Day Trading in Roth IRA: Key Features and Restrictions

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

eOption - Best stock broker for 2025 (United States)

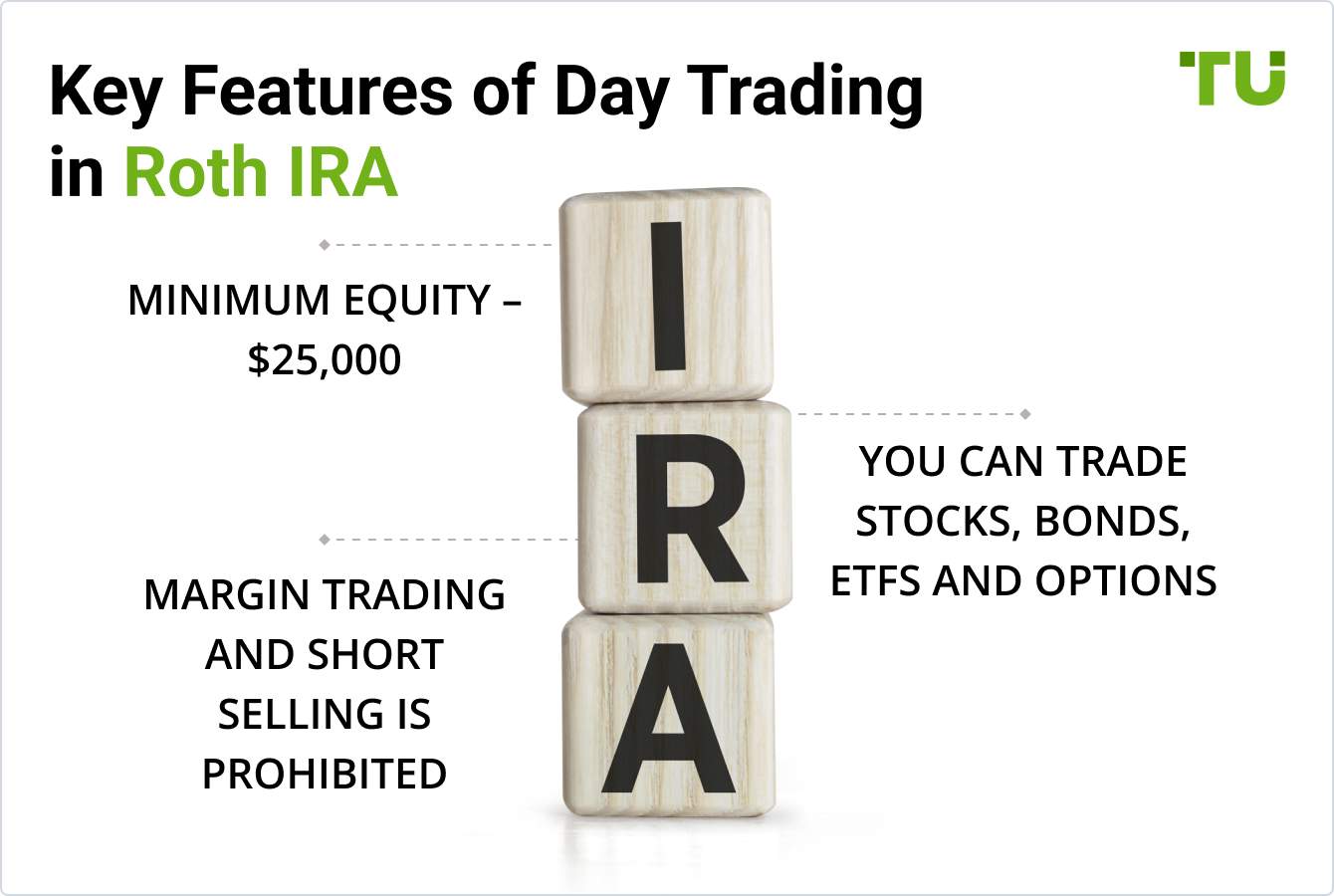

Day trading in a Roth IRA is permitted by the SEC and FINRA. However, you must meet certain requirements and adhere to restrictions set by tax authorities and financial regulators, including the pattern day trading rule, which requires maintaining a minimum account balance of $25,000 to engage in frequent day trading activities.

Day trading (the practice of buying and selling securities within the same trading day) is a strategy that appeals to many investors due to its potential for quick profits. On the other hand, a Roth IRA (Individual Retirement Account) is a retirement savings account that offers tax-free growth and tax-free withdrawals in retirement. Combining these two concepts raises a compelling question: Can you day trade in a Roth IRA?

This article explores the feasibility, rules, benefits, and risks associated with day trading within a Roth IRA, providing insights for both novice and advanced traders.

Can You Day Trade in a Roth IRA?

Day trading in a Roth IRA is possible, but there are important rules and restrictions to be aware of. The IRS does not ban day trading in Roth IRAs, but these accounts are designed to promote long-term investing for retirement rather than frequent trading.

Here are the main points to consider:

Pattern Day Trading Rules:

According to the SEC, a pattern day trader is someone who executes four or more day trades within five business days. If an account is classified as a pattern day trader account, it must maintain a minimum equity of $25,000. However, this rule is typically applied to margin accounts, which are not allowed in Roth IRAs.

Prohibited Transactions:

Margin trading involves borrowing money from the broker to buy securities, which is not permitted in Roth IRAs. This restriction limits the ability to use leverage to amplify returns.

Short selling, or selling securities that you do not own with the intention of buying them back at a lower price, is also prohibited in Roth IRAs because it requires a margin account.

Unsettled Funds Restrictions:

When you sell a security in a Roth IRA, the proceeds from the sale must fully settle before they can be used to purchase new securities. This settlement period is typically two business days (T+2). This restriction can limit the frequency of trades, as traders cannot use the proceeds from a sale until the funds have settled.

Challenges and Considerations:

Liquidity Constraints: The need for funds to settle before reuse can constrain liquidity and reduce the flexibility of day trading.

No Leverage: The inability to use margin means traders cannot leverage their positions to amplify gains, which is a common strategy in day trading.

Risk of Losses: Day trading is inherently risky and can lead to significant losses. Given the contribution limits of Roth IRAs, recovering from substantial losses can be challenging.

Types of Investments Allowed in a Roth IRA

Roth IRAs allow various types of investments, each with unique features, pros, and cons. Understanding these options is crucial for effective trading.

| Which investor are they suitable for? | Features | Pros | Cons and Risks | Minimum Investment and Costs | Profitability | |

|---|---|---|---|---|---|---|

| Stocks | Moderate, Aggressive, Growth-Focused | Common and preferred stocks | Potential for high returns ownership in companies | High risk Market volatility | Varies by broker and stock price | High Potential |

| Bonds | Conservative | Government vs. corporate bonds | Stable returns lower risk | Lower profitability compared to stocks | Typically $1,000 or more | Lower Returns |

| ETFs (Exchange-Traded Funds) | Moderate. Growth-Focused | Diversified portfolio | Lower risk, cost-effective | Market dependent | Varies, often no minimum investment | Moderate |

| Options | Aggressive | Call and put options | Flexibility, potential for high returns | High risk, complexity | Varies, often requires approval from broker | High Potential |

The choice of investment instruments depends on the investor's risk tolerance and financial goals. Below are the types of investors and the suitable investments for each.

Conservative Investor

Conservative investors want to protect their money and prefer safe, steady returns. They should invest in bonds and ETFs, which offer reliable income and low risk.

Moderate Investor

Moderate investors are okay with some risk for the chance of higher returns. They should invest in stocks and ETFs to get a good balance of growth and stability.

Aggressive Investor

Aggressive investors are willing to take big risks for big rewards. They should invest in stocks and options, which can offer high returns but come with higher volatility.

Growth-Focused Investor

Growth-focused investors aim for long-term gains and can handle market ups and downs. They should invest in stocks and ETFs that promise steady growth over time and help manage risk through diversification.

We advise investors to be cautious. Avoid taking risks if you're unsure. Manage your investment portfolio responsibly. Diversify your investments by including assets with varying levels of risk. Only invest money you can afford to lose. These strategies will help protect your finances in an unstable market.

Step-by-Step Guide on Opening and Funding a Roth IRA for Day Trading

Day trading within a Roth IRA can be a strategic way to grow your retirement savings tax-free, but it requires a methodical approach to setting up the account correctly. Here’s a step-by-step guide to help you open and fund your Roth IRA for day trading.

Choose a broker. Pay attention to the size of commissions, the convenience of the platform, the availability of market research tools and other parameters.

Open a Roth IRA account. Go through the registration procedure, fill out the application, read the terms and conditions.

Fund a Roth IRA. Deposit funds into your account in any way convenient for you.

Select an investment instrument. These can be Stocks, Bonds, ETFs, Options.

Develop a trading strategy. There must be a clear trading plan with specific risk management rules.

Start trading. Invest, control results, test different strategies and approaches.

We at Traders Union constantly monitor brokers and know everything about them. Below is a sample table of what to look for when choosing a broker.

| Broker | Regulation | Number of Assets | Investor Protection | Commissions for Stock Trading | Open an Account |

|---|---|---|---|---|---|

| Webull | SEC, FINRA | 5,000+ stocks and ETFs | SIPC up to $500,000 (includes $250,000 cash) | $0 | Study review |

| Robinhood | SEC, FINRA | 5,000+ stocks and ETFs | SIPC up to $500,000 (includes $250,000 cash) | $0 | Study review |

| Interactive Brokers | SEC, FINRA, CFTC | 12,000+ stocks, ETFs, options, futures, forex | SIPC up to $500,000 (includes $250,000 cash) | $0 – $0.005 per share (tiered pricing) | Open an account Your capital is at risk. |

| Fidelity | SEC, FINRA | 7,000+ stocks, ETFs, options | SIPC up to $500,000 (includes $250,000 cash) | $0 | Study review |

| Charles Schwab | SEC, FINRA | 6,000+ stocks, ETFs, options | SIPC up to $500,000 (includes $250,000 cash) | $0 |

Tips for Day Trading in Roth IRA for Beginners

We at Traders Union have some tips for new traders. It's important to understand the risks, choose the right broker, manage your portfolio well, and do proper research.

Choose a Right Broker – You can find out how to choose the right stock broker in our study. Features to Look For: Low fees, user-friendly platforms, robust customer support, and educational resources.

Portfolio Management – Strategies for balancing risk and return, rebalancing portfolios, and maintaining liquidity. Here you can learn how to make an investment portfolio in 6 steps.

Research and Analysis – Discuss the need for detailed market analysis, staying informed about market news, and using technical analysis tools. Here you can learn how to start trading stocks.

Tools and Resources for Analysis – Highlight tools like charting software, financial news platforms, and analytical reports. Find out how to use stock trading tools and indicators?

Strategies for Minimizing Risk – Emphasize the importance of setting stop-loss orders, using position sizing, and maintaining a diversified portfolio. Learn more about how to implement risk management.

Setting Stop-Loss Orders – Explain how stop-loss orders work and why they are essential for risk management. Learn more about stop loss order in TU Research.

Pros and Cons of Day Trading in a Roth IRA

Day trading has both advantages and disadvantages. We at Traders Union analyzed the main pros and cons of this method of investment.

- Pros

- Cons

- Tax Advantages: Roth IRAs offer tax-free growth and withdrawals, which can significantly benefit day traders by eliminating capital gains taxes.

- Flexibility in Trading: Traders can buy and sell securities without worrying about the tax implications of each transaction.

- Restrictions on Margin Trading: Roth IRAs do not allow margin trading, limiting the ability to leverage trades.

- Unsettled Funds Limitations: Traders must wait for funds to settle before reusing them, which can restrict trading frequency.

- Risk of Significant Losses: Day trading is inherently risky, and losses can quickly accumulate.

Risks and Warnings of Day Trading in Roth IRA

Day trading has significant risks. The biggest risk is losing money. The stress from this risk can affect your decision-making. Only trade with money you can afford to lose. Stress can make you lose emotional stability, so it's important to control your emotions, stick to your strategy, and keep detailed records of your trades.

Another important risk is legal and tax issues. You might accidentally break IRS (Internal Revenue Service, US) rules. To avoid penalties, make sure you understand all the legal and tax regulations.

| Risk Type | Description | Examples |

|---|---|---|

| Financial Loss | Potential for rapid and significant losses. | 2018 market dip causing widespread losses among day traders. |

| Emotional Stress | Stress from financial risk can affect decision-making and health. | Traders experiencing anxiety and sleep disturbances. |

| Legal Violations | Non-compliance with IRS rules can lead to penalties. | Penalties for excessive trades or disqualification for prohibited trades. |

| Tax Complications | Misunderstanding tax rules may result in unexpected tax liabilities. | Misclassification of IRA leading to tax burdens and fines. |

Expert opinion

Day trading is a popular method often used for retirement savings, including Roth IRAs. It involves less stress and time than scalping, making it a preferred choice for many. However, day trading carries significant risks, and you can lose money. Only invest what you can afford to lose.

I will provide some recommendations for Day Traders in a Roth IRA:

Educate Yourself: Understand the markets and Roth IRA rules, including allowed investments and settlement periods.

Have a Trading Strategy: Develop and stick to a solid trading strategy to avoid emotional decisions.

Manage Your Risk: Use stop-loss orders and position sizing to limit losses and protect your capital.

Choose the Right Broker: Pick a broker that supports Roth IRAs, offers necessary tools, low fees, a user-friendly platform, and good customer support.

Conduct Thorough Research: Stay updated on market news and trends. Use technical analysis tools for informed decisions.

Monitor Your Emotional Health: Manage stress and avoid trading based on fear or greed. Take breaks when needed.

Start Small: Begin with small positions to learn the process and gradually increase as you gain experience.

By following these tips, you can effectively manage day trading in a Roth IRA while aiming for your long-term financial goals.

Summary

In conclusion, while day trading in a Roth IRA is possible, it comes with many rules and risks. The main benefits are tax advantages and trading flexibility. However, there are strict limits on margin trading and fund settlement, plus a high risk of losing money. Both beginners and experienced traders should approach day trading in a Roth IRA with careful planning, strong risk management, and a clear understanding of all the rules and regulations.

FAQs

Is Day Trading in a Roth IRA possible?

Yes. Day trading is possible. Traders can use such strategies.

What amount should be in a Roth IRA for Day Trading?

In accordance with SEC and FINRA requirements, you must have at least $25,000 in your account.

Is Short Selling possible for Day Trading in a Roth IRA?

No. Financial regulators prohibit Short Selling. You can go long.

What assets can be traded?

Day Trading in a Roth IRA is possible with assets such as Stocks, Bonds, ETFs, and Options.

Related Articles

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

The CFTC protects the public from fraud, manipulation, and abusive practices related to the sale of commodity and financial futures and options, and to fosters open, competitive, and financially sound futures and option markets.

A Roth IRA (Individual Retirement Account) is a tax-advantaged retirement savings account available in the United States. It allows individuals to contribute after-tax income to the account, and the contributions grow tax-free. When qualified withdrawals are made in retirement, including both contributions and earnings, they are typically tax-free as well.