Warrior Trading Pro Course: A Comprehensive Review

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Warrior Trading Pro course is a premium educational program for day traders, featuring comprehensive lessons on technical analysis, trading strategies, and market psychology, all led by successful trader Ross Cameron. It offers two main membership options: Warrior Starter ($797) and Warrior Pro ($2.997), providing access to various modules, tools, and mentoring sessions designed to enhance trading performance and profitability.

In this article, we explore the Warrior Trading Pro course, a leading educational platform designed to elevate day trading skills and strategies. Founded by experienced day trader Ross Cameron, Warrior Trading has become one of the largest and most recognized communities for retail investors.

What is a Warrior Trading Pro Course?

The Warrior Trading Pro course is a top-tier educational program tailored for day traders, offering in-depth lessons on technical analysis, trading strategies, and market psychology, all taught by successful trader Ross Cameron. The course comes with two primary membership options: Warrior Starter and Warrior Pro. Each option grants access to a range of modules, tools, and mentoring sessions aimed at boosting trading skills and profitability.

Warrior Trading offers two main membership options: Warrior Starter and Warrior Pro. These memberships provide access to various courses and trading tools, catering to traders of different experience levels.

Warrior Starter membership

Cost: $797 (currently discounted from $997 with the offer code SUMMER24START).

Features:

Access to the Day Trading: The Basics course.

Live trading chat room.

Partial access to stock scanners and news services.

Optional paper trading simulator add-on.

Warrior Pro membership

Cost: $2,997 (currently discounted from $3,997 with the offer code SUMMER24PRO).

Features:

Comprehensive access to all courses, including Day Trading: Strategies and Scaling.

Mentoring from experienced traders.

Customizable stock scanner.

Full access to the trading simulator and chat room.

Overview of popular Warrior Trading courses

Day Trading: The Basics

This essential course provides a solid foundation for day traders, covering crucial topics such as the history of the stock market, reading trading platforms, making trades, using trading tools, and developing the right mindset. The course is ideal for traders of all levels, offering valuable insights into strategy development and scaling.

Highlights:

Designed for traders of all levels.

Covers the history of the stock market.

Guides on reading a trading platform.

Teaches the basics of making trades.

Introduces essential trading tools.

Emphasizes the importance of mindset.

Helps determine the best trading strategy for individuals.

Course content:

The journey kicks off with the "Becoming a Day Trader" module, a foundational 1-hour and 4-minute lecture. This session introduces the core principles of day trading, explains the mindset traders need, and covers the essential skills for navigating the financial markets.

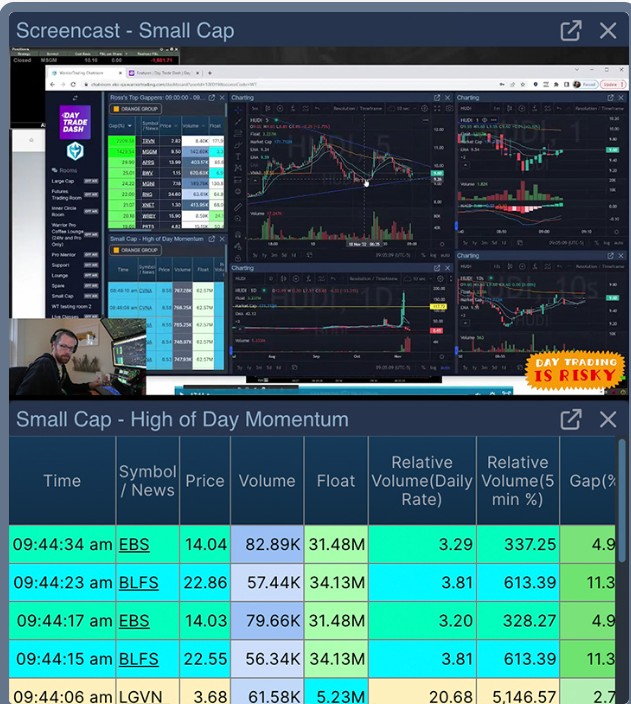

Once the basics are covered, the course dives into "Picking Stocks for Day Trading," a series of three lectures that last 1 hour and 32 minutes. Here, you'll learn how to spot potential stocks, get a handle on market trends, and use the right tools to pick the best opportunities. This part helps participants analyze stock movements and make smarter trading decisions.

Next, the course covers different account types in two quick lectures, totaling 29 minutes. This section gives traders the rundown on the various account options, their advantages, and why picking the right account type matters for different trading strategies.

The course then moves into "Fundamental Analysis," a 43-minute lecture that walks you through how to assess a company's financial health, read economic indicators, and understand how these factors affect stock prices. This is a crucial building block for making smart trading choices.

In the "Technical Analysis" section, traders work through eight lectures (3 hours and 57 minutes total). This deep dive covers chart patterns, technical indicators, and trend analysis, giving traders the tools to read market data and forecast price movements.

Next up is a "Trading Platform Walk-Through," a practical 25-minute session that helps participants get comfortable with the trading platforms they'll be using. This ensures traders know how to navigate the tools needed to execute trades.

The "Order Entry Window" lecture, lasting 42 minutes, gives a detailed look at placing trades, different order types, and how to optimize your entries and exits. This helps traders place their trades with confidence.

The course also covers market dynamics with a "Level 1 Market Depth & Order Entry" lecture (23 minutes). Here, traders learn about market depth, order books, and how this information impacts their trading decisions.

Building on that, the "Level 2 Market Depth & Hot Keys" module has two lectures, totaling 58 minutes, that go deeper into order execution, setting up hotkeys, and understanding real-time market data. This advanced section equips traders to move quickly and efficiently.

The "Time & Sales (The Tape)" lecture, a 1-hour and 5-minute session, teaches traders how to read time and sales data to get a feel for market sentiment and trading patterns. This skill helps traders predict market moves and fine-tune their strategies.

The "Stock Halts" module (49 minutes) breaks down how stock halts work, their effect on trading strategies, and how to handle these events when they occur.

In "Scanning 101," a 20-minute lecture, traders learn how to use scanning tools to find potential trades based on specific criteria. This session highlights the importance of selecting stocks wisely and making decisions at the right time.

The course also includes "Preparing to Sim Trade," with two lectures totaling 1 hour and 16 minutes. Participants are walked through the steps of simulating trades, trying out strategies, and honing their skills in a no-risk environment.

A significant portion of the course is dedicated to "The Psychology of Trading," a five-lecture module spanning 4 hours and 12 minutes. It tackles the mental challenges traders face, stress management, and building the mental toughness needed to succeed in trading.

Lastly, the course wraps up with "Day Trading as a Business," focusing on scaling strategies, risk management, and planning for long-term success. It emphasizes treating trading like a professional career with its own growth path.

Day Trading: Strategies and Scaling

This flagship course offers in-depth coverage of small-cap day trading strategies, technical analysis, chart pattern recognition, stock selection, and more. It is renowned for its comprehensive format and detailed examples, providing traders with the knowledge and skills needed to succeed in various market conditions.

Highlights:

Strategies for all market conditions.

In-depth technical analysis and chart patterns.

Stock selection and watchlist creation.

Advanced order entry techniques.

Momentum, gap and go, reversals, dip buying, and more.

Business approach to trading, including taxes.

Development of trading plans.

Emphasis on trading psychology.

Course content:

The course starts with an "Intro to Day Trading," which includes two lectures totaling 1 hour and 20 minutes. This section introduces you to the fundamentals of day trading, focusing on what you need to navigate the fast-paced world of trading. You'll learn how to set up your trading space, get a handle on market dynamics, and mentally prepare for the trading day.

Next is a crucial 1-hour and 47-minute session on "Risk Management." This part is all about learning how to protect your money while still aiming for returns. You'll get advice on creating a risk management plan, understanding leverage, and setting stop-loss orders to minimize losses.

Then, there are two lectures on "Stock Selection & Building a Watch List," which last 1 hour and 51 minutes. In this section, you’ll figure out how to spot the right stocks and build a watchlist that suits your strategy. It emphasizes the need for thorough research, technical analysis, and using screeners to pick stocks that meet specific criteria.

The program also covers "Daily Chart Patterns" in a 1-hour and 15-minute session. You'll learn to recognize common chart patterns, understand what they mean, and apply them in your trades.

Moving deeper into chart analysis, there's a more extensive section on "Intraday Chart Patterns" with 10 lectures adding up to 2 hours and 36 minutes. This part focuses on patterns used in intraday trading, teaching you how to spot opportunities based on real-time data.

The "Level 2, Tape Reading, and Hot Keys/Buttons" module consists of six lectures, totaling 3 hours and 24 minutes. This is where you’ll learn to read the Level 2 order book, use tape reading for insights into market sentiment, and set up hot keys/buttons to execute trades quickly.

The "Gap and Go Trading" strategy is covered in eight lectures, lasting 6 hours and 5 minutes. You’ll learn how to take advantage of price gaps in stocks, with tips on entry/exit points, risk management, and adjusting to different market conditions.

For those who are into momentum trading, there’s a big section with 19 lectures covering 19 hours and 30 minutes. This deep dive into momentum trading will teach you how to jump on fast-moving stocks, time your trades, and analyze volume while managing risks and aiming for high profits.

The "Reversal Trading" section, with six lectures over 2 hours and 45 minutes, gives strategies for identifying when the market might reverse direction. You'll learn about candlestick patterns, support/resistance levels, and how to set up trades during market reversals.

For short-sellers, the "Short-Selling Momentum Strategies" module features seven lectures, totaling 3 hours. This part shows you how to profit when stocks are on the decline by using momentum strategies, finding bearish trends, and executing trades with precision.

Advanced traders will appreciate the "High-Speed Breakout Trading (Expert Level)" module, which includes three lectures lasting 4 hours and 24 minutes. This section focuses on fast-paced breakout strategies, ideal for those who want to capitalize on rapid market moves.

There’s also a 55-minute session on "Stock Scanning," which teaches how to use scanning tools to find trading opportunities that match your criteria. This is all about efficient stock selection and quick decision-making.

The course also tackles the psychological side of trading in "Position Management, Trader Psychology, Building Discipline, & Recovering from Loss". This 1-hour and 53-minute lecture helps you manage your trades, develop discipline, and bounce back from losses.

In the "Creating a Trading Plan" module, with two lectures totaling 3 hours and 18 minutes, you’ll learn how to craft a solid trading plan. You’ll cover goal-setting, strategies, and rules to stay consistent.

A quick but important 22-minute lecture called "When to Trade with Real Money" helps you know when you're ready to switch from paper trading to live trading, offering tips on risk management and indicators of readiness.

One of the highlights is the "Small Account Challenge," a 23-hour and 36-minute session that gives strategies for growing a small account. You'll learn how to manage risks and make the most out of each trade to build your account over time.

If you run into common issues, the "Troubleshooting - Potential Solutions to Common Challenges" module offers 14 lectures totaling 2 hours and 39 minutes. It’s packed with practical advice for overcoming challenges and improving your performance.

The "Taxes & Accounting for Day Traders" lecture is a quick 21-minute session that breaks down how to handle taxes and accounting for your trading activities.

In the "Overview of Trading Tools," which is 1 hour and 59 minutes long, you’ll explore different tools and technologies to help you trade more effectively.

The course wraps up with "The Capstone Class," a 50-minute lecture that ties everything together, offering a final review of the key strategies and lessons learned.

Finally, the "Interviews with Profitable Traders" module, with 22 lectures spanning 19 hours and 26 minutes, gives you access to real-world tips and advice from successful traders. You’ll hear their stories, strategies, and what’s worked for them in live markets. The course is available through Warrior Pro Membership.

Other Warrior Trading courses

While the primary focus is on the Warrior Starter and Warrior Pro memberships, Warrior Trading offers additional courses catering to specific trading needs and skill levels.

Advanced day trading strategies. Focuses on advanced strategies for experienced traders. Is a part of the Warrior Pro Membership.

Day trading essentials. Covers the basics for beginners.Available with Warrior Starter Membership.

Swing trading strategies. Dedicated to swing trading techniques. Requires Pro Membership for access.

Who is Ross Cameron?

Ross Cameron is the founder of Warrior Trading and a prominent figure in the day trading community. With over a decade of experience, Cameron has verified over $10 million in trading profits, making him a credible source for trading education. His results are documented through broker statements, showcasing his success in small-cap day trading.

The Warrior Trading Pro course is different than most programs out there

If you're thinking about the Warrior Trading Pro course, the "Small Account Challenge" part is something you really shouldn’t skip. It’s easy to miss, but this 23-hour section is a game changer for those feeling unsure about starting with limited funds. Unlike many programs that gear their strategies towards bigger budgets, this challenge focuses on smart, calculated growth for smaller accounts. The idea here isn’t about chasing quick wins — it’s about steady, reliable progress, which is what really matters if you want to stay in the game long term. It's a practical approach that makes sense, especially when you're just getting started and need to protect your cash while still aiming for growth.

Another unique advantage of this course is the "Intraday Chart Patterns" module. Most courses teach strategies that work well in theory but fall short when the market changes. This one is different. It emphasizes how to quickly read and adapt to what's happening in real time. Intraday trading is fast-paced, and you can’t afford to hesitate. This course teaches you to recognize patterns and make quick, well-thought decisions, which gives you a real edge when markets are volatile and unpredictable.

Summary

The Warrior Trading Pro course offers traders a solid foundation in day trading, with useful insights and strategies for navigating the financial markets. Ross Cameron’s platform caters to traders at different skill levels, making it a trusted and helpful resource for anyone aiming to sharpen their trading abilities. While it may be priced higher than some other options, the value from Warrior Trading’s in-depth courses and expert support is clear. For traders serious about growing their knowledge and improving their performance, Warrior Trading is definitely worth considering.

FAQs

Is the Warrior Trading Pro course suitable for beginners?

Yes, the Warrior Trading Pro course offers a structured approach to day trading, making it accessible for beginners. It covers foundational topics and advanced strategies to cater to all experience levels.

What makes Ross Cameron's courses unique?

Ross Cameron's courses are known for their comprehensive content and real-world trading insights. His verified trading success and detailed lessons provide traders with valuable knowledge and practical strategies.

How does Warrior Trading compare to other trading platforms?

Warrior Trading is recognized for its extensive educational resources and interactive community. Compared to other platforms, it offers a more detailed and hands-on approach to trading education, backed by a large community of active traders.

Can international traders benefit from Warrior Trading?

Yes, Warrior Trading is accessible to international traders, with a focus on U.S.-based stocks and markets. Traders worldwide can benefit from its strategies and educational content, though regional considerations may apply.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Breakout trading is a trading strategy that focuses on identifying and profiting from significant price movements that occur when an asset's price breaches a well-defined level of support or resistance.