Is there an indicator that draws support and resistance?

The concept of support and resistance is one of the most important elements of technical analysis. It can be used to identify potential areas of buying or selling pressure in a particular market. But is there an indicator that draws support and resistance? In this article, the experts at TU will discuss the possibility of an indicator drawing support and resistance lines on a chart and how it can be used to aid in trading decisions.

Indicator that draws support and resistance: review

Support and resistance refer to specific price levels at which the price of an asset has historically struggled to break through. When the price of an asset is approaching a support level, it is expected to find buying interest and potentially bounce back up. On the other hand, when the price of an asset is approaching a resistance level, it is expected to encounter selling pressure and potentially pull back.

Traders can use various techniques and indicators to identify potential support and resistance levels. These may include chart patterns, technical indicators, and even fundamental analysis. By understanding how to identify and utilize these levels, traders can better understand market trends and make informed decisions about when to enter or exit positions.

In this blog post, the experts at TU will delve into the details of support and resistance and provide practical examples and tips on how to incorporate these concepts into your trading strategy. Whether you are a beginner or an experienced trader, this post will give valuable insights and information on the role of support and resistance in financial markets.

The usefulness of support and resistance levels

Based on the opinion of seasoned traders and analysts, the TU experts have compiled the following use cases for support and resistance levels:

1. Identify trends

Support and resistance levels are price levels on a chart that can act as barriers, preventing the price of an asset from moving above or below them. They can be visualized as a horizontal or diagonal line. If the price of an asset is consistently finding support at a certain price interval, it may be considered an upward trend. Conversely, if the price is consistently encountering resistance at a certain price interval, it may be regarded as a downward trend. By identifying these levels, traders can better understand the direction and strength of a trend.

2. Set stop losses

Stop-loss orders are used to automatically exit a trade if the price of an asset moves against the trader's position beyond a certain level. By using support and resistance levels to set these orders, traders can limit their potential losses in a trade. For example, if a trader is long on an asset and the price reaches a resistance level, they may set a stop-loss order just below the resistance level to minimize their potential loss if the price moves against them.

3. Determine entry points

Support and resistance levels can also be used to determine entry points for trades. If the price of an asset is approaching a support level and the trader believes the trend is likely to continue, they may enter a long position at or near the support level. Similarly, if the price is approaching a resistance level and the trader believes the trend is likely to reverse, they may enter a short position at or near the resistance level.

4. Identify breakouts

A breakout occurs when the price of an asset moves above a resistance level or below a support level. These moves can indicate a change in trend and potentially present trading opportunities. For example, if the price of an asset breaks above a long-term resistance level, it may signal the start of an uptrend.

5. Confirm trend strength

The ability of a support or resistance level to hold or be broken can indicate the strength of a trend. For example, if an asset's price can consistently break through a resistance level, it may be considered a strong uptrend. On the other hand, if the price is consistently unable to break through a resistance level, it may be viewed as a weak uptrend or a potential reversal.

6. Provide targets

Traders can use support and resistance levels to set price targets for their trades. For example, if a trader enters a long position near a support level, they may set their target price at a resistance level above the entry point. This can help them plan their trade and manage their risk.

7. Spot reversal patterns

Certain chart patterns, such as double tops and bottoms, can be formed at support and resistance levels and indicate potential trend reversals. A double-top pattern, for example, occurs when the price of an asset reaches a resistance level and then falls back, only to rise again and fail to break through the resistance level. This pattern can indicate that the uptrend may be coming to an end and a reversal may be imminent.

Indicator for Support and Resistance: pros and cons

S&R indicator automatically finds the closest support and resistance levels (or zones) for the loaded traffic.

👍 Pros:

•The indicator works on all timeframes (it is advisable to choose at least M15)

•The indicator works on all markets

•Doesn’t redraw

•Flexible settings

👎 Cons:

•There is no guarantee that the levels will work the way you expect them to

•The indicator does not issue warnings / alerts

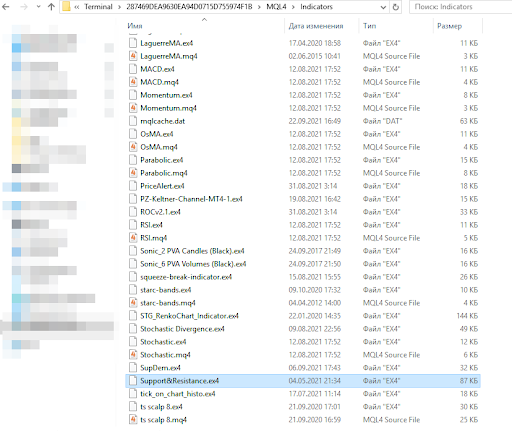

How To Set Up Support&Resistance Indicators in MT4

The installation of the indicator is usual. Here is a step-by-step guide for the users of Windows:

Launch your Metatrader

Open the folder with the platform data using the File/Data Folder menu

In the folder, open MQL4/Indicators folder

Insert Support&Resistance.ex4 file from the downloaded archive

Restart your MT4 platform (or refresh the Navigator window).

How to Set Up Indicator

That’s it! All is set. You can now open any chart on the MetaTrader 4 platform and add S&R indicator to it through the menu Insert / Indicators / Custom / SupportResistance.

Tips on Drawing Support and Resistance Levels

Experts have outlined the following tips for anyone looking to use support and resistance levels as part of their trading strategy:

1. Use horizontal lines

One standard method of drawing support and resistance levels is to use horizontal lines to mark the levels on a chart. These lines can be drawn at the price levels where the asset has consistently found support or encountered resistance in the past.

2. Look for round numbers

Experts suggest that prices often exhibit psychological resistance or support at rounded numbers, such as $10, $20, or $100. Therefore, these levels can be good candidates for support and resistance levels.

3. Consider the time frame

The time frame of the chart being analyzed can influence the significance of a support or resistance level. For example, a support level on a daily chart may be more significant than one on a 1-hour chart.

4. Look for trend lines

Trend lines can also act as support and resistance levels. These are diagonal lines drawn on a chart that connect a series of highs or lows. A trend line that is consistently being touched by the price without being broken through may be considered a support or resistance level.

5. Use multiple time frames

It can be helpful to analyze the same asset using different time frames to identify potential support and resistance levels. For example, a daily chart may show a significant resistance level that is not apparent on a 4-hour chart.

6. Look for chart patterns

Certain chart patterns, such as head and shoulders or triangles, can also indicate potential support and resistance levels.

7. Consider volume

The volume of trading activity can also be a valuable indicator of support and resistance levels. For example, if a significant resistance level is approached and there is a decrease in volume, it may be a sign that the resistance level is not as strong as it appears.

8. Use multiple indicators

Combining multiple indicators, such as moving averages, oscillators, and trend-following indicators can help confirm the strength of a support or resistance level.

9. Be flexible

It is important to remember that support and resistance levels are not exact and can change over time. Therefore, it is important to continually monitor these levels and adjust them as necessary.

FAQs

1. How to identify support/resistance lines?

You can identify the supply-demand zone in three steps:

1. Spot the current price.

2. Find ERCs.

3. Identify the origin of the price movement.

2. Are there any technical indicators that automatically draw support and resistance levels on a chart?

Yes, several technical indicators can automatically draw support and resistance levels on a chart. These indicators use mathematical calculations based on past price data to identify potential support and resistance levels.

3. How accurate are automatic support and resistance indicators?

The accuracy of automatic support and resistance indicators can vary depending on the specific indicator and the market conditions. Some indicators may be more accurate in certain market conditions or for certain assets, while others may be less reliable.

4. Can traders use automatic support and resistance indicators as the sole basis for their trading decisions?

It is generally not advisable for traders to rely solely on automatic support and resistance indicators as the basis for their trading decisions. While these indicators can help identify potential levels of support and resistance, they should be used with other analysis tools and techniques, such as fundamental analysis and market news, to make more informed decisions.

5. Are there any drawbacks to using automatic support and resistance indicators?

One potential disadvantage of using automatic support and resistance indicators is that they are based on past price data, which means they may only sometimes accurately predict future price movements. Additionally, different indicators may produce different results, leading to conflicting signals and making it easier for traders to make informed decisions.

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

3

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

-

4

Long position

A long position in Forex, represents a positive outlook on the future value of a currency pair. When a trader assumes a long position, they are essentially placing a bet that the base currency in the pair will appreciate in value compared to the quote currency.

-

5

Upward Trend

Uptrend is a market condition in which prices are generally rising. Uptrends can be identified by using moving averages, trendlines, and support and resistance levels.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).