Waka Waka Expert Advisor Review

Waka Waka EA uses a grid system and capitalizes on market inefficiencies. It employs RSI and ATR indicators, tailored for AUD/CAD, AUD/NZD, and NZD/CAD on M15.

-

Backtesting suggests profitability with a high win rate and moderate drawdown.

-

The EA incorporates a martingale strategy, which poses a significant risk.

-

During some tests, Waka Waka EA experienced complete deposit depletion.

-

It's best suited for traders who are comfortable with high-risk strategies and can closely monitor trades.

potential of Expert Advisors (EAs). One such tool that has recently garnered attention is the Waka Waka EA. The problem many traders face is the overwhelming uncertainty and risk associated with trading, exacerbated by the volatility of the Forex market. This uncertainty often results in hesitance to trust automated systems, despite their potential for optimizing trading strategies.

This article aims to shed light on the Waka Waka EA, providing a comprehensive review of its workings, strategies, and real-world performance metrics. By dissecting its features, analyzing its backtested and live performance data, and evaluating its profitability, we offer readers a clear understanding of whether the Waka Waka EA stands as a reliable tool in the arsenal of Forex trading.

-

Is Forex trading bot profitable?

The profitability of a Forex trading bot can vary widely depending on its strategy and market conditions.

-

What is Waka Waka EA?

Waka Waka EA is an automated trading system designed to exploit market inefficiencies using a grid system with RSI and ATR indicators.

-

How to Download and Setup Waka Waka EA?

To download and set up Waka Waka EA, purchase it from the MQL5 marketplace and follow the provided instructions for installation on your MetaTrader platform.

How does Waka Waka EA work?

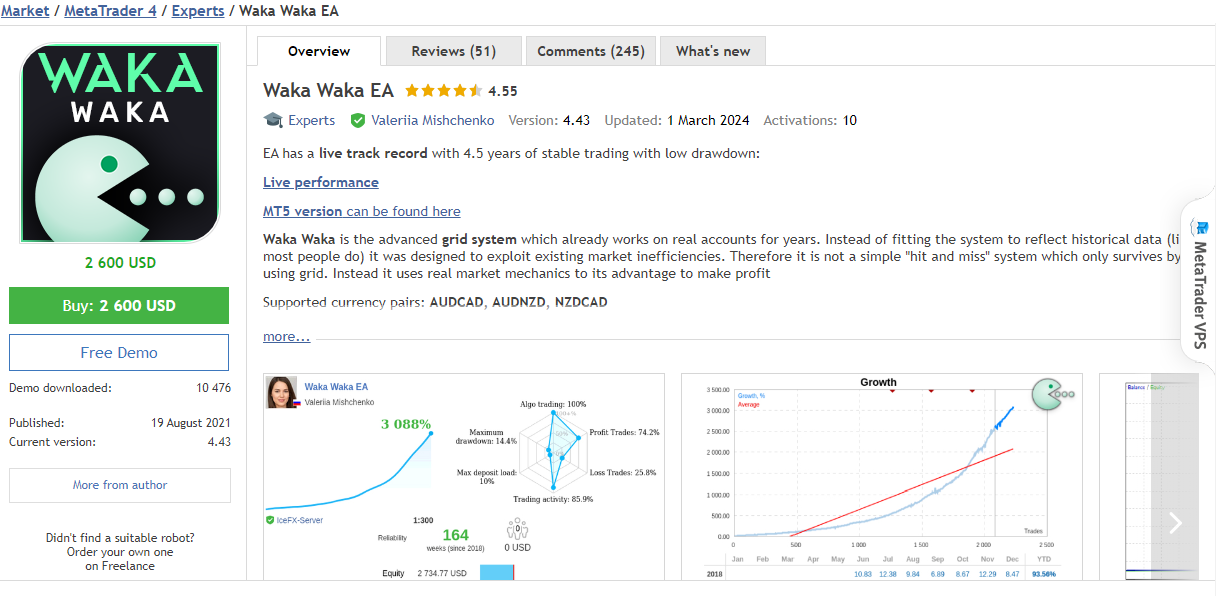

The Waka Waka EA represents a modern approach to automated Forex trading, operating as an advanced grid system. Unlike many of its counterparts tailored to match historical data patterns - a method that can potentially misalign with current market dynamics - Waka Waka EA prides itself on being designed to capitalize on existing market inefficiencies.

This suggests a strategic departure from the traditional "hit and miss" methodology, where survival depends heavily on the grid. Instead, it leverages genuine market mechanics to create profit opportunities.

The EA boasts a live track record spanning over four and a half years, showcasing stable trading with modest drawdown—a metric that many traders scrutinize closely. It supports specific currency pairs: AUD/CAD, AUD/NZD, and NZD/CAD, and is optimized for the M15 timeframe.

Waka Waka EA Page on MQL Market

For traders interested in Waka Waka EA, the prudent course of action would be to initiate testing in a controlled environment, such as a demo account. This provides an opportunity to familiarize oneself with the bot’s operational nuances without the immediate risk of real capital. Conducting tests enables traders to gauge the bot's responses to different market scenarios, which is invaluable for understanding its potential performance with live funds.

Only through thorough testing and analysis can one gain the confidence required to deploy such a tool in the demanding world of Forex trading.

What is the strategy of Waka Waka?

The strategy underpinning the Waka Waka EA is multifaceted, integrating various technical indicators to navigate the Forex market.

Central to its operation are:

-

the Relative Strength Index. The RSI is employed as a momentum oscillator that measures the speed and change of price movements, assisting in identifying overbought or oversold conditions. A unique aspect of Waka Waka EA's application of the RSI is its purposeful filtering to sift out trades with minimal potential, thus aiming for opportunities with a greater likelihood of profit.

-

the Average True Range (ATR). It provides insight into market volatility. The EA utilizes ATR to adjust trade distances intelligently—larger distances in more volatile markets and shorter ones when the markets are more subdued. This dynamic adaptation is crucial for a grid system, as it balances the frequency of trade entries with prevailing market conditions.

The EA does not rely solely on these indicators. It also integrates Bollinger Bands to determine optimal entry and exit points based on market price and volatility, allowing for a more comprehensive analysis before executing trades. This layered approach, considering both momentum and market volatility, aims to carve out a strategic edge in executing trades.

Waka Waka EA's strategy is not just about when to enter the market but also how to manage ongoing trades. Its grid system is designed to place additional trades at predetermined intervals, creating a 'grid' of buy or sell orders at incrementally advantageous prices. This grid can maximize profits from trends and soften the impact of adverse movements.

Waka Waka EA's strategy is a composite of momentum-based trade filtering, volatility adjustment, and strategic grid placement. This blend is intended to exploit market inefficiencies rather than merely mimic past data, aiming for sustained profitability rather than sporadic success.

What is waka waka ea myfxbook

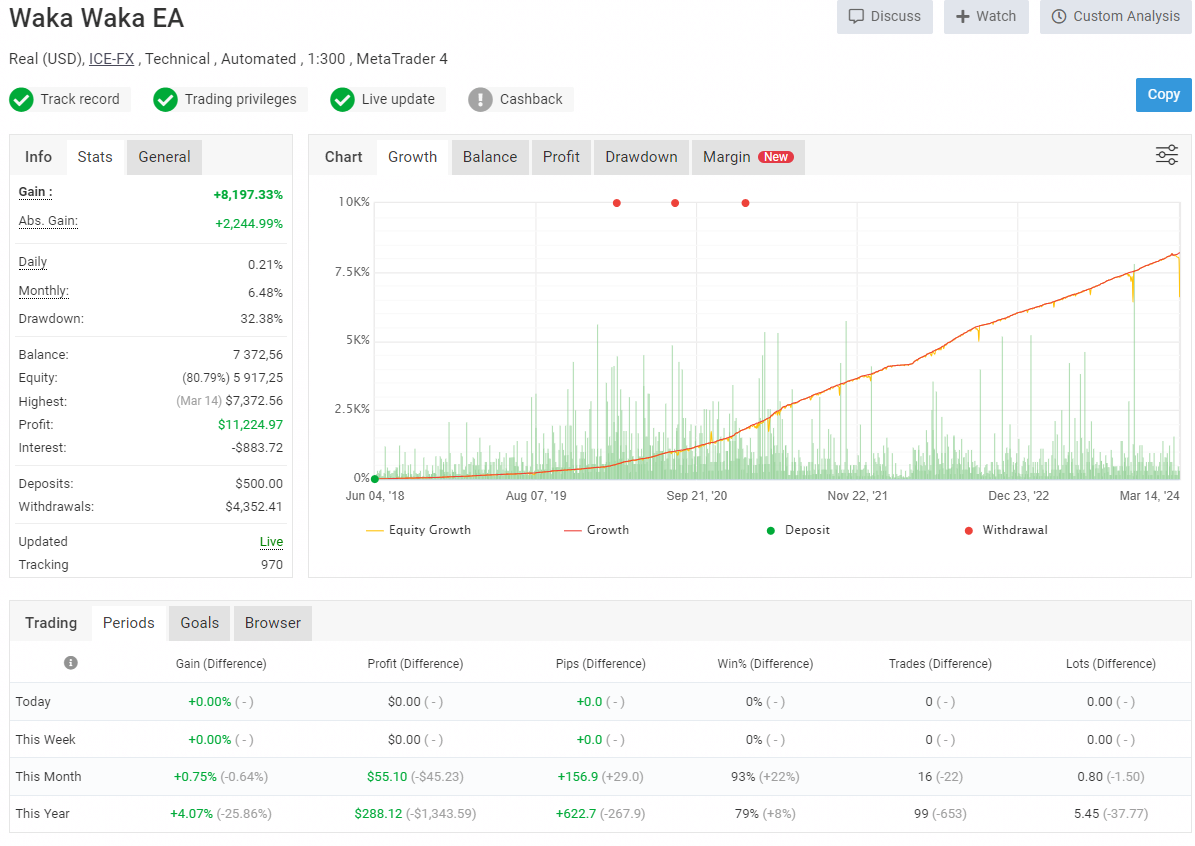

The Waka Waka EA's performance, as reflected on Myfxbook, provides a transparent look at its real-world application over a substantial period.

Waka Waka EA Real-Time Monitoring

The figures present a robust gain of +8,197.33%, with an absolute gain of +2,244.99%. These numbers are impressive, indicating a potential for significant profitability. However, it is essential to observe that the account also experienced a peak drawdown of 32.38%, a risk factor that should not be overlooked.

A drawdown of this magnitude can be a warning sign for traders with a low risk tolerance, as it indicates a substantial decline from a peak to a trough in the value of the account. High drawdowns can challenge one's emotional and financial resilience, especially if trading with significant capital.

Reviewing the equity growth and balance chart, there is a consistent upward trajectory, with green dots indicating deposits and red dots marking withdrawals. The chart illustrates a general long-term increase in equity, but it also exhibits periods of stagnation and volatility, as evidenced by the vertical spikes in the graph.

The decision to risk money with Waka Waka EA would depend on an individual's risk appetite, trading objectives, and capital adequacy. The impressive gains could be enticing, but they must be weighed against the possibility of substantial drawdowns. A prudent trader would also consider the trading style of the EA, the specific strategies used, and whether it aligns with their own trading philosophy.

While the Myfxbook account demonstrates the potential for high returns with Waka Waka EA, it also highlights the importance of understanding and managing the associated risks. Thorough analysis and cautious optimism should guide any decision to engage with this or any trading bot.

Best Forex Brokers in 2024

Is Waka Waka EA profitable?

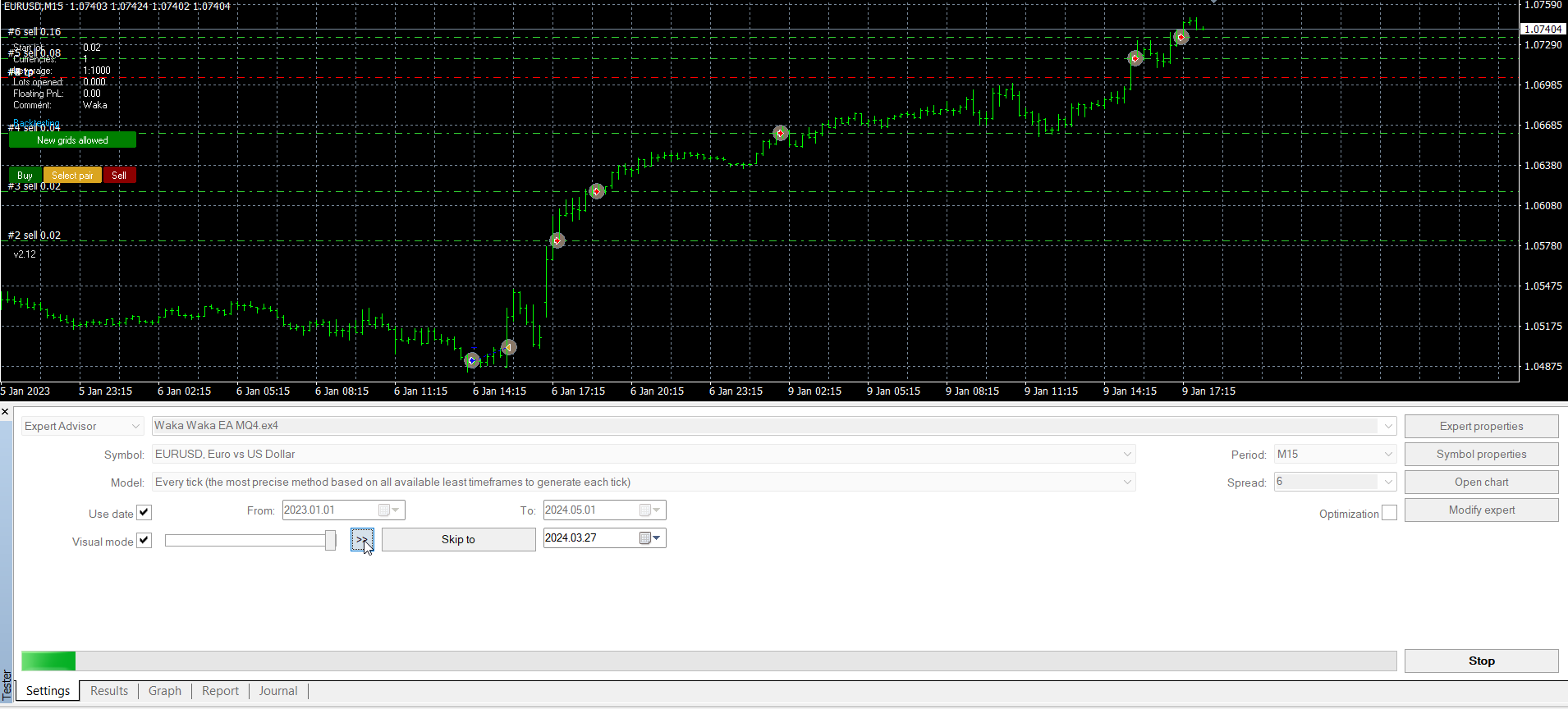

The Waka Waka EA underwent rigorous backtesting on the EUR/USD pair with a 15-minute chart, spanning 2023 to 2024, to evaluate its profitability using factory settings.

Backtesting Waka Waka EA

Here’s a succinct breakdown of the findings:

-

Profitability: The EA demonstrated a consistent upward trend in profits throughout the testing period.

-

Drawdown: The maximum drawdown observed warrants attention, suggesting a need to balance the profitability against potential risk exposure.

-

Trade Management: The EA’s ability to manage trades effectively was a contributing factor to the overall growth of the account.

While the backtesting results appear positive, traders should consider these points before concluding:

-

The simulation’s starting conditions and how they may relate to an individual's actual trading scenario.

-

The necessity of understanding the implications of drawdown and whether it aligns with personal risk management strategies.

-

The importance of validating these backtesting results through forward testing under current market conditions.

Overall, the backtesting suggests that Waka Waka EA could be a profitable tool. Yet, prudent practice would advise further validation to ensure these results are not only historically relevant but also indicative of future performance.

What are the results of Waka Waka EA?

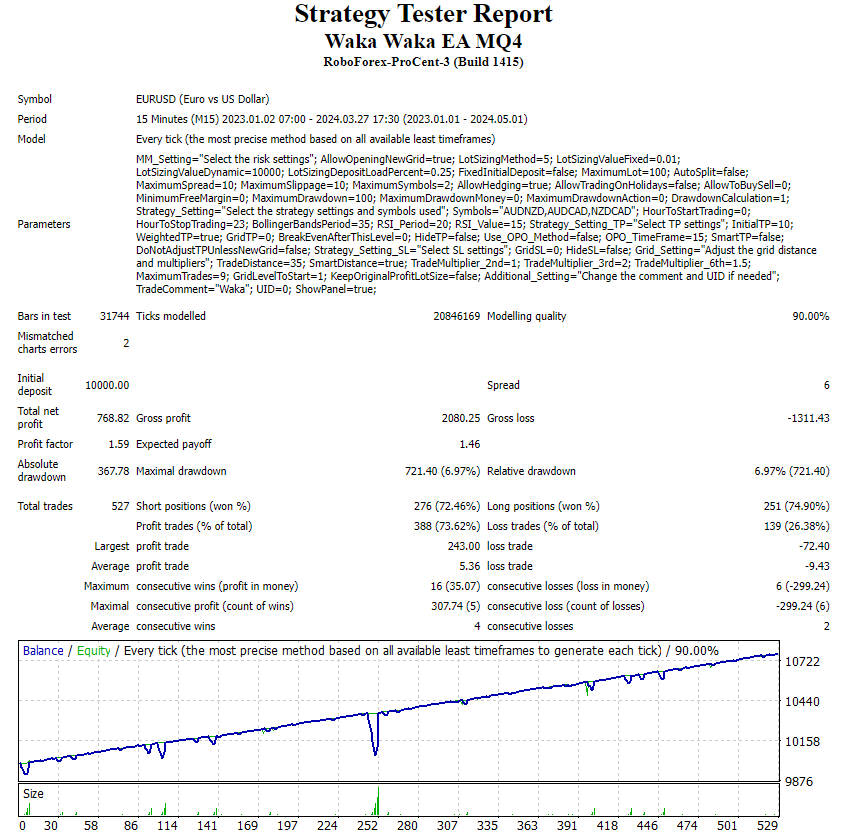

The Waka Waka EA's strategy tester report offers a quantitative glimpse into its performance, with specific attention to the martingale components within its strategy:

The results of Waka Waka EA

-

Profitability: The EA closed with a net profit of $768.82 on a $10,000 initial deposit.

-

Drawdown: A maximum relative drawdown of 6.97% was observed, which is moderate and within acceptable risk parameters for many traders.

-

Win Rate: The EA achieved a win rate of 72.46% for short positions and 74.90% for long positions, a respectable figure in trading.

In terms of the martingale strategy:

-

The largest loss trade was -$243.00, yet the EA compensated with a maximum consecutive win of $307.74.

-

This suggests a martingale strategy where trade size may increase after a loss to recover previous losses.

Note: the profit chart shows a moment of serious "failure" - this period should be analyzed more carefully. It is necessary to clearly understand the technical and fundamental market reasons for such a drawdown.

For trading, these points are crucial:

-

Monitor the martingale element closely to ensure it aligns with your risk management strategy.

-

Consider the proportion of profitable trades and the potential impact of a large loss.

The results indicate that while the Waka Waka EA can be profitable, understanding the inherent risks and mechanics, like the martingale strategy, is essential for informed trading decisions.

What are the stats on Waka Waka EA?

The statistics of the Waka Waka EA reveal mixed outcomes. In certain tests, the EA has shown a tendency to deplete the trading account entirely, a situation known colloquially as a "blow deposit." Here are the summarized pros, cons, and use cases:

👍 Pros

• High win rate, which suggests strong entry and exit strategies.

• Moderate drawdown in reported tests, indicating a potentially manageable risk level.

👎 Cons

• Instances of account depletion in some tests point to an aggressive risk profile.

• Use of martingale strategy can lead to significant losses if not monitored closely.

Use Cases:

-

Suitable for traders comfortable with high-risk, high-reward strategies.

-

Potentially beneficial for those able to actively monitor and manage trades to mitigate risks associated with the martingale strategy.

It is essential for users to match the EA’s risk profile with their risk appetite and trading strategy to utilize its full potential while being aware of the stakes involved.

Expert Tip:

When utilizing Expert Advisors like Waka Waka EA, always begin with a demo account to observe its decision-making in real-time. This hands-off approach allows you to measure performance without financial risk and understand the EA's mechanics. Remember, EAs are tools, not replacements for strategic decision-making

Summary

The Waka Waka EA presents as a high-risk, high-reward trading tool, exhibiting a strong win rate and moderate drawdowns in certain conditions. However, its use of a martingale strategy and potential for account depletion warrants caution. It's imperative for traders to test the EA thoroughly and ensure its aggressive strategy aligns with their risk tolerance before implementation.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).