at times, especially when the market is volatile, it hasn’t been severe enough to disrupt my strategy. I haven’t encountered many requotes, and the process of placing orders—whether it’s market orders, limit orders, or setting up stop losses—is easy to understand.

Transaction results and overall impressions

Overall, I’m satisfied with my trading outcomes and how the platform handles transactions. The execution speed supports my day-to-day trading, allowing me to react quickly when it matters. One feature I find quite helpful is CopyFX — it’s a simple way to follow experienced traders when I want to add variety to my approach without managing everything myself.

My Experience With RoboForex. How I trade

Experimenting with algorithmic trading through R Trader has also been straightforward, which is a plus if you’re not a coding expert but still want to test automated strategies. These extras make RoboForex more than just a basic platform; it’s a place where I can adapt my trading to fit different goals.

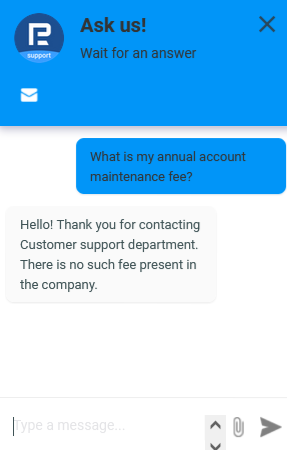

How accessible is the RoboForex customer support?

My Experience With RoboForex. How I trade

I've interacted with their customer support through various channels: live chat, phone, and email. The live chat feature is particularly efficient, often providing immediate assistance for most queries. Phone support is also available 24/7 along with email support, but I haven't needed to use it much, as the live chat typically resolves my issues promptly. The support team is generally knowledgeable and helpful, addressing concerns effectively. However, during peak times, there can be slight delays in response. Overall, my experience with RoboForex's customer support has been satisfactory, with most issues being resolved through the live chat feature.

RoboForex withdrawal methods

Over time, I’ve become familiar with the withdrawal process. Making a withdrawal starts by logging into the Members Area and choosing "Withdraw Funds" — then, you pick from options like bank transfers, e-wallets (e.g., Skrill, Neteller, etc.), or credit/debit cards. The steps are pretty simple to follow, and I've rarely faced any confusion along the way.

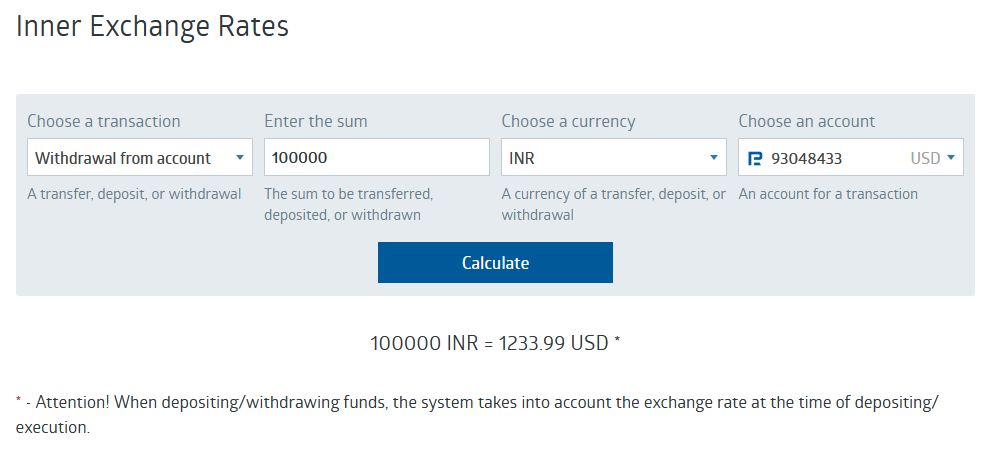

When it comes to the time it takes and any fees, I've seen differences based on which method I use. E-wallets are usually the fastest for me, often getting completed within a day, with fees ranging between 1% to 1.9%. On the other hand, bank transfers have taken up to three business days, and the fees can be steeper, sometimes reaching 4%. Checking the exact fee details ahead of time has saved me from surprises.

One thing I appreciate is that I can check the status of my withdrawal right in the Members Area, so I always know where things stand. Occasionally, if I withdraw a larger sum or use a new method, they might ask for extra verification. As long as I send the documents quickly, it hasn’t led to any major holdups.

You can also check the expected withdrawal amount as per prevailing exchange rates using the calculator provided by RoboForex.

My Experience With RoboForex. How I trade

Conclusion

Looking back at my time with RoboForex, I’d say the broker has mostly delivered on what I was looking for. The platform has been reliable, with easy-to-use tools and a broad range of assets that match different ways of trading. I really value competitive spreads, which come in handy when I’m trading frequently, and I find their platforms like MetaTrader 5 and R Trader intuitive. Plus, withdrawals through e-wallets have been quick and efficient. On the flip side, bank transfers can be slower—sometimes up to three days with higher fees—and withdrawing large amounts sometimes means extra verification steps. There have also been moments when customer service was slower during busy periods.

Overall, I think RoboForex is a good pick for traders who want access to lots of assets and customizable tools. Newcomers can use the demo account to learn the basics, while more experienced traders can benefit from low spreads and the advanced features on the platform. That said, if you’re looking for a broker with strict top-tier regulation or super-fast bank transfers, you might want to consider other options. Personally, I plan to keep trading with RoboForex for now, as the benefits still outweigh the downsides for me. Even so, I’m always staying alert for any changes or new offerings to make sure I’m getting the most out of my trading experience.

FAQs

What types of accounts can new traders explore on RoboForex?

RoboForex offers various accounts like Standard, ECN, and Prime. Each has its own perks and trading terms to match different approaches.

Are there unexpected costs with withdrawing funds from RoboForex?

While most methods are straightforward about their fees, some bank transfers can cost more. It’s good to double-check their fee details beforehand.

How dependable are the trading platforms at RoboForex?

In my experience, platforms like MetaTrader 5 and R Trader are solid. The quick execution is a big plus, especially when timing matters in trading.

Why is RoboForex’s CopyFX tool useful for beginners?

CopyFX is great for newcomers who want to follow experienced traders’ moves. It’s a practical way to learn and pick up strategies without jumping in blindly.

Is trading with RoboForex safe in terms of regulation?

RoboForex is regulated by the IFSC, which adds a safety layer, though it’s not as strict as top-tier regulators. Still, it does offer some assurance.

Can I manage different types of accounts on RoboForex?

Yes, you can open and handle various accounts from the Members Area, giving you room to adapt as your trading approach changes.

What should I be mindful of when moving from demo to live trading?

While demo trading mirrors live conditions pretty well, dealing with real money introduces emotional challenges. It’s different when your actual funds are on the line.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).