Best Crypto and Forex Brokers For TradingView

Best TradingView broker - OANDA

Top TradingView brokers:

-

OANDA - Best for trading with advanced technical analysis tools (TradingView charts support)

-

FOREX.com - Diverse range of tradable assets (80+ currency pairs)

-

Interactive Brokers - Best broker for international investors (assets from 33 countries, 150+ markets)

-

Eightcap - Best broker to trade directly from TradingView charts

-

Vantage Markets - Best for trading CFDs on major U.S. Stocks (zero fees apply)

-

IC Markets - Biggest Forex broker by trading volume (average volume over 22.68B per day)

TradingView isn’t a brokerage firm but rather a charting platform and social network that delivers detailed data to identify potential trading opportunities.

This guide will help you discover the best TradingView brokers and identify the ones that best fit your preference. You’ll also learn more about the benefits of using broker integration on this platform and how to start trading today.

-

What brokers work with TradingView?

The platform currently supports 50 brokers, and the plan is to add more.

-

Can I trade directly from TradingView?

Yes, it’s possible to trade via TradingView, but only if you integrate a broker with this service.

-

Is there a cost to connect my brokerage to TradingView?

No, this connection is free.

-

Can I add my broker to TradingView?

You can only choose from the list of brokers provided by TradingView.

Best trading broker with TradingView support

TradingView is an excellent choice as a platform to use for trading since it doesn't earn revenue from that. Instead, the platform has advertisements and premium subscriptions, and that’s how the service earns its profit. As for trading, everything is free, and the only charges imposed are by the chosen brokerage firm.

Here’s an overview of the best TradingView broker options:

OANDA

The name OANDA is an acronym for “Olsen & Associates” or “Olsen AND Associates”. It is registered in the United States and provides its clients with a wide range of financial services in most countries of the world. The company was founded in 1996 and is currently regulated in four jurisdictions. The main regulator of the broker is the UK Financial Conduct Authority (FCA). Oanda Canada is licensed by IIROC. The company has several significant awards to its credit, including a victory in the category "Best Forex Trading Technologies" from the UK Forex Awards, "Best Trading Platform" from FX Week, as well as "Best Customer Service" from the US Foreign Exchange Report.

| 💰 Account currency: | USD, EUR, HKD, SGD |

| 🚀 Minimum deposit: | No |

| ⚖️ leverage: | Up to 1:200 |

| 💱 Spread: | 0 points |

| 🔧 Instruments: | FX, Indices, Bullion, Commodities, Crypto |

| 💹 Level of margin call / stop out | Stop Out - 50% |

FOREX.com

Forex.com is a company owned by GAIN Capital Holdings, Inc. (NYSE: GCAP) and has earned a reputation as a reliable broker in the trading industry for its transparent work and high quality of services. The company cooperates with clients in 140 countries. The broker is registered in the Cayman Islands and supervised by CIMA (Certified Institute for Management Accountants). The license number is 25033. The parent company of the Forex.com broker is registered in England and Wales under the number 1761813 at the UK Companies House. It is licensed by one of the most reputable regulators in the world, FCA (No. 113942).

| 💰 Account currency: | USD, EUR, GBP |

| 🚀 Minimum deposit: | $1000 |

| ⚖️ leverage: | Up to 1:400 |

| 💱 Spread: | 0.2 points |

| 🔧 Instruments: | Forex, cryptocurrencies, indices, commodities, stocks |

| 💹 Level of margin call / stop out | N/a |

Interactive Brokers

Interactive Brokers is among the best-known US investment companies, operating since 1977. The broker offers to trade currency pairs, but its basic instruments are stocks, CFD, indices, metals, ETF, futures, and other exchange market assets. You can also trade cryptocurrencies on Interactive Brokers. The company is regulated by the US Securities and Exchange Commission (SEC), the US Financial Industry Regulatory Authority (FINRA), the UK Financial Regulatory Authority (FCA), and other international financial regulation commissions. In 2020, the broker was awarded the "Best Online Broker” (Barron's) and "Best Broker for Economical Investments" (NerdWallet) titles and got five stars in the Online Stock Trading for Traders category (Canstar). Also, the broker is popular in other countries. Here you can read reviews of Interactive Brokers in Canada, Singapore, Australia, Hong Kong, Ireland.

| 💰 Account currency: | USD, EUR, GBP, AUD, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NZD, NOK, PLN, SGD, SEK, CHF, CNH |

| 🚀 Minimum deposit: | No |

| ⚖️ leverage: | Depending on the asset |

| 💱 Spread: | 0 points |

| 🔧 Instruments: | Stocks, options, futures, currency, metals, bonds, ETF, mutual funds, CFD, EPF, Robo-portfolios, hedge funds |

| 💹 Level of margin call / stop out | Depending on the asset |

Eightcap

Eightcap offers more than 800 trading instruments, namely CFDs [contract for (price) differences] on currency pairs, cryptocurrencies, indices, stocks, commodities, and precious metals. The broker has a minimum deposit of $100, a free demo account, and two live account types, which differ in trading costs. One account type has standard spreads without a fee, and the other has raw spreads that carry a brokerage fee. The maximum leverage is 1:500. Traders can use any strategy with minimal restrictions. Trading is carried out through MetaTrader 4, MetaTrader 5, and TradingView. Eightcap has two main features. First, the broker has a powerful training and analytical base. Second, the platform offers a number of unique tools, for example, Capitalise.ai, which provides automated trading with minimal risk. At the same time, there are no options for passive income, not even a referral program.

| 💰 Account currency: | AUD, USD, GBP, EUR, NZD, CAD, and SGD |

| 🚀 Minimum deposit: | 100 USD |

| ⚖️ leverage: | Up to 1:500 |

| 💱 Spread: | 0 points |

| 🔧 Instruments: | CFDs on currency pairs, cryptocurrencies, indices, stocks, commodities, and precious metals |

| 💹 Level of margin call / stop out | 80%/50% |

Vantage Markets

Vantage Markets is a multi-asset broker that has been operating since 2009. The company operates under the licenses of four regulators – the UK (FCA, 590299), Australia (ASIC, 428901), Vanuatu (VFSC, 700271), and South Africa (FSCA, 51268). Over the years, Vantage Markets has received numerous accolades and prestigious awards. Read more about Vantage Markets Available Countries.

| 💰 Account currency: | AUD, USD, GBP, EUR, SGD, and CAD |

| 🚀 Minimum deposit: | $50 |

| ⚖️ leverage: | Up to 1:20 (for CFDs on stocks), up to 1:500 (for currency pairs) |

| 💱 Spread: | 0 points |

| 🔧 Instruments: | Currency pairs (57), CFDs on stocks (226), indices (26), and commodities (22), energy, ETFs, bonds, share SFDs |

| 💹 Level of margin call / stop out | 100/50% |

IC Markets

IC Markets is a multi-regulated STP/ECN broker that offers trading of 2,250+ instruments on MetaTrader, TradingView and cTrader platforms. Currently, IC Markets provides its services to over 200,000 clients worldwide. The broker processes over 500,000 trades daily and its monthly trading volume is almost $1.4 trillion as of June 2024. It is regulated by CySEC, ASIC, and FSA. The broker was incorporated in 2007 and is constantly developing, improving, and adding new services and products.

| 💰 Account currency: | EUR, USD, GBP, CAD, AUD, HKD, NZD, CHF, SGD, and JPY |

| 🚀 Minimum deposit: | $200 |

| ⚖️ leverage: | 1:500 (FSA); 1:30 (ASIC and CySEC) |

| 💱 Spread: | 0 points |

| 🔧 Instruments: | Cryptos and Forex CFDs on indices, commodities, stocks, bonds, and futures |

| 💹 Level of margin call / stop out | 50%/100% |

Best Crypto Brokers on TradingView

Bybit

The Bybit cryptocurrency exchange first appeared in 2018. It is a standalone derivatives trading platform with inverse and perpetual futures contracts with up to 1:200 leverage. Quarterly USD futures are available at Bybit in combination with BTC, ETH, XRP, EOS, LTC, and multiple tokens. There is a linear futures contract on BTC/USDT. The exchange has several technological advantages: it provides for mutual insurance of market participants against possible sharp price movements. There are offsets for long and short positions, and there is market depth.

Binance

The Binance exchange is one of the largest cryptocurrency exchanges in the world with its headquarters in Hong Kong. According to the CoinMarketCap cryptocurrency portal, Binance holds the top spot in terms of aggregate indicators of the platform's daily turnover, the number of novices and active users, liquidity, and web traffic (ranking, queries, statistics in search engines, etc.). The exchange is also a cryptocurrency startup that has its own “native asset” used in the Binance ecosystem as the “basis gas” (payment internal unit). More about Binance Card

WhiteBIT

The WhiteBIT exchange is a universal platform for trading and exchanging cryptocurrencies. In addition to basic (simplified) trading, there are spot and margin trading. Bitcoin, Litecoin, Ethereum, Ripple, DASH, and dozens of other altcoins are traded on the exchange. Fiats are represented by the USD and the EUR. For margin trading, 1:10 leverage is provided. In addition to active trading, there is the possibility of investing in a blockchain project with interest payments (from Crypto Lending). The exchange has a standard referral program, and trading commissions are fixed. There is a TradingView web terminal and a mobile trading application. The company offers its own GitHub solution for the cryptocurrency business.

Is TradingView a Broker?

Let’s start with discussing what TradingView is. The platform is a social network of investors and traders. It’s essentially a collection of various products focused on technical analysis and other indicators that could reveal more information about particular assets and markets. The community is vast and strong, so you can exchange opinions and ideas with other traders.

As for TradingView brokers, they are brokerage companies that partnered with TradingView to make their services available on this platform. These are add-ons that you install by connecting your TradingView and brokerage accounts on this social network. Once you set everything up, you can access markets like Forex, stocks, crypto, and others.

Can you trade on TradingView?

Yes, you can trade on TradingView. That’s the short answer, but the trick lies in using TradingView supported brokers. The platform works on partnering with new brokers, and you can currently choose from over 40 options.

Here is a quick explanation of how to trade on TradingView:

Access your TradingView account. Connect it to the desired broker – you can find more on how to do this in the guide below.

Pick your instrument. After you open a chart, you’ll find the active instrument in the upper-left part of the screen. Click on it to activate a dialogue box where you can pick the available categories. These include indexes, stocks, crypto, Forex, etc.

Place the trade. The blue button on the chart marks the buy rate, while the red one indicates the sell rate. Choose the desired option to reveal the parameter setting screen. You’ll find trade size, limit orders, stop loss, take profit and other options. Once you get everything done, you can click “BUY” or “SELL” to open the position. Maybe, you are also interested in information on how to set take profit (TP) and stop loss (SL) in TradingView.

How to connect my account to TradingView

TradingView broker integration is simple and only takes a couple of clicks after you sign up for accounts on both platforms. Here’s the detailed explanation of the process.

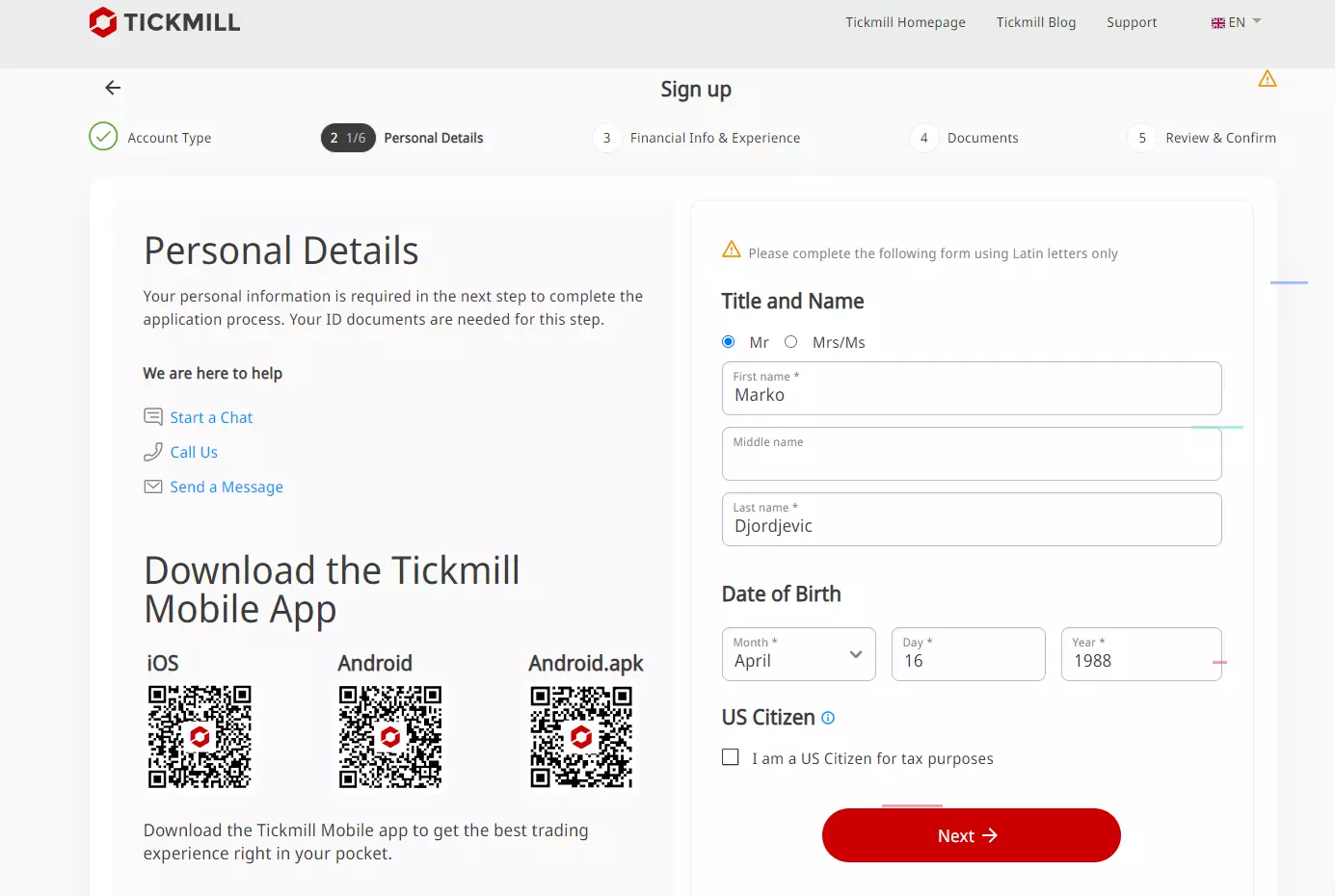

Register an account with the desired broker

The first step is to sign up for an account with your preferred broker. The choice depends on your preference, but make sure integration with TradingView is an option. The best course of action is to choose from the Traders Union’s list of recommended TradingView brokers.

Now, the registration process may vary on the platform. Here are the general steps to take:

Find Create an Account or Sign Up button to start the registration process.

Pick an individual or business account, depending on your needs.

Enter personal details as required.

Provide ID documents to confirm your identity.

Review everything and complete the registration.

Register an account with TradingView integration

It might take a while for the platform to verify the documents and make your account active.

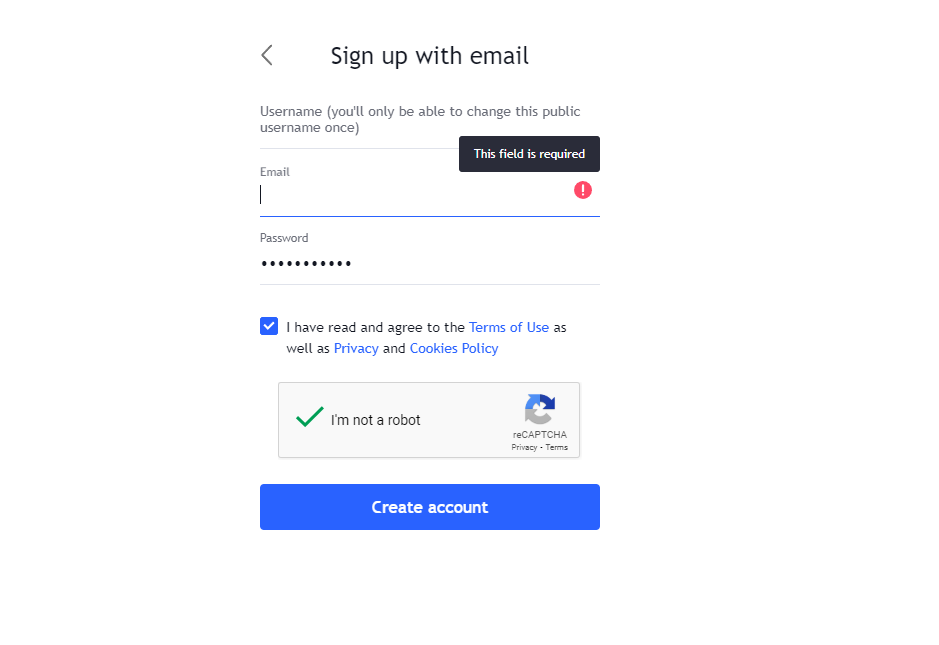

Sign up for a TradingView account

The next step is to register a TradingView account. The Traders Union experts recommend starting with the free option, at least until you test the platform. Once you are ready, feel free to switch to a paid plan.

You’ll find the Get Started button in the upper-right section of the TradingView homepage. It’ll take you to the page where you need to choose a plan, and then you can register.

Register a TradingView account

Apart from using your email, you can speed up the process and register with Google, Facebook, LinkedIn, and several other options.

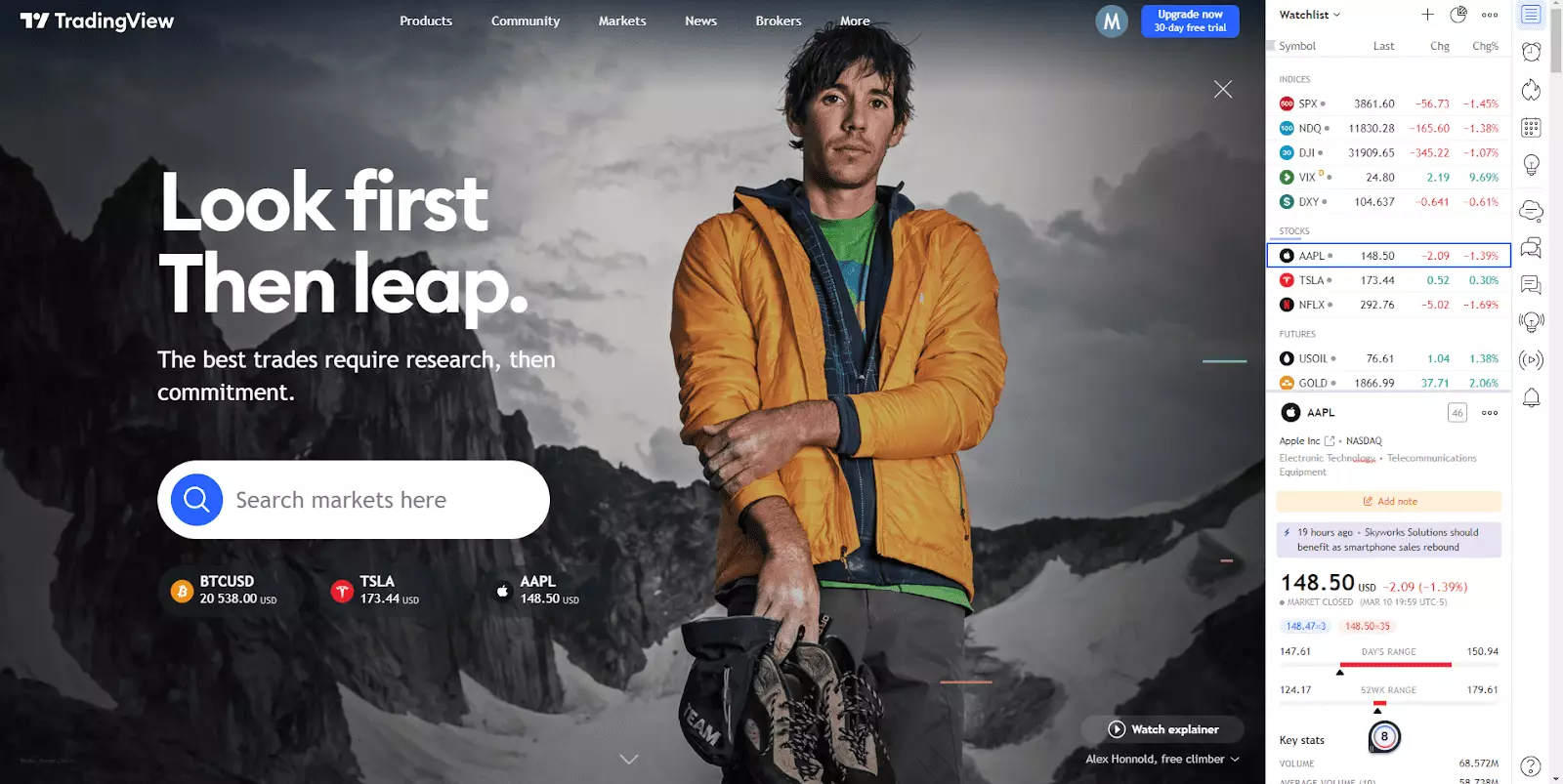

Access your TradingView account

It’s necessary to verify your email to make your account active. The platform will immediately log you in for the first time. Once you are at the homepage, see if you need to use your credentials to log in again.

Once you access your profile, you’ll have the right-hand menu available, and TradingView will show your profile photo in the upper-right section.

TradingView account

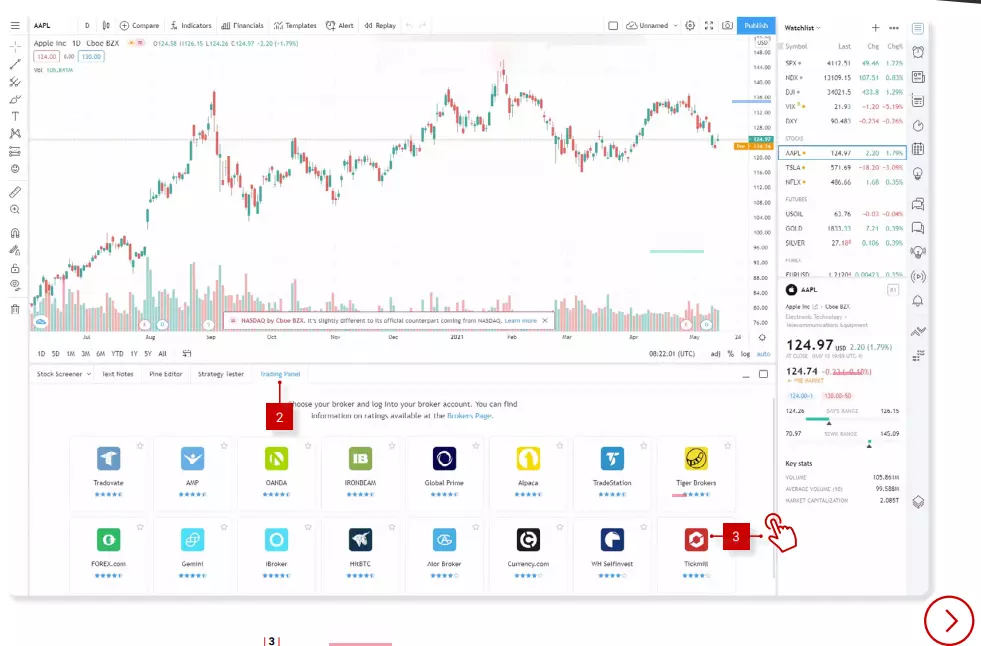

Integrate the broker to Your TradingView

From your TradingView account, open any chart. Once the chart is loaded, you’ll notice the Trading Panel menu.

TradingView account

The platform will show the available brokers for integration. Find the desired broker and click on its logo.

You’ll notice a pop-up where you’ll need to enter your broker account credentials. Double check if you entered the details correctly and click Connect. You should now be able to use the broker’s features within the TradingView account.

Step-by-Step Guide on How to Open a Forex AccountShould I use TradingView brokers?

TradingView is an incredibly useful platform, and brokers only take that experience to the next level. They implement the option of real asset trading on this network, which simplifies and improves the trading experience for the investors.

Here are the benefits of using the best TradingView brokers:

One of the best platforms for technical analysis. The platform is easy to use for beginners, and it provides advanced technical data for experienced investors. You can find over 100 technical indicators, with thousands more created by the community, and there’s the convenience of using dozens of drawing tools.

Adjust charts to your requirements. TradingView isn’t only comprehensive, but it also allows you to tailor data to your requirements. You can pick from a dozen of different chart types, such as Renko, Point & Figure, and Kagi. If you are a premium user, you can have multiple charts per tab.

Customized alerts. TradingView allows users to set parameters that trigger alerts about critical market changes. Volume, volatility, and ten other metrics can help to set alerts to your preferences. And TradingView brokers are there to ensure you act quickly if you need to open a position.

A vast selection of markets available. TradingView offers comprehensive data for a variety of markets, such as stocks, futures, bonds, crypto, Forex, and indices. But if you plan to use a specific market, make sure the chosen broker supports it. The trading availability will depend on the broker selected.

Get market insights from other users. TradingView has a community that gathers millions of traders. Users can share insights, patterns, and other useful information. It’s possible to follow users whose strategy you like to get the latest info about their activity.

Is TradingView free?

TradingView is free but with limited functionality. The Basic account is free, but it has considerable restrictions. For example, you can only see one chart per tab and save a single chart layout. You can’t choose custom time frames or range bars, and there’s no option to export chart data. The Basic plan is free forever, but if you want to maximize your TradingView experience, considering a paid option might be smart.

The Pro plan removes ads and ensures you can create custom side intervals and other useful features. Pro+ takes the next step with intraday exotic charts and other advanced details. The Premium plan delivers maximum data to ensure you don’t miss a single potential trading opportunity.

Here’s an overview of the plans available on TradingView:

| Price | Basic | Pro | Pro+ | Premium |

|---|---|---|---|---|

|

Monthly fee |

Free forever |

$12.95 |

$24.95 |

$49.95 |

|

Annual fee |

Free forever |

$155.40 |

$299.40 |

$599.40 |

We suggest checking out the TradingView pricing page for more information about each plan.

Does TradingView Support Backtesting?

Yes. One main feature that makes TradingView stand out is its backtesting support. Backtesting enables traders to test their strategies through historical price data, which evaluates their performance in past market conditions. Some key points about backtesting on TradingView include:

Strategy Tester: TradingView provides a powerful strategy tester. It enables traders to backtest their strategies against historical price data.

Custom Strategies: Using TradingView’s proprietary scripting language named Pine Script, traders can develop and backtest custom strategies.

Historical Price Data: The platform provides a vast repository of historical data for different financial markets. The data enables traders to conduct accurate backtests.

Performance Metrics: TradingView also generates performance metrics to help traders examine the effectiveness of their strategies.

User-Friendly Interface: The platform’s visualisations and user-friendly interface enable traders to easily interpret and analyse the results of their backtests.

Community Sharing: To foster user knowledge and collaboration, traders can share their backtested strategies with the TradeView community.

Expert Opinion

TradingView is a highly regarded platform for technical analysis, charting, and trading, celebrated for its robust features and user-friendly interface. It's particularly favored by those who appreciate detailed charting capabilities and a vibrant community of traders. The platform supports a variety of assets, including forex, stocks, and cryptocurrencies, and offers integration with numerous brokers, enhancing its versatility.

For beginners, TradingView can be an invaluable tool, providing access to real-time data, a plethora of indicators, and the ability to execute trades directly through the platform. It's essential, however, to choose a broker that complements your trading style and offers seamless integration with TradingView. Look for brokers that are well-regulated, transparent in their fee structure, and provide robust customer support.

When starting, it's wise to utilize TradingView's paper trading feature, which allows you to practice trading strategies without financial risk. Engage with the community to learn from experienced traders, but always conduct your own research and remain skeptical of following trade signals blindly. Remember, trading involves risk, and it's crucial to use risk management strategies to protect your capital. Embrace continuous learning and start with small investments to build your confidence and experience.

Team that worked on the article

Aneeca Younas is a math wizard with extensive knowledge in research, data mining, forum commenting, and all types of writing and editing. As a contributor to the Traders Union website, Aneeca’s goal is to help newcomers and experienced users have the best possible information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.