How To Trade With RoboForex

Top RoboForex strategies:

-

1

Trend following strategy.

-

2

Moving average strategy.

-

3

Chart-pattern-trading.

-

4

50 pips a day Forex.

Historical Price Chart of Clearway Energy

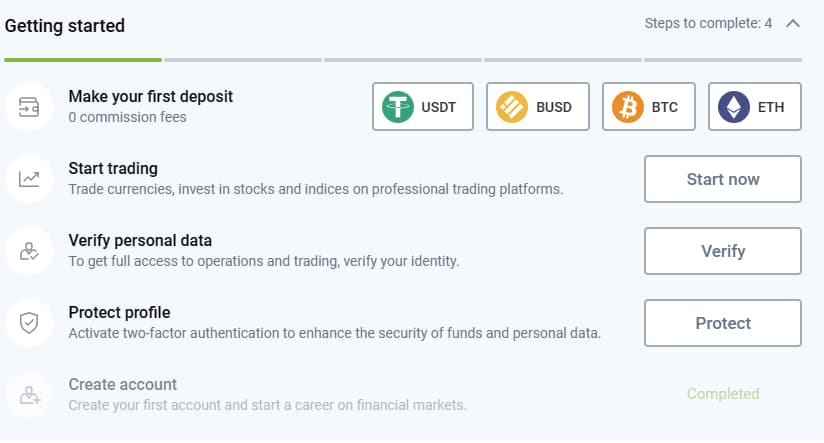

After completing the registration process and opening a trading account in the RoboForex membership area, you can start trading in the Forex and stock markets. If you are in a region where the no-deposit bonus is permitted, you must deposit at least $10 to begin trading on your live account.

If you are new to trading and have no knowledge about any of the top RoboForex trading strategies, it is advisable to refrain from opening trading positions. You need an in-depth understanding of Forex and the best RoboForex strategies to succeed as a trader. So, what are the best RoboForex strategies, and is it compulsory to trade with these strategies? Continue reading to find out.

Why do you need to use RoboForex strategies?

Integrating a top RoboForex strategy is necessary for success in the fiercely competitive Forex market. The trading industry is always changing, so you need the best RoboForex strategy to compete at any level in the marketplace. The best RoboForex trading strategies are vital to lowering the rate at which traders, especially new traders, miss out on trades. The RoboForex trading strategy helps increase the chance of profiting from buying or selling a currency pair.

A well-organized RoboForex strategy increases the chances of long-term trading success as it defines entry and exit points and guarantees trading consistency. A trading strategy also strengthens discipline because, without one, choices could be made more intuitively than logically, increasing the likelihood of unpredictable results and financial loss.

Top RoboForex strategies

Traders design RoboForex strategies by selecting a technical or fundamental analysis method and additional tools like trading signals and automated strategies. The best RoboForex strategies are made to accommodate a trader's time constraints, level of risk tolerance, and other factors. Below are the best RoboForex strategies for new and seasoned traders.

1. Trend following strategy

Trend-following strategy

Identifying the direction of market prices and taking positions in line with them constitutes the trend-following strategy, which is one of the best RoboForex strategies. The underlying premise of the following strategies is that the price will move in the same direction going forward and that the trend will hold.

This approach is well-known for providing traders with distinct entry and exit points because they can use technical indicators to determine the trend's direction and place stop-loss orders to reduce risk. Moreover, trend following can be applied in a range of markets, giving traders versatility and profitable opportunities.

On the downside, the strategy may lead to late entries and exits since traders must wait for trend confirmation before taking a position. Profit opportunities may be lost as a result of this.

2. Moving average strategy

Moving average strategy

Another popular RoboForex strategy Forex traders use to track the movement of a security's price and ignore daily price swings is the moving average strategy. This strategy is easy to comprehend as it generates trading signals by identifying market trends using the moving average indicator. And this is possible using various moving averages, such as exponential moving averages (EMA) or simple moving averages (SMA).

Traders employ this strategy by searching for crossovers between the moving averages of two distinct time intervals. Hence, a buy signal occurs when the shorter duration moving average crosses above the longer duration moving average. Additionally, there is a sell signal when the shorter duration moving average crosses below the longer duration moving average.

On the negative side, moving averages are based on past price movements and cannot predict future price movements.

3. Chart-pattern-trading

Chart pattern trading

The next RoboForex strategy that can increase a trader's chances of successful trades is chart pattern trading. This approach helps traders recognize current market conditions, trends, and important support and resistance levels, thereby offering a dependable means of monitoring price fluctuations in the market.

The trading patterns that this strategy identifies, such as head and shoulders, double tops, and triangles, can be used by traders to confirm trades using technical indicators like oscillators and moving averages. The drawback is that traders must be proficient in technical analysis and recognize various chart patterns to use this RoboForex strategy.

4. 50 pips a day Forex

50 pips a day Forex

A different RoboForex strategy called "50 pips a day" enables traders to make 50 pips every day by using a combination of technical indicators to find trades with a high probability. The goal of the 50-pip strategy is to profit from roughly half of a currency pair's daily range.

Any currency pair can benefit from this strategy, as entry and exit points can be predicted using a 15-minute chart. Incorporating the 50 pip-per-day strategy into trades requires traders to seek out currency pairs with a narrow spread and a clear trend. Remember that this is just a one-day trading strategy and that there are other ways to trade Forex. With a daily profit cap of 50 pips, swing traders may not find it obliging.

Which is the best RoboForex strategy for beginners?

The moving average is among the best RoboForex strategies for beginners and the basis for numerous successful trading strategies. Trend following is another friendly strategy that users can use. Moving averages and other simple trend indicators can help novices determine the trend's direction. Other excellent choices include swing, breakout, and support and resistance trading. Inexperienced traders can get RoboFrex trading signals from experts to trade Forex. The use of forex signals as a comprehensive strategy allows novice traders to take advantage of the knowledge and experience of seasoned traders. You can also use the RoboForex Strategy Builder, which simplifies the process of developing a trading strategy by offering a tool for creating effective and proven strategies.

Expert tips to improve your Forex trading

You must first find a trustworthy broker and develop the habit of taking the time to learn about the characteristics of a broker. For example, RoboForex is a beignner-friendly broker that combines many of the top Forex trading tools to make trading more engaging. Therefore, becoming aware of these is a benefit that users of this platform can enjoy. Other tips to improve your Forex trading strategy are:

-

Always examine yourself to determine what motivates their trades and discover strategies for eliminating greed and fear from the picture.

-

Establish and follow reasonable risk-to-reward ratios. Never take on more risk in a single trade than you can afford to lose. You can lessen potential losses and protect your capital by using stop-loss orders.

-

Avoid investing all of your money in a single trade. Spreading the risk across your trades will shield your portfolio from the effects of the volatility of a single currency.

-

Integrate fundamental and technical analysis to gain a thorough grasp of the market. While fundamental analysis offers insights into the larger market context, technical analysis aids in timing entry and exit points.

Is Forex trading risky?

Yes. Although Forex is the largest and most accessible trading market globally, there are several risks associated with trading in this market. Forex trading is a sophisticated, intricate, and well-informed financial activity that demands skill and attention to detail. In Forex trading, some of the features that help boost a trader's profitability are catalysts for risks.

For example, a trader can use leverage to open large positions with a small amount of capital. Using leverage very aggressively can result in significant losses on initial investments in volatile markets. While there is a chance of losing money when trading Forex, if traders are cautious, they can benefit from using these features to profit by adhering to risk management guidelines.

FAQs

Which is the most profitable trading strategy?

Every trading strategy has advantages and disadvantages that two traders can take advantage of to increase profits; there is no one ideal approach. For instance, some traders consider the scalping strategy, candlestick or chart pattern strategy, and swing to be the best trading strategies.

Is there a 100% winning strategy in Forex?

Since losses are a part of trading and guarantee market diversity and competition, there is no 100% win strategy in Forex trading.

How can I get 50 pips a day?

To get 50 pips a day, traders may have to wait until the candle closes at 7:00 GMT. Next, they will make sure to open a sell-stop order that needs to be two pip below the low and a buy-stop order that needs to be two pip above the high. Keep an eye on the transaction to determine when the price is approaching a high or low, execute any pending orders, and cancel the others.

What is the 1 2 3 strategy in Forex trading?

The 123 strategy is a fundamental technical analysis tool that traders use to identify potential trend reversals in financial markets. In the 123-chart pattern, each movement culminates in a pivot point where a three-wave formation is formed.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).