According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- cTrader

- MetaTrader4

- MetaTrader5

- FSA Seychelles

- 2012

Our Evaluation of XBTFX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

XBTFX is a moderate-risk broker with the TU Overall Score of 6.72 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by XBTFX clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

XBTFX provides access to a large number of CFDs on the most sought-after assets. The entry threshold is low, a demo is available, and the minimum deposit is only $10. Spreads on the Standard account are average for the market, while on ECN they are below the market average. The fee is less than that of this broker’s leading competitors. Passive income is available in all the main options, which is a big plus. The main disadvantages are that deposits and withdrawals are made only in cryptocurrencies and this broker does not disclose some trading information on its website.

Brief Look at XBTFX

XBTFX is a CFD and cryptocurrency broker for BTC, ETH, XRP, LTC, BNB, and other altcoins. CFDs on more than 200 assets, such as currency pairs, cryptocurrencies, stocks, indices, commodities, and precious metals are available. There is a free demo account and two live account types, namely Standard and ECN. Clients can open an Islamic swap-free account upon request. The minimum deposit is $10. Spreads on the ECN account are raw starting from 1 pips. There are no trading fees on Standard and Islamic accounts, while on ECN, the fee is $3.5 per full lot. MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader are available to traders. The maximum leverage is 1:500. This broker offers good training with articles for novice traders and experienced market participants. Passive income options are a copy trading service, MAM and PAMM accounts, and a referral program.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- This broker offers a wide pool of assets from different groups, which provides for diversifying risks and expanding profit potential;

- The demo account is free, while for trading on live account types a $10 deposit is required. Top trading platforms are available;

- This broker does not set restrictions on trading, thus scalping, hedging, use of advisors, and trading news are available;

- Traders’ costs are minimal with spreads starting from 1 pips (or from 0.01 pips on the ECN account);

- Educational materials are aimed at novice traders and experienced users;

- Several passive income options such as the copy trading service, joint accounts, and a referral program are available;

- Technical support works 24/7 and is available via call center and email.

- All trading instruments are CFDs;

- Deposits and withdrawals can be made only in cryptocurrencies, fiat currency is not available;

- This broker does not provide its services to residents of Belgium, Belarus, Russia, Iran, North Korea, Sudan, Yemen, etc.

TU Expert Advice

Author, Financial Expert at Traders Union

XBTFX offers diverse trading services, including CFDs on Forex, cryptocurrencies, stocks, indices, commodities, and precious metals. It supports cTrader, MetaTrader 4, and MetaTrader 5 platforms, and provides Standard, ECN, and Islamic accounts with leverage up to 1:500. A minimum deposit of $10 is required, and traders benefit from competitive spreads starting from 1 pips on the Standard account. Additionally, educational resources, copy trading, and referral programs, are available.

However, XBTFX has drawbacks, including deposits and withdrawals limited to cryptocurrencies, the lack of fiat currency support, and absence of stringent regulation. While it does not suit traders prioritizing traditional monetary transactions or strict regulatory frameworks, it offers attractive options for those seeking diverse assets, low entry barriers, and various trading platforms.

- You seek a diverse range of assets for risk diversification and increased profit potential and if minimal trading costs with spreads starting from 1 pip (or from 0.01 pips on the ECN account) are important to you.

- You prefer a broker that doesn't impose restrictions on trading activities, allowing for scalping, hedging, use of advisors, and trading news.

- Stringent regulation is a top priority for you, as XBTFX is primarily regulated by the International Financial Services Commission (IFSC) in Belize, considered less stringent than regulators like CySEC or FCA.

- You rely on fiat currencies, such as USD, EUR, GBP, and others, for your deposits and withdrawals, as XBTFX does not support them.

XBTFX Trading Conditions

Your capital is at risk. Leveraged trading in foreign currency contracts and CFDs are complex financial products traded on margin intended for retail, professional and eligible counterparty clients. Leveraged trading is risky and may not be suitable for all investors. Ensure you understand the risks involved as you may lose all your invested capital. Most CFDs have no set maturity date and a CFD position matures on the date an open position is closed.

| 💻 Trading platform: | МetaТrader 4, MetaTrader 5, and cTrader |

|---|---|

| 📊 Accounts: | Standard, ECN, and Islamic |

| 💰 Account currency: | USD, BTC, ETH, USDT, DAI, and XRP |

| 💵 Deposit / Withdrawal: | Crypto wallets |

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | CFDs on currency pairs, cryptocurrencies, stocks, indices, commodities, and precious metals |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: |

Free demo account; Three live account types; Low entry threshold; Tight spreads; Competitive fees; Many passive income options; Deposits and withdrawals are available only in cryptocurrencies. |

| 🎁 Contests and bonuses: | Bonuses from Traders Union |

Many brokers that offer multiple live account types have different minimum deposit requirements. XBTFX requires a minimum deposit of $10 regardless of the account type. Leverage also does not depend on the account type but is determined only by the asset type. The highest leverage of 1:500 is available for currency pairs. This company's technical support works 24/7. It is available through several communication channels, including phone, email, and tickets. Tickets can only be created after registration.

XBTFX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

KE Nairobi

KE Nairobi Overall good

No weakness

US Washington

US Washington Accessibility and simplicity. The company's consultants have been very helpful to me!

Didn't find it

DE Frankfurt am Main

DE Frankfurt am Main Only benefit s

Lack

UZ Tashkent

UZ Tashkent Wide range of instruments, Transparency and reliability

-

NG Lagos

NG Lagos The union exclusively represents the employees of a specific company, ensuring that workplace issues and grievances are addressed in a targeted manner

It has no weakness

DE Frankfurt am Main

DE Frankfurt am Main The company improves the quality of services

There are few training courses

PK Mian Channu

PK Mian Channu Great

No

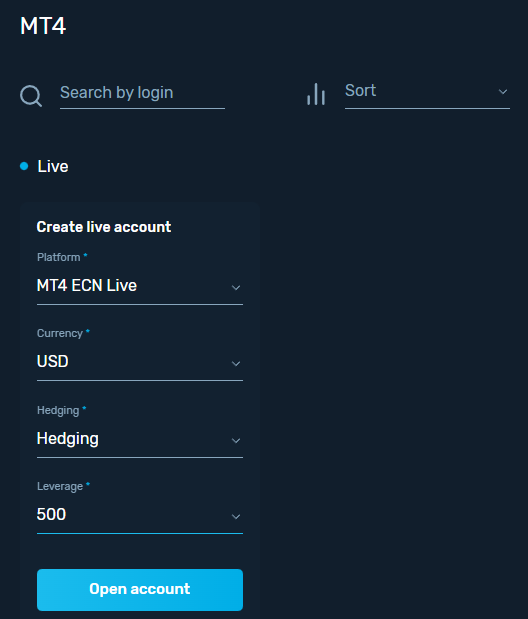

Trading Account Opening

To start working with this broker, register on its official website, go through the identification procedures, open a live account, make a deposit, and download a trading platform. After installing and launching the platform, enter your registration data, and start trading. TU’s experts have prepared a step-by-step guide on the registration process and features of the user account.

Go to this broker's website and click the “Register” button in the upper right corner.

Enter your first and last names, as well as your email address. Create a password and enter it twice. Enter your phone number and select your country of residence from the list. Agree to the terms of service by ticking the box and click the “Continue” button.

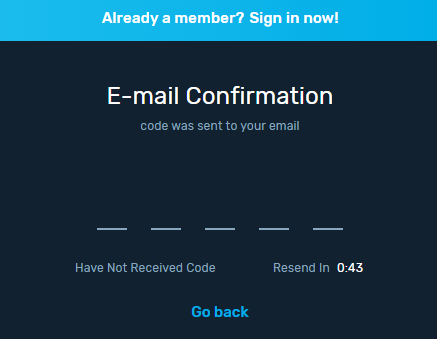

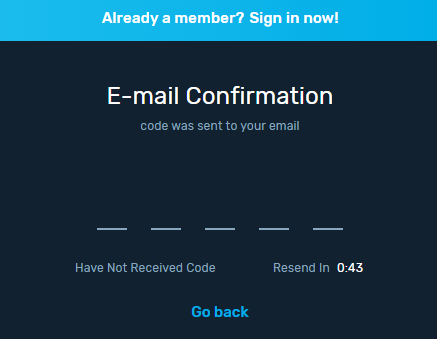

An email with a confirmation code will be sent to the specified address. Enter it in the appropriate box on the website. Then enter your email and password to log in.

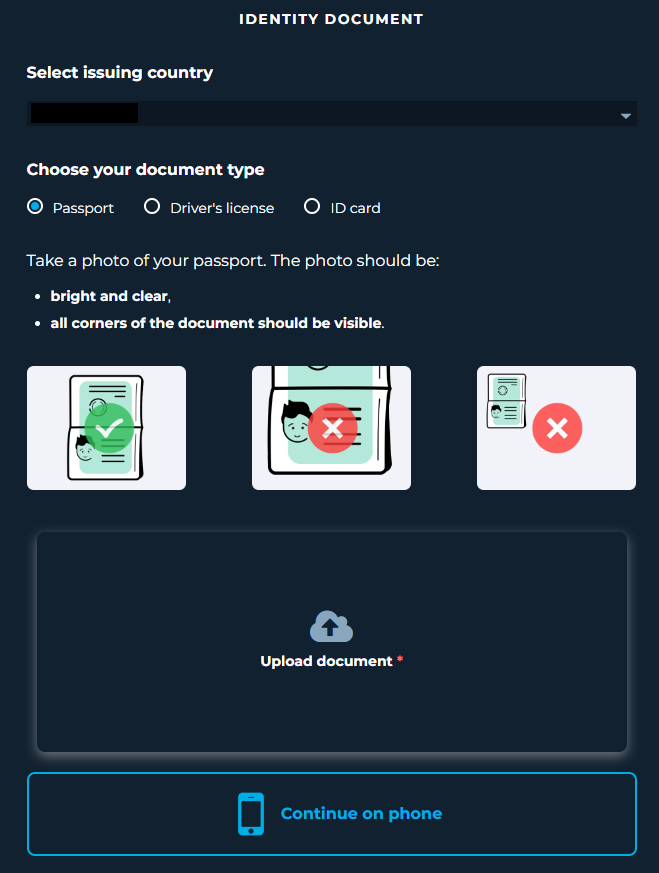

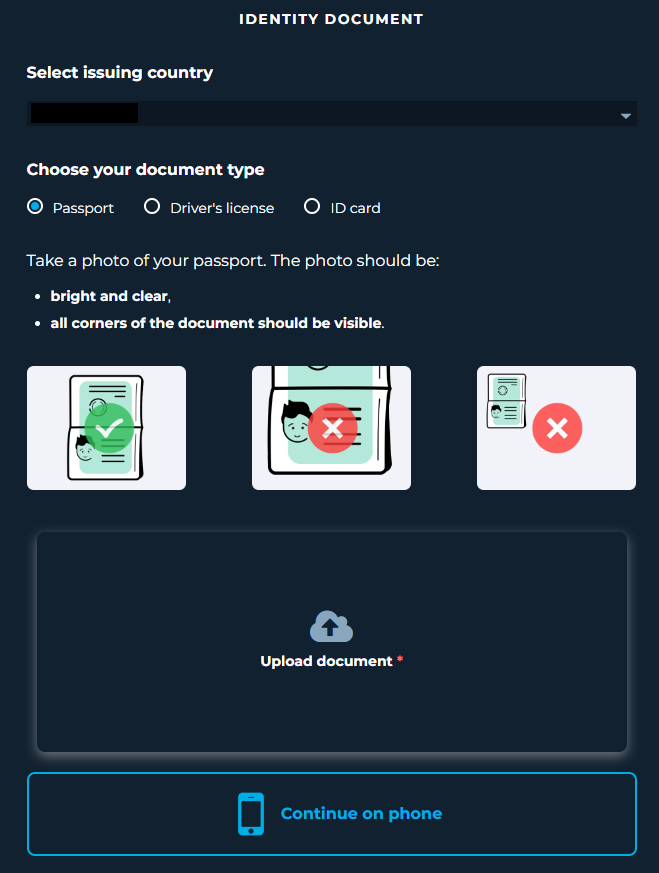

Go to the “Profile” section in the main menu on the left. Select the “Verification” block and click the “Next step” button. Select the type of document confirming your identity and upload its scan/photo. Take a selfie with this document and submit it using the appropriate form. Follow the instructions on the screen to verify. Then wait for verification to complete.

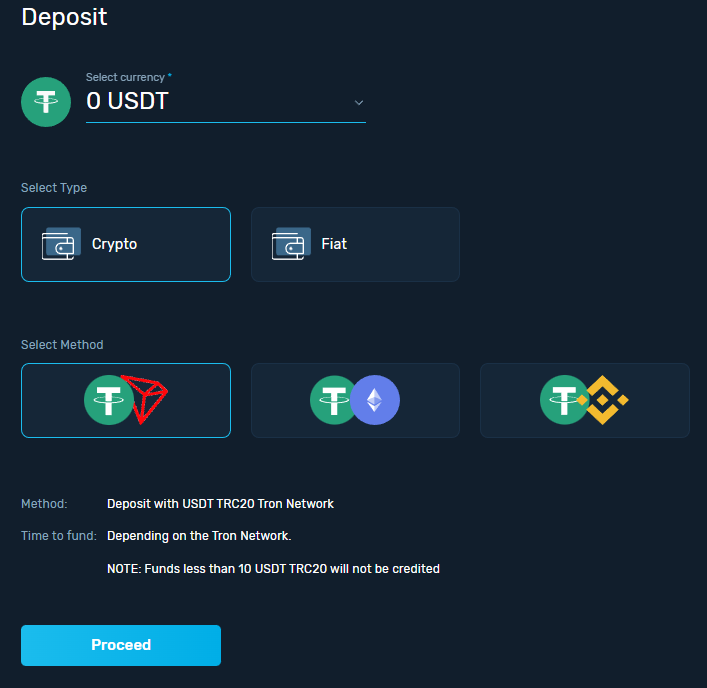

Go to the “Funds” section in the main menu on the left. Click the “Deposit” tab, select the deposit channel, and follow the instructions on the screen to fund your account. Note that deposit in fiat currency is not yet available (despite the availability of the corresponding button).

Go to the “Trading Accounts” section in the menu on the left. Choose the suitable platform. Provide the requested information (type, base currency, and leverage) and click the “Open account” button. After that, download and install the platform, start it, and enter your registration data.

Features of the user account:

-

Dashboard. It displays basic information on open accounts with detailed information;

-

Balance. In this block, traders see their assets and can link external wallets to their accounts;

-

Trading accounts. This block provides for opening and closing live and demo accounts;

-

Funds. This is a block for making deposits and withdrawals with the possibility to cancel the transaction;

-

Exchange. This section provides for converting currency into cryptocurrencies and back (a fee is charged);

-

History. It provides information on all trader’s transactions, as well as account analytics;

-

IB. This block provides for registering in the referral program, as well as tracking and managing bonus payments;

-

Profile. Here traders enter their personal data, get verified, and set security details;

-

Support service. Here traders have the opportunity to create a ticket with a request to this broker's managers;

-

PAMM and copy trading. This block is dedicated to passive income services.

Regulation and safety

XBTFX has a safety score of 4.7/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 13 years

- Not tier-1 regulated

XBTFX Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

XBTFX Security Factors

| Foundation date | 2012 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker XBTFX have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of XBTFX with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, XBTFX’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

XBTFX Standard spreads

| XBTFX | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,8 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,0 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,8 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,2 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

XBTFX RAW/ECN spreads

| XBTFX | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with XBTFX. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

XBTFX Non-Trading Fees

| XBTFX | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 50 | 0 | 0 |

Account types

As a rule, traders’ priority is to choose the best account type for them. XBTFX offers Standard, ECN, and Islamic accounts. Standard and Islamic accounts use STP technology, while ECN uses ECN technology. Spreads on the Standard account are higher, but there is no fee for trading currency pairs, cryptocurrencies, metals, indices, and commodities. On ECN, spreads are lower and raw; however, there is a $3.5 fee per full lot for trading the listed assets, excluding cryptocurrencies. Cryptocurrencies on ECN are traded with a fee of 0.075% of the trade amount. All accounts are subject to a $0.1 fee for trading stocks (or 0.45% depending on the region). The Islamic account is similar to Standard, except that it’s swap-free. Also, there is a fee for trading cryptocurrencies of 0.15% of the trade amount.

Account types:

Usually, if traders are not familiar with this broker, they first open a demo account. This provides for exploring possibilities of this broker during market conditions, but without financial risks, as demos use virtual currency. Then, based on their strategic preferences, clients open one of the live account types. Swap-free accounts are available to Islamic users.

Deposit and withdrawal

XBTFX received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

XBTFX offers limited payment options and accessibility, which may impact its competitiveness.

- BTC available as a base account currency

- No deposit fee

- Bitcoin (BTC) accepted

- Minimum deposit below industry average

- Wise not supported

- No bank card option

- Limited deposit and withdrawal flexibility, leading to higher costs

What are XBTFX deposit and withdrawal options?

XBTFX offers a limited selection of deposit and withdrawal methods, including Bank Wire, Neteller, BTC, USDT, Ethereum. This limitation may restrict flexibility for users, making XBTFX less competitive for those seeking diverse payment options.

XBTFX Deposit and Withdrawal Methods vs Competitors

| XBTFX | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are XBTFX base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. XBTFX supports the following base account currencies:

What are XBTFX's minimum deposit and withdrawal amounts?

The minimum deposit on XBTFX is $10, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact XBTFX’s support team.

Markets and tradable assets

XBTFX offers a limited selection of trading assets compared to the market average. The platform supports 200 assets in total, including 75 Forex pairs.

- Crypto trading

- 75 supported currency pairs

- Indices trading

- Copy trading not available

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by XBTFX with its competitors, making it easier for you to find the perfect fit.

| XBTFX | Plus500 | Pepperstone | |

| Currency pairs | 75 | 60 | 90 |

| Total tradable assets | 200 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products XBTFX offers for beginner traders and investors who prefer not to engage in active trading.

| XBTFX | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

XBTFX received a score of 6.25/10, reflecting an average offering in terms of trading platforms and tools. The broker covers essential functionality but may fall short in some advanced features or platform diversity compared to leading competitors.

- MetaTrader is available

- One-click trading

- Free VPS for uninterrupted trading

- No TradingView integration

- No access to API

Supported trading platforms

XBTFX supports the following trading platforms: MT4, MT5, WebTrader. This selection covers the basic needs of most retail traders. We also compared XBTFX’s platform availability with that of top competitors to assess its relative market position.

| XBTFX | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key XBTFX’s trading platform features

We also evaluated whether XBTFX offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | No |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 96 |

| Tradable assets | 200 |

Additional trading tools

XBTFX offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

XBTFX trading tools vs competitors

| XBTFX | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | No | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

XBTFX supports mobile trading, offering dedicated apps for both iOS and Android. XBTFX received 2/10 in this section, which suggests limited user interest or weak performance of the apps.

- User-friendly interface

- Weak user feedback on Android

We compared XBTFX with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| XBTFX | Plus500 | Pepperstone | |

| Total downloads | No data | 10,000,000 | 100,000 |

| App Store score | No data | 4.7 | 4.0 |

| Google Play score | No data | 4.4 | 4.0 |

| Mob. 2FA | No | Yes | Yes |

| Mob. Indicators | No | Yes | Yes |

| Mob. Alerts | No | Yes | Yes |

Education

Experienced traders are well aware that practice alone is not enough for success. It is necessary to learn trading methods and life hacks. The market is constantly changing, so it is extremely important to follow the current realities. Moreover, sometimes clients with practically no experience come to brokers. For this reason, some companies offer educational programs. It can be regular FAQs on the basics of trading, or full-fledged training courses. XBTFX, like many competitive platforms, is somewhere in the middle. This broker's website has several extensive and practically useful articles for both novice traders and professionals. The same block provides expert opinions and the latest news with integrated analytics.

The main disadvantage of XBTFX’s educational system is its small volume. But the articles cover almost all the most important topics, including risk management and the psychology of trading. So even experienced market participants can find a lot of useful things here.

Customer support

Every broker needs technical support, because traders sometimes face situations that cannot be resolved by themselves. Moreover, sometimes there is a real problem that requires an urgent solution. If traders receive prompt and qualified assistance, they have no doubts about a broker. But if technical support responds slowly or is incompetent, clients may become disappointed with the broker and go to its competitor. XBTFX offers the highest level of client service. Its specialists work 24/7 and can be reached by phone, email, and tickets.

Advantages

- Multiple communication channels are available

- Managers work 24/7

- Competence of technical support is highly evaluated by users

Disadvantages

- Non-clients cannot submit tickets

Whether you are this broker’s client or just intend to become one, contact managers for relevant assistance. Client service is there to help you. The following communication channels are available:

call center;

email (support);

email (general questions);

tickets in the user account.

Note that the call center is not available round the clock, but only from 14:00 to 22:00 GMT. This broker has official profiles on Facebook, Twitter, and Reddit, where you can also contact managers. Subscribe to them to stay up to date with this broker’s latest news.

Contacts

| Foundation date | 2012 |

|---|---|

| Registration address | Hodges Bay, P.O. Box 1348, St. John's, Antigua |

| Regulation |

FSA Seychelles

Licence number: SD169 |

| Official site | https://xbtfx.io/ |

| Contacts |

+44 2921 28 0290

|

Comparison of XBTFX with other Brokers

| XBTFX | Eightcap | XM Group | RoboForex | TeleTrade | 4XC | |

| Trading platform |

cTrader, MetaTrader4, MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | MT5, MT4, WebTrader |

| Min deposit | $10 | $100 | $5 | $10 | $10 | $50 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | 1.00% | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.2 points | From 0 points |

| Level of margin call / stop out |

No | 80% / 50% | 100% / 50% | 60% / 40% | 70% / 20% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed review of XBTFX

This broker has been operating since 2019, so it is obviously not among the old-timers. Nevertheless, it has more than 10,000 clients now. This speaks for the attractiveness of this broker’s conditions, which are really competitive. These are spreads from 0.01 pips, fees of $3.5 per lot, and the absence of restrictions on trading strategies. This company uses virtual servers and microservice architecture, which ensures high performance and trade executions without delays. This broker uses KYC (Know Your Client) algorithms to validate users, and the SSL protocol to protect internet connection. Thus, this broker has an advanced technological stack, guaranteeing its clients comfortable and safe working conditions.

XBTFX by the numbers:

Minimum deposit is $10;

Minimum spread (on the ECN account) is 0.01 pips;

Maximum fee is $3.5 per lot;

Payments under the referral program are up to 30%;

3 trading platforms.

XBTFX is a convenient CFD broker

The convenience of trading is largely determined by the platform. XBTFX provides for working with MetaTrader 4, MetaTrader 5, and cTrader. These are the most popular solutions with which the vast majority of users are familiar. A special advantage of MT platforms is that they can be easily and extensively customized using hundreds of free plug-ins. The second aspect is a large pool of assets. Currently, XBTFX provides access to over 200 trading instruments, and their number is constantly growing. These include CFDs on currency pairs, cryptocurrencies, stocks, indices, commodities, and precious metals. A variety of assets is very important, as it allows traders to form diversified investment portfolios. Moreover, the more of them, the wider the trader's strategic opportunities. XBTFX offers moderate leverage up to 1:500. There are many brokers that allow traders to trade with leverage up to 1:1000 or more. However, it’s important to understand that high leverage means an increase in both profit potential and trading risks.

Useful services offered by XBTFX:

Copy trading. This is a service of copying trades, which is also called social trading service. If traders register as investors, they earn passively and get a unique experience by watching the work of a professional. If they act as signal providers, they trade in the usual way receiving a fee from investors for their successful trades;

PAMM and MAM accounts. Joint accounts have managers who execute trades using their own capital and investors’ funds. Like signal providers, managers earn on fees. Investors who own sub-accounts in the MAM or PAMM system do not trade themselves, earning 100% passively;

Training. XBTFX’s educational service has three types of materials. The first type is training guides. The second type is experts’ opinions about the market, instruments, or strategies. The third type is breaking news with analytics. The materials are aimed at traders of different levels.

Advantages:

To open a demo account, a deposit is not required. To open a live account, you are required to deposit only $10;

This broker provides favorable trading conditions without withdrawal fees;

Three trading platforms are available. All these are proven and convenient solutions that can be customized;

This broker provides such passive income options as copy trading, joint accounts, and a referral program;

Technical support works 24/7.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i