Best Time to Trade Forex in Colombia

When Forex trading in Colombia, the best time is during the New York – London market session overlap from 12PM to 4PM MCT, before the trading day ends and rolls over..

As a globally recognized industry, Forex is garnering increasing amounts of attention and investment around the world – including in Colombia. As a beginner, it can be difficult to know when the best time is to trade Forex in Colombia. This article is here to help you understand the various Forex trading sessions, time zones in Colombia, and best currency pairs in Colombia. Traders Union researchers have conducted studies to find out the best time to trade Forex, to help you figure out the best Forex market hours for trading in Colombia.

Forex Trading Sessions in Colombia

Although the Forex market is open 24 hours a day, 5 days a week (Monday to Friday), there are specific hours within the 24-hour cycle that traders should prioritize, depending on where they are in the world. If a trader is based in Colombia, they should focus on trading during the market sessions that align with Colombia’s time zones. As Colombia shares its singular time zone with the USA’s Eastern seaboard, we will use Eastern Standard Time when looking at the Forex trading sessions in Colombia.

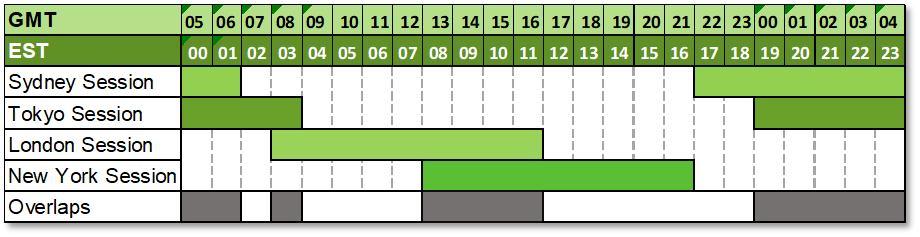

Market opening hours vary depending on the country that the market is in. For example, the London currency market is the world’s biggest, and is open from 3AM EST to 12PM EST. Due to the always-open nature of Forex trading, there are periods in the day where the market hours of currency exchanges in different countries overlap each other – these are called market session overlaps. Here is a brief overview of the four main market sessions, using Eastern Standard Time:

Sydney Session (Australian Session)

The official trading day starts in Sydney, Australia, when the Sydney market opens. It opens at 5PM and closes at 2AM EST. The most active currency pairs in the region are NZD/USD, AUD/USD, as well as other currency pairs featuring NZD and AUD.

Due to time zone differences, a trader in Colombia could begin trading in the Sydney market session on a Sunday afternoon, as it would already be Monday morning in Australia.

Tokyo Session (Asian Session)

The Tokyo Forex market session (sometimes called the Asian session) opens two hours after Sydney’s and runs from 7PM to 4AM EST. The Tokyo market takes in the bulk of trading in Asia, and the pairs seeing the most amount of action are USD/JPY, GBP/USD and GBP/JPY.

This market session’s time zone would allow a trader in Colombia to start trading in Monday’s session on a Sunday evening, local time. However, as Tokyo’s session is open when it’s late night in Colombia, it’s not the most ideal session for traders there.

London Session (European Session)

The London Forex market session, or European session, dominates the currency markets, as London is where most Forex trends often originate. Its market session is open from 3AM to 12PM EST (noon). The most active trading pairs are EUR/USD, GBP/USD, EUR/GBP, and USD/CHF. The afternoon hours of the London market session are ideal for traders in Colombia, particularly where it overlaps with the New York session.

New York Session (North American Session)

The New York market session, Or North American session, is the second largest Forex trading platform in the world, and runs from 8AM to 5PM EST. As 90% of all trades involve USD, and the New York exchange runs alongside the New York stock exchange, the New York session is extremely active. The best currency pairs to trade during this session are ones including the dollar, such as EUR/USD, USD/JPY, GBP/USD.

As New York and Colombia share the same time zone (EST), this market session would be easiest to operate in for traders based in Colombia.

Forex Trading Sessions

Time Zones in Colombia

Forex operates 24 hours a day when considering all time zones across the world, and the level of activity at different times of the day depends on which exchanges are active at each hour. For example, if you’re in Colombia and decide to trade at nighttime, after 9PM EST, then you’ll be primarily trading in the Tokyo and Sydney sessions, leading to lower liquidity, decreased volatility and higher spreads. Therefore, it’s important for traders to be aware of the time zones that affect their active trading hours.

The whole of Colombia lies within a single timezone, Colombia Standard Time (COT) and does not observe daylight saving time. During the USA’s daylight saving months, from March until November, COT operates one hour behind Eastern Standard Time (EST-1) and five hours behind Greenwich Meridian Time (but six hours compared to London, which also observes daylight savings). Through early November until mid-March, when daylight saving time puts the clocks back an hour, Colombia’s time is the same as New York’s EST, and five hours behind GMT and London Time.

A simpler way to look at this is that COT is always five hours behind Coordinated Universal Time (UTC). Traders in Colombia must be aware of daylight savings in other countries, as it will affect the times that sessions open in relation to their own timezone.

What is the best time to trade Forex in Colombia?

The best time to trade Forex in Colombia, like in any other part of the world, depends on your overall trading strategy, the currency pairs you're interested in, and your personal schedule. Colombia follows Eastern Standard Time (ET) outside of daylight saving time, and Eastern Daylight Time (EDT) during daylight saving time. Therefore, Forex traders in Colombia need to adjust their trading hours to match the time zone differences.

The time you decide to trade should be based on when market sessions in major trading centers are occuring around the world, and how their active hours relate to Colombia.

Factors that you should consider when trading Forex in Colombia are:

-

London Session: The London session, which runs from 3AM to 11AM EST (4:00 AM to 12:00 PM EDT during daylight saving time), is the most active market session and is known for its high liquidity. It’s also a good time for trading major currency pairs involving the Euro and British Pound.

-

New York Session: The New York session runs from 8AM to 5PM EST, so due to Colombia’s timezone alignment with Eastern Standard Time, trading during this session would be the least complicated for a trader in Colombia. The New York session is the second largest in terms of trading volume, so a Colombia-based trader could see high liquidity trading within this market session.

-

Overlap with Major Trading Sessions: The most liquid and active times for Forex trading are when the main trading sessions overlap. These periods usually have tighter spreads and increased trading activity. For traders in Colombia, the most significant overlap occurs during the London-New York session overlap, which is from 8AM to 12PM (noon) EST during Standard Time, and from 9AM to 1PM during daylight saving time.

-

Early Asian Session: The opening hours of the Tokyo (Asian) session, starting around 8:00PM COT, can be suitable for night traders who prefer trading outside of regular working hours.

-

Currency Pairs: Different currency pairs have varying levels of activity at different times of the day. For example, traders trading USD/JPY may find better opportunities during the Tokyo-London session overlap.

Best time to trade Forex - TU Research

TU’s own research department conducted a study about the best time to trade Forex, and after interviewing over 2,000 successful traders, we concluded that the best time to trade Forex is when liquidity and volatility are at their highest. The market sessions mentioned above account for more than 65% of the global Forex market’s volume and liquidity (London – 35%, New York – 20%, Tokyo – 6%, Sydney – 4%). Therefore, to ensure maximum possible liquidity, traders in Colombia should be trading during those major market sessions.

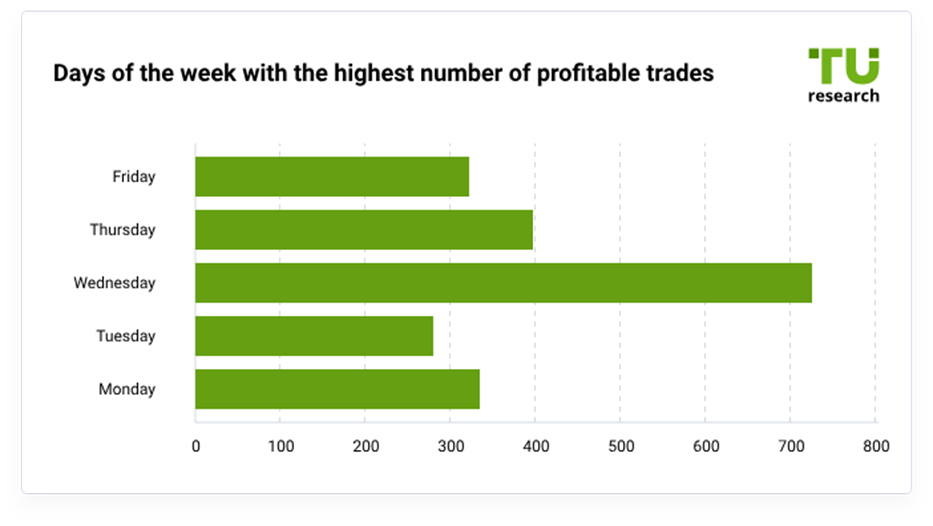

Days of the week with the highest number of profitable trades (by vote)

TU researchers also found that according to the interviewed traders, Wednesday is the best day for Forex trading. 35% of respondents reported that Wednesday is a better day for buying and selling currency pairs than other days of the week.

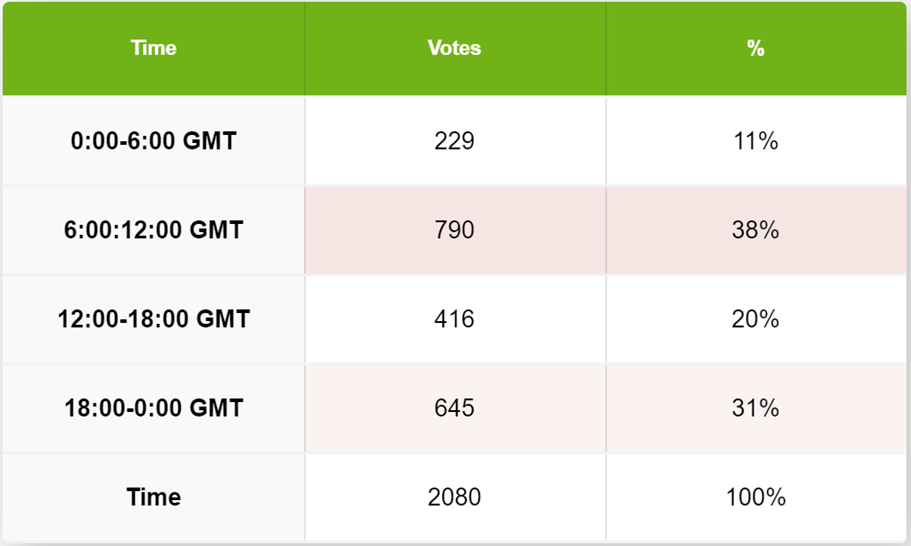

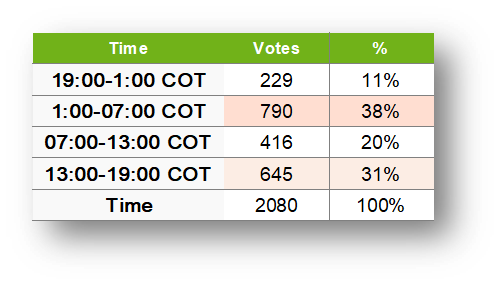

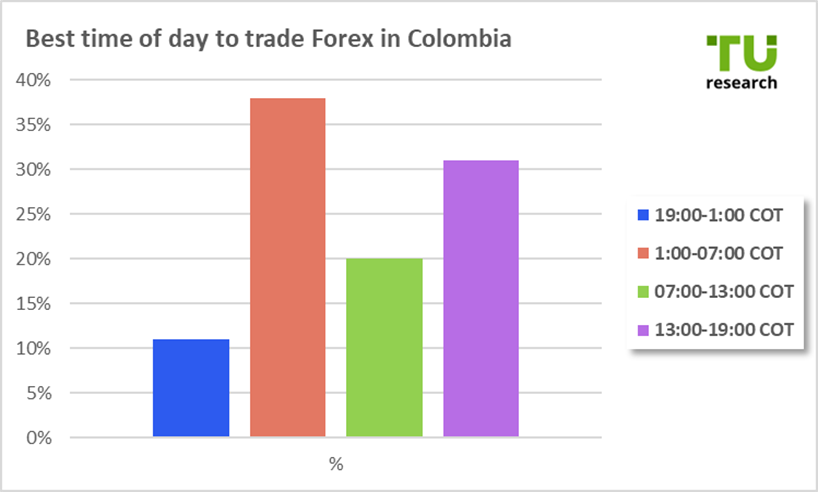

TU experts also gathered data on which time of day is best for day trading Forex. The information provided by surveyed respondents showed that 38% of traders prefer to trade during the hours 6AM GMT to 12PM (noon) GMT, and 31% preferred to trade between 6PM GMT to 12AM (midnight) GMT.

The best time of day to trade Forex with the highest number of successful trades, %

Best time for Forex day trading in Colombia

As per the results of the TU expert’s survey, the best time for day trading Forex in Colombia would be 6AM GMT to 12PM (noon) GMT, and 6PM GMT to 12AM (midnight) GMT. In Colombia Time this equates to 1AM to 7AM (COT), and 1PM to 7PM (COT).

Best time for day trading Forex

It’s important to note that this survey was conducted on people from all over the planet, living in different timezones, and using only GMT, so results don’t necessarily represent the best times for traders in Colombia. The spread across results indicates that the general consensus on best times for Forex trading has a wide range.

Best time of day to trade Forex in Colombia

When taking into consideration the time difference in Colombia, we can conclude that 7AM to 7PM COT might work best for a Colombian trader, unless they are comfortable with trading late at night.

If you want to day trade in Colombia, you should be aiming to trade when the markets have the highest liquidity. This would be during the market session overlaps of London and New York, so from 8AM/9AM to 12PM/1PM.

It's also worth noting that China is Colombia’s largest trading partner of commodities by volume. The percentage of global currency exchange that the Chinese Renminbi (CNY) occupies has been showing significant growth over the last few years. As the stock market has a significant effect on currency exchange rates, and China’s presence in the Forex market is growing, experienced traders in Colombia may want to take advantage of the Asian session hours, though liquidity and volatility are relatively low.

Best Forex pairs to trade in Colombia trading sessions

The best Forex pairs to trade in Colombia are completely dependent on the hours that a trader decides to trade. Considering the best Colombian trading hours closely align with the New York session’s opening hours, we can use these hours as a guide for selecting the best currency pairs for Colombia.

While trading during the London - New York session overlap, currency pairs involving the US dollar (e.g. EUR/USD, GBP/USD) are particularly active. During the early hours of the New York session, currency pairs featuring USD would see high trading volume. During the European session, traders would see most action on currency pairs like EUR/USD, EUR/JPY, and GBP/USD.

Time to pause Forex trading in Colombia

Due to the time differences in Colombia, there are certain hours when trading should be put on hold, relative to the hours of the international trading day. The trading day typically ends at 5PM COT. To avoid incurring interest or overnight fees, traders should be aware of the rollover from the previous trading day to the next.

Other times to avoid trading in Colombia are hours with lower liquidity, such as those with no market session overlaps, and the opening hours of slightly less active markets such as Sydney and Tokyo. Due to these factors, the best time to pause trading in Colombia is just before 5PM (COT), while deprioritizing the hours from 5PM to 3AM (COT).

Best Forex brokers in Colombia

RoboForex

RoboForex is among the best Forex brokers in Columbia and meets the needs of traders of different levels. To achieve this, they offer traders attractive trading opportunities, small minimum deposits, trading assistant tools, etc. The most reputable financial market professionals recognize them as trustworthy partners and top-regulated brokers.

Again, RoboForex Standard Accounts have no fees, making it the best broker for beginners. As for ECN accounts, the fee is $2 per lot, substantially lower than the average in the industry.

Extra features

Regulators: IFSC

Copy trading platform: Yes (CopyFX)

Minimum deposit: $10

Free VPS server: Yes

Trading platforms: MT4, MT5, cTrader, R StocksTrader, R MobileTrader, and R WebTrader

Leverage: 1:2000

Demo accounts: Yes

Instruments:

- Forex (currency pairs)

- Index CFDs

- ETFs

- Cryptocurrency CFDs

- Oil CFDs

- Real securities

- CFD on European and U.S. stocks

👍 Pros

•Low commissions and tight spreads

•Low minimum deposits and immediate cash withdrawals are available

•No-deposit bonus of $30

•12,000+ trading instruments

•RoboForex provides investors with a demo and an Islamic account

👎 Cons

•The R StocksTrader platform has a dearth of cryptocurrency trading tools

IC Markets

IC Market is another top Forex broker in Columbia and a top choice for automated traders. It is also the best Forex broker for traders seeking low-cost Forex/CFD trading platforms. This broker has a competitive product selection and a flexible fee structure, offering very tight spreads with a reasonable commission.

The account opening process is easy, and there are surplus payment options. For the Standard account, pip values begin at 0.6, while they are 0 for the cTrader and Raw Spread accounts. Read more about IC Markets reviews from clients in Colombia.

Extra features

Copy trading platform: Yes

Minimum deposit: $200

Free VPS server: Yes

Trading platforms: MT4, MT5, cTrader

Leverage: 1:1 to 1:500

Demo accounts: Yes

Instruments:

- Currency pairs

- CFDs on futures

- Indices

- Commodities

- Metals

- Stocks

- Bonds

- Cryptocurrencies

👍 Pros

•Swift execution of orders

•Over 2,100 instruments

•Excellent customer service

•Numerous analytical training resources are readily available

•It is permitted to use trading advisors and mobile trading apps

👎 Cons

•Since stocks, ETFs, and funds cannot be traded, IC Markets is not advised for long-term investors

Exness

Exness is another top Forex broker in Columbia recommended for Forex and CFD traders. This broker provides users access to the best trading platforms to trade currency pairs, cryptocurrencies, stocks, indices, metals, and commodities. It is among the best online brokers in Columbia, considering the number of accounts traders can sign up for on the platform.

When a trader opens 10 positions and trades at least 5 lots, their leverage increases to 1:Unlimited from their initial leverage of 1:2000.

You may also be interested in reviews about Exness from clients in Venezuela.

Extra features

Copy trading platform: Yes

Minimum deposit: $1

Free VPS server: Yes

Trading platforms: MT4, MT5, Web terminal, Mobile platforms, Exness Trade Terminal

Leverage: 1:2000

Demo account: Yes

Instruments:

- Currencies

- Assets of stock and commodity markets

- Cryptocurrencies

👍 Pros

•The broker offers CFDs for cryptocurrencies, stocks, more than 120 currency pairs, energy, and metals

•Exness offers low commission, quick order execution, and quick fund withdrawal

•A demo or training account is available

•Availability of narrow spreads and segregated accounts

👎 Cons

•Currently, the Exness training resource section is only available in English

FAQ

What is the best time period to trade Forex?

When Forex trading in Colombia, the best time is during the New York – London market session overlap from 12PM to 4PM MCT, before the trading day ends and rolls over.

What is the hardest month to trade Forex?

November, December and the summer months can be more difficult for trading, as traders on vacation lead to lower liquidity and wider spreads.

What currency should I trade at night?

If trading in the evening and early night (7PM to 12AM Colombia Time), trade currency pairs featuring AUD, NZD, and JPY. If trading late night until early morning (12AM to 6AM COT), focus on GBP and EUR pairs.

What is the best session to trade EUR USD?

The European and North American sessions work best for EUR and USD pairs. Traders should also take advantage of the session overlap, from 8AM to 12PM Colombia Time.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).