Oanda vs Forex.com - Which Broker Is Better?

Oanda vs Forex.com is a popular search term among traders looking to find a reliable broker. Which of these two is the better choice?

Before picking a broker, it's important to do a background check about their history and every other important detail. Trading the financial markets comes with a certain level of risk that requires you to do your due diligence regarding your choice of broker.

For a start, you want to be sure of details such as their reputation and how long Forex.com and Oanda have served customers with brokerage services. After that, you can then go on to determine which of the two brokers has the capacity and services to meet your needs when it comes to trading.

Trader’s Union is glad to help you do the hard work. Our team of experts did all the research and placed Oanda side by side with Forex.com to ascertain which entity comes out on top. To do that objectively, we spent time evaluating the different brokers based on 11 key criteria. Our team carried out all the analyses and presented them in tables to make it easy for you to compare and contrast the pros and cons.

You'll also find that we awarded an overall rating to both brokers which should help you decide in the end which one matches your specific needs between Forex.com and Oanda.

Oanda vs. Forex.com: Overall Ranking

Oanda and Forex.com both rank among the heavyweights in the world of forex broking. If you are from the US, these two brokers have got you covered. That is good news because there are many other forex brokerages online that restrict traders in the United States from accessing their platform. That’s mostly down to regulations and laws.

Here’s how we’ve rated Forex.com vs Oanda according to 11 areas of consideration.

| Feature | Oanda | Forex.com |

|---|---|---|

Overall |

8.3 |

8.7 |

Regulation |

8.9 |

8.5 |

Fees |

9 |

8.5 |

Trading Assets |

8 |

9 |

Investment Instruments |

7.9 |

9 |

Platforms and Charting Tools |

8.6 |

8.3 |

Margin Rates |

8 |

7.5 |

Deposit and Withdrawal |

- |

- |

Research |

9 |

8 |

Education |

8 |

7.5 |

Support |

8.5 |

7.5 |

Bonuses |

8 |

8 |

Oanda vs Forex.com: Pros and Con

Before diving into the pros and cons, we’ll do a brief introduction of Oanda and Forex.com to get you acquainted with both brokers.

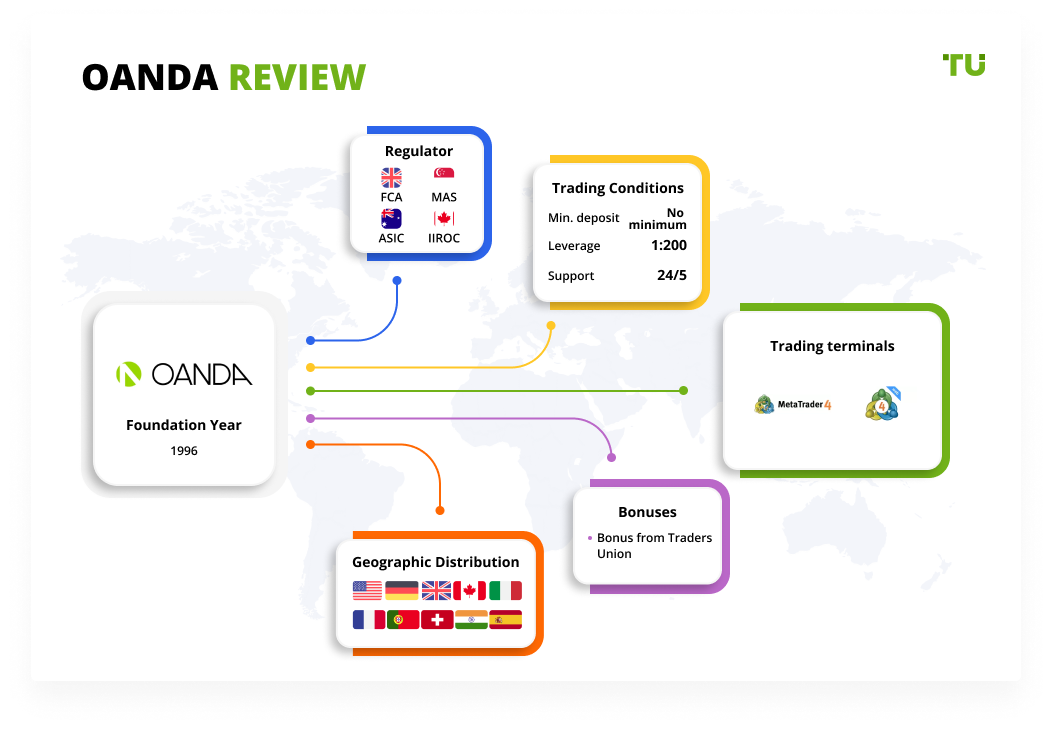

Oanda review

Olsen & Associates, also known as OANDA, is a US-registered company set up to offer a plethora of financial services to clients around the world. Its history goes as far back as 1996, and it is now under regulation in four jurisdictions. The broker has licenses from different regulators, of which the United Kingdom Financial Conduct Authority (FCA) is the major one.

Speaking of recognitions and awards, Oanda doesn’t lag behind as it has several awards to its name. The US Foreign Exchange Report awarded it the Best Customer Service, while FX Week crowned it the Best Trading Platform. There’s also an award from the UK Forex Awards where Oanda bagged top honors in the Best Forex Trading Technologies category.

Forex.com review

In the case of Forex.com, you will find that its parent company is a financial group known as Gain Capital Holdings. The forex broker is also not new in the industry as it has over a decade of experience up its sleeves. The main goal at Forex.com is to satisfy customer obligations in a responsible manner. Apart from having approval and licensing from the FCA, Gain Capital Holdings is also regulated by reputable financial bodies in different jurisdictions. One such top-rated regulatory body is the Cayman Islands regulator CIMA.

From all indications, many points of similarity exist between these brokers, so we've outlined the overall pros and cons to consider between Oanda and Forex.com below.

| Oanda | Forex.com | |

|---|---|---|

| Overall Pros | Regulated by a range of reputable financial bodies | Orders executed at high speeds |

| Real-time news and fundamental analysis tools | 4500+ instruments across various markets | |

| localized and multilingual phone support | Tight spreads on over 90 assets | |

| User-friendly platform for new forex traders | Rebate and discount programs are available | |

| Outstanding research tools | High-level investor protection | |

| Financial information publicly available | Diverse technical research tools | |

| High educational value through written content and videos | Caters to a wider audience of users | |

| Orders get executed with no requotes | Creates a variety of quality, written content daily | |

| Deposit minimum as low as $1 | Low fees and relatively cheap commission costs | |

| Overall Cons | Low leverage | High initial deposit starting at $100 |

| Cumbersome and complex complaint procedure | Customer support is not responsive enough | |

| No programs offering bonus | Fewer deposit and withdrawal options | |

| Slow withdrawal of funds | Lacks a multi-language version | |

| Customer support isn’t 24/7 | Non-existent video-form research | |

| Only FX and CFD available | No multilingual customer support |

Regulation

| Regulated By: | Oanda | Forex.com |

|---|---|---|

US Regulation |

Yes |

Yes |

FINRA |

No |

No |

SIPC Protection |

No |

No |

Non-US regulators |

Yes |

Yes |

Oanda has the United Kingdom Financial Conduct Authority (FCA) as its principal regulator, but there are also a handful of other reputable regulators for this broker. The others include Malta Financial Services Authority and the Investment Industry Regulatory Organization of Canada (IIROC). More regulators include the Australian Services and Investments

Commission (ASIC), the Commodity Futures Trading Commission (CFTC), and the Monetary Authority of Singapore (MAS).

For Forex.com, the United Kingdom Financial Conduct Authority (FCA) serves as the main regulatory body behind its activities. But there are other financial regulators also providing oversight functions on its operation. They include the Japanese Financial Services Authority (FSA), the United States Commodity Futures Trading Commission (CFTC), the Investment Industry Regulatory Organization of Canada (IIROC), the Australian Services and Investments Commission (ASIC), and the Cayman Islands Monetary Authority (CIMA).

When you consider other top-tier, middle-tier, and low-tier licenses obtained, Oanda becomes the winner in this category by a slight edge. But especially because the National Futures Association has on two occasions cited Forex.com in the past. With the market being a high-risk place, managing to stay free from citations is indeed a big achievement for Oanda.

Trading Conditions

| Trading Conditions | Oanda | Forex.com |

|---|---|---|

Minimum Deposit |

No minimum deposit |

$100 |

Up to 1:50 |

Up to 1:500 |

|

Number of Markets |

Over 100 markets |

Over 4500 different markets |

Trading Accounts |

Standard, Core, and Swap-free |

Standard, Commission, and Direct Market Access |

Base Account Currencies |

USD, EUR, HKD, SGD |

USD, EUR, GBP |

Trading Assets

| Asset Name | Oanda | Forex.com |

|---|---|---|

Forex Pairs |

Yes |

Yes |

Stock CFDs |

Yes |

Yes |

Crypto CFDs |

Yes |

Yes |

Commodity CFDs |

Yes |

Yes |

Real Stocks |

No |

Yes |

Options |

Yes |

Yes |

Spread Betting |

Yes |

Yes |

Other assets |

Indices, precious metals, bonds, futures |

Futures, industry sectors, bonds, metals |

As a trader, one of the biggest fans of consideration that should influence your decision is access to as many financial instruments as possible. Forex.com has more than 4500 available to customers all of which cut across crypto, commodities, CFDs, Forex, and more. The most interesting part is that there are currently more than 90 currency pairs for anyone who trades Forex.

That gives you a far wider range of choices when compared to a little over 70 currency pairs offered by Oanda. But that doesn’t mean Oanda performs too badly in this category as it offers a good range of commodity CFDs. While you may have no access to individual assets, you can cross-diversify by trading bond CFDs. There’s also a platform to play in the equity markets using Oanda's index CFDs.

Forex.com comes out on top but most retail traders still find both brokerage offerings comfortable enough.

Oanda fees vs Forex.com - Fees

Trading Fees

| Fee | Oanda | Forex.com |

|---|---|---|

Min EURUSD spread |

0.1 |

1 |

Average EURUSD spread |

1.2 |

1.3 |

CFD commission |

None |

0.1% - 0.15% |

Per lot fee |

$4 |

$11 |

With regards to commissions and fees, it's clear to see that Oanda has a trading environment with more competitive pricing. That's true, especially when you consider Forex.com which has a minimum EURUSD spread pegged at 1 pip and the average lying at around 1.3 pips. That's different for Oanda where the minimum spread is 0.1 pips for EURUSD.

But Forex.com still has its advantages for traders that decide to go with the DMA account. Users under this category get charged on a commission basis for raw spreads and they can enjoy discounts depending on trade volumes. So you might find Forex.com’s pricing structure somewhat more favorable if you’re an active trader with high-frequency operations.

On the other hand, Oanda seems to favor retail traders more with its cost structure. Overall, Oanda comes out on top.

Non-Trading Fees

| Oanda | Forex.com | |

|---|---|---|

Account Fee |

None |

Commission-free for standard accounts and $5 per 100,000 traded for commission accounts |

Deposit Fee |

Free |

Free |

Bank Transfer Withdrawal Fee |

$20 |

Free |

Debit/Credit Card Withdrawal Fee |

Free |

Free |

Inactivity Fee |

After 12 months of inactivity, 10 units of your account’s currency denomination |

$15 monthly after 12 months of inactivity |

As mentioned earlier, our Forex.com vs Oanda analysis yielded quite a lot of similarities between the two brokers. So in order to get more objective results, we not only compared trading fees but also looked at funding/withdrawal costs and inactivity fees.

Looking at the nontrading fees, inactive traders have to pay a charge of $15/month after 12 months of inactivity on forex.com. Users on Oanda also have to pay inactivity fees monthly after 12 months of inactivity as well, but this time lower.

While there isn’t that much difference, especially since funding and withdrawals are almost free (except for third-party charges, Oanda only charges $20 in fees for bank transfer withdrawals. All the same, Oanda still comes out on top in this category due to its overall pricing structure.

Margin Rates

| Oanda | Forex.com |

|---|---|

Tier 1 (0.50%) |

Major pairs 2%-3% |

Tier 2 (1.00%) |

Some pairs 5%-7% |

Tier 3 (5.00%) |

Other pairs 10%-20% |

Tier 4 (20%) |

XAU/USD and XAG/USD are 100% |

Passive Income Tools

| Oanda | Forex.com | |

|---|---|---|

Yes |

No |

|

PAMM/RAMM |

No |

No |

Managed Accounts |

No |

No |

Other |

- |

- |

Available Trading Platforms

| Oanda | Forex.com | |

|---|---|---|

MT4 |

Yes |

Yes |

MT5 |

Yes |

Yes |

cTrader |

No |

No |

Proprietary trading platform |

Yes |

Yes |

Other trading platforms |

Oanda API suite, Web trading platform, ZuluTrade |

Virtual trading demo, Desktop platform |

To get a more in-depth look into the available trading platforms and existing conditions on any broker’s platform, our team of experts sometimes have to set up accounts to explore the range of tools and facilities. That way, Traders Union can then evaluate the level of authenticity of the trading platform to the best extent possible.

With that in mind, Forex.com maintains a good lead ahead of Oanda. Both brokers offer their individual proprietary trading platforms, as well as a range of other trading platforms. But when you put the quality of the trading environment together with usability and intuitiveness, Forex.com ranks higher. However, that doesn't take anything away from Oanda.

Top 10 Forex Educators and Mentors| Features | Oanda | Forex.com |

|---|---|---|

iOS |

Yes |

Yes |

Android |

Yes |

Yes |

Apple Watch App |

No |

No |

Touch ID |

No |

Yes |

Face ID |

No |

No |

Deposit and Withdrawal

| Deposit and Withdrawal Method | Oanda | Forex.com |

|---|---|---|

Bank Transfer |

Yes |

Yes |

Credit/Debit Card |

Yes |

Yes |

Electronic Wallets |

Skrill and Neteller |

Skrill and Neteller |

Crypto |

No |

No |

Other options |

Alternate payment methods |

Research

| Research Type | Oanda | Forex.com |

|---|---|---|

News Feed |

Yes |

Yes |

Fundamental Data |

Yes |

Yes |

Chart Analysis |

Yes |

Yes |

Trading Ideas |

Yes |

Yes |

E-Mail Reports |

Yes |

Yes |

Other |

Mainichi, Order book, MarketPulse, Reuters, Mainichi |

Reuters news feed, economic calendar, Trading Central |

Education

| Education Type | Oanda | Forex.com |

|---|---|---|

Demo-account/Paper Trading |

Yes |

Yes |

Courses |

Yes |

Yes |

Articles |

Yes |

Yes |

Videos |

Yes |

Yes |

Webinars |

Yes |

Yes |

Books |

E-books available |

No |

Other |

- |

Investor Dictionary (Glossary) |

Support

| Support Features | Oanda | Forex.com |

|---|---|---|

Working Days |

Sundays - Fridays |

Sundays - Fridays |

Yes |

Yes |

|

Phone |

Yes |

Yes |

Online chat |

Yes |

Yes |

Other |

Chatbots, FAQ support |

Complaint form, FAQ support |

Promo

| Promo | Oanda | Forex.com |

|---|---|---|

Forex bonuses |

Yes |

Yes |

Referral Program |

Yes |

Yes |

Other |

Rebates and commission markdowns |

Wire transfer fee reimbursements and monthly rebates for high-volume trades |

Oanda or Forex.com: Which Broker is Actually Better?

Here at Traders Union, we value objectivity over sentiments when comparing and contrasting two different platforms. In our Oanda versus Forex review, we went on to analyze each broker based on 11 key criteria, including regulation, trading conditions and tools, research and education, customer service, mobile capabilities, and more.

From our findings, both brokerages have their strengths and weaknesses which tend to overlap eventually. To be more specific, however, trades have more than 4,500 markets to access on Forex.com. That statistic alone blows Oanda which offers just above 120 markets out of the water.

However, we believe that the better market research platform is Oanda. But even that doesn’t put it above Forex.com which offers more than 90 currency pairs and a better mobile trading experience.

Oanda vs Forex.com: Which One Is Better For Newbies?

As a beginner, set your sights on evaluating the educational structure of any broker to see which one has the most quality content. In our Forex.com vs Oanda analysis, we found that both platforms have a good educational division but Oanda edges Forex.com a bit. Generally speaking, both platforms offer lots of value in terms of research in education in the form of articles, webinars, videos, and courses.

You also want to consider how responsive the customer support team is for any broker. Although both Forex.com and Oanda offer email support and live chats, Oanda is the clear leader here because of its multilingual/localized phone service.

Forex.com or Oanda: Which Broker is Actually Cheaper?

One thing to keep in mind is that the average spreads data is not always available for every broker. That's because not all brokers publish such data, making it somewhat cumbersome to have an in-depth view of their pricing structures. But when it comes to the overall pricing structure, our assessment places Oanda ahead of Forex.com.

Oanda vs Forex.com: Which One Is Better For Day Trading?

In the aspect of trading forex and CFDs, one of the most widely used platforms is MetaTrader. You can access MetaTrader 4 on both Forex.com and Oanda but the latter also has a social trading side to its services.

Another important aspect of day trading is the broker’s online interface, especially when involved in the forex marketplace. Having an interface that isn't user-friendly and intuitive nullifies any other attractive features for traders. In this case, while Oanda doesn’t perform badly, Forex.com comes out on top easily. That's because more traders seem to complain about the desktop and online interfaces, stating the absence of sufficient tools and intuitiveness to their experience.

Once more, both Oanda and Forex.com have features that even out the competition between their individual platforms. Consider the fact that Oanda’s traders have access to its API that allows them to add a good level of customization to their trading experience.

Oanda broker

To be fair, however, Oanda edges Forex.com out when you consider the mobile app utility. Oanda has a good Apple/iOS app that provides a convenient on-the-go experience for traders. That is in contract with the mobile app delivery of forex.com which seems to have a lot of catching up to do. But if you are more inclined to trade on a desktop interface or via the web, you might want to go with Forex.com.

Coming from the angle of forex spreads, both brokers aren’t that far apart from each other and that's because they are both market makers. So even if you find some points of difference across the pairs, they become somewhat unified and evened out when you average these differences out.

Summary

For traders in the United States, there aren't that many reputable forex trading platforms. So it implies that Oanda and Forex.com are leading brokers in the space, making them great options for American traders looking to get into the forex market.

But if your location is outside the US, deciding what platform is best for you between Oanda vs Forex.com requires you to choose based on your preferences.

Thankfully, Traders Union experts have done objective research to outline key performance indicators in this guide. From our findings, both Forex.com and Oanda aren’t that far apart. You’ll find that they both offer comparable tools, support, educational tools, fees, and spreads. While professional forex traders may want to go with Oanda, newbies might find forex.com the more suitable option.

In the end, it’s safe to say that both brokers are leaders in the industry. That’s because they are forex market makers with a structure designed to stand the test of time. So whichever forex broker you decide to go with, the bottom line remains that you’ll be trading on two of the best platforms around today.

FAQs

Are Oanda and Forex.com regulated in the US?

Yes. Oanda and Forex.com are regulated by the CFTC. Brokers work in the USA absolutely legally.

Do Oanda and Forex.com have deposit insurance?

No. Oanda and Forex.com are not members of the SIPC, therefore deposit insurance does not apply to these brokers.

Can I trade real stocks with Oanda and Forex.com?

Real shares are offered only by Forex.com broker. Broker Oanda does not have such assets for trading.

Are the spreads significantly different between brokers Oanda and Forex.com?

The differences in the minimum spread are significant. Oanda offers a spread from 0.1, and Forex.com – from 1 pip. However, the average spread for EURUSD is not very different for them. For Oanda it is 1.2 pips, for Forex.com – 1.3 pips.

Team that worked on the article

Glory is a professional writer for the Traders Union website with over 5 years of experience in creating content in the areas of NFT, Crypto, Metaverse, Blockchain, or Web3 in general. Over the last couple of years, Glory has also traded on different cryptocurrency and NFT platforms including Binance, Coinbase, Opensea, and others.

“I understand a lot about this space, being familiar with CEX, DeFi, and DEX, as well as operating across the Ethereum, Binance, and Polygon networks. Also, I know the intricacies and subtleties of NFTs and crypto, thus I am able to bring to table the best content and help connect with the audience better.”

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.