IC Markets is a major international broker from Australia established in 2007 and currently providing services in the majority of countries. The broker is considered reliable, as it is regulated in Australia (ASIC, AFSL) and EU (CySEC).

IC Markets is known for offering exceptional services for active traders, providing them with some of the lowest commissions in the market and excellent order execution quality. The broker also features great opportunities for earning passive income. In this review, we will take a look at the copy trading services offered by IC Markets, which are provided in partnership with ZuluTrade and MyFxBook Autotrade, top social trading platform providers.

We have prepared an IC Markets copy trading review. Learn how to find a successful trader and start copying their trades, about the important trading conditions and also the pros and cons of this type of earning.

What does copy trading mean?

-

1

It provides faster entry to the financial markets without spending a lot of time on learning;

-

2

The earnings can potentially be at the level of the most successful traders of the platform;

-

3

Comparatively low entry threshold on the majority of social trading platforms.

Naturally, copy trading also has some drawbacks. The thing is that excellent results of managing traders in the past do not guarantee the same outcomes in the future. Just as any investment service, copy trading on IC Markets involves the risk of loss.

IC Markets copy trading pros and cons

Partnership with two major copy trading signal providers

Minimum deposit at $200

Wide selection of trading instruments

Regulation in Australia and EU

Trading results of the traders in the past do not guarantee the same outcome in the future

1.5 pips markup to the spread

The service is available only on the Standard account

How to get started with IC Markets copy trading?

-

1

Register on ZuluTrade Platform;

-

2

Open an account on IC Markets and wait for your documents to be verified;

-

3

Request a document from the broker, confirming that you allow to connect your account to ZuluTrade software and agree to trading conditions. The guidelines on further actions are attached to it as well.

Video about ZuluTrade platform

Copy trading on demo account

You can learn to copy trades in a demo mode on ZuluTrade by going through a simple registration. You will instantly receive virtual $100,000 to try to search for and copy traders. If you are happy with the results, you will need to open a live account on ZuluTrade and link your IC Markets account to it.

What is ZuluTrade network in 2024?

| Copy trading platform | ZuluTrade |

|---|---|

| Regulation | Greece and EU (HCMC), USA (CFTC), Japan (KFB) |

| Platforms | MT4, MT5, ZTP |

| Number of brokers that offer it | 34 |

| Top brokers | AvaTrade, IC Markets, TickMill, EverFx, WelTrade, Axi, InstaForex, FX Open, AAAFx, Oanda, Swissquote |

| Minimum investment for copying |

Set by the broker. From $50 to $1,000 on average

Combos Service – from $2,000 |

| Service use fee |

Profit Sharing Plan: $30 monthly subscription + 25% share of

profits

Classic Plan – depends on the chosen broker. $20 on average per standard lot in a currency pair. |

| Brokerage commission | Commission for order execution is charged according to the conditions of your broker. |

| Account types | Profit Sharing, Classic |

| Size of the network | Over 1,000 strategy providers |

How to find the right trader to copy with IC Markets?

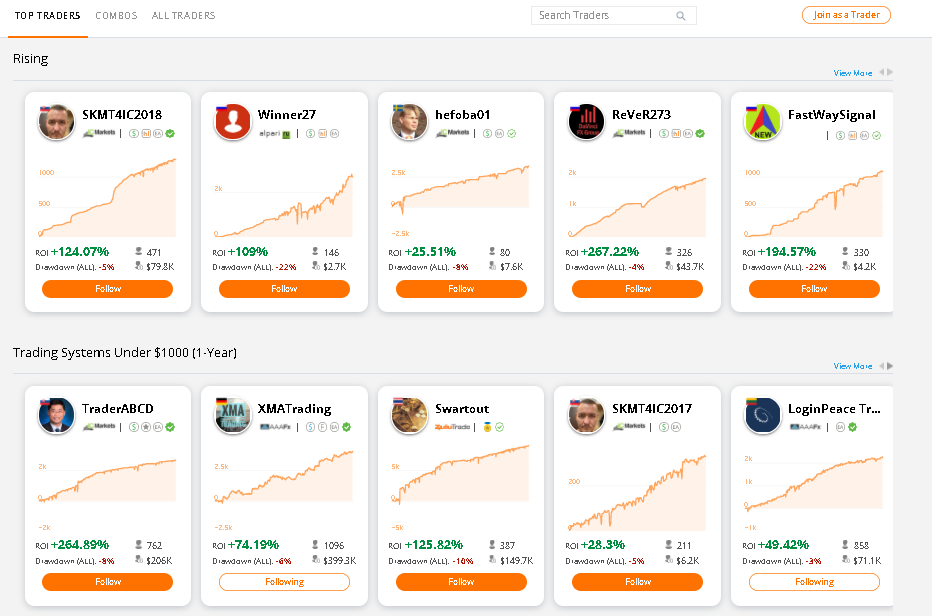

The easiest way is to follow the recommendations of ZuluTrade, the algorithms and editors of which publish the most successful signal providers in the Top Traders section. They are divided into selections based on different criteria: number of copiers, return growth dynamics, amount under management, etc.

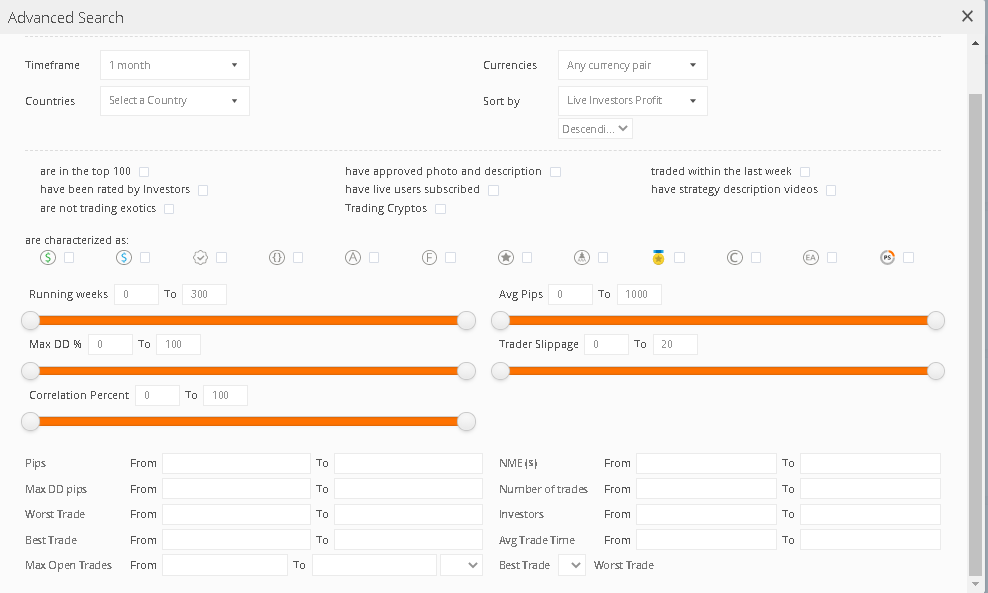

The second method implies that you independently search for traders using the filters on ZuluTrade. You can search by such criteria as performance, slippage, experience, etc. Practice shows that this method is effective rather for more experienced users. The beginners would still be advised to use the recommendations.

-

Pay attention not to outstanding performance, but rather at consistency. If a trader allows deep slippages and trades with return a month later, it is best to avoid him, because subscribing to him at the wrong time, you risk losing everything.

-

The longer the positive return history the signal provider on the platform has, the better. It reduces the risk of his good result being pure luck.

-

Diversify investment among several traders with different strategies.

How to get started copying trades with IC Markets

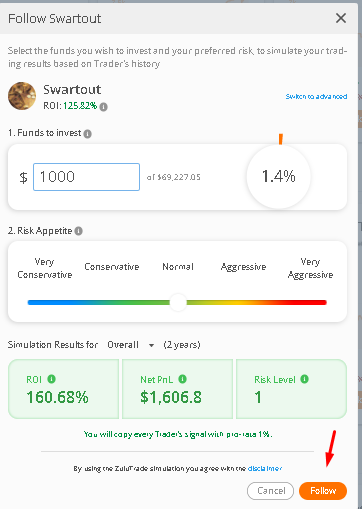

A window will pop up, where you will need to set the amount you want to use to copy the trades. The minimum deposit on IC Markets is $200, but some signal providers from ZuluTrade may set a higher entry threshold. For the most successful managers, the minimum amount can range from $500 to several thousand dollars.

MyFxBook Autotrade from IC Markets

Beneficial commission policy

Convenient analytics on traders

You can try copy trading on a demo account

8 trading platforms are supported

No filters for searching traders

Outdated interface

Complicated connecting

Provider main features

| Regulation | The provider does not accept funds from the users; does not require a license |

| Platforms | MT4, MT5, cTrader |

| Number of brokers that offer it | 39 |

| Top brokers | Tickmill, IC Markets, FxOpen, Pepperstone, Axi (Axitrader) |

| Minimum investment for copying | 1,000 USD |

| Service use fee | 0%* |

| Signal providers | 162 |

Can I make money by copying traders on IC Markets?

-

License from the top regulators of Australia and EU.

-

Partnerships with top copy trading platform providers.

-

Beneficial trading conditions, low commissions.

However, one should always keep in mind that financial results of traders in the past do not guarantee the same outcome in the future. When starting to copy trades on IC Markets, all trading risks must be taken into consideration. If you want to know about other ways how to make money on IC Markets, read the Traders Union article.

How much does IC Markets copy trading cost?

Specifically, only the Standard account type is available for working with copy trading, where the average spread is 1 pip. And there is a markup to the spread, which is 1.5 pips. Therefore, the average spread for EURUSD is 2.5 pips and for other trading pairs it could be even higher.

Is IC Markets copy trading safe?

ZuluTrade social trading platform provider is also licensed by the Cyprus Securities and Exchange Commission and operates in compliance with the EU rules.

Summary

IC Markets works with the top social trading platform providers – ZuluTrade and MyFxBook Autotrade, which provides the broker’s customers a great foundation for starting to copy trades. In particular, the platforms together have around 2,000 signal providers and dozens thousands of clients.

In addition, the regulation of the broker in Australia and EU is worth mentioning, as well as its good trading conditions: diverse Forex and CFD markets, low commissions and top quality order execution.

However, conditions of IC Markets for copying traders with ZuluTrade are worse due to the 1.5 pips markup to the spread and availability of the service only on the Standard account, which does not have the best conditions in terms of commissions.

We also recommend reviewing the offers of eToro, the leader of our rating of social trading platforms. The broker does not charge a manager fee and offers the biggest number of signal providers – over 100,000.

Expert Commentary

Antony Robertson, Traders Union Financial Analyst

IC Markets has created excellent conditions both for active trading and for investment. The broker really has some of the lowest commissions in the market and excellent order execution speed, which is valued by scalpers and algorithmic traders. There is also little doubt about the reliability of the Australian company.

Partnership with MyFxBook Autotrade and ZuluTrade is a cherry on top of the cake for the beginners, who are not prepared to trade on their own yet, but are ready to invest. These platforms offer a truly impressive choice of signal providers and a potential of a good return.

However, one must keep in mind that copy trading on IC Markets is not the Holy Grail. Even experienced traders make mistakes and can lose money, which is why it is recommended to start with a demo account, carefully approach the choice of providers and also monitor their performance.

IC Markets Social and copy trading reviews

Investor

Madrid, Spain

Beginner Trader

Paris, France

IT Recruiter

India

FAQ

What is the minimum deposit for copy trading on IC Markets?

On MyFxBook Autotrade the minimum deposit is $1,000, and on ZuluTrade - $200. However, signal providers can set their own requirements for the minimum deposit.

What is the average return rate of copy trading on IC Markets?

There is no average return rate, as it depends on a multitude of factors: chosen trader, market situation, etc. You should be well aware that there is a chance you will earn money and that you may also lose money.

In which cases should I stop copying a trader?

Considerable slippages on the trading account should not be allowed. If a trader trades in the red or his results are volatile (alternating between profit and loss) for over 1-2 months, it is best to unsubscribe from him.

Does IC Markets have additional copy trading fees?

Yes, the broker uses a markup for the spread of 1.5 pips.