Trading On An Uptrend: Features And Expert Advice

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

An uptrend, often referred to as a bull market or bull run , is a financial market condition characterized by steadily rising prices of stocks, bonds, commodities, or other investment instruments. Some of the easiest aspects to understand when an uptrend begins are:

- A constant increase in the price of a stock or other asset over an extended period.

- Improvement in key economic indicators such as GDP, employment and consumer spending.

- Prevalence of positive sentiment and confidence among market participants, which is reflected in high trading volumes and increased investment activity.

Trading in a bull market offers traders unique opportunities for profit . The market is showing steady growth, attracting the attention of both beginners and experienced investors. To successfully navigate this favorable environment, it is necessary not only to understand the basic principles of trading, but also to master certain strategies and risk management methods. Let's look at the key aspects of trading in a bull market, sharing useful tips and strategies to help you make the most of uptrend market opportunities.

What is an uptrend

An uptrend or bull run, is a market condition characterized by steadily rising prices of investment instruments . At the same time, the traded asset forms higher price peaks, and local corrections are relatively minor.

At this time, investors actively buy most of the traded shares or other assets, which further pushes prices up. This phenomenon is called bull run. Thus, an uptrend in the markets is accompanied by a positive market sentiment and rising asset values over an extended period of time.

An uptrend can last from a few weeks to several months or even years, depending on the cyclicality of the traded asset and other factors such as economic conditions, news and market sentiment.

Rising prices. A steady increase in asset values as seen on the charts.

Investor Confidence. Positive sentiment among market participants who are confident of further growth.

High trading volume. Active buying and selling of assets, which confirms the strength of the trend.

Economic growth. Often accompanied by improving economic indicators such as GDP, employment and corporate profits.

Decreased volatility. Prices are rising more smoothly, with less volatility.

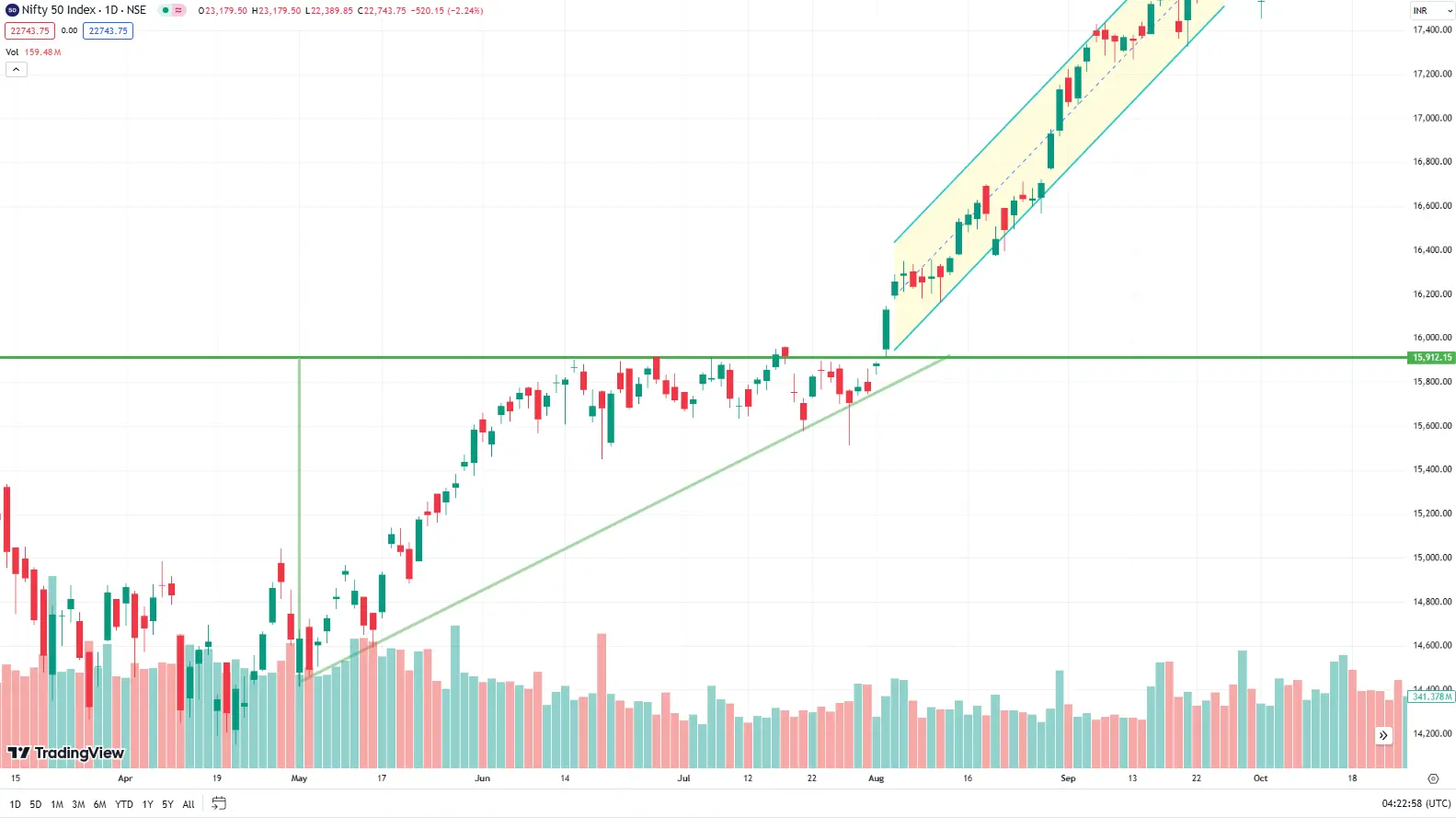

What a bull market looks like on a chart

What a bull market looks like on a chartHow to spot a bull market

In the financial markets, knowing how to identify an uptrend (or bullish trend) and take advantage of it is an important skill for any trader. Trading in an uptrend provides the opportunity to make significant profits if you correctly recognize the signals indicating the beginning of a trend and apply the appropriate strategies. Let's look at some of them:

Indicators for an uptrend

Moving Averages:

Simple Moving Average (SMA): When a short-term SMA (such as the 50-day) crosses above a long-term SMA (such as the 200-day), it signals the start of an uptrend (called the "golden cross").

Exponential Moving Average (EMA): EMA reacts faster to price changes and is often used to more accurately identify trends.

50 day MA crossing 200 day MA

50 day MA crossing 200 day MARelative Strength Index (RSI). An RSI above 50 indicates an uptrend. Readings above 70 may signal overbought, which could foreshadow a correction, but in the overall context it also indicates a strong bull market.

RSI strategy plotted on charts

RSI strategy plotted on chartsMoving Average Convergence/Divergence (MACD) indicator. When the MACD line crosses the signal line upward, it is a bullish signal. Also, if the MACD histogram becomes positive, it indicates an uptrend.

MACD line crossing the signal line

MACD line crossing the signal lineTrading figures for an uptrend

Ascending Triangle. Formed when price lows rise but highs remain at the same level. A break above the horizontal resistance level confirms the uptrend.

Ascending triangle plotted on charts

Ascending triangle plotted on chartsFlag. After a strong upward movement (flagpole), the price consolidates in a narrow range, forming a flag. An upward breakout from the flag confirms the continuation of the uptrend.

Flag pattern plotted on charts

Flag pattern plotted on chartsWedge. A rising wedge forms when price highs and lows rise, but at a steeper angle. An upward breakout from the wedge confirms the bullish trend.

An uptrend is also accompanied by a number of additional phenomena, by which one can determine the beginning of the revival of investors and enter the market in time.

Trading volume (Volume). An increase in volume when the price rises confirms the strength of the uptrend. If volume decreases on a rally, it may indicate trend weakness.

Trend Lines. Drawing a trend line through rising lows helps identify an uptrend. As long as the price is above this line, the trend is considered upward.

Support and Resistance levels. Breaking through a significant resistance level and its subsequent testing as support is a strong confirmation of the beginning or continuation of an uptrend.

How to trade in a bull market

Trading in a bull market (uptrend) provides traders with excellent opportunities for profit. To trade profitably in an uptrend, you need to understand the main features and apply uptrend trading strategies.

The main rule here is to trade with the trend, not against it. This means buying assets during corrections and holding them until new highs are reached. Moving averages, such as SMA and EMA, help determine the direction of the trend. In an uptrend, the price usually stays above its moving averages, especially the 50-day and 200-day SMA. Indicators like MACD and RSI can confirm the strength of the trend. If MACD is above zero and RSI is above 50, it usually indicates a strong uptrend.

Buying on corrections is one of the best strategies for trading in an uptrend. Instead of buying at the peaks, wait for small price pullbacks (called corrections) to buy assets at a more favorable price and reduce risks. Always set stop-losses below support levels or moving averages to limit losses in case of a sharp trend reversal. Risk management is also crucial — don’t risk more than 1-2% of your capital on a single trade and diversify your portfolio to avoid significant losses.

Trailing stops will help lock in profits as the price rises, allowing you to protect your gains and continue following the trend. Analyzing news and events is also important — positive news can strengthen the uptrend, while negative news can cause a correction. Stay disciplined and stick to your trading strategy, don’t succumb to emotions, and avoid impulsive decisions.

For trading in an uptrend, you can use the “Buy and Hold” strategy, which involves buying assets and holding them for a long time as long as the trend remains upward. You can also use continuation patterns, such as ascending triangles and flags, to enter the market on confirmed signals. Adding to existing positions upon trend confirmation allows you to increase profits as the price rises.

Follow the trend by buying assets during corrections.

Use moving averages and indicators to confirm the trend.

Set stop-losses and manage risks.

Apply trailing stops to lock in profits.

Analyze news and events affecting the market.

Stay disciplined and follow your strategy.

To trade profitably in an uptrend market, it is good to find a reliable broker. We have prepared a comparison table of Forex brokers offering a wide range of assets. They have good trading conditions, in particular the choice of currency pairs and trading commissions.

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Max. leverage |

1:300 | 1:500 | 1:200 | 1:50 | 1:30 |

|

Spread by account type Standard |

Yes | Yes | Yes | Yes | Yes |

|

Spread by account type ECN |

No | 0,1 | 0,15 | 0,2 | 0,2 |

|

Spread by account type Raw |

No | No | No | 0,1 | No |

|

Scalping |

Yes | Yes | Yes | Yes | Yes |

|

Trading bots (EAs) |

Yes | Yes | Yes | Yes | Yes |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Handling emotions while trading in a bull market

Trading in a bull market requires a conscious approach and discipline. One of the key pieces of advice is to follow the trend and use proven strategies. Firstly, don't be afraid to enter trades when the market is rising. Waiting for a pullback might lead to missed opportunities, so it's important to act quickly and decisively. I also recommend using technical analysis to confirm your decisions. Indicators such as moving averages can help identify entry and exit points.

The second important aspect is risk management. Even in a bull market, corrections can occur, so always use stop-losses to protect your capital. The position size should also be reasonable: don't invest all your funds in one trade. Spread your capital across several instruments to reduce risks. Portfolio diversification remains relevant even in a growing market.

Finally, don't forget about the emotional component. Rapid market growth can lead to overconfidence and a desire to increase risks. However, it's important to stay calm and stick to your strategy. Regularly review your goals and results to adjust your plan if necessary. Always be prepared for possible changes and don't let emotions drive your decisions.

Conclusion

Trading in a bull market offers you huge opportunities for growth and profit. By following the trend, prudently managing risks and controlling emotions, you can make the most of favourable market conditions. The main thing is to stick to a well thought out strategy and a disciplined approach.

The bull market is the time for active actions and realisation of the most fantastic trading ideas. Don't be afraid to use technical analysis tools such as moving averages and support and resistance levels to find the best entry and exit points. Diversifying your portfolio will help reduce risk and protect your capital from possible corrections. Always have your finger on the pulse of the market and be prepared to adjust your strategy as conditions change.

A bull market has great potential and promises many opportunities that can lead to prosperity. Therefore, trading in the bull market can be an exciting experience that will bring you not only financial success but also many sublime emotions. You should not neglect such opportunities.

FAQs

How can you identify the beginning of a bull market?

The beginning of a bull market is often identified by a sustained rise in the prices of stocks or other assets over a period of time. Key indicators include increasing prices of major indices, improving economic indicators, rising trading volumes, and optimistic market sentiment. Technical analysis, such as using moving averages and resistance levels, can also help confirm the start of a bull trend.

What strategies are best to use in a bull market?

In a bull market, it's effective to use strategies focused on buying and holding assets. This can include purchasing stocks of large companies with stable growth, using trend indicators to enter trades, and employing stop-losses to protect capital. Diversification strategies to reduce risks and participating in IPOs of promising companies can also be considered.

How can you manage risks when trading in a bull market?

Risk management in a bull market involves using stop-losses to limit losses in case of corrections and sensible capital allocation. Avoid investing all your funds in a single asset or trade. Diversifying your portfolio helps reduce overall risk. It’s also important to regularly review and adjust your strategy based on changing market conditions.

How can you handle the emotional aspects of trading in a bull market?

Rapid market growth can lead to overconfidence and a desire to increase risks, which can result in mistakes. It’s important to stay calm and follow your strategy, regardless of market noise. Regularly analyzing results and reviewing goals can help keep you on track. Meditation, physical exercise, and support from experienced colleagues can also aid in managing emotions.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

An ECN, or Electronic Communication Network, is a technology that connects traders directly to market participants, facilitating transparent and direct access to financial markets.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.