Main Types of Forex Signals Services

In the past, traders were given only two choices; they could either place their money in an account with a financial manager or trade on their own, using signals provided by an experienced expert. Today, traders are spoiled for choices. For those seeking a forex signal service.

You'll come across these categories:

-

Signal Provider

-

Investor Service

-

Copy Trading

Signal Provider

A forex signal provider is a kind of service that is geared specifically for retail traders. When you use a signal provider, the charges can be an annual or monthly flat fee or a performance-based fee, contingent on the quality of services they provide.

A standard forex signals service provides you with an account on which they post their signals. This includes an offer price or buys price along with a stop loss cost and the price for taking a profit. You may realize that when you sign up with a forex signal provider, you'll have to execute the work of making trades promptly. Additionally, you will need to control those positions (or the trading lot or contract) to consider risks.

The prices are reasonable; however, the challenge is choosing a forex signal provider who has been around for a long time and boasts of a solid track record that demonstrates the gains, drawdown, and volatility of their trading. Certain signal providers will be available to advise you on the appropriate size of trading to use based on your risk tolerance and the amount you are willing to invest.

Investor Services

Investor services are a service that stays at the top of the spectrum and is usually expensive. The minimum requirements for joining the service are at the upper end of the spectrum. It's also known as a fund management company, also known as an investment firm.

These types of services generally require you to put in the amount over a specific amount of time and allow earning monthly, quarterly, or annually on the investment (of course, after deducting the various types of charges).

As the name implies, this type of high-end service is for those with a budget of $50k to $60k or a bit more and are looking to be in the game for the long term. Investors generally invest and hold for long durations of time.

If you intend to use an investment program, be sure to pay attention to the costs and the return, as well as the guarantee of your principal, and of course, take into account all of this for inflation.

Returns will naturally differ depending on the location where your money is put and how risky it is.

Copy Trading

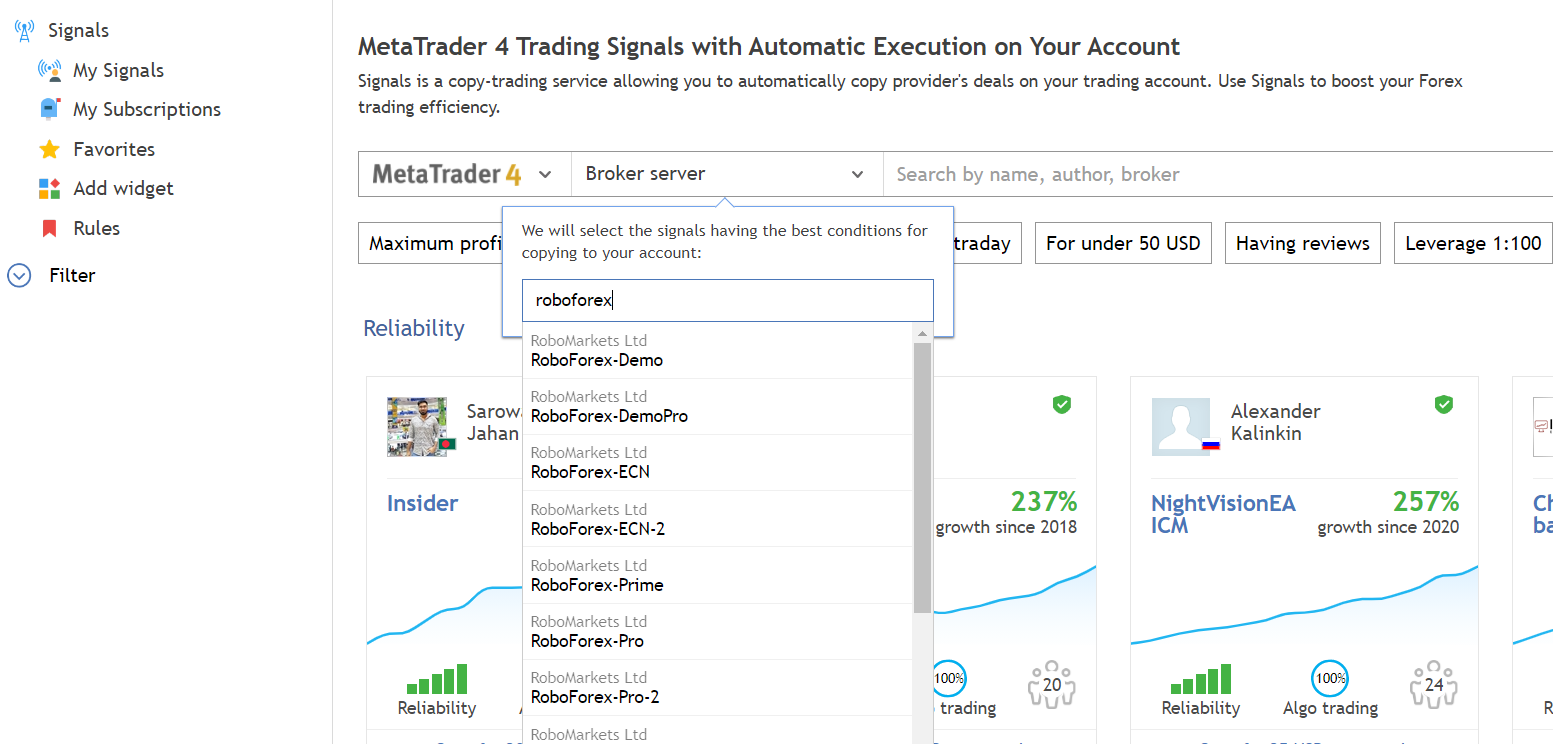

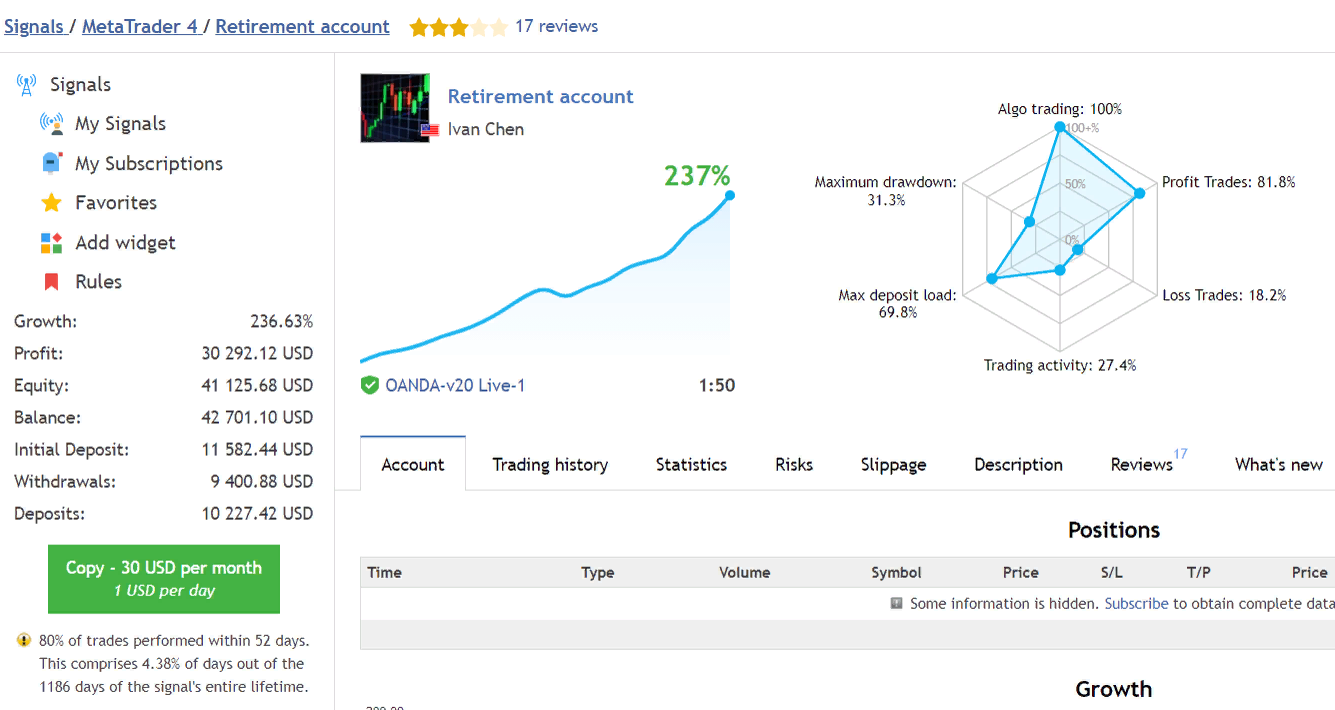

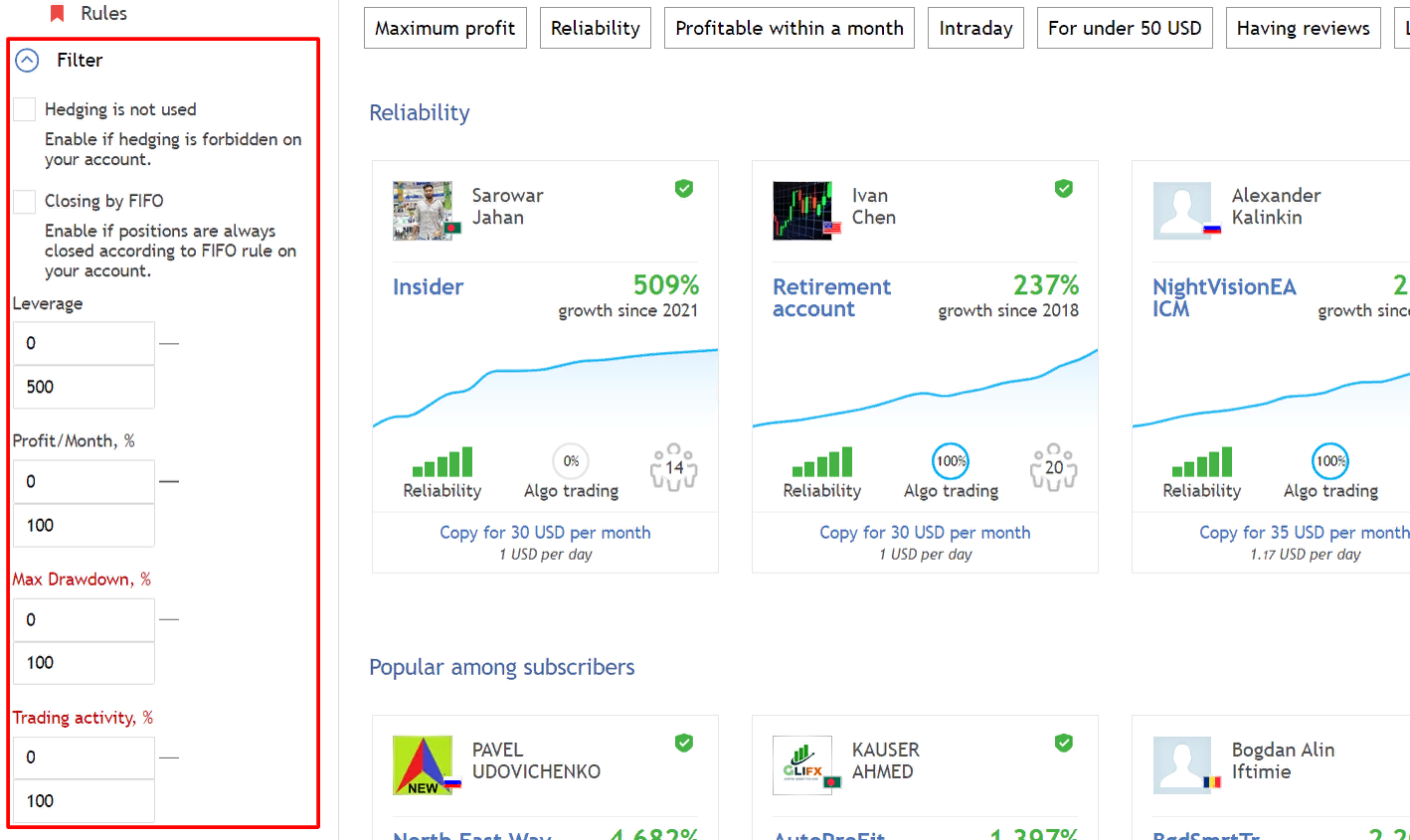

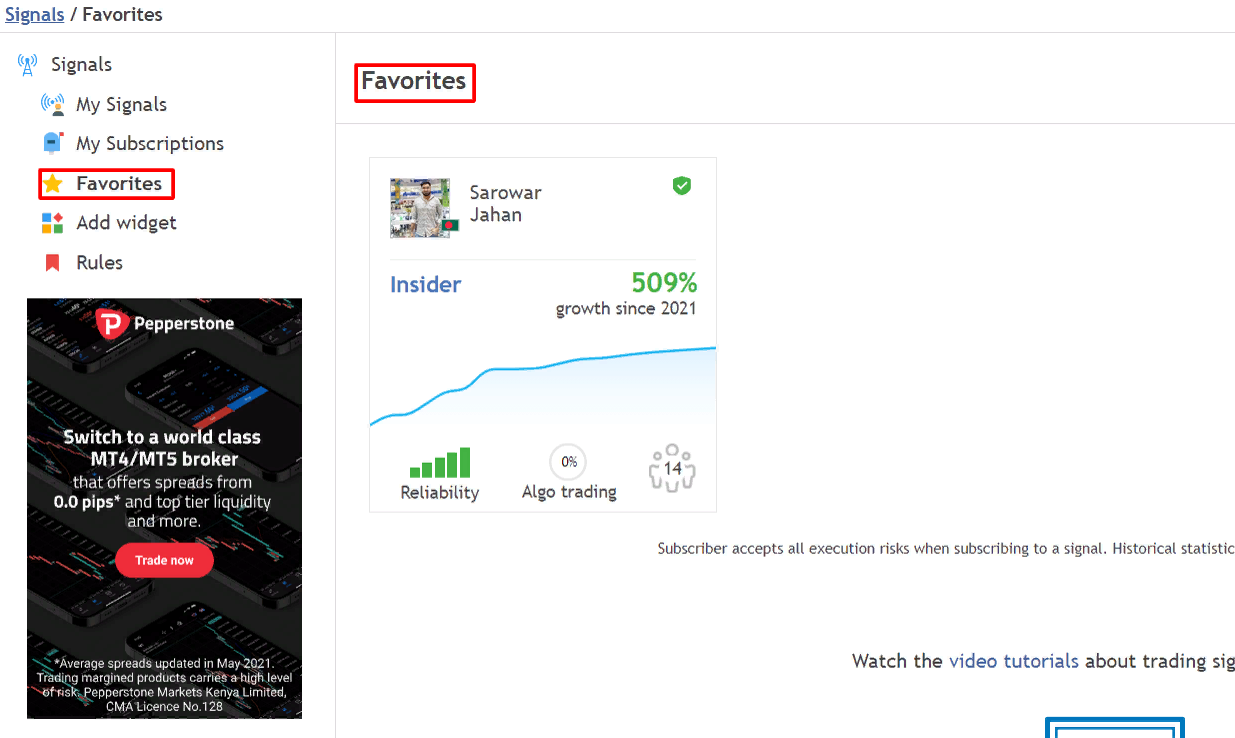

Copy-trading, also known as mirror trading, is the newest trend that has swept the currency or forex markets. It's also known under the term social trading.

It doesn't matter what it's called; copy trading operates with the premise that you can copy trades of "successful" traders then, you pay the same amount for the use of the service.

Copy-trading, based on the platform, is hands-free and all you need to do is reserve the amount you'd like to allocate and the size of your trade or the size of the contract per trade.

Although copy trading is vast and is probably where most traders who are new to trading begin, it has certain risks.