How To Use ChatGPT In Forex Trading: Creating Strategies

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

To use ChatGPT in trading, follow these steps:

Step 1. Log in to your OpenAI account

Step 2. Engage with ChatGPT to gain insights and request code snippets

Step 3. Request code specific to your trading bot requirements

Step 4. Customize the generated code to align with your trading approach

Step 5. Integrate the trading bot with your preferred trading platform

Step 6. Test the functionality and performance of the trading bot

Step 7. Monitor and refine the trading bot based on market conditions and outcomes

In the fast-paced world of trading, leveraging advanced technologies can give traders a significant advantage. One such innovation making waves is ChatGPT. This advanced language model, developed by OpenAI, offers traders valuable tools for enhancing their strategies. Its capabilities include generating insights, assisting with coding, and automating trading processes. In this article, the experts at TU will examine practical ways traders can integrate ChatGPT into their trading activities for improved outcomes.

How to use ChatGPT in trading?

Log in to your OpenAI account

Begin the process by logging in to your OpenAI account, which will grant you access to the ChatGPT model and its functionalities.

Engage with ChatGPT

Engaging with ChatGPT allows you to gain insights, request code snippets, and receive tailored responses to your trading inquiries. Interact with ChatGPT by providing prompts related to trading.

Example Prompt:

"Can you explain the concept of options trading and its strategies?"

Request code for your trading bot

Prompt ChatGPT to generate code specific to your trading bot requirements. For example:

Example Prompt:

"Can you provide Pine Script code for a mean reversion strategy based on Bollinger Bands?"

ChatGPT will generate code snippets that can serve as a foundation for implementing your highly analytical trading strategy.

Customize the generated code

Personalize the generated code to align with your specific trading approach and preferences. Make modifications to incorporate additional indicators, risk management techniques, or complex analytical models. This customization ensures that the trading bot reflects the intricacies of your trading style.

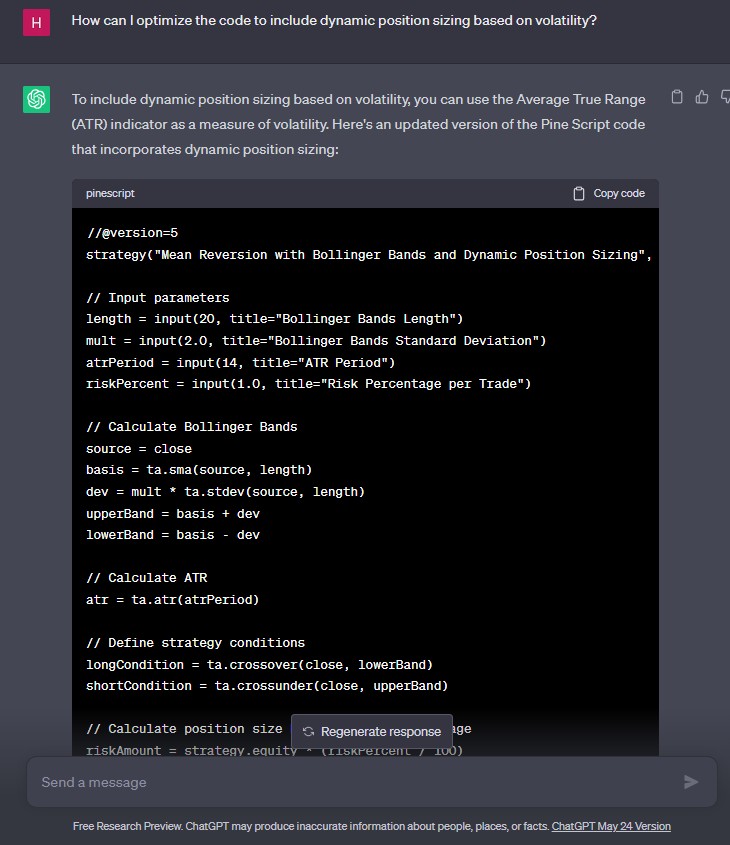

Example Prompt:

"How can I optimize the code to include dynamic position sizing based on volatility?"

By refining and adapting the code, you can enhance the functionality and sophistication of your trading bot.

Integrate the trading bot with a platform

Integrate the generated code with your preferred trading platform or API. This integration allows for seamless execution of trades and access to real-time market data. Consult the platform's documentation to understand the integration requirements and guidelines.

Test the trading bot

Prior to live trading, thoroughly test the functionality and performance of your trading bot. Utilize historical data or a simulated environment to validate the bot's behavior and analyze its outcomes. Rigorous testing ensures that the bot operates reliably and aligns with your highly analytical trading strategy.

Monitor and refine the trading bot

Once your trading bot is live, closely monitor its performance and continuously review its trading outcomes. Regularly assess its effectiveness, making adjustments based on market conditions, evolving requirements, and data-driven insights. This iterative process ensures that your trading bot remains finely tuned and optimized.

Best trading strategies that you can try with ChatGPT

Here are three trading strategies that you can explore with the assistance of ChatGPT:

Trend following strategy

Trend following strategy aims to identify and capitalize on market trends. ChatGPT can assist by analyzing historical price data and generating insights on potential trends. Traders can use these insights to make informed decisions on entering or exiting trades based on the direction of the trend.

Mean reversion strategy

Mean reversion strategies rely on the principle that prices tend to revert to their average over time. ChatGPT can aid in identifying potential instances of overbought or oversold conditions, allowing traders to take advantage of price reversals. By generating code and providing insights, ChatGPT can assist in implementing and fine-tuning mean reversion strategies.

Breakout strategy

Breakout strategies involve trading assets when they surpass a predefined price level or range. ChatGPT can analyze historical price patterns and provide insights on potential breakouts. Traders can use this information to enter trades at the onset of a breakout and potentially capitalize on significant price movements.

To successfully implement ChatGPT trading strategies, it is important to choose a reliable broker. We have studied the conditions on the best trading platforms and prepared a comparison table:

| Demo | Min. deposit, $ | Max. leverage | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Investor protection | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | 100 | 1:500 | 0,4 | 1,5 | £85,000 €20,000 | Open an account Your capital is at risk. |

|

| Yes | 5 | 1:1000 | 0,7 | 1,2 | £85,000 €20,000 | Open an account Your capital is at risk. |

|

| Yes | No | 1:500 | Not supported | Not supported | No | Open an account Your capital is at risk. |

|

| Yes | 10 | 1:2000 | 0,5 | 2 | €20,000 | Open an account Your capital is at risk. |

|

| Yes | 100 | 1:500 | 0,4 | 1,2 | No | Open an account Your capital is at risk. |

Important factors to consider while using ChatGPT for trading

When incorporating ChatGPT into trading practices, it is crucial to take into account several important factors to ensure effective and reliable results:

Understanding of trading strategies. Recognize that ChatGPT - generated trading strategies serve as initial outputs that require fine-tuning to align with specific requirements. It is imperative to possess a comprehensive understanding of trading strategies and apply domain expertise. Additionally, it's important to be aware that the AI model relies on predictions and may be susceptible to biases or errors inherent in the training data. Thus, it is advisable to validate and cross-reference these strategies with other trusted sources and methods.

Market dynamics. Keep in mind that ChatGPT operates as a language model and does not possess an intrinsic comprehension of intricate market dynamics. To effectively utilize the insights and predictions generated by ChatGPT, it is essential to have a solid understanding of the market's complexities, including factors that influence price movements, trends, and volatility. By combining the model's outputs with your market knowledge, you can make more informed trading decisions.

Regular monitoring and updates. Markets are dynamic, constantly evolving entities. The predictive capabilities and insights provided by ChatGPT may lose relevance over time as market conditions change. It is vital to continuously monitor the model's performance and periodically update it to ensure the predictions remain accurate and valuable. Regular evaluation of the model's output against real-world market data is crucial to maintain its effectiveness.

The precise wording of requests. Pay close attention to the wording of your requests to ChatGPT. The AI's responses heavily rely on the information provided, and imprecise or ambiguous queries may yield unexpected or undesirable results. Ensure clarity and specificity in your requests to obtain accurate and relevant insights from the model. Additionally, when implementing the AI-generated codes into a trading platform, be cautious of potential character or spacing discrepancies that may lead to non-functioning codes.

Code fine-tuning and debugging. Fine-tuning and debugging are necessary steps when utilizing codes generated by ChatGPT for trading purposes. For instance, if employing TradingView strategies, it is crucial to update the AI-generated codes to version 4 of the pine language for proper functionality. Thoroughly review and modify the codes to align them with the specific requirements and constraints of your trading platform.

How can ChatGPT help traders improve their trading performance?

Extracting insights from unstructured data.ChatGPT leverages its ability to process large volumes of unstructured data, including financial news articles and social media posts. By analyzing this data, it provides traders with valuable insights and information. Traders can benefit from sentiment analysis, enabling them to gauge positive or negative sentiment towards specific stocks or market trends, assisting in informed trading decisions.

Simplifying technical analysis. ChatGPT assists traders by helping them code technical indicators and strategies. This simplifies the process of technical analysis, enabling traders to identify price patterns and trends. By utilizing these insights, traders can make more accurate and well-informed trading decisions.

Predictions and forecasts. Through fine-tuning with historical market data and news, ChatGPT can generate predictions and forecasts. These predictions serve as a valuable resource for traders, aiding in the identification of potential market opportunities. However, it is important to validate these predictions with other reliable sources and methods to ensure accuracy and minimize risks.

Trading strategy automation. ChatGPT's language generation capabilities allow traders to automate their trading strategies. By generating trading scripts and algorithms, traders can streamline their trading operations and execute trades efficiently. This automation potential saves time and effort while potentially improving trading performance.

Improved decision-making. Verall, ChatGPT enhances trading performance by providing traders with a broader range of insights, information, and predictions. By leveraging these resources, traders can make better-informed decisions, identify market trends, and potentially maximize their profitability.

Pros and cons of using ChatGPT while trading

- Pros

- Cons

Market insights and analysis. ChatGPT can assist retail traders in accessing market news, forecasting price movements, and performing sentiment analysis. It provides valuable insights that can aid in making informed trading decisions.

Education and understanding. For novice traders, ChatGPT serves as a valuable resource for learning trading concepts, understanding economic indicators, and accessing educational materials. It can help bridge the knowledge gap and support traders in developing their expertise.

Trading script generation. ChatGPT is a useful tool for extracting trading scripts and algorithms compatible with various trading platforms. This simplifies the process of automating trading strategies and saves time for traders.

Trading signal generation. Recent reports suggest that ChatGPT can decode financial news, speeches, and other content to provide trading signals. This enables traders to stay updated with relevant information and potentially capitalize on market opportunities.

Automation potential. ChatGPT is an excellent choice for traders seeking to automate their trading strategies. By leveraging its capabilities, traders can streamline their operations and execute trades efficiently.

Potential code issues. The code generated by ChatGPT may contain bugs, inconsistencies, or misleading data. Relying solely on this code without proper review and validation can lead to significant financial losses.

Limited access. Due to its popularity, the availability of the free basic version of ChatGPT is limited. Access to the chatbot system depends on factors such as time of day and the number of users logged in, which may restrict its availability for some traders.

By providing historical data or hypothetical market conditions, you can ask ChatGPT to simulate how a strategy might perform

When using ChatGPT for trading, one powerful strategy is to leverage it as a customizable risk management assistant. By feeding it specific data about your portfolio, such as trade size, asset type, and volatility, you can ask ChatGPT to calculate risk levels and recommend adjustments. For example, you could input, "Given a $10,000 portfolio with 2% risk per trade, what is the maximum position size for an asset with 1.5% daily volatility?" ChatGPT can outline scenarios and help you identify overexposure in real time. This practical, calculated approach empowers you to trade with discipline and avoid emotional decision-making.

Another unique way to use ChatGPT is for backtesting strategies with real-world scenarios. By providing historical data or hypothetical market conditions, you can ask ChatGPT to simulate how a strategy might perform. For instance, input past trends for a particular stock or forex pair and request ChatGPT to assess how your chosen indicators would behave. While ChatGPT doesn’t replace full-fledged backtesting tools, it acts as a first-pass filter, allowing you to refine your approach before committing to more complex systems. This proactive analysis can save time and guide you toward profitable decision-making.

Conclusion

ChatGPT opens up new opportunities for traders. AI helps analyze the market and develop strategies, as well as make informed decisions. Thanks to its algorithm, it adapts to the user's tasks, be it analyzing technical indicators or searching for trends. However, it is important to remember that successful trading requires not only the use of AI tools, but also an understanding of market mechanisms, risk management and discipline. ChatGPT does not replace the experience of a trader, but serves as a powerful addition to improve efficiency. Invest time in learning the functionality and testing strategies to maximize the potential of this tool. This approach will help improve trading results and minimize errors.

FAQs

Can ChatGPT help with trading?

Yes, ChatGPT can assist with trading by providing insights, generating code, and aiding in decision-making.

What is the most successful trading strategy?

There is no universally "most successful" trading strategy as success depends on various factors, including market conditions and individual preferences.

What is the momentum strategy of ChatGPT?

The momentum strategy of ChatGPT involves identifying and capitalizing on trends or price movements in the market.

Can ChatGPT predict stock prices?

ChatGPT can provide predictions and forecasts based on historical market data and news, but it is important to validate these predictions with other sources and methods.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.