Having the Best MT4 Brokers for beginners to choose from will help traders achieve their goals more effectively. Traders Union analysts have prepared an article to help you choose the best option. The experts selected 5 companies, compared them between each other and gave scores. Using the results of the analysis, traders can find the information they need about the Best MT4 Brokers for beginners in 2024.

1

RoboForex - Best MT4 Broker in 2024

RoboForex bonus programs are the company's strong points. Every trader gets a $30 Welcome Bonus, if they deposit $10 or more to their account. Additional bonuses include 5%-15% cash back on the fees depending on the trading volume, as well as additional 10% extra funds for more than 1,000 traded.

The minimum deposit on all accounts except R StockTrader is $10. The minimum deposit for trading stocks on the R StocksTrader and copying trades on the CopyFx platform is $100. The spread on Prime and ECN accounts is floating, from 0 pips, on Pro and ProCent accounts – floating from 1.3 pips. You can trade 36 currency pairs, metals and CFDs on this type of account.

For trading, RoboForex has available the following applications: MetaTrader 4, MetaTrader 5, and R StocksTrader, as well as its web terminal, on which you can work on real and demo accounts.

Leverage is up to 1:300-1:500 depending on the account type, as required by the regulatory authorities. The leverage on the cent account is up to 1:2000. On standard accounts, manual increase of leverage to 1:2000 is possible during registration, but this option is subject to certain rules. This parameter is appreciated by experienced traders and amateurs of aggressive trading. With RoboForex, you can earn not only on trading but also on the affiliate program, making a profit from users you have referred to a broker. Multilingual support helps market participants solve their pressing problems 24/7.

2

Exness - Best MT4 Broker in 2024

Due to an expanded range of trading accounts, Exness is suitable for both professionals and novice traders with little or no experience. The former trade on Pro accounts, and the latter trade on standard and cent accounts. Occasionally, Exness pays bonuses to its new and existing clients.

Not every broker can compete with the range of trading instruments offered by Exness. The company provides 5 classes of CFDs. Commodities can be split into two more groups — metals and energies. The choice of currency pairs is one of the widest on the market. There are over 100 pairs, including majors, minors, and exotics. Leverage is up to 1:2,000 on all account types. Further, active traders can use unlimited leverage subject to requirements for the number of traded lots. The requirements for standard and professional account types are 5 lots, for the cent account, it is 500 lots. The swap-free option is available for all account types.

Market execution is available for trades with currency pairs, indices, stocks, and commodities. Trades on the Pro account are executed instantly. This rule doesn’t apply to cryptocurrencies. Only market execution is available when trading those. Trading conditions on one account type on different platforms are similar. That is, swaps and spreads for Standard account types on MT4, MT5, or Exness in-house platforms are the same.

3

FTMO - Best MT4 Broker in 2024

FTMO offers a classic set of trading instruments: from currency pairs and stock assets to cryptocurrencies. Trading platforms are MetaTrader4, MetaTrader5, and cTrader. Trading conditions during testing and on a real account are the same.

4

Gerchik&Co - Best MT4 Broker in 2024

In their reviews, the company's clients point out a relatively low deposit for an STP broker, which is only $100. Users also pay attention to a large number of trading instruments, narrow spreads, and the ability to use robots to automate trading. Order execution is also fast.

Gerchik&Co offers clients small leverage — only 1:100 — which significantly reduces the degree of risk since a client with small leverage loses several times less than a client with a leverage of 1:1000 or higher.

The broker gives clients access to a large number of educational materials as well as personal statistics with 37 parameters, which allow the client to analyze and adjust his market actions to achieve better results.

The brokerage company provides clients with high-quality and prompt support services on the website and by phone. There are other ways to contact the company; feedback can be given through social media and messengers.

5

IronFX - Best MT4 Broker in 2024

IronFX is regulated by multiple reliable bodies, in particular CySEC, FCA, FSCA. IronFX provides clients with the best terms for active trading. The minimum amount for replenishing an account is $100, the leverage is 1:30. IronFX offers demo accounts so traders can test the platform and practice strategies. The Company serves retail and institutional customers from over 180 countries.

Best MT4 Broker for beginners: Investment Programs

Earning passive income is just as important for traders as earning profit by actively trading. Therefore, it is important to consider investment instruments offered by the company. There are different investment programs and their choice strongly depends on a specific broker. TU analysts have prepared a review of investment programs of the 5 best brokers.

1

RoboForex - Investment Programs

Investment Programs, Available Markets and Products of the Broker

RoboForex is the ideal broker for those looking to invest their money in the Forex market. This company has everything to earn a stable income — from professional analytics to technical functionality and optimal trading conditions. It is especially worth noting its investment program like RoboForex CopyFx which allows you to receive passive income without doing anything. According to customer reviews, RoboForex is the most popular brokerage company.

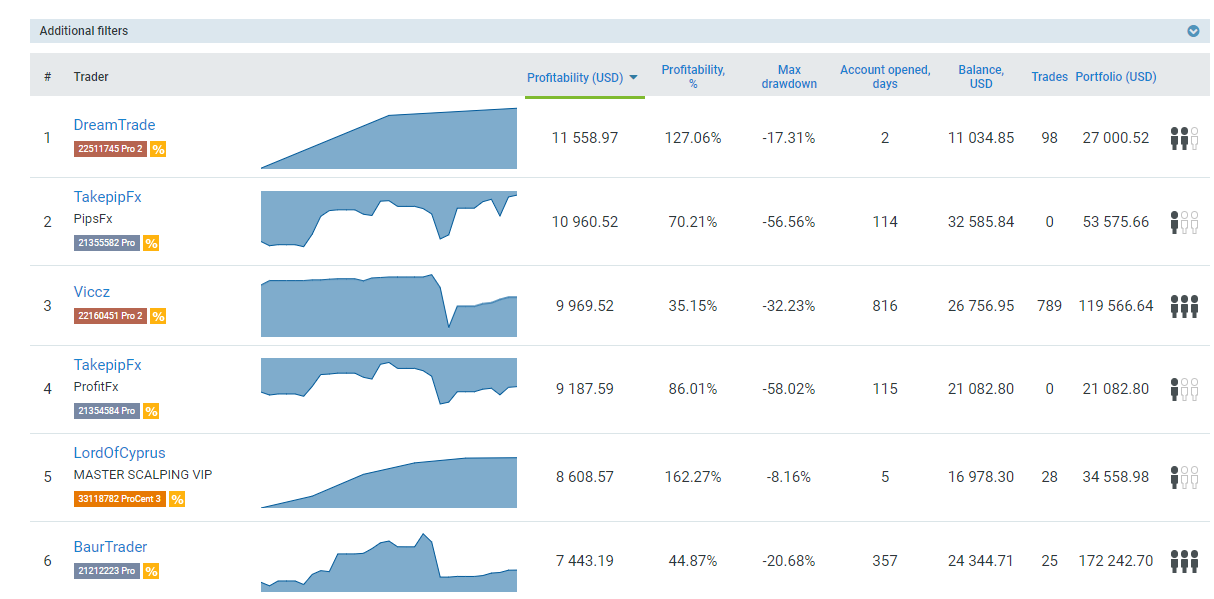

RoboForex CopyFx is a service for copying deals

RoboForex CopyFx is a passive investment option that involves connecting an investor's account to a professional trader's account and then copying his transactions. In this case, all trader's transactions are automatically opened on the investor's account. A specific trader's commission is deducted from the investor's profit in case of a successful transaction. The entire service is fully automated which minimizes your work to almost 0%. Learn More about CopyFX From RoboForex

CopyFX at RoboForex - how to choose a trader | Firsthand experience of Oleg Tkachenko

The minimum deposit is only $100, so everyone can test the waters. Having started working, the investor gets access to professional traders' ratings, which indicates the period of the account's existence, profitability, maximum drawdown level, and other statistics. Also, the investor can contact the trader directly.

An investor can connect to an unlimited number of traders, provided that his deposit can withstand such a load. Such diversification of risks makes it possible to form a full-fledged investment portfolio from traders' transactions.

An investor can disconnect from a trader at any time if he doesn't like something in his trading methods. It is a serious tool for protecting a deposit from RoboForex, which not all brokerage companies provide.

Separately, it should be noted that any person can simultaneously act as both an investor and a trader. All statistics on the effectiveness of copying transactions are displayed in the client's account.

Algorithm of working with the CopyFx copy trading platform:

-

Once you register and pass verification, open a trading account. Investors can open any account, except for accounts with the MT5 and R StocksTrader platforms. Traders planning to provide signals open a separate account by choosing Open FxCopy Trader Account.

-

In the Investment menu, open MT4 Trader Rating. Traders must meet minimum requirements of the broker in order to be included in the rating, such as the number of trades, the number of days the account has been active, and profitability. You will need to contact Customer support to learn about specific requirements.

-

You will see main criteria in the list of traders: maximum drawdown, number of copy traders, profitability, account existence period, etc.

-

Click on the profile of each trader to view trading statistics. You can activate the copy trading option in the profile of the trader you’d like to copy.

Copy trading is available on real accounts, subject to the deposit in the amount higher than the one specified in the trader’s profile. You can disconnect from a trader’s account at any time.

How to start investing in copy trading with RoboForex | Firsthand experience of Oleg Tkachenko

RoboForex affiliate program

It is not necessary to be familiar with trading to make money with RoboForex. Attract customers and earn up to 50% of the company's income. It works like this:

-

You register as a partner, after which you receive information materials for posting on your website/blog, forums, or social networks. You also get a referral link.

-

The person follows your referral link and deposits capital in his account.

-

The broker receives the spread and credits a part of his profit to the partner's account in the referral trades.

Also, each partner can participate in the loyalty program with the possibility of receiving up to 20% additional partner remuneration every month.

Depending on the chosen partnership program and account type, the total amount of partner rewards can exceed 50% of the fees paid by the referral. For example, on Affiliate accounts, rewards are up to 70%. Taking into account the general fee of the VIP program with the loyalty reward, the total rewards of a partner could be as high as 84%.

2

Exness - Investment Programs

Investment Programs, Available Markets and Products of the Broker

Exness clients can make passive income on copy and algorithmic trading. Forex novice traders can earn from copying trades of experienced traders with the social trading platform and standard opportunities of MetaTrader platforms. If Exness clients know how to trade, they can make additional income on broadcasting their own strategies.

How to start earning with social trading

Exness clients can choose any convenient method to receive trading signals. These can be signals broadcast directly on MetaTrader or in the Exness in-house mobile app.

-

Strategy copying. This option is available on the Exness proprietary platform. Investors choose the strategy based on important parameters for them, such as income, number of subscribers, leverage, fees, etc. The Most Copied option allows traders to view the most popular strategies among investors.

Who can provide strategies? Experienced traders with effective trading can do that. Currently, Exness offers two account types for providers — Social Standard and Social Pro. The minimum deposit for both of them is $500. Leverage is up to 1:200 and the fee is up to 50% of the investor’s profit.

Who can become an investor? Any Exness client with a verified user account can be an investor. The minimum investment is $10, thus this option is available even to Forex novice traders without big capital. Investors choose strategies and copy them in the social trading mobile app. Install it on your smartphone or tablet and log into your Exness user account. The broker’s website provides a link to download the app from Google Play and the App Store. Also, there is a QR code.

-

Copy trading . To copy trades of other traders, use the MetaQuotes signal service — MQL4 on MT4 and MQL5 on MT5. First, investors pay subscription fees, and later they pay fees to traders for successful trades.

In addition to copying trades and strategies, Exness clients can use bots and expert advisors, which are available in app stores on the MQL4 and MQL5 websites. There are paid and free plug-ins. Also, you can ask an experienced trader to develop an advisor to fit your trading goals. Algorithmic trading is not available for Exness proprietary platforms.

How to copy signals from traders to your account. | Firsthand Experience of Oleg Tkachenko by TU

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of thedeal and all the steps from signing up to withdrawal of profits.

Partnership programs

Partner rewards are another type of passive income available to Exness clients. Any broker’s client can receive these rewards, regardless of their trading activity and deposits. The main condition to receive fees is to comply with the partnership program requirements.

Rewards for Exness partners:

-

From $880 to $31,200 per month under the Introducing Broker (IB) program;

-

From $10 to $1,850 for each client who makes the first deposit under the Affiliate Program.

Rewards for IBs depend on the number of referred clients — the more of them there are, the higher the fee. The maximum rate is 40% of Exness income from referral trading. Participants in the Affiliate Program receive fees subject to the first referral deposits.

3

FTMO - Investment Programs

Investment Programs, Available Markets and Products of the Broker

The FTMO offer is itself an investment program, the essence of which is as follows: each trader can get 400 thousand USD at his disposal, but before that, you need to go through two test steps. Before testing, there is an opportunity to practice on a demo account.

Invest in yourself | How to become a professional trader with almost no investment

The path to becoming an FTMO trader and earning real money consists of 2 steps:

-

Evaluation stage. At this stage, the trader chooses the amount of the initial deposit from 10 thousand to 200 thousand US dollars. The test fee, respectively, will be €155 euros for a deposit of 10 thousand US dollars. The higher the deposit, the larger the fee. Requirements: target achieving a profit of 10% of the deposit, which must be received within a maximum of 30 days when trading at least 10 days. It is not necessary to trade all 30 days. Permissible losses are allowed up to 10% of the total deposit or up to 5% daily.

-

Verification stage. At this stage, the trader is given up to 60 days to meet the requirements for the maximum daily and total drawdown, but the requirements for the target profit are reduced by 2 times. Conditions are simplified to work on more conservative strategies.

Testing is paid and depends on several factors such as the type of account chosen (regular trading or aggressive) and on the initial deposit amount. The fee is paid only once, so at the second stage, you do not need to pay. If the test is passed, the trader receives real money under management of about 400 thousand dollars. In case of a violation, the test must be re-taken. The number of "retakes" is not limited, but discounts are not provided.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of thedeal and all the steps from signing up to withdrawal of profits.

FTMO’s affiliate program:

The FTMO affiliate program involves attracting traders who would like to unleash their potential, but do not have start-up capital. The company offers each affiliate 8% of the fee amount paid by the referral. Each affiliate receives a referral link and marketing materials.

4

Gerchik&Co - Investment Programs

Investment Programs, Available Markets and Products of the Broker

The brokerage company has favorable offers for active market participants and investors, including those who are not ready for active trading due to a lack of experience or time. In this case, the client can benefit from Gerchik & Co’s investment programs.

Trust management, or TIMA Service

The service operates on a standard model: the investor chooses a manager, makes a deposit, and consistently makes a profit, while the account manager does the trading.

Minimum deposit is $100. This amount is more than sufficient to begin investing. The investor can increase the deposit at his discretion. The higher the deposit, the higher the profit.

Trader's calculator. An investor can use a special calculator on the website to calculate the annual return on investment. This function allows you to select the most advantageous conditions for yourself and begin investing competently.

Manager’s rating. This section contains detailed information about managers and their success. The rating takes into account the indicator of income and drawdowns, as well as the amount of the minimum deposit and the amount of commission paid to the manager by the investor.

Safety and security. The brokerage company does not have access to the funds invested by the client. Deposits are held in a clearing account at a European bank.

Risk manager. Even though the manager does the trading, the client has the right to control the trading process. The manager has no right to exceed the drawdown level specified by the investor, and the "Risk Manager" service will automatically close all unprofitable orders.

No limitations. An investor can either invest in one account and receive up to 300% per year or invest in several accounts.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of thedeal and all the steps from signing up to withdrawal of profits.

Referral program

In addition to passive earnings in the foreign exchange market, the broker invites clients to join the referral program and earn extra money with almost no effort.

Web partner. The client of the company receives remuneration for registering new clients using an individual referral link or banner. The partner receives $4 for each lot of clients who register through an individual link.

Payments are made during the trading activity of the clients brought in by the partner. Thus, the trader receives a consistent passive income without having to trade.

Any active user of social networks can become a partner. To do this, it is enough to register with the company and pass verification. The whole process takes no more than 10 minutes.

5

IronFX - Investment Programs

Investment Programs, Available Markets and Products of the Broker

IronFX offers the TradeCopier platform as a passive income option. Beginners can use the platform to copy strategies of experienced traders. After registering as a Follower, users can access the rating of the most effective IronFX clients called Strategy Providers. At the initial stage, a Follower can choose one Strategy Provider for copying. However, once the platform is used actively, connecting to several traders from the rating becomes available.

To start copying trades on the TradeCopier platform, follow these steps:

-

Register as a Follower. The registration form can be found in the section of the website with information about TradeCopier. Provide your first name, last name, email, choose the Copy Trade account type and its base currency, and create a password;

-

Pass verification (provide documents to confirm identity and place of residence) and make a deposit;

-

Choose a Strategy Provider from the general list of providers and connect to their account.

The TradeCopier platform is not available in all countries. For example, it is not offered by the FCA-regulated branch in the United Kingdom. As an alternative, traders can use the signal copying service directly in the MetaTrader 4 platform. All conditions of its operation are described on the MT4 website in the Signals section.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of thedeal and all the steps from signing up to withdrawal of profits.

Is CFD Trading Good For Beginners?

CFD trading can be an excellent way for beginners to get started in the financial markets. With CFDs, traders can take advantage of small price movements in the underlying asset or security without having to buy the asset itself

However, beginners should understand CFD trading carries a higher degree of risk than other forms of trading due to its leveraged nature. As such, having a good understanding of how CFDs work before getting started and using risk management strategies when trading is vital.

👍 Pros

•Low entry cost - CFD trading requires less capital than other forms of trading, making it an ideal choice for those just starting out.

•Easy to access - CFDs are available on most online trading platforms, making them easy to access from anywhere in the world.

•Potential for passive income - CFDs can be used as a form of passive income if you know how to manage your trades correctly.

•Leverage - CFDs offer traders the ability to use leverage, which can increase their potential returns significantly.

•Flexibility - CFDs are highly flexible instruments that allow traders to take advantage of both rising and falling markets.

👎 Cons

•Risks of high leverage - Leverage can magnify profits but also losses, so it's essential to understand the risks before entering into any trade.

•Most beginners lose money - As with any form of trading, most beginners will lose money when first starting out with CFD trading. It's, therefore, essential to have a good understanding of the markets before investing any capital.

What is a Good CFD Trading Provider for Beginners?

A good CFD trading provider for beginners should offer several features that can help new traders get started in CFD trading. Here are some of the things that a good CFD broker should offer:

Low Minimum Deposit

A good CFD trader provider for beginners should not have a high minimum deposit requirement. Trading CFDs involves a certain degree of risk, and it is vital that beginner traders are able to start trading without having to risk too much capital. Forex minimum deposit requirements enable them to practice trading on a live account with low risk and help them build their trading confidence.

Accounts for Beginners

A good CFD trading provider should offer demo, cent, and micro accounts for beginners. For instance, demo accounts allow traders to practice trading without risking real money. They should also offer cent and micro accounts that enable traders to open small positions with minimal capital while gaining real market experience. These account types are better suited for new traders who are just starting out and need to build their trading skills gradually.

Passive Income Options

A good CFD trading provider should also have passive income options available to its clients. Passive income options such as copy trading and PAMM accounts allow traders to earn extra income without having to actively manage their trades. This is an excellent option for beginner traders who may not have enough time to actively manage their trades but still want to earn additional income.

Advanced Educational Content

A good CFD trading provider should offer educational resources to help beginner traders learn the ropes. Advanced educational content such as webinars, tutorials, and online courses can help beginners learn trading strategies, understand risk management, and familiarize themselves with the trading platform. This can be a big help in building their confidence in their ability to trade and ultimately become successful traders.

By finding a CFD trading provider that offers low minimum deposit, accounts for beginners, passive income options, and advanced educational content, new traders can confidently enter the world of CFD trading and start to build their trading skills and experience.

Can I Make Money in CFD Trading as a Beginner?

Yes, it's possible to make money in CFD trading as a beginner, but it's not easy. It requires discipline and dedication to research and refine your skills. You need to have a robust trading plan that is regularly updated as you gain more experience. It's also essential to find the right broker who offers demo accounts with virtual funds so you can practice before investing real money. Trading CFDs involves risk, so it's best for experienced traders rather than beginners.

How To Start Trading CFDs Better

Trading CFDs can be a complex and risky undertaking, but with the right approach, you can improve your performance and increase your profitability over time. Here are some tips to help you trade CFDs effectively:

Learn the Fundamental Concepts

Before you start trading, it is essential to understand the fundamental concepts behind the CFD market. Understand the factors that drive market trends, the role of leverage, and how margin works. Learn about the difference between long and short positions and how to analyze market data to make informed trading decisions.

Practice on a Demo Account

Before you start trading with real money, practice on a demo account. This will enable you to test various trading strategies, familiarize yourself with the trading platform, and gain experience without risking your capital. Take advantage of the demo account to refine your approach and develop your trading skills.

Pay Attention to Risk Management

CFDs offer several advantages, such as the ability to leverage, which can increase your potential profits. However, keep in mind that it also carries potential risks. A sound risk management strategy is essential. To manage risks, you must set stop-loss orders and use moderate leverage. Proper risk management is critical for long-term success in CFD trading.

Use Technical Analysis

Technical analysis is a powerful tool that can help you predict market trends and make informed trading decisions. Learn about technical indicators such as moving averages, oscillators, and Bollinger bands, and understand how they work. Use charting software to analyze market data and identify trends, support, resistance levels, and price patterns that can provide valuable insights into market behavior.

Plan Your Trades and Stick to It

Develop a comprehensive trading plan that outlines your approach, risk management strategy, and exit criteria. By developing a detailed plan ahead of time, you can reduce the likelihood of making impulsive decisions based on emotions or speculation. Stick to your plan, and don't let your emotions govern your trading decisions. Consistency and discipline are critical components of successful CFD trading.

Can I Make Money in CFDs Without Large Investments?

Yes, you can make money with CFDs without having to make a large investment. Most CFD brokers have a low minimum deposit requirement, which means you can start trading with a small amount of money. The minimum deposit can range from $10-$200, depending on the broker. The reason why this is possible is that CFDs are traded on high leverage, which enables you to trade with a fraction of the trade's value as your initial margin deposit.

The maximum leverage ratio varies from broker to broker and the region of the world. For example, in the EU and the UK, the maximum leverage ratio for retail traders on CFD trades is capped at 1:33. However, professional clients can still have access to high leverage with additional requirements.

On the other hand, for offshore regulated entities, the maximum leverage ratio can rise to as high as 1:1000. Countries like Belize, Seychelles, and the Cayman Islands offer offshore regulation for CFD brokers, often with more relaxed regulations and a lower level of investor protection.

Summary

Choosing a good broker for beginners is not a simple task. To make it easier, TU experts have prepared this review. Based on the collected information, we have given scores to each company. In the Overall score table, you will learn about the best MT4 Broker for beginners in 2024, and also advantages and disadvantages of its closest competitors.

Overall score of the best MT4 Brokers for beginners

| RoboForex | Exness | FTMO | Gerchik&Co | IronFX | |

|---|---|---|---|---|---|

|

Overall score |

8.61 |

7.58 |

7.37 |

6.49 |

6.98 |

|

Execution of orders |

8.95 |

9.6 |

8.6 |

2.79 |

6.85 |

|

Investment instruments |

8.2 |

8.79 |

4.89 |

5.97 |

8.87 |

|

Withdrawal speed |

9.71 |

8.79 |

7.21 |

7.43 |

7.23 |

|

Customer Support work |

9.17 |

9.29 |

8.01 |

8.85 |

7.03 |

|

Variety of instruments |

8.75 |

8.02 |

7.52 |

8.75 |

8.02 |

|

Trading platform |

6.86 |

1 |

7.96 |

5.14 |

3.88 |

|

|

|||||

|

|

|

|

|

|

|

FAQ

Is it possible to work with offshore brokers?

It is best not to work with offshore brokers. However, if you have chosen such a company, you need to check and analyze it very thoroughly. There are offshore brokers with good reputations. Before you start working with such a company, deposit the minimum amount and start trading. Once you’ve worked with the broker for a little while and checked how it operates and how quickly it processes withdrawals, you can start depositing higher amounts.

Why is a license important for a broker?

License is the key document testifying to the broker’s reliability. It means that the company complies with the requirements of the financial regulatory authority that issued it. It is recommended that you choose brokers with licenses from top financial regulators: the USA, European Union, the UK, as these jurisdictions have the strictest licensing requirements.

What commissions and fees should I take into consideration when I am choosing a broker?

The commissions and fees in the financial markets are divided into trading and non-tradings ones. Trading fees are the fees that are charged directly during trading (spread, commission per lot, etc.), while non-trading fees are the ones charged outside the trading process (for example, account fee, inactivity fee, deposit and withdrawal fee).

What learning instruments can a broker offer?

Brokers offer various educational options. These include full-fledged educational courses, or video tutorials, articles, and books. Companies also often hold seminars and webinars.

Best MT4 Broker for beginners by Countries

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.