Having the Best MT4 Brokers for swap-free trading to choose from will help traders achieve their goals more effectively. Traders Union analysts have prepared an article to help you choose the best option. The experts selected 5 companies, compared them between each other and gave scores. Using the results of the analysis, traders can find the information they need about the Best MT4 Brokers for swap-free trading in 2025.

MT4 Features

MT4 is the most popular trading platform for Forex trading in the world. The platform offers several important advantages, including the following:

-

a possibility of installation of additional indicators and instruments of technical analysis;

-

wide opportunities for interface customization. Charts and windows can be customized to your preferences;

-

9 time frames of trading instruments charts;

-

a possibility to use expert advisors for trading automation;

-

128-bit data encryption system, which makes transactions with MT4 secure and confidential;

-

quote archive, which allows traders to monitor history of asset prices;

-

a large number of versions. Brokers upgrade MT4, constantly improving the platform and adding new “perks”.

The important aspect of MT4 is that the platform is free. Traders do not have to pay a fee for using the platform.

1

XM Group - Best MT4 Broker in 2025

Trading conditions of XM Broker are ideal for both novice traders and professionals. There are standard and ultra low spreads accounts, loyal minimum deposit requirements, leverage as provided by requirements of the European regulators. To test strategies, get acquainted with the functionality of platforms, mobile app and test their potential, a demo account is provided.

The broker is a market maker in the international financial market. This means that XM Group has direct access to liquidity and can provide traders with the best quotes. Spreads on Ultra accounts are from 0.6 pips. The company guarantees an almost complete absence of slippage regardless of market volatility level and a competitive market spread in moments of sudden price movements.

Learn More about XM allow scalping

2

RoboForex - Best MT4 Broker in 2025

RoboForex bonus programs are the company's strong points. Every trader gets a $30 Welcome Bonus, if they deposit $10 or more to their account. Additional bonuses include 5%-15% cash back on the fees depending on the trading volume, as well as additional 10% extra funds for more than 1,000 traded.

The minimum deposit on all accounts except R StockTrader is $10. The minimum deposit for trading stocks on the R StocksTrader and copying trades on the CopyFx platform is $100. The spread on Prime and ECN accounts is floating, from 0 pips, on Pro and ProCent accounts – floating from 1.3 pips. You can trade 28 currency pairs, metals and CFDs on this type of account.

For trading, RoboForex has available the following applications: MetaTrader 4, MetaTrader 5, and R StocksTrader, as well as its web terminal, on which you can work on real and demo accounts.

Leverage is up to 1:300-1:500 depending on the account type, as required by the regulatory authorities. The leverage on the cent account is up to 1:2000. On standard accounts, manual increase of leverage to 1:2000 is possible during registration, but this option is subject to certain rules. This parameter is appreciated by experienced traders and amateurs of aggressive trading. With RoboForex, you can earn not only on trading but also on the affiliate program, making a profit from users you have referred to a broker. Multilingual support helps market participants solve their pressing problems 24/7.

3

Markets4you - Best MT4 Broker in 2025

Trading conditions at Forex4you (Markets4you) are among the most attractive ones on the market. First of all, there are no requirements for the minimum deposit amount: according to the conditions, the replenishment amount is from $0 for all types of accounts. With a minimum transaction volume of 0.01, the trader is offered a leverage of up to 1: 4000, which is one of the largest values on Forex. Stop Out Level is 10–20% depending on the type of account.

Markets4you offers 150+ trading instruments, such as Forex pairs, indices, commodities, and stocks. Also, standard and cent accounts, cash back, as well as bonus and partnership programs are available. Markets4you provides access to the Share4you copy trading platform as a passive income option. Each trader can be both an investor and a signal provider.

Markets4you offers cent, classic, and professional accounts, which differ in spread. There are floating spreads starting from 0.1 pips. Pro accounts have fixed fees per lot, which are $0.10 on the Cent Pro account and $7 on the Classic Pro. Copy trading on the Share4you platform is available on each of the accounts, except for the Classic Standard. The lock is allowed on all account types. Deposit and withdrawal methods include Visa/Mastercard cards and electronic payment systems, such as WebMoney, Skrill, and Neteller.

4

AvaTrade - Best MT4 Broker in 2025

AvaTrade offers traders only two types of accounts - Standard and Demo accounts. Trading conditions for Standard accounts differ across different trading platforms.

When registering a Demo account, traders will receive a bonus in the form of 10,000 US dollars on the account for obtaining trading skills.

Another advantage of AvaTrade, which is often noted by traders, is a large choice of assets - there are more than 250 of them.

The broker’s customers also distinguish a low spread and commissions, the speed of order execution, and a wide range of trading platforms. Beginners will appreciate the availability of microlots.

5

IC Markets - Best MT4 Broker in 2025

IC Markets offers high execution speeds due to servers located in New York and London. Trading conditions differ subject to the regulator that supervises the activities of a certain division. For example, clients of IC Markets regulated by CySEC can trade 13 cryptocurrencies 24/5, while clients of ASIC- and FSA-regulated divisions can trade 24/7.

IC Markets clients from all jurisdictions can trade on STP and ECN account types with floating spreads, leverage, and various deposit/withdrawal methods. The company doesn’t have proprietary trading platforms. It offers classic MT4, MT5 and TradingView, as well as a more complicated cTrader. These platforms are available in desktop, web, and mobile versions to ensure the most comfortable trading conditions.

TOP 5 Comparison

In order to select the Best MT4 Broker for swap-free trading in 2025, we first need to compare their main features. TU experts have created a table, where you can find and compare the key features of the best companies for swap-free trading.

| XM Group | RoboForex | Markets4you | AvaTrade | IC Markets | |

|---|---|---|---|---|---|

|

Trading platform |

MT4, MT5, Mobile Trading, XM App |

MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader |

MT4, Mobile Trading, MT5 |

MT4, Mobile Trading, AvaTrader, AvaOptions, AvaSocial, AVA Option, MT5 |

MT4, cTrader, MT5, TradingView |

|

Min deposit |

$5 |

$10 |

No |

$100 |

$200 |

|

Leverage |

From 1:1 |

From 1:1 |

From 1:10 |

From 1:200 |

From 1:1 |

|

Trust management |

No |

No |

No |

No |

No |

|

Accrual of % on the balance |

No |

10.00%% |

No |

No |

No |

|

Spread |

From 0.8 points |

From 0 points |

From 0.1 points |

From 0.9 points |

From 0 points |

|

Level of margin call / stop out |

100% / 50% |

60% / 40% |

100% / 20% |

25% / 10% |

100% / 50% |

|

Execution of orders |

Market Execution |

Market Execution, Instant Execution |

Market Execution, Instant Execution |

Instant Execution |

Market Execution |

|

No deposit bonus |

No |

No |

No |

No |

No |

|

Cent accounts |

No |

Yes |

Yes |

No |

No |

Best MT4 Broker for swap-free trading: Investment Programs

Earning passive income is just as important for traders as earning profit by actively trading. Therefore, it is important to consider investment instruments offered by the company. There are different investment programs and their choice strongly depends on a specific broker. TU analysts have prepared a review of investment programs of the 5 best brokers.

1

XM Group - Investment Programs

Investment Programs, Available Markets, and Products of the Broker

XM Broker broker is focused on providing professional trading services, because its policy does not provide for passive investment programs. However, as an aid to active traders, the company provides several support services, which are worth considering in more detail.

MQL5 Trading Signals

MQL5 is a community of traders from all over the world located on the platform of MetaQuotes company, the developer of Metatrader platforms. XM Broker offers direct access to MQL5 trading signals from traders with productive trading for more than 1 month. In addition, traders get direct access to the programming environment directly from within the broker's trading terminals. Learn More about XM Copy Trading

Advantages of MQL5 signal copy service:

-

automatic copy trading from MQL5 website (there is an option of manual copying);

-

signals can be combined with algorithmic trading (creating advisors based on MQL5 signals using a program code inside the platform);

-

copy service is already built into Metatrader.

Disadvantage: signals are provided for 1 month, after which the question about paying for a subscription appears. One trading account can be subscribed to only one signal provider.

Important!

If you are a large investor and plan on investments over $ 10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

XM Broker affiliate program

XM Broker offers only one variant of affiliate program with the following conditions:

The broker offers one type of partnership program, which implies a one-time reward of $450-$650 subject to the country of each invited trader.

Advantages of XM Group:

Marketing support. More than 20 banner options in 25 languages, click tracking links, and ready-made websites and landing pages are available;

A separate partner’s user account that provides for tracking statistics and conversion for each of the created campaigns by country, age category, etc.;

Personal account managers and weekly payouts.

For more information on conditions of the partnership program, contact the support service.

2

RoboForex - Investment Programs

Investment Programs, Available Markets and Products of the Broker

RoboForex is the ideal broker for those looking to invest their money in the Forex market. This company has everything to earn a stable income — from professional analytics to technical functionality and optimal trading conditions. It is especially worth noting its investment program like RoboForex CopyFx which allows you to receive passive income without doing anything. According to customer reviews, RoboForex is the most popular brokerage company.

RoboForex CopyFx is a service for copying deals

RoboForex CopyFx is a passive investment option that involves connecting an investor's account to a professional trader's account and then copying his transactions. In this case, all trader's transactions are automatically opened on the investor's account. A specific trader's commission is deducted from the investor's profit in case of a successful transaction. The entire service is fully automated which minimizes your work to almost 0%. Learn More about CopyFX From RoboForex

CopyFX at RoboForex - how to choose a trader | Firsthand experience of Oleg Tkachenko

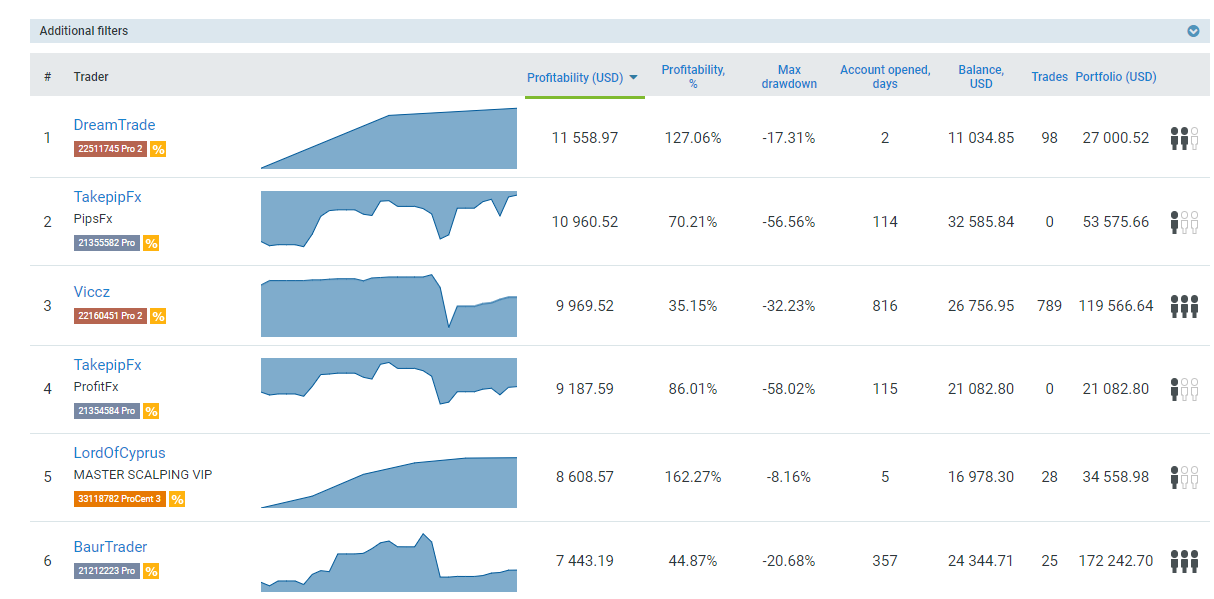

The minimum deposit is only $100, so everyone can test the waters. Having started working, the investor gets access to professional traders' ratings, which indicates the period of the account's existence, profitability, maximum drawdown level, and other statistics. Also, the investor can contact the trader directly.

An investor can connect to an unlimited number of traders, provided that his deposit can withstand such a load. Such diversification of risks makes it possible to form a full-fledged investment portfolio from traders' transactions.

An investor can disconnect from a trader at any time if he doesn't like something in his trading methods. It is a serious tool for protecting a deposit from RoboForex, which not all brokerage companies provide.

Separately, it should be noted that any person can simultaneously act as both an investor and a trader. All statistics on the effectiveness of copying transactions are displayed in the client's account.

Algorithm of working with the CopyFx copy trading platform:

-

Once you register and pass verification, open a trading account. Investors can open any account, except for accounts with the MT5 and R StocksTrader platforms. Traders planning to provide signals open a separate account by choosing Open FxCopy Trader Account.

-

In the Investment menu, open MT4 Trader Rating. Traders must meet minimum requirements of the broker in order to be included in the rating, such as the number of trades, the number of days the account has been active, and profitability. You will need to contact Customer support to learn about specific requirements.

-

You will see main criteria in the list of traders: maximum drawdown, number of copy traders, profitability, account existence period, etc.

-

Click on the profile of each trader to view trading statistics. You can activate the copy trading option in the profile of the trader you’d like to copy.

Copy trading is available on real accounts, subject to the deposit in the amount higher than the one specified in the trader’s profile. You can disconnect from a trader’s account at any time.

How to start investing in copy trading with RoboForex | Firsthand experience of Oleg Tkachenko

RoboForex affiliate program

It is not necessary to be familiar with trading to make money with RoboForex. Attract customers and earn up to 50% of the company's income. It works like this:

-

You register as a partner, after which you receive information materials for posting on your website/blog, forums, or social networks. You also get a referral link.

-

The person follows your referral link and deposits capital in his account.

-

The broker receives the spread and credits a part of his profit to the partner's account in the referral trades.

Also, each partner can participate in the loyalty program with the possibility of receiving up to 20% additional partner remuneration every month.

Depending on the chosen partnership program and account type, the total amount of partner rewards can exceed 50% of the fees paid by the referral. For example, on Affiliate accounts, rewards are up to 70%. Taking into account the general fee of the VIP program with the loyalty reward, the total rewards of a partner could be as high as 84%.

3

Markets4you - Investment Programs

Investment Programs, Available Markets and Products of the Broker

Markets4you is the perfect broker for those who wish to combine active trading with passive investment. Technological platforms and best trading conditions allow to traders optimize the profitability of passive investments with minimal risks. PAMM accounts, social trading and diversified investment portfolios are the most popular services not only for investors, but also for traders who receive an additional commission with their help.

Share4you — a new way of copy trading

Share4you — fully automated copy trading platform that does not require downloading, knowledge or trading experience. The idea of this platform is that a trader conducting active trading gets into the broker rating. A potential investor selects a trader and joins his account. Trades are automatically copied to the investor's account. In case of a successful trading, the investor pays a predetermined commission from his profit to the trader.

-

The number of traders that an investor can connect to is not limited. Thus, the investor can form his own investment diversified portfolio of many traders with strategies of different risk levels.

-

An investor can at any time disconnect an account from a trader. This minimizes risks if it seems to the investor that the trader has started to conduct higher-risk trading or there is a possibility of loss.

-

Instant copy speed. Copy trading speed on the Share4you platform is several milliseconds (ms), which is one of the highest rates on the market.

-

Broker’s own risk assessment system.

Any person can be both an investor and a trader. The investor’s personal account displays the performance of copy trading and the average portfolio return. To become a trader, you just need to start trading - the account automatically gets into the rating with the assignment of a risk level. The higher the rate of return, the higher gets the position in the rating and the greater the chance to attract investors.

If you are a large investor and plan on investments over $ 10,000, contact us at vip-invest@tradersunion.comor by the feedback form on our website. Our professional team will take you through all the intricacies of thedeal and all the steps from signing up to withdrawal of profits.

Markets4you affiliate program

Partnership programs provide the opportunity to earn additional income by inviting new active clients through a referral link. Forex4you offers the following partnership programs:

The Affiliate. This is a three-tier partnership program for developing a sub- partner network. The reward is up to 50% of spread and fees of the first-tier clients, up to 16.7% - from the second-tier clients, and up to 5.6% - from the third-tier clients.

The Agent. It is a one-tier program offering a reward up to 65% of each referral’s spread and fees.

ProSTP MarkUp. This is a program with a flexible approach to the formation of the partner’s fee. The reward is $7-$15 per each standard full lot traded by a referral.

The broker offers comprehensive free informational and technical support including marketing materials, assistance in developing campaigns, landing pages, widgets, banners, etc.

4

AvaTrade - Investment Programs

Investment Programs, Available Markets and Products of the Broker

income with AvaTrade is available to both active market participants and those who choose passive trading.

The broker offers two services for earning passive income:

DupliTrade Platform

Allows you to copy transactions of experienced market participants in a real-time mode. A user-friendly interface facilitates the task of managing and compiling investment portfolios and gives access to proven trading strategies.

-

Quick registration. Open an account at DupliTrade and link it to the account at AvaTrade. Data from the platform will be automatically transferred to your account.

-

Access to providers of the best strategies. Each of them uses different, but equally effective trading methods and styles, thanks to which you can increase your funds.

-

Mobility. Trading on DupliTrade is carried out even if you do not have access to a computer.

Trading experience does not matter. The platform provides the same conditions for both experienced traders and beginners. You can also open a demo account at DupliTrade and practice. Learn More About AvaTrade Copy Trading

ZuluTrade Platform

The automated trading service is popular with traders. The platform collects recommendations from leading traders, after which it automatically conducts the most profitable transactions. The customer of the service only has to choose traders, whose recommendations the platform will follow.

-

The convenience of use. A user-friendly interface facilitates the process of managing your account.

-

Mobility. You can use ZuluTrade not only from a computer but also from a tablet or mobile device.

-

Rating. The service forms a list of traders with the best profit indicators and the number of subscribers. The user can also choose a trader depending on which tools are chosen.

-

Safety. The platform provides customer protection with the ZuluGuard feature. It is provided for cases when the trader selected by the user changes the strategy or his or her profit indicators fall in the rating.

The Traders Union customers with different levels of experience will benefit from the convenience of automated trading. The platforms are designed to generate passive income streams, but the trader who has gained enough experience can eventually become an expert whose orders are copied and whose advice is the basis for conducting transactions by the service.

AvaTrade affiliate program

AvaTrade also offers its customers the opportunity to earn additional profit on partnership. Affiliate program participants get access to the latest affiliate marketing strategies, the flexible commission accrual structure, and the acceleration of this process. The partner is also provided with a personal manager.

There are several types of partnerships on AvaTrade.

-

Introducing broker. The partner's task is to attract customers. The employees of the company deal with the adaptation of beginners, while the partner receives a commission from their trade.

-

Investment manager. For managing multiple accounts at the same time, the partner receives a reward and part of their income.

-

Educational center. The partner’s task is to organize the educational process for new customers and select qualified personnel to improve the quality of training materials.

-

Service Provider. One of the highest-paid partnerships. The partner receives income for the development of innovations, trading tools, and platforms for the broker, providing trading signals.

5

IC Markets - Investment Programs

Investment Programs, Available Markets and Products of the Broker

IC Markets offers different passive income options. Certain investment services or products are subject to countries and regulators.

Passive income options offered by IC Marketspass

IC Markets’ office is regulated by FSA and offers the most advanced opportunities for passive income. Subject to the broker’s division, the following investment income options are available:

-

IC Social, cTrader Copy Trading, and Myfxbook social platforms in the Signal Start format — FSA;

-

ZuluTrade — ASIC and FSA;

-

cTrader Automate, MQL4, and MQL5 — all jurisdictions;

-

IC Shares to invest in stocks on the Australian Securities Exchange — ASIC.

ZuluTrade, MQL, and cTrader Copy Trading allow traders to completely automate the trading process, which means that trades of chosen providers are copied without the participation of investors. Myfxbook and IC Social are apps for social trading, that is investors decide themselves what trades to copy. cTrader Automate is designed for algorithmic trading and is suitable for experienced traders.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of thedeal and all the steps from signing up to withdrawal of profits.

Partnership programs

The broker offers a referral program where existing clients can earn from inviting new ones. How to receive partner rewards from IC Markets:

-

Upon registration with the broker, apply for participation in the partnership program;

-

Share a unique referral link on thematic platforms, social media, etc.;

-

Wait for referrals to start trading.

Each standard lot closed by a referee, brings 0.4 pips of the broker’s spread to the inviting client.

What Is A Forex Swap Free Account?

A Forex swap-free account, also known as an Islamic account, adheres to Islamic religious principles by neither charging nor earning interest on trades.

How Does A Forex No-Swap Account Work?

In a standard Forex account, traders often hold positions overnight, which involves the exchange of one currency for another. When this happens, there is typically a swap charge (or interest) applied, as the positions are subject to the difference in interest rates between the two currencies being traded. This charge is either paid or earned by the trader.

In a no-swap account, these interest charges are eliminated, and instead, the account may involve other fees or charges to compensate for the absence of swap charges. Some swap-free brokers may widen the spreads or charge a commission to cover the costs associated with offering swap-free accounts.

It's important to note that Islamic accounts are not exclusively for Muslim traders. Non-Muslim traders who wish to avoid swap charges for other reasons can also opt for a swap-free account.

Why Are Islamic Accounts Swap Free?

Islamic accounts are swap-free to comply with the principles of Islamic finance, which are guided by Sharia law. Sharia law is the legal framework derived from the religious precepts of Islam. It governs various aspects of life, including economic and financial activities.

One of the key principles of Islamic finance is the prohibition of riba. Riba is the interest charged on loans or deposits. Riba is considered unjust and exploitative because it lead to wealth accumulation by the lenders at the expense of the borrowers.

In a standard Forex trading account, when a trader holds a position overnight, they either earn or pay a swap charge (interest). This practice is in direct conflict with the prohibition of riba in Islamic finance.

To accommodate the needs of Muslim traders who want to participate in Forex trading without violating their religious beliefs, some brokers offer swap-free or Islamic accounts.

Are Forex Halal Or Haram?

The acceptability of Forex trading from an Islamic perspective is a topic of debate. The main reason being it depends on the trading approach. The main concerns revolve around the concepts of riba (interest), gharar (excessive uncertainty), and speculation.

Riba (interest)

As mentioned earlier, Islamic finance prohibits charging or receiving of interest. In standard Forex accounts, traders holding positions overnight may earn or pay swap charges (interest), which goes against this principle. However, swap-free or Islamic accounts address this issue.

Gharar (excessive uncertainty)

Some scholars argue that Forex trading involves a high degree of uncertainty due to the rapid fluctuations in currency values, making it haram (forbidden). However, others argue that not all forms of uncertainty are prohibited. Since currency exchange is a necessity in global trade, Forex trading can be considered halal (permissible) if conducted without excessive speculation.

Speculation

Forex trading can involve a high degree of speculation. Some scholars argue that this speculative aspect makes Forex trading akin to gambling, which Islam prohibits. However, others contend that if traders approach Forex trading with proper analysis, risk management, and avoid excessive speculation, it can be considered halal.

Is Forex Trading Halal or Haram? - Halal Investment GuideHow to Choose a Swap-Free Account?

It can be challenging to choose the right swap free forex broker due to the many options available. Consider the factors below to choose the right swap-free account for your forex trading needs.

1. Broker's reputation and regulation

Research the broker's background, customer reviews, and check whether they hold licenses from reputable regulatory authorities like the FCA, ASIC, CySEC, or others.

2. Additional fees or charges

Swap-free accounts may have alternative fee structures to compensate for the absence of swap charges. Brokers may widen spreads or charge a commission on trades. Analyze and compare the fee structure among various brokers to determine which one offers the most cost-effective option.

3. Customer support

A broker with a dedicated support team for swap-free account users will be better equipped to address your concerns and provide guidance on maintaining Sharia compliance.

4. Demo Accounts

A demo account allows you to practice before going live. Find a swap-free broker with a functional demo account to learn the basics before you finally invest your real money.

5. Trading platform and tools

Evaluate the broker's trading platform and tools to ensure they are user-friendly. They should provide essential features like charting, technical analysis, and risk management. A reliable platform, such as MetaTrader 4 or 5, is preferred by many traders.

Summary

Choosing a good broker for swap-free trading is not a simple task. To make it easier, TU experts have prepared this review. Based on the collected information, we have given scores to each company. In the Overall score table, you will learn about the best MT4 Broker for swap-free trading in 2025, and also advantages and disadvantages of its closest competitors.

Overall score of the best MT4 Brokers for swap-free trading

| XM Group | RoboForex | Markets4you | AvaTrade | IC Markets | |

|---|---|---|---|---|---|

|

Overall score |

8.53 |

8.28 |

7.32 |

8.03 |

8.35 |

|

Execution of orders |

9.35 |

8.95 |

8.65 |

8.5 |

9.45 |

|

Investment instruments |

9.2 |

4.9 |

6.8 |

10 |

9.9 |

|

Withdrawal speed |

7 |

8 |

5 |

5 |

8 |

|

Customer Support work |

8.7 |

9.6 |

8.5 |

7.9 |

7.19 |

|

Variety of instruments |

8.02 |

9.02 |

5.77 |

10 |

8.02 |

|

Trading platform |

8.9 |

9.2 |

9.22 |

6.8 |

7.51 |

|

|

|||||

|

|

|

|

|

|

|

FAQ

What is swap-free trading?

Swap-free trading means trading, when a position is automatically closed once a day for several minutes and then automatically opened again. This is required to avoid swap fee charges, which is important for traders living by Sharia law.

What are the versions of MT4?

There are three main versions of the MetaTrader 4 platform. Traders can work on desktop, mobile and web versions. Some brokers do not offer the desktop version, but traders can download it from the MQL5 website, log in and use it.

Does the choice of a beginner differ from the choice of an experienced trader?

Yes. A novice trader should primarily consider the availability of educational tools and a demo account, as well as basic assets. A more experienced trader is interested in wider opportunities on advanced account types, a wider choice of instruments for technical analysis, and a greater number of trading instruments.

What is a demo account and why is it important?

On a demo account, you trade by using virtual funds. It is important to choose a broker offering a demo account both for beginners, who are only learning, and for experienced traders, who can use this account type to test new strategies or EAs risk-free.

What commissions and fees should I take into consideration when I am choosing a broker?

The commissions and fees in the financial markets are divided into trading and non-tradings ones. Trading fees are the fees that are charged directly during trading (spread, commission per lot, etc.), while non-trading fees are the ones charged outside the trading process (for example, account fee, inactivity fee, deposit and withdrawal fee).

What learning instruments can a broker offer?

Brokers offer various educational options. These include full-fledged educational courses, or video tutorials, articles, and books. Companies also often hold seminars and webinars.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.